Market Overview

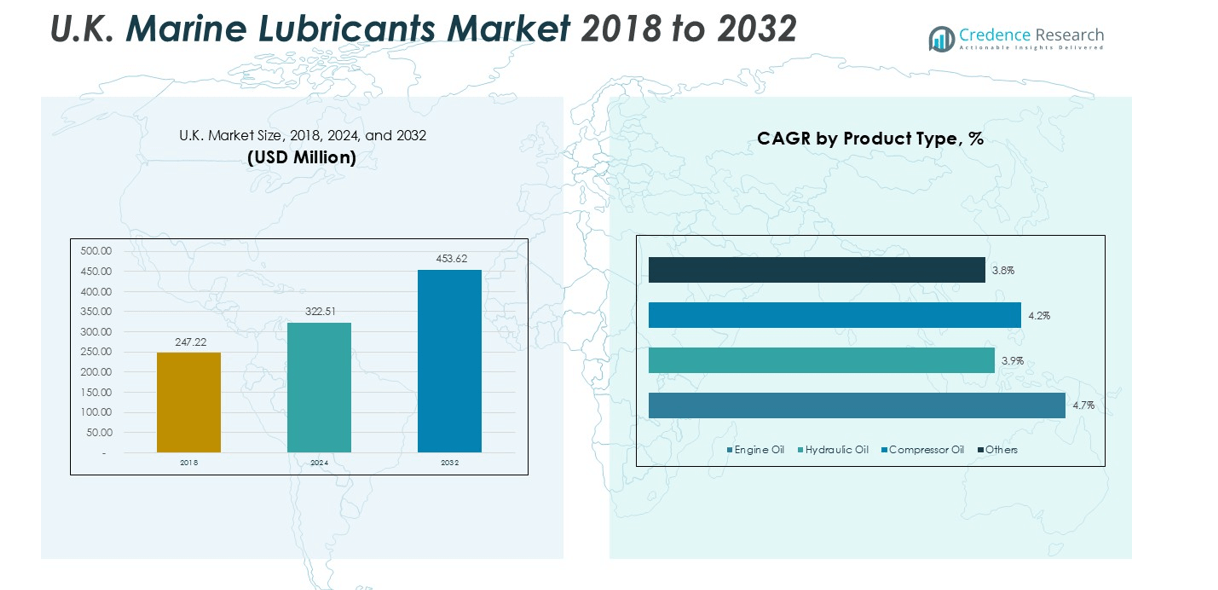

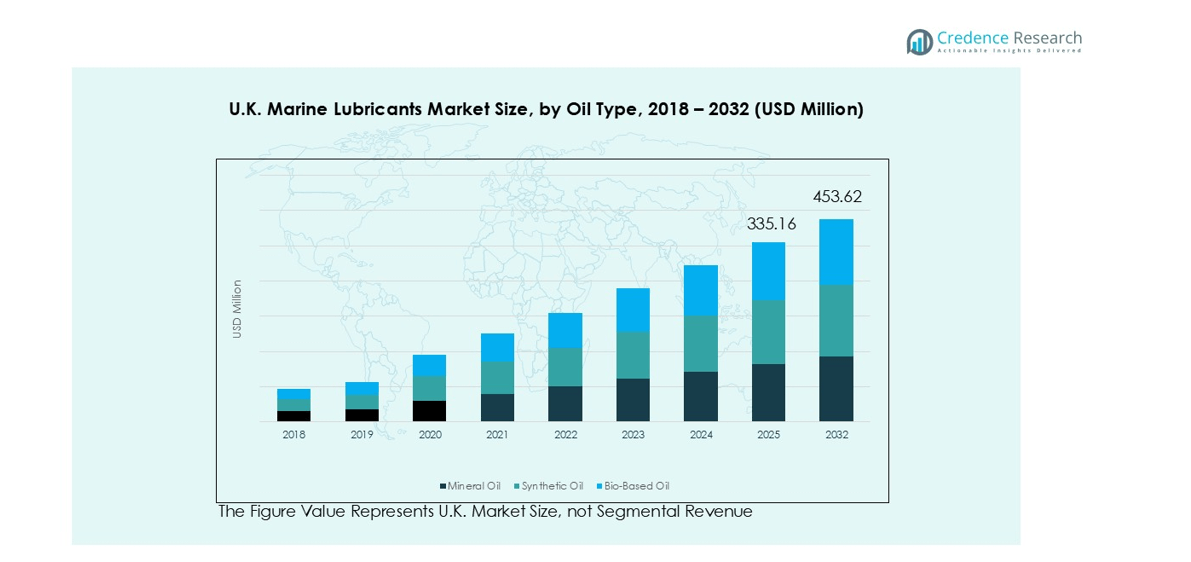

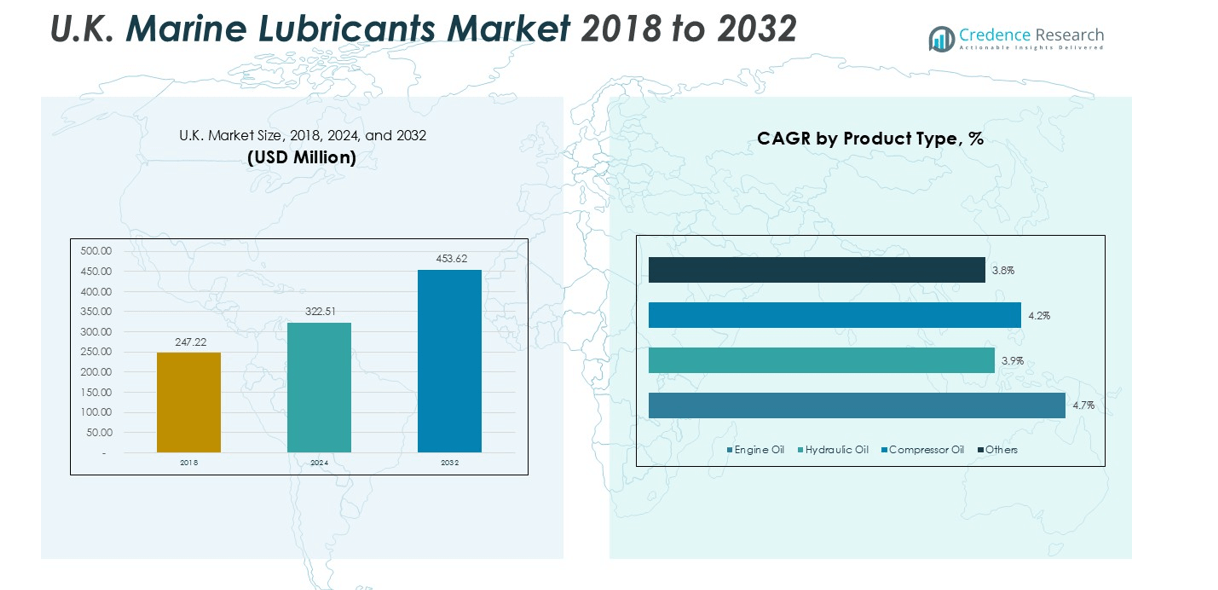

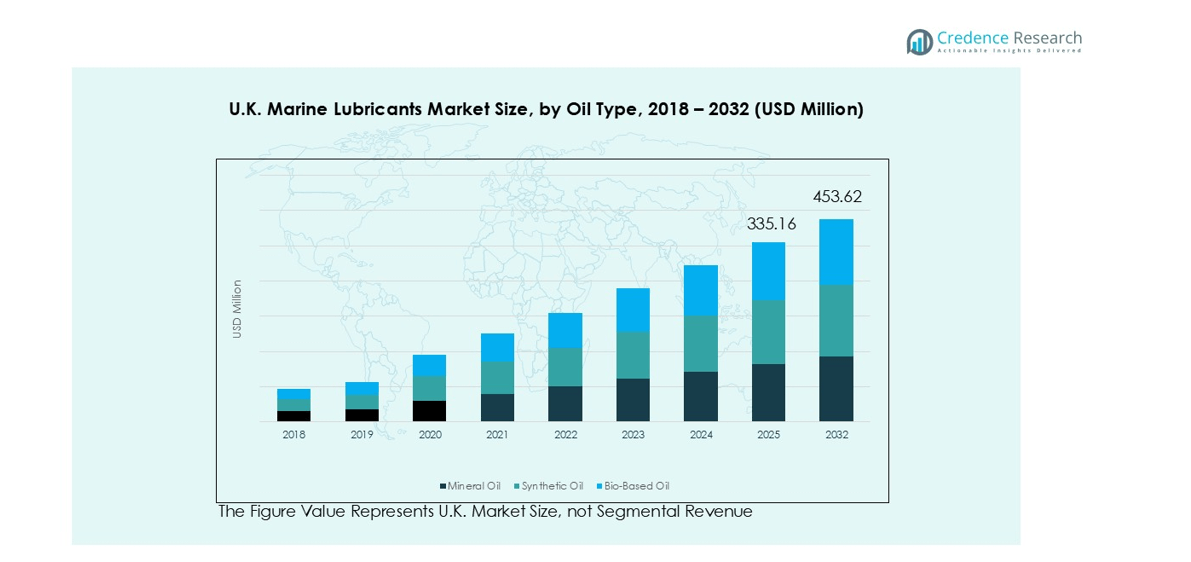

The U.K. Marine Lubricants Market size was valued at USD 247.22 million in 2018, reaching USD 322.51 million in 2024, and is anticipated to attain USD 453.62 million by 2032, growing at a CAGR of 4.32% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.K. Marine Lubricants Market Size 2024 |

USD 322.51 million |

| U.K. Marine Lubricants Market, CAGR |

4.32% |

| U.K. Marine Lubricants Market Size 2032 |

USD 453.62 million |

The competitive landscape of the U.K. Marine Lubricants Market is dominated by major players such as BP p.l.c., Shell Plc, ExxonMobil Marine Limited, Chevron Corporation, TotalEnergies, and Fuchs Lubricants, all of which maintain strong distribution networks and advanced lubricant technologies. These companies focus on sustainable formulations, enhanced vessel performance, and compliance with IMO emission standards. Strategic partnerships with shipping operators and port authorities further strengthen their market position. England emerges as the leading region, accounting for 46.2% of the total market share, supported by its extensive maritime trade activities, major ports including Southampton and London, and significant ship maintenance operations.

Market Insights

- The U.K. Marine Lubricants Market was valued at USD 322.51 million in 2024 and is projected to reach USD 453.62 million by 2032, growing at a CAGR of 4.32% during the forecast period.

- Growth is driven by increasing maritime trade, fleet expansion, and the demand for high-performance lubricants that enhance vessel efficiency and reduce emissions.

- Key trends include a shift toward bio-based and synthetic lubricants, digital monitoring solutions for maintenance optimization, and innovation in eco-friendly marine oils.

- The market is moderately competitive, with major players such as BP p.l.c., Shell Plc, ExxonMobil Marine Limited, Chevron Corporation, TotalEnergies, and Fuchs Lubricants focusing on sustainability and product innovation.

- England holds 46.2% of the regional market share, driven by major ports like Southampton and London, while the mineral oil segment accounts for 51.8% of total sales, owing to its cost-effectiveness and widespread application in marine vessels.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

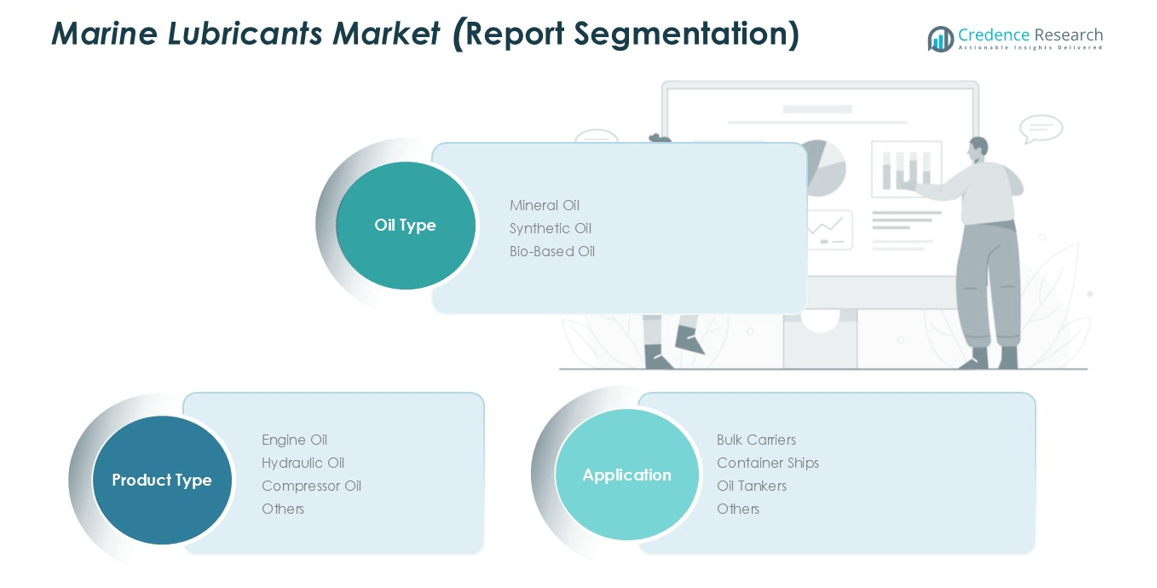

Market Segmentation Analysis:

By Oil Type

The U.K. marine lubricants market is dominated by mineral oil, holding around 72% market share in 2024, driven by its affordability, availability, and compatibility with most vessel engines. Synthetic oils are rapidly gaining traction due to their enhanced oxidation stability, longer drain intervals, and fuel-efficiency benefits, supporting fleets adopting cleaner propulsion systems. Meanwhile, bio-based oils are emerging as an eco-friendly alternative, particularly for operations in environmentally sensitive zones, supported by stricter IMO and U.K. coastal regulations encouraging the use of Environmentally Acceptable Lubricants (EALs).

- For instance, Shell introduced its biodegradable marine lubricants in 2024, targeting offshore and Arctic shipping operations to meet stringent environmental regulations.

By Product Type

Engine oil leads the product type segment, accounting for approximately 46% of total revenue due to its essential role in powering main and auxiliary engines across commercial fleets. This dominance is driven by the need for high-performance lubricants that ensure durability, emission compliance, and fuel efficiency. Hydraulic and compressor oils follow, supported by growth in offshore operations, automation of deck machinery, and LNG fuel systems. Specialty lubricants such as greases and gear oils in the ‘Others’ category are also expanding, fueled by demand for premium formulations and enhanced vessel maintenance practices.

- For instance, Klüber Lubrication’s PFPE-based bearing lubricants enable safe operation in aggressive environments of chemical and LNG tankers, improving machinery lifespan and reducing operational costs through advanced wear and corrosion protection.

By Application

Among applications, bulk carriers dominate the U.K. marine lubricants market with nearly 58% market share, owing to their large engine capacities, long operating hours, and major role in commodity transport. Container ships form the second-largest segment, driven by increasing trade volumes and the need for high-performance oils in high-speed operations. Oil tankers contribute a significant portion, supported by active crude and product transport routes through U.K. ports. The ‘Others’ category, including offshore and service vessels, is expanding rapidly with the country’s rising offshore energy and defense maritime activities.

Key Growth Drivers

Expanding Maritime Trade and Fleet Modernization

The steady expansion of maritime trade and modernization of the U.K.’s commercial fleet are key growth catalysts for the marine lubricants market. Increasing seaborne imports and exports, supported by advanced port infrastructure, boost demand for high-performance lubricants in bulk carriers, tankers, and container ships. Fleet operators are investing in modern engines and propulsion systems, driving the use of synthetic and specialized lubricants to enhance engine efficiency, reduce maintenance intervals, and meet stricter emission standards.

- For instance, ExxonMobil launched a new line of marine cylinder oils optimized for ultra-low sulfur fuels, enhancing engine performance and compliance with environmental regulations.

Stringent Environmental Regulations

Tightening emission and discharge regulations by the International Maritime Organization (IMO) and the U.K. Maritime and Coastguard Agency are compelling ship operators to adopt cleaner lubricant formulations. The push toward low-sulfur fuels, environmentally acceptable lubricants (EALs), and reduced carbon footprints is creating steady demand for bio-based and synthetic oils. These regulatory mandates are accelerating product innovation and encouraging lubricant manufacturers to develop eco-compliant, biodegradable solutions that ensure both performance and sustainability.

- For instance, bio-based lubricants such as Repsol’s MAKER BIO TELEX hydraulic oil exemplify innovation in eco-friendly solutions; this lubricant offers high performance while biodegrading at least 60% over 28 days and reducing environmental impact in port operations

Rising Offshore Energy and Marine Services Activities

The growth of offshore wind energy projects and marine service operations across the U.K. coastline is generating substantial lubricant demand. Offshore support vessels, dredgers, and service ships rely on high-quality lubricants to operate hydraulic systems, deck machinery, and propulsion equipment efficiently. Increasing investment in renewable energy infrastructure and subsea exploration enhances operational intensity, fueling the consumption of specialized marine oils with extended service life, high resistance to oxidation, and superior water separation properties.

Key Trends & Opportunities

Shift Toward Environmentally Acceptable Lubricants (EALs)

A major trend shaping the U.K. marine lubricants market is the transition toward EALs made from biodegradable base stocks. Shipowners are proactively switching to low-toxicity and non-bioaccumulative lubricants, especially for operations in restricted or environmentally sensitive zones. This transition presents growth opportunities for manufacturers offering certified EAL products with proven performance under marine operating conditions, aligning with sustainability commitments and upcoming regulatory expectations.

- For instance, Shell has expanded its EAL portfolio through the acquisition of the Panolin Group’s Environmentally Considerate Lubricants business, integrating their certified products to meet marine operating conditions.

Digitalization and Predictive Maintenance Integration

Advancements in digital monitoring, condition-based maintenance, and onboard sensor technologies are creating new opportunities for lubricant suppliers. Integration of smart analytics enables real-time lubricant health tracking, extending oil change intervals and reducing downtime. Suppliers offering data-driven maintenance solutions and digital lubricant management platforms are gaining a competitive advantage, as ship operators seek to optimize operational costs and improve energy efficiency through predictive performance insights.

- For instance, 3Lions Group offers digital oil analysis sensors that provide real-time monitoring of lubricant parameters such as viscosity and oxidation levels, enabling immediate detection of issues and predictive maintenance to avoid costly downtime.

Key Challenges

High Operational Costs and Price Volatility

The marine lubricants market faces persistent challenges due to fluctuating crude oil prices and high operational expenses in the shipping industry. Price instability directly affects lubricant production costs and profit margins. Furthermore, operators facing tighter budgets often prioritize cost control over product quality, limiting the adoption of premium or sustainable lubricants. This volatility creates pressure on manufacturers to balance competitive pricing with consistent product performance and quality.

Regulatory Compliance and Supply Chain Constraints

Complying with evolving environmental and performance regulations remains a significant hurdle for lubricant producers and distributors. Frequent policy updates, certification requirements, and restricted lubricant discharges in European waters increase complexity in formulation and logistics. Additionally, supply chain disruptions, especially in base oil sourcing and additive availability, can hinder timely product delivery. These constraints emphasize the need for robust supply networks and adaptive production strategies to maintain market stability and compliance.

Regional Analysis

England

England dominates the U.K. marine lubricants market, holding a market share of 61% in 2024. Major ports such as London, Southampton, and Liverpool serve as vital hubs for commercial shipping, offshore operations, and naval activities. The high vessel traffic across the English Channel and the North Sea drives significant lubricant consumption for bulk carriers, container ships, and oil tankers. Furthermore, the region’s advanced maritime infrastructure and presence of key suppliers like Shell and BP enhance availability, fueling steady demand for mineral and synthetic lubricants across engine and hydraulic systems.

Scotland

Scotland accounts for 21% of the U.K. marine lubricants market share, primarily driven by its strong offshore energy and fishing sectors. Ports such as Aberdeen, Peterhead, and Inverness support extensive offshore supply and service vessel operations. The growing offshore wind and oil exploration activities in the North Sea boost demand for high-performance synthetic and bio-based lubricants suited to extreme marine environments. The region’s focus on sustainability and renewable energy further promotes the adoption of environmentally acceptable lubricants (EALs), positioning Scotland as a key contributor to the market’s long-term growth.

Wales

Wales represents 10% of the U.K. marine lubricants market, supported by its ports in Milford Haven, Cardiff, and Port Talbot, which handle bulk cargo, oil, and energy products. The region’s shipping activity is closely tied to petroleum logistics, ship repair services, and coastal freight transport. Demand for marine lubricants in Wales is largely concentrated in engine oils and hydraulic systems used by tankers and service vessels. Continued investments in port modernization and coastal trade are expected to sustain lubricant demand, especially for heavy-duty and energy-efficient formulations.

Northern Ireland

Northern Ireland holds 8% of the U.K. marine lubricants market share, with key ports including Belfast, Larne, and Warrenpoint serving both commercial and passenger shipping. The regional market is supported by ship maintenance, coastal ferry operations, and growing trade connectivity with Ireland and mainland Europe. Lubricant demand is driven by smaller cargo vessels, ferries, and offshore supply fleets operating in regional waters. Increasing emphasis on environmentally compliant and cost-effective lubricants is gradually transforming the local market, creating growth opportunities for suppliers offering EAL and low-viscosity marine formulations.

Market Segmentations:

By Oil Type

- Mineral Oil

- Synthetic Oil

- Bio-Based Oil

By Product Type

- Engine Oil

- Hydraulic Oil

- Compressor Oil

- Others

By Application

- Bulk Carriers

- Container Ships

- Oil Tankers

- Others

By Region

- England

- Scotland

- Wales

- Northern Ireland

Competitive Landscape

The competitive landscape of the U.K. Marine Lubricants Market is defined by the presence of major players such as BP p.l.c., Shell Plc, ExxonMobil Marine Limited, Chevron Corporation, TotalEnergies, Fuchs Lubricants, and Klüber Lubrication. These companies maintain strong market positions through extensive product portfolios, advanced formulation technologies, and established distribution networks across major U.K. ports. Strategic initiatives such as sustainability programs, bio-based lubricant development, and partnerships with shipping operators enhance their market reach. The competition is also influenced by growing demand for environmentally acceptable lubricants (EALs), prompting innovation in synthetic and biodegradable oils. Local and regional suppliers are focusing on niche products, such as hydraulic and compressor oils, to gain a competitive edge. Furthermore, digitalization and condition-monitoring solutions are being integrated by leading firms to support predictive maintenance, reduce operational costs, and strengthen customer relationships, consolidating the competitive environment in a highly regulated and performance-driven market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, Castrol, a subsidiary of BP p.l.c., launched its MHP lubricant range in the U.K. to enhance performance in four-stroke medium-speed marine engines operating on alternative fuels such as LNG and biofuel blends.

- In March 2023, Shell Plc extended its strategic partnership with Wärtsilä Corporation to strengthen collaboration in marine engine lubricant solutions, focusing on improving efficiency and sustainability across vessel operations.

- On 9 April 2024, Castrol launched its new “TLX” marine engine oil range in the UK, designed for medium-speed four-stroke engines operating on diverse fuels including residual, VLSFO, ULSFO and gas-dual systems, thus targeting evolving fuel and emission requirements.

- On 2 January 2024, Shell Plc (via Shell Lubricants) completed the acquisition of U.K.-based M&I Materials Ltd’s product lines MIDEL and MIVOLT, enabling Shell to expand its synthetic and natural ester-based fluid offerings relevant to offshore and marine applications.

Report Coverage

The research report offers an in-depth analysis based on Oil Type, Product Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The U.K. marine lubricants market is expected to witness steady growth driven by rising maritime trade and fleet expansion.

- Increasing adoption of environmentally acceptable lubricants (EALs) will shape future product development.

- Synthetic and bio-based lubricants will gain higher market penetration due to performance and sustainability benefits.

- Stricter emission and discharge regulations will encourage innovation in eco-friendly formulations.

- Expansion of offshore wind and renewable energy projects will boost lubricant demand in support vessels.

- Digital monitoring and predictive maintenance solutions will enhance lubricant management efficiency.

- Partnerships between lubricant suppliers and ship operators will strengthen long-term service contracts.

- Investments in port infrastructure modernization will support steady lubricant consumption.

- The transition to low-sulfur fuels and LNG-powered vessels will create demand for specialized lubricant grades.

- Market competition will intensify as global brands and regional suppliers focus on sustainability and value-added services.