Market Overview:

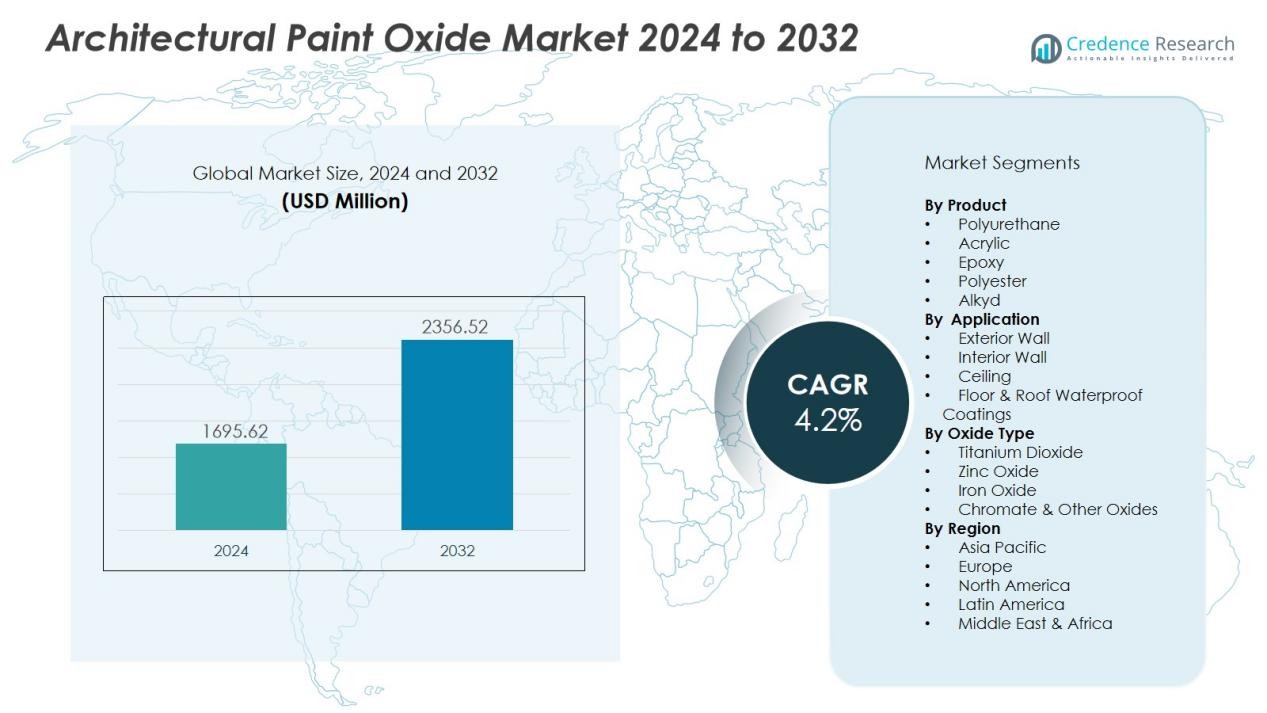

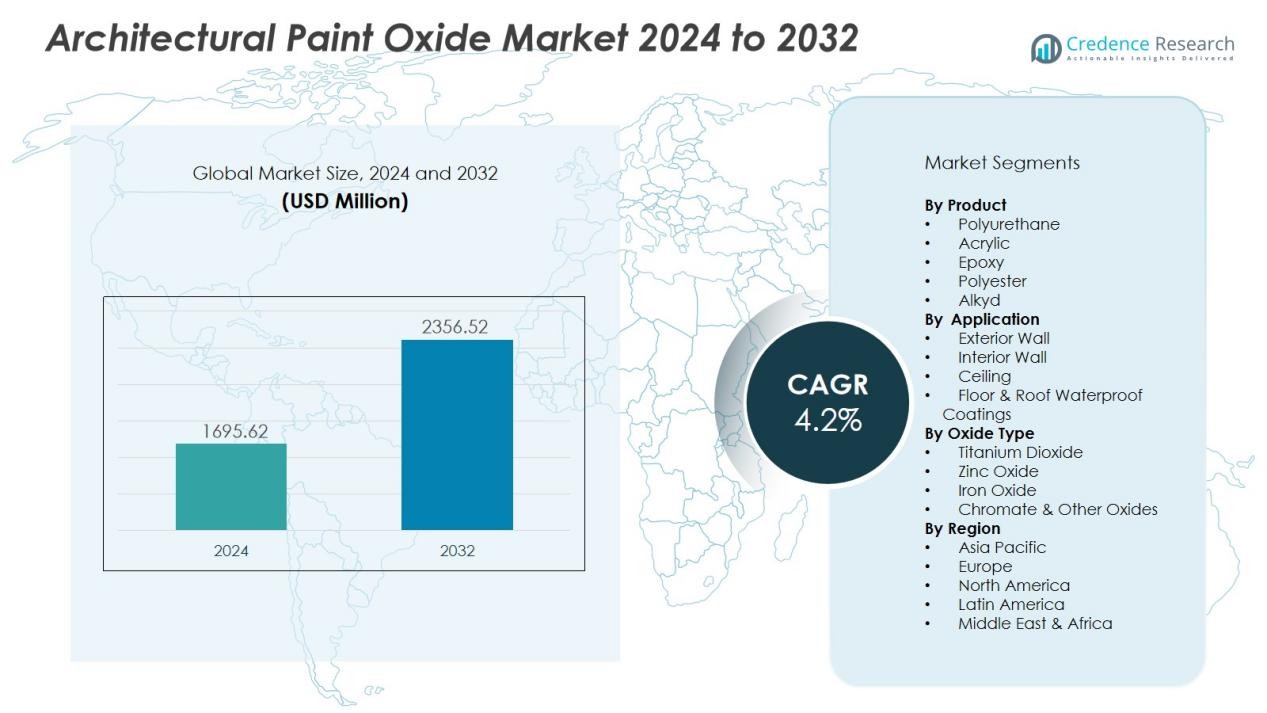

The Architectural Paint Oxide Market size was valued at USD 1695.62 million in 2024 and is anticipated to reach USD 2356.52 million by 2032, at a CAGR of 4.2 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Architectural Paint Oxide Market Size 2024 |

USD 1695.62 Million |

| Architectural Paint Oxide Market, CAGR |

4.2% |

| Architectural Paint Oxide Market Size 2032 |

USD 2356.52 Million |

Growth in this market is primarily driven by rapid urbanization, heightened infrastructure investment, and rising demand for aesthetically rich and performance-oriented coatings. The push for low-VOC and sustainable paints has further stimulated demand for oxide pigments that offer high weather resistance, UV stability, and compliance with environmental regulations.

Regionally, the Asia-Pacific region leads with the largest share—about 42.3% in 2024—driven by fast-moving urban development in countries such as China and India. North America is expected to exhibit strong growth ahead of other regions due to increasing renovation activity and stringent eco-regulations. Europe also remains significant thanks to its mature construction base and high focus on eco-friendly solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Architectural Paint Oxide Market was valued at USD 1,695.62 million in 2024 and is projected to reach USD 2,356.52 million by 2032, growing at a CAGR of 4.2% during the forecast period.

- The Asia-Pacific region holds the largest market share at 42.3% in 2024, driven by rapid urbanization, large-scale infrastructure projects, and growing demand for durable, eco-friendly coatings.

- North America, with a 28.5% market share in 2024, shows strong growth due to increasing renovation activities, stringent environmental regulations, and the demand for sustainable paints.

- Europe accounts for 30% of the global market share in 2024, supported by strict building sustainability regulations and high demand for aesthetic and functional coatings in renovation projects.

- By segment, the product segment (Polyurethane, Acrylic, Epoxy, Polyester, Alkyd) holds the highest share, followed by the application segment (Exterior Wall, Interior Wall, Ceiling, Floor & Roof Waterproof Coatings).

Market Drivers:

Rising Urbanization and Infrastructure Development

The rapid urbanization witnessed globally plays a pivotal role in driving the growth of the Architectural Paint Oxide Market. Increasing urban populations create a higher demand for residential and commercial spaces, leading to the expansion of the construction industry. Urban infrastructure projects, including roads, bridges, and public buildings, further enhance the need for durable and visually appealing coatings. Architectural paints with oxide pigments are preferred for their ability to withstand weather conditions while offering vibrant, long-lasting colors.

- For instance, Shepherd Color has developed chromium iron oxide pigments such as Black 10G975, which delivers exceptional durability through high infrared reflection combined with UV and chemical stability, making it well-suited for building materials including siding, roofing extrusions, and architectural panels requiring long-term weather resistance.

Demand for Sustainable and Low-VOC Paints

Sustainability is a significant driver in the Architectural Paint Oxide Market. Growing environmental concerns and stringent regulations on volatile organic compound (VOC) emissions are pushing the industry toward eco-friendly solutions. Paints made with oxide pigments, which are typically low in VOCs, meet these requirements while ensuring excellent durability and performance. The market’s shift toward sustainability is evident in consumer preference for products that contribute to healthier indoor environments and greener buildings.

- For instance, Sherwin-Williams’ Harmony Interior Acrylic Latex Paint delivers a zero VOC formula at less than 50 g/L combined with antimicrobial agents that inhibit mold and mildew growth on the paint film

Advancements in Coating Technologies

Technological advancements in coating systems are shaping the demand for architectural paint oxides. Innovations in pigment formulations, such as the development of more weather-resistant and UV-stable oxide pigments, enhance the durability of paints and coatings. These advancements not only improve the aesthetic appeal but also increase the longevity of painted surfaces, making oxide-based paints highly sought after for both residential and commercial applications.

Increasing Renovation and Remodeling Activities

The growing trend of home renovations and commercial space remodeling is fueling demand for high-quality architectural paints. Consumers are opting for paint products that offer enhanced aesthetic qualities and long-term performance. The Architectural Paint Oxide Market benefits from this trend as oxide-based paints offer a wide range of colors and finishes, meeting both aesthetic and functional requirements for renovation projects. As people continue to invest in upgrading existing structures, the market for architectural paint oxides remains robust.

Market Trends:

Adoption of Low‑VOC and Water‑based Formulations

The Architectural Paint Oxide Market shows strong momentum toward low‑VOC and water‑based paint systems. Many manufacturers invest in oxide pigments that disperse well in aqueous media and support compliance with tighter environmental regulations. The shift away from solvent‑borne coatings drives usage of iron oxides, titanium dioxide and zinc oxides with improved performance. These pigments deliver enhanced durability and weather resistance while meeting sustainability targets. Industry players adopt these blends to respond to rising demands from green building certifications and eco‑conscious consumers.

- For instance, AkzoNobel launched its Dulux Trade Scuffshield Matt, a water-based decorative paint that achieves VOC content below 10g/L, contributing to compliance with EU limits and boosting usage in certified green buildings.

Functional and Smart Coatings Integration

Coating products in this market increasingly incorporate smart or functional properties such as self‑cleaning, antimicrobial or reflective capabilities. Innovations in oxide pigment chemistry enable coatings to reflect UV light, resist microbial growth or reduce surface soiling. This trend expands usage beyond pure aesthetic decoration into performance‑driven applications in commercial and residential projects. Suppliers in the Architectural Paint Oxide Market partner with technology firms to embed new pigment‑based functionalities. End‑users favour these advanced coatings for their long‑term asset value, reduced maintenance costs and selective premium pricing.

- For instance, Rhino Shield has developed advanced UV-reflective ceramic coatings that achieve a Solar Reflectance Index (SRI) rating of 106 to 107, enabling homeowners to reduce cooling costs through superior solar heat reflection while maintaining UV resistance through top-grade titanium dioxide pigments combined with ceramic microspheres.

Market Challenges Analysis:

Raw‑Material Price Volatility and Supply‑Chain Constraints

The Architectural Paint Oxide Market confronts substantial pressure from fluctuating prices of key pigment raw materials such as titanium, iron and zinc oxides. Manufacturers struggle to set stable product pricing when underlying input costs swing due to geopolitical tensions or supply shortages. It takes longer for producers to adjust formulations and secure alternative sources without affecting performance. The ripple effect of cost increases often forces either margin compression or higher end‑product pricing. Supply‑chain disruptions add uncertainty that can delay delivery and upset project schedules in construction and renovation.

Regulatory Compliance Complexity and Performance Trade‑Offs

This market also faces intricate regulatory demands covering volatile organic compounds (VOCs), heavy‑metal content, and environmental impact of coatings. Producers in the architectural paint oxide market must invest heavily in R&D to reformulate pigments and binders to comply with regional standards. It becomes difficult to maintain durability, colour stability and weather resistance while operating under tighter emission limits. Some end‑users resist paying premium prices for reformulated products, which reduces market uptake. Manufacturers must navigate diverse regulatory frameworks across regions, increasing complexity and administrative burden.

Market Opportunities:

Expansion in Emerging Construction and Renovation Sectors

The Architectural Paint Oxide Market presents substantial opportunities through growth in residential and commercial construction in emerging economies. Rapid urbanisation and rising infrastructure budgets in regions like Asia‑Pacific drive demand for high‑performance coating solutions. Manufacturers can leverage this trend by developing oxide pigments that meet durability and aesthetic criteria demanded in large‑scale projects. Renovation and refurbishment of older buildings also open the market for premium oxide‑based coatings that deliver superior weathering resistance and colour retention. It becomes possible to capture new segments by targeting such retrofit applications where performance and lifecycle costs matter. Suppliers who adjust their product portfolios to serve these evolving needs stand to gain competitive advantage.

Technology‑Driven Product Differentiation and Eco‑Friendly Solutions

Innovating oxide pigment formulations offers another strategic opportunity in the architectural paint oxide market. Development of pigments tailored for water‑based and low‑VOC systems addresses increasing regulatory and consumer pressure for environmentally safe coatings. Smart coatings that offer additional functionalities—such as UV reflection, antimicrobial surfaces or rapid colour change—open new high‑value niches. It benefits companies to invest in R&D collaborations and integrate advanced pigment technologies to raise barriers to entry. Strategic partnerships between pigment producers and paint formulators can accelerate product launches and differentiation. By focusing on sustainability and functionality, it becomes feasible to penetrate premium segments and enhance margin potential.

Market Segmentation Analysis:

By Product (Resin/Coating Type)

The product segment covers polyurethane, acrylic, epoxy, polyester and alkyd coatings. Acrylic resin holds a leading share thanks to its durability, weather‑resistance and strong performance in both interior and exterior uses. Epoxy coatings show higher growth potential due to superior chemical resistance and protective film formation. Manufacturers adopt these resin types and tailor oxide pigments for each formulation to meet performance demands. This segmentation lets suppliers target product portfolios more precisely and capture value from high‑end applications.

- For instance, PPG Industries’ fluoropolymer-based (PVDF) ‘PPG DURANAR® coatings’ have demonstrated over 30 years of exterior color and gloss retention on major architectural projects globally

By Oxide Type (Pigment Chemistry)

Oxide type segmentation divides the market into titanium dioxide, zinc oxide, iron oxide, chromate and other oxide pigments. Titanium dioxide dominates because of its high whiteness, opacity and UV resistance. Iron oxide is growing faster due to cost‑effectiveness, colour versatility and strong use in decorative paints. Zinc oxide serves niche roles in antimicrobial or UV‑blocking coatings. This breakdown guides pigment producers toward the chemical classes that capture value and meet regulatory, aesthetic and functional demands.

By Application (Surface & End‑Use)

Application segmentation includes exterior wall, interior wall, ceiling, floor and roof waterproof coatings. Exterior wall coatings account for the largest share since buildings require high‑performance protection against weather and UV exposure. Floor and roof waterproof coatings reveal rising demand in renovation and infrastructure sectors, showing fastest growth potential. The application analysis helps paint formulators and pigment suppliers align R&D and marketing efforts with surfaces where performance and aesthetics matter most. It also highlights opportunities in retrofit and commercial projects.

Segmentations:

By Product

- Polyurethane

- Acrylic

- Epoxy

- Polyester

- Alkyd

By Application

- Exterior Wall

- Interior Wall

- Ceiling

- Floor & Roof Waterproof Coatings

By Oxide Type

- Titanium Dioxide

- Zinc Oxide

- Iron Oxide

- Chromate & Other Oxides

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia‑Pacific Region

The Asia‑Pacific region held a market share of 42.3% in the Architectural Paint Oxide Market in 2024. It benefited from intensifying urbanisation, large‐scale infrastructure projects and rising disposable incomes in countries like China and India. Builders and developers in this region chose oxide‑based coatings for their high durability and strong weather resistance. Regulatory emphasis on eco‑friendly construction further increased demand for low‑VOC and sustainable pigment systems. Supply chains in the region matured, enabling faster local production and reducing lead times. Product makers targeted this region for custom formulations tailored to both new builds and renovation sectors.

North America Region

The North America region accounted for an estimated 28.5% share of the architectural paint oxide market in 2024. It experienced strong demand due to renovation trends, stringent environmental standards and growth in sustainable building paints. It featured a strong preference for coatings offering high performance, low VOC emissions and long surface lifetimes. Manufacturers invested in R&D to develop advanced oxide pigments and partnered with paint formulators to deliver region‑specific solutions. The mature construction market and replacement cycles further supported volume uptake. Regional suppliers emphasised quick delivery, local service and tailored colour palettes to maintain competitive edge.

Europe Region

Europe contributed roughly 30% of the global architectural paint oxide market share in 2024. Market growth came from strict regulatory frameworks for indoor air quality and building sustainability, which favoured oxide‑based coatings. It featured widespread renovation activity in heritage and commercial buildings, driving demand for coatings offering both aesthetics and functional performance. Manufacturers focused on high‑performance pigments suitable for complex substrates and demanding climates. Regional paint companies emphasised green credentials, reduced heavy‑metal content and lifecycle durability to meet buyer expectations. The competitive landscape encouraged consolidation and technology partnerships to expand regional reach.

Key Player Analysis:

- The Sherwin-Williams Company (U.S.)

- PPG Industries, Inc. (U.S.)

- Nippon Paints (India) Private Limited (India)

- Asian Paints (India)

- Akzo Nobel N.V. (Netherlands)

- Kansai Paint Co., Ltd. (Japan)

- DuPont (U.S.)

- BASF SE (Germany)

- RPM International Inc. (U.S.)

- Axalta Coating Systems Ltd. (U.S.)

- Jotun A/S (Norway)

- Berger Paints India Ltd. (India)

Competitive Analysis:

In the competitive landscape of the Architectural Paint Oxide Market, major players such as RPM International Inc. (U.S.), Axalta Coating Systems Ltd. (U.S.), Jotun A/S (Norway) and Berger Paints India Ltd. (India) dominate. These companies invest heavily in R&D to develop oxide‐pigment formulations that offer high durability and comply with low‑VOC requirements. They leverage broad distribution networks and established relationships with large‐scale construction and renovation firms. It forces smaller niche suppliers to differentiate through specialty products or regional focus. These market leaders maintain cost efficiency by scaling procurement and production of raw materials. They position their offerings around premium functionality and aesthetic appeal to capture higher margin segments. Stakeholders entering this market must anticipate strong brand competition and focus on innovation, service, or partnerships to carve out meaningful share.

Recent Developments:

- In October 2025, The Sherwin-Williams Company completed the acquisition of BASF’s Brazilian architectural paints business, Suvinil, enhancing its presence in the Latin American market.

- In July 2025, Nippon Paints (India) Private Limited, in collaboration with India Champions for the World Championship of Legends 2025, launched the n-SHIELD range of vehicle protection films.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Product, Application, Oxide Type and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Demand will expand in emerging economies due to intensified urban construction projects.

- Suppliers will shift toward water‑based and low‑VOC oxide pigments to meet regulatory and consumer pressures.

- Product developers will integrate functional properties like UV reflection and antimicrobial performance into oxide pigments.

- Renovation and retrofit applications will create growth niches for premium oxide‑based coatings offering durability and aesthetics.

- Pigment manufacturers will invest in local sourcing and regional production hubs to reduce cost and lead‑time risks.

- Digital‑direct sales channels and DIY consumer segments will open new distribution pathways for oxide‑based paints.

- Partnerships between pigment producers and paint formulators will accelerate specialized product launches and market penetration.

- Sustainability credentials—including recyclability and reduced heavy‑metal content—will become key selection criteria for oxide pigments.

- Colour trends toward earthy, natural tones will boost demand for iron oxides and specialized mineral pigment blends.

- Raw‑material price volatility and supply‑chain constraints will drive innovation in alternative pigment chemistries and sourcing strategies.