Market Overview

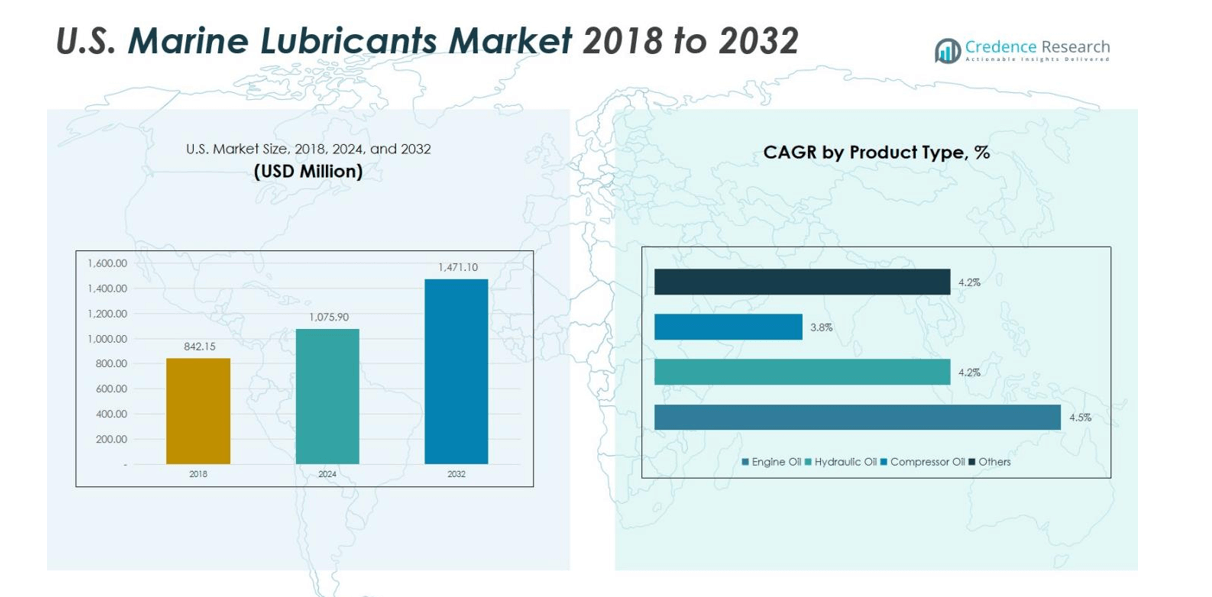

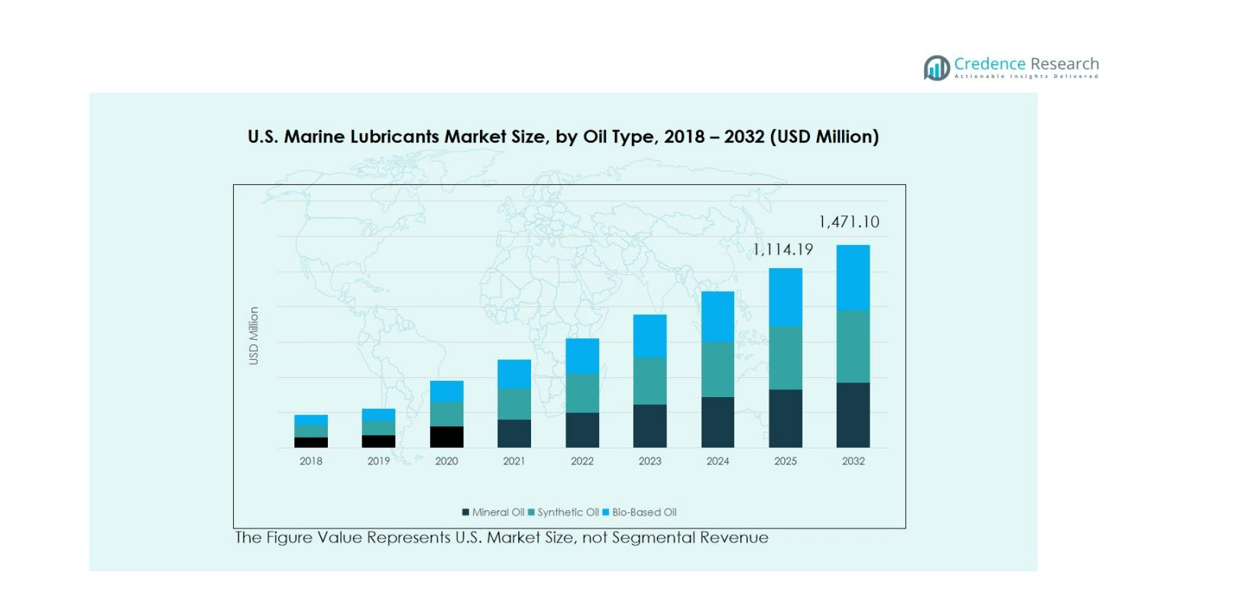

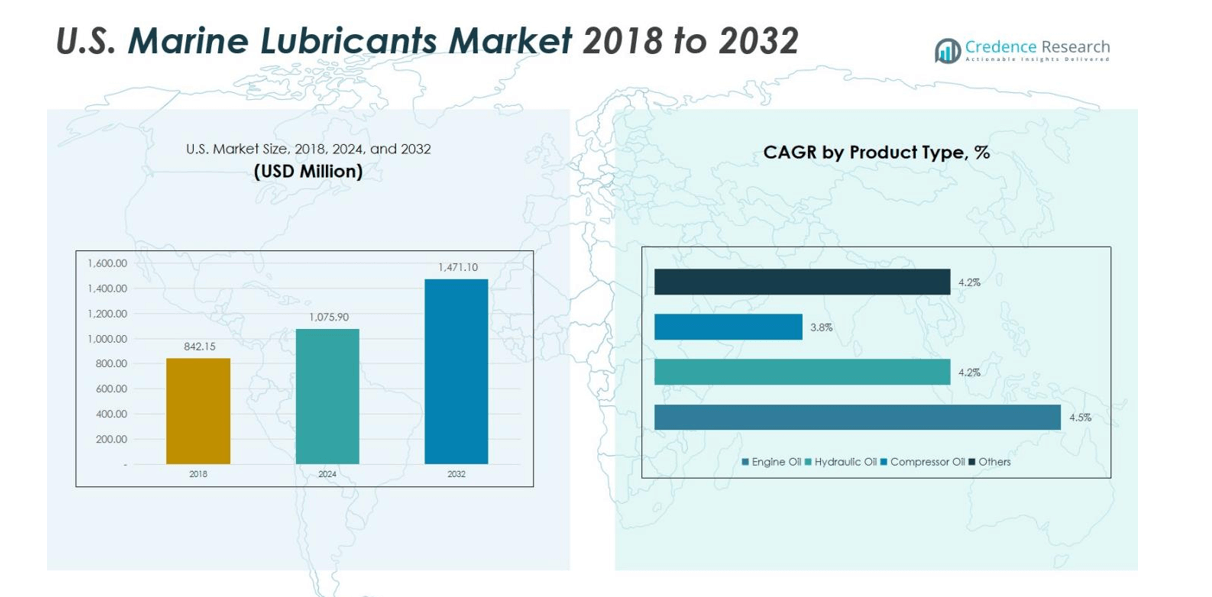

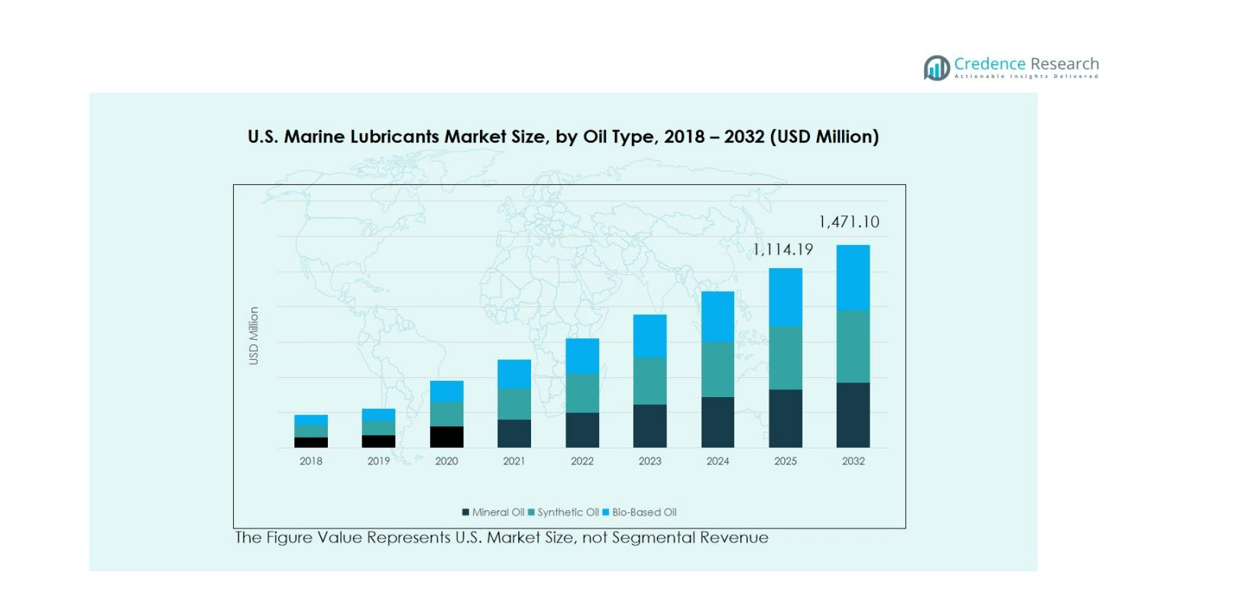

The U.S. Marine Lubricants Market size was valued at USD 842.15 million in 2018, increasing to USD 1,075.90 million in 2024, and is anticipated to reach USD 1,471.10 million by 2032, growing at a CAGR of 4.07% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Marine Lubricants Market Size 2024 |

USD 1,075.90 million |

| U.S. Marine Lubricants Market, CAGR |

4.07% |

| U.S. Marine Lubricants Market Size 2032 |

USD 1,471.10 million |

The U.S. Marine Lubricants Market is shaped by the strong presence of leading companies such as ExxonMobil Marine Limited, Chevron Corporation, TotalEnergies, Repsol, Klüber Lubrication, Pennzoil, Vickers Oils, and Jax Inc. These players dominate through extensive product portfolios, advanced synthetic and bio-based formulations, and strong distribution networks across major ports. They continue to invest in R&D and sustainability-driven innovation to meet evolving environmental regulations and performance demands. Regionally, the South region leads the market with a 41% share, driven by its concentration of maritime hubs such as Houston and New Orleans, significant offshore oil and gas activities, and high lubricant consumption from commercial and industrial fleets.

Market Insights

- The U.S. Marine Lubricants Market was valued at USD 1,075.90 million in 2024 and is projected to reach USD 1,471.10 million by 2032, growing at a CAGR of 4.07% during the forecast period.

- Growth is driven by expanding maritime trade, increasing vessel maintenance needs, and rising demand for high-performance synthetic and bio-based lubricants to improve fuel efficiency and engine life.

- Market trends include a shift toward environmentally sustainable formulations and the adoption of advanced lubricants that comply with stringent U.S. EPA marine emission standards.

- The competitive landscape features major players such as ExxonMobil Marine Limited, Chevron Corporation, TotalEnergies, Repsol, and Klüber Lubrication, focusing on innovation, port service expansion, and strategic collaborations.

- Regionally, the South region dominates the market with a 41% share due to dense port infrastructure and offshore operations, while the mineral oil segment holds the largest share at 54% owing to its wide usage in conventional marine engines.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Oil Type

The oil type segment is led by the mineral oil sub-segment, which commands a dominant share of 72% of the U.S. marine lubricants market. This prevalence is driven by its lower cost, widespread availability, and compatibility with legacy marine engine systems. Meanwhile, synthetic oils are gaining traction due to their superior thermal stability and enhanced lubricant life, and bio-based oils are gradually emerging as environmentally-friendly alternatives in response to stricter regulations and sustainability goals.

- For instance, Valvoline Inc. manufactures marine heavy-duty engine oils like ValMarin, which are formulated using mineral oils tailored for high performance in demanding marine conditions.

By Product Type

Within the product-type segmentation, engine oil remains the dominant sub-segment, accounting for 50% of market revenue. The high share reflects the large fleet of marine diesel and two-stroke engines in operation, which demand regular oil changes and high-volume consumption. Hydraulic and compressor oils follow at smaller shares, but are growing in importance as onboard automation, hydraulics and pneumatic systems become more sophisticated and require specialized lubricant solutions.

- For instance, Hydraulic oils have also seen notable innovation; ExxonMobil offers a range of mineral and synthetic hydraulic oils formulated to improve efficiency and protect marine equipment from corrosion, supporting more sophisticated onboard hydraulics.

By Application

Under application segments, bulk carriers hold the largest share around 57% of the market reflecting their global dominance in tonnage and the proportionate lubricant consumption on these vessels. This dominance is driven by the vast number of bulkers in the fleet lifecycle and their high engine hours. Container ships and oil tankers follow, benefiting from expanding trade volumes and stricter lubricant performance requirements, while the “Others” segment (such as passenger ships, offshore support vessels) is gaining incremental share owing to growing niche applications.

Key Growth Drivers

Expansion of Seaborne Trade

Rising seaborne trade volumes remain a major growth catalyst for the U.S. marine lubricants market. Increasing imports, exports, and intercoastal shipping activities are driving higher utilization of fleets and engines, resulting in more frequent lubricant replacement cycles. The expansion of bulk and container shipping operations contributes to sustained lubricant demand, as vessel operators prioritize performance and protection under extended operating conditions. This steady trade growth continues to reinforce lubricant consumption across U.S. ports and coastal trade routes.

- For instance, according to BIMCO, global shipyards delivered 350 new containerships with a total capacity of 2.2 million TEU in 2023, indicating substantial fleet renewal that correlates with rising lubricant consumption.

Stricter Emission and Environmental Regulations

Stringent emission norms established by the International Maritime Organization (IMO) and U.S. Environmental Protection Agency (EPA) are propelling the adoption of advanced lubricants. Marine operators increasingly prefer low-sulfur, ash-less, and environmentally compliant formulations to meet new fuel and emission standards. This regulatory push has accelerated the shift toward high-performance synthetic and bio-based lubricants that enhance fuel efficiency, reduce carbon footprint, and support sustainable marine operations. Consequently, compliance requirements are transforming lubricant formulation and market composition in the U.S.

- For instance, Cepsa has developed the Gavia 4050 lubricant designed for slow marine two-stroke engines using very low sulfur fuel oil (VLSFO) as mandated by IMO 2020, ensuring optimal engine performance while complying with sulfur limits.

Technological Advancement in Vessel Propulsion and Automation

The integration of advanced propulsion systems, automation technologies, and digital monitoring across U.S. fleets is stimulating lubricant innovation. Modern vessels require high-performance lubricants capable of enduring high pressures, variable loads, and elevated temperatures. Synthetic lubricants with enhanced thermal and oxidation stability are increasingly preferred in such systems. These technological developments, coupled with ongoing vessel modernization and retrofitting programs, are expanding opportunities for premium lubricant formulations that extend equipment life and operational reliability.

Key Trends and Opportunities

Shift Toward Synthetic and Bio-Based Lubricants

A major trend shaping the U.S. marine lubricants market is the growing preference for synthetic and bio-based oils. Synthetic lubricants offer superior wear protection, longer drain intervals, and improved efficiency, while bio-based variants meet eco-label standards and minimize marine pollution. This shift aligns with the industry’s sustainability agenda and supports regulatory compliance. As environmental awareness strengthens, suppliers are focusing on expanding their eco-friendly product lines, creating new growth avenues in the premium lubricant segment.

- For instance, RSC Bio Solutions has launched FUTERRA™, a synthetic bio-based lubricant line offering extended service intervals up to 8,000 hours while meeting stringent environmental regulations and supporting equipment efficiency in marine applications.

Expansion of Lifecycle and Aftermarket Services

Marine lubricant providers are increasingly adopting a service-oriented approach by offering value-added solutions such as oil condition monitoring, predictive maintenance, and lubricant performance analytics. These lifecycle service models enhance operational efficiency for fleet operators and reduce total cost of ownership. In the U.S., this trend is fostering long-term partnerships between lubricant manufacturers and shipping companies. The move toward integrated services strengthens customer retention while expanding revenue streams beyond traditional product sales.

- For instance, Shell also offers Shell LubeAnalyst, a lab-based oil analysis program that uses extensive benchmarking data to identify potential equipment issues early, helping shipping companies prevent costly downtime.

Key Challenges

Volatility in Base-Oil Feedstock Prices

The marine lubricants industry in the U.S. faces persistent challenges from fluctuating crude oil and base-stock prices. These cost variations directly affect production margins and create pricing instability across the supply chain. Manufacturers struggle to balance profitability with competitive pricing, especially amid unpredictable global energy markets. This volatility often discourages bulk procurement and investment in high-value lubricants, potentially constraining market growth during periods of sharp raw material price swings.

Compatibility and Regulatory Compliance Complexities

Ensuring that modern lubricant formulations are compatible with diverse marine engine types and evolving emission standards remains a technical challenge. Ship operators must validate lubricant performance without compromising warranty or operational safety. At the same time, ongoing updates to international marine fuel and environmental regulations require constant product reformulation and re-certification. These complexities increase production costs, prolong approval timelines, and can slow the adoption of innovative lubricant solutions across the U.S. fleet.

Regional Analysis

Northeast

The Northeast region accounts for a market share of 24% in the U.S. marine lubricants industry, driven by its dense network of commercial ports such as New York–New Jersey and Boston. The region’s strong presence in containerized cargo operations and short-sea shipping enhances lubricant consumption, especially for medium- and high-speed marine engines. Increasing port modernization projects and rising vessel maintenance activity further support lubricant demand. Moreover, the emphasis on sustainable maritime operations is encouraging the adoption of synthetic and bio-based lubricants across major shipping and logistics operators in the region.

Midwest

Holding a 15% market share, the Midwest region’s demand for marine lubricants is primarily supported by its extensive inland waterway system, particularly along the Mississippi River. Barge and cargo vessel operations transporting agricultural and industrial commodities drive steady lubricant usage in this area. Growth in regional trade and investments in port infrastructure at key terminals, such as those in Illinois and Missouri, are improving vessel traffic and maintenance needs. The market also benefits from the rising adoption of efficient engine oils designed for riverine and towing vessels, ensuring optimal performance under variable load conditions.

South

The South region dominates the U.S. marine lubricants market with a 41% share, anchored by major maritime hubs like Houston, New Orleans, and Tampa. Its strong offshore oil and gas activity, extensive shipping routes, and high vessel density make it the core lubricant consumption zone. The region’s thriving energy exports and offshore exploration stimulate demand for engine, hydraulic, and compressor oils used in heavy-duty marine applications. Additionally, increasing investments in port expansions and stricter environmental regulations are driving the use of high-performance, low-sulfur synthetic lubricants in coastal and offshore fleets.

West

The West region represents a 20% share of the U.S. marine lubricants market, led by major ports such as Los Angeles, Long Beach, and Seattle. The region’s lubricant demand is influenced by strong trans-Pacific trade, containerized shipping growth, and active naval operations. Environmental compliance under California’s stringent emission standards has accelerated the shift toward bio-based and synthetic lubricants. Growing investment in green port initiatives and the transition to cleaner vessel propulsion systems continue to support lubricant upgrades, positioning the West Coast as a strategic hub for sustainable marine lubricant deployment.

Market Segmentations:

By Oil Type:

- Mineral Oil

- Synthetic Oil

- Bio-Based Oil

By Product Type:

- Engine Oil

- Hydraulic Oil

- Compressor Oil

- Others

By Application:

- Bulk Carriers

- Container Ships

- Oil Tankers

- Others

By Region

- North East

- Midwest

- South

- West

Competitive Landscape

The competitive landscape of the U.S. Marine Lubricants Market is characterized by the presence of major players such as ExxonMobil Marine Limited, Chevron Corporation, TotalEnergies, Repsol, Klüber Lubrication, Pennzoil, Vickers Oils, and Jax Inc. These companies compete through product innovation, sustainability initiatives, and strategic partnerships to strengthen market presence. Leading firms focus on expanding their portfolio of high-performance synthetic and bio-based lubricants to meet evolving emission standards and enhance fuel efficiency. Continuous investment in R&D enables the development of advanced formulations tailored for modern propulsion and automation systems. Companies are also leveraging digital monitoring and predictive maintenance services to deliver value-added solutions that improve vessel uptime. Additionally, strategic collaborations with shipping companies and shipyards are helping manufacturers reinforce distribution networks and aftersales support, positioning them competitively in a market increasingly defined by technology integration, environmental compliance, and premium lubricant adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, ExxonMobil Marine Limited secured a USD 954 million indefinite-delivery/indefinite-quantity contract to supply lubrication solutions to the U.S. Navy, strengthening its presence in the U.S. marine lubricants sector.

- In July 2025, Castrol (a BP subsidiary) introduced its new MHP range of marine-engine lubricants across the U.S. and international ports, targeting next-generation marine propulsion systems and ensuring compliance with evolving emission regulations.

- In 2025, Vickers Oils confirmed a new distributor partnership and launched a collaboration with XIANGXINGCHENG PetroChemical Co for U.S. and global marine-lubricant distribution.

- In July 2025, Chevron Marine Lubricants partnered with Petrol Ofisi to streamline vessel operations and reduce downtimes for the fleet of Susesea, enhancing marine-engine performance across key trades.

Report Coverage

The research report offers an in-depth analysis based on Oil Type, Product Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The U.S. marine lubricants market is expected to experience steady growth driven by rising vessel maintenance and fleet expansion.

- Demand for synthetic and bio-based lubricants will increase due to stricter emission and environmental regulations.

- Technological advancements in vessel propulsion and automation will drive the need for high-performance lubricants.

- Growing offshore oil and gas activities will continue to boost lubricant consumption in the southern coastal region.

- Digital monitoring and condition-based maintenance systems will enhance lubricant efficiency and reduce downtime.

- Port modernization and infrastructure development will support market expansion in key maritime hubs.

- Collaborations between lubricant manufacturers and shipping companies will strengthen product innovation and service offerings.

- Sustainability initiatives and the shift toward low-emission shipping will accelerate eco-friendly lubricant adoption.

- Competitive pressure will lead to further investments in R&D and product differentiation.

- The market will increasingly favor integrated service models combining lubricants with technical and operational support.