Market Overview

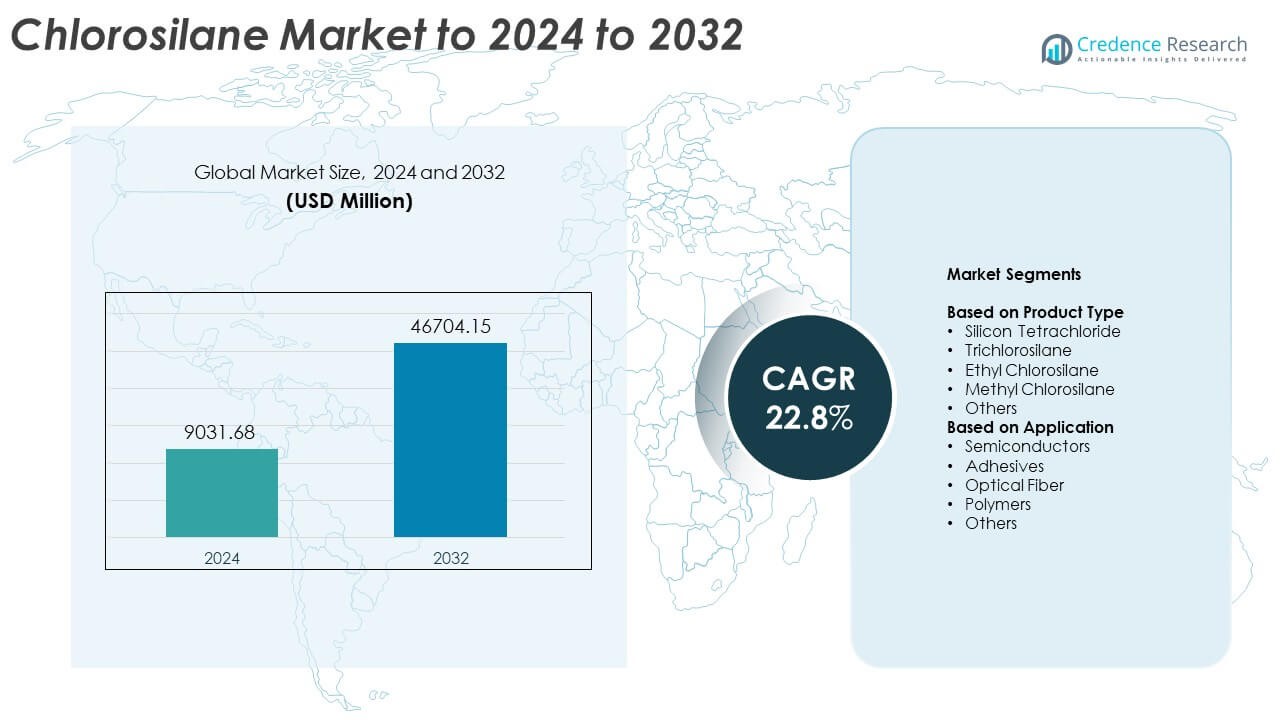

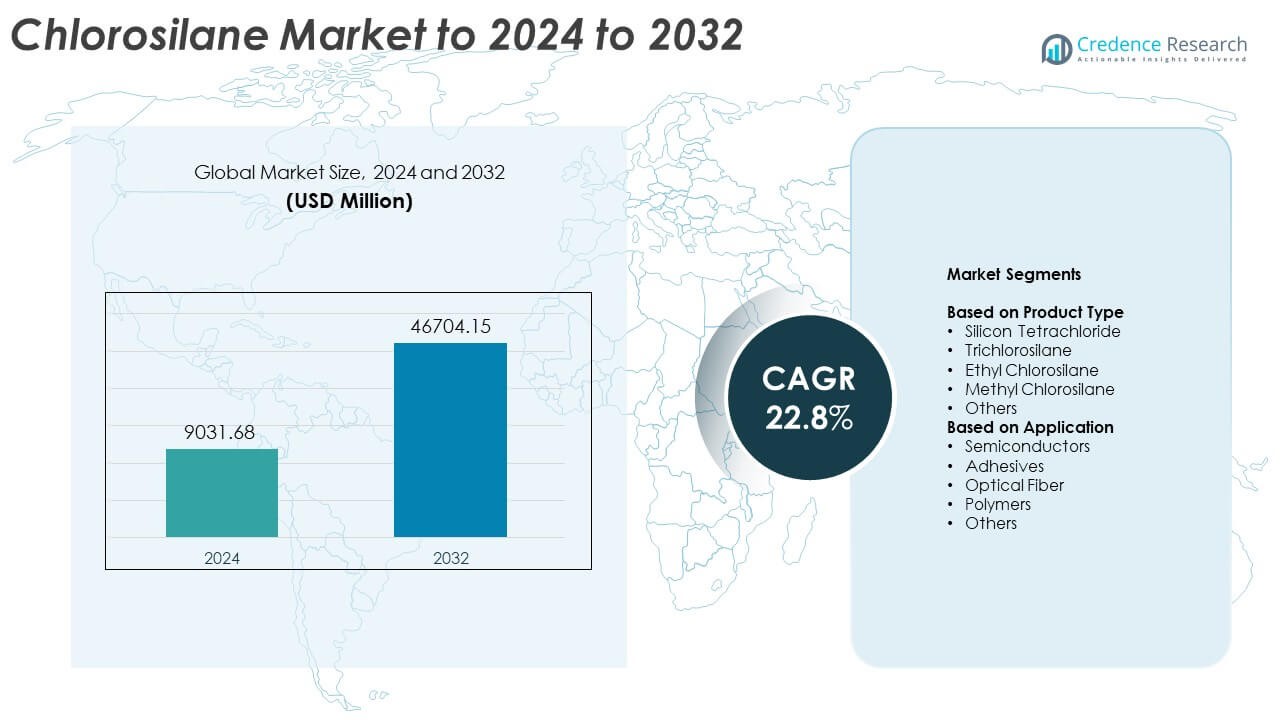

The Chlorosilane Market size was valued at USD 9031.68 million in 2024 and is anticipated to reach USD 46704.15 million by 2032, at a CAGR of 22.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chlorosilane Market Size 2024 |

USD 9031.68 Million |

| Chlorosilane Market, CAGR |

22.8% |

| Chlorosilane Market Size 2032 |

USD 46704.15 Million |

The chlorosilane market features prominent players including Wacker Chemie AG, Shin-Etsu Chemical Co., Ltd, Dow Inc., Tokuyama Corporation, Merck KGaA, Evonik, OCI Company Ltd, Gelest Inc., Wynca Group, BRB Silicones, and Linde AG. These companies dominate global production through large-scale manufacturing facilities and advanced purification technologies supporting semiconductor and solar applications. Asia Pacific led the market in 2024 with a 40% share, driven by strong demand from electronics and photovoltaic industries in China, Japan, and South Korea. North America accounted for 30%, supported by rising semiconductor investments, while Europe held 20%, reflecting its focus on renewable energy and high-purity chemical production.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The chlorosilane market was valued at USD 9031.68 million in 2024 and is projected to reach USD 46704.15 million by 2032, expanding at a CAGR of 22.8% during the forecast period.

- Growing semiconductor and solar photovoltaic production drives strong demand for high-purity chlorosilanes, particularly silicon tetrachloride and trichlorosilane used in wafer and polysilicon manufacturing.

- Advancements in purification technologies and rising adoption of eco-friendly synthesis methods mark key trends, with manufacturers focusing on sustainable, low-emission production.

- The market is moderately consolidated, with global players emphasizing regional capacity expansion and product innovation to enhance competitiveness amid tightening environmental regulations.

- Asia Pacific dominated the market with a 40% share in 2024, followed by North America at 30% and Europe at 20%; by product, silicon tetrachloride led with 36.7% share, reflecting its critical role in optical fiber and semiconductor applications.

Market Segmentation Analysis:

By Product Type

Silicon tetrachloride dominated the chlorosilane market in 2024, accounting for 36.7% of the total share. Its strong demand is driven by extensive use in optical fibers, semiconductors, and polysilicon production. Increasing solar photovoltaic deployment and growth in the electronics sector further accelerate consumption. Trichlorosilane also gained traction due to its critical role in producing high-purity silicon for solar panels and integrated circuits. The segment benefits from advancements in purification technologies and expanding renewable energy capacity, particularly in Asia-Pacific manufacturing hubs.

- For instance, the OCI Tokuyama Semiconductor Materials Sdn. Bhd. (OTSM) plant being built in Samalaju is a joint venture that targets an annual production capacity of 8,000 metric tons of high-purity polysilicon, with commercial operations scheduled for 2029.

By Application

Semiconductors held the largest share of 41.2% in the chlorosilane market in 2024, driven by surging demand for high-performance chips and integrated circuits. Chlorosilanes serve as essential precursors in the chemical vapor deposition process, ensuring high-purity silicon layers. The rapid expansion of the electronics and solar industries strengthens market growth. Optical fiber applications also show robust growth, supported by global broadband infrastructure expansion and 5G deployment. Rising investments in telecommunications and smart device manufacturing sustain strong consumption across emerging economies.

- For instance, ASML recognized revenue on 2 High NA EUV systems in the fourth quarter of 2024, and had shipped a third High NA EUV system to a customer by the end of the year.

Key Growth Drivers

Expanding Semiconductor and Electronics Industry

The rising demand for semiconductors is a major growth driver for the chlorosilane market. Chlorosilanes play a crucial role in producing high-purity silicon, used in integrated circuits and microchips. The global shift toward advanced technologies such as AI, IoT, and electric vehicles boosts semiconductor consumption. Rapid industrialization and government support for chip manufacturing in Asia-Pacific and North America further strengthen the supply chain. Increased investment in silicon wafer production continues to propel chlorosilane demand across key manufacturing regions.

- For instance, Wacker’s new “Etching Line Next” in Burghausen expands semiconductor-grade polysilicon cleaning capacity by over 50%.

Rising Adoption of Solar Photovoltaics

The accelerating adoption of solar energy significantly drives chlorosilane consumption. Trichlorosilane and silicon tetrachloride are essential materials for producing polysilicon used in solar panels. Growing emphasis on renewable energy targets and declining installation costs enhance global solar capacity. Governments worldwide are incentivizing green energy projects, promoting large-scale solar infrastructure development. Expanding polysilicon production capacities in China, India, and the U.S. reinforce chlorosilane market growth through sustainable energy transitions.

- For instance, Daqo guided an initial polysilicon output range of 110,000 to 140,000 metric tons for the full year 2025 in April 2025.

Growth in Optical Fiber and Communication Networks

The increasing deployment of optical fiber networks is fueling chlorosilane demand. Silicon tetrachloride is a primary precursor in manufacturing optical fiber preforms, ensuring high transmission efficiency. The surge in 5G rollout, cloud computing, and data center expansion supports market growth. Telecommunication companies are investing heavily in broadband infrastructure to meet high-speed connectivity needs. This trend positions chlorosilane as a key material in the digital infrastructure ecosystem.

Key Trends & Opportunities

Shift Toward High-Purity and Eco-Friendly Production

Manufacturers are focusing on developing high-purity chlorosilane products to meet semiconductor-grade specifications. Advancements in refining and distillation technologies enhance product quality and yield. Companies are also adopting cleaner production processes to minimize by-products and emissions. Environmental regulations promoting low-waste and energy-efficient chemical synthesis methods create new opportunities. These innovations align with sustainability goals while maintaining consistent purity standards required by advanced industries.

- For instance, Hemlock (referring to Hemlock Semiconductor, HSC) reports it has recycled an average of 8.4 million pounds (3,810 metric tons) of materials per year since 2008.

Increasing Investment in Regional Manufacturing Expansion

Major producers are expanding chlorosilane production facilities in Asia-Pacific, driven by strong electronics and solar manufacturing bases. Strategic joint ventures and localization of supply chains reduce import dependence and improve cost efficiency. Rising foreign direct investment in India, China, and Southeast Asia supports regional industrialization. These developments create opportunities for new entrants to integrate into growing value chains. Enhanced capacity expansion strategies strengthen global market competitiveness.

- For instance, OCI is boosting Malaysian polysilicon capacity from 35,000 to 56,600 metric tons. The project strengthens Asia-Pacific upstream supply.

Key Challenges

Stringent Environmental and Safety Regulations

The production and handling of chlorosilanes pose environmental and occupational safety risks. Strict government regulations on emissions and waste disposal increase compliance costs. Producers must adopt advanced containment and treatment systems to manage hazardous by-products. The need for specialized storage and transportation also adds to operational expenses. Meeting these regulatory requirements while maintaining profitability remains a significant industry challenge.

Volatility in Raw Material Prices and Supply Disruptions

Fluctuations in raw material costs, particularly silicon and chlorine, directly affect production margins. Global supply chain disruptions, energy shortages, and transportation constraints exacerbate pricing instability. Dependence on a few major suppliers for high-purity inputs increases market vulnerability. Manufacturers face challenges in maintaining stable supply amid geopolitical uncertainties and trade restrictions. Managing cost efficiency under volatile conditions continues to be a major restraint for producers.

Regional Analysis

North America

In 2024, North America accounted for approximately 30% of the global chlorosilane market. The region’s strong presence in semiconductor manufacturing and solar-grade silicon production drives demand. Government incentives for renewables and domestic chip supply-chain investments further reinforce market growth. Increased construction of data centres and expansion of optical-fiber infrastructure also support chlorosilane consumption in the region.

Europe

Europe held around 20% of the global chlorosilane market in 2024. Growth arises from the region’s focus on renewable energy installation and strict chemical manufacturing standards. The plastics, adhesives and polymers industries in Europe also absorb chlorosilane-based intermediates. However, slower industrial expansion compared with Asia limits more rapid share gains.

Asia Pacific

Asia Pacific dominated with roughly 40% market share in 2024. Rapid growth in electronics, solar-PV manufacturing and smart devices underpins high chlorosilane usage across China, India and Japan. Large-scale polysilicon plants and optical-fiber glass production further support consumption. Rising regional self-reliance in semiconductor materials strengthens Asia Pacific’s market position.

Latin America

Latin America captured about 6% of the global chlorosilane market in 2024. Expansion of solar power installations in Brazil and Chile creates new demand streams for high-purity silicon precursors. Constraint on local manufacturing capacities and reliance on imports limit faster growth, but favourable renewable-energy targets provide upward momentum.

Middle East & Africa

The Middle East & Africa region represented about 4% of the market in 2024. Growth stems from oil-&-gas downstream diversification and increasing solar-PV deployments in Gulf countries. Regulatory changes and rising demand for silicones and specialty adhesives in infrastructure rebuilds support market advancement. Limited domestic chemical manufacturing, however, constrains share expansion.

Market Segmentations:

By Product Type

- Silicon Tetrachloride

- Trichlorosilane

- Ethyl Chlorosilane

- Methyl Chlorosilane

- Others

By Application

- Semiconductors

- Adhesives

- Optical Fiber

- Polymers

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The chlorosilane market is characterized by the presence of major players such as Wacker Chemie AG, BRB Silicones, Shin-Etsu Chemical Co., Ltd, Gelest Inc., Dow Inc., Wynca Group, Tokuyama Corporation, Merck KGaA, OCI Company Ltd, Evonik, and Linde AG. The competitive landscape remains moderately consolidated, with leading companies focusing on expanding production capacities and enhancing product purity to meet semiconductor-grade requirements. Firms are investing in advanced distillation and purification technologies to strengthen their foothold in solar and electronic applications. Strategic collaborations with downstream manufacturers ensure supply stability and technical integration across value chains. Players are also pursuing vertical integration to control raw material sourcing and reduce dependency on imports. In addition, sustainability initiatives and process optimization strategies are gaining traction to comply with environmental standards and reduce emissions. Continuous research in high-purity chlorosilane formulations and regional capacity expansion underline the competition’s focus on innovation and long-term market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2023, Evonik Industries completed an expansion of its rubber silanes production capacity at its joint venture plant, Evonik Lanxing (Rizhao) Chemical Industrial Co., Ltd., in China

- In 2023, BRB Silicones: Showcased novel silane, additive, resin, and water repellent products at the European Coatings Show.

- In 2023, Shin-Etsu Chemical Co., Ltd.: Established a Sustainable Silicone Business Development Department to focus on environmentally friendly silicone products.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising semiconductor production will sustain high demand for chlorosilane across Asia and North America.

- Expanding solar energy projects will continue driving trichlorosilane use in polysilicon manufacturing.

- Increasing investments in 5G networks will boost demand for silicon tetrachloride in optical fiber applications.

- Advancements in purification and distillation will enhance production efficiency and product quality.

- Growing preference for eco-friendly processes will encourage adoption of low-emission manufacturing technologies.

- Strategic partnerships between chemical producers and electronics firms will strengthen supply stability.

- Emerging economies will attract new chlorosilane capacity to meet rising industrial needs.

- Technological innovation in semiconductor materials will open opportunities for high-purity chlorosilane products.

- Government incentives for renewable energy and domestic chipmaking will support long-term growth.

- Market consolidation among leading producers will improve global competitiveness and production efficiency.