CHAPTER NO. 1 : GENESIS OF THE MARKET

1.1 Market Prelude – Introduction & Scope

1.2 The Big Picture – Objectives & Vision

1.3 Strategic Edge – Unique Value Proposition

1.4 Stakeholder Compass – Key Beneficiaries

CHAPTER NO. 2 : EXECUTIVE LENS

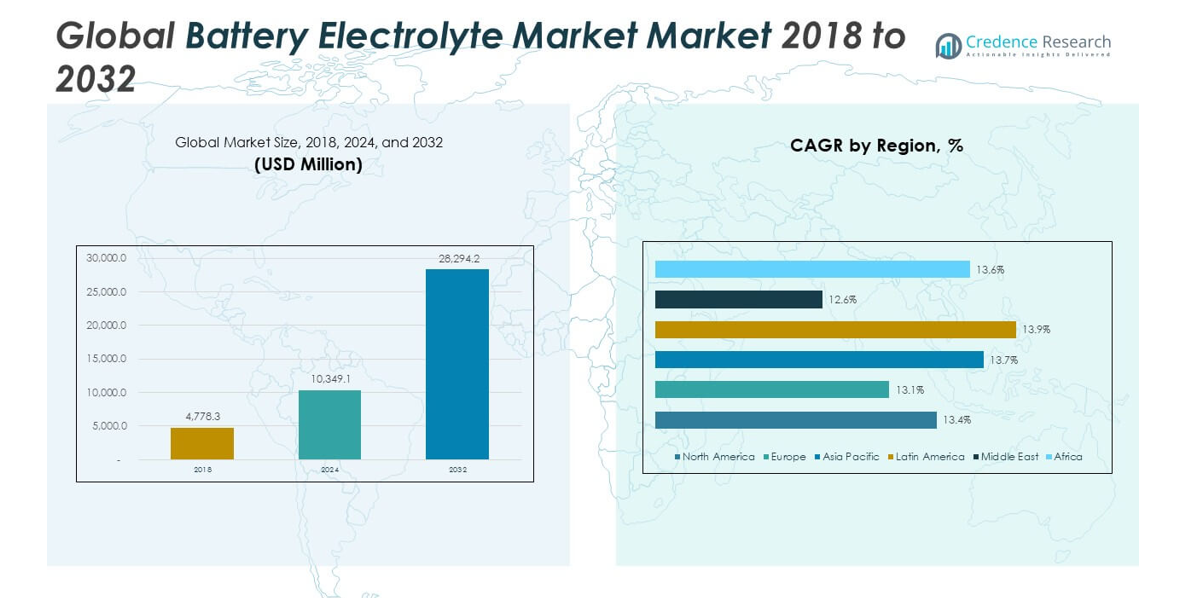

2.1 Pulse of the Industry – Market Snapshot

2.2 Growth Arc – Revenue Projections (USD Million)

2.3. Premium Insights – Based on Primary Interviews

CHAPTER NO. 3 : BATTERY ELECTROLYTE MARKET FORCES & INDUSTRY PULSE

3.1 Foundations of Change – Market Overview

3.2 Catalysts of Expansion – Key Market Drivers

3.2.1 Momentum Boosters – Growth Triggers

3.2.2 Innovation Fuel – Disruptive Technologies

3.3 Headwinds & Crosswinds – Market Restraints

3.3.1 Regulatory Tides – Compliance Challenges

3.3.2 Economic Frictions – Inflationary Pressures

3.4 Untapped Horizons – Growth Potential & Opportunities

3.5 Strategic Navigation – Industry Frameworks

3.5.1 Market Equilibrium – Porter’s Five Forces

3.5.2 Ecosystem Dynamics – Value Chain Analysis

3.5.3 Macro Forces – PESTEL Breakdown

CHAPTER NO. 4 : KEY INVESTMENT EPICENTER

4.1 Regional Goldmines – High-Growth Geographies

4.2 Product Frontiers – Lucrative Electrolyte Type Categories

4.3 Application Sweet Spots – Emerging Demand Segments

CHAPTER NO. 5: REVENUE TRAJECTORY & WEALTH MAPPING

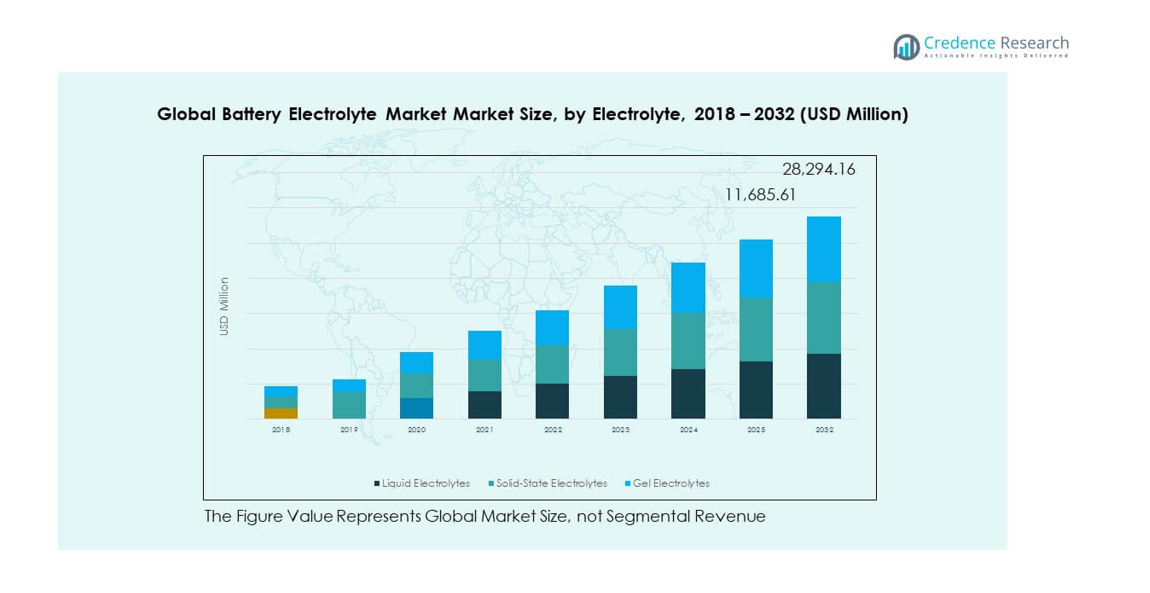

5.1 Momentum Metrics – Forecast & Growth Curves

5.2 Regional Revenue Footprint – Market Share Insights

5.3 Segmental Wealth Flow – Electrolyte Type, Battery Type, and Application Revenue

CHAPTER NO. 6 : TRADE & COMMERCE ANALYSIS

6.1. Import Analysis By Region

6.1.1. Global Battery Electrolyte Market Import Revenue By Region

6.2. Export Analysis By Region

6.2.1. Global Battery Electrolyte Market Export Revenue By Region

CHAPTER NO. 7 : COMPETITION ANALYSIS

7.1. Company Market Share Analysis

7.1.1. Global Battery Electrolyte Market: Company Market Share

7.2. Global Battery Electrolyte Market Company Revenue Market Share

7.3. Strategic Developments

7.3.1. Acquisitions & Mergers

7.3.2. New Product Launch

7.3.3. Regional Expansion

7.4. Competitive Dashboard

7.5. Company Assessment Metrics, 2024

CHAPTER NO. 8 : BATTERY ELECTROLYTE MARKET – BY ELECTROLYTE TYPE SEGMENT ANALYSIS

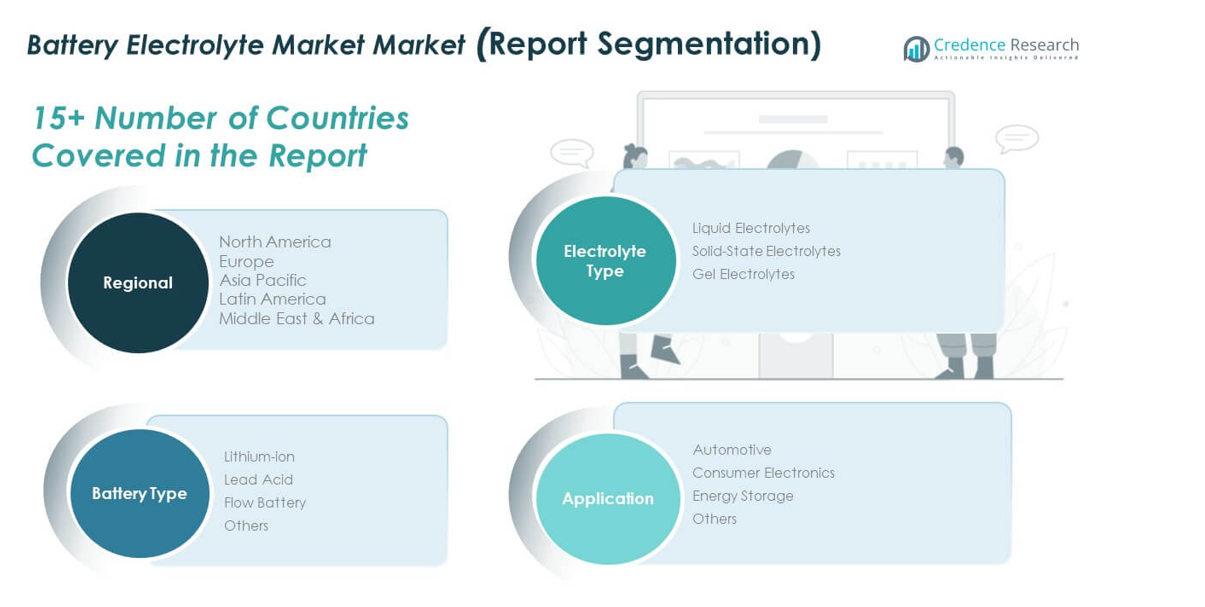

8.1. Battery Electrolyte Market Overview By Electrolyte Type Segment

8.1.1. Battery Electrolyte Market Revenue Share By Electrolyte Type

8.2. Liquid Electrolytes

8.3. Solid-State Electrolytes

8.4. Gel Electrolytes

CHAPTER NO. 9 : BATTERY ELECTROLYTE MARKET – BY BATTERY TYPE SEGMENT ANALYSIS

9.1. Battery Electrolyte Market Overview By Battery Type Segment

9.1.1. Battery Electrolyte Market Revenue Share By Battery Type

9.2. Lithium-ion

9.3. Lead Acid

9.4. Flow Battery

9.5. Others

CHAPTER NO. 10 : BATTERY ELECTROLYTE MARKET – BY APPLICATION SEGMENT ANALYSIS

10.1. Battery Electrolyte Market Overview By Application Segment

10.1.1. Battery Electrolyte Market Revenue Share By Application

10.2. Automotive

10.3. Consumer Electronics

10.4. Energy Storage

10.5. Others

CHAPTER NO. 11 : BATTERY ELECTROLYTE MARKET – REGIONAL ANALYSIS

11.1. Battery Electrolyte Market Overview By Region Segment

11.1.1. Global Battery Electrolyte Market Revenue Share By Region

10.1.2. Regions

11.1.3. Global Battery Electrolyte Market Revenue By Region

11.1.4. Electrolyte Type

11.1.5. Global Battery Electrolyte Market Revenue By Electrolyte Type

11.1.6. Battery Type

11.1.7. Global Battery Electrolyte Market Revenue By Battery Type

11.1.8. Application

11.1.9. Global Battery Electrolyte Market Revenue By Application

CHAPTER NO. 12 : NORTH AMERICA BATTERY ELECTROLYTE MARKET – COUNTRY ANALYSIS

12.1. North America Battery Electrolyte Market Overview By Country Segment

12.1.1. North America Battery Electrolyte Market Revenue Share By Region

12.2. North America

12.2.1. North America Battery Electrolyte Market Revenue By Country

12.2.2. Electrolyte Type

12.2.3. North America Battery Electrolyte Market Revenue By Electrolyte Type

12.2.4. Battery Type

12.2.5. North America Battery Electrolyte Market Revenue By Battery Type

12.2.6. Application

12.2.7. North America Battery Electrolyte Market Revenue By Application

12.3. U.S.

12.4. Canada

12.5. Mexico

CHAPTER NO. 13 : EUROPE BATTERY ELECTROLYTE MARKET – COUNTRY ANALYSIS

13.1. Europe Battery Electrolyte Market Overview By Country Segment

13.1.1. Europe Battery Electrolyte Market Revenue Share By Region

13.2. Europe

13.2.1. Europe Battery Electrolyte Market Revenue By Country

13.2.2. Electrolyte Type

13.2.3. Europe Battery Electrolyte Market Revenue By Electrolyte Type

13.2.4. Battery Type

13.2.5. Europe Battery Electrolyte Market Revenue By Battery Type

13.2.6. Application

13.2.7. Europe Battery Electrolyte Market Revenue By Application

13.3. UK

13.4. France

13.5. Germany

13.6. Italy

13.7. Spain

13.8. Russia

13.9. Rest of Europe

CHAPTER NO. 14 : ASIA PACIFIC BATTERY ELECTROLYTE MARKET – COUNTRY ANALYSIS

14.1. Asia Pacific Battery Electrolyte Market Overview By Country Segment

14.1.1. Asia Pacific Battery Electrolyte Market Revenue Share By Region

14.2. Asia Pacific

14.2.1. Asia Pacific Battery Electrolyte Market Revenue By Country

14.2.2. Electrolyte Type

14.2.3. Asia Pacific Battery Electrolyte Market Revenue By Electrolyte Type

14.2.4. Battery Type

14.2.5. Asia Pacific Battery Electrolyte Market Revenue By Battery Type

14.2.6. Application

14.2.7. Asia Pacific Battery Electrolyte Market Revenue By Application

14.3. China

14.4. Japan

14.5. South Korea

14.6. India

14.7. Australia

14.8. Southeast Asia

14.9. Rest of Asia Pacific

CHAPTER NO. 15 : LATIN AMERICA BATTERY ELECTROLYTE MARKET – COUNTRY ANALYSIS

15.1. Latin America Battery Electrolyte Market Overview By Country Segment

15.1.1. Latin America Battery Electrolyte Market Revenue Share By Region

15.2. Latin America

15.2.1. Latin America Battery Electrolyte Market Revenue By Country

15.2.2. Electrolyte Type

15.2.3. Latin America Battery Electrolyte Market Revenue By Electrolyte Type

15.2.4. Battery Type

15.2.5. Latin America Battery Electrolyte Market Revenue By Battery Type

15.2.6. Application

15.2.7. Latin America Battery Electrolyte Market Revenue By Application

15.3. Brazil

15.4. Argentina

15.5. Rest of Latin America

CHAPTER NO. 16 : MIDDLE EAST BATTERY ELECTROLYTE MARKET – COUNTRY ANALYSIS

16.1. Middle East Battery Electrolyte Market Overview By Country Segment

16.1.1. Middle East Battery Electrolyte Market Revenue Share By Region

16.2. Middle East

16.2.1. Middle East Battery Electrolyte Market Revenue By Country

16.2.2. Electrolyte Type

16.2.3. Middle East Battery Electrolyte Market Revenue By Electrolyte Type

16.2.4. Battery Type

16.2.5. Middle East Battery Electrolyte Market Revenue By Battery Type

16.2.6. Application

16.2.7. Middle East Battery Electrolyte Market Revenue By Application

16.3. GCC Countries

16.4. Israel

16.5. Turkey

16.6. Rest of Middle East

CHAPTER NO. 17 : AFRICA BATTERY ELECTROLYTE MARKET – COUNTRY ANALYSIS

17.1. Africa Battery Electrolyte Market Overview By Country Segment

17.1.1. Africa Battery Electrolyte Market Revenue Share By Region

17.2. Africa

17.2.1. Africa Battery Electrolyte Market Revenue By Country

17.2.2. Electrolyte Type

17.2.3. Africa Battery Electrolyte Market Revenue By Electrolyte Type

17.2.4. Battery Type

17.2.5. Africa Battery Electrolyte Market Revenue By Battery Type

17.2.6. Application

17.2.7. Africa Battery Electrolyte Market Revenue By Application

17.3. South Africa

17.4. Egypt

17.5. Rest of Africa

CHAPTER NO. 18 : COMPANY PROFILES

18.1. UBE Industries Ltd

18.1.1. Company Overview

18.1.2. Product Portfolio

18.1.3. Financial Overview

18.1.4. Recent Developments

18.1.5. Growth Strategy

18.1.6. SWOT Analysis

18.2. Guangzhou Tinci Materials Technology Co. Ltd

18.3. Mitsubishi Chemical Holdings Corporation

18.4. Targray Industries Inc

18.5. Shenzhen Capchem Technology Co. Ltd

18.6. NEI Corporation

18.7. Advanced Electrolyte Technologies, LLC

18.8. Solvay SA

18.9. Enchem Co. Ltd.

18.10. Capchem

18.11. Other Key Players