Market Overview

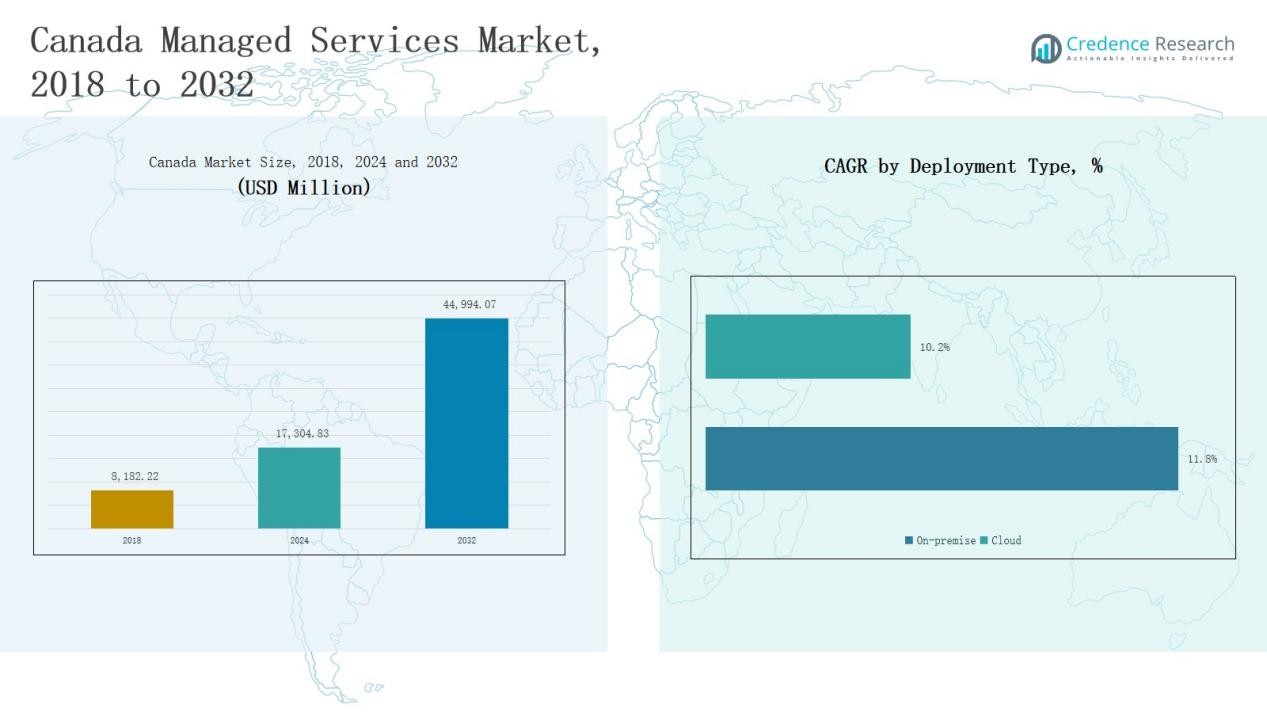

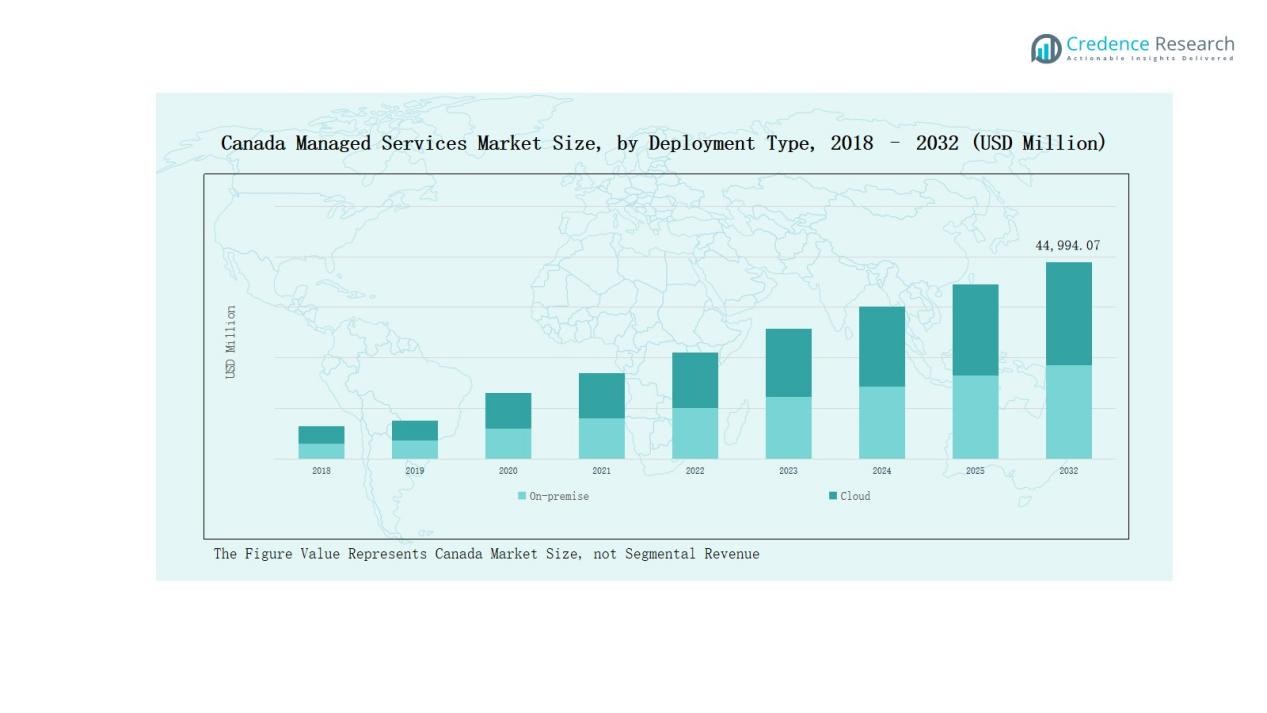

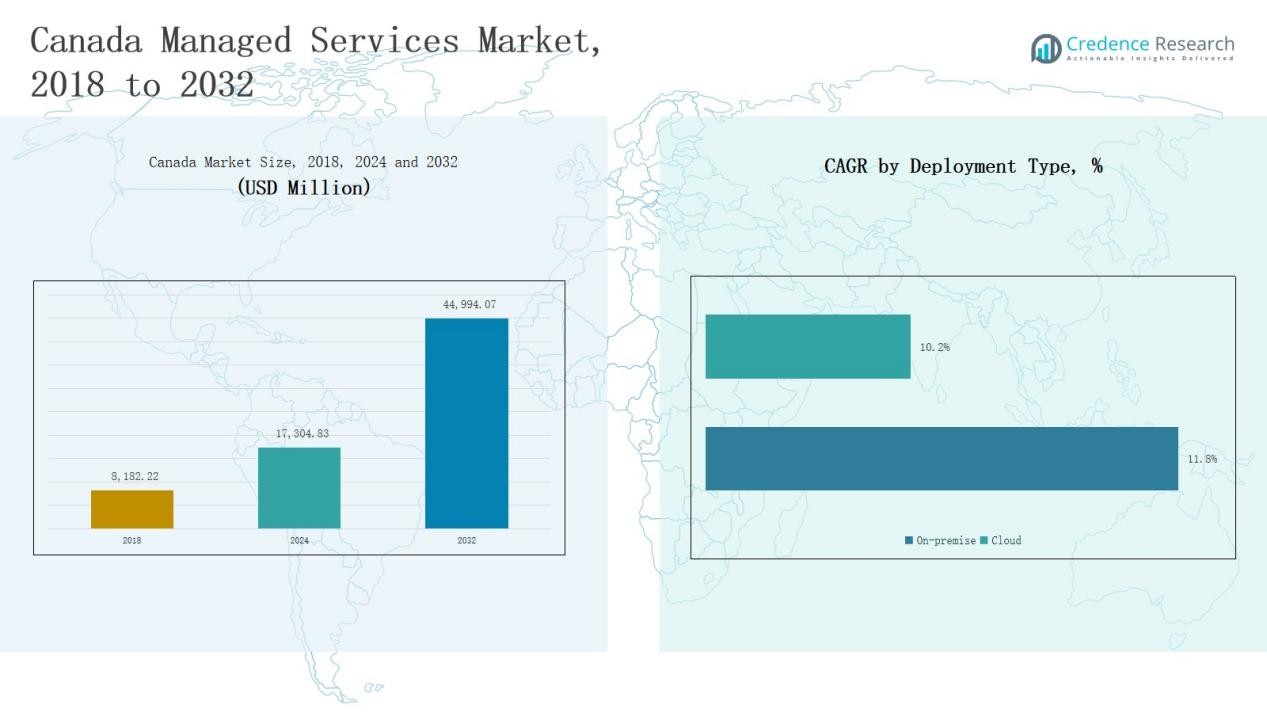

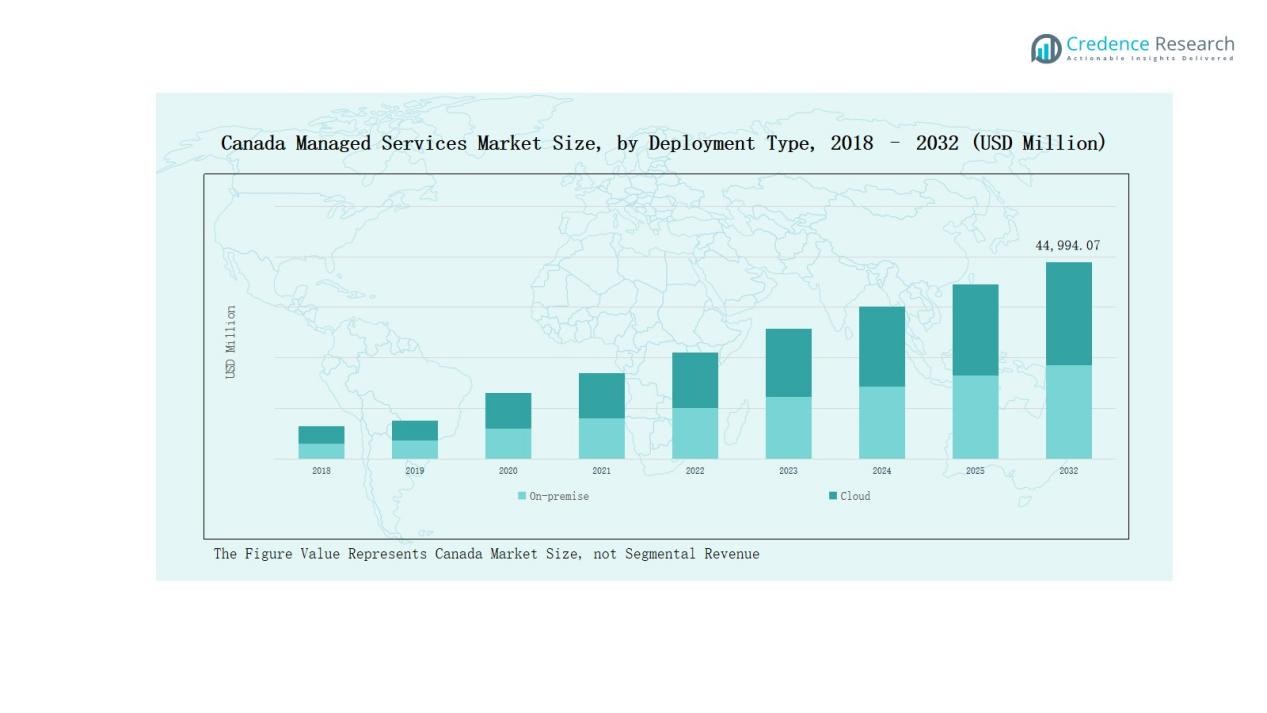

The Canada Managed Services Market was valued at USD 8,182.22 million in 2018, grew to USD 17,304.83 million in 2024, and is projected to reach USD 44,994.07 million by 2032, expanding at a CAGR of 11.82% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Canada Managed Services Market Size 2024 |

USD 17,304.83 Million |

| Canada Managed Services Market, CAGR |

11.82% |

| Canada Managed Services Market Size 2032 |

USD 44,994.07 Million |

The Canada Managed Services Market is dominated by global and regional technology leaders delivering end-to-end IT, cloud, and cybersecurity solutions. Key players include IBM Corporation, Microsoft Corporation, Cisco Systems, Inc., Accenture, Google LLC, Tata Consultancy Services (TCS), Hewlett Packard Enterprise (HPE), Fujitsu Limited, Dell Technologies Inc., and Genatec. These companies strengthen their presence through cloud infrastructure expansion, managed security offerings, and strategic alliances with local enterprises. Continuous investment in automation, AI integration, and hybrid IT models enhances service efficiency and competitiveness. Ontario emerged as the leading region in 2024, capturing 39% of the national market share, supported by its robust digital infrastructure, concentration of large corporations, and strong demand for managed cloud and data center services.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Canada Managed Services Market grew from USD 8,182.22 million in 2018 to USD 17,304.83 million in 2024 and is projected to reach USD 44,994.07 million by 2032, registering strong growth.

- Ontario dominated with 39% of the national share in 2024, supported by advanced IT infrastructure, financial institutions, and strong cloud adoption across enterprises.

- The Managed IT Infrastructure & Data Center segment led with 32.5% share, driven by digital transformation, hybrid infrastructure, and scalable computing demand.

- Cloud deployment accounted for 64.2% of total share due to rising SaaS adoption, remote operations, and cost-efficient scalability across industries.

- Large enterprises captured 58.7% share, supported by outsourcing of IT operations, while SMEs showed faster growth with rising cloud-based service adoption.

Market Segment Insights

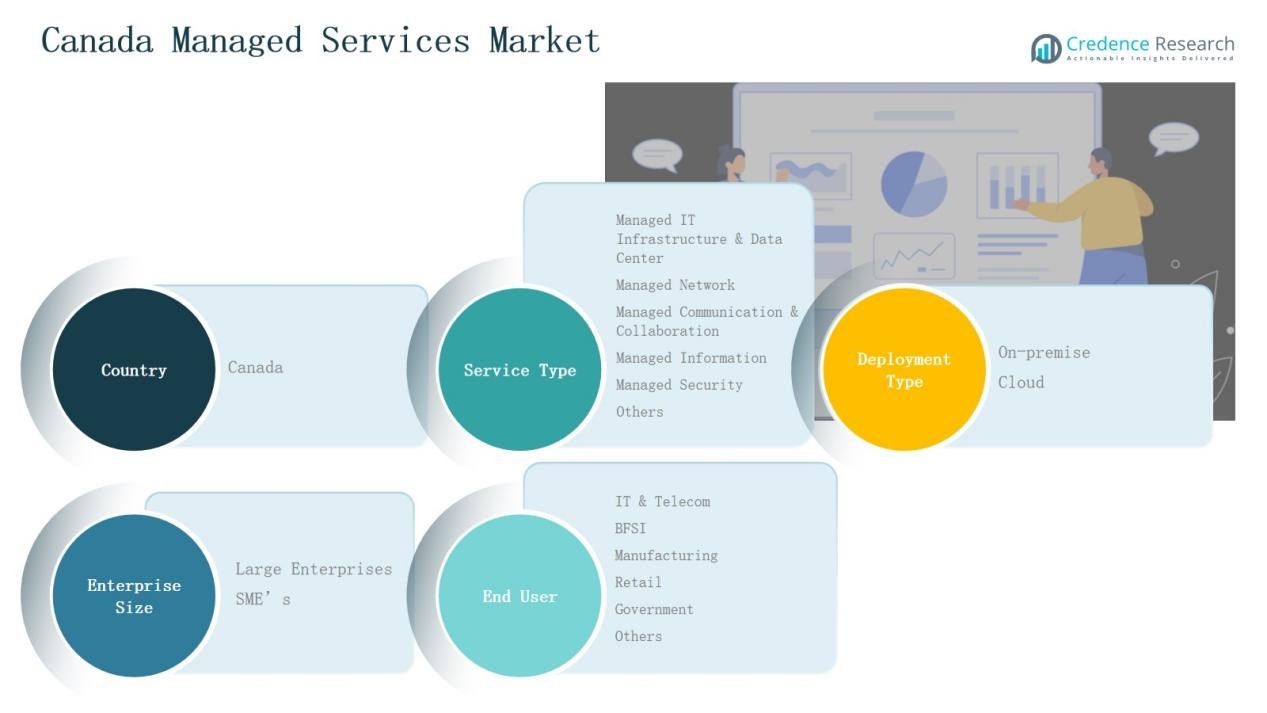

By Service Type:

The Managed IT Infrastructure & Data Center segment dominated the Canada Managed Services Market in 2024, accounting for 32.5% of the total share. The segment’s leadership stems from the increasing digital transformation across enterprises and the demand for scalable storage and computing solutions. Managed Security followed closely, driven by rising cyber threats and data compliance mandates. Continuous IT modernization and hybrid infrastructure adoption across industries strengthen demand for infrastructure-focused managed services in the country.

- For instance, HP Inc. reported significant growth in its managed infrastructure services in Canada, driven by rising demand for hybrid infrastructure adoption across multiple industries.

By Deployment Type:

The Cloud segment held the largest share of 64.2% in the Canada Managed Services Market in 2024. Its growth is supported by the widespread shift toward remote operations, SaaS integration, and cost-effective scalability. Cloud-based managed services enable faster deployment, improved flexibility, and simplified management for enterprises. The segment continues to expand as businesses migrate from legacy systems to cloud ecosystems to enhance productivity and operational efficiency across hybrid IT environments.

- For instance, Microsoft Canada introduced new Azure Backup and Arc-enabled management capabilities to support enterprises in optimizing multi-cloud monitoring and security.

By Enterprise Size:

The Large Enterprises segment led the Canada Managed Services Market in 2024, capturing 58.7% of the total share. The segment benefits from complex IT environments that require advanced infrastructure management, cybersecurity, and network optimization services. Large organizations increasingly outsource IT functions to enhance focus on core operations and minimize operational costs. Meanwhile, SMEs are witnessing faster growth due to rising cloud adoption and cost-efficient managed service models that reduce in-house IT dependency.

Key Growth Drivers

Rising Cloud Adoption Across Enterprises

The Canada Managed Services Market is driven by strong cloud migration trends among enterprises seeking agility and scalability. Organizations across industries are shifting workloads to hybrid and multi-cloud environments, creating demand for managed cloud, data center, and network services. Service providers offering end-to-end integration, security management, and cost optimization solutions are gaining prominence. The increasing reliance on SaaS and IaaS platforms enhances operational efficiency while reducing capital expenditure on traditional IT infrastructure.

- For instance, Bell Canada partnered with Microsoft Azure to launch cloud-managed network solutions for Canadian businesses, improving performance monitoring and security compliance.

Expanding Need for Cybersecurity and Compliance

Escalating cyber threats and evolving data privacy regulations have accelerated demand for managed security services. Canadian businesses are prioritizing network monitoring, threat detection, and incident response to ensure operational continuity. The adoption of frameworks aligned with PIPEDA and GDPR compliance further supports growth. Providers offering AI-based threat intelligence and zero-trust architecture solutions strengthen their market positioning. The heightened need for secure IT infrastructure continues to boost long-term investment in managed cybersecurity services.

- For instance, eSentire announced the expansion of its AI-driven Managed Detection and Response platform, enhancing real-time threat intelligence capabilities tailored for Canadian financial institutions under PIPEDA guidelines.

Digital Transformation in Key Industries

Digital transformation across sectors such as BFSI, healthcare, retail, and government is fueling market expansion. Organizations are outsourcing IT management to enhance productivity, deploy automation, and streamline workflows. Managed service providers deliver tailored solutions like cloud migration, infrastructure automation, and data analytics integration. The increasing use of digital collaboration tools, IoT connectivity, and analytics platforms continues to drive service innovation and demand for managed solutions in both public and private sectors.

Key Trends & Opportunities

Growth of AI-Driven Managed Solutions

AI and automation are transforming service delivery across the Canada Managed Services Market. Providers are deploying predictive analytics, machine learning, and automation tools for proactive monitoring and system optimization. These capabilities reduce downtime and improve efficiency across IT and security operations. AI-driven managed services also enable faster decision-making and self-healing networks, positioning vendors to meet growing client expectations for intelligent, scalable, and cost-efficient digital infrastructure management.

- For instance, AI systems implemented by Canadian firms can detect unusual login activities across locations and isolate compromised devices rapidly, strengthening security postures and operational continuity.

Expansion of Cloud-Native and Hybrid Models

The adoption of cloud-native and hybrid deployment models is creating new opportunities for managed service providers. Enterprises are combining private and public cloud environments to balance cost, performance, and data sovereignty. Vendors offering seamless orchestration, interoperability, and managed hybrid solutions are gaining competitive advantage. This trend supports flexible scalability while addressing security and compliance requirements, reinforcing the shift toward agile, service-based IT ecosystems across Canada’s evolving enterprise landscape.

- For instance, IBM Canada launched a managed hybrid cloud orchestration platform in early 2025 to help enterprises seamlessly integrate multi-cloud environments, driving agility and optimized resource use.

Key Challenges

Data Privacy and Sovereignty Concerns

Stringent data localization and privacy regulations pose operational challenges for managed service providers. Canadian enterprises are cautious about storing sensitive information in cross-border cloud environments. Compliance with national frameworks such as PIPEDA requires robust data governance and transparent security practices. Providers must ensure adherence to legal and contractual requirements while maintaining scalability. Addressing sovereignty and privacy risks remains essential for sustaining trust and expanding managed services adoption.

Shortage of Skilled IT Professionals

A persistent shortage of skilled professionals limits service delivery and scalability across the managed services ecosystem. Demand for expertise in cybersecurity, AI integration, and cloud management outpaces supply. This talent gap drives up labor costs and delays project execution for service providers. Companies are investing in workforce training and automation to mitigate resource constraints. Building specialized skill sets and retention strategies is critical to maintaining competitiveness in Canada’s fast-evolving IT environment.

Rising Cost Pressures and Pricing Competition

Intense competition among global and local providers exerts downward pressure on service pricing. Customers increasingly demand flexible subscription models and measurable ROI, reducing profit margins. Managing infrastructure modernization, security investments, and operational efficiency simultaneously challenges profitability. Providers must differentiate through value-added services, automation, and customer-centric engagement to sustain growth. Balancing competitive pricing with innovation remains a critical challenge in the Canada Managed Services Market.

Regional Analysis

Ontario

Ontario led the Canada Managed Services Market in 2024, capturing 39% of the national share. The province’s dominance is driven by its strong base of financial institutions, IT hubs, and government organizations adopting advanced managed IT and cloud solutions. Demand for cybersecurity, data center management, and network optimization services continues to grow due to high digital transformation rates. Toronto and Ottawa serve as key centers for managed service providers offering scalable and compliance-focused solutions. It benefits from robust infrastructure and the concentration of global technology players.

Quebec

Quebec accounted for 22% of the market share in 2024, supported by expanding industrial sectors and rapid cloud migration among enterprises. Montreal and Quebec City have become preferred locations for data centers and managed cloud operations. Growing investment in IT modernization and cybersecurity frameworks strengthens local demand. It experiences strong adoption across BFSI, manufacturing, and retail sectors. Government-backed digital innovation initiatives also enhance service provider opportunities in infrastructure management and communication services.

British Columbia

British Columbia held 18% of the market share in 2024, driven by the presence of technology startups and small to mid-sized enterprises emphasizing managed IT infrastructure. Vancouver’s digital economy and strong adoption of remote work solutions continue to expand demand for cloud and communication management services. It also benefits from growing emphasis on secure data storage and regulatory compliance across industries. The province’s strong connectivity infrastructure and innovation ecosystem support sustained growth in managed services.

Alberta

Alberta represented 13% of the total market share in 2024, with demand concentrated in the energy, manufacturing, and government sectors. Businesses in the province increasingly outsource IT and security operations to reduce costs and enhance efficiency. Calgary and Edmonton are emerging hubs for managed network and hybrid cloud solutions. It benefits from enterprise digitization efforts and growing investments in cybersecurity frameworks. Managed service providers focusing on automation and predictive analytics are expanding their regional presence.

Rest of Canada

The Rest of Canada accounted for 8% of the market share in 2024, supported by gradual adoption across smaller provinces such as Manitoba, Saskatchewan, and Nova Scotia. Regional enterprises are shifting toward cloud and managed communication services to streamline operations and reduce capital expenses. It reflects steady growth driven by IT modernization initiatives in education, healthcare, and local government sectors. The growing availability of affordable managed service packages supports adoption among small and medium businesses.

Market Segmentations:

By Service Type:

- Managed IT Infrastructure & Data Center

- Managed Network

- Managed Communication & Collaboration

- Managed Information

- Managed Security

- Others

By Deployment Type:

By Enterprise Size:

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By End User:

- IT & Telecom

- Banking, Financial Services, and Insurance (BFSI)

- Manufacturing

- Retail

- Government

- Others

By Region

- Ontario

- Quebec

- British Columbia

- Alberta

- Rest of Canada

Competitive Landscape

The Canada Managed Services Market is highly competitive, with global and domestic providers offering integrated IT, cloud, and security solutions. Key players such as IBM Corporation, Microsoft Corporation, Cisco Systems, Accenture, and Google LLC lead through advanced infrastructure management, cybersecurity, and AI-driven automation services. It features strong participation from regional firms like Genatec and Softchoice Corporation, which focus on tailored support for mid-sized enterprises. Companies are expanding managed cloud, network, and data center portfolios to enhance efficiency and resilience. Strategic alliances, acquisitions, and cloud service partnerships strengthen their competitive edge across sectors such as BFSI, IT & telecom, and manufacturing. Continuous investment in automation, predictive monitoring, and hybrid IT models supports differentiation in a market defined by technological innovation and service reliability. The competition remains centered on value-added offerings, regulatory compliance, and long-term service contracts that ensure customer retention and sustainable growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- IBM Corporation

- Microsoft Corporation

- Accenture

- Cisco Systems, Inc.

- Google LLC

- Tata Consultancy Services (TCS)

- Genatec

- HP Enterprise (HPE)

- Fujitsu Limited

- Dell Technologies Inc.

- Wipro Limited

- Infosys Limited

- Rackspace Technology

- Cognizant Technology Solutions

- DXC Technology Company

- AT&T Business

- NTT Data Corporation

- Tech Mahindra Limited

- Capgemini SE

- Softchoice Corporation

Recent Developments

- In September 2025, Evergreen acquired three Alberta-based managed service providers LAN Solutions, Corporate Networks, and The ITeam to strengthen its footprint in the Canadian IT services sector.

- In September 2025, Accenture completed the acquisition of IAMConcepts, a Canadian identity and access management firm, enhancing its cybersecurity and managed services capabilities across the country.

- In July 2025, OpenText entered a strategic partnership with TELUS to launch Canadian sovereign AI-powered cloud solutions for government and enterprise clients.

- In December 2024, Service Express acquired Mid-Range, a Toronto-based managed infrastructure provider, expanding its Canadian presence and service portfolio.

Report Coverage

The research report offers an in-depth analysis based on Service Type, Deployment Type, Enterprise Size, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for cloud-based managed services will continue expanding across enterprises of all sizes.

- Cybersecurity management will remain a top priority for businesses adopting digital operations.

- Hybrid and multi-cloud environments will drive need for advanced integration and monitoring solutions.

- AI and automation will transform service delivery, improving speed and reducing operational costs.

- Managed network and data center services will grow with rising connectivity and IoT adoption.

- SMEs will increasingly outsource IT management to focus on core business operations.

- Industry-specific managed solutions will gain traction in BFSI, healthcare, and retail sectors.

- Partnerships between global tech giants and local providers will strengthen regional service capabilities.

- Sustainability and energy-efficient data centers will become central to managed service strategies.

- Continuous innovation in analytics, security, and cloud orchestration will shape the market’s competitive landscape.