Market Overview:

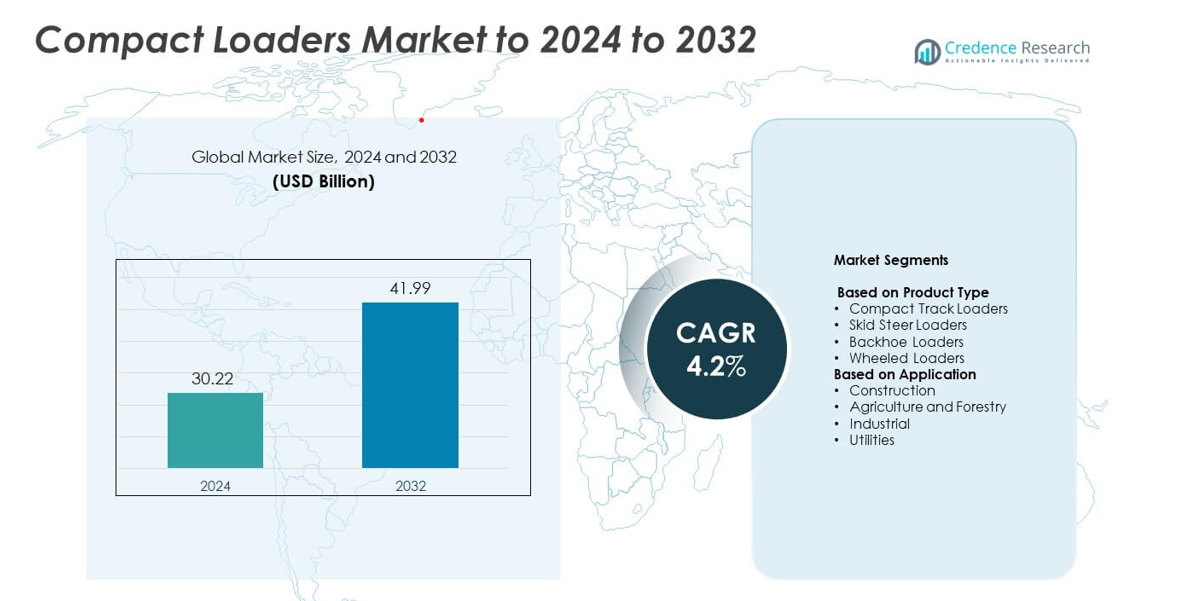

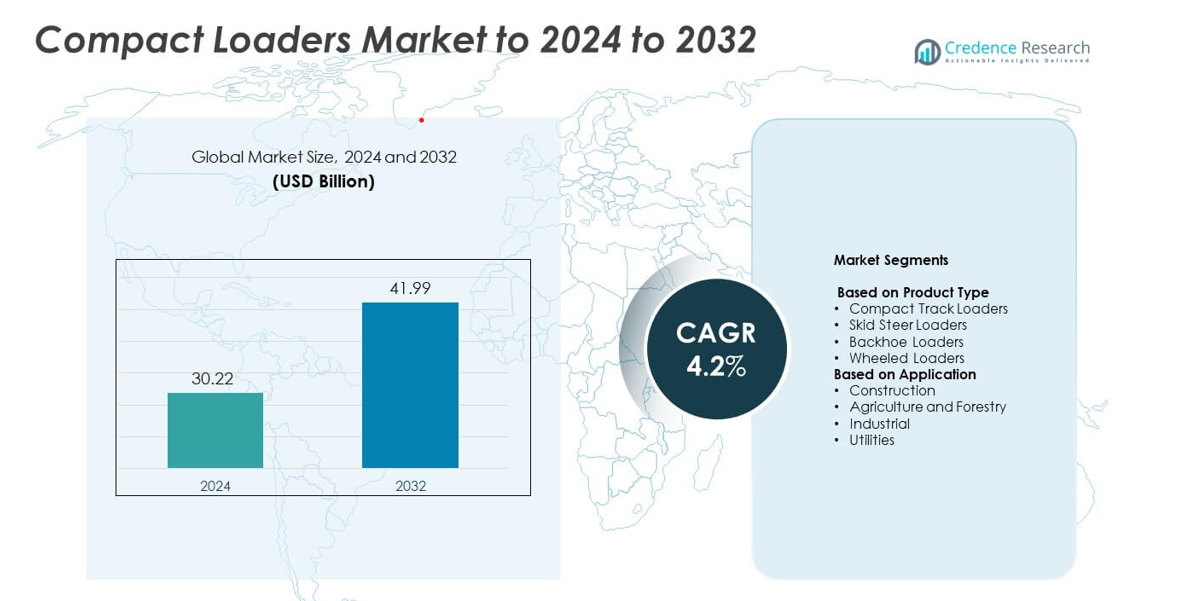

The Compact Loaders Market size was valued at USD 30.22 Billion in 2024 and is anticipated to reach USD 41.99 Billion by 2032, at a CAGR of 4.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Compact Loaders Market Size 2024 |

USD 30.22 Billion |

| Compact Loaders Market, CAGR |

4.2% |

| Compact Loaders Market Size 2032 |

USD 41.99 Billion |

The compact loaders market is led by major players such as Caterpillar Inc., Volvo Construction Equipment, Komatsu Ltd., Deere & Company, and Sany Heavy Industry Co. Ltd., which focus on advanced technology integration, product diversification, and sustainability-driven designs. These companies emphasize hybrid and electric loader development to align with global emission standards and operational efficiency goals. North America dominated the global market with a 37.8% share in 2024, supported by extensive infrastructure projects, construction equipment rentals, and a strong presence of key manufacturers. Europe followed, driven by automation adoption and stringent energy-efficiency regulations.

Market Insights

- The compact loaders market was valued at USD 30.22 Billion in 2024 and is projected to reach USD 41.99 Billion by 2032, growing at a CAGR of 4.2%.

- Growing urbanization, infrastructure expansion, and mechanization in agriculture are major factors fueling market growth worldwide.

- Technological advancements such as telematics integration, automation, and electric loader development are key emerging trends.

- The market is moderately consolidated, with players focusing on product innovation, partnerships, and rental fleet expansion to strengthen their competitive edge.

- North America led with a 37.8% market share in 2024, followed by Europe at 27.4%, while the compact track loaders segment dominated with 44.6% of total global revenue.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The compact track loaders segment dominated the compact loaders market in 2024, holding a 44.6% share. These machines deliver superior traction, stability, and performance on uneven terrains, making them ideal for construction and landscaping. Their low ground pressure minimizes surface damage, enabling effective operation in muddy or soft soil conditions. Rising adoption in rental fleets and increasing investments in compact construction equipment drive demand. Manufacturers such as Bobcat Company and Caterpillar focus on models with enhanced hydraulic power and telematics integration to improve productivity and fuel efficiency.

- For instance, Caterpillar’s 299D3 XE lists a rated operating capacity of 3,560 lb at 35% tipping load and ground pressure of 5.4 psi, dropping to 4.8 psi with 450 mm tracks

By Application

The construction segment accounted for the largest 49.2% share of the compact loaders market in 2024. High demand stems from their use in road maintenance, excavation, and material handling tasks. Compact size, versatility, and easy maneuverability make them suitable for confined urban projects. Growth in infrastructure development and residential construction activities in emerging economies further boosts segment adoption. Leading equipment makers such as JCB and Volvo Construction Equipment offer advanced loader models with improved lifting capacity, operator comfort, and safety controls to enhance site efficiency.

- For instance, JCB’s 270T compact track loader uses a 74 hp EcoMAX engine and delivers a 2,723 lb rated operating capacity.

Key Growth Drivers

Rising Infrastructure and Urban Development Projects

Expanding urban infrastructure and residential construction projects are major growth catalysts for the compact loaders market. Governments across developing regions are investing heavily in road networks, housing, and public utilities. Compact loaders are preferred due to their versatility, smaller turning radius, and ability to operate in confined sites. The increasing adoption of rental equipment for short-term projects further fuels demand. This driver remains crucial as infrastructure spending continues to accelerate across Asia-Pacific and North America.

- For instance, John Deere’s 333G posts a 10,570 lb tipping load and a 3,700 lb rated operating capacity at 35% tipping load, supporting heavy roadwork tasks.

Technological Advancements in Equipment Design

Ongoing innovations in loader design and automation are driving market expansion. Manufacturers are integrating telematics, GPS-based monitoring, and hybrid powertrains to improve efficiency and reduce fuel consumption. Enhanced operator comfort through ergonomic cabins and joystick controls increases productivity and reduces fatigue. These technological upgrades are improving machine reliability and performance in diverse working conditions. The focus on electrification and automation makes this driver vital for long-term sustainability and competitiveness in the compact loaders segment.

- For instance, Volvo CE’s ActiveCare Direct provides 24/7/365 machine monitoring and monthly fleet reports, offered free for one year on applicable new machines.

Growing Demand from Agriculture and Forestry Applications

Rising mechanization in farming and forestry sectors supports strong market growth. Compact loaders are increasingly used for material handling, land preparation, and livestock operations due to their efficiency and adaptability. Their compatibility with multiple attachments enables use across various agricultural processes. The expanding agricultural equipment rental market also promotes accessibility for small and medium-scale farmers. This trend ensures steady adoption in rural regions and contributes significantly to overall equipment demand.

Key Trends & Opportunities

Adoption of Electric and Hybrid Loaders

The market is witnessing a clear shift toward electric and hybrid compact loaders as emission regulations tighten globally. These models offer lower noise levels, reduced maintenance needs, and improved energy efficiency. Major manufacturers are launching battery-powered versions with fast-charging capabilities for urban and indoor applications. Incentives for clean construction machinery in Europe and North America strengthen adoption. This transition presents a strong opportunity for companies to align with global sustainability goals and achieve operational cost savings.

- For instance, Bobcat’s all-electric T7X features a 72.6 kW·h battery, up to six hours runtime, and an approximate 12-hour charge on a 240 V/40 A outlet.

Integration of Smart Telematics and IoT Systems

Telematics and IoT integration are transforming fleet management in the compact loaders market. Connected systems provide real-time performance data, predictive maintenance alerts, and remote diagnostics, reducing downtime and enhancing productivity. Operators can track fuel use, working hours, and load cycles to optimize efficiency. Equipment manufacturers are increasingly embedding these technologies to improve customer service and reduce operational costs. The rise of data-driven construction management presents a major opportunity for value differentiation among global brands.

- For instance, CASE SiteWatch on the TV620B includes telematics hardware and a 1-year data subscription, enabling remote diagnostics through SiteConnect.

Key Challenges

High Initial and Maintenance Costs

The significant upfront investment required for advanced compact loaders poses a barrier for small contractors and farmers. Machines equipped with telematics and hybrid systems often demand higher maintenance expertise and costlier spare parts. These factors limit adoption in cost-sensitive regions. Additionally, fluctuating raw material prices affect production costs, challenging manufacturers to balance affordability and innovation. Addressing these cost barriers remains crucial for expanding market reach and sustaining growth momentum.

Shortage of Skilled Operators

A persistent shortage of trained operators is restraining market growth, particularly in developing economies. Operating advanced compact loaders with integrated technologies requires specialized training and experience. The lack of skilled personnel often results in inefficient machine use and higher operational risk. Equipment manufacturers and contractors are investing in digital simulators and training programs to bridge this skill gap. Expanding operator education and certification initiatives is essential to ensure productivity and workplace safety in construction and industrial applications.

Regional Analysis

North America

North America held the largest 37.8% share of the compact loaders market in 2024. The region benefits from strong construction and landscaping activity, particularly in the United States and Canada. High equipment rental penetration and technological innovation among manufacturers support continued growth. Key players such as Caterpillar and Bobcat dominate with advanced track and skid steer loaders. Government infrastructure investments and residential renovation projects further stimulate demand. Growing preference for electric and hybrid models aligns with sustainability regulations, reinforcing North America’s leadership in the global market.

Europe

Europe accounted for a 27.4% share of the compact loaders market in 2024. The region’s growth is driven by modernization of construction practices, increased adoption of low-emission machinery, and robust municipal infrastructure development. Countries such as Germany, France, and the United Kingdom emphasize energy-efficient equipment to meet stringent environmental policies. Leading European manufacturers focus on compact design and automation to enhance efficiency. The expansion of rental fleets and adoption of smart telematics systems are strengthening equipment utilization rates across construction and industrial sectors.

Asia-Pacific

Asia-Pacific captured a 24.9% share of the compact loaders market in 2024. Rapid urbanization, large-scale infrastructure development, and agricultural mechanization are key growth drivers in China, India, and Japan. Government investments in smart city projects and rural infrastructure enhance market opportunities. The region’s rising preference for affordable, multipurpose loaders supports strong sales among small contractors. Local manufacturers are expanding production capacity to meet domestic and export demand. Increasing foreign direct investments and equipment leasing services continue to accelerate adoption across construction and utility applications.

Latin America

Latin America held an 6.1% share of the compact loaders market in 2024. Economic recovery and growing construction activity in Brazil, Mexico, and Chile are driving steady demand. The shift toward compact and versatile equipment supports infrastructure and agricultural operations. Favorable credit programs for small and medium enterprises are encouraging equipment purchases. Manufacturers are strengthening distribution networks and after-sales services to expand market reach. However, uneven economic conditions and import tariffs continue to affect machinery imports, limiting large-scale equipment upgrades in certain markets.

Middle East and Africa

The Middle East and Africa accounted for a 3.8% share of the compact loaders market in 2024. The market is supported by ongoing infrastructure investments, mining activity, and urban expansion across Gulf nations and South Africa. Governments are prioritizing construction and housing development, creating demand for efficient compact machinery. Equipment suppliers are focusing on durability and low-maintenance models suitable for extreme environments. Rising investments in renewable energy and industrial projects also promote loader use. Despite strong potential, regional growth faces constraints from high equipment costs and limited operator training programs.

Market Segmentations:

By Product Type

- Compact Track Loaders

- Skid Steer Loaders

- Backhoe Loaders

- Wheeled Loaders

By Application

- Construction

- Agriculture and Forestry

- Industrial

- Utilities

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The compact loaders market is characterized by intense competition among major global players such as Volvo Construction Equipment, Sany Heavy Industry Co. Ltd., Caterpillar Inc., Komatsu Ltd., Doosan Corporation, Hitachi Construction Machinery Co. Ltd., Liebherr Group, Deere & Company, Yanmar Holding Co. Ltd., Xuzhou Construction Machinery Group Co. Ltd., and New Holland. These companies focus on expanding their product portfolios through technological advancements, automation, and hybrid machinery to meet growing demand for fuel-efficient and low-emission equipment. Strategic collaborations, mergers, and distribution partnerships help strengthen regional presence and service networks. Continuous investment in research and development drives innovation in telematics, hydraulics, and energy-efficient systems. The competition also extends to rental and after-sales services, where customer support and operational reliability play crucial roles in brand preference. Rising adoption of electric models and smart equipment solutions further intensifies rivalry, pushing manufacturers toward sustainable production and digital integration strategies to maintain a competitive edge.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2024, Caterpillar unveiled a next-generation lineup of skid-steer loaders (SSLs) and compact track loaders (CTLs).

- In 2024, John Deere launched five new P-Tier models, including the 330 and 334 P-Tier SSLs and the 331, 333, and 335 P-Tier CTLs. These machines introduced advanced features and improved comfort to assist operators.

- In 2023, New Holland introduced the new C330 vertical-lift compact track loader, emphasizing superior boom design and maneuverability.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for compact loaders will rise with expanding infrastructure and residential construction projects.

- Electric and hybrid loaders will gain popularity due to emission regulations and fuel savings.

- Rental equipment services will expand as small contractors prefer cost-efficient options.

- Integration of telematics and IoT will enhance fleet management and predictive maintenance.

- Manufacturers will focus on compact, high-performance models for confined urban sites.

- Growth in agriculture and forestry applications will support long-term market stability.

- Automation and operator-assist technologies will improve safety and efficiency in operations.

- Asia-Pacific will emerge as the fastest-growing region driven by urbanization and industrialization.

- Partnerships between OEMs and rental firms will strengthen distribution and after-sales networks.

- Ongoing R&D in battery systems and hydraulics will drive innovation in next-generation loaders.