Market Overview

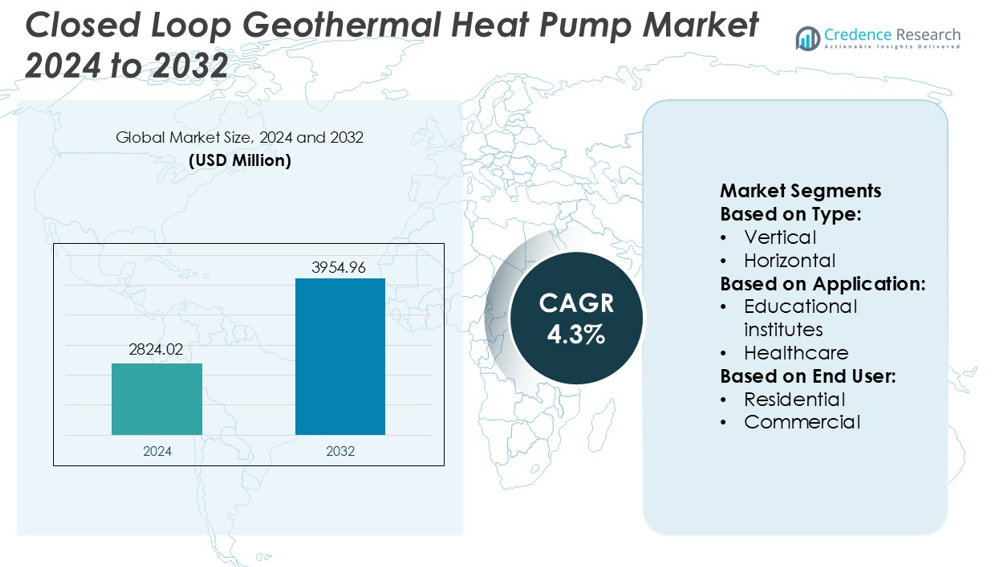

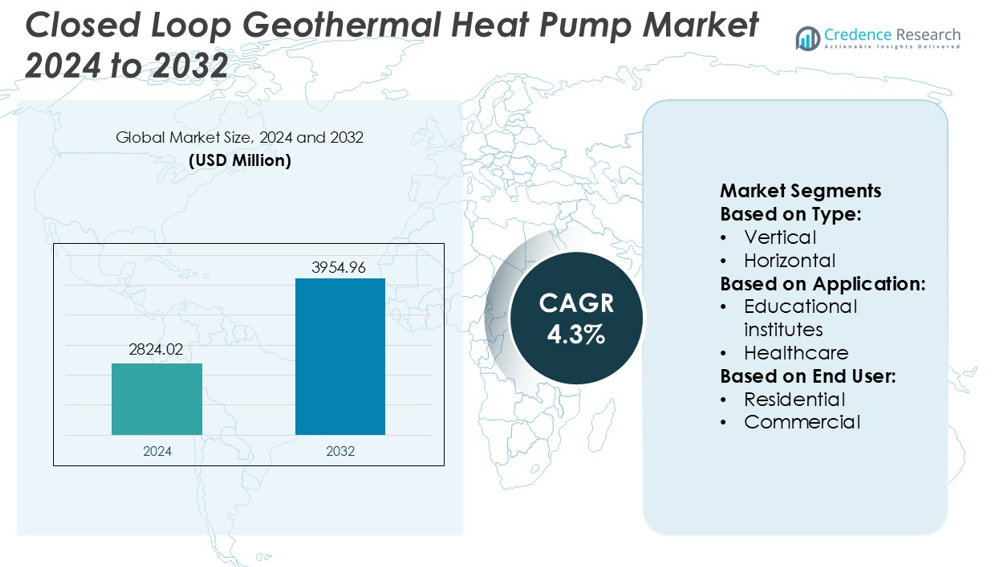

Closed Loop Geothermal Heat Pump Market size was valued USD 2824.02 million in 2024 and is anticipated to reach USD 3954.96 million by 2032, at a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Closed Loop Geothermal Heat Pump Market Size 2024 |

USD 2824.02 million |

| Closed Loop Geothermal Heat Pump Market, CAGR |

4.3% |

| Closed Loop Geothermal Heat Pump Market Size 2032 |

USD 3954.96 million |

The Closed Loop Geothermal Heat Pump Market is driven by strong competition among leading HVAC manufacturers, technology innovators, and renewable energy solution providers. Top players develop high-efficiency heat pump units, advanced loop field designs, and smart control systems that lower energy usage and enhance long-term reliability. Many manufacturers expand through partnerships with construction firms, green-building developers, and utility programs that promote sustainable heating and cooling. Product portfolios continue to shift toward eco-friendly refrigerants, variable-speed compressors, and low-maintenance components. Asia Pacific remains the leading region with 36% market share, supported by rapid commercial construction, rising energy costs, and strong investment in sustainable infrastructure and residential retrofits.

Market Insights

- Closed Loop Geothermal Heat Pump Market size was valued at USD 2824.02 million in 2024 and will reach USD 3954.96 million by 2032, growing at a CAGR of 4.3%.

- Demand rises due to energy-efficient heating in residential and commercial buildings, where residential installations hold the largest segment share because homeowners seek long-term cost savings and lower emissions.

- Smart controls, variable-speed compressors, and eco-friendly refrigerants define key market trends, as manufacturers focus on quieter systems, improved loop efficiency, and lower maintenance costs.

- Competition remains strong, with companies investing in advanced drilling, hybrid systems, and utility partnerships, but high upfront installation costs and limited installer availability continue to slow adoption in developing countries.

- Asia Pacific leads with 36% market share due to rapid urban construction, higher electricity costs, and government support for sustainable infrastructure, while North America grows steadily through tax rebates, green-building certifications, and rising retrofitting of older HVAC systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Vertical systems hold the dominant share in the Closed Loop Geothermal Heat Pump Market, driven by higher efficiency and suitability for limited land areas. These systems use deeper boreholes that maintain stable underground temperatures, which improves heat exchange and reduces seasonal performance loss. Vertical installations are preferred in urban buildings, commercial sites, and institutions where land availability is restricted. Horizontal systems are used in rural locations due to lower drilling costs and simpler layouts. Growing construction in cities and stricter building energy codes continue to support the dominance of vertical systems.

- For instance, Ecoforest’s vertical geothermal pump series achieves a seasonal performance factor of 5.25 and operates with vertical drilling depths reaching 120 meters, enabling high thermal output in small-footprint installations.

By Application

The residential segment leads the market with the largest share, supported by rising adoption of sustainable heating solutions in single-family homes and multi-housing units. Homeowners prefer closed loop geothermal systems because they reduce long-term energy bills, offer consistent indoor comfort, and require minimal maintenance. Government rebates and green building incentives further promote installation. Commercial and healthcare facilities also show steady growth, as these properties benefit from lower operating costs and improved HVAC reliability. Educational institutes and retail buildings adopt geothermal systems as part of sustainability targets and carbon-reduction goals.

- For instance, Mitsubishi Electric Corporation manufactures the Ecodan air source heat pump system, delivering output up to 14,000 watts while consuming 3,300 watts of electrical input to achieve a high coefficient of performance.

By End User

Residential users account for the dominant market share, driven by increasing demand for eco-friendly heating and cooling in new and existing homes. Consumers replace traditional HVAC units with geothermal systems to cut electricity usage and avoid fluctuations in fuel prices. Commercial users are expanding adoption in offices, hotels, malls, and data-driven facilities that need stable temperature control. Industrial sites remain a smaller segment, but interest is rising in systems that manage heating loads and process cooling. Incentive programs, technology improvements, and energy-efficient building regulations continue to boost residential leadership.

Key Growth Drivers

Rising Demand for Energy-Efficient Heating and Cooling

Energy-efficient HVAC systems are gaining preference as electricity prices increase and climate policies tighten. Closed loop geothermal heat pumps reduce power consumption, deliver stable heating and cooling, and operate without fossil fuels. Homeowners and businesses adopt these systems to achieve long-term savings and meet green building standards. Government rebates and zero-emission targets further accelerate installations. As urban construction expands and sustainability certifications become common, demand for efficient geothermal systems continues to rise across both residential and commercial buildings.

- For instance, Kensa Heat Pumps manufactures the Shoebox NX ground-source unit designed for closed loop networks, with a 5,000-watt heating output and a coefficient of performance of 4.36, as rated under EN standard test conditions.

Supportive Government Policies and Incentives

Many countries offer financial incentives, tax credits, and low-interest financing to promote geothermal adoption. These benefits lower upfront installation costs and attract homeowners, schools, hospitals, and retail buildings. Energy-efficiency mandates also require commercial spaces to upgrade HVAC systems, driving replacement of traditional units. Green construction codes encourage geothermal heating in new developments. Public agencies and municipal utilities increasingly support geothermal investment as part of carbon reduction strategies. Continued policy support strengthens market expansion and boosts awareness of long-term environmental and economic benefits.

- For instance, Carrier offers closed-loop compatible geothermal units such as the Carrier GT series, where the 50YE model delivers a heating capacity of 12,300 watts with power consumption of 2,900 watts, achieving a coefficient of performance of 4.24 under ISO 13256-1 certification.

Growing Adoption in Space-Constrained Urban Buildings

Vertical closed loop geothermal systems are gaining traction in dense cities where land is limited. Deep boreholes allow installations without needing large open areas, making the technology ideal for high-rise buildings, universities, and commercial complexes. These systems provide reliable temperature control year-round and reduce noise compared to air-based HVAC units. Developers prefer geothermal designs to improve property value and meet sustainability standards. As cities target net-zero emissions and stricter green building rules arrive, vertical systems will continue to drive demand in urban infrastructure.

Key Trends & Opportunities

Integration with Smart and Hybrid Energy Systems

Manufacturers are developing smart controls and hybrid geothermal systems that work alongside solar panels, thermal storage, and energy management software. These configurations optimize power usage and adjust temperatures based on real-time demand. Smart monitoring reduces maintenance costs and enhances system performance. The trend supports adoption in high-efficiency homes, green campuses, and commercial buildings. As connected buildings expand and digital HVAC controls gain visibility, integration with smart energy platforms becomes a major opportunity for geothermal suppliers, installers, and technology partners.

- For instance, Modine Manufacturing Company offers the Atherion geothermal-ready commercial HVAC platform that integrates with building energy management systems and delivers an airflow capacity of 18,000 cubic meters per hour while maintaining temperature control accuracy within 0.6°C under onboard digital modulation.

Rising Use in Educational and Healthcare Facilities

Schools, universities, and hospitals adopt closed loop geothermal heat pumps to reduce operating expenses and improve indoor comfort. Educational institutes benefit from year-round temperature stability and quiet operation that supports learning environments. Healthcare facilities value reduced emissions, improved air quality, and better system durability. Many institutions upgrade existing HVAC systems as part of sustainability commitments. This trend creates opportunities for turnkey geothermal installation services and long-term maintenance contracts. Public-sector funding also encourages adoption in community buildings and government facilities.

- For instance, NIBE Energy Systems Ltd supplies the NIBE F1345 geothermal heat pump for institutional projects, offering a twin-compressor model with a nominal heating output of 60,000 watts, as measured under EN 14511 testing.

Expansion into Cold Climate Regions

Closed loop geothermal systems perform well in extreme winter conditions, where air-source heat pumps lose efficiency. Growing adoption in northern regions creates opportunities for manufacturers offering enhanced heat exchangers and durable loop materials. Cold climate incentives and lower heating bills attract homeowners and commercial buildings. This trend supports broader market penetration and encourages product innovations designed for severe temperature variations.

Key Challenges

High Initial Installation Cost

Upfront drilling and system setup remain expensive compared to conventional HVAC units. Many homeowners delay adoption because payback periods are long without government incentives. Commercial and residential developers hesitate to install geothermal systems in small projects due to higher construction budgets. While long-term energy savings are strong, the cost barrier limits uptake in price-sensitive markets. Greater financing support, cost-effective drilling techniques, and wider contractor networks are required to reduce overall installation expenses.

Lack of Skilled Installers and Technical Awareness

Geothermal heat pump projects require specialized drilling, engineering, and system design knowledge. Many regions lack experienced installers and service technicians, which slows adoption. Customers often remain unaware of the technology’s lifespan, reliability, and cost benefits. Limited marketing and low public awareness create misconceptions about system complexity. Training programs, certified workforce development, and awareness campaigns are needed to increase consumer acceptance and expand the installer base for residential and commercial projects.

Regional Analysis

North America

North America leads the Closed Loop Geothermal Heat Pump Market with nearly 38% market share, supported by high adoption of renewable heating and cooling systems and favorable environmental regulations. The United States records strong demand due to energy-efficient infrastructure upgrades and incentive programs promoting geothermal installations in residential and commercial facilities. Federal and state rebates lower installation cost barriers, while building owners prioritize long-term savings and reduced carbon footprints. Canada is witnessing increased installations in cold-climate regions, where heat pumps offer reliable performance and lower heating expenses. Advancements in drilling equipment and loop field efficiency further support market expansion across the region.

Europe

Europe holds 33% market share, driven by strong sustainability mandates, decarbonization targets, and reduced fossil-fuel dependency. Countries like Germany, Sweden, and the Netherlands actively promote geothermal heating solutions through subsidies, tax rebates, and heat-transition policies. High-efficiency building construction and strict energy-performance standards push adoption in residential and educational facilities. District-level geothermal projects also expand across Nordic nations, where long winters increase heating demand. Technological improvements in borehole drilling and horizontal loop design reduce installation time and operational cost. The growing preference for silent, low-maintenance heating systems continues to make closed loop geothermal systems popular among European homeowners and commercial developers.

Asia Pacific

The Asia Pacific region accounts for 22% market share, supported by rapid urbanization, rising electricity bills, and increased spending on sustainable infrastructure. China, Japan, and South Korea integrate geothermal technology into green building programs and carbon-neutrality commitments. Commercial complexes and industrial facilities invest in closed loop heat pumps to stabilize indoor temperatures and lower long-term energy costs. Countries with geothermal potential, including Indonesia and the Philippines, also execute pilot projects for large-scale installations. Growth in data centers, healthcare facilities, and educational institutions further accelerates adoption. Domestic manufacturers provide cost-competitive systems, making geothermal technology accessible for medium-scale applications.

Latin America

Latin America captures 4% market share, with growing activity in Mexico, Chile, and Brazil. These nations promote renewable energy transitions and focus on alternatives to fuel-based heating. Commercial offices, hospitality buildings, and universities adopt closed loop geothermal systems to reduce operational costs and enhance indoor comfort. Lack of awareness and high upfront installation costs still slow adoption; however, government-supported clean-energy investments and pilot geothermal heating projects are improving market conditions. Increased interest from real estate developers in premium building projects is pushing demand. Ongoing geothermal resource mapping and drilling investments also encourage long-term growth across the region.

Middle East & Africa

The Middle East & Africa region holds 3% market share, where adoption is emerging across high-temperature climates that demand year-round cooling efficiency. Countries like the UAE, Saudi Arabia, and South Africa use closed loop geothermal systems in luxury residential projects, educational campuses, and commercial buildings to reduce electricity consumption. Government energy-efficiency programs push sustainable construction, though limited geothermal awareness and drilling costs remain challenges. Pilot projects in desert regions show significant cooling savings using ground-source heat exchange. Future expansion relies on green building mandates, public-private energy partnerships, and increased investment in advanced HVAC technologies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Type:

By Application:

- Educational institutes

- Healthcare

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the Closed Loop Geothermal Heat Pump Market features Ecoforest, Mitsubishi Electric Corporation, Kensa Heat Pumps, Carrier, Modine Manufacturing Company, NIBE Energy Systems Ltd, Dandelion, Daikin, Bard HVAC, and De Dietrich. The Closed Loop Geothermal Heat Pump Market is characterized by strong innovation, steady product upgrades, and expanding installation partnerships. Manufacturers focus on high-efficiency systems that deliver reliable heating and cooling with lower electricity consumption and minimal maintenance. R&D efforts target improved ground loop design, faster drilling methods, and smart controls that enable real-time performance monitoring and remote adjustments. Companies also invest in eco-friendly refrigerants and variable-speed compressor technology to meet green building standards and government energy-efficiency targets. Strategic collaborations with construction firms, HVAC contractors, and renewable energy service providers help increase system adoption in residential, commercial, and educational facilities. Incentive programs, tax rebates, and sustainable building codes further support market competition, pushing brands to deliver quieter systems, longer equipment life, and stronger warranty coverage. As consumers prioritize long-term savings and carbon reduction, manufacturers focus on offering durable systems backed by strong after-sales service and training.

Key Player Analysis

Recent Developments

- In October 2025, Dandelion introduced a groundbreaking geothermal lease program to reduce upfront investment costs and accelerate adoption of residential geothermal heating and cooling.

- In June 2025, Carrier announced the relaunch of its geothermal heat pump product line featuring several innovations such as deluxe communicating models for better integration and performance, two-stage operation for entry-level models to enhance efficiency and comfort, smaller and lighter units for easier installation, and improvements in serviceability.

- In December 2024, Mitsubishi Electric announced a investment to retrofit a U.S. factory (in Kentucky) for producing variable-speed compressors, key components in high-efficiency heat pumps.

- In April 2024, Modine has opened a second additional facility in Serbia will manufacture coils for commercial and residential heat pump applications. This is new plant highlights the company’s dedication to investing in energy-efficient technologies, such as heat pumps, that help reduce energy consumption and emissions.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will increase as homeowners and businesses shift toward low-emission heating and cooling solutions.

- Government subsidies and energy-efficiency incentives will support faster adoption across new buildings.

- Advancements in drilling technology will lower installation time and reduce project costs.

- Smart controls and remote monitoring will become standard, improving performance and maintenance.

- Integration with solar PV and thermal storage will expand hybrid geothermal systems.

- Commercial buildings, schools, and hospitals will accelerate adoption to cut energy operating expenses.

- Green building certifications will push architects and contractors to specify geothermal heat pumps.

- Eco-friendly refrigerants and variable-speed compressors will strengthen system reliability and efficiency.

- Growth in cold-climate regions will rise as closed loop systems deliver stable year-round performance.

- Training programs for installers and HVAC technicians will expand, improving installation quality and system lifespan.Top of Form