Market Overview:

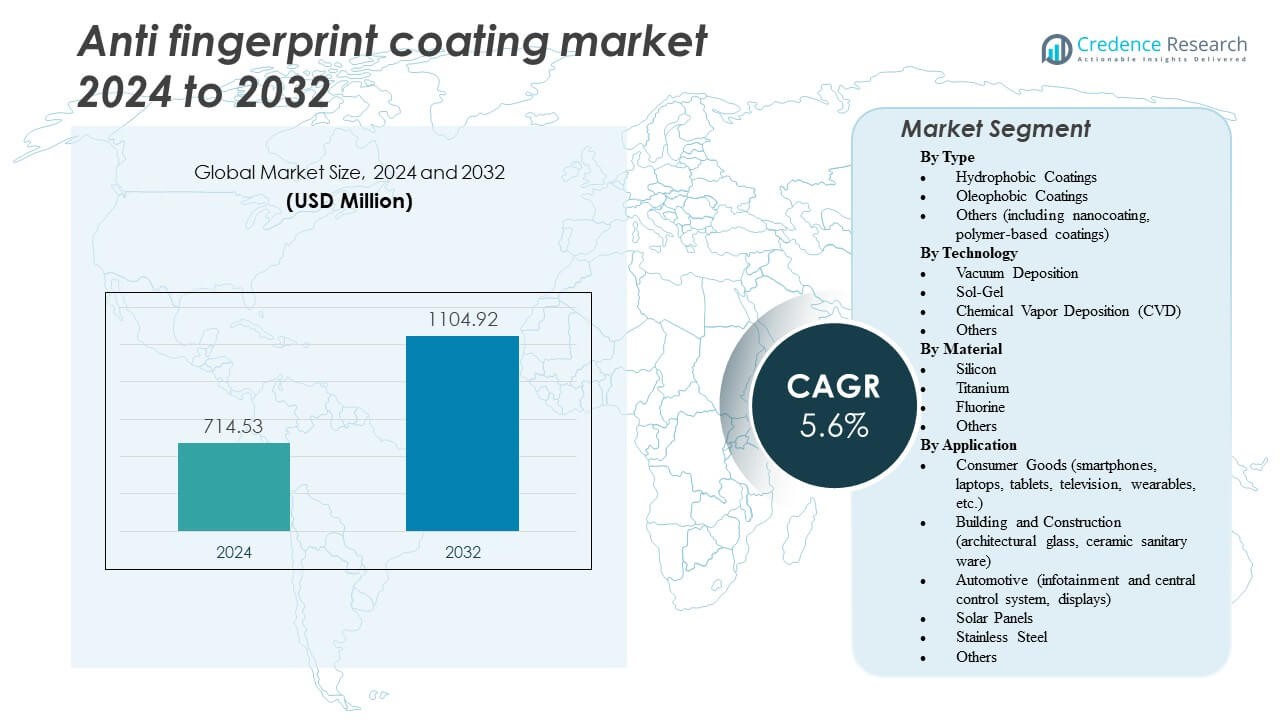

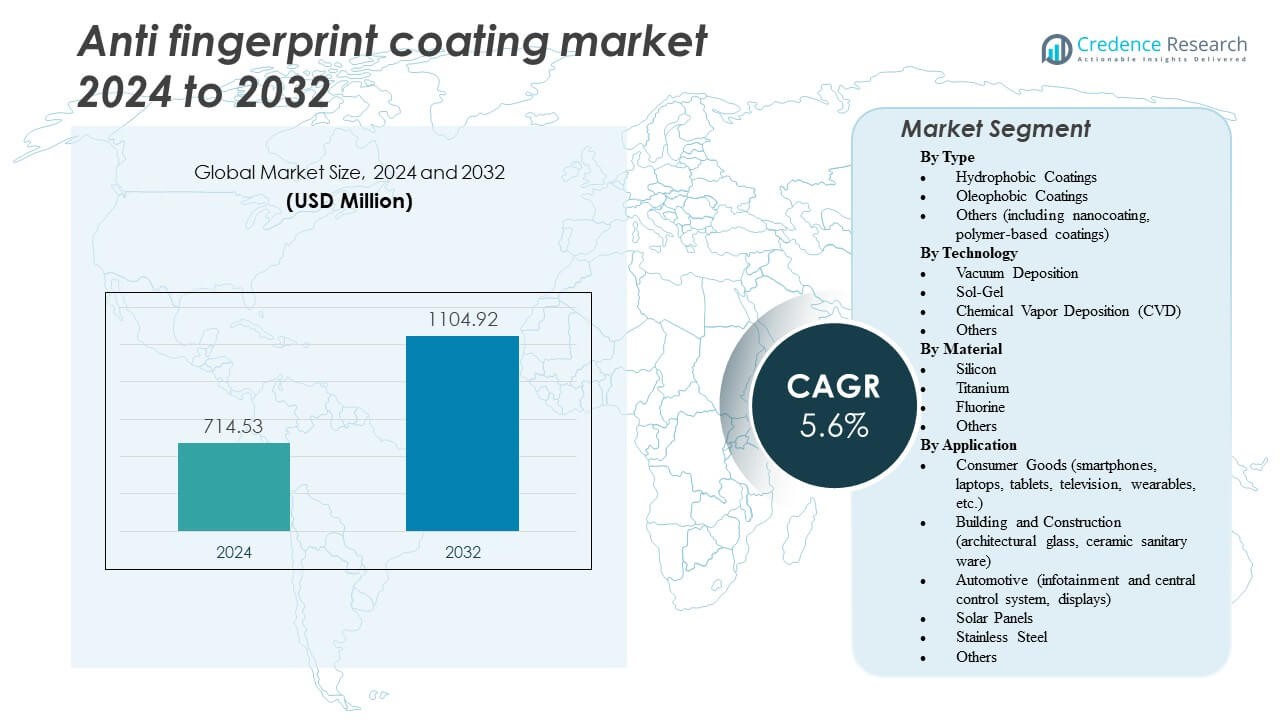

The Anti‑fingerprint coating market is projected to grow from USD 714.53 million in 2024 to an estimated USD 1,104.92 million by 2032, with a compound annual growth rate (CAGR) of 5.6% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Anti‑Fingerprint Coating Market Size 2024 |

USD 714.53 Million |

| Anti‑Fingerprint Coating Market, CAGR |

5.6% |

| Anti‑Fingerprint Coating Market Size 2032 |

USD 1,104.92 Million |

The market receives strong impetus from increasing consumer preference for cleanliness and durability in high‑touch surfaces. Manufacturers integrate anti‑fingerprint coatings into display devices, high‑end automotive interiors and architectural glazing to reduce maintenance efforts and preserve aesthetics. It leverages advances in nanotechnology and oleophobic chemistries that enhance smear‑resistance and prolong surface life. Demand rises particularly in electronics and automotive sectors where touchscreens and glossy finishes dominate. Consumer expectations for premium product appearance and hygiene foster coating adoption. OEMs and suppliers expand deployment across broader product categories to capture value from this trend.

Regional dynamics play a key role in market expansion. North America leads driven by strong electronics manufacturing and high consumer demand for premium surface finishes. Europe follows with growth supported by stringent environmental regulations and advanced automotive interiors. Asia‑Pacific shows fastest growth owing to large electronics assembly base, burgeoning automotive production and rapid urban infrastructure build‑out. Emerging markets in Latin America, the Middle East and Africa present new opportunities thanks to rising disposable incomes and increased focus on surface aesthetics and hygiene in consumer and commercial segments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Anti‑fingerprint coating market is valued at USD 714.53 million in 2024 and projected to reach USD 1,104.92 million by 2032, growing at a CAGR of 5.6%.

- Rising demand for smudge-free surfaces in consumer electronics and automotive interiors drives market growth.

- High production costs and performance durability challenges limit wider adoption in budget segments.

- North America leads the market due to advanced electronics manufacturing and strong consumer preference for premium finishes.

- Europe grows steadily with demand from automotive interiors, architectural glass, and stricter environmental regulations.

- Asia‑Pacific emerges rapidly, fueled by large electronics and automotive manufacturing hubs and expanding urban infrastructure.

- Emerging regions such as Latin America, the Middle East, and Africa offer growth potential through increasing disposable incomes and premium surface demand.

Market Drivers

Escalating Demand for Enhanced Surface Cleanliness in Consumer Electronics

The anti-fingerprint coating market benefits strongly from ever‑increasing manufacture of smartphones, tablets and wearables that require pristine surfaces. Electronics makers apply it to screens and touch interfaces to reduce cleaning frequency and boost aesthetic value. The coherence between consumer expectation and device finish drives manufacturers to adopt the coating early. It improves oil and smudge resistance on glass and metal, prompting integration into high‑volume production. Brand owners highlight the coating as a product differentiator and quality marker. Rising middle‑class populations in emerging economies accelerate demand for premium devices, reinforcing uptake. OEMs invest in coating processes to meet both performance and visual goals. This driver remains central to growth across electronics segments.

- For instance, Apple officially specifies a “fingerprint-resistant oleophobic coating” on all recent iPhone and iPad displays, as documented in Apple’s technical specifications for the iPhone 17 Pro (2025) and iPad Pro (2025). This coating enables reduced fingerprint visibility and easier cleaning across millions of shipped units; the oleophobic layer is fully laminated to the display and retains effectiveness even after extensive daily usage.

Automotive Interiors and Exteriors Adoption Accelerating Premiumisation of Vehicle Surfaces

The anti-fingerprint coating market expands as automakers shift toward premium finishes in cabins and body panels, especially where touch controls and glossy surfaces prevail. Designers incorporate it into screens, door panels, consoles and even exterior trims to resist fingerprints and enhance appeal. Consumers expect vehicles that feel luxurious and easy to maintain, so manufacturers integrate the coating to fulfil those demands. As electric vehicles grow, interior aesthetics take on greater importance and drive coating uptake. Suppliers partner to adapt coatings for automotive substrates and durability standards. The evolving vehicle cabin environment prompts broader coating deployment. This automotive push provides a sustained and increasing addressable market.

Growing Emphasis on Hygiene and Maintenance Reduction in Architectural and Commercial Spaces

The anti-fingerprint coating market gains from heightened interest in surfaces that stay cleaner longer in public spaces such as offices, hotels, airports and healthcare facilities. Property owners install coated glass, stainless steel and ceramic elements to simplify hygiene protocols and reduce cleaning costs. Architectural designers select it for high‑touch partitions, elevator doors and kiosks where smudges degrade appearance. The coating helps maintain visual clarity in glass façades and interior glazing systems subject to frequent contact. Maintenance teams welcome its ability to reduce visible smears and preserve aesthetics. Building‑automation integrators recommend it for smart buildings that value both function and form. The hygiene‑driven use case strengthens the coating market beyond consumer goods.

Technological Advancements and Material Innovation Driving Application Spread Across Substrates

The anti-fingerprint coating market benefits from rapid development of nanotechnology, oleophobic chemistries and vacuum‑deposition systems that enable coating of diverse substrates. Researchers and producers develop coatings that bond with glass, plastic, metal and composite surfaces, widening application scope. The improved durability and clarity of newer coatings make them viable in automobiles, architecture and industrial instrumentation. Coating manufacturers scale production and refine formulations to lower cost and raise performance. Multi‑function coatings now merge anti‑fingerprint capability with anti‑microbial or anti‑glare features, adding value. System integrators adopt these innovations to meet stringent performance and aesthetic requirements. This continuous innovation cycle underpins market expansion into adjacent verticals.

- For instance, FeelInGlass (AGC Group) publicly details its ultra-thin glass range, available in thicknesses from 0.5 to 2.1 mm, with optional anti-fingerprint and anti-glare acid-etching treatments. The technical documentation specifies measurable performance such as improved touch clarity, reduced fingerprint adhesion, and tailorable gloss levels for architectural and industrial uses.

Market Trends

Rise of Vacuum Deposition and Sol‑Gel Technologies for High‑Precision Coating Layers

The anti-fingerprint coating market shows strong uptake of vacuum deposition and sol‑gel processes because they deposit ultra‑thin, uniform films with high adhesion and clarity. These technologies extend functionality into demanding applications like automotive screens, architectural glass and high‑end consumer electronics. Manufacturers now favour vacuum systems that provide consistent performance and scalability for large volumes. Sol‑gel routes allow lower‑temperature processing on plastics and specialty substrates, broadening adoption. Equipment suppliers invest in automation to reduce cycle times and cost per unit. End‑users invite coatings specified to meet optical, mechanical and tactile requirements simultaneously. The shift toward advanced coating technologies accentuates differentiation among device and surface suppliers.

- For instance, Bühler Leybold Optics’ vacuum deposition systems are used for Gen 10 glass substrates sized up to 2.88 m × 3.13 m in large-area display and automotive glazing, with demonstrated scalability and high uniformity for industrial production.

Premiumisation of Devices and Interiors Elevates Demand for Aesthetic Surface Treatments

In the anti-fingerprint coating market the sensory experience of product and surface plays increasing importance, driving demand for coatings that preserve sheen, clarity and touch quality. Electronics designers emphasise display and frame finishes that resist fingerprints and smudges without degrading optical clarity. Automotive OEMs elevate cabin materials with glossy consoles and fingerprint‑resistant trims to support luxury branding. Architects specify fingerprint‑repellent glass and stainless steel panels in premium office and retail spaces where visual integrity matters. The value proposition shifts from purely functional to aesthetic and tactile differentiation. Suppliers align product roadmaps to meet both form and function in next‑generation surfaces. This premiumisation trend extends the coating application horizon beyond traditional segments.

- For instance, Corning Gorilla Glass DX+ reduces front-surface reflection by 75% compared to standard glass, enabling greater clarity and contrast for premium smartwatch and portable device displays

Expansion into Emerging Substrates and Surfaces Broadens Application Reach

The anti-fingerprint coating market diversifies into new materials and surfaces beyond typical glass and metal sheets, including plastics, ceramics and composite panels. Electronics companies employ the coating on foldable devices, wearables and curved panels that pose higher smudge challenges. Automotive manufacturers adopt it on interior leathers, plastics and fabric overlays where touch‑sensitive areas accumulate fingerprints. Building‑materials suppliers incorporate it into ceramic sanitary ware, kitchen appliances and decorative panels in response to hygiene and design demands. Coating formulators adapt chemistry to accommodate flexible substrates and irregular shapes, enabling broader deployment. This substrate diversification opens pathways into novel high‑volume applications and supports sustained growth.

Environmental and Regulatory Pressures Encourage Development of Sustainable Coating Solutions

In the anti-fingerprint coating market manufacturers respond to stricter environmental regulations and consumer expectations by developing low‑VOC, solvent‑free and fluorine‑reduced coatings. Regulatory frameworks in Europe and North America pressure formulators to ensure safe end‑of‑life disposal and reduced chemical footprint. Coating producers invest in alternative chemistries and production methods that meet sustainability standards while maintaining performance. Sustainability credentials also become marketing tools for device makers and architects seeking green building certifications. The move toward eco‑friendly coatings drives mergers, partnerships and innovation in the supply chain. This regulatory‑driven trend nudges the market toward higher‑value, higher‑performance solutions that comply and differentiate simultaneously.

Market Challenges Analysis

High Production Cost and Cost‑Sensitivity in Key End‑Use Segments

The anti-fingerprint coating market confronts challenge from elevated production cost of advanced formulations, deposition equipment and substrate preparation. Some end‑use sectors operate under tight cost constraints and hesitate to adopt premium coatings unless benefits clearly outweigh added cost. Coating manufacturers must justify higher unit cost through improved performance and longer life. Some consumers and OEMs perceive fingerprint resistance as optional, limiting willingness to pay. Supply‑chain disruptions and raw‐material price volatility further strain margins. Scalability issues may arise when coating large surfaces or complex shapes at high volumes. OEMs may delay adoption until cost reduction occurs. This cost barrier restricts penetration especially in low‑cost consumer goods and budget automotive segments.

Performance Durability and Substrate Compatibility Limit Wider Deployment

The anti-fingerprint coating market also faces challenge from durability issues when coatings fail under harsh environmental conditions or repeated use. Certain substrates such as flexible plastics, curved glass or composite materials may present adhesion or wear problems. End‑users demand coatings that remain effective over years in high‑touch zones, yet some formulations degrade or lose oleophobicity. Warranty and reliability concerns may delay uptake in safety‑critical applications like automotive interiors or architectural façades. Testing and certification requirements add time and cost for coating providers. Compatibility across multiple manufacturing processes and downstream treatments further complicates integration. Manufacturers must invest in R&D and validation to overcome these performance hurdles and gain broader acceptance.

Market Opportunities

Emergence of Smart Surfaces and IoT‑Enabled Devices Expands Application Scope

The anti-fingerprint coating market enjoys opportunity from expansion of smart surfaces and Internet‑of‑Things (IoT) devices that expose high‑touch interfaces in homes, offices and vehicles. As display panels proliferate in appliances, automotive cabins and building controls, demand for fingerprint‑resistant finishes grows. Coating suppliers can partner with OEMs to embed coatings into sensors, interactive kiosks and wearables. The shift toward connected living and smart infrastructure presents large volumes of new surfaces requiring enhanced cleanliness and usability. Coatings tailored for curved, flexible or transparent substrates unlock additional end‑use possibilities. Suppliers who align with smart‑device roadmaps can capture growth from this expanding ecosystem. This opportunity encourages investment into next‑generation coatings that meet both functional and aesthetic requirements.

Growth in Emerging Economies and Infrastructure Development Drives New Markets

The anti-fingerprint coating market finds opportunity in rapidly developing regions where infrastructure growth, rising consumer wealth and manufacturing investment converge. Emerging economies in Asia‑Pacific, Latin America and the Middle East increasingly require high‑quality construction materials, automotive components and consumer electronics. Coated glass, stainless steel panels and premium appliances in public and private projects create new demand. Local OEMs and coating manufacturers can tailor cost‑effective solutions to these regions, tapping latent markets. Urbanisation and rising middle‑class populations fuel demand for surfaces that look new and resist smudges without expensive maintenance. Expansion into these geographies offers coating players a broader addressable base and allows scaling through partnerships and regional production footprints.

Market Segmentation Analysis:

By Type:

The anti-fingerprint coating market sees significant adoption of hydrophobic and oleophobic coatings due to their ability to repel water, oils, and smudges effectively. Hydrophobic coatings dominate applications in consumer electronics and automotive displays for improved surface cleanliness. Oleophobic coatings gain traction in devices requiring frequent touch interactions, maintaining clarity and aesthetic appeal. Other coatings, including nanocoatings and polymer-based formulations, provide specialized properties for industrial and architectural applications. It continues to expand into sectors demanding durability and low-maintenance surfaces, strengthening its market relevance.

- For example, SCHOTT AG’s Xensation® cover glass features durable oleophobic and hydrophobic coatings. It reduces fingerprint visibility and ensures cleaner, long-lasting surfaces for high-end smartphones.

By Technology:

Vacuum deposition and sol-gel techniques lead the anti-fingerprint coating market due to precision layer formation and uniformity. CVD methods support high-durability coatings for industrial and architectural applications. Other emerging technologies enable application on flexible or irregular substrates, widening potential usage. It allows manufacturers to tailor coatings for optical clarity, tactile quality, and long-lasting performance. Investment in these processes ensures scalability and consistency across high-volume production. Technology advancements drive market competitiveness by enhancing coating efficiency and performance reliability.

By Material:

Silicon, titanium, and fluorine-based coatings hold significant shares in the anti-fingerprint coating market because of their superior oleophobic and hydrophobic characteristics. Silicon coatings are widely used in consumer electronics for smooth surfaces. Titanium formulations provide mechanical strength and chemical resistance, suitable for automotive and industrial segments. Fluorine-based coatings offer enhanced repellency on glass and metal surfaces. Other materials enable cost-effective alternatives for niche applications. It allows customization based on substrate compatibility, durability requirements, and end-use performance.

- For example, Lienchy Metal offers a nano-ceramic anti-fingerprint coating for stainless steel plates that features 6H pencil hardness and passes salt-spray resistance tests above 1,500 hours.

By Application:

Consumer electronics, including smartphones, laptops, tablets, and wearables, dominate the anti-fingerprint coating market due to high-touch surfaces. Automotive interiors and infotainment displays adopt coatings to maintain aesthetic appeal. Building and construction sectors apply coatings on architectural glass and ceramic sanitary ware for low-maintenance surfaces. Solar panels and stainless steel surfaces gain traction for efficiency and cleanliness. Other applications, including industrial equipment and appliances, expand the market further. It demonstrates broad applicability across sectors demanding hygiene, aesthetics, and functional surface protection.

Segmentation:

By Type

- Hydrophobic Coatings

- Oleophobic Coatings

- Others (including nanocoating, polymer-based coatings)

By Technology

- Vacuum Deposition

- Sol-Gel

- Chemical Vapor Deposition (CVD)

- Others

By Material

- Silicon

- Titanium

- Fluorine

- Others

By Application

- Consumer Goods (smartphones, laptops, tablets, television, wearables, etc.)

- Building and Construction (architectural glass, ceramic sanitary ware)

- Automotive (infotainment and central control system, displays)

- Solar Panels

- Stainless Steel

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Region

In the North American region, the Anti‑fingerprint coating market held an estimated 37% share of the global market in 2024. The United States serves as the primary driver, thanks to high disposable incomes, robust demand for premium consumer electronics and advanced display technologies. Manufacturers invest significantly in coating technologies to differentiate devices and enhance surface aesthetics and maintenance ease. It benefits from a strong R&D ecosystem and early adoption of high‑touch device innovations. Supply‑chain strength and established automotive and architectural industries support further deployment of coatings. North American firms also emphasize partnerships and customized formulations that meet stringent durability and performance standards.

Europe Region

The European region contributed roughly 24% to 26% of the global anti‑fingerprint coating market in 2024. Stringent environmental regulations and quality mandates compel manufacturers to adopt coatings that meet advanced performance benchmarks. It sees growing demand in automotive interiors, high‑end architectural glass and premium consumer electronics. Countries such as Germany lead with both production and innovation of coating technologies. European coating producers also focus on sustainability, low‑VOC formulations and lifecycle performance, which strengthen market positioning. A solid base of luxury vehicle makers and high‑spec consumer brands raises application potential for advanced coatings. Regulatory compliance and premium market segments together push market growth in the region.

Asia‑Pacific and Rest of World

In the Asia‑Pacific region, the market share stood at about 24%, with the region showing fastest growth. China, India and Southeast Asia drive demand owing to large electronics manufacturing bases, automotive production hubs and expanding construction sectors. It draws benefit from lower manufacturing costs, strong industrial growth and rising consumer‑middle class demand for premium finishes. The Rest of World (including Latin America, Middle East & Africa) accounts collectively for the remaining share‑likely below 15%‑and presents emerging opportunities in infrastructure, automotive and appliance markets. Coating suppliers increasingly target these regions to scale operations and capture new growth lanes driven by urbanisation and surface quality expectations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- AGC Inc.

- Cytonix LLC

- Daikin Industries Ltd.

- Harves Co. Ltd.

- Izovac Ltd.

- Henkel AG & Co. KGaA

- Dow Inc.

- Carl Zeiss Limited

- Shin-Etsu Chemical Co. Ltd.

- Solvay SA

- PPG Industries Inc.

- NAGASE & Co. Ltd.

- Aculon Inc.

- SDC Technologies Inc.

- NanoSlic Smart Coatings

- Nanokote Pty Ltd

- Cytonix LLC

Competitive Analysis:

The competitive analysis of the Anti‑fingerprint coating market reveals a highly dynamic landscape where global players vie on innovation, geography and scale. Market leaders prioritise R&D investments to introduce low‑VOC, high‑performance coatings and secure intellectual property through patents. They strengthen competitive position through mergers, strategic partnerships and geographical expansion enabling production closer to key end‑users. It faces pressure from new entrants offering niche polymer‑based or nanocoating solutions at lower cost. Established firms leverage strong brand recognition, extensive distribution networks and large manufacturing capacity to maintain market share. Smaller firms focus on flexible substrates and customised solutions to address emerging segments in consumer electronics and architecture. This competition drives continuous cost reduction, improved coating durability and broader application scope.

Report Coverage:

The research report offers an in-depth analysis based on Type, Technology, Material and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Anti-fingerprint coating market will expand with rising demand from consumer electronics.

- Automotive interiors and displays will drive increased adoption of durable coatings.

- Architectural glass and high-touch commercial surfaces will present growing opportunities.

- Emerging materials and nanotechnology will enhance coating performance and substrate compatibility.

- Sustainability-focused coatings will gain preference due to stricter environmental regulations.

- Expansion in Asia-Pacific and other developing regions will boost market penetration.

- OEM partnerships and collaborations will accelerate customized coating solutions.

- Smart devices and IoT-enabled surfaces will create new application avenues.

- Advanced deposition and sol-gel technologies will improve production efficiency.

- Continuous innovation in multifunctional coatings will strengthen the market’s competitive landscape.