Market Overview

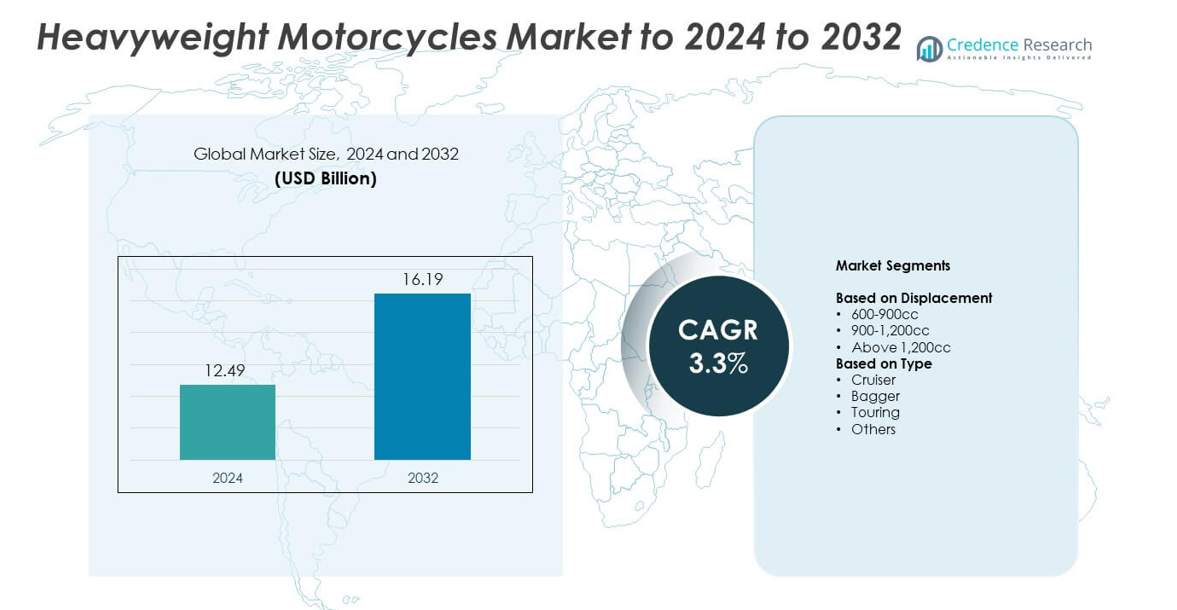

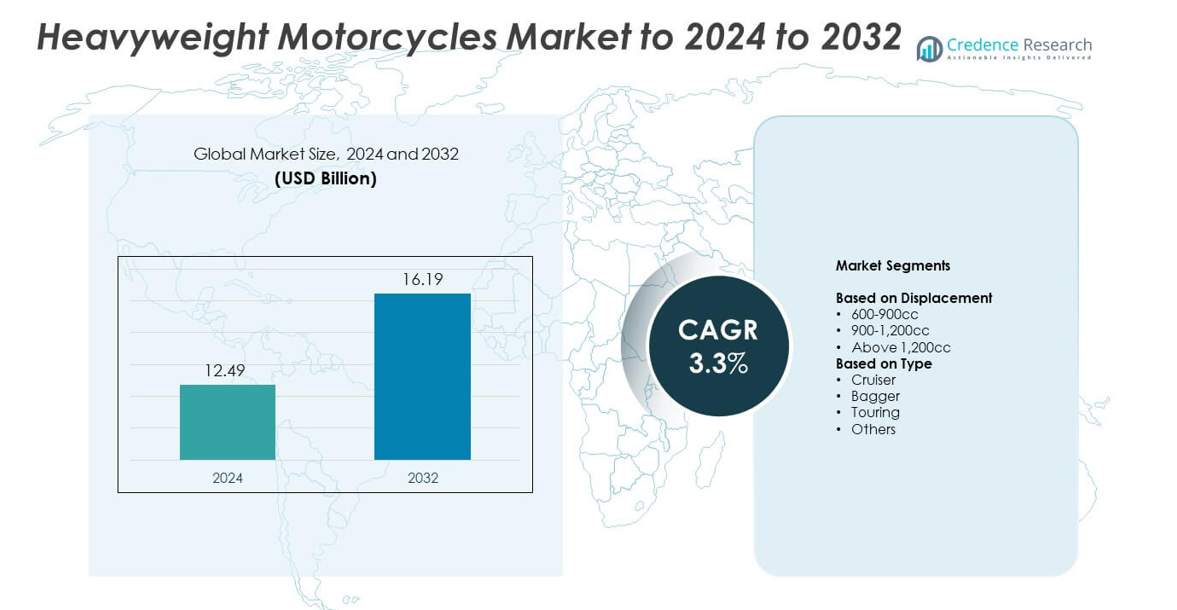

Heavyweight Motorcycles Market size was valued at USD 12.49 Billion in 2024 and is anticipated to reach USD 16.19 Billion by 2032, at a CAGR of 3.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Heavyweight Motorcycles Market Size 2024 |

USD 12.49 Billion |

| Heavyweight Motorcycles Market, CAGR |

3.3% |

| Heavyweight Motorcycles Market Size 2032 |

USD 16.19 Billion |

The heavyweight motorcycles market is characterized by the presence of leading manufacturers such as Ducati, Yamaha Motor, Moto Guzzi, Sena Technologies, BMW Motorrad, Kawasaki Motors, Eicher Motors, Harley-Davidson, Suzuki Motor, Honda Motor, and Polaris. These companies compete through advanced engineering, design innovation, and strong brand positioning across premium motorcycle categories. North America remains the leading regional market, commanding a 39% share in 2024, supported by a mature consumer base and well-established riding culture. Europe follows with a 28% share, driven by demand for high-performance and luxury motorcycles, while Asia-Pacific shows rapid growth due to rising incomes and expanding urban mobility trends.

Market Insights

- The heavyweight motorcycles market was valued at USD 12.49 billion in 2024 and is projected to reach USD 16.19 billion by 2032, growing at a CAGR of 3.3%.

- Rising consumer preference for premium cruiser and touring models, along with expanding electric motorcycle options, is fueling steady market growth.

- Key trends include the integration of rider-assist systems, connected technologies, and growing demand for customized and lifestyle-oriented motorcycles.

- The market is highly competitive, with leading brands focusing on innovation, emission compliance, and strategic partnerships to expand their global presence.

- Regionally, North America led the market with a 39% share in 2024, followed by Europe at 28% and Asia-Pacific at 24%, while the 900–1,200cc displacement segment held the largest share at 47%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Displacement

The 900–1,200cc segment dominated the heavyweight motorcycles market with a 47% share in 2024. This segment’s leadership is driven by a balance between power, fuel efficiency, and affordability, appealing to both touring and performance riders. Manufacturers such as Harley-Davidson and Triumph focus on this range due to strong consumer preference for mid-range torque and stability. Growing demand for motorcycles that offer superior control in urban and highway conditions supports steady adoption. The segment’s technological refinements in engine performance and lightweight materials further enhance its growth prospects.

- For instance, Triumph’s Tiger 1200 uses a 1,160 cc triple delivering 110.4 kW and 130 Nm, targeting mid-range torque in this band.

By Type

The cruiser segment held the largest market share of around 52% in 2024. Its dominance is supported by high demand for stylish, comfortable, and long-distance motorcycles across North America and Europe. Brands like Harley-Davidson, Indian Motorcycle, and Honda continue to expand cruiser lineups with improved ergonomics and V-twin engines. Strong aftermarket customization options and brand-driven lifestyle appeal also sustain market traction. The cruiser category’s blend of design aesthetics, riding comfort, and heritage value remains a major factor fueling its market leadership.

- For instance, Indian’s PowerPlus 112 V-Twin in the Challenger produces 126 hp and 133 ft-lb from 1,834 cc, underpinning cruiser performance.

Key Growth Drivers

Rising Demand for Premium Touring and Cruiser Bikes

The growing preference for premium touring and cruiser motorcycles is a major market driver. Consumers in developed regions seek comfort, advanced features, and brand prestige. Manufacturers are introducing high-performance models with adaptive cruise control, infotainment systems, and advanced braking. Rising disposable incomes and motorcycle ownership among middle-aged riders further support market expansion. Increasing leisure riding and touring events across the U.S. and Europe continue to strengthen demand for heavyweight motorcycles with superior design and long-distance endurance.

- For instance, BMW’s R 1250 GS boxer makes 100 kW and 143 Nm from 1,254 cc, and adds Dynamic Brake Control for enhanced stability.

Expansion of Electric Heavyweight Motorcycles

The shift toward electric propulsion is creating new growth opportunities in the heavyweight segment. Manufacturers are investing in high-torque electric models offering extended range and rapid charging. Improved battery density and performance capabilities allow electric motorcycles to match conventional engines. Brands such as Harley-Davidson are leading this shift with their electric lineups. Consumer awareness of eco-friendly alternatives and regulatory incentives for clean mobility are accelerating adoption, positioning electric heavyweight motorcycles as a key area of market transformation.

- For instance, Damon’s HyperSport claims 200 hp, 200 Nm, and up to 200 miles combined range, with 0–60 mph in under 3 seconds.

Technological Integration and Connectivity Features

Advanced electronics and digital connectivity are reshaping the riding experience in heavyweight motorcycles. Integration of rider-assist technologies such as traction control, cornering ABS, and Bluetooth-enabled dashboards enhances performance and safety. Real-time diagnostics, navigation aids, and adaptive lighting systems further elevate convenience. Leading manufacturers are leveraging IoT-based platforms for predictive maintenance and performance optimization. These advancements not only enhance user engagement but also attract younger riders who prioritize innovation and digital control in premium motorcycle models.

Key Trends & Opportunities

Customization and Lifestyle Branding

Customization has become a major trend as riders seek personalized styling and performance upgrades. Manufacturers offer modular accessories, color schemes, and ergonomic options to enhance individuality. The trend is reinforced by social media-driven communities that promote brand loyalty and lifestyle identity. Companies are investing in dedicated customization studios to boost engagement. This shift from mass production to personalization is reshaping consumer expectations, especially within the cruiser and touring categories, where aesthetic appeal and comfort define purchase preferences.

- For instance, Harley-Davidson’s 2025 accessories catalog spans about 800 pages, reflecting deep factory customization breadth.

Growth in Emerging Asian Markets

Asia-Pacific is witnessing rising interest in heavyweight motorcycles due to economic growth and changing consumer lifestyles. Countries like India, China, and Thailand are experiencing increased adoption among affluent urban riders. Global brands are expanding assembly facilities and retail networks across the region to capture demand. Improved infrastructure and growing leisure riding culture further stimulate sales. Government initiatives promoting domestic manufacturing and favorable trade policies are enabling cost-efficient production, strengthening the region’s position in the global heavyweight motorcycle market.

- For instance, Honda reported cumulative motorcycle production of 500,000,000 units and guided FY2025 unit sales to 20.2 million, with Asia accounting for 17.17 million units.

Key Challenges

High Ownership and Maintenance Costs

Heavyweight motorcycles involve high purchase and upkeep expenses, limiting affordability for mass consumers. Maintenance of large-displacement engines, premium parts, and insurance premiums add to long-term ownership costs. This restricts adoption in price-sensitive regions and reduces repeat purchases. Even with financing options, the total cost of ownership remains a deterrent for younger riders. Manufacturers face pressure to balance premium features with competitive pricing while maintaining brand exclusivity and profitability in mature markets.

Stringent Emission and Safety Regulations

Evolving environmental and safety standards pose significant challenges to manufacturers. Compliance with stricter emission norms, such as Euro 5 and BS6, requires costly redesigns and advanced engine systems. These regulations increase development and production costs while extending time-to-market. Additionally, countries enforcing higher safety requirements, including mandatory ABS and crash testing, add regulatory complexity. Balancing performance, compliance, and affordability remains difficult, particularly for manufacturers operating across multiple regional regulatory frameworks.

Regional Analysis

North America

North America held the largest share of around 39% in the heavyweight motorcycles market in 2024. The region’s dominance is driven by the strong presence of leading brands such as Harley-Davidson and Indian Motorcycle. A well-established leisure riding culture and extensive highway networks support steady sales. Consumers prefer cruiser and touring models with advanced comfort and safety features. High disposable income levels and growing demand for premium motorcycles further enhance market strength. The United States continues to represent the primary revenue hub, supported by a robust dealer network and strong aftermarket customization trends.

Europe

Europe accounted for nearly 28% of the heavyweight motorcycles market share in 2024. The market is fueled by increasing demand for performance-oriented and luxury motorcycles across countries such as Germany, the UK, and Italy. European manufacturers focus on design innovation, lightweight chassis, and emission-compliant engines. The rise of electric motorcycles and sustainable mobility initiatives further strengthen market growth. A strong touring culture and widespread motorcycle events contribute to brand engagement and consumer loyalty. Expanding financing options and evolving lifestyle preferences also sustain consistent growth in this mature market.

Asia-Pacific

Asia-Pacific captured about 24% of the global market share in 2024, driven by rapid urbanization and rising disposable incomes. The region’s expanding middle-class population and improving road infrastructure are boosting motorcycle ownership. Countries such as India, China, and Japan are witnessing growing adoption of heavyweight motorcycles among enthusiasts and affluent riders. Global brands are localizing production to lower costs and increase availability. The shift toward premium models and the rise of motorcycle clubs are enhancing demand. Government initiatives supporting domestic manufacturing further strengthen regional competitiveness in this segment.

Latin America

Latin America represented approximately 6% of the heavyweight motorcycles market in 2024. Growth in this region is supported by increasing interest in leisure motorcycling and gradual income improvements. Brazil and Mexico lead the market due to rising demand for premium and mid-range motorcycles. The expanding dealer presence of international brands improves product accessibility and after-sales services. Economic stability and flexible financing options are also encouraging purchases. Although overall penetration remains lower than in developed regions, growing motorcycle tourism and urban commuting trends offer steady expansion opportunities.

Middle East & Africa

The Middle East & Africa region held around 3% of the global market share in 2024. Rising urbanization, expanding road networks, and increasing adoption of premium motorcycles among affluent consumers support regional growth. The UAE and Saudi Arabia are key contributors due to high disposable incomes and a strong preference for luxury brands. Africa is gradually emerging as a potential market with improving road conditions and expanding retail networks. Manufacturers are targeting niche segments through strategic partnerships and experiential marketing, helping to build brand awareness and attract new consumer groups.

Market Segmentations:

By Displacement

- 600-900cc

- 900-1,200cc

- Above 1,200cc

By Type

- Cruiser

- Bagger

- Touring

- Others

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The heavyweight motorcycles market features key players such as Ducati, Yamaha Motor, Moto Guzzi, Sena Technologies, BMW Motorrad, Kawasaki Motors, Eicher Motors, Harley-Davidson, Suzuki Motor, Honda Motor, and Polaris. The competitive environment is defined by strong brand positioning, product innovation, and a growing focus on premium and electric models. Manufacturers emphasize advanced engineering, digital connectivity, and rider-assist technologies to strengthen product differentiation. Strategic collaborations with component suppliers and technology firms support innovation in performance and safety. Companies invest heavily in R&D to enhance efficiency and reduce emissions. Marketing strategies centered on lifestyle branding and customization appeal to younger and affluent riders. Expanding dealer networks and digital retail channels further boost global accessibility. The competition remains intense, with continuous product upgrades and design enhancements aimed at improving comfort, performance, and sustainability while capturing new consumer segments across emerging and developed markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ducati

- Yamaha Motor

- Moto Guzzi

- Sena Technologies

- BMW Motorrad

- Kawasaki Motors

- Eicher Motors

- Harley-Davidson

- Suzuki Motor

- Honda Motor

- Polaris

Recent Developments

- In 2023, Harley-Davidson Launched the entry-level, single-cylinder X 440 in India as part of a joint venture with Hero MotoCorp.

- In November 2023, Moto Guzzi unveiled a revamped V85 range for the 2024 model year.

- In 2023, Honda Introduced the all-new Hornet 750 and Transalp 750 models in Europe, expanding its middleweight segment.

Report Coverage

The research report offers an in-depth analysis based on Displacement, Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Manufacturers will continue expanding electric heavyweight models as battery range and torque improve.

- Integration of advanced safety systems such as adaptive cruise control and cornering ABS will increase.

- Customization and modular design options will strengthen customer engagement and brand loyalty.

- Emerging markets in Asia-Pacific will play a larger role in global sales growth.

- Connected motorcycle ecosystems with cloud-based diagnostics and performance tracking will become standard.

- Premium touring and cruiser categories will remain the highest revenue contributors.

- Collaborations between traditional OEMs and EV startups will accelerate product innovation.

- Sustainability-focused materials and low-emission engines will gain higher regulatory and consumer preference.

- Expansion of digital sales channels and immersive showrooms will enhance customer experience.

- Continuous R&D investments will drive performance upgrades and strengthen competition among leading brands.