Market Overview

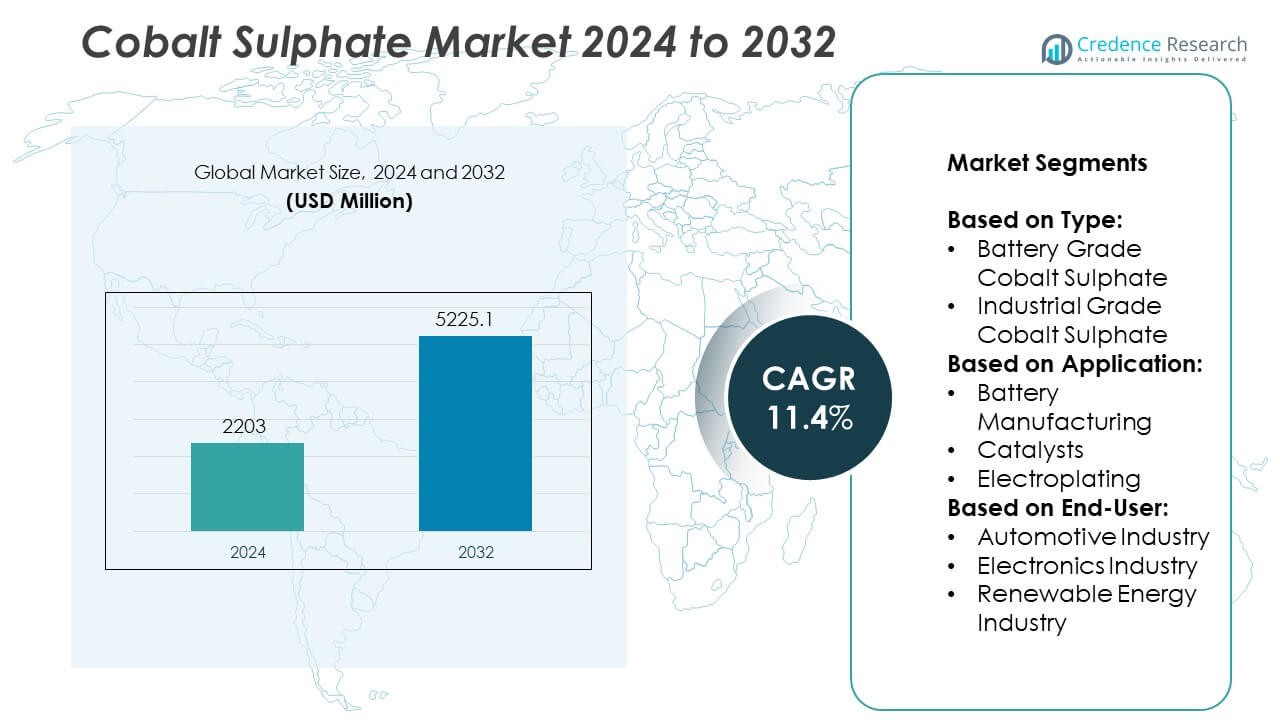

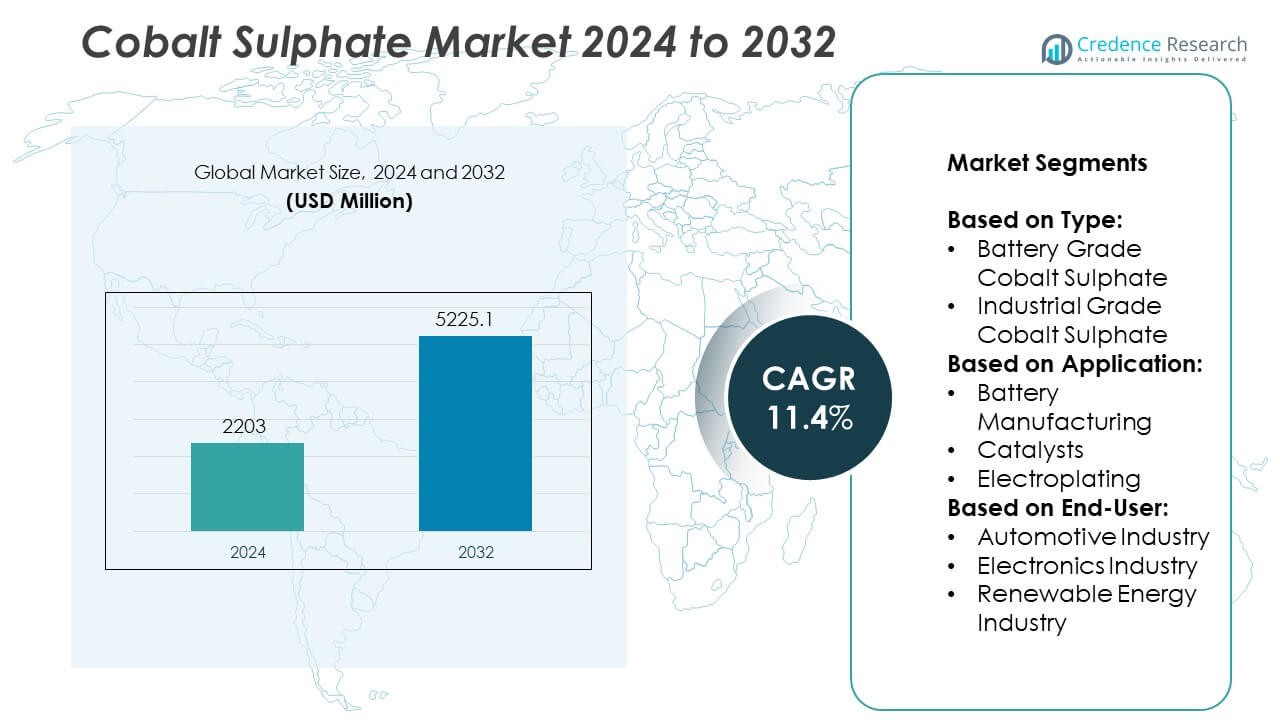

Cobalt Sulphate Market size was valued at USD 2203 million in 2024 and is anticipated to reach USD 5225.1 million by 2032, at a CAGR of 11.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cobalt Sulphate Market Size 2024 |

USD 2203 Million |

| Cobalt Sulphate Market, CAGR |

11.4% |

| Cobalt Sulphate Market Size 2032 |

USD 5225.1 Million |

The Cobalt Sulphate market advances through rising demand from the electric vehicle and energy storage sectors, where it serves as a critical input for lithium-ion battery cathodes. Governments enforce stricter emission norms and promote clean energy transitions, boosting battery manufacturing activities. Manufacturers invest in refining technologies to meet high-purity standards for battery-grade materials. Trends such as vertical integration, responsible sourcing, and recycling gain momentum as industry players seek supply chain stability and ESG compliance.

Asia-Pacific dominates the cobalt sulphate market due to strong battery manufacturing infrastructure, extensive electric vehicle production, and government-supported clean energy initiatives. China leads regional demand and supply, with large-scale refining capacity and integrated value chains. Europe emerges as a key growth hub with investments in gigafactories and regulatory frameworks promoting localized battery supply chains. North America focuses on developing domestic cobalt processing and reducing import dependence to strengthen its energy transition goals. Latin America and Africa contribute through mining and upstream opportunities, especially in cobalt-rich regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The cobalt sulphate market was valued at USD 2203 million in 2024 and is projected to reach USD 5225.1 million by 2032, growing at a CAGR of 11.4% during the forecast period.

- Rising demand for lithium-ion batteries in electric vehicles and renewable energy systems drives the need for battery-grade cobalt sulphate across global markets.

- Vertical integration across supply chains, increased focus on ethical sourcing, and growing adoption of recycled cobalt represent key trends shaping the industry’s direction.

- Leading players such as Glencore, Umicore, China Molybdenum, and Zhejiang Huayou Cobalt actively invest in refining capacity, partnerships with EV manufacturers, and innovation in battery-grade production technologies.

- Price volatility, supply concentration in the Democratic Republic of Congo, and evolving environmental regulations create operational and procurement challenges for stakeholders.

- Asia-Pacific remains the dominant region due to large-scale EV manufacturing and battery production, while Europe and North America show rapid growth through localization strategies and clean energy policies.

- The market shows a shift toward sustainable production practices, regional diversification of refining hubs, and adoption of high-purity materials aligned with evolving battery chemistries and energy storage needs.

Market Drivers

Rising Adoption of Electric Vehicles Accelerates Demand for Battery-Grade Cobalt Sulphate

The global shift toward electric mobility drives significant growth in the Cobalt Sulphate market. EV manufacturers increasingly rely on lithium-ion batteries, where cobalt sulphate plays a critical role in the cathode chemistry. It enhances energy density, battery stability, and thermal performance. Leading automotive OEMs expand production capacity and secure long-term supply contracts for cobalt-based materials. Demand strengthens with government mandates on emission reduction and subsidies for electric vehicle adoption. The Cobalt Sulphate market benefits from strategic investments in battery material supply chains to ensure security and scalability.

- For instance, Umicore secured a long-term agreement to supply high-purity cobalt precursors from its Kokkola plant in Finland, supporting production of up to 100,000 EV batteries annually.

Expansion of Energy Storage Infrastructure Enhances Market Growth

The growing focus on renewable energy integration into power grids increases the need for efficient energy storage systems. Cobalt sulphate supports stationary battery storage applications that ensure grid reliability and load balancing. Energy developers deploy battery storage projects to manage intermittent generation from solar and wind sources. It leads to sustained demand for high-performance cathode materials that include cobalt sulphate. The market gains momentum through partnerships between energy companies and battery manufacturers. The Cobalt Sulphate market aligns with national clean energy goals and infrastructure modernization programs.

- For instance, Glencore’s cobalt hydroxide supplies support over 30,000 metric tons of annual cobalt sulphate output for grid storage projects through its strategic partnerships with European battery manufacturers.

Technological Advancements in Battery Chemistry Support Material Optimization

Advancements in lithium-ion battery formulations influence demand patterns for cobalt sulphate. Manufacturers explore nickel-rich chemistries that still require cobalt for structural and thermal stability. It results in continued consumption of cobalt sulphate despite efforts to reduce dependency. Research institutions and industrial R&D units focus on improving cobalt utilization efficiency. Supply chain innovations and recycling technologies also emerge to optimize material flow. The Cobalt Sulphate market adapts to evolving technical requirements in next-generation battery designs.

Government Policies and Strategic Investments Foster Supply Chain Resilience

Policymakers support domestic and regional production of critical battery materials including cobalt sulphate. Strategic reserves, financial incentives, and permitting reforms help attract investment in refining and processing facilities. Countries with cobalt reserves accelerate downstream integration to capture more value. It creates opportunities for new entrants and joint ventures in the refining segment. Market participants diversify sourcing and processing hubs to reduce geopolitical risks. The Cobalt Sulphate market gains stability through these proactive supply chain measures.

Market Trends

Vertical Integration Across Battery Supply Chains Gains Momentum

Major battery manufacturers and EV OEMs increasingly pursue vertical integration strategies to secure cobalt sulphate supply. Companies invest in upstream mining operations and midstream refining assets to mitigate price volatility and ensure traceability. This trend strengthens control over critical raw materials and reduces dependency on third-party suppliers. Partnerships emerge between miners, refiners, and end-users to streamline logistics and reduce lead times. The Cobalt Sulphate market reflects this consolidation through long-term offtake agreements and captive production capabilities. It supports enhanced cost management and stable material availability.

- For instance, Jinchuan Group commissioned a new refining line capable of producing 280,000 metric tons per year of nickel and cobalt sulfates combined to serve high-nickel cathode producers.

Increased Focus on Sustainable and Ethical Sourcing Practices

Environmental and social governance (ESG) concerns influence procurement strategies across the cobalt value chain. Buyers place higher emphasis on traceable, responsibly sourced cobalt to meet regulatory and consumer expectations. Certification programs and digital tracking technologies gain traction to validate sourcing practices. Producers invest in cleaner refining technologies and community engagement in mining regions. The Cobalt Sulphate market incorporates sustainability benchmarks as part of its competitive differentiation. It responds to growing demand for transparent and low-impact supply chains.

- For instance, ERG and Thara signed an agreement to establish a cobalt refinery in Saudi Arabia targeting an annual capacity of 25,000 metric tons of cobalt sulphate for domestic and export markets.

Recycling and Urban Mining Emerge as Supplementary Supply Sources

Recycled cobalt from end-of-life batteries offers an emerging alternative to primary extraction. Battery recyclers expand capacity to recover cobalt sulphate and reduce reliance on mined feedstock. Closed-loop systems enhance material efficiency and lower the environmental footprint of battery production. OEMs and recyclers form alliances to collect and process used batteries at scale. The Cobalt Sulphate market integrates recycled content into mainstream production streams. It reflects growing interest in circular economy practices and raw material security.

Geographical Diversification of Refining Capacity Reduces Supply Risks

Refining activity for cobalt sulphate increasingly expands beyond traditional centers in China. Countries such as Indonesia, Finland, and Australia invest in localized processing infrastructure to support regional battery industries. This diversification addresses geopolitical concerns and encourages balanced market participation. Strategic government support accelerates project development and licensing processes. The Cobalt Sulphate market benefits from distributed refining hubs that stabilize supply and improve responsiveness. It aligns with global strategies for energy independence and industrial resilience.

Market Challenges Analysis

Volatile Raw Material Pricing and Supply Chain Disruptions Undermine Stability

Fluctuating cobalt prices create major uncertainty for downstream manufacturers relying on cobalt sulphate. Price instability stems from concentrated mining activity in the Democratic Republic of Congo and sensitivity to geopolitical developments. Disruptions in transportation, labor, and export regulations can delay delivery schedules and inflate costs. This volatility complicates procurement planning and margin management across the battery supply chain. The Cobalt Sulphate market faces pressure to establish more resilient and diversified sourcing structures. It must address pricing unpredictability through hedging mechanisms and long-term agreements.

Regulatory and Environmental Pressures Increase Compliance Burden

Tightening environmental standards and regulatory frameworks challenge cobalt sulphate producers. Governments enforce stricter rules on emissions, waste disposal, and occupational safety at both mining and refining stages. Compliance increases operational costs and delays permitting for new capacity. Companies must invest in cleaner technologies and reporting systems to meet evolving expectations. The Cobalt Sulphate market encounters delays in project execution due to complex permitting requirements and environmental assessments. It navigates rising scrutiny from regulators, investors, and advocacy groups demanding transparent and

Market Opportunities

Growing Localization of Battery Supply Chains Opens Regional Investment Avenues

The push to develop localized battery manufacturing ecosystems creates new demand for regionally refined cobalt sulphate. Governments in North America, Europe, and Asia-Pacific provide incentives to build domestic processing and cathode material facilities. Investors target new refineries that can supply battery-grade cobalt sulphate closer to cell production hubs. This trend enhances supply chain security while supporting national clean energy goals. The Cobalt Sulphate market finds opportunities through these regional expansions and public-private partnerships. It supports emerging players and promotes competitive decentralization of global refining capacity.

Rising Demand for Energy Storage Systems Drives New Application Potential

The accelerating deployment of renewable energy systems requires scalable energy storage solutions to ensure grid stability. Stationary lithium-ion battery systems use cobalt sulphate in cathode chemistries that offer high energy density and cycle stability. Utilities and commercial energy operators invest in large-scale storage infrastructure to support decarbonization targets. Battery developers seek reliable sources of cobalt sulphate to meet rising volume requirements in this segment. The Cobalt Sulphate market expands its reach beyond mobility applications into utility-scale projects. It aligns with broader trends in electrification and energy transition.

Market Segmentation Analysis:

By Type:

Battery grade cobalt sulphate holds the largest market share due to its critical role in lithium-ion battery production. It meets stringent purity standards required by cathode material manufacturers in the automotive and energy sectors. Producers prioritize process optimization to supply high-purity cobalt sulphate to EV and energy storage industries. Industrial grade cobalt sulphate finds use in electroplating, pigments, and ceramics. Demand remains steady but grows at a slower pace due to limited application scope. The Cobalt Sulphate market concentrates investments in battery-grade refinement to support emerging energy technologies.

- For instance, China Molybdenum’s refining facility in Tenke Fungurume supports annual production of 16,000 metric tons of battery-grade cobalt sulphate to meet demand from global battery manufacturers.

By Application:

Battery manufacturing leads the application segment, driven by the increasing deployment of electric vehicles and stationary storage systems. Cobalt sulphate enhances battery energy density, stability, and charge retention, making it essential for high-performance battery chemistries. Catalysts represent a stable application area, particularly in chemical processing and fuel refining. Electroplating uses cobalt sulphate for surface finishing in industrial and decorative coatings. The Cobalt Sulphate market expands primarily through battery manufacturing while maintaining consistent demand in traditional industrial segments.

- For instance, Umicore’s cathode materials plant in Nysa, Poland began commercial production and is supported by refined cobalt sulphate sourced from its Kokkola refinery, contributing to a total cathode output capacity of 20,000 metric tons annually.

By End-User:

The automotive industry accounts for the largest share of cobalt sulphate consumption due to the shift toward electrified transportation. EV manufacturers rely on cobalt-rich cathodes to support longer range and improved battery safety. The electronics industry continues to use cobalt sulphate in portable devices requiring compact, durable power sources. The renewable energy industry emerges as a high-growth segment with increased investments in grid-scale storage and backup power systems. The Cobalt Sulphate market supports these industries by enabling reliable energy solutions and promoting the transition to clean mobility and power.

Segments:

Based on Type:

- Battery Grade Cobalt Sulphate

- Industrial Grade Cobalt Sulphate

Based on Application:

- Battery Manufacturing

- Catalysts

- Electroplating

Based on End-User:

- Automotive Industry

- Electronics Industry

- Renewable Energy Industry

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a significant position in the global street sweeper market, accounting for approximately 26.3% of the total market share. The region’s demand is primarily driven by the United States, supported by established municipal infrastructure, high urbanization rates, and strict environmental regulations. Local governments invest in modern cleaning equipment to maintain public hygiene and reduce fine particulate emissions, especially in large metropolitan areas. Adoption of advanced mechanical and vacuum sweepers is prevalent, with growing interest in electric and hybrid variants. Cities such as New York, Los Angeles, and Chicago deploy large fleets of sweepers, often sourced through public-private partnerships. The street sweeper market in North America benefits from recurring municipal budgets and the presence of leading manufacturers like Elgin Sweeper and Tennant Company.

Europe

Europe captures around 24.8% of the street sweeper market, supported by well-developed urban infrastructure, stringent environmental compliance policies, and ongoing smart city initiatives. Countries including Germany, France, the UK, and the Netherlands emphasize low-emission municipal vehicles, which fuels demand for electric and compact sweepers. The European Union’s Green Deal and city-specific clean air mandates increase procurement of eco-friendly sweeping solutions. Municipalities prioritize noise reduction and emission standards, accelerating the shift toward battery-powered and LNG-based sweepers. Several local manufacturers, including Bucher Municipal and Aebi Schmidt, maintain strong distribution networks across Europe. It continues to be a mature but innovation-driven market with rising investment in autonomous street cleaning technologies.

Asia-Pacific

Asia-Pacific leads the global market with the highest share of 31.7%, attributed to rapid urbanization, infrastructure development, and expanding city cleaning programs across China, India, Japan, and Southeast Asia. The region sees large-scale procurement of street sweepers for both municipal and industrial use. China dominates the regional landscape due to its aggressive urban sanitation programs and domestic manufacturing capabilities. Local governments prioritize mechanized road cleaning to combat air pollution and improve public health standards. In India, the Swachh Bharat Abhiyan and smart city programs promote adoption of street cleaning vehicles in tier-1 and tier-2 cities. Japan and South Korea focus on precision cleaning and automation, investing in compact, high-efficiency sweepers suitable for narrow urban lanes.

Latin America

Latin America holds a modest 9.3% share of the global street sweeper market. Brazil and Mexico represent the leading markets, supported by urban renewal programs and improvements in city infrastructure. Public health initiatives, flood prevention, and pollution control encourage procurement of mechanical and vacuum sweepers. Budget constraints pose challenges, but international development funding and municipal reforms create opportunities. Local governments increasingly recognize the value of equipment that reduces labor dependency and improves cleaning efficiency. The market in Latin America shows steady growth potential, particularly in countries modernizing their municipal services.

Middle East & Africa

The Middle East & Africa region accounts for approximately 7.9% of the street sweeper market. GCC countries such as Saudi Arabia and the UAE drive demand through smart city projects, airport expansion, and tourism-centric urban beautification. Municipalities in these countries invest in technologically advanced sweepers to maintain cleanliness in high-traffic urban and industrial zones. Africa’s adoption remains limited but grows in key cities across South Africa, Nigeria, and Kenya. International partnerships, public sector reforms, and rising focus on sanitation contribute to incremental growth. The region seeks compact, fuel-efficient machines that offer affordability and durability in diverse terrain conditions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Umicore

- CNMC

- Glencore

- FreeportMcMoRan

- LS Group

- Hindustan Zinc

- ERG

- Jinchuan Group

- Zhejiang Huayou Cobalt

- China Molybdenum

- Sherritt International

- Huayou Cobalt

- Eurasian Resources Group

- Vale

- CMOC Group

Competitive Analysis

Key players in the cobalt sulphate market include Glencore, China Molybdenum, Zhejiang Huayou Cobalt, Umicore, Jinchuan Group, and Eurasian Resources Group. These companies maintain strong positions through integrated operations, refined production capabilities, and strategic access to cobalt resources. They invest heavily in expanding battery-grade cobalt sulphate output to meet surging demand from electric vehicle and energy storage sectors. Most leading players own or partner with cobalt mines, ensuring control over raw material supply and reducing exposure to geopolitical risks.Technological advancements in refining processes and recycling solutions enhance product purity and sustainability, aligning with evolving customer requirements. Players focus on long-term supply agreements with battery and automotive manufacturers, strengthening their value chain position. Regional diversification of refining facilities helps mitigate disruptions and meet regulatory standards in target markets. ESG compliance, traceability, and responsible sourcing have become key differentiators, prompting these companies to adopt transparent and sustainable practices. Competitive intensity remains high, driven by capacity expansions, localization efforts, and vertical integration strategies.

Recent Developments

- In March 2025, Umicore published its Due Diligence Compliance Report evaluating its supply chain practices against updated cobalt, lithium, and nickel frameworks.

- In March 2025, Eurasian Resources Group (ERG) declared force majeure on cobalt deliveries from its Metalkol operation due to the DRC due to a temporary export ban imposed by the DRC government.

- In 2025, Jinchuan Group’s 280,000-tonne-per-year nickel sulfate plant, specifically designed for power battery applications, began operations. This plant is part of Jinchuan Group’s broader efforts to expand its production capacity and meet the growing demand for nickel sulfate in the electric vehicle battery sector.

Market Concentration & Characteristics

The Cobalt Sulphate market exhibits moderate to high concentration, with a limited number of integrated producers controlling a significant portion of global supply. Leading participants maintain upstream access to cobalt resources and operate refining facilities that meet battery-grade purity specifications. The market is characterized by high capital intensity, regulatory sensitivity, and technical precision in processing. Supply security remains critical, prompting vertical integration strategies and long-term offtake agreements with battery and EV manufacturers. Geographic concentration of cobalt mining in the Democratic Republic of Congo creates inherent supply risks, driving investments in recycling, alternative sources, and regional refining hubs. The Cobalt Sulphate market emphasizes traceability, ESG compliance, and technological innovation to support energy transition goals. It responds to evolving battery chemistries and demand from electric mobility and stationary storage sectors with tailored, high-purity products. Competitive advantage depends on production efficiency, environmental

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for cobalt sulphate will rise with continued expansion of electric vehicle manufacturing worldwide.

- Battery manufacturers will prioritize high-purity cobalt sulphate to meet performance and safety standards.

- Recycling of end-of-life batteries will become a vital secondary source of cobalt sulphate.

- Supply chain localization will drive new refinery projects across North America, Europe, and Asia.

- ESG compliance and responsible sourcing will remain key purchasing criteria for end-users.

- Technological advancements will improve refining efficiency and reduce environmental impact.

- Strategic partnerships between miners, refiners, and battery makers will strengthen market integration.

- Alternative battery chemistries may influence long-term cobalt demand but will not eliminate it.

- Market participants will diversify raw material sources to mitigate geopolitical and pricing risks.

- Investment in automation and digital monitoring will enhance product consistency and operational control.