Market Overview:

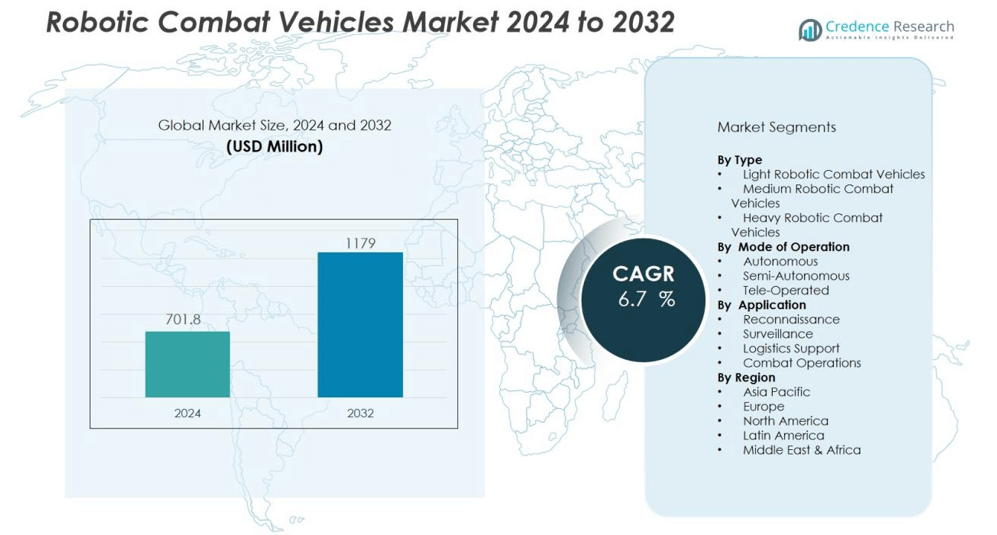

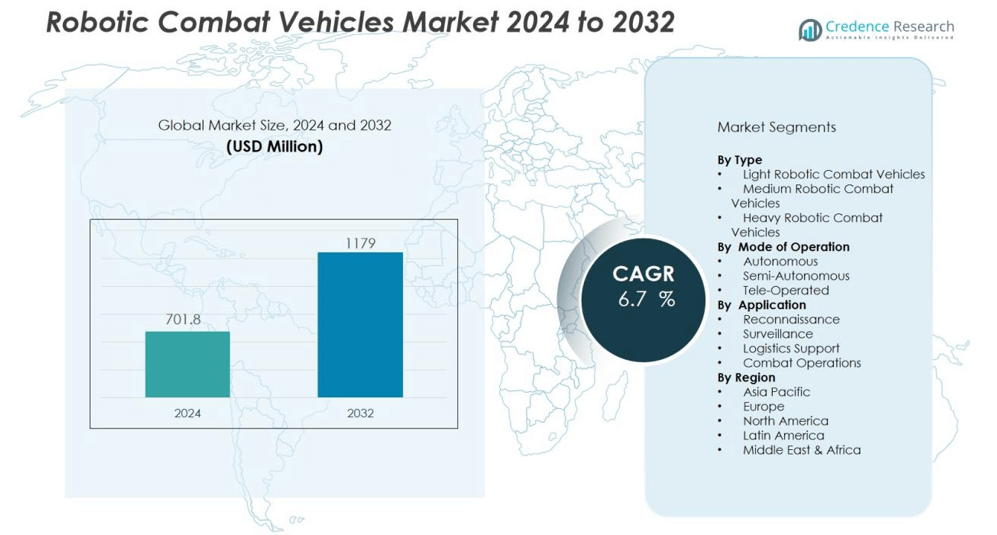

The robotic combat vehicles market size was valued at USD 701.8 million in 2024 and is anticipated to reach USD 1179 million by 2032, at a CAGR of 6.7 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Robotic Combat Vehicles Market Size 2024 |

USD 701.8 million |

| Robotic Combat Vehicles Market, CAGR |

6.7% |

| Robotic Combat Vehicles Market Size 2032 |

USD 1179 million |

Key drivers include the need to reduce soldier exposure in high-risk zones and the increasing deployment of unmanned systems for surveillance, reconnaissance, and combat operations. Advancements in artificial intelligence, remote control technologies, and weapon integration enhance operational efficiency and battlefield effectiveness. Military forces are focusing on modular platforms that allow integration of diverse payloads, improving mission adaptability.

Regionally, North America leads the market due to large-scale U.S. Department of Defense programs, such as the Robotic Combat Vehicle initiative. Europe follows with investments from NATO members, emphasizing defense autonomy and cross-border security. Asia-Pacific is emerging as a fast-growing region, fueled by defense modernization in China, India, and South Korea. The Middle East also shows rising adoption, supported by regional security concerns and military collaborations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The robotic combat vehicles market was valued at USD 701.8 million in 2024 and is expected to reach USD 1179 million by 2032, growing at a CAGR of 7%.

- Rising demand for unmanned ground systems drives adoption, as militaries aim to reduce soldier exposure in high-risk missions.

- Advancements in AI, autonomous navigation, and remote control systems improve operational efficiency and battlefield decision-making.

- Modular payload integration strengthens flexibility, enabling vehicles to adapt to reconnaissance, logistics, and direct combat roles.

- High development costs and technical complexities challenge scalability, while cybersecurity risks raise concerns about system reliability.

- North America holds 38% market share, led by U.S. defense programs and strong R&D investments. Europe follows with 27%, supported by NATO-led projects and modernization initiatives.

- Asia-Pacific secures 22% market share, with China, India, and South Korea driving growth through defense funding and indigenous programs.

Market Drivers:

Rising Demand for Unmanned Ground Systems in Combat Operations:

The robotic combat vehicles market grows due to the rising demand for unmanned ground systems. Militaries deploy these vehicles to reduce risks to soldiers during frontline missions. They support operations such as surveillance, target acquisition, and armed response. Nations seek platforms that enhance force protection while maintaining combat effectiveness.

- For instance, Howe & Howe’s Ripsaw MS2 UGV was capable of accelerating from 0–50 mph in 5.5 seconds with its maximum one-ton payload, a specification derived from manufacturer data and demonstrated in military evaluations.

Advancements in Artificial Intelligence and Autonomous Capabilities:

The market benefits from rapid progress in artificial intelligence and autonomous navigation. AI-powered systems enable vehicles to detect, analyze, and respond to threats with minimal human intervention. Enhanced sensor fusion and machine learning strengthen real-time decision-making on the battlefield. It drives adoption among armed forces aiming to improve situational awareness and combat readiness.

- For instance, Northrop Grumman’s RQ-4 Global Hawk operates at altitudes up to 60,000 feet for missions lasting over 30 hours.

Integration of Modular Payloads and Weapon Systems:

The robotic combat vehicles market gains momentum from the ability to integrate modular payloads. Militaries require flexibility in deploying weapons, sensors, and electronic warfare systems on a single platform. This adaptability supports varied missions, from reconnaissance to direct combat. It encourages investments in scalable designs that meet evolving defense needs.

Growing Defense Modernization and Strategic Investments:

Global defense modernization programs provide a major driver for market expansion. Governments allocate budgets to replace legacy systems with robotic and autonomous alternatives. Ongoing military collaborations strengthen research and development of next-generation combat platforms. It ensures sustained growth of the robotic combat vehicles market through long-term procurement and strategic partnerships.

Market Trends:

Increasing Focus on Autonomous Capabilities and AI Integration:

The robotic combat vehicles market is witnessing a growing emphasis on autonomy and artificial intelligence integration. Defense forces prioritize vehicles capable of independent navigation, threat recognition, and rapid response with minimal operator input. Enhanced AI algorithms support real-time data processing, strengthening decision-making in complex environments. Militaries are investing in swarm technologies, enabling multiple unmanned vehicles to coordinate on the battlefield. It reflects a shift toward reducing reliance on manual operations and improving tactical agility.

- For instance, Milrem Robotics partnered with SteerAI in February 2025 to integrate its CoreX AI autonomy kit onto 20 THeMIS unmanned ground vehicles, equipping them for fully autonomous navigation trials across varied terrains without human intervention.

Expansion of Multi-Mission and Modular Platforms:

The market shows a clear trend toward the development of multi-mission and modular platforms. Defense manufacturers design vehicles that can adapt to reconnaissance, logistics, and combat roles with interchangeable payloads. Flexible weapon integration, surveillance systems, and countermeasure modules make platforms more versatile in evolving combat scenarios. Military programs increasingly demand scalable designs that align with long-term modernization strategies. It highlights the importance of cost-effective solutions that extend operational value across multiple mission profiles.

- For Instance, General Dynamics Land Systems has delivered nearly 5,000 Stryker 8×8 vehicles to the U.S. Army, fielding them across nine Brigade Combat Teams.

Market Challenges Analysis:

High Development Costs and Technical Complexities:

The robotic combat vehicles market faces significant challenges due to high development costs and technical hurdles. Advanced sensors, AI systems, and autonomous navigation require large investments in research and engineering. Integrating multiple technologies into a reliable and combat-ready platform increases complexity. Defense contractors often face delays in testing and deployment because of these demands. It creates financial risks for governments and industries aiming to scale production within tight budgets.

Cybersecurity Threats and Operational Reliability Concerns:

The market also struggles with cybersecurity risks and questions of operational reliability. Robotic combat vehicles rely heavily on data links and AI-driven systems, making them vulnerable to cyberattacks. Disruptions to communication networks can compromise mission effectiveness and battlefield safety. Concerns over durability in harsh environments and dependence on continuous connectivity further limit adoption. It highlights the need for robust security protocols and resilient designs before widespread deployment.

Market Opportunities:

Expanding Role in Modern Warfare and Defense Strategies:

The robotic combat vehicles market presents strong opportunities through its expanding role in modern warfare. Nations seek advanced unmanned systems to strengthen force protection and operational reach. Demand grows for platforms capable of reconnaissance, surveillance, and frontline support in high-risk zones. Armed forces view robotic systems as critical for reducing casualties and enhancing tactical efficiency. It opens pathways for long-term procurement programs and broader adoption across defense operations.

Rising Investments in R&D and International Collaborations:

The market gains further opportunities from rising investments in research and international collaborations. Defense contractors and governments fund projects to develop autonomous capabilities, AI-driven combat tools, and modular weapon systems. Cross-border partnerships encourage technology sharing and accelerate innovation. Export potential also grows as developing nations adopt robotic systems for modernization. It creates a global landscape where vendors can secure contracts through advanced solutions and strategic alliances.

Market Segmentation Analysis:

By Type:

The robotic combat vehicles market by type includes light, medium, and heavy platforms. Light vehicles dominate due to their mobility and suitability for reconnaissance and rapid deployment. Medium-class systems gain traction for balanced firepower and protection in diverse terrains. Heavy vehicles remain limited but attract interest for high-intensity combat roles. It shows strong demand for scalable solutions tailored to different mission requirements.

- For instance, Milrem Robotics’ THeMIS platform excels in medium-class applications with a maximum payload capacity of 1,200 kilograms and operational endurance of up to 15 hours in hybrid mode, supporting both combat and logistics operations.

By Mode of Operation:

The market by mode of operation is divided into autonomous, semi-autonomous, and tele-operated systems. Semi-autonomous vehicles lead adoption because they combine human oversight with advanced navigation features. Autonomous systems witness steady growth as AI capabilities strengthen battlefield decision-making. Tele-operated platforms remain important where manual control is necessary for complex missions. It reflects an ongoing shift toward higher autonomy levels to enhance operational efficiency.

- For instance, Rheinmetall’s Mission Master XT can traverse extreme terrain entirely autonomously, achieving a maximum unrefueled range of 750 km.

By Application:

The robotic combat vehicles market by application covers reconnaissance, surveillance, logistics, and combat operations. Reconnaissance and surveillance segments hold significant demand due to their ability to provide real-time intelligence. Logistics-focused platforms support supply transport in contested areas with reduced risk to personnel. Combat applications continue to expand as militaries integrate advanced weapon payloads. It highlights the rising role of unmanned systems in frontline missions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segmentations:

By Type:

- Light Robotic Combat Vehicles

- Medium Robotic Combat Vehicles

- Heavy Robotic Combat Vehicles

By Mode of Operation:

- Autonomous

- Semi-Autonomous

- Tele-Operated

By Application:

- Reconnaissance

- Surveillance

- Logistics Support

- Combat Operations

By Region:

North America

Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Rest of Latin America

Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

North America

North America holds the largest market share of 38% in the robotic combat vehicles market, supported by major defense initiatives. The United States leads regional growth with extensive funding for the Robotic Combat Vehicle program under the U.S. Army. Large-scale investments in AI, autonomous navigation, and modular weapon systems drive innovation. Canada also contributes through modernization programs that align with NATO requirements. It benefits from strong collaboration between defense contractors and government agencies. The region maintains leadership through advanced R&D infrastructure and robust procurement policies.

Europe

Europe accounts for a market share of 27% in the robotic combat vehicles market, led by NATO-driven projects and national defense upgrades. Countries like Germany, the United Kingdom, and France prioritize unmanned ground systems to strengthen operational readiness. Collaborative programs under the European Defence Fund accelerate research and technology development. Strong demand for modular, multi-mission vehicles supports growth across the region. It benefits from active participation of domestic defense contractors and cross-border partnerships. Regional strategies emphasize autonomous solutions to enhance military resilience.

Asia-Pacific

Asia-Pacific secures a market share of 22% in the robotic combat vehicles market, supported by rising defense budgets and modernization efforts. China drives regional expansion through large investments in unmanned ground combat platforms and AI integration. India enhances focus on indigenous defense programs under initiatives like “Make in India.” South Korea invests in next-generation robotic systems to strengthen military preparedness. It gains momentum through strong government funding and partnerships with local manufacturers. The region continues to evolve as a competitive market driven by security priorities and technological innovation

Key Player Analysis:

- BAE Systems

- Cobham Plc

- Boston Dynamics

- Elbit Systems Ltd.

- General Dynamics Corporation

- Endeavor Robotics (iRobot)

- Lockheed Martin Corporation

- Qinetiq

- Saab AB

- Thales Group.

- Northrop Grumman Corporation

- Textron Systems

Competitive Analysis:

The robotic combat vehicles market is characterized by strong competition among global defense and technology leaders. Key players include BAE Systems, Cobham Plc, Boston Dynamics, Elbit Systems Ltd., General Dynamics Corporation, Endeavor Robotics (iRobot), Lockheed Martin Corporation, and Qinetiq. These companies focus on advancing autonomy, AI integration, and modular designs to secure military contracts. Strategic partnerships with defense agencies enable them to accelerate innovation and field-testing. It remains driven by heavy investments in R&D and large-scale procurement programs. Market participants also expand through joint ventures and technology-sharing agreements to strengthen their presence. Continuous emphasis on developing multi-mission platforms and improving survivability supports competitive differentiation. The landscape highlights ongoing efforts to balance affordability, advanced capabilities, and battlefield reliability in next-generation systems.

Recent Developments:

- In August 2025, BAE Systems launched a series of rapid capability kit installations for the Armored Multi-Purpose Vehicle (AMPV) including integrated effectors for advanced missions.

- In April 2025, Cobham Satcom announced its acquisition by Solix Group to accelerate business growth, with regulatory approvals pending.

- In April 2024, Thales completed the acquisition of Cobham Aerospace Communications, integrating this business into its avionics portfolio.

Report Coverage:

The research report offers an in-depth analysis based on Type, Mode of Operation, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The robotic combat vehicles market will expand as defense forces prioritize unmanned solutions for combat missions.

- AI integration will improve autonomous navigation, threat detection, and decision-making capabilities on the battlefield.

- Modular platforms will gain adoption, enabling flexible integration of weapons, sensors, and electronic warfare tools.

- Nations will increase procurement to reduce risks to soldiers during frontline operations and high-risk missions.

- Swarm technologies will advance, allowing multiple robotic vehicles to coordinate effectively in complex environments.

- Cybersecurity resilience will remain a key focus to protect communication and control systems from threats.

- Cross-border defense collaborations will accelerate innovation and joint development of advanced robotic platforms.

- Demand for multi-mission vehicles capable of reconnaissance, logistics support, and direct combat will strengthen.

- Emerging economies will create opportunities by investing in modernization programs and indigenous defense production.

- The market will evolve toward scalable, cost-effective solutions, ensuring long-term adoption across global defense strategies.