Market Overview

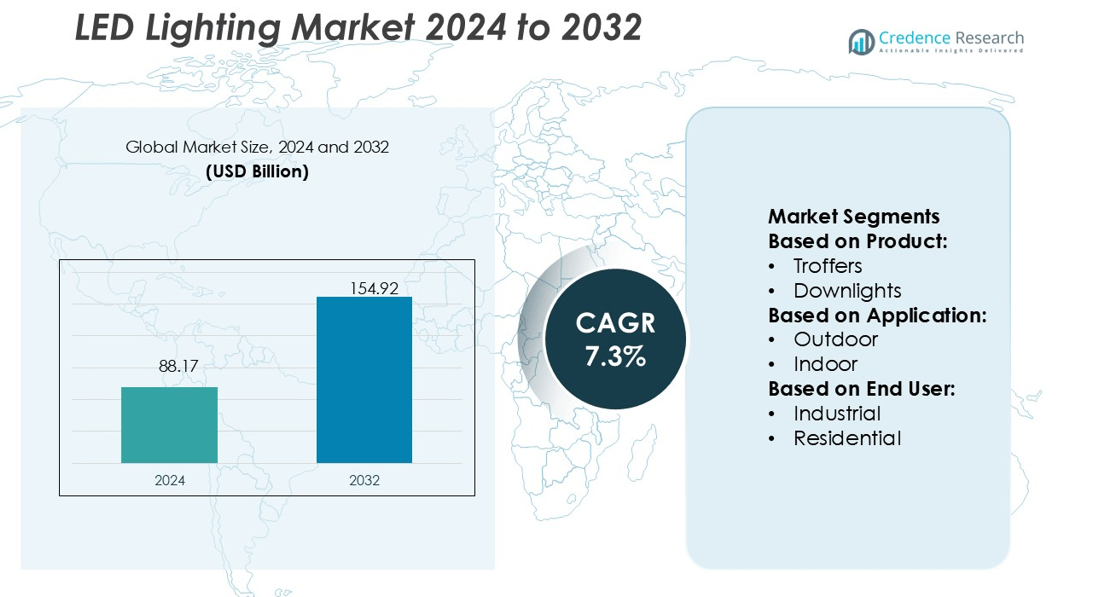

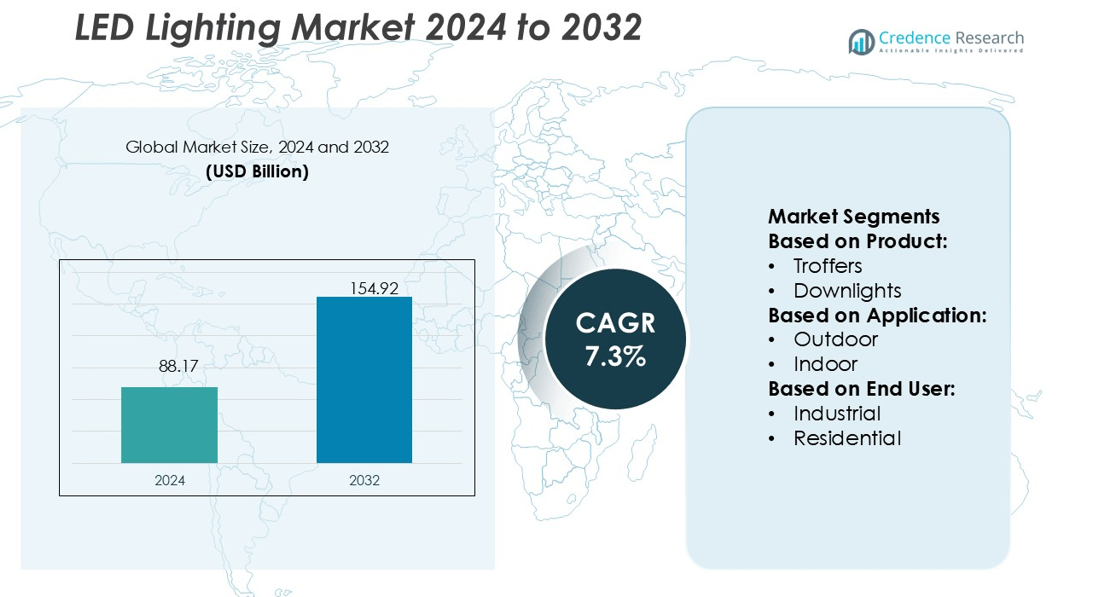

LED Lighting Market size was valued USD 88.17 billion in 2024 and is anticipated to reach USD 154.92 billion by 2032, at a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| LED Lighting Market Size 2024 |

USD 88.17 billion |

| LED Lighting Market, CAGR |

7.3% |

| LED Lighting Market Size 2032 |

USD 154.92 billion |

The LED lighting market is driven by prominent players such as Acuity Brands, Inc., Cree Lighting USA LLC, Dialight, Halonix Technologies Private Limited, Hubbell, LSI Industries Inc., Nanoleaf, Panasonic Corporation, Savant Technologies LLC, and Seoul Semiconductor Co., Ltd. These companies focus on advancing smart lighting solutions, energy-efficient designs, and sustainable technologies to strengthen global competitiveness. Asia-Pacific emerges as the leading region, commanding 34% market share in 2024, supported by rapid urbanization, large-scale infrastructure projects, and strong government initiatives promoting energy efficiency. The region’s manufacturing capacity and cost advantages further reinforce its dominance.Top of Form

Market Insights

- The LED Lighting Market was valued at USD 88.17 billion in 2024 and is projected to reach USD 154.92 billion by 2032, growing at a CAGR of 7.3% during the forecast period.

- Rising demand for energy-efficient and sustainable lighting solutions drives market expansion, with strong adoption in residential, commercial, and industrial sectors supported by government incentives and stricter energy standards.

- Smart lighting and IoT integration emerge as key trends, with companies investing in connected solutions, human-centric lighting, and recyclable product designs to meet evolving consumer and corporate sustainability goals.

- Intense competition among players such as Acuity Brands, Inc., Panasonic Corporation, Hubbell, and Seoul Semiconductor Co., Ltd. drives continuous innovation, though high initial investment costs remain a restraint in price-sensitive markets.

- Asia-Pacific leads with 34% share in 2024, while the luminaries segment holds the largest share among product categories, supported by widespread deployment in infrastructure and smart city projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The luminaries segment leads the LED lighting market, capturing 41% share in 2024. This dominance is driven by strong adoption of troffers, downlights, and streetlights in large-scale infrastructure and commercial projects. Troffers remain widely deployed in office spaces due to energy savings and easy retrofitting. Streetlights also gain traction with government initiatives for smart city development and reduced energy costs. The integration of advanced control systems further supports demand. Meanwhile, lamps, including A-lamps and T-lamps, continue to serve residential retrofitting but lag behind luminaries in growth momentum.

- For instance, Dialight has deployed over a million industrial LED fixtures globally. Its Vigilant® High Bay luminaires, including models with up to 71,000 lumens at up to 155 lumens per watt, can achieve significant energy savings, with some applications reporting over 65% reduction in energy consumption compared to conventional lighting systems.

By Application

Indoor applications hold 62% market share, making them the dominant segment in 2024. Residential and commercial buildings rely heavily on indoor LED systems for efficiency, design flexibility, and longer lifespan compared to traditional lighting. Demand is supported by large-scale urban housing projects and corporate investments in energy-efficient infrastructure. For instance, LEDs in offices reduce energy consumption by nearly 50% compared to fluorescent fixtures. Outdoor applications, particularly in street lighting, stadiums, and parking spaces, are growing steadily due to public infrastructure upgrades but remain secondary to indoor adoption.

- For instance, SunLike LEDs have a very high color rendering index, with some versions achieving a CRI of 95 or higher. This indicates that they reproduce colors more accurately and vibrantly than conventional LEDs. Some product lines may reach up to CRI 97 or 98.

By End-User

The commercial segment dominates with 38% share in 2024, supported by widespread LED deployment in offices, retail spaces, and hospitality sectors. Businesses prioritize LEDs for cost savings, sustainability compliance, and advanced lighting controls that enhance work environments. Industrial usage also contributes significantly with adoption in warehouses and factories to improve operational efficiency. Residential demand is growing but remains smaller in share, driven by falling LED prices and consumer awareness of energy savings. Government initiatives for sustainable infrastructure and green building certifications continue to strengthen commercial adoption.

Key Growth Drivers

Energy Efficiency and Cost Savings

Energy efficiency remains the primary driver of LED lighting adoption, as LEDs consume up to 75% less energy than incandescent bulbs and last 25 times longer. This efficiency directly reduces electricity bills for residential, commercial, and industrial users, making LED technology highly attractive. Governments and organizations promote adoption through incentives, rebates, and stricter energy standards, further boosting market growth. Companies also emphasize lifecycle cost benefits, where reduced maintenance and replacement costs add long-term value. This strong financial and environmental benefit continues to drive widespread deployment globally.

- For instance, Hubbell’s Protecta X LED luminaire offers a system life exceeding 120,000 hours at 25 °C and claims 50% energy savings compared to fluorescent alternatives in field deployment.

Government Regulations and Sustainability Goals

Stringent government policies on energy conservation and carbon emissions significantly accelerate LED adoption. Bans on incandescent and halogen lamps across multiple regions encourage replacement with LED systems. Additionally, sustainability goals linked to climate change mitigation push organizations to adopt eco-friendly lighting solutions. International commitments, such as the Paris Agreement, enhance pressure on industries to cut emissions, with lighting as a critical focus area. Smart city initiatives also integrate LED streetlights with connected systems, reducing energy consumption and operational costs. Regulations and sustainability mandates strongly reinforce market expansion.

- For instance, Aculux 5° Precision Spot delivery 32,000 CPCB (candela per beam) from a 3-inch aperture, offering beam control in demanding environments.

Technological Advancements and Smart Integration

Continuous innovations in LED technology contribute to market growth, offering higher efficiency, better color rendering, and improved design flexibility. Integration with smart systems allows remote operation, automated controls, and adaptive lighting, which enhance user convenience and energy management. Advances in wireless connectivity, such as IoT and Li-Fi, expand LED applications across smart homes, offices, and outdoor infrastructure. Manufacturers are also introducing human-centric lighting that mimics natural daylight, improving health and productivity. These technological breakthroughs not only expand the scope of applications but also strengthen LED market competitiveness.

Key Trends & Opportunities

Smart and Connected Lighting Expansion

Smart lighting is rapidly transforming the market, enabling remote control, automation, and energy optimization. Integration with IoT, sensors, and voice assistants supports connected home ecosystems and commercial building automation. Enterprises use data-driven insights from connected lighting systems to improve energy management and enhance workplace environments. Governments deploy smart streetlighting solutions to improve efficiency and safety in urban areas. The expansion of connected lighting creates opportunities for service providers, software developers, and hardware manufacturers to offer integrated solutions, positioning smart systems as a key growth frontier.

- For instance, LSI’s AirLink Blue system uses a Bluetooth mesh network that lets fixtures autonomously dim or switch based on motion and daylight. Multiple fixtures can be grouped together, with some sensors capable of controlling up to 150 fixtures in a coordinated fashion.

Focus on Sustainable and Circular Solutions

Sustainability trends shape LED innovation, with companies adopting recyclable materials, eco-friendly packaging, and low-impact manufacturing processes. Circular economy practices, such as refurbishment and reusability of lighting components, reduce waste and align with environmental regulations. Consumers increasingly prioritize sustainable brands, while corporate buyers align purchases with ESG goals. Green building certifications further support LED adoption in construction projects. Opportunities arise for manufacturers to create differentiated offerings through eco-focused designs. The strong global shift toward environmental responsibility positions sustainable LED solutions as a significant opportunity for market players.

- For instance, Panasonic’s circular plastics project recovers 17,000 tonnes per year via cascade recycling and 8,000 tonnes per year via horizontal recycling, feeding back into appliances and components.

Key Challenges

High Initial Investment Costs

Despite long-term savings, the higher upfront cost of LED lighting compared to traditional systems poses a challenge, especially in price-sensitive markets. Small-scale consumers and businesses may delay adoption due to budget constraints. While government incentives help offset costs, the financial barrier remains in emerging economies with limited subsidy structures. Manufacturers face pressure to reduce prices without compromising quality. Overcoming this challenge requires scaling production, enhancing cost efficiencies, and creating financing models that spread costs over time to make LED systems more accessible.

Market Fragmentation and Intense Competition

The LED lighting market is highly fragmented, with numerous global, regional, and local players competing aggressively. Price wars and low-cost imports reduce profit margins, particularly in developing regions. Differentiation based on quality, innovation, and after-sales services becomes essential for survival. Intellectual property disputes and counterfeit products further disrupt the market landscape. Larger players invest heavily in R&D, but smaller firms struggle to maintain competitiveness. This intense rivalry challenges long-term profitability and drives consolidation trends as companies seek scale and stronger market positioning.

Regional Analysis

North America

North America holds 28% share of the LED lighting market in 2024, driven by strong adoption across commercial, residential, and outdoor applications. The United States leads the region with federal energy-efficiency programs, rebates, and building codes promoting LED installations. Smart city initiatives further accelerate deployment of connected streetlights. Canada emphasizes sustainable construction projects that integrate advanced lighting systems into residential and commercial buildings. The region also benefits from high disposable incomes and consumer awareness of energy savings. Leading manufacturers invest in R&D for smart and connected solutions, strengthening market penetration across industries.

Europe

Europe accounts for 26% share of the global LED lighting market in 2024, supported by strict environmental regulations and EU directives banning inefficient lighting systems. Countries such as Germany, France, and the UK drive demand with large-scale retrofitting projects in residential and commercial sectors. The push for carbon neutrality and adoption of circular economy principles further encourage LED integration. Government-backed smart city programs promote energy-efficient streetlighting, enhancing regional market growth. Strong investments in research and design foster innovations in sustainable lighting solutions. Europe’s regulatory framework and focus on green infrastructure sustain its competitive positioning.

Asia-Pacific

Asia-Pacific dominates the global LED lighting market with 34% share in 2024, making it the largest regional segment. China leads with extensive production capacity and government initiatives supporting energy-efficient infrastructure. India follows with smart city projects and subsidies encouraging LED adoption in residential and public sectors. Rapid urbanization, industrialization, and rising construction activities across Southeast Asia further fuel demand. The region also benefits from strong manufacturing bases, enabling competitive pricing and large-scale exports. Growth is reinforced by expanding smart home adoption and increasing corporate investments in digitalized, sustainable lighting systems.

Latin America

Latin America holds 7% share of the global LED lighting market in 2024, with growth supported by urban development and infrastructure modernization. Brazil and Mexico lead the regional demand, particularly in streetlighting and commercial building retrofits. Government energy-efficiency programs and falling LED costs support residential adoption. However, economic constraints and limited subsidy structures restrict wider deployment. Despite challenges, opportunities arise from smart lighting initiatives in metropolitan areas and ongoing construction projects. Regional distributors and partnerships with global players help strengthen supply chains. Increasing awareness of cost savings drives gradual adoption across the region.

Middle East & Africa

The Middle East & Africa region captures 5% share of the LED lighting market in 2024, with growth driven by smart city initiatives, large-scale construction projects, and investments in energy-efficient infrastructure. The United Arab Emirates and Saudi Arabia lead adoption through government-led sustainability programs. Africa shows rising demand in urban centers, though adoption remains limited by cost barriers. Rapid urbanization and population growth create future opportunities for residential and commercial deployment. Infrastructure projects linked to events and tourism further support LED penetration. Despite challenges, ongoing investments in smart and sustainable lighting strengthen regional prospects.

Market Segmentations:

By Product:

By Application:

By End User:

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The LED lighting market is highly competitive, shaped by key players including Dialight, Seoul Semiconductor Co., Ltd., Hubbell, Nanoleaf, Acuity Brands, Inc., LSI Industries Inc., Panasonic Corporation, Halonix Technologies Private Limited, Cree Lighting USA LLC, and Savant Technologies LLC. The LED lighting market features a highly competitive landscape, with companies focusing on innovation, cost optimization, and strategic expansion to strengthen their positions. Manufacturers prioritize energy-efficient designs, smart integration, and sustainable solutions to meet rising global demand. Investment in research and development enables the introduction of advanced lighting systems with improved performance, connectivity, and design flexibility. Companies are also expanding distribution networks, forming strategic partnerships, and targeting emerging economies to capture new opportunities. Price competition, rapid technological evolution, and sustainability requirements drive continuous product differentiation, making innovation and adaptability critical for long-term success.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Dialight

- Seoul Semiconductor Co., Ltd.

- Hubbell

- Nanoleaf

- Acuity Brands, Inc.

- LSI Industries Inc.

- Panasonic Corporation

- Halonix Technologies Private Limited

- Cree Lighting USA LLC

- SAVANT TECHNOLOGIES LLC

Recent Developments

- In July 2025, Access Fixtures, a leading manufacturer of high-performance commercial, industrial, and sports LED lighting, launched a new online calculator and comprehensive guide focused on LED light amperage.

- In April 2025, VueReal announced a significant expansion of its Reference Design Kit (RDK) portfolio with new industry-specific bundles. Purpose-built for automotive and consumer electronics, the vertical RDKs are designed to fast-track microLED product development and commercialization with unprecedented speed and integration readiness.

- In March 2025, Signify Holding announced a joint venture with Dixon Technologies (India) Ltd., subject to regulatory approvals. This partnership aims to manufacture high-quality lighting products and accessories for prominent brands in the competitive Indian market. The joint venture will focus on producing a wide range of innovative and cost-effective lighting solutions, including LED bulbs, downlights, spotlights, battens, rope lights, strips, and various LED lighting accessories, all made in India.

- In February 2025, Cree LED, a Penguin Solutions brand, unveiled the new XLamp XP-L Photo Red S Line LEDs, a groundbreaking advancement in horticulture lighting technology. Designed to deliver exceptional efficiency, durability, and seamless system upgrades, these LEDs are optimized for high-performance applications in greenhouses, vertical farms, and other large-scale growing operations

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The LED lighting market will expand with rising demand for energy-efficient solutions.

- Smart lighting systems will gain wider adoption in residential and commercial spaces.

- Governments will continue supporting the transition through stricter energy regulations.

- Sustainability goals will drive innovation in recyclable and eco-friendly lighting products.

- Connected lighting with IoT integration will enhance data-driven energy management.

- Human-centric lighting will see growth with applications in health and workplace productivity.

- Emerging economies will adopt LEDs rapidly through smart city and infrastructure projects.

- Technological advances will improve efficiency, color rendering, and design flexibility.

- Market competition will intensify, pushing companies toward mergers and collaborations.

- Falling costs of LEDs will accelerate adoption across all end-user segments.