Market Overview:

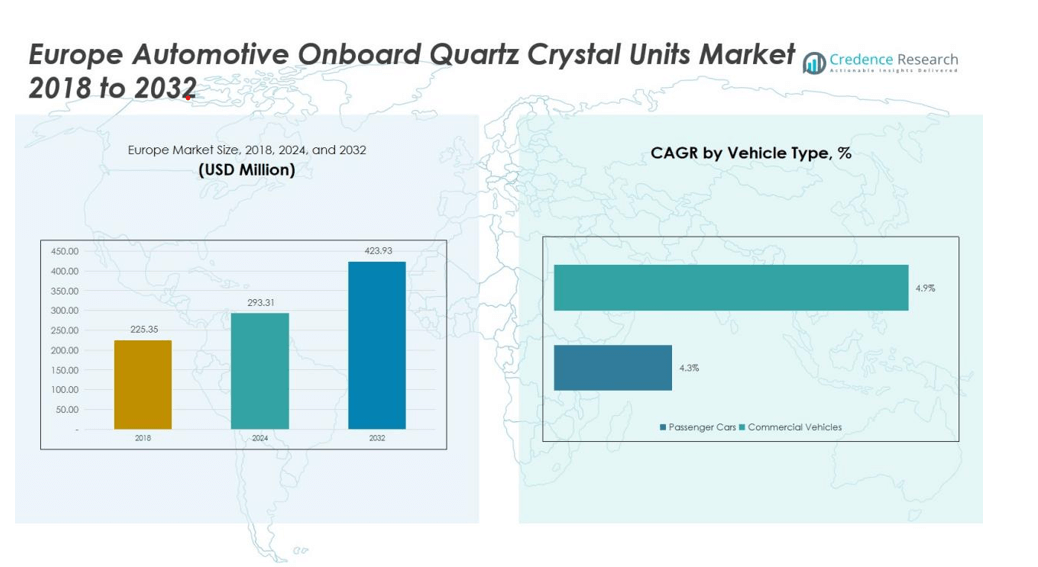

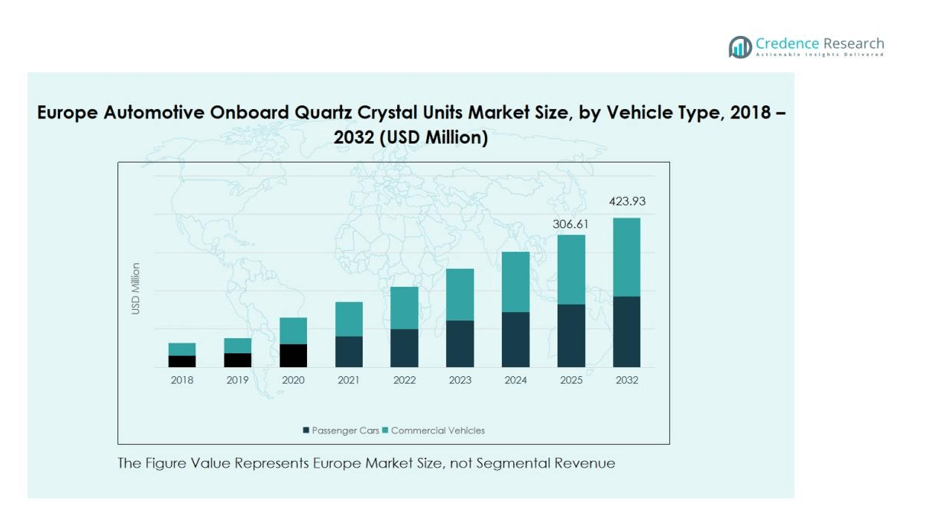

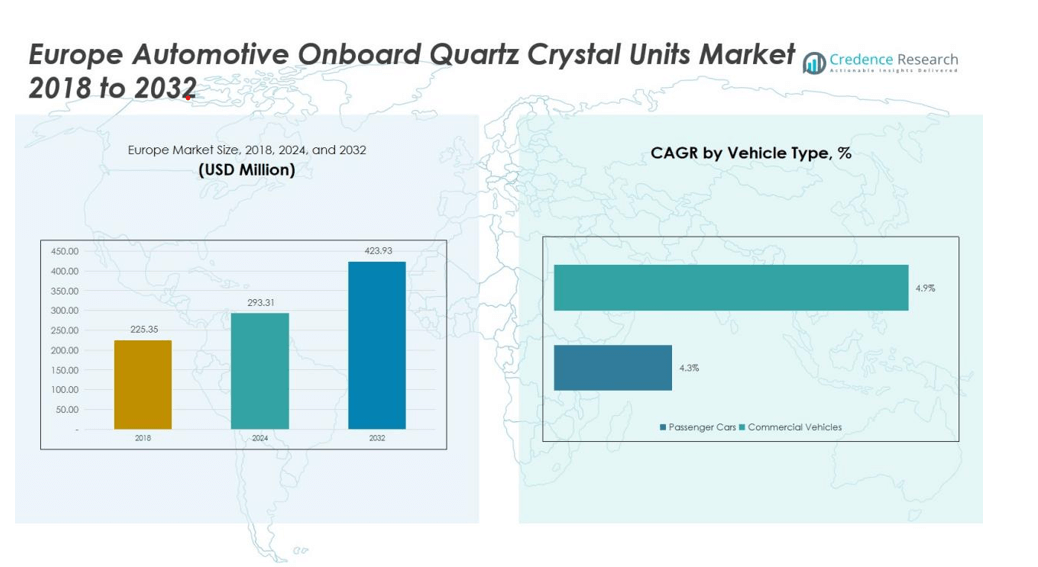

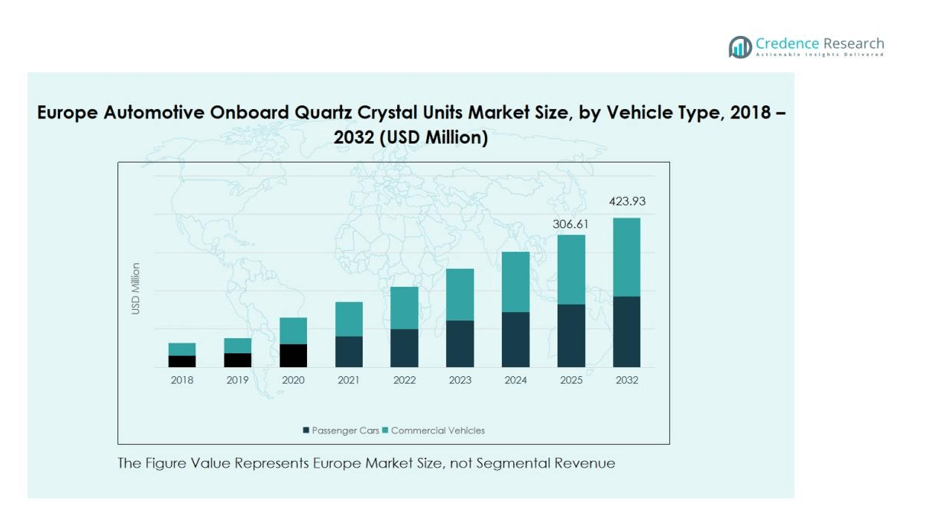

The Europe Automotive Onboard Quartz Crystal Units Market size was valued at USD 225.35 million in 2018 to USD 293.31 million in 2024 and is anticipated to reach USD 423.93 million by 2032, at a CAGR of 4.70% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Automotive Onboard Quartz Crystal Units Market Size 2024 |

USD 293.31 million |

| Europe Automotive Onboard Quartz Crystal Units Market , CAGR |

4.70% |

| Europe Automotive Onboard Quartz Crystal Units Market Size 2032 |

USD 423.93 Million |

Market growth is driven by rising demand for connected vehicles, electric mobility, and enhanced in-vehicle communication systems. Automakers are adopting high-stability crystal oscillators to improve signal accuracy and power efficiency. The shift toward autonomous and smart vehicles has also intensified the need for reliable frequency control components with superior temperature and vibration resistance. Technological innovations and miniaturization trends continue to influence product advancements across OEMs and Tier-1 suppliers.

Germany dominates the regional market, supported by its strong automotive manufacturing base and high R&D investment. France and the UK contribute significantly due to increasing adoption of advanced electronics in passenger and commercial vehicles. Central and Eastern Europe are emerging as growth hubs, driven by expanding vehicle production and localization of electronic component manufacturing.

Market Insights:

- The Europe Automotive Onboard Quartz Crystal Units Market was valued at USD 225.35 million in 2018, reaching USD 293.31 million in 2024, and is projected to attain USD 423.93 million by 2032, growing at a CAGR of 4.70% during the forecast period.

- Germany leads the market with nearly 36% share, supported by its strong automotive production base and extensive R&D infrastructure. France follows with around 21% share, driven by EV adoption and connected vehicle advancements, while the UK accounts for about 18% due to rapid integration of smart vehicle technologies.

- Southern and Eastern Europe represent the fastest-growing region with a combined share of roughly 15%, supported by rising localization of electronic component manufacturing and expanding automotive assembly operations.

- By vehicle segment, passenger cars dominate with nearly 68% share owing to extensive use of infotainment, ADAS, and energy management systems.

- By application, powertrain and safety systems together account for about 54% share, reflecting the growing reliance on precision timing components for performance control and stability in advanced automotive electronics.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Precision Timing in Advanced Vehicle Electronics

The Europe Automotive Onboard Quartz Crystal Units Market is driven by the growing need for precise frequency control in modern automotive electronics. Automakers increasingly rely on quartz crystal units for critical functions such as engine management, transmission control, infotainment, and safety systems. These components ensure stable timing and synchronization across multiple electronic control units. The expansion of electronic content per vehicle is strengthening their demand among OEMs and Tier-1 suppliers.

- For Instance, Murata Manufacturing Co., Ltd. introduced its third-generation HCR crystal series offering exceptional frequency accuracy of ±40 ppm and reliable performance from –40°C to +125°C to support advanced driver-assistance and communication systems in next-generation vehicles.

Rising Electrification and Integration of Smart Vehicle Technologies

The shift toward electric and hybrid vehicles has significantly increased the integration of advanced electronics. It has amplified the requirement for high-reliability crystal oscillators capable of performing under high temperature and vibration conditions. Quartz crystal units play a vital role in controlling power electronics, battery management, and communication systems. The focus on enhancing power efficiency and sensor performance supports consistent demand for advanced frequency control solutions.

- For Instance, NDK Nihon Dempa Kogyo supplies automotive-grade crystals like the NX1612SA series, which meet AEC-Q200 standards for precise timing in various vehicle systems, potentially including EV battery management.

Expansion of Connected and Autonomous Vehicle Ecosystems

Growing adoption of connected and autonomous vehicles across Europe is creating a strong market pull for precision timing devices. These vehicles depend on accurate synchronization for vehicle-to-everything (V2X) communication, navigation, and real-time data processing. Crystal units enable seamless connectivity and ensure the reliability of complex onboard systems. Their stability and low phase noise characteristics make them indispensable in emerging smart mobility architectures.

Emphasis on Reliability, Durability, and Compliance Standards

Automotive manufacturers are prioritizing components that meet strict reliability and quality standards under diverse operating conditions. The demand for quartz crystal units meeting AEC-Q200 and ISO/TS 16949 standards continues to rise. It ensures long-term operational stability and compliance with safety regulations across European markets. Continuous advancements in miniaturization and temperature-compensated designs further enhance their suitability for next-generation automotive applications.

Market Trends:

Adoption of Miniaturized and High-Performance Crystal Technologies

The Europe Automotive Onboard Quartz Crystal Units Market is witnessing a growing shift toward miniaturized, high-frequency components optimized for advanced automotive electronics. Automakers are integrating compact crystal units that support lighter and more energy-efficient electronic control systems. It reflects the industry’s move toward downsized components that deliver enhanced frequency precision and thermal stability. High-performance variants, including temperature-compensated and voltage-controlled crystal oscillators, are gaining traction for use in ADAS, infotainment, and EV power systems. Demand is also rising for quartz components with higher shock resistance to meet the rigorous operational standards of modern vehicles. The trend aligns with the automotive sector’s pursuit of improved reliability and performance consistency under harsh environmental conditions.

- For instance, Diodes Incorporated developed its XRQ series of automotive-compliant crystals that endure shocks up to 8,000g—over five times the standard 1,500g—ensuring stable operation in tire-pressure monitoring, infotainment, and ADAS applications while meeting SAE J2657 specifications

Integration of Crystal Units in Connected and Electric Vehicle Platforms

Integration of quartz crystal units in connected, electric, and autonomous vehicles is becoming a defining trend across the European market. It supports the development of high-speed communication interfaces and real-time control systems in next-generation mobility platforms. Growing investment in V2X communication, telematics, and smart navigation technologies is strengthening demand for frequency-stable components. EV manufacturers are incorporating these units to optimize synchronization between power converters, sensors, and control modules. Rising deployment of 5G networks is further encouraging the use of advanced oscillators for low-latency data transmission. The expanding role of frequency control in vehicle connectivity and energy efficiency continues to shape product innovation across the European automotive electronics supply chain.

- For Instance, In July 2025, Murata Manufacturing commercialized its XRCGB_F_C series 2016-size crystal units, which achieve a 60% reduction in implementation space compared to conventional 3225-size units.

Market Challenges Analysis:

High Cost Pressure and Complex Supply Chain Dependencies

The Europe Automotive Onboard Quartz Crystal Units Market faces increasing challenges due to pricing pressure and complex supply chain structures. Manufacturers must balance cost efficiency with stringent performance and reliability requirements from automakers. It remains difficult to manage material costs, particularly for high-purity quartz and specialized packaging materials. Supply chain disruptions, geopolitical tensions, and limited regional production capacity increase lead times and procurement risks. OEMs and Tier-1 suppliers face higher operational costs when sourcing precision components from Asia. These challenges are compelling European suppliers to enhance local production and strengthen vendor partnerships.

Technological Substitution and Integration Complexity in Modern Vehicles

Technological convergence across vehicle electronics introduces new compatibility and integration issues for crystal units. It is becoming difficult to maintain performance accuracy when multiple frequency sources operate simultaneously within compact architectures. The rise of MEMS oscillators poses a competitive challenge due to their smaller size and lower power consumption. Integrating quartz units into evolving EV and ADAS systems requires continuous design optimization and testing. Environmental regulations further increase compliance costs and restrict material choices. These factors collectively create barriers to scalability and slow down adoption among small and mid-tier automotive component manufacturers.

Market Opportunities:

Expansion of Electric and Autonomous Vehicle Manufacturing Across Europe

The Europe Automotive Onboard Quartz Crystal Units Market is poised to benefit from the rapid expansion of electric and autonomous vehicle manufacturing. Automakers are investing heavily in advanced electronics that depend on high-precision timing components. It creates strong demand for quartz units that ensure synchronization in battery management, infotainment, and communication systems. The transition toward vehicle electrification across Germany, France, and the UK provides long-term growth potential. Government incentives and sustainability mandates are accelerating EV adoption, which increases the use of compact and durable crystal oscillators. This shift is expected to generate continuous opportunities for suppliers offering temperature-resistant and energy-efficient crystal technologies.

Adoption of Advanced Connectivity and 5G-Enabled Vehicle Systems

Widespread implementation of 5G and V2X communication systems is opening new opportunities for crystal component manufacturers. It strengthens the need for precise frequency control solutions that support faster and more reliable data exchange in connected vehicles. Automakers are focusing on smart cockpit systems, predictive diagnostics, and cloud-based control units. These applications require quartz units with superior stability and low phase noise characteristics. The growing demand for enhanced in-vehicle connectivity and real-time information flow supports continuous innovation in frequency management technologies. European suppliers with expertise in automotive-grade crystal design can leverage these trends to expand their market footprint.

Market Segmentation Analysis:

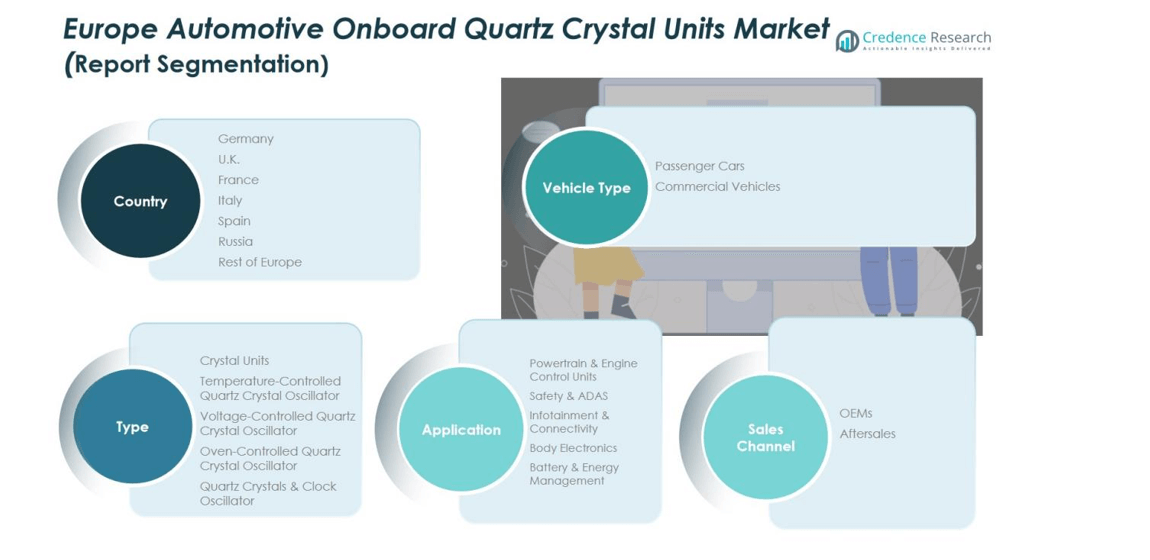

By Vehicle Segment

The Europe Automotive Onboard Quartz Crystal Units Market is segmented into passenger cars and commercial vehicles. Passenger cars hold a dominant share due to the growing use of advanced electronics in infotainment, safety, and navigation systems. It continues to gain momentum with the integration of electric powertrains and connected technologies. Commercial vehicles are also contributing steadily, supported by the adoption of telematics and real-time monitoring systems. The expansion of logistics and fleet management sectors strengthens demand for precision frequency components in heavy-duty applications.

- For instance, the European fleet management market is forecasted to grow from 16.3 million active units in 2023 to 27.6 million by 2028, representing a compound annual growth rate of 11.1%.

By Application Segment

The market covers applications such as powertrain and engine control units, safety and ADAS, infotainment and connectivity, body electronics, and battery and energy management. Powertrain and safety systems account for the largest share due to the critical role of timing components in performance control and safety monitoring. Infotainment and connectivity applications are growing rapidly with the rise of smart cockpit systems. Battery management systems in electric vehicles are creating new opportunities for high-reliability quartz oscillators designed for voltage and temperature stability.

- For instance, Infineon’s programmable oscillators used in advanced powertrain and ECU modules achieve outstanding signal precision with a frequency range up to 2.1 GHz and ultra-low RMS jitter performance of just 110 fs, ensuring superior timing stability in high-performance automotive environments.

By Sales Channel Segment

The market is distributed through OEM and aftermarket channels. OEMs dominate due to direct integration of crystal units during vehicle production. It supports compliance with automotive standards and ensures product reliability. The aftermarket segment is expanding with increased vehicle lifespan and replacement of frequency components in older models, particularly across Eastern and Southern Europe.

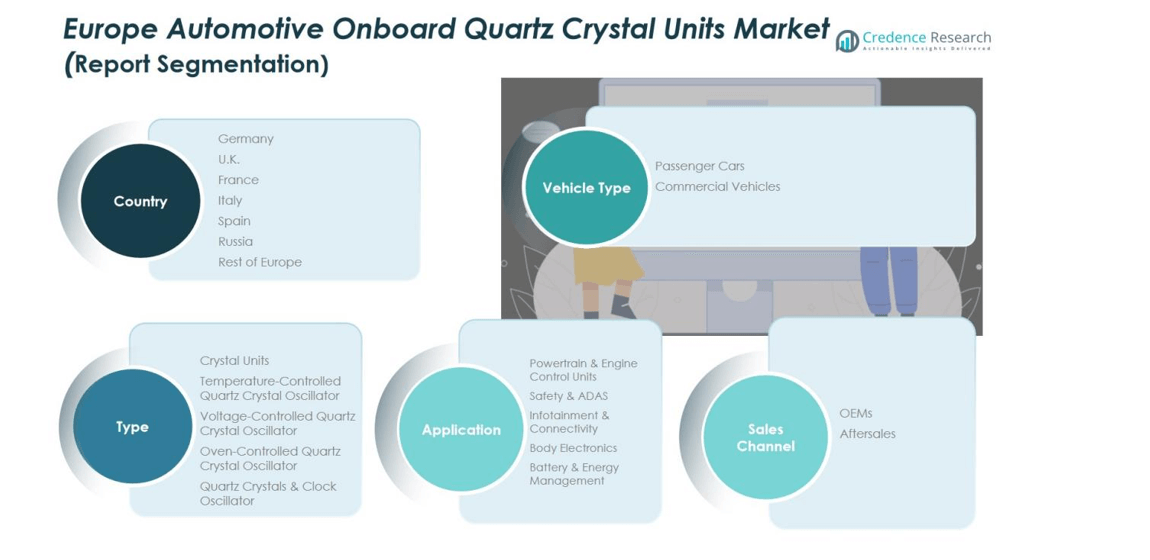

Segmentations:

By Vehicle Segment

- Passenger Cars

- Commercial Vehicles

By Application Segment

- Powertrain & Engine Control Units

- Safety & ADAS

- Infotainment & Connectivity

- Body Electronics

- Battery & Energy Management

By Type Segment

- Crystal Units

- Temperature-Controlled Quartz Crystal Oscillator (TCXO)

- Voltage-Controlled Quartz Crystal Oscillator (VCXO)

- Oven-Controlled Quartz Crystal Oscillator (OCXO)

- Quartz Crystals & Clock Oscillator

By Sales Channel Segment

By Country (Europe)

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Rest of Europe

Regional Analysis:

Germany Leading Regional Production and Technological Advancements

The Europe Automotive Onboard Quartz Crystal Units Market is strongly driven by Germany’s dominance in automotive production and innovation. The country hosts major OEMs and Tier-1 suppliers investing in precision electronic components. It benefits from advanced manufacturing capabilities, strong R&D programs, and collaborations between crystal unit producers and automotive electronics firms. The rise of electric and autonomous vehicles further supports high-volume adoption of temperature-stable and vibration-resistant quartz oscillators. Government support for sustainable transport initiatives strengthens the demand outlook within Germany’s automotive supply chain.

France and the United Kingdom Accelerating Adoption of Advanced Vehicle Electronics

France and the UK hold significant shares of the regional market, supported by their focus on smart mobility and connected vehicle systems. Automakers are integrating high-performance quartz components across infotainment, telematics, and ADAS platforms. It aligns with national strategies emphasizing road safety, communication infrastructure, and electrification. French manufacturers are adopting energy-efficient oscillators for EV applications, while UK-based firms are prioritizing high-frequency control systems in autonomous technology development. Both countries benefit from strong engineering ecosystems and ongoing investments in EV and hybrid vehicle production.

Southern and Eastern Europe Emerging as Competitive Manufacturing Hubs

Southern and Eastern European nations, including Italy, Spain, and Poland, are emerging as cost-competitive manufacturing bases for electronic components. It supports localized production and faster supply to automotive assembly plants. Rising vehicle output and growing aftermarket demand in these regions encourage expansion of quartz component suppliers. Increasing investment from Asian and global manufacturers in local facilities strengthens the regional value chain. The growing focus on affordable yet reliable automotive electronics positions these countries as future growth contributors within the European quartz crystal unit market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Jauch Group

- NDK (Nihon Dempa Kogyo Co., Ltd.)

- TXC Corporation

- Kyocera Corporation

- Seiko Epson Corporation

- Daishinku Corp (KDS)

- TKD Science

- Guoxin Micro

- Diodes Incorporated

- CTS Corporation

- Murata Manufacturing Co., Ltd.

Competitive Analysis:

The Europe Automotive Onboard Quartz Crystal Units Market is characterized by strong competition among established global and regional manufacturers. Key players include Jauch Group, NDK (Nihon Dempa Kogyo Co., Ltd.), TXC Corporation, Kyocera Corporation, Seiko Epson Corporation, Daishinku Corp (KDS), and TKD Science. These companies compete through innovation in crystal oscillator design, improved temperature stability, and miniaturization to meet modern automotive standards. It focuses on developing automotive-grade quartz components that ensure precise timing and long-term reliability under demanding environments. Strategic partnerships with OEMs and Tier-1 suppliers strengthen their presence in major European markets. Continuous investments in R&D and production automation support efficiency, cost optimization, and compliance with AEC-Q200 and ISO standards. The competitive environment emphasizes quality, technological leadership, and supply reliability to maintain strong positioning within the evolving automotive electronics ecosystem.

Recent Developments:

- In October 2025, Jauch Group expanded its high-performance lithium-ion round cell lineup by launching the LI18650 and LI21700 models, designed for medical, industrial, and power tool applications.

- In August 2024, NDK formed a strategic alliance with Rotakorn Electronics AB, enabling the supply of crystal units and oscillators to customers in Nordic countries.

Report Coverage:

The research report offers an in-depth analysis based on Vehicle, Application, Type, Sales Channel and Country. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Europe Automotive Onboard Quartz Crystal Units Market is expected to witness steady growth supported by advancements in automotive electronics.

- Demand for temperature-resistant and vibration-stable crystal units will increase with EV and ADAS integration.

- OEMs will prioritize suppliers offering automotive-grade products compliant with AEC-Q standards.

- Smart mobility initiatives and connected vehicle development will create new application opportunities.

- Manufacturers will invest in miniaturized and energy-efficient designs for compact control modules.

- Localization of electronic component production across Eastern Europe will strengthen supply resilience.

- Collaborations between crystal manufacturers and semiconductor companies will accelerate innovation in oscillator technology.

- The growing shift toward electric and hybrid vehicles will expand the need for reliable timing devices.

- European sustainability goals will encourage the use of eco-friendly materials and efficient manufacturing processes.

- Long-term growth will rely on advanced R&D capabilities and partnerships focused on next-generation vehicle electronics.