Market Overview

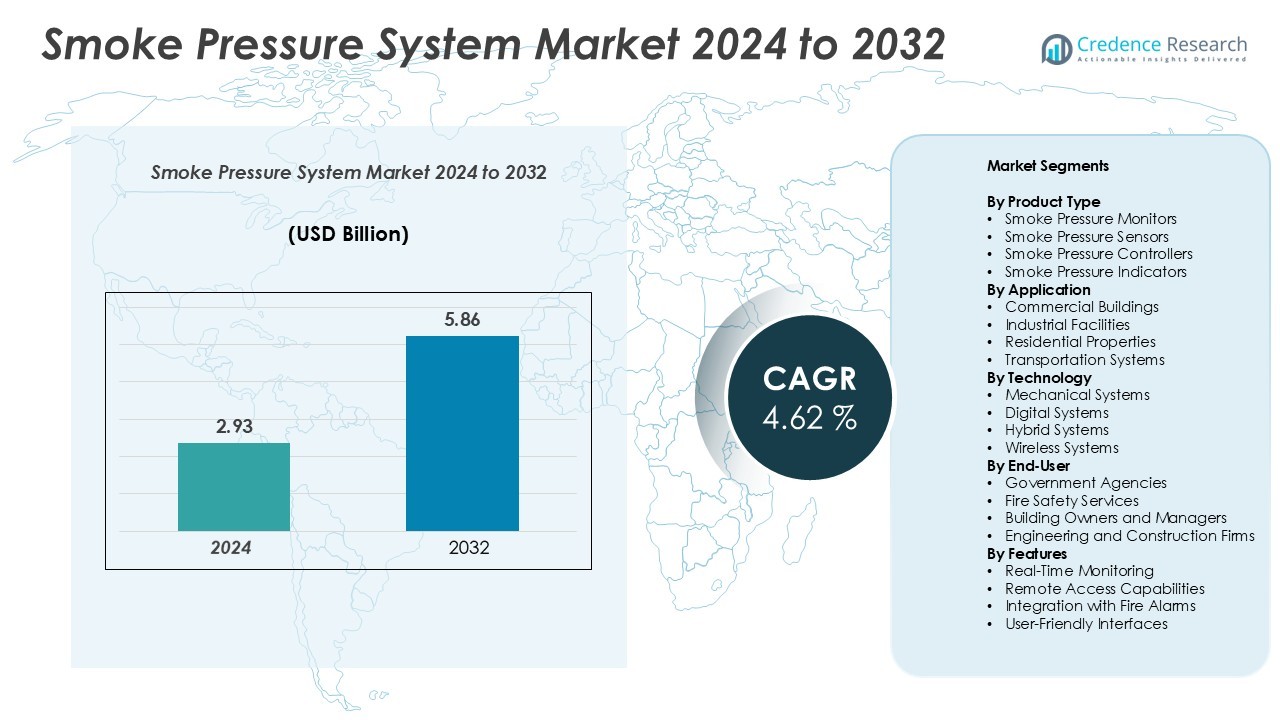

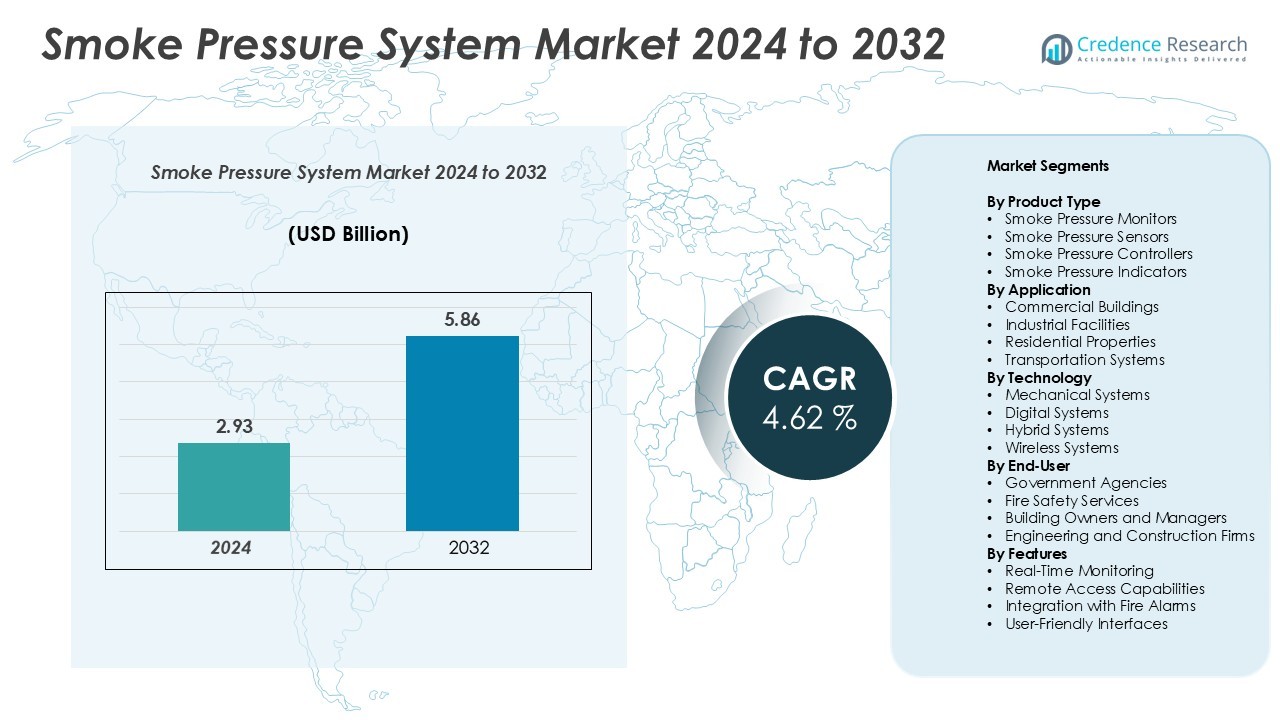

The Smoke Pressure System Market size was valued at USD 2.93 billion in 2024 and is anticipated to reach USD 5.86 billion by 2032, growing at a CAGR of 4.62% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smoke Pressure System Market Size 2024 |

USD 2.93 Billion |

| Smoke Pressure System Market, CAGR |

4.62% |

| Smoke Pressure System Market Size 2032 |

USD 5.86 Billion |

The Smoke Pressure System Market is led by key players such as Greenheck Fan Corporation, Kingspan Group, Colt, Belimo Aircontrols, Sodeca, Crossflow, GSBmbH, Blauberg Ventilatoren, Priorit, and Air Pressure Solutions. These companies dominate through advanced pressure management technologies, compliance with global fire safety standards, and integration with smart building systems. Greenheck Fan Corporation and Kingspan Group lead in large-scale commercial applications, while Belimo Aircontrols and Colt focus on automation and digital control solutions. Regionally, North America holds the largest market share of 34.7%, driven by strict safety regulations and modernization of building infrastructure. Europe follows with 29.3%, supported by strong adoption of EN 12101-6 compliant systems and widespread industrial retrofitting initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Smoke Pressure System Market was valued at USD 2.93 billion in 2024 and is projected to reach USD 5.86 billion by 2032, growing at a CAGR of 4.62% during the forecast period.

- Strong regulatory frameworks and increased safety awareness drive demand for automated smoke pressure systems across commercial and industrial sectors.

- Integration of IoT, real-time monitoring, and cloud-based control systems defines major market trends, improving efficiency and predictive maintenance capabilities.

- Leading companies such as Greenheck Fan Corporation, Kingspan Group, Belimo Aircontrols, and Colt dominate the competitive landscape with advanced pressure control technologies and smart building integration.

- North America leads the global market with a 34.7% share, followed by Europe with 29.3%, while digital systems hold 39.8% of the technology segment due to rising adoption in smart infrastructure and high-rise construction projects worldwide.

Market Segmentation Analysis:

By Product Type

Smoke pressure controllers held the dominant share in the Smoke Pressure System Market, accounting for 34.6% of total revenue in 2024. These controllers maintain consistent pressure differentials during fire emergencies, ensuring safe evacuation routes. Their precision in automatic regulation supports compliance with global fire safety standards. The growing use of programmable logic and sensor integration enhances real-time response accuracy. For instance, Sauter AG developed the EY-modulo 5 controller, featuring advanced pressure balancing for high-rise applications, improving building safety and operational reliability. Demand for intelligent controllers continues to rise across commercial and industrial buildings.

- For instance, Fr. Sauter AG’s EY-modulo 5 automation station (model EY-AS525F005U) is part of its EY-modulo 5 system family offering 26 inputs/outputs and native BACnet/IP communication.

By Application

Commercial buildings dominated the market with a 41.2% share in 2024 due to strict safety mandates in office complexes, malls, and hospitals. Modern HVAC integration and fire safety automation have increased adoption of smoke pressure systems in these infrastructures. Facility managers prefer centralized control systems for managing large-area ventilation during emergencies. For instance, Siemens introduced the Desigo Fire Safety system, which integrates pressure management with smoke extraction control, offering faster emergency response. Growing urban infrastructure and smart building projects strengthen system deployment in the commercial sector worldwide.

- For instance, The Siemens Desigo Fire Safety system can be integrated with building management systems (BMS), such as the Desigo CC, to coordinate actions like the activation of smoke extract fans. This communication often uses the BACnet protocol, allowing the fire system to automatically initiate emergency HVAC operations based on signals from highly sensitive detectors, such as those with ASAtechnology.

By Technology

Digital systems led the market with a 39.8% share in 2024, driven by demand for precise monitoring and automation. These systems use advanced sensors and IoT connectivity to enable data-driven fire safety management. They provide predictive maintenance and integration with building management systems for seamless operation. For instance, Johnson Controls launched the Metasys system, offering digital airflow control with real-time pressure monitoring and remote diagnostics. The ongoing shift toward smart and connected buildings fuels rapid adoption of digital smoke pressure systems across industrial and commercial environments.

Key Growth Drivers

Increasing Stringency of Fire Safety Regulations

Governments and regulatory bodies are tightening fire safety norms across commercial, residential, and industrial buildings. The enforcement of international standards such as EN 12101-6 and NFPA 92 mandates the installation of smoke control and pressure systems to protect evacuation routes. This drives strong adoption in new constructions and retrofitting projects. For instance, Honeywell’s pressure management solutions comply with EN and ISO safety standards, ensuring efficient smoke containment in high-rise and underground facilities. The rising number of smart city and infrastructure developments, particularly in Asia-Pacific and the Middle East, further strengthens market demand, as developers prioritize compliance and occupant safety through automated smoke pressure systems.

- For instance, Honeywell’s XLS3000 Fire Alarm Control Panel (FACP), which can be integrated into a larger fire safety network, supports up to 3,180 addressable detection points. BACnet MS/TP and Modbus RTU connectivity are supported through optional gateway modules, such as the XLS-GW-EM or the Universal CLSS Gateway.

Rapid Expansion of Smart Building Infrastructure

The growing adoption of intelligent building technologies is a major catalyst for smoke pressure system integration. Building automation systems increasingly include real-time smoke detection, remote monitoring, and digital pressure control modules to improve emergency response efficiency. Manufacturers are embedding IoT and AI technologies to ensure predictive maintenance and faster fault detection. For instance, Siemens’ Desigo CC platform integrates ventilation, pressure control, and fire safety systems under a unified management interface, enhancing safety coordination. With global smart building investments exceeding billions annually, the need for automated smoke pressure control grows as a fundamental component of intelligent safety infrastructure, particularly in commercial complexes and mixed-use developments.

- For instance, the Siemens Desigo CC is a robust and highly scalable building management platform that supports a broad range of integrations. It integrates multiple disciplines, including HVAC, fire safety, access control, and video surveillance.

Rising Construction of High-Rise and Underground Facilities

Urbanization and infrastructure growth are leading to a surge in high-rise buildings, tunnels, subways, and underground parking structures, where effective smoke management is crucial. The confined nature of these structures demands efficient pressure regulation to maintain smoke-free escape routes. For instance, Colt International introduced its Colt-Shaft smoke control system designed for high-rise stairwells, offering optimized airflow and pressure stabilization. These developments are driving strong demand from developers and fire safety contractors seeking compliance with modern construction safety codes. The increasing number of mixed-use skyscrapers in urban centers across Asia and the Middle East further accelerates market growth for advanced, automated smoke pressure systems.

Key Trends & Opportunities

Integration of IoT and Cloud-Based Monitoring

IoT and cloud technologies are transforming smoke pressure management by enabling centralized monitoring, remote diagnostics, and predictive analytics. These systems provide real-time data on airflow, temperature, and differential pressure across multiple zones. For instance, Schneider Electric’s EcoStruxure platform connects pressure control devices to cloud-based dashboards, allowing continuous tracking and performance optimization. This trend reduces maintenance downtime and improves safety response times. The opportunity lies in expanding IoT-enabled smoke pressure systems for smart cities and connected infrastructure, where centralized fire safety management is essential for operational efficiency and occupant protection.

- For instance, Schneider Electric’s own website confirms that its EcoStruxure platform has been implemented in more than 480,000 sites worldwide and connects over 1 billion devices.

Growth of Retrofitting and Modernization Projects

A rising focus on upgrading older buildings to comply with new fire safety standards is creating lucrative opportunities for smoke pressure system providers. Retrofitting projects across Europe and North America emphasize energy-efficient and digitally compatible pressure systems. For instance, Belimo’s retrofit actuators and sensors offer flexible integration with existing ventilation frameworks, ensuring compliance without extensive structural changes. Increasing government incentives for sustainable and safe building renovation projects strengthen the retrofit market. This trend presents long-term growth potential as aging infrastructure undergoes modernization to meet contemporary fire safety and environmental performance standards.

- For instance, Belimo Holding AG’s Retrofit solutions include actuators and sensors that integrate with existing HVAC ventilation frameworks; their documentation states that a connected device online in the cloud extends its warranty from 5 years to 7 years.

Key Challenges

High Installation and Maintenance Costs

Smoke pressure systems require precise engineering, integration with HVAC systems, and adherence to strict safety codes, leading to significant upfront costs. For small-scale or budget-constrained projects, this limits adoption. Complex maintenance involving calibration, testing, and sensor replacement further adds operational expenses. For instance, systems using multiple digital controllers and sensors often require professional maintenance contracts to ensure reliability. These financial barriers affect market penetration, particularly in developing regions where awareness and budgets for advanced fire safety systems remain limited. Addressing cost challenges through modular designs and scalable solutions is critical for wider adoption.

Technical Integration and Design Complexity

Integrating smoke pressure systems with building management and fire alarm networks requires advanced design coordination between engineers, architects, and system integrators. Inadequate synchronization can cause system failures or pressure imbalances, compromising safety. For instance, in hybrid systems combining mechanical and digital control, precise airflow modeling and calibration are essential to maintain consistent pressure across escape routes. Lack of skilled technicians and design expertise in emerging markets further complicates implementation. Manufacturers and construction firms must invest in training programs and standardized design frameworks to ensure reliable system performance and regulatory compliance.

Regional Analysis

North America

North America dominated the Smoke Pressure System Market with a 34.7% share in 2024, driven by strict fire safety regulations and rapid adoption of intelligent building systems. The U.S. leads regional growth due to the enforcement of NFPA standards and modernization of commercial infrastructure. Increasing retrofitting of older buildings with smart ventilation and pressure monitoring systems supports steady demand. For instance, Johnson Controls’ advanced pressure control systems are widely adopted across U.S. commercial facilities. Canada follows with investments in sustainable construction and digital fire safety upgrades, further strengthening the region’s leadership position.

Europe

Europe held a 29.3% market share in 2024, supported by stringent building safety standards such as EN 12101-6 and growing awareness of advanced fire protection solutions. Countries like Germany, the U.K., and France are leading adopters, emphasizing smoke pressure control in high-rise and public infrastructure projects. The region benefits from strong technological presence and extensive R&D by companies like Colt International and Sauter AG. Ongoing renovation of aging infrastructure and integration of digital pressure systems enhance Europe’s demand outlook, ensuring compliance and energy-efficient safety management across smart building networks.

Asia-Pacific

Asia-Pacific accounted for 25.8% of the global market in 2024, emerging as the fastest-growing region. Rapid urbanization, large-scale infrastructure projects, and government investments in smart cities drive adoption across China, Japan, India, and South Korea. Fire safety regulations are strengthening, particularly in commercial and residential high-rise developments. For instance, Siemens’ integrated smoke pressure control systems have been deployed in several metro and airport projects in China. Increasing construction of mixed-use skyscrapers and growing awareness of advanced fire protection systems are set to propel regional growth over the forecast period.

Latin America

Latin America represented a 5.6% share in 2024, with steady adoption in Brazil, Mexico, and Argentina. The region’s growth is driven by modernization of commercial buildings, healthcare facilities, and transportation infrastructure. Government initiatives to improve urban safety standards are fostering greater acceptance of automated pressure control systems. For instance, Schneider Electric’s building safety systems are being integrated into large commercial complexes across Mexico. Rising foreign investments in industrial and residential construction, coupled with growing emphasis on energy-efficient ventilation technologies, are expected to support the gradual expansion of the smoke pressure system market in the region.

Middle East & Africa

The Middle East & Africa accounted for 4.6% of the market in 2024, supported by increasing demand from high-rise and mega infrastructure projects. The UAE and Saudi Arabia are leading adopters, driven by urban development programs such as Vision 2030. Modern commercial towers and transportation hubs increasingly use digital smoke pressure systems for compliance and safety assurance. For instance, Honeywell’s automated fire safety solutions are integrated into high-end developments in Dubai. Africa’s market remains emerging, with gradual adoption in South Africa and Egypt as regulatory frameworks for fire protection continue to strengthen.

Market Segmentations:

By Product Type

- Smoke Pressure Monitors

- Smoke Pressure Sensors

- Smoke Pressure Controllers

- Smoke Pressure Indicators

By Application

- Commercial Buildings

- Industrial Facilities

- Residential Properties

- Transportation Systems

By Technology

- Mechanical Systems

- Digital Systems

- Hybrid Systems

- Wireless Systems

By End-User

- Government Agencies

- Fire Safety Services

- Building Owners and Managers

- Engineering and Construction Firms

By Features

- Real-Time Monitoring

- Remote Access Capabilities

- Integration with Fire Alarms

- User-Friendly Interfaces

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Smoke Pressure System Market is characterized by strong competition among global and regional players focusing on innovation, safety compliance, and digital integration. Leading companies such as Greenheck Fan Corporation, Kingspan Group, Colt, Belimo Aircontrols, Sodeca, Crossflow, GSBmbH, Blauberg Ventilatoren, Priorit, and Air Pressure Solutions are investing heavily in R&D to enhance system precision, automation, and energy efficiency. For instance, Belimo Aircontrols offers pressure control actuators with advanced sensors for real-time monitoring and smart building integration. Kingspan Group emphasizes sustainable ventilation systems compliant with EN fire safety standards, while Greenheck Fan Corporation provides customizable pressure control units for large-scale infrastructures. Strategic partnerships, product innovation, and adoption of IoT-based technologies are shaping market competition. Moreover, companies are expanding into emerging regions through localized manufacturing and tailored safety solutions, strengthening their global footprint and ensuring compliance with evolving fire protection regulations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Greenheck Fan Corporation

- Kingspan Group

- Colt

- Belimo Aircontrols

- Sodeca

- Crossflow

- GSBmbH

- Blauberg Ventilatoren

- Priorit

- Air Pressure Solutions

Recent Developments

- In June 2024, Edwards, a subsidiary of Carrier, introduced a new Optica duct smoke detector for commercial and industrial areas. It is specially designed to detect HVAC smoke in commercial and industrial premises.

- In April 2024, Honeywell International Inc introduced a new Fire Lite alarm system for residential, commercial, and industrial sectors. It is used for small and medium-scale enterprises. It offers features such as cloud support, remote operation, and improved compliance.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, Technology, End-User, Features and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing demand for intelligent smoke pressure systems will enhance automation and emergency control efficiency.

- Integration of IoT and cloud-based analytics will improve monitoring accuracy and maintenance management.

- Smart building expansion across major cities will drive adoption of connected smoke pressure control units.

- Governments will enforce stricter fire safety standards, boosting compliance-driven installations worldwide.

- Manufacturers will focus on energy-efficient and sustainable system designs to reduce operational costs.

- Retrofitting of aging infrastructure will create steady demand for modular and digital control upgrades.

- Advanced sensor technologies will enable faster pressure response and improved evacuation safety.

- Regional construction booms in Asia-Pacific and the Middle East will accelerate market penetration.

- Collaboration between fire safety firms and automation providers will lead to innovative hybrid systems.

- Ongoing R&D investments will expand system adaptability across high-rise, industrial, and transport applications.