Market Overview:

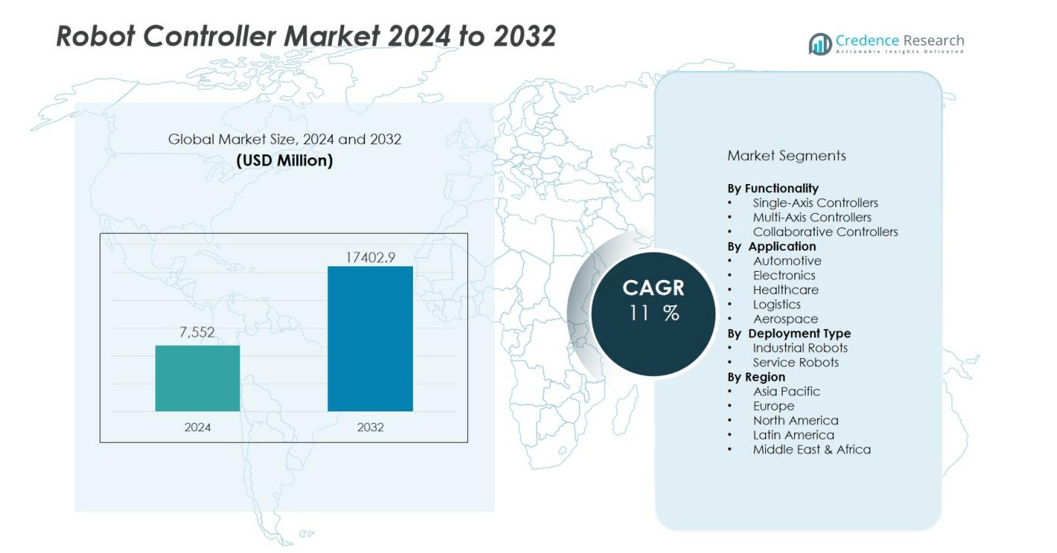

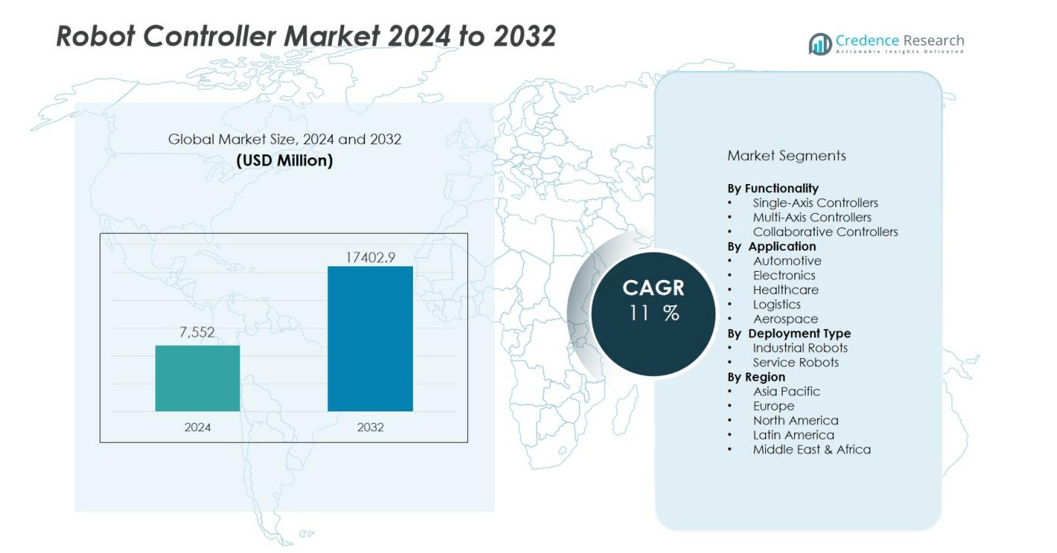

The robot controller market size was valued at USD 7,552 million in 2024 and is anticipated to reach USD 17402.9 million by 2032, at a CAGR of 11 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Robot Controller Market Size 2024 |

USD 7,552 million |

| Robot Controller Market, CAGR |

11% |

| Robot Controller Market Size 2032 |

USD 17402.9 million |

Key drivers include rising demand for industrial automation, advancements in collaborative robots, and the shift toward smart factories. Growing deployment of controllers with AI-driven motion planning, IoT connectivity, and energy-efficient designs enhances efficiency and operational flexibility. Expanding use of robotics in automotive, electronics, healthcare, and warehousing strengthens adoption.

Regionally, Asia-Pacific dominates the robot controller market, supported by strong manufacturing bases in China, Japan, and South Korea. North America follows with high demand for advanced robotics in automotive and healthcare. Europe maintains steady growth, led by Germany’s strong industrial automation ecosystem. Emerging markets in Latin America and the Middle East also show potential, driven by increasing investments in automation technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The robot controller market was valued at USD 7,552 million in 2024 and is projected to reach USD 17,402.9 million by 2032 at a CAGR of 11 %.

- Rising demand for industrial automation across automotive, electronics, and food processing sectors strengthens adoption of advanced controllers.

- The growth of collaborative and service robots creates opportunities for safety-focused and user-friendly controller systems.

- Integration of AI algorithms, IoT connectivity, and smart factory solutions enhances efficiency and predictive maintenance capabilities.

- Expanding applications in healthcare, logistics, and warehousing drive demand for adaptable and precise control systems.

- High costs of deployment, complex integration, and cybersecurity risks remain major challenges for widespread adoption.

- Asia-Pacific holds 62 % of global share, followed by Europe at 17 % and North America at 16 %, with emerging markets in Latin America and the Middle East showing rising potential.

Market Drivers:

Rising Demand for Industrial Automation Across Sectors:

The robot controller market is supported by the rapid adoption of industrial automation in key industries. Automotive, electronics, and food processing sectors are investing in robotic systems to improve efficiency and reduce labor dependency. It strengthens demand for advanced controllers that ensure precise motion and task execution. Continuous modernization of production facilities increases the need for reliable controller solutions.

- For instance, ABB’s IRB 6760 and IRB 6750S robots is True, based on official press releases and product information from ABB. The specified performance metrics are contingent on the use of ABB’s OmniCore controller and specific tooling.

Advancements in Collaborative and Service Robots:

The rise of collaborative robots has created new opportunities for controller manufacturers. These systems require controllers with high safety standards, flexible programming, and user-friendly interfaces. It has expanded adoption beyond traditional factories into small and medium businesses. Service robots in logistics, healthcare, and retail further push the need for smart control systems.

- For instance,Universal Robots’ UR5e cobot—featuring a 5 kg payload and ±0.03 mm repeatability—is part of a product line that surpassed 50,000 units sold worldwide in 2020. The company operates in more than 90 countries globally.

Integration of AI, IoT, and Smart Factory Technologies:

The push toward Industry 4.0 has transformed the expectations of the robot controller market. Controllers now integrate AI-driven algorithms for path optimization and IoT connectivity for real-time monitoring. It allows manufacturers to achieve predictive maintenance and reduce downtime. The adoption of smart factories continues to fuel interest in advanced control systems.

Expanding Applications Across Healthcare and Logistics:

Robotics adoption in healthcare, warehousing, and distribution centers increases demand for specialized controllers. Hospitals deploy robots for surgery assistance and logistics tasks, requiring precise and adaptable control systems. It has also driven logistics providers to invest in automation for order fulfillment and material handling. Broader application areas continue to create growth avenues for the market.

Market Trends:

Increasing Adoption of AI-Driven and IoT-Enabled Controllers:

The robot controller market is witnessing a clear shift toward intelligent and connected systems. Controllers now include AI features that optimize motion, reduce energy use, and improve decision-making. It helps industries achieve predictive maintenance and seamless coordination across robotic fleets. IoT-enabled controllers provide real-time monitoring and remote access, enhancing operational efficiency. Integration with cloud platforms allows data-driven insights for production planning. Growing demand for flexible, software-driven architecture ensures controllers remain adaptable to evolving industrial needs.

- For instance, NVIDIA’s Isaac platform can accelerate AI for robotics, with inference performance varying widely depending on the specific task and hardware. For some perception tasks, optimized workflows on high-end hardware like an RTX 4090 can achieve thousands of inferences per second, which enables real-time motion and environment processing for robotic fleets in manufacturing. However, the actual performance will depend on the complexity of the AI models and the specific hardware being used.

Expansion of Robotics in Non-Industrial Applications:

The adoption of controllers is moving beyond traditional manufacturing into new sectors. Healthcare facilities require advanced controllers for surgical robots and patient care systems. It drives innovation in safety, precision, and usability. Logistics and warehousing companies are deploying robots for material handling and last-mile delivery, raising demand for high-performance controllers. Agriculture is also adopting robotics for planting, harvesting, and monitoring. The broadening application base highlights the evolving role of controllers in enabling efficiency across diverse environments.

- For instance, Intuitive Surgical’s da Vinci® X system does feature motion-scaling, and the installed base of da Vinci systems was 8,887 globally as of the first quarter of 2024.

Market Challenges Analysis:

High Costs and Complexity of Integration:

The robot controller market faces challenges linked to the high cost of deployment and integration. Advanced controllers require significant investment, limiting adoption among small and medium enterprises. It demands specialized training for operators, which increases overall implementation expenses. Integration with existing manufacturing infrastructure often proves complex, creating delays and added costs. Compatibility issues between different robotic platforms also reduce operational efficiency. These barriers restrict widespread adoption, especially in cost-sensitive industries.

Cybersecurity Risks and Limited Standardization:

Growing connectivity of controllers exposes industries to cybersecurity threats. It raises concerns about data theft, operational disruption, and system vulnerabilities. The lack of global standardization in communication protocols complicates cross-platform integration. Limited interoperability reduces flexibility for companies investing in automation. Evolving regulations on data security also increase compliance pressure on manufacturers. These challenges underline the need for stronger security frameworks and unified standards in the market.

Market Opportunities:

Growing Demand for Automation in Emerging Economies:

The robot controller market holds strong opportunities in emerging economies where automation adoption is accelerating. Expanding manufacturing hubs in Asia-Pacific, Latin America, and Africa are investing in robotics to improve productivity. It creates demand for cost-effective and scalable controllers tailored to regional needs. Governments promoting industrial digitalization and smart factory initiatives further boost adoption. The rise of small and medium enterprises in these regions expands the customer base. Affordable solutions that balance performance and cost can capture significant market share.

Expansion in Healthcare, Logistics, and Agriculture Applications:

New applications outside traditional manufacturing open promising opportunities for controller providers. Healthcare robotics, including surgical and rehabilitation systems, require advanced controllers with high precision and safety features. It strengthens demand for specialized solutions across hospitals and research institutions. Logistics companies seek automation in warehouses and distribution centers, increasing reliance on high-performance controllers. Agricultural robotics for planting, harvesting, and monitoring also expand the scope of applications. These diverse sectors create long-term growth potential for innovative controller technologies.

Market Segmentation Analysis:

By Functionality:

The robot controller market is segmented by functionality into single-axis, multi-axis, and collaborative control systems. Multi-axis controllers hold strong demand due to their precision in automotive and electronics production. It supports complex motion control and high-speed operations across assembly lines. Collaborative controllers grow rapidly as industries prioritize safety and flexible interactions between humans and robots. Single-axis systems remain relevant in small-scale tasks where cost efficiency is key.

- For instance, Elmo Motion Control’s Titanium Maestro multi-axis controller delivers an industry-leading 100 microseconds cycle time for up to 16 axes, enabling ultra-fast, highly synchronized movements critical for electronics assembly

By Application:

The market by application includes automotive, electronics, healthcare, logistics, and aerospace. Automotive leads adoption, driven by welding, painting, and assembly needs. It supports automation of repetitive tasks while ensuring consistency and quality. Electronics manufacturing benefits from controllers in micro-assembly and testing operations. Healthcare relies on controllers for surgical robots, rehabilitation devices, and hospital logistics systems. Logistics and aerospace sectors continue to expand usage in material handling and precision operations.

- For instance, Intuitive Surgical’s total da Vinci installed base reached 8,606 systems globally by the end of 2023, which enabled over 2.2 million procedures during that year.

By Deployment Type:

By deployment type, the robot controller market is categorized into industrial and service robots. Industrial robots dominate with widespread use in manufacturing and heavy industries. It delivers accuracy, efficiency, and durability required in mass production. Service robots are gaining traction in healthcare, warehousing, and hospitality. Their controllers emphasize adaptability, compact design, and user-friendly programming. Expanding service sectors highlight the growing role of controllers outside traditional factories.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segmentations:

By Functionality:

- Single-Axis Controllers

- Multi-Axis Controllers

- Collaborative Controllers

By Application:

- Automotive

- Electronics

- Healthcare

- Logistics

- Aerospace

By Deployment Type:

- Industrial Robots

- Service Robots

By Region:

North America

Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Rest of Latin America

Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

Asia-Pacific:

Asia-Pacific holds approximately 62 % of the global share, outpacing other regions. The robot controller market benefits from rapid industrialisation in China, Japan, and South Korea. Strong government policies support smart manufacturing and drive automation investment. Local suppliers innovate to deliver cost-effective, high-performance controllers. SMEs invest in collaborative robots, expanding regional adoption. The region’s digital infrastructure and Industry 4.0 focus reinforce its dominance.

North America:

North America represents close to 16 % of the global market share. The robot controller market gains from high automation uptake in automotive, healthcare, and logistics. Investment in AI and IoT strengthens smart factory deployments. The U.S. leads with strong R&D and electric vehicle manufacturing initiatives. Robotics firms expand within regional manufacturing and battery production. Companies deploy controllers for precision and efficiency. Strong innovation ecosystems sustain market momentum.

Europe:

Europe holds around 17 % of the global market share. The robot controller market thrives on Germany’s automotive and machinery leadership. It enjoys industrial automation programmes and supportive regulatory frameworks. Collaborative robot integration has grown across electronics and aerospace sectors. Countries like France, Italy, and the U.K. drive deployment through advanced infrastructure. Europe’s focus on precision applications and sustainability strengthens its steady market position.

Key Player Analysis:

Competitive Analysis:

The robot controller market is shaped by strong competition among established global players. Yaskawa, Yamaha Robotics, Wittmann, Staubli Robotics, Omron Adept Technologies, Nachi-Fujikoshi, Kawasaki Heavy Industries, Fanuc, and Harmo drive technological innovation and market growth. It focuses on improving controller precision, connectivity, and compatibility with evolving robotic applications. Companies invest in advanced multi-axis and collaborative controllers to meet rising demand across industries. Strategic collaborations and product launches strengthen their global presence while ensuring adaptability to smart factory requirements. Competitive intensity remains high as manufacturers balance cost efficiency with advanced performance features. Expanding applications in healthcare, logistics, and electronics continue to create opportunities for differentiation among leading providers.

Recent Developments:

- In August 2025, Wittmann Battenfeld planned to unveil its new MacroPower injection molding machine with a redesigned, single-piece body and updated control systems at the K 2025 trade show.

- In May 2025, Omron introduced the OL-450S, a new autonomous mobile robot solution for material handling with advanced features like omni-directional drive and wireless charging.

- In August 2025, it was announced that Nachi-Fujikoshi launched a new energy-saving hydraulic unit equipped with a synchronous motor in September 2024.

Report Coverage:

The research report offers an in-depth analysis based on Functionality and Application, Deployment Type and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The robot controller market will expand with rising adoption of industrial automation across sectors.

- Controllers will integrate AI-driven capabilities to enhance accuracy, flexibility, and decision-making.

- Demand for collaborative robots will increase, creating opportunities for safety-focused control systems.

- IoT-enabled controllers will support real-time monitoring and predictive maintenance in smart factories.

- Healthcare robotics adoption will rise, driving demand for controllers with high precision and safety.

- Logistics and warehousing will remain key growth areas, supported by e-commerce expansion.

- Agricultural robotics will emerge as a new segment requiring cost-effective and adaptable controllers.

- Cybersecurity features in controllers will become a critical focus to protect connected systems.

- Emerging economies will provide strong opportunities through government-backed digitalization and automation programs.

- Innovation in modular and software-driven architectures will strengthen controller adaptability for diverse applications.