Market Overview

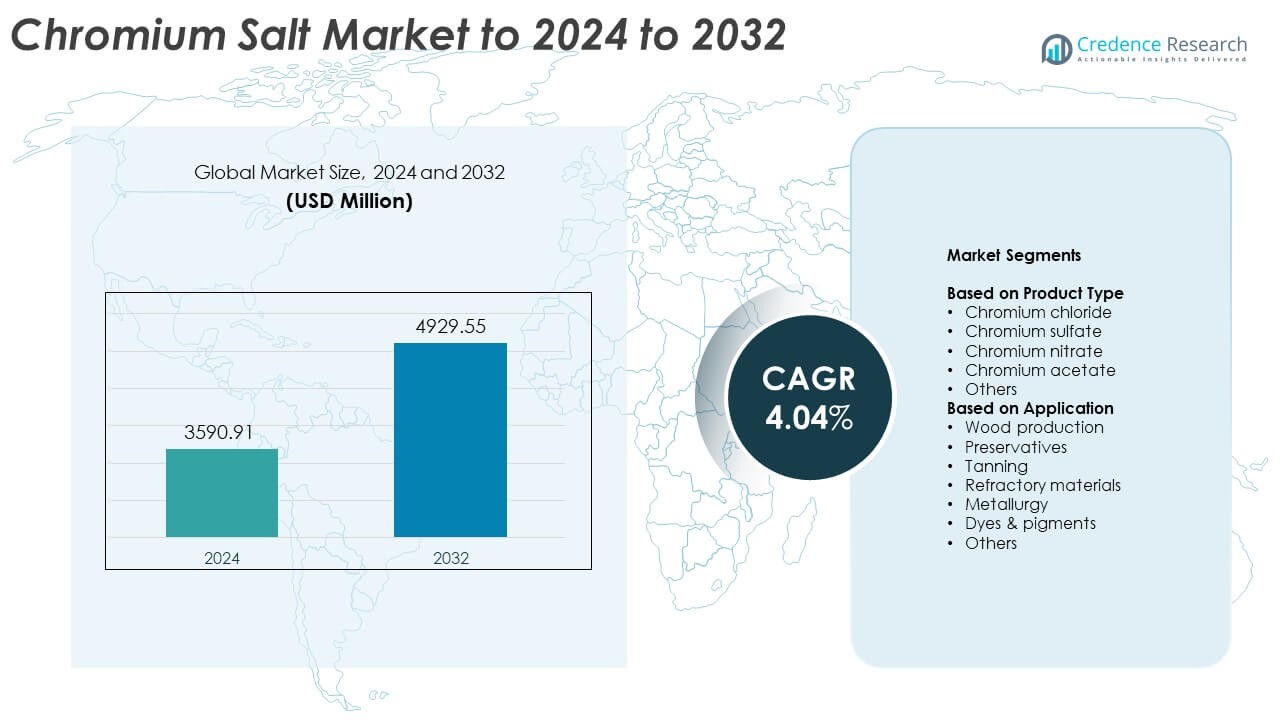

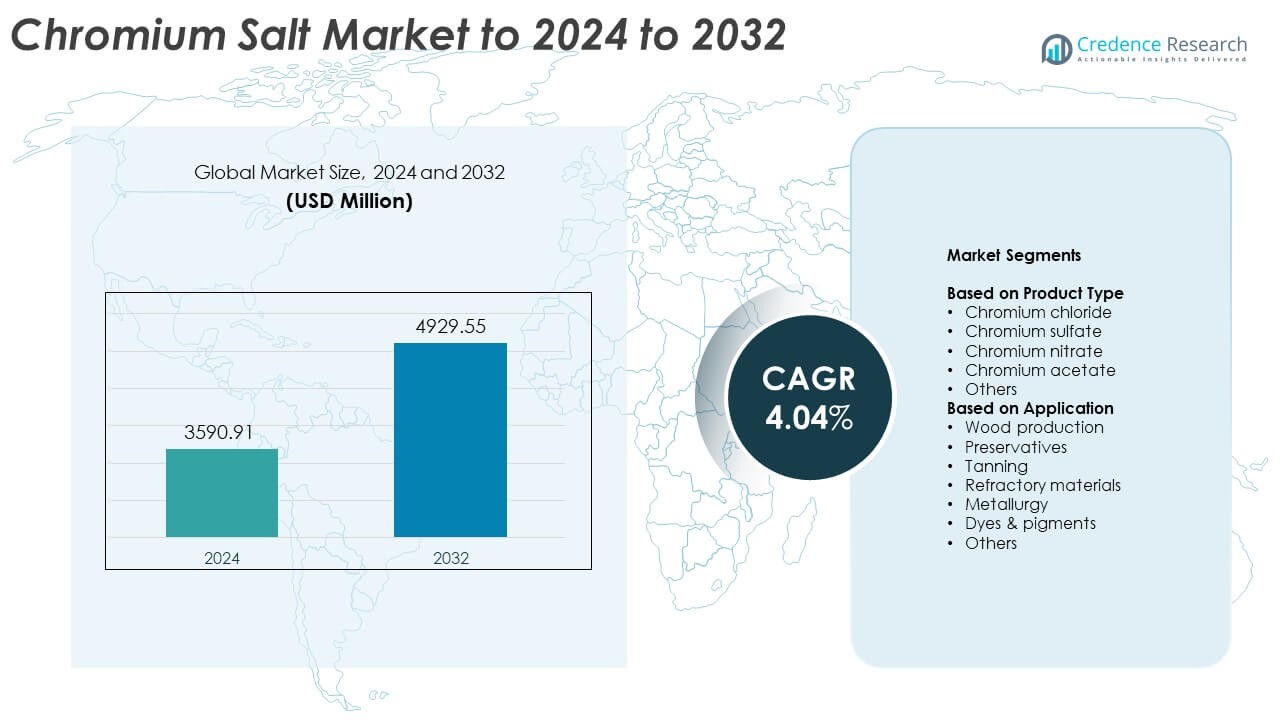

Chromium Salt Market size was valued at USD 3590.91 million in 2024 and is anticipated to reach USD 4929.55 million by 2032, at a CAGR of 4.04% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chromium Salt Market Size 2024 |

USD 3590.91 Million |

| Chromium Salt Market, CAGR |

4.04% |

| Chromium Salt Market Size 2032 |

USD 4929.55 Million |

The chromium salt market is led by prominent players including Lanxess AG, Merck KGaA, Thermo Fisher Scientific Inc., Ciba Speciality Chemicals, Bayer, Chemtura Corporation, Central Drug House, Loba Chemie Pvt. Ltd., Cymit Química S.L., and Sun Industries. These companies dominate through extensive product portfolios, strong distribution networks, and continuous advancements in sustainable chromium formulations. North America leads the global market with about 33% share in 2024, driven by robust demand from metal finishing and leather industries. Europe follows with nearly 27% share, supported by stringent environmental standards and advanced processing technologies, while Asia Pacific, accounting for 29%, remains the fastest-growing region due to rapid industrialization and expanding manufacturing capabilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The chromium salt market was valued at USD 3590.91 million in 2024 and is projected to reach USD 4929.55 million by 2032, growing at a CAGR of 4.04% during the forecast period.

- Rising demand from leather tanning, metallurgy, and pigment industries is a key driver boosting chromium sulfate consumption globally.

- Growing adoption of eco-friendly trivalent chromium compounds and advancements in recycling technologies are shaping emerging market trends.

- The market is highly competitive with major players focusing on sustainable production, product innovation, and capacity expansion to strengthen their global presence.

- North America leads with a 33% share, followed by Europe at 27% and Asia Pacific at 29%, while the tanning segment dominates applications with 38% share in 2024, supported by strong industrial and automotive demand.

Market Segmentation Analysis:

By Product Type

Chromium sulfate dominates the chromium salt market, accounting for about 42% share in 2024. Its dominance is driven by extensive use in leather tanning, textile dyeing, and metal finishing processes due to its strong tanning and coloring properties. The compound provides excellent adhesion, corrosion resistance, and durability, making it crucial in producing high-quality leather goods and coated metals. Increasing demand from the automotive and apparel industries further supports its growth. Meanwhile, chromium chloride and nitrate are gaining traction in catalyst production and laboratory applications.

- For instance, Vishnu Chemicals reports an 80,000 MTPA chromium capacity, measured as SDC (Sodium Dichromate).

By Application

The tanning segment leads the chromium salt market with around 38% share in 2024. This leadership stems from the extensive use of chromium sulfate in leather processing, where it enhances flexibility, durability, and resistance to heat and water. Expanding global footwear and automotive upholstery industries are key growth drivers. Wood preservation and metallurgy applications also contribute significantly, driven by rising construction and alloy production activities. Additionally, demand from pigments and refractory materials segments continues to rise, supported by ongoing industrialization in emerging economies.

- For instance, Elementis (prior to the 2022 sale of its chromium business to Yildirim Group) operated from 5 manufacturing sites in the United States.

Key Growth Drivers

Rising Demand from Leather and Textile Industries

The growing use of chromium sulfate in leather tanning and textile dyeing is a major driver. Chromium salts improve product durability, water resistance, and color fastness, essential for high-quality finished goods. Expanding footwear and apparel production in countries like India, China, and Vietnam continues to boost consumption. The increasing shift toward sustainable tanning processes that optimize chromium recovery further enhances market adoption across industrial operations.

- For instance, Golden Chemicals’ high-exhaust chrome salt achieves above 85% chromium exhaustion. The CLRI note adds 20–25% post-tanning chemical savings. Adoption cuts waste and boosts uptake.

Expanding Metallurgical and Refractory Applications

Chromium salts play a critical role in metallurgy, enhancing corrosion resistance and heat stability in alloys. Growing steel and refractory production across automotive, aerospace, and energy sectors drives significant demand. Chromium compounds help in hardening metal surfaces and improving oxidation resistance, vital for high-temperature applications. The continuous growth in infrastructure development and industrial equipment manufacturing sustains long-term market growth.

- For instance, Outokumpu reported 422,000 tonnes of stainless steel deliveries in Q4 2024, a 6% decrease compared to the previous year, with full-year deliveries hitting a historical low due to weak market conditions and subdued demand in Europe and high import pressure.

Growing Use in Wood Preservation and Chemical Processing

Chromium salts are widely applied in wood preservatives and chemical synthesis due to their strong biocidal and oxidation properties. Their role in extending the lifespan of wood used in construction, railways, and marine sectors strengthens market expansion. Rising construction activities, along with demand for durable, weather-resistant materials, drive consumption. Increasing use of chromium compounds as catalysts in chemical industries also supports growth.

Key Trends & Opportunities

Shift Toward Eco-Friendly Chromium Compounds

Environmental concerns are prompting manufacturers to invest in low-toxicity and recyclable chromium salts. Development of trivalent chromium-based alternatives is gaining traction due to reduced environmental impact compared to hexavalent forms. Stringent global regulations on waste disposal and emission control are further accelerating this transition. Companies focusing on cleaner production technologies and sustainable formulations are positioned to capture emerging opportunities in green manufacturing.

- For instance, Stahl EasyWhite Tan cuts salt in wastewater by at least 80%. The process also reduces water use by about 40%. Adoption lowers environmental load.

Technological Advancements in Production and Recovery

Innovations in production and waste recycling technologies are improving the efficiency of chromium salt manufacturing. Advanced recovery systems enable reprocessing of chromium waste, minimizing raw material losses and environmental hazards. Automation and process optimization in chemical plants are enhancing product quality and consistency. These advancements support cost-effective production and align with tightening environmental standards worldwide.

- For instance, a chrome recovery and reuse system designed by the CSIR-Central Leather Research Institute (CLRI) was installed at M/s. Arafath Leathers in Pallavaram, near Chennai. The system was designed to handle the exhaust chrome liquor from 5 chrome tanning drums.

Key Challenges

Stringent Environmental and Health Regulations

The chromium salt market faces challenges due to increasing restrictions on hexavalent chromium compounds. Their toxicity and potential health risks have led to stricter global environmental regulations, especially in Europe and North America. Compliance with emission norms raises production costs and requires technology upgrades. Many manufacturers are transitioning toward safer formulations to maintain market access and regulatory approval.

Fluctuating Raw Material Prices and Supply Risks

Volatility in raw material prices, particularly chromite ore, affects production costs and profit margins. Disruptions in global supply chains and dependency on limited mining regions further add uncertainty. Manufacturers face challenges in maintaining consistent pricing and sourcing quality materials. Long-term contracts and diversification of suppliers are becoming essential strategies to mitigate these market risks.

Regional Analysis

North America

North America holds the largest share of the chromium salt market at around 33% in 2024. The region’s dominance is supported by the strong presence of metal finishing, leather tanning, and pigment manufacturing industries. High demand for chromium sulfate in the U.S. and Canada is driven by advanced automotive and construction sectors. Strict environmental standards have also prompted investments in eco-friendly chromium compounds. Continuous innovation and recycling technologies in chemical production further enhance regional growth.

Europe

Europe accounts for approximately 27% of the global chromium salt market in 2024. The region benefits from a well-established industrial base and significant demand from leather, textile, and coating industries. Countries like Germany, Italy, and France are major consumers due to their strong automotive and fashion sectors. Strict environmental regulations encourage the adoption of trivalent chromium compounds, fostering market evolution toward sustainable formulations. Growing investments in advanced tanning technologies continue to support market stability.

Asia Pacific

Asia Pacific represents about 29% share of the chromium salt market in 2024, emerging as the fastest-growing region. The dominance of China and India stems from large-scale leather processing, textile dyeing, and metallurgy operations. Rapid industrialization and infrastructure expansion boost consumption across multiple applications. Rising exports of chromium-based chemicals and pigments strengthen regional competitiveness. Favorable government initiatives and low production costs also attract foreign investments, further driving growth in this market.

Latin America

Latin America holds nearly 7% share of the chromium salt market in 2024. The growth is mainly driven by increasing use of chromium compounds in leather tanning and construction industries. Brazil and Mexico lead regional demand due to expanding footwear and automotive production. Investments in metal finishing and pigment manufacturing sectors are gradually improving market prospects. However, limited local production and environmental restrictions create dependence on imports from Asian suppliers.

Middle East & Africa

The Middle East & Africa region accounts for around 4% share of the chromium salt market in 2024. Rising industrialization, infrastructure projects, and growth in leather processing industries contribute to steady demand. South Africa remains a key producer of chromite ore, supplying raw materials for chromium-based products. Expanding construction and automotive sectors across Gulf nations further stimulate market growth. However, slower technological adoption and regulatory challenges restrain faster expansion compared to other regions.

Market Segmentations:

By Product Type

- Chromium chloride

- Chromium sulfate

- Chromium nitrate

- Chromium acetate

- Others

By Application

- Wood production

- Preservatives

- Tanning

- Refractory materials

- Metallurgy

- Dyes & pigments

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The chromium salt market features strong competition among leading players such as Lanxess AG, Thermo Fisher Scientific Inc., Ciba Speciality Chemicals, Central Drug House, Cymit Química S.L., Merck KGaA, Bayer, Loba Chemie Pvt. Ltd., Chemtura Corporation, and Sun Industries. These companies focus on product innovation, process optimization, and expanding production capacities to meet growing demand from industries like leather, metallurgy, and coatings. Market participants are adopting sustainable manufacturing practices and investing in eco-friendly trivalent chromium formulations to comply with strict environmental norms. Strategic partnerships, regional expansions, and supply chain collaborations are becoming key growth strategies to enhance market presence. The competition is also shaped by advancements in recycling technologies and increasing use of chromium compounds in emerging economies. Continuous R&D efforts toward developing high-purity and performance-oriented salts further strengthen the global market’s competitive dynamics and ensure steady product differentiation across industrial applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Lanxess AG (Germany)

- Thermo Fisher Scientific Inc. (United States)

- Ciba Speciality Chemicals (Switzerland)

- Central Drug House (India)

- Cymit Química S.L. (Spain)

- Merck KGaA (Germany)

- Bayer (Germany)

- Loba Chemie Pvt. Ltd. (India)

- Chemtura Corporation (United States)

- Sun Industries (Australia)

Recent Developments

- In 2025, Lanxess announced it intends to increase its chromium sulfate production capacity due to rising demand from the leather tanning and metal finishing industries.

- In 2024, Thermo Fisher introduced the Thermo Scientific Dionex Inuvion Ion Chromatography system, which can be used in the analytical testing of various chemical samples, including for the presence of chromium ions in water or industrial samples.

- In 2023, Merck launched its AIDDISON drug discovery software platform and ChemisTwin digital reference materials platform to digitalize laboratory workflows, which aids in the analysis and quality control of various chemicals, including chromium salts.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for trivalent chromium compounds will rise due to strict environmental regulations.

- Growth in leather and textile industries will continue to drive chromium sulfate consumption.

- Increasing adoption of eco-friendly production technologies will enhance market sustainability.

- Expanding metallurgical applications will strengthen demand across industrial sectors.

- Recycling and recovery technologies will reduce waste and improve raw material efficiency.

- Asia Pacific will remain the fastest-growing region due to industrial expansion.

- Development of high-performance coatings and pigments will open new market avenues.

- Technological innovation in process optimization will lower production costs.

- Strategic partnerships between producers and end users will improve supply chain stability.

- Rising construction and automotive activities will sustain long-term chromium salt demand.