Market Overview

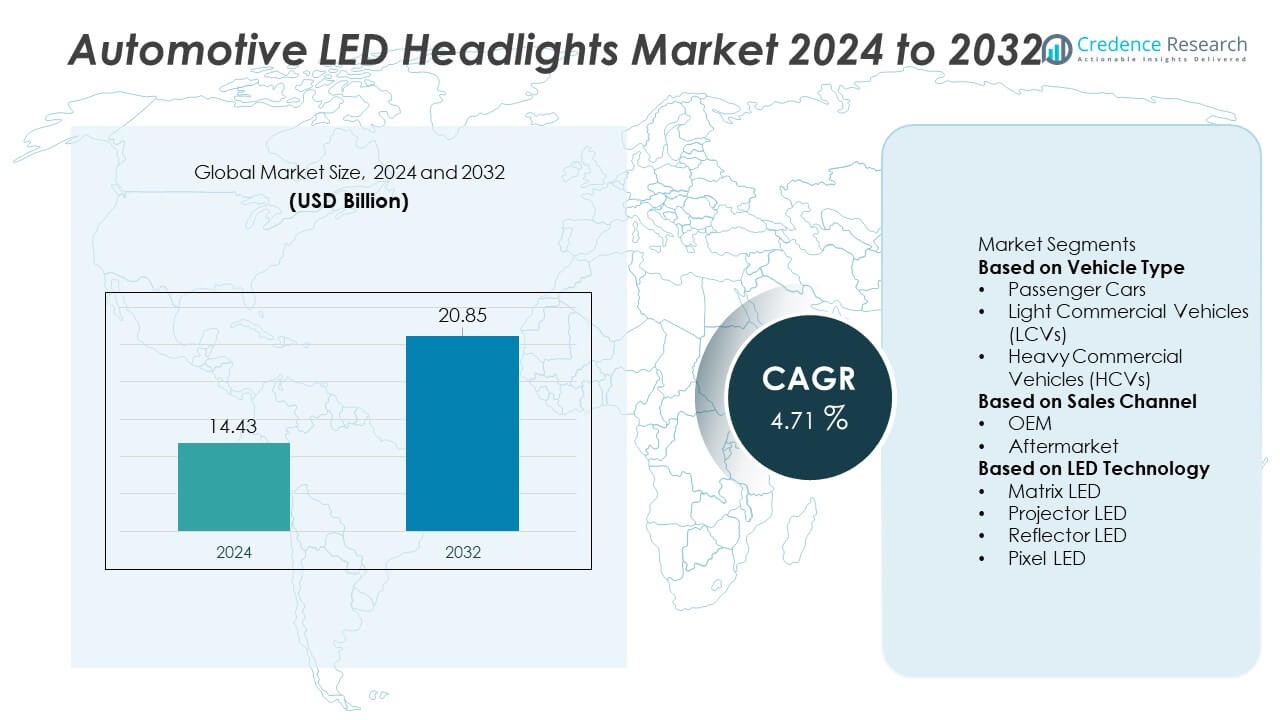

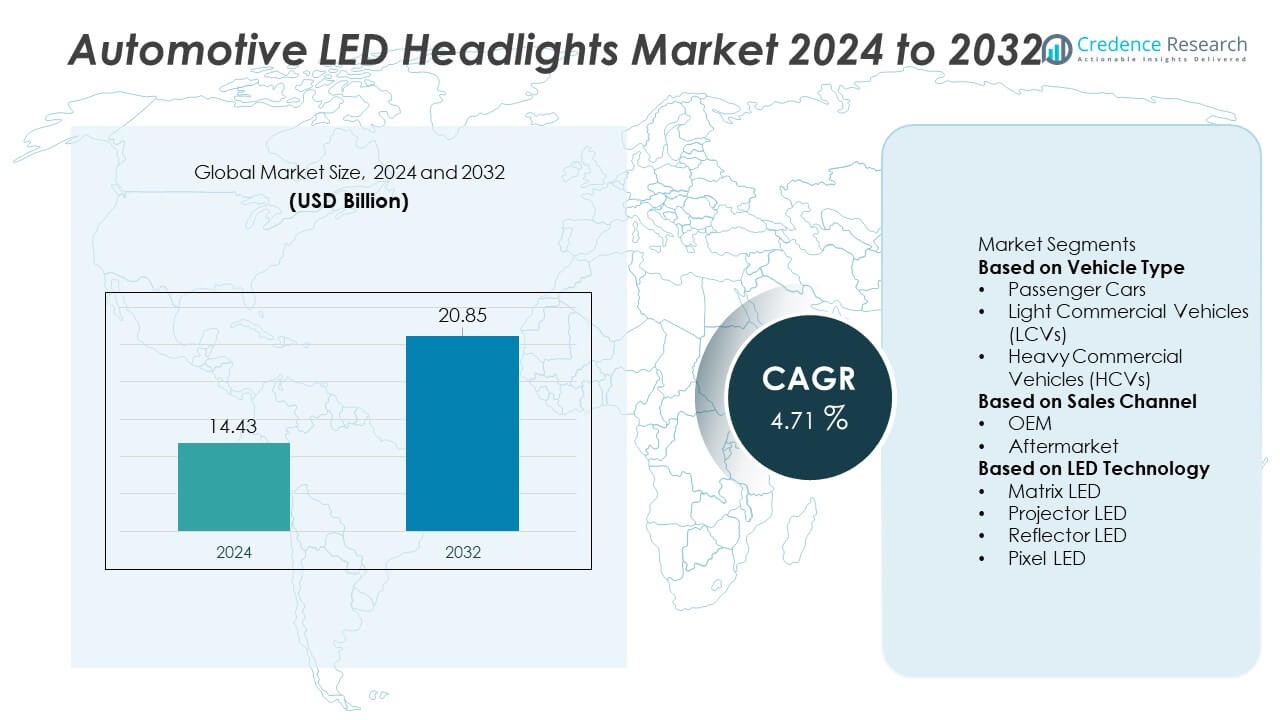

The Automotive LED Headlights Market was valued at USD 14.43 billion in 2024 and is projected to reach USD 20.85 billion by 2032, expanding at a CAGR of 4.71% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive LED Headlights Market Size 2024 |

USD 14.43 Billion |

| Automotive LED Headlights Market, CAGR |

4.71% |

| Automotive LED Headlights Market Size 2032 |

USD 20.85 Billion |

The Automotive LED Headlights market is driven by leading players such as HELLA GmbH & Co. KGaA, OSRAM Licht AG, Stanley Electric Co., Ltd., Koito Manufacturing Co., Ltd., Magneti Marelli S.p.A., Valeo S.A., Philips (Signify), ZKW Group, Hyundai Mobis, and Lumileds Holding B.V. These manufacturers expand advanced LED technologies, including matrix and projector systems, to improve visibility, energy efficiency, and safety across modern vehicle platforms. Asia Pacific leads the market with a 34% share due to high vehicle production and strong LED integration, followed by Europe with a 32% share driven by premium vehicle demand, while North America holds a 28% share supported by rapid adoption of advanced lighting systems in SUVs and EVs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Automotive LED Headlights market is valued at USD 14.43 billion in 2024 and grows at a CAGR of 4.71% through 2032.

- Market growth is driven by rising demand for energy-efficient, long-lasting lighting systems, with the passenger car segment holding a 71% share due to strong LED integration in compact, mid-range, and premium vehicles.

- Key trends include rapid adoption of adaptive lighting, matrix LED technology, and intelligent beam-control features that enhance visibility, safety, and vehicle styling.

- Competition intensifies as major players focus on thermal management innovation, compact optical modules, and OEM collaborations, while high initial costs remain a restraint in entry-level vehicle categories.

- Asia Pacific leads the market with a 34% share, followed by Europe at 32%, and North America at 28%, while OEM sales dominate with a 78% share, reflecting strong factory-installed LED adoption across new vehicle models.

Market Segmentation Analysis:

By Vehicle Type

Passenger cars lead the Automotive LED Headlights market with a 71% share, driven by rising adoption of LED systems across compact, mid-range, and premium models. Automakers integrate advanced LED units to improve visibility, reduce power use, and enhance styling. Growing demand for safe night-driving features also boosts LED penetration in passenger cars. LCVs show steady uptake as fleet owners prioritize longer-lasting lighting systems. HCVs adopt LEDs to support extended operating hours and lower maintenance needs. Expanding production of electric passenger cars strengthens demand for efficient LED headlamps across global markets.

- For instance, HELLA introduced an SSL | 100 matrix LED module that contains 100 controllable pixels in a single unit, enabling precise beam adaptation during high-speed driving.

By Sales Channel

OEM sales dominate the market with a 78% share, supported by widespread integration of LED headlights in factory-fitted vehicle configurations. Automakers focus on energy-efficient lighting to meet safety rules and improve design appeal. OEMs also push adaptive and intelligent LED technologies to enhance driving precision. The aftermarket grows as vehicle owners upgrade from halogen units to LED systems for better durability and brightness. Replacement demand rises in regions with harsh weather conditions. Continued emphasis on premium lighting packages strengthens OEM-led adoption across major automotive brands.

- For instance, Koito developed a laser-assisted LED headlamp system capable of projecting a high-beam reach of 600 meters, offering stronger range than standard LED modules that average 250 to 300 meters.

By LED Technology

Projector LED technology holds a 46% share, making it the dominant segment due to its focused beam pattern and enhanced road illumination. Automakers use projector LEDs to improve night visibility while maintaining compact headlamp designs. Matrix LED systems gain traction as premium vehicles adopt adaptive beam functions. Reflector LEDs remain popular in mass-market models due to low cost and easy integration. Pixel LED technology emerges in luxury cars for precise light distribution and advanced safety features. Growing interest in intelligent headlamp functions supports innovation across LED technologies.

Key Growth Drivers

Rising Adoption of Energy-Efficient and Long-Lasting Lighting Systems

Automotive LED headlights gain strong traction as manufacturers shift toward energy-efficient systems that improve vehicle performance and reduce power consumption. LEDs offer longer lifespan, faster illumination, and higher brightness than halogen and HID lamps, making them ideal for modern vehicle platforms. Growing awareness of road safety encourages automakers to integrate brighter and more reliable lighting technologies. The push toward sustainability and reduced CO₂ emissions strengthens the use of LEDs in EVs and hybrid models. These advantages drive widespread adoption across passenger cars and commercial fleets.

- For instance, Audi adopted this LED platform in high-performance headlamps that operate for more than 5,000 hours under continuous load. The compact footprint enables tighter optical layouts in EV headlight modules.

Increasing Demand for Advanced Safety and Adaptive Lighting Features

Consumers and regulators prioritize road safety, fueling demand for adaptive LED headlights that adjust beam patterns based on driving conditions. Technologies such as matrix LEDs and automatic high-beam systems enhance visibility while minimizing glare for oncoming traffic. Automakers integrate intelligent lighting functions to support safe night driving and improve driver comfort. These advanced features become standard in mid-range and premium vehicles, boosting LED penetration. Safety-focused innovations continue to drive strong replacement and upgrade demand across global markets.

- For instance, Valeo introduced an adaptive beam module equipped with 40 individually controlled LEDs, allowing beam changes within 20 milliseconds.

Expansion of Premium and Mid-Range Vehicle Production

Growth of premium and feature-rich mid-range vehicles supports the adoption of LED headlights as standard equipment. Automakers use stylish LED headlamp designs to enhance brand appeal and differentiate new models. The rising influence of EV manufacturers accelerates LED usage due to the technology’s low energy draw and design flexibility. Increased disposable income and demand for modern vehicle aesthetics further strengthen LED adoption. As OEMs push advanced lighting packages across wider vehicle segments, the market experiences steady, long-term growth.

Key Trends & Opportunities

Advancement of Intelligent and Adaptive LED Headlight Technologies

Intelligent lighting systems such as matrix LED and pixel LED headlights present strong opportunities as automakers focus on precision illumination and enhanced visibility. These technologies offer dynamic beam control, selective high-beam masking, and improved road-edge detection. Integration with ADAS platforms creates new product opportunities for suppliers. Premium and EV manufacturers lead adoption, pushing demand for compact, efficient, and software-controlled lighting units. This trend accelerates as consumers seek comfort, safety, and futuristic design elements.

- For instance, ZKW developed a pixel LED module with 1,024 individually addressable light points, enabling highly precise adaptive control.

Growing Aftermarket Demand for LED Upgrades and Customization

The aftermarket sees rising demand as vehicle owners upgrade from halogen and HID lamps to LED headlights for improved brightness, durability, and aesthetics. Affordable plug-and-play LED conversion kits expand consumer adoption. Custom lighting accessories such as DRLs, projector units, and sequential indicators gain popularity among younger buyers. Aftermarket growth strengthens in regions with older vehicle fleets and harsh driving conditions. This trend creates strong opportunities for suppliers offering certified, high-performance LED solutions.

- For instance, Philips (Signify) released an Ultinon Pro9000 retrofit LED bulb delivering 1,500 lumens per lamp (for H4 and H7 types) with a color temperature of 5,800 K. Other versions, such as the H11, deliver 1,350 lumens.

Key Challenges

High Initial Cost of LED and Advanced Lighting Systems

LED headlights remain more expensive than halogen and HID systems, limiting adoption in low-cost vehicle segments. Advanced technologies such as matrix and pixel LEDs increase manufacturing costs due to complex components and control modules. Price-sensitive markets hesitate to shift fully to LED solutions. Automakers face challenges balancing cost with performance while integrating premium lighting features across broader vehicle lines. High cost continues to slow adoption in entry-level models and developing regions.

Technical Integration and Thermal Management Issues

LED systems require effective heat dissipation to maintain performance and lifespan. Poor thermal management can lead to reduced brightness, color changes, or early failure. Automakers must design compact yet efficient cooling systems to support high-intensity LED modules. Integration challenges increase with advanced technologies like matrix LEDs that need precise control units and sensors. These technical complexities raise development time and require specialized expertise, creating hurdles for manufacturers and suppliers.

Regional Analysis

North America

North America holds a 28% share of the Automotive LED Headlights market, supported by strong adoption of advanced lighting technologies in passenger cars and SUVs. Automakers integrate LED systems to improve safety, styling, and energy efficiency across new vehicle models. Higher consumer preference for premium and mid-range vehicles accelerates LED penetration across the U.S. and Canada. Strict road safety regulations and rising demand for adaptive headlights further strengthen market growth. Expanding EV production also boosts the use of LED headlights due to their low power consumption and design flexibility.

Europe

Europe accounts for a 32% share, driven by strong demand for advanced lighting technologies in premium and luxury vehicle segments. Leading automotive manufacturers in Germany, France, and the U.K. integrate matrix and projector LED systems to meet safety norms and enhance night visibility. The region’s strict regulatory standards push OEMs to adopt energy-efficient lighting solutions. EV adoption and the shift toward intelligent lighting systems also support market expansion. Europe remains a key hub for innovation in adaptive headlights and LED-based safety enhancements.

Asia Pacific

Asia Pacific leads the global market with a 34% share, fueled by large-scale vehicle production across China, Japan, India, and South Korea. Growing demand for passenger cars and rising vehicle exports strengthen LED headlight adoption across various segments. Automakers focus on upgrading lighting systems to improve road safety and meet evolving consumer expectations. Expanding EV manufacturing and rapid urbanization increase the need for energy-efficient lighting. Competitive pricing and high penetration of mid-range vehicles further drive LED adoption across the region.

Latin America

Latin America holds a 4% share, driven by steady adoption of LED headlights in Brazil, Mexico, and Argentina. Increasing demand for safer and more durable lighting systems supports LED penetration across mid-range vehicles. OEM adoption rises as automakers introduce modern lighting packages in new models. The aftermarket plays a key role as consumers upgrade from halogen units to LEDs for better visibility and longer lifespan. Economic improvements and expanding vehicle fleets contribute to gradual growth in the region.

Middle East & Africa

The Middle East & Africa region captures a 2% share, supported by rising demand for LED headlights in countries such as the UAE, Saudi Arabia, and South Africa. Harsh climate conditions increase the need for durable and energy-efficient lighting systems. OEM adoption grows as global automakers introduce new models with LED-based exterior lighting. Premium vehicle sales and increased EV interest also strengthen market momentum. The aftermarket contributes to growth as vehicle owners seek visibility improvements and longer-lasting lighting solutions.

Market Segmentations:

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

By Sales Channel

By LED Technology

- Matrix LED

- Projector LED

- Reflector LED

- Pixel LED

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Automotive LED Headlights market includes major players such as HELLA GmbH & Co. KGaA, OSRAM Licht AG, Stanley Electric Co., Ltd., Koito Manufacturing Co., Ltd., Magneti Marelli S.p.A., Valeo S.A., Philips (Signify), ZKW Group, Hyundai Mobis, and Lumileds Holding B.V. These companies strengthen their market presence by expanding LED technology portfolios, improving energy efficiency, and integrating adaptive lighting systems into modern vehicles. Manufacturers focus on matrix LEDs, projector modules, and intelligent beam-control technologies to support rising safety standards and enhance night-driving visibility. Strategic partnerships with automakers help accelerate the adoption of premium lighting systems across passenger and commercial vehicles. Continuous innovation in thermal management, optical design, and compact headlamp structures drives product differentiation. As EV adoption increases, suppliers develop lightweight, low-power LED solutions that improve vehicle range and support futuristic design requirements. The market remains highly competitive as companies invest in R&D and expand global production capabilities.

Key Player Analysis

- HELLA GmbH & Co. KGaA

- OSRAM Licht AG

- Stanley Electric Co., Ltd.

- Koito Manufacturing Co., Ltd.

- Magneti Marelli S.p.A.

- Valeo S.A.

- Philips (Signify)

- ZKW Group

- Hyundai Mobis

- Lumileds Holding B.V.

Recent Developments

- In September 2025, Hyundai Mobis reaffirmed its vision for future mobility at the IAA Mobility 2025 expo, highlighting lighting among its core innovation pillars including “Sustainable Electrification” and “Vision in Motion.”

- In July 2025, ams OSRAM and Marelli (formerly Magneti Marelli S.p.A.) announced a collaboration to supply micro-LED headlights with high-resolution pixel control for the premium electric sedan Nio ET9.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Sales Channel, LED Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Automotive LED headlight adoption will rise as automakers prioritize energy-efficient lighting systems.

- Adaptive and matrix LED technologies will gain traction with growing focus on safety.

- EV manufacturers will increase LED integration to support low power consumption and modern styling.

- OEMs will expand LED features across mid-range vehicles, strengthening overall market penetration.

- Aftermarket upgrades will grow as consumers replace halogen units with LED systems.

- Advances in thermal management will improve durability and performance of high-intensity LEDs.

- Pixel LED and laser-assisted LED technologies will emerge in more premium vehicle models.

- Stringent lighting and safety regulations will accelerate adoption across global markets.

- Compact LED modules will support modern headlamp designs and lightweight vehicle structures.

- Emerging markets will experience faster LED adoption as vehicle production and safety awareness increase.