| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Canada Industrial Hemp Market Size 2023 |

USD 270.63 Million |

| Canada Industrial Hemp Market, CAGR |

20.9% |

| Canada Industrial Hemp Market Size 2032 |

USD 1,496.90 Million |

Market Overview

Canada Industrial Hemp Market size was valued at USD 270.63 million in 2023 and is anticipated to reach USD 1,496.90 million by 2032, at a CAGR of 20.9% during the forecast period (2023-2032).

The Canada Industrial Hemp market is experiencing robust growth, driven by rising consumer awareness of sustainable and plant-based products, coupled with expanding applications across industries such as food and beverages, textiles, personal care, and construction. Government support through favorable regulations and incentives for hemp cultivation further propels market expansion. The growing demand for eco-friendly alternatives to synthetic materials has positioned hemp as a valuable resource in producing biodegradable plastics, insulation materials, and natural fibers. Technological advancements in processing and product development are enhancing the efficiency and versatility of hemp-derived products. Additionally, increasing investments in research and development are uncovering new industrial and nutritional uses of hemp, reinforcing its commercial potential. As consumers continue to prioritize health, sustainability, and innovation, industrial hemp is emerging as a key component in Canada’s transition toward a greener economy, making it an attractive sector for investors, manufacturers, and agricultural producers alike.

The geographical landscape of the Canadian industrial hemp market reflects a well-distributed network of production and innovation across provinces such as Ontario, Quebec, Western Canada, and British Columbia. Each region contributes uniquely Ontario and Quebec focus on value-added food and wellness products, Western Canada leads in large-scale cultivation, and British Columbia emphasizes premium organic and niche offerings. This regional diversity supports a robust national supply chain and caters to a wide range of domestic and international demands. The market also features a strong presence of key players who are driving innovation, product diversification, and global outreach. Leading companies include Curaleaf Holdings, Inc., Aurora Cannabis Inc., Canopy Growth Corporation, and The Cronos Group, alongside specialized hemp producers such as Fresh Hemp Foods Ltd., Parkland Industrial Hemp Growers Co-op. Ltd., and Blue Sky Hemp Ventures Ltd. These companies are instrumental in shaping the market through strategic partnerships, advanced processing technologies, and a focus on sustainability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Canada industrial hemp market was valued at USD 270.63 million in 2023 and is projected to reach USD 1,496.90 million by 2032, growing at a CAGR of 20.9% during the forecast period.

- The global industrial hemp market was valued at USD 7,987.24 million in 2023 and is expected to reach USD 46,774.80 million by 2032, growing at a CAGR of 21.7% from 2023 to 2032.

- Industrial hemp is gaining popularity due to its wide applications in food, personal care, textiles, construction, and bio-composites.

- Key market drivers include rising demand for plant-based nutrition, sustainable agriculture, and eco-friendly industrial materials.

- Market trends show increasing use of hemp in organic health foods, hempcrete in green construction, and hemp fiber in sustainable textiles.

- Competitive analysis highlights the presence of major players like Aurora Cannabis, Canopy Growth, and Curaleaf focusing on innovation and global expansion.

- Market restraints include regulatory complexities, lack of processing infrastructure, and limited awareness among consumers and farmers.

- Regional growth is led by Ontario and Western Canada, while Quebec and British Columbia are emerging as hubs for organic and value-added hemp products.

Report Scope

This report segments the Canada Industrial Hemp Market as follows:

Market Drivers

Government Support and Regulatory Advancements

One of the primary drivers of the industrial hemp market in Canada is strong governmental support and evolving regulatory frameworks. For instance, Health Canada’s legalization of industrial hemp under the Cannabis Act and the Industrial Hemp Regulations has enabled farmers and businesses to cultivate, process, and export hemp without the constraints associated with cannabis-related restrictions. Furthermore, the Canadian government offers various grants and subsidies to promote sustainable farming practices, including hemp cultivation. This regulatory clarity, combined with financial incentives, is encouraging more stakeholders to invest in the hemp industry and is fostering confidence in its long-term viability.

Rising Demand for Sustainable and Eco-Friendly Products

The increasing awareness of climate change and environmental degradation is shifting consumer preferences toward sustainable and biodegradable alternatives, with industrial hemp emerging as a preferred raw material. Hemp requires significantly less water and pesticide use compared to traditional crops such as cotton, and it improves soil health through phytoremediation. As a result, industries are increasingly incorporating hemp into products like biodegradable plastics, paper, textiles, and construction materials. In particular, hempcrete a bio-composite used for construction is gaining popularity for its insulation properties and minimal carbon footprint. This alignment with sustainability goals is making industrial hemp a strategic choice for environmentally conscious companies and consumers alike.

Expanding Applications in Food, Health, and Personal Care

Another major driver of the Canadian industrial hemp market is the broadening scope of its applications across high-growth industries such as food and beverages, health supplements, and personal care. For instance, hemp seeds, rich in protein, fiber, and essential fatty acids, are increasingly used in plant-based diets and functional snacks. The demand for hemp protein powders, hemp seed oil, and functional snacks is rising among health-conscious consumers. In the personal care sector, hemp-derived cannabidiol (CBD) and other compounds are gaining traction for their therapeutic and anti-inflammatory properties, leading to the development of skincare, cosmetics, and wellness products. This diversification of use-cases is significantly boosting market growth and creating new revenue streams for producers and manufacturers.

Technological Innovation and Research & Development

Ongoing innovation in processing technologies and continued investment in research and development are accelerating the growth of the hemp market in Canada. Advances in mechanical processing, fiber separation, and cannabinoid extraction are improving product quality and production efficiency. At the same time, academic institutions and private companies are exploring new applications for hemp, from biofuels and nanomaterials to animal feed and pharmaceuticals. These innovations are not only enhancing the competitiveness of Canadian hemp products in global markets but are also helping to overcome traditional challenges such as inconsistent quality and processing costs. As technology continues to evolve, it is unlocking the full commercial potential of industrial hemp and positioning Canada as a global leader in this emerging sector.

Market Trends

Growth of Hemp-Based Food and Beverage Products

One of the most notable trends in Canada’s industrial hemp market is the rapid growth in demand for hemp-based food and beverage products. Hemp seeds and hemp seed oil have gained popularity due to their high nutritional value, including protein, omega-3 and omega-6 fatty acids, vitamins, and dietary fiber. For instance, Canadian companies like Blue Sky Hemp Ventures are utilizing advanced processing technologies to produce hemp protein powders and cold-pressed oils that cater to the growing demand for plant-based and functional foods. This trend is further supported by growing interest in vegan and gluten-free diets, which have elevated the demand for nutrient-rich, allergen-free ingredients. In addition, the food and beverage industry is seeing a shift toward clean-label products, where hemp fits perfectly as a wholesome, recognizable component. The expansion of product lines and wider retail distribution of hemp-based goods are expected to continue driving market growth in this segment.

Rising Use of Hemp in Sustainable Construction Materials

Another emerging trend is the use of hemp-derived materials in Canada’s sustainable construction sector. Industrial hemp offers ecological and performance advantages when used in construction, particularly in the form of hempcrete—a biocomposite made from hemp hurd and lime. Hempcrete provides excellent insulation, is lightweight, and helps regulate indoor air quality, making it an attractive alternative to traditional concrete and insulation materials. With Canada placing greater emphasis on reducing carbon emissions in the building sector, hemp-based solutions are gaining recognition as an eco-friendly alternative. Several pilot projects and green building initiatives across provinces are integrating hempcrete into residential and commercial construction. Furthermore, the push for energy-efficient homes and green certifications is prompting builders and architects to explore renewable materials like hemp. As awareness grows and construction standards evolve, hemp is likely to become a mainstream material in Canada’s evolving green building landscape.

Expansion of Hemp Textiles and Sustainable Fashion

The Canadian textile and fashion industries are also embracing hemp fibers due to their durability, breathability, and environmentally friendly properties. Hemp uses fewer pesticides and water compared to cotton and is biodegradable, making it highly appealing to ethical fashion brands and eco-conscious consumers. For instance, Hemp & Company, based in British Columbia, produces hemp clothing blended with organic cotton, catering to the demand for sustainable fashion. As the demand for sustainable fashion increases, Canadian designers and textile manufacturers are exploring hemp as a core material for clothing, accessories, and home décor items such as curtains and upholstery. Hemp’s natural resistance to UV light, mildew, and its long-lasting quality further contribute to its appeal in textile production. Startups and established brands alike are entering the hemp apparel space, aligning their product offerings with consumer demand for responsible production. This trend not only diversifies the hemp market but also positions Canada as a contributor to global sustainable textile innovation.

Advancements in Processing Technology and Product Innovation

The industrial hemp sector in Canada is undergoing rapid transformation through technological innovation and research. Modern processing equipment has improved the efficiency of hemp fiber separation, cannabinoid extraction, and oil refining, leading to the production of higher-quality end products. Enhanced methods of extracting cannabidiol (CBD), terpenes, and other valuable compounds from hemp are unlocking new opportunities in wellness, cosmetics, and pharmaceuticals. Concurrently, Canadian researchers are exploring innovative uses for hemp biomass in areas such as biofuels, biodegradable plastics, and nanomaterials. These technological breakthroughs are reducing production costs and increasing scalability, making hemp products more competitive both domestically and internationally. The ongoing commitment to research and development by universities, government institutions, and private enterprises is positioning Canada at the forefront of global hemp innovation. This trend is expected to strengthen as the industry matures, attracting further investment and expanding the range of hemp-derived applications.

Market Challenges Analysis

Regulatory Complexity and Market Fragmentation

Despite Canada’s progressive stance on industrial hemp, the market continues to face regulatory complexities that hinder consistent growth. The distinction between industrial hemp and cannabis remains a challenge, particularly in areas related to licensing, cannabinoid extraction, and THC content thresholds. For instance, Health Canada’s Industrial Hemp Regulations under the Cannabis Act specify that hemp must contain less than 0.3% THC, yet discrepancies between federal and provincial guidelines often create compliance difficulties for producers. These regulatory inconsistencies create uncertainty for businesses, especially small and medium-sized enterprises (SMEs), that lack the resources to navigate complex legal frameworks. Furthermore, the evolving nature of cannabis and hemp-related legislation globally impacts Canada’s export potential, as producers must meet diverse standards across different jurisdictions. These barriers can slow down innovation, discourage new entrants, and limit the ability of Canadian hemp producers to fully leverage international market opportunities.

Infrastructure Limitations and Knowledge Gaps

Another significant challenge facing the Canadian industrial hemp industry is the lack of adequate infrastructure for processing and value-added production. While cultivation has expanded, the supporting infrastructure—such as decortication facilities, fiber processing plants, and cannabinoid extraction labs—remains underdeveloped in many regions. This imbalance restricts the industry’s capacity to scale efficiently and adds logistical costs for transporting raw hemp materials to centralized facilities. Additionally, there is a gap in industry-specific knowledge and skilled labor, particularly in areas like agronomy, supply chain management, and hemp-specific product development. Many farmers are still unfamiliar with best practices for hemp cultivation, which can affect yield quality and profitability. To achieve sustained growth, the sector must invest in education, training, and research partnerships that build technical expertise across the value chain. Addressing these infrastructure and knowledge challenges is critical for Canada to establish a competitive and resilient industrial hemp industry on the global stage.

Market Opportunities

The Canada industrial hemp market presents considerable opportunities driven by the global shift toward sustainable, plant-based, and biodegradable products. With increasing consumer awareness of environmental issues, industrial hemp stands out for its low environmental impact and versatility. Hemp requires fewer inputs such as water and pesticides compared to conventional crops and helps restore soil health, making it an ideal candidate for regenerative agriculture. This positions Canada, with its expansive arable land and supportive regulatory environment, to become a leading supplier of hemp-based raw materials. The growing demand for hemp-derived food and personal care products, particularly hemp seed oil, protein powders, and skin-care formulations, opens new revenue streams for Canadian manufacturers. As health-conscious and environmentally aware consumers continue to drive demand, hemp’s nutritional benefits and natural profile make it a preferred choice across food, wellness, and beauty sectors.

Additionally, industrial applications of hemp in bioplastics, construction materials, textiles, and automotive components represent significant untapped potential. As industries look for low-carbon and renewable material alternatives, hemp fibers and composites are gaining traction due to their strength, durability, and biodegradability. Canada can capitalize on this trend by investing in advanced processing technologies and infrastructure to support value-added production. Furthermore, growing global interest in cannabidiol (CBD) for therapeutic use, combined with increasing international acceptance of hemp-derived products, enhances export prospects for Canadian producers. By leveraging its strong agricultural base, supportive regulatory landscape, and commitment to innovation, Canada is well-positioned to expand its presence in the global industrial hemp value chain. With targeted investment and strategic partnerships, the country can unlock a broad spectrum of opportunities across both domestic and international markets.

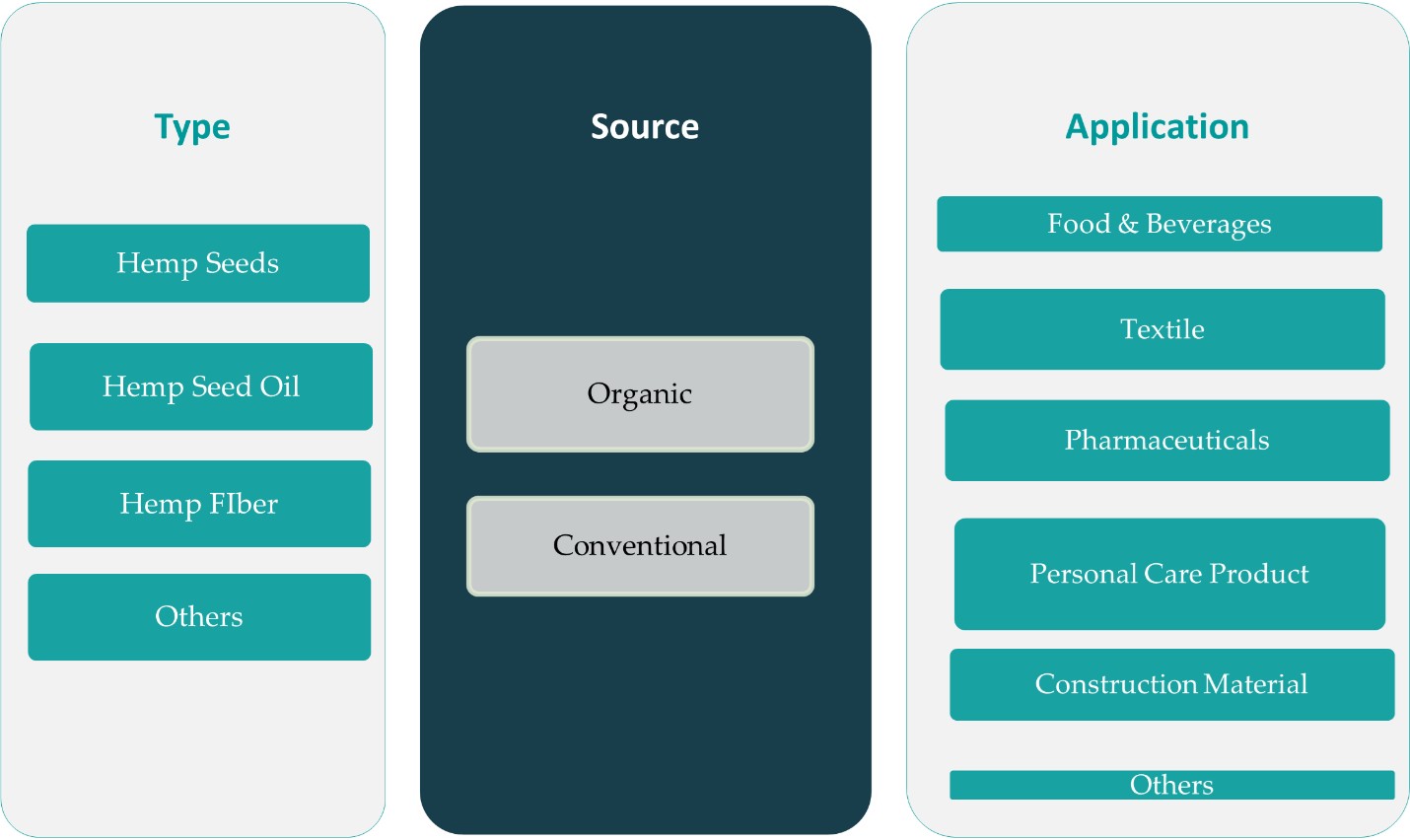

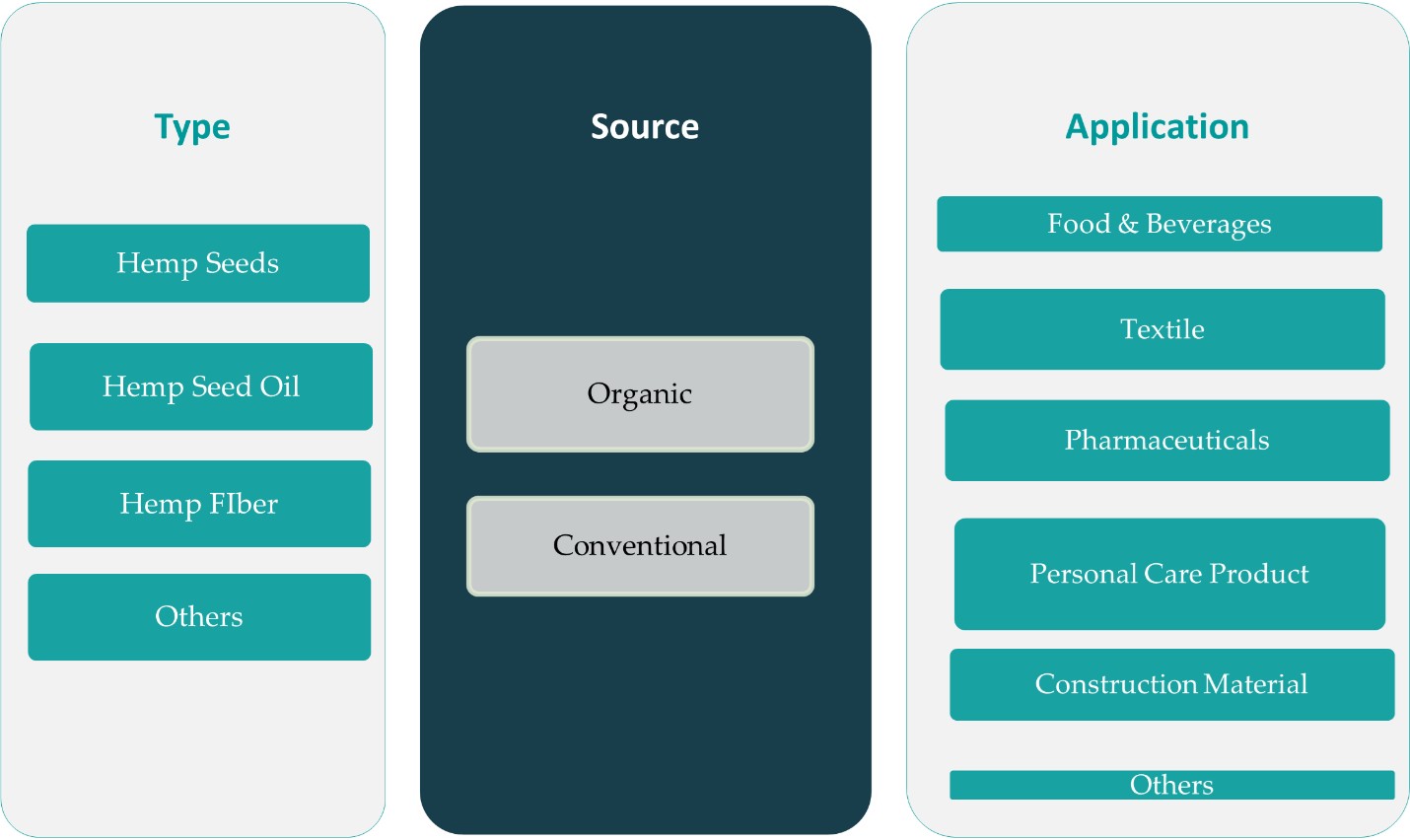

Market Segmentation Analysis:

By Type:

The Canadian industrial hemp market is categorized into four primary product types: hemp seed, hemp seed oil, hemp fiber, and others, each serving distinct industrial applications. Among these, hemp seed holds a significant market share due to its high nutritional value and growing incorporation into health foods and dietary supplements. The rising popularity of plant-based protein sources has fueled demand for hemp seed in protein powders, energy bars, and cereals. Hemp seed oil is also witnessing notable growth in the personal care and nutraceutical sectors, valued for its skin-nourishing and anti-inflammatory properties. Meanwhile, hemp fiber is gaining traction in the sustainable textile, paper, construction, and automotive industries owing to its strength and biodegradability. This segment is poised for further expansion as eco-conscious manufacturing becomes more mainstream. The “others” category, including hemp biomass and extracts, is gradually expanding, especially with increasing interest in cannabinoid applications. These diversified uses across industries underline hemp’s versatility and its broad commercial potential in Canada.

By Source:

Based on source, the Canada industrial hemp market is segmented into organic and conventional hemp. The conventional segment currently dominates in terms of volume and acreage, supported by well-established supply chains and lower production costs. Conventional hemp cultivation meets the demand for large-scale industrial applications, such as textiles and construction materials, where cost efficiency is critical. However, the organic segment is rapidly growing, driven by heightened consumer preference for clean-label and chemical-free products. Organic hemp is particularly in demand for food, supplements, and personal care products, where product purity and environmental sustainability are key purchasing factors. Canadian farmers and producers are increasingly shifting toward certified organic practices to meet both domestic and international demand, especially from markets like the U.S. and Europe. As regulatory bodies and certification programs streamline organic verification processes, this segment is expected to gain further momentum. Together, these segments reflect Canada’s ability to cater to both value-driven and volume-driven hemp markets.

Segments:

Based on Type:

- Hemp Seed

- Hemp Seed Oil

- Hemp Fiber

- Others

Based on Source:

Based on Application:

- Food & Beverages

- Textile

- Pharmaceuticals

- Construction Material

- Others

Based on the Geography:

- Ontario

- Quebec

- Western Canada

- British Columbia

- Atlantic Canada

Regional Analysis

Ontario

Ontario holds the largest share of the industrial hemp market in Canada, accounting for approximately 32% of the national market. The province benefits from a combination of fertile agricultural land, favorable climate conditions, and robust infrastructure that supports cultivation, processing, and distribution. Ontario is also home to several research institutions and agricultural innovation centers that contribute to advancements in hemp production and product development. The proximity to major urban centers such as Toronto provides strong demand for hemp-based food, health, and personal care products. Additionally, the province’s access to domestic and export markets, coupled with strong provincial support for sustainable agriculture, positions Ontario as a central hub for industrial hemp innovation and commercialization.

Quebec

Quebec commands around 24% of the Canadian industrial hemp market, driven by a well-established agricultural sector and increasing consumer interest in eco-friendly and plant-based products. The province has seen a surge in hemp farming, particularly in response to demand from the food and personal care sectors. Hemp seed oil, hemp protein, and organic hemp-based consumables are particularly popular among Quebec’s health-conscious consumers. Moreover, government initiatives that promote local organic farming and sustainable practices are encouraging hemp cultivation across rural and semi-urban regions. With growing awareness and support for agricultural diversification, Quebec is poised to expand its role in both domestic and international hemp supply chains, especially in the organic and wellness product segments.

Western Canada

Western Canada, encompassing Alberta, Saskatchewan, and Manitoba, represents approximately 28% of the national hemp market share. This region has historically been a leader in hemp cultivation due to its vast land availability and favorable growing conditions. Western Canada is especially prominent in the production of hemp seed and hemp fiber, supplying raw materials to both domestic processors and international markets. The prairie provinces have developed efficient farming practices and benefit from supportive provincial policies that encourage industrial hemp as part of crop rotation strategies. However, limited local processing infrastructure remains a challenge, often necessitating transportation to processing facilities in other regions. Nonetheless, ongoing investment in agri-tech and processing capacity signals strong future potential for Western Canada in the hemp value chain.

British Columbia

British Columbia accounts for an estimated 11% of the national market, with a focus on niche and value-added hemp products, particularly in the organic and health-related categories. The province’s environmentally conscious population and established wellness industry create a strong local demand for hemp-derived skincare, nutritional supplements, and specialty foods. British Columbia’s coastal climate presents some limitations for widespread cultivation, but greenhouse production and small-scale organic farming are steadily increasing. The province also serves as a key export gateway to Asian markets, offering potential for international expansion of hemp-based products. Though its cultivation scale is smaller compared to other provinces, British Columbia plays a strategic role in innovation, branding, and premium product positioning within the broader Canadian industrial hemp market.

Key Player Analysis

- Curaleaf Holdings, Inc.

- AURORA CANNABIS INC.

- Canopy Growth Corporation

- The Cronos Group

- Fresh Hemp Foods Ltd.

- Parkland Industrial Hemp Growers Co-op. Ltd.

- Blue Sky Hemp Ventures Ltd.

- Valley Bio Limited

- PharmaCielo Ltd.

Competitive Analysis

The Canada industrial hemp market is characterized by strong competition among key players who are leveraging innovation, partnerships, and sustainability to gain market advantage. Leading companies such as Curaleaf Holdings, Inc., Aurora Cannabis Inc., Canopy Growth Corporation, The Cronos Group, Fresh Hemp Foods Ltd., Parkland Industrial Hemp Growers Co-op. Ltd., Blue Sky Hemp Ventures Ltd., Valley Bio Limited, and PharmaCielo Ltd. play a vital role in shaping the industry. These companies are actively investing in R&D to develop high-quality hemp-derived products for diverse sectors, including food and beverage, personal care, construction, and textiles. Several players focus on expanding their processing capabilities and product lines to cater to rising consumer demand for organic, clean-label, and sustainable alternatives. Additionally, strategic collaborations and export-driven growth are helping Canadian firms strengthen their global presence. The market also sees competition in raw material sourcing, with firms optimizing supply chains for cost efficiency. While larger corporations dominate in scale and infrastructure, co-operatives and regional enterprises are carving niches by targeting specialty segments such as organic hemp and eco-friendly construction materials. This competitive landscape promotes innovation and accelerates the development of value-added hemp products across Canada and beyond.

Recent Developments

- In October 2024, Canopy Growth Corporation acquired Wana, which includes Wana Wellness, LLC, The CIMA Group, LLC, and Mountain High Products, LLC. With this acquisition, Canopy USA holds 100% of Wana’s equity interests. The acquisition will help the company to build a leading brand-focused cannabis company in the US.

- In October 2024, AURORA CANNABIS INC. launched an expanded range of premium medical cannabis oils in Australia in partnership with MedReleaf Australia. Designed to meet diverse patient needs, the new offerings include Aurora THC 25 (Sativa), Aurora THC 25 (Indica), Aurora 12.5:12.5 oil, Aurora 50:50 oil, and Aurora 10:100 oil, all available in 30 ml bottles for physician prescription.

- In June 2024, Curaleaf Holdings, Inc. launched new lines of hemp-derived THC products under its Select and Zero Proof brands. These products will be available across 25 states and the District of Columbia through direct-to-consumer delivery and Curaleaf’s national distribution network.

- In May 2024, The Cronos Group partnered with GROW Pharma, a leading distributor of medicinal cannabis in the UK, to expand its PEACE NATURALS brand into the UK. Through this collaboration, Cronos will supply high-quality, premium cannabis products, ensuring patients in the UK have access to the globally recognized brand PEACE NATURALS.

- In February 2024, RISE Dispensaries, the cannabis retail chain owned by Green Thumb Industries Inc., expanded its presence with the opening of its 15th retail location in Florida and 92nd nationwide. The new store will feature special promotions and complimentary merchandise for its first customers. It opens the company to a much larger reach of its products like chocolate, mints, gummies, and tarts made by its Incredibles brand.

- In January 2023, HempMeds Brasil launched two new full-spectrum products. These new products were created to suit the new requirements of Brazilian doctors who intend to suggest it to their patients.

Market Concentration & Characteristics

The Canada industrial hemp market exhibits a moderate to high level of market concentration, with a mix of large-scale corporations and regionally focused enterprises shaping the industry landscape. Major players such as Curaleaf Holdings, Aurora Cannabis Inc., and Canopy Growth Corporation hold a significant portion of the market due to their expansive infrastructure, advanced processing capabilities, and established distribution networks. At the same time, cooperatives and niche firms contribute to market diversity by targeting specific applications like organic hemp foods, sustainable textiles, and hempcrete. The market is characterized by its versatility, driven by demand from a broad range of sectors including food and beverage, personal care, construction, and industrial manufacturing. Innovation, regulatory compliance, and sustainability remain central to competitive differentiation. With the increasing adoption of hemp in eco-conscious industries and continued investment in R&D, the market is gradually maturing while retaining opportunities for new entrants focused on specialized or value-added products.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Source, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Canada will likely expand its hemp cultivation area due to increasing global demand for sustainable raw materials.

- The industrial hemp sector will attract more investments as interest in plant-based products continues to rise.

- Technological advancements will enhance hemp processing efficiency and product diversification.

- Farmers will adopt improved hemp varieties with higher yields and better resistance to pests and diseases.

- The market for hemp-derived wellness and cosmetic products will experience steady growth.

- Hemp fibre will gain more relevance in textile, automotive, and construction industries for eco-friendly solutions.

- Regulatory frameworks will continue to evolve, supporting industry development while ensuring product safety.

- Research and development will play a key role in discovering new industrial and pharmaceutical applications of hemp.

- Export opportunities will increase as international markets open up and recognize Canadian hemp quality.

- Collaboration between stakeholders will strengthen, leading to a more integrated and competitive hemp value chain.