| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Capsule Hotel Market Size 2024 |

USD 230.7 Million |

| Capsule Hotel Market, CAGR |

8.31% |

| Capsule Hotel Market Size 2032 |

USD 435.9 Million |

Market Overview:

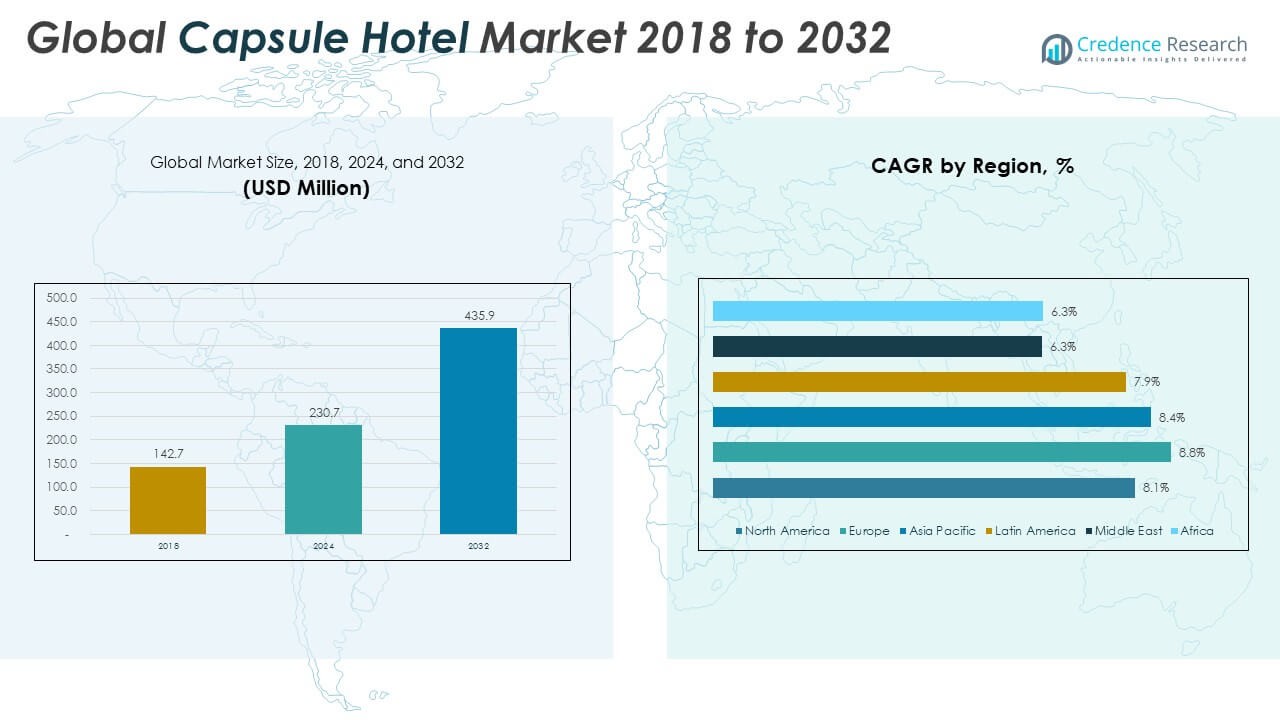

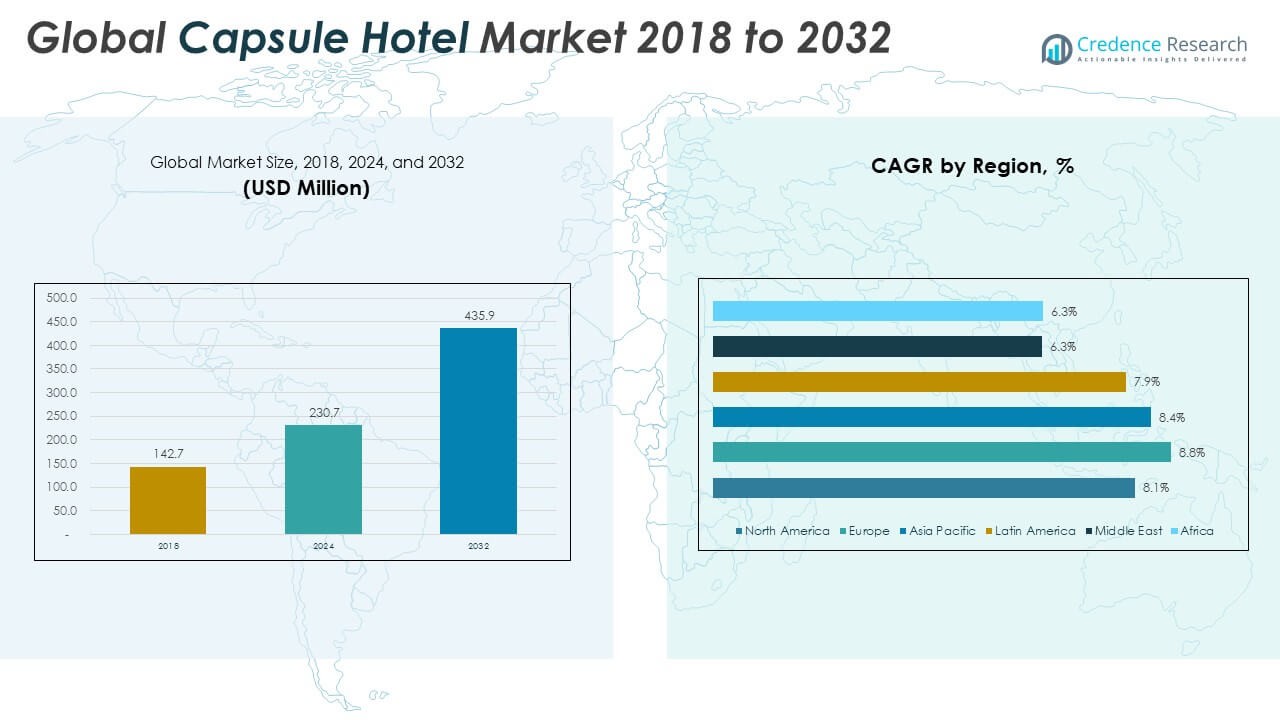

The Global Capsule Hotel Market size was valued at USD 142.7 million in 2018 to USD 230.7 million in 2024 and is anticipated to reach USD 435.9 million by 2032, at a CAGR of 8.31% during the forecast period.

The growth of the global capsule hotel market is primarily driven by the increasing demand for affordable and efficient accommodation among urban travelers, particularly solo tourists, business commuters, and digital nomads. The compact design and cost-effectiveness of capsule hotels appeal to a generation of price-sensitive yet experience-driven consumers, especially millennials and Gen Z, who seek value-oriented lodging without compromising on essential comfort. Technological integration also plays a pivotal role, with many capsule hotels adopting automated check-in systems, IoT-enabled pods, and app-based services to enhance user convenience and operational efficiency. The expansion of low-cost travel, rising domestic tourism in developing countries, and the growing popularity of short-term stays in transit hubs such as airports and railway stations further fuel adoption. Moreover, sustainability trends and urban zoning constraints are prompting hospitality developers to explore space-saving, low-footprint lodging solutions, making capsule hotels an ideal fit for densely populated cities.

Asia-Pacific dominates the global capsule hotel market, contributing nearly 60% of total revenue, with Japan at the forefront due to its historical association with the capsule concept. Cities like Tokyo and Osaka are home to some of the most technologically advanced and thematically diverse capsule hotels, catering to both domestic and international travelers. China and South Korea are also witnessing rapid growth, driven by urbanization, domestic tourism, and government support for innovative accommodation formats. In North America, the concept is gradually gaining acceptance, particularly in metropolitan areas like New York, Los Angeles, and Toronto, where rising hotel costs and space constraints are encouraging investment in pod-based lodging. Europe is emerging as a lucrative market, with countries such as the UK, Germany, and the Netherlands embracing capsule hotels to meet budget travel demand amid high hotel tariffs. Meanwhile, Latin America and the Middle East & Africa are experiencing early-stage developments, with strong future potential fueled by expanding tourism sectors and increasing interest in modular, flexible accommodations.

Market Insights:

- The Global Capsule Hotel Market was valued at USD 230.7 million in 2024 and is projected to reach USD 435.9 million by 2032, growing at a CAGR of 8.31%.

- Rising demand for affordable lodging among solo travelers, business commuters, and digital nomads is driving consistent market expansion.

- Technological integration such as IoT-enabled pods, smart check-ins, and app-based services is improving customer experience and operational efficiency.

- Consumers increasingly prefer minimalist, themed, and experience-based accommodations, which capsule hotels deliver through compact and creative designs.

- Rapid urbanization and high real estate costs are prompting developers to adopt capsule hotels as space-efficient solutions in dense metropolitan areas.

- Challenges such as limited space for long-term stays and regulatory barriers in new markets may slow expansion and adoption.

- Asia-Pacific holds nearly 60% of global revenue, with Japan leading the market, while Europe and North America show increasing investment and acceptance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Affordable Urban Accommodations Among Solo and Budget Travelers

The Global Capsule Hotel Market is expanding due to increasing demand for compact, cost-effective lodging solutions in urban centers. Budget-conscious travelers, particularly solo tourists, business commuters, and backpackers, prefer capsule hotels for their affordability and convenience. These travelers seek essential amenities, cleanliness, and accessibility without paying for unnecessary luxuries. Capsule hotels offer a practical alternative to conventional hotels by reducing costs through efficient space utilization and minimalistic designs. The growth of domestic tourism and short city stays further accelerates this demand, especially in countries with high population density and expensive real estate. Travelers increasingly choose these facilities for quick layovers, short-term stays, or digital work trips.

- For example, Urbanpod in Mumbai operates with 140 pods, each occupying just 50–90 square feet, providing essential amenities such as secure key card access, free Wi-Fi, personal lockers, and adjustable air-conditioning, all at an average nightly rate of INR 2,000

Technological Integration Enhancing User Experience and Operational Efficiency

Advanced technology plays a critical role in driving the Global Capsule Hotel Market. Operators are integrating automated check-in kiosks, app-based room reservations, smart climate control, and IoT-enabled pods to attract tech-savvy customers. These innovations enhance customer convenience and improve property management efficiency. Capsule hotels benefit from reduced staffing requirements, faster room turnover, and centralized system controls, which make operations more profitable. High-speed internet, smart lighting, and USB charging ports are now standard in many capsules, appealing to younger demographics. These features position capsule hotels as future-ready, digitally driven hospitality providers.

- Capsule Hotel Switzerland, for instance, has implemented a fully digitalized guest journey: 50% of guests access their capsules via mobile phones, check-in times average under two minutes, and 100% of payments are automated.

Changing Consumer Preferences Favoring Minimalism and Unique Experiences

Modern consumers increasingly favor experiences that align with minimalism and functional aesthetics. Capsule hotels, with their streamlined layouts and efficient use of space, meet this preference while offering a novel accommodation format. The rising popularity of themed capsules—such as book-themed, anime-themed, or wellness-inspired interiors—creates distinctive experiences for guests. These elements encourage repeat stays and social media engagement, helping operators build strong brand identities. The Global Capsule Hotel Market aligns well with this shift in consumer behavior, offering accommodations that are simple yet memorable. It capitalizes on the desire for authenticity and comfort without excess.

Urbanization and Space Constraints Prompting Demand for Space-Efficient Lodging

Rapid urbanization and increasing real estate costs are prompting developers to seek innovative solutions for lodging infrastructure. Capsule hotels require significantly less space per guest than traditional hotels, making them ideal for high-traffic areas such as transit hubs, business districts, and city centers. The modular nature of capsules allows flexible property layouts and adaptive reuse of underutilized spaces, such as office basements or airports. Governments and private developers are beginning to support such space-efficient models to address urban accommodation shortages. It provides an effective response to high land value and limited construction capacity in major cities. The growing number of smart city projects globally supports this trajectory.

Market Trends:

Adoption of Thematic and Niche Capsule Designs to Enhance Customer Appeal

Operators in the Global Capsule Hotel Market are increasingly embracing themed interiors and customized capsule environments to attract targeted customer segments. Themes such as sci-fi, anime, book lounges, and wellness-focused pods are gaining traction among younger travelers. These unique themes help differentiate properties and create memorable guest experiences. Thematic designs also contribute to viral marketing, with customers frequently sharing their stays on social media. This trend strengthens brand recognition and drives organic promotion. It allows capsule hotels to move beyond functional lodging and enter the lifestyle and experience-driven accommodation space.

Integration of Smart Technologies and Contactless Services to Drive Efficiency

Technological advancement is shaping the evolution of capsule hotels, with smart pods, contactless check-ins, and mobile-based room access becoming industry standards. Guests expect seamless digital interactions, from booking to check-out, supported by features like AI-based concierge services, automated lighting, and temperature control. These enhancements improve operational efficiency while meeting modern expectations for convenience and personalization. Many properties are adopting self-service kiosks and centralized controls to reduce human intervention and streamline staffing. The Global Capsule Hotel Market reflects this trend by increasingly offering digital-first experiences. It helps optimize space utilization and supports scalability across multiple locations.

Expansion into Non-Traditional Locations to Tap New Demand Streams

Capsule hotels are gradually moving beyond traditional city centers into transit hubs, airport terminals, university campuses, and hospital zones. These non-traditional settings align with short-term stay requirements and high guest turnover. Airports, in particular, are emerging as growth hubs for capsule concepts, offering travelers rest and privacy during layovers or delayed flights. This trend reflects a shift toward highly flexible, location-agnostic lodging models. The Global Capsule Hotel Market is adapting by tailoring capsule designs to suit different use cases and customer flows. It demonstrates versatility and potential to diversify beyond tourism-heavy zones.

- For instance, At Kuala Lumpur International Airport, CapsuleTransit by CHG World operates container-style capsule hotels with amenities such as lockers, showers, and wellness kits, specifically catering to transit passengers and reporting occupancy rates exceeding 80% during peak travel periods.

Increased Emphasis on Sustainability and Space-Efficient Architecture

Sustainable design and energy-efficient infrastructure are becoming core priorities in the capsule hotel segment. Developers are incorporating eco-friendly materials, LED lighting, low-power appliances, and modular construction techniques to reduce environmental impact. This aligns with the growing traveler preference for green accommodations and supports regulatory compliance in urban areas. The compact footprint of capsule hotels inherently reduces resource consumption, making them suitable for environmentally conscious markets. Many operators also promote reduced linen usage, smart HVAC systems, and waste-minimization practices. It positions the Global Capsule Hotel Market as an innovative solution that balances guest needs with sustainability goals.

- For instance, LUBAN CABIN capsule houses use recycled steel and reclaimed wood, reducing construction waste by up to 50% and operational energy requirements to just 2–5 kWh per capsule per night, compared to 10–20 kWh for a traditional hotel room.

Market Challenges Analysis:

Space Constraints and Limited Guest Comfort Restrict Broader Adoption

One of the major challenges in the Global Capsule Hotel Market is the confined space inherent to the capsule design, which can limit guest comfort and appeal. While efficient for short stays, the restricted movement and lack of private amenities make it unsuitable for extended stays or family accommodations. Travelers who prioritize personal space or require special accessibility features often opt for conventional hotel formats. Noise from adjacent pods and shared facilities may also impact guest satisfaction, especially in high-traffic locations. This limitation restricts the customer base primarily to solo, budget, or transit-focused travelers. It hinders expansion into premium or long-stay segments and may affect repeat customer engagement in certain markets.

Regulatory Barriers and Operational Challenges in New Geographies

Regulatory inconsistencies and zoning restrictions present significant barriers to market entry in various regions. The capsule hotel format does not always align with traditional hospitality classifications, which complicates licensing, safety compliance, and construction approvals. In some countries, building codes and fire safety regulations limit pod-stacking configurations or mandate larger minimum room sizes, affecting scalability. The Global Capsule Hotel Market faces operational risks in markets lacking infrastructure or awareness of the model. It must also navigate cultural perceptions that may associate capsules with low-end lodging or impersonal experiences. These regulatory and perception-based hurdles can delay investment decisions and slow down global expansion plans.

Market Opportunities:

Expansion into Untapped Regions and Transit-Oriented Infrastructure

Emerging markets in Latin America, the Middle East, and parts of Africa present promising opportunities for the Global Capsule Hotel Market. These regions are experiencing rising tourism, urbanization, and demand for affordable accommodations. Airports, railway stations, and university campuses offer high-traffic locations ideal for capsule hotel integration. It can capitalize on the growing need for compact, cost-effective lodging in areas where traditional hotel infrastructure is underdeveloped. By partnering with transit authorities and real estate developers, capsule hotel operators can establish a strong presence in strategically located hubs. This approach supports rapid market entry with relatively low capital expenditure.

Collaboration with Hospitality Platforms and Innovation in Hybrid Models

Digital travel platforms and booking aggregators offer significant opportunities for visibility and customer acquisition. The Global Capsule Hotel Market can leverage these partnerships to reach tech-savvy, value-driven travelers. Hybrid models that combine capsule pods with co-working spaces, wellness zones, or boutique services can attract new customer segments. These concepts appeal to digital nomads, remote workers, and experience-focused tourists. It can drive occupancy rates by offering added utility beyond sleep accommodation. Strategic collaborations with lifestyle brands and flexible service design can support premium positioning in key urban markets.

Market Segmentation Analysis:

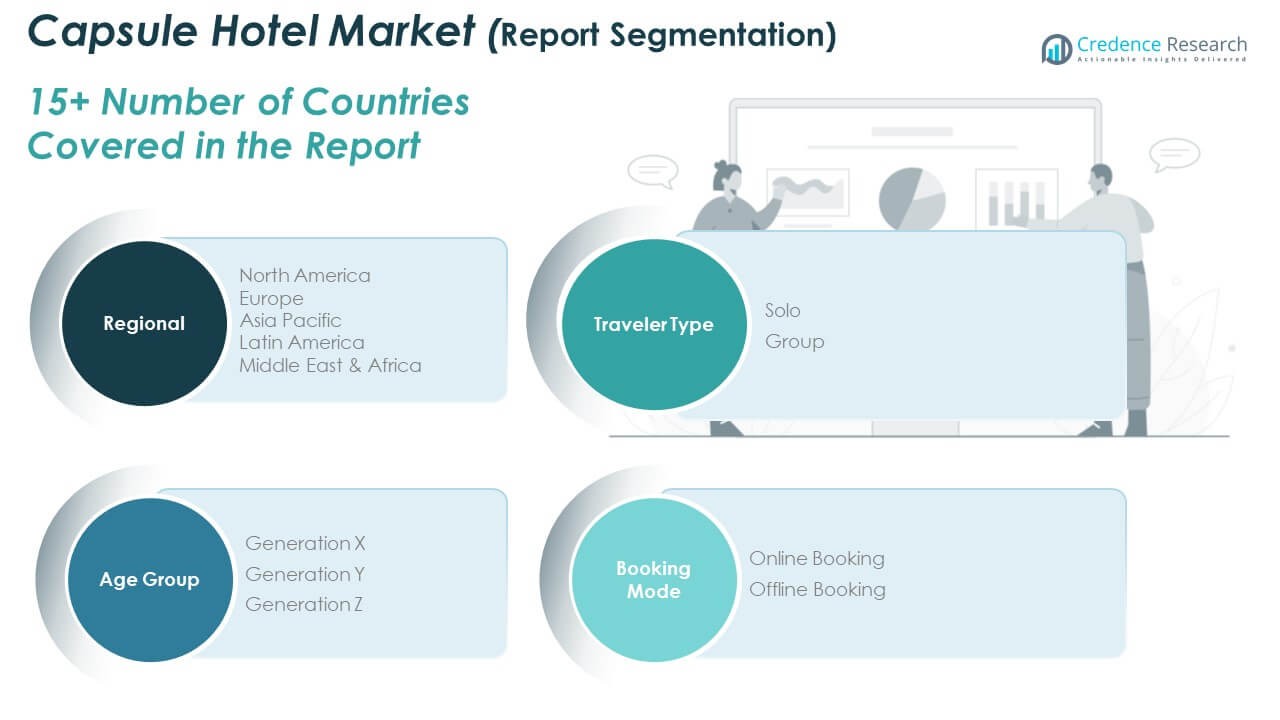

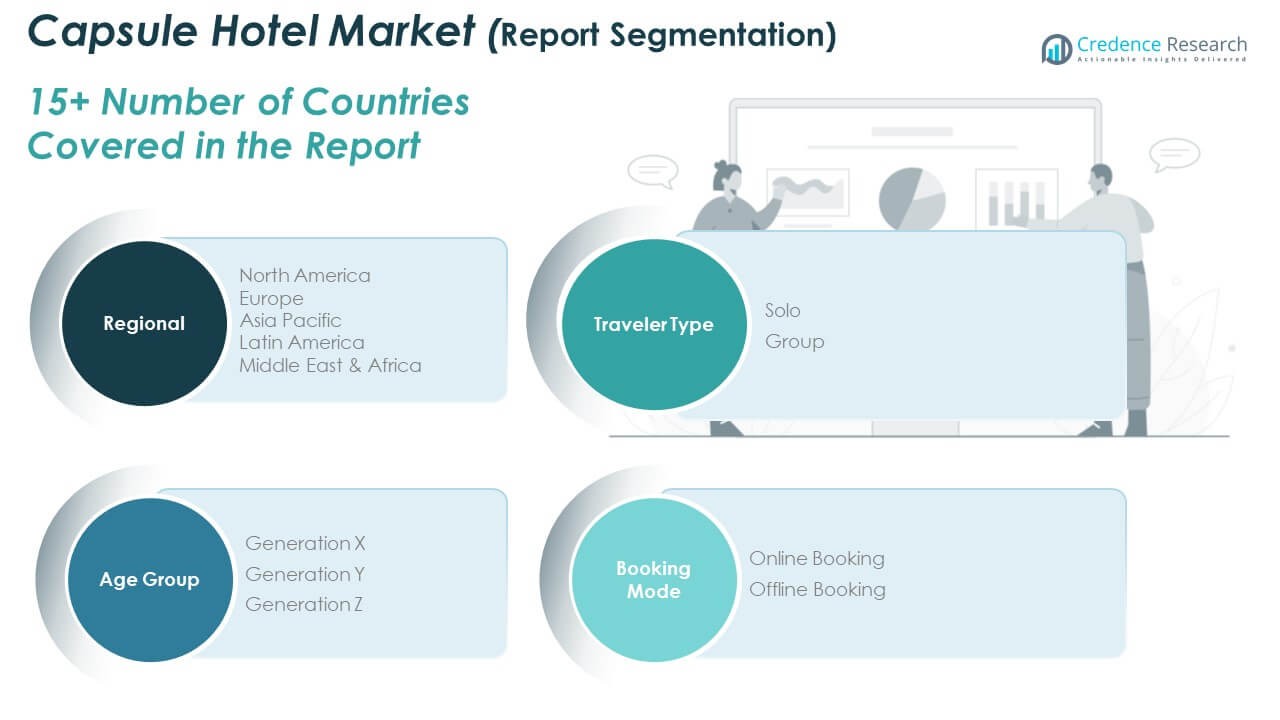

The Global Capsule Hotel Market is segmented by traveler type, age group, and booking mode, each reflecting key behavioral and demographic trends shaping the industry.

By traveler type, solo travelers hold the dominant share, driven by growing numbers of business commuters, digital nomads, and independent tourists seeking cost-effective, minimalistic lodging. Group travelers account for a smaller portion but show rising interest in themed capsule stays and urban leisure travel.

- For example, The Millennials Hotel (Japan): The hotel specifically targets individual travelers by offering smart pods with personal iPod controls, reclining beds, and workspaces—making it a favorite for business tourists and independent travelers.

By age group, Generation Y leads market demand due to their tech-savvy nature, frequent travel habits, and openness to non-traditional accommodations. Generation Z follows closely, showing strong interest in experience-driven, affordable lodging that aligns with budget and social media appeal. Generation X maintains a steady presence, particularly in business-focused capsule facilities with upgraded amenities.

By booking mode, online booking accounts for the majority share. Travelers increasingly prefer digital platforms for convenience, price comparison, and real-time availability. Offline bookings retain relevance in walk-in locations and partnerships with local travel agencies. The Global Capsule Hotel Market adapts its offerings across these segments to remain competitive and meet evolving consumer expectations.

- For instance, Bobobox app data from June 2025 confirms 100% of their pod reservations use the app’s all‑digital check‑in system complete with QR‑key access, B‑Pad controls, and host‑chat support

Segmentation:

By Traveler Type

By Age Group

- Generation X

- Generation Y

- Generation Z

By Booking Mode

- Online Booking

- Offline Booking

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

The North America Capsule Hotel Market size was valued at USD 29.65 million in 2018 to USD 47.39 million in 2024 and is anticipated to reach USD 88.18 million by 2032, at a CAGR of 8.10% during the forecast period. North America holds a moderate share in the Global Capsule Hotel Market, driven by increasing adoption in urban centers such as New York, San Francisco, and Toronto. Rising hotel prices and growing solo travel trends are creating demand for affordable, space-efficient lodging. Airport capsules and tech-integrated pods appeal to business travelers and millennials seeking flexible, short-stay solutions. Operators are leveraging partnerships with transport hubs and hospitality startups to expand footprint. The region benefits from strong digital infrastructure, supporting smart check-ins and app-based services. It continues to gain ground as urban populations prioritize practicality and experience in travel accommodation.

The Europe Capsule Hotel Market size was valued at USD 40.11 million in 2018 to USD 66.71 million in 2024 and is anticipated to reach USD 130.76 million by 2032, at a CAGR of 8.80% during the forecast period. Europe accounts for a growing share of the Global Capsule Hotel Market, supported by rising backpacker tourism, intercity mobility, and budget-conscious travelers. Cities such as London, Berlin, and Amsterdam are witnessing increased capsule hotel investments, particularly near train stations and airports. Inflation in room rates across major cities is shifting consumer preference toward low-cost, modern accommodations. The trend aligns well with Europe’s focus on sustainable, space-saving hospitality solutions. It is gaining traction among young travelers and students seeking convenience, cleanliness, and connectivity. The region’s high CAGR reflects strong future potential and increased interest from both private developers and institutional investors.

The Asia Pacific Capsule Hotel Market size was valued at USD 53.39 million in 2018 to USD 86.87 million in 2024 and is anticipated to reach USD 165.50 million by 2032, at a CAGR of 8.40% during the forecast period. Asia Pacific leads the Global Capsule Hotel Market, contributing the highest regional revenue share. Japan remains the origin and innovation hub for capsule hotels, followed by growing markets in China, South Korea, and Southeast Asia. High population density, urban real estate constraints, and advanced technology infrastructure support capsule hotel growth. Airports, business districts, and transit hubs serve as key development zones. Domestic tourism and cultural familiarity with compact living reinforce demand. It continues to evolve with innovations such as sleep-tech pods and themed capsules, catering to a wide spectrum of travelers.

The Latin America Capsule Hotel Market size was valued at USD 9.05 million in 2018 to USD 14.33 million in 2024 and is anticipated to reach USD 26.33 million by 2032, at a CAGR of 7.90% during the forecast period. Latin America holds an emerging but promising position in the Global Capsule Hotel Market. Countries like Brazil, Mexico, and Colombia are beginning to explore capsule lodging concepts in their urban tourism sectors. The growing middle class, coupled with rising domestic travel, creates favorable conditions for market entry. Capsule hotels offer an attractive solution to overcrowding in city centers and tourist hotspots. Governments and private operators are evaluating space-saving alternatives in hospitality to increase accessibility. It is positioned to benefit from increasing interest in low-cost and sustainable travel solutions across the region.

The Middle East Capsule Hotel Market size was valued at USD 7.29 million in 2018 to USD 10.69 million in 2024 and is anticipated to reach USD 17.44 million by 2032, at a CAGR of 6.30% during the forecast period. The Middle East contributes a smaller but steadily growing share to the Global Capsule Hotel Market. High inbound travel in cities like Dubai, Doha, and Riyadh is prompting investment in modern, transit-friendly accommodations. Capsule hotels are gaining traction in airports and business hubs to serve short-stay passengers and solo travelers. While adoption is still at an early stage, interest is building through smart city initiatives and tourism diversification strategies. The market’s growth reflects the need for scalable and affordable alternatives to luxury hotels. It holds potential for integration with transport infrastructure and hospitality innovation zones.

The Africa Capsule Hotel Market size was valued at USD 3.20 million in 2018 to USD 4.69 million in 2024 and is anticipated to reach USD 7.67 million by 2032, at a CAGR of 6.30% during the forecast period. Africa represents the smallest regional share in the Global Capsule Hotel Market, yet it shows gradual expansion potential. Urban centers such as Nairobi, Lagos, and Cape Town are exploring compact lodging formats for domestic tourists and business travelers. Capsule hotels align well with the continent’s growing urban populations and infrastructural development plans. Investments in airport modernization and tourism initiatives support potential capsule hotel adoption. Operators have an opportunity to introduce low-cost, high-efficiency lodging in underserved areas. It is likely to benefit from demographic shifts and increased travel affordability in the coming years.

Key Player Analysis:

- Ninehours

- De Bedstee Hotel

- Urban Pod Pvt Ltd

- FIRST CABIN HD CO., LTD.

- UZ Airport Capsule Hotel

- Petra Capsule Hostel

- Cabana

- Bloc Hotel

- CityHub

- Yotel

- Henkel Corporation

- Unilever Plc.

- VI-Jon Laboratories Inc.

Competitive Analysis:

The Global Capsule Hotel Market features a moderately fragmented competitive landscape, with a mix of established regional brands and emerging niche players. Key operators such as The Millennials, First Cabin, and Nine Hours in Japan set industry benchmarks through innovation, design, and tech integration. It attracts new entrants seeking to capitalize on rising demand for affordable and efficient lodging in high-density urban areas. Companies compete on factors such as pod design, technology adoption, pricing, and strategic location. Operators are investing in smart infrastructure, mobile-based services, and thematic interiors to enhance differentiation. The market also witnesses increased collaborations with travel platforms and real estate developers to expand visibility and footprint. It presents opportunities for scalable models, particularly through airport integration, co-living spaces, and business travel hubs, making adaptability and brand positioning critical to sustained competitiveness.

Recent Developments:

- In 2025, Bobobox launched five new properties across Indonesia Bobocabin Dieng, Bobopod Thamrin, Bobocabin Sukawana, Bobocabin Patra Parapat, and Bobocabin Ijen bringing its network to 37 locations and showcasing its rapid domestic growth strategy.

- In April 2025, First Cabin International announced plans to open Hawaii’s first capsule hotel in Waikiki Business Plaza. The property will include 103 single-person pods across economy, business, and first-class tiers—marking a luxury approach in pod hospitality.

Market Concentration & Characteristics:

The Global Capsule Hotel Market exhibits moderate concentration, with dominance by a few well-established brands primarily based in Asia, while new entrants continue to expand in North America and Europe. It operates within a niche segment of the hospitality industry, characterized by compact, cost-efficient, and technology-enabled lodging solutions. The market favors players that can innovate in space utilization, offer seamless digital experiences, and adapt to evolving traveler preferences. It caters mainly to solo, budget-conscious, and short-stay travelers, with increasing appeal among digital nomads and business commuters. The structure supports rapid scalability due to low capital requirements and modular designs. It shows strong alignment with urbanization trends, transit-oriented development, and demand for affordable accommodation in dense metropolitan areas.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on traveler type, age group, and booking mode. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Market revenue is projected to grow steadily, driven by rising demand for low-cost, efficient lodging solutions.

- Expansion into transit hubs such as airports and railway stations will increase market penetration.

- Growing preference for short-stay and solo travel will sustain demand across urban centers.

- Integration of IoT and automation will enhance customer experience and operational efficiency.

- Emerging markets in Latin America and Africa will offer new growth opportunities.

- Thematic and hybrid capsule models will attract diverse traveler segments.

- Strategic partnerships with travel platforms and real estate developers will support global expansion.

- Smart city initiatives and urban zoning reforms will favor capsule hotel developments.

- Sustainability trends will encourage the adoption of compact, low-footprint accommodation.

- Competitive differentiation through design innovation and digital services will shape long-term success.