Market Overview

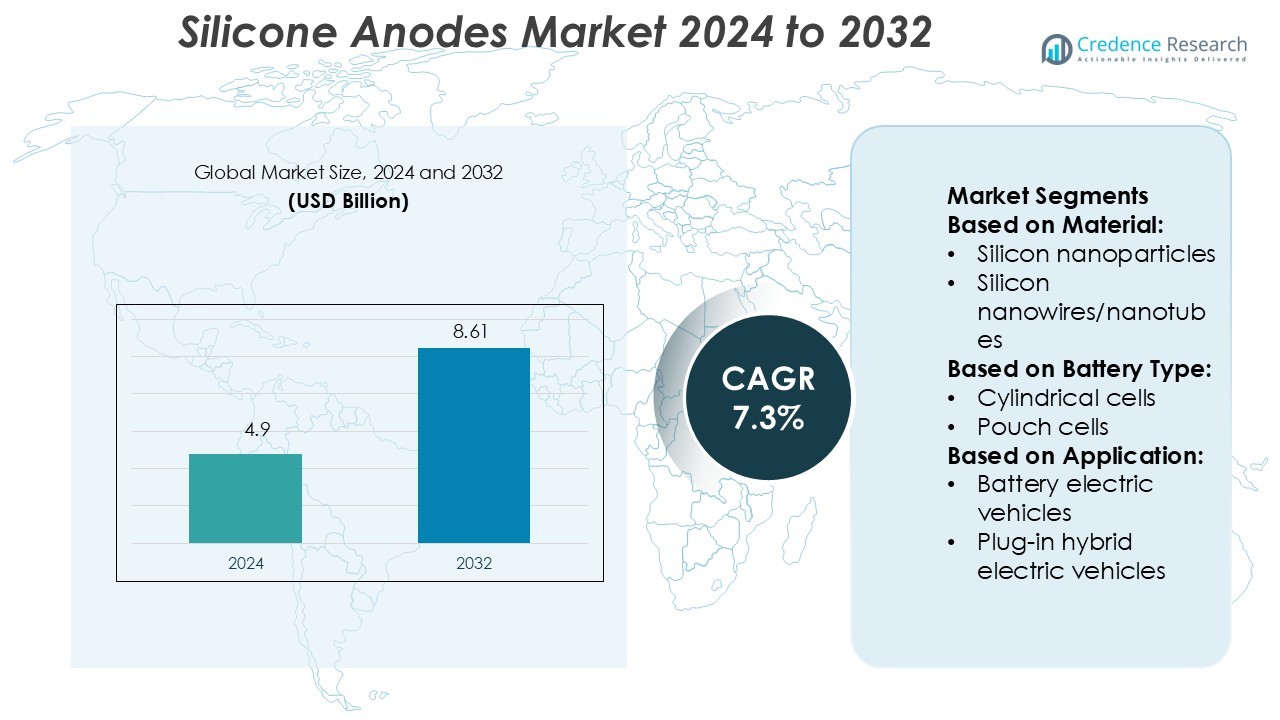

Silicone Anodes Market size was valued USD 4.9 billion in 2024 and is anticipated to reach USD 8.61 billion by 2032, at a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Silicone Anodes Market Size 2024 |

USD 4.9 Billion |

| Silicone Anodes Market, CAGR |

7.3% |

| Silicone Anodes Market Size 2032 |

USD 8.61 Billion |

The silicone anodes market is led by key players including Momentive, Elkem ASA, Shin-Etsu Chemical Co., Ltd., Wacker Chemie AG, Innospec Inc., KCC Corporation, Siltech Corporation, Gelest Inc., Evonik Industries AG, and The Dow Chemical Company. These companies focus on developing advanced silicon-carbon composites, nanostructured materials, and scalable production methods to enhance battery performance. Strategic partnerships with EV and battery manufacturers strengthen their market presence and technology adoption. Asia-Pacific dominates the global market with a 36% share, driven by extensive battery manufacturing in China, Japan, and South Korea. The region’s robust R&D infrastructure, government incentives, and growing EV production make it the primary hub for innovation and large-scale commercialization of silicon-based anode materials.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Silicone Anodes Market was valued at USD 4.9 billion in 2024 and is projected to reach USD 8.61 billion by 2032, growing at a CAGR of 7.3% during the forecast period.

- Rising demand for high-energy-density batteries in electric vehicles and consumer electronics is driving market growth, supported by advancements in silicon-carbon composite technologies.

- Increasing focus on nanostructured silicon materials and sustainable manufacturing processes defines current market trends, with firms investing in scalable and eco-efficient production.

- The market faces restraints from high production costs and volume expansion challenges during charge cycles, which impact large-scale adoption.

- Asia-Pacific leads with a 36% share, followed by North America at 32% and Europe at 28%, with silicon-carbon composites dominating the material segment due to their superior stability and conductivity in next-generation lithium-ion batteries.

Market Segmentation Analysis:

By Material

Silicon-carbon composites dominated the silicone anodes market with the largest share due to their superior electrochemical stability and extended cycle life. The carbon matrix effectively buffers silicon’s volume expansion during charge cycles, enhancing structural integrity. This composition improves conductivity and prevents electrode pulverization, making it ideal for high-performance batteries. Growing research on nanostructured carbon coatings further strengthens this segment’s position. Manufacturers focus on hybrid nanocomposites for scalable production, supporting demand from electric vehicles and portable devices. Advancements in silicon-carbon integration continue to drive material innovation in next-generation anodes.

- For instance, Momentive’s silicone solution SFR100 is a non-halogenated flame-retardant fluid used in high-voltage battery systems to enable fire safety for battery housing components. The product exhibits excellent electrical insulation and can improve low-temperature impact resistance.

By Battery Type

Lithium-ion batteries held the dominant share in the silicone anodes market, driven by their widespread use in EVs and consumer electronics. The superior energy density and long lifecycle of lithium-ion batteries make them the preferred choice for high-capacity applications. Within this category, cylindrical cells contribute significantly due to their mechanical stability and efficient thermal management. The integration of silicon anodes enhances battery energy density by up to 40%, improving vehicle range and charging performance. Growing EV adoption and industrial-scale lithium-ion production reinforce this segment’s dominance globally.

- For instance, Elkem’s former battery unit Vianode opened the Via ONE plant at Herøya with four full-size furnaces and 2,000 tons per-year capacity, enough for 30,000 EVs yearly. Elkem earlier funded a NOK 65 million graphite pilot in Kristiansand to qualify products.

By Application

The automotive sector led the silicone anodes market, with battery electric vehicles (BEVs) accounting for the highest share. Rising demand for long-range, fast-charging EVs drives silicon anode adoption in this category. BEVs benefit from higher capacity retention and improved charge cycles provided by silicon-based anodes. The segment’s growth is supported by expanding EV manufacturing and battery R&D investments. Consumer electronics, especially smartphones and wearables, also show rising interest in miniaturized silicon anodes for enhanced performance. Overall, BEVs remain the primary growth engine in the market’s application landscape.

Key Growth Drivers

Rising Electric Vehicle (EV) Adoption

The increasing shift toward electric mobility is a major growth driver for the silicone anodes market. EV manufacturers demand higher energy density and longer battery life, which silicon anodes deliver more effectively than graphite. The ability to store up to ten times more lithium ions makes them essential for next-generation EV batteries. Automakers are heavily investing in R&D partnerships with battery innovators to commercialize silicon-enhanced cells, boosting performance and reducing charging time. This trend continues to accelerate silicon anode adoption across global EV platforms.

- For instance, Wacker Chemie reports that its potting compound ELASTOSIL® CM 181 is a syntactic silicone foam used for filling the gaps between battery cells. It provides electrical insulation and thermal protection for the cells.

Advancements in Nanostructured Silicon Materials

Nanotechnology innovations are enhancing the mechanical stability and conductivity of silicon anodes. Nanostructured materials like silicon nanowires and nanoparticles effectively reduce volume expansion during charge cycles, improving cycle life and safety. Research institutions and manufacturers are developing scalable synthesis methods for uniform nanostructures to enable mass production. These advances reduce performance degradation and improve compatibility with current lithium-ion architectures. The continuous refinement of nano-engineered silicon materials drives technological competitiveness and boosts commercialization potential in high-capacity batteries.

- For instance, Siltech Corporation produces a silicone gel named Silmer G-115, an optically clear, addition-cured system used for encapsulating and protecting electronic components. It offers good chemical and electrical resistance and is designed for a wide range of operating temperatures.

Growing Investment in Battery R&D and Manufacturing Expansion

Global investments in battery research and large-scale gigafactories are driving demand for advanced anode materials. Governments and private companies are funding silicon battery development to meet energy storage needs in EVs, electronics, and grid systems. Firms are expanding production capabilities for silicon-carbon composites and SiOx materials to support the rising demand. Collaborative programs between automakers and material suppliers accelerate technology transfer and reduce production costs. This ecosystem-wide investment promotes market maturity and accelerates large-scale deployment of silicon-based anode technologies.

Key Trends & Opportunities

Integration of Silicon Anodes in Solid-State Batteries

The growing focus on solid-state battery technology presents a significant opportunity for silicon anodes. Solid electrolytes offer better compatibility with high-capacity materials like silicon, improving energy density and safety. Companies are optimizing silicon designs to address interfacial stability and lithium diffusion challenges. The combination of solid-state architectures and silicon anodes can extend driving range and enhance charging speed. As solid-state commercialization progresses, demand for silicon-based materials is set to rise sharply in both automotive and consumer electronics sectors.

- For instance, Dow launched DOWSIL™ EG-4175 Silicone Gel, rated to withstand continuous service temperatures up to 180 °C for next-gen IGBT modules used in EVs.

Strategic Partnerships and Supply Chain Localization

Strategic collaborations among battery makers, automakers, and raw material suppliers are shaping the future of silicon anodes. Companies are localizing supply chains to ensure material security and reduce dependency on imports. Joint ventures enable efficient scale-up of production technologies and support faster product validation. Emerging economies, particularly in Asia-Pacific and North America, are seeing new investments in silicon material processing. These partnerships not only foster innovation but also create opportunities for sustainable growth through localized manufacturing ecosystems.

- For instance, NanoSystec provides active alignment modules achieving < 100 nm precision in opto-electronic coupling, and positioning systems with < 1 µm placement tolerance, which support integration of epi-based photonic and MEMS components into consumer devices.

Shift Toward Sustainable Production and Recycling

Sustainability is becoming a critical trend in the silicone anodes market. Manufacturers are exploring eco-friendly synthesis processes and recycling methods to recover silicon from end-of-life batteries. Green manufacturing reduces emissions and aligns with environmental regulations worldwide. Companies are adopting renewable-powered production and cleaner chemical treatments to minimize waste. This focus on circular economy models provides long-term growth potential while supporting global efforts toward decarbonization and sustainable material use in energy storage technologies.

Key Challenges

Volume Expansion and Structural Degradation

One of the primary challenges in silicon anodes is their significant volume expansion—up to 300% during lithiation. This expansion causes mechanical stress, leading to particle cracking and loss of electrical contact. Repeated expansion cycles degrade the anode structure, reducing battery life and performance stability. Although researchers are developing nanostructured designs and composite blends to mitigate these effects, large-scale commercial solutions remain cost-intensive. Overcoming this technical challenge is crucial for the widespread adoption of silicon anode batteries.

High Manufacturing Costs and Scalability Issues

Despite their advantages, silicon anodes face cost and scalability challenges due to complex manufacturing processes. Producing high-purity silicon materials and advanced coatings requires expensive equipment and energy-intensive steps. Scaling nanomaterial synthesis while maintaining uniformity and performance is difficult at industrial levels. These factors increase production costs, limiting adoption in cost-sensitive applications like consumer electronics. To achieve broad commercialization, manufacturers must develop cost-effective, scalable, and reliable production techniques that ensure consistent performance and long-term durability.

Regional Analysis

North America

North America held a market share of 32% in the silicone anodes market, driven by strong EV adoption and advanced battery R&D. The U.S. leads regional growth with major manufacturers investing in silicon-carbon composite technologies. Companies such as Sila Nanotechnologies and Amprius Technologies are expanding pilot production to meet EV demand. Government incentives for energy storage and electrification projects support large-scale commercialization. Collaboration between automakers and research institutions accelerates silicon integration into lithium-ion batteries, enhancing regional competitiveness and innovation across electric mobility and energy storage applications.

Europe

Europe accounted for 28% of the silicone anodes market, supported by strict environmental policies and rapid EV penetration. Germany, France, and the U.K. are major contributors due to their robust automotive and clean energy sectors. EU-backed funding programs promote silicon-based battery innovation under green mobility initiatives. Companies such as Nexeon and BASF are advancing silicon material production to reduce dependency on graphite imports. The region’s strong sustainability goals and rising investments in gigafactories strengthen its market share. Europe’s focus on carbon-neutral transportation continues to drive demand for high-performance silicon anodes.

Asia-Pacific

Asia-Pacific dominated the silicone anodes market with a 36% share, making it the largest regional contributor. China, Japan, and South Korea lead due to established battery manufacturing ecosystems and large-scale EV production. Major players like Panasonic, Samsung SDI, and CATL are incorporating silicon anodes to enhance energy density. Regional government subsidies for EVs and domestic battery production further strengthen market expansion. Rapid industrialization, cost-efficient raw material sourcing, and continuous R&D investments make Asia-Pacific a global hub for next-generation anode material development and high-volume commercialization.

Latin America

Latin America captured a 2% share in the silicone anodes market, reflecting its emerging role in battery material supply chains. Brazil and Mexico are leading regional growth with increasing EV imports and manufacturing interest. The region benefits from abundant raw materials, creating opportunities for localized silicon production. Multinational firms are exploring partnerships to develop lithium-silicon battery projects. Although market adoption remains limited, growing renewable energy initiatives and government incentives for green technologies are expected to enhance demand, gradually expanding Latin America’s footprint in the global silicone anodes market.

Middle East & Africa

The Middle East & Africa accounted for 2% of the silicone anodes market, primarily driven by clean energy diversification efforts. Countries like the UAE and Saudi Arabia are investing in advanced battery research aligned with Vision 2030 initiatives. Partnerships with global technology firms support knowledge transfer and pilot-scale production. Africa’s growing interest in electric mobility and solar-powered storage systems creates potential for silicon anode applications. Despite low production capacity, increasing focus on renewable integration and sustainable manufacturing is expected to foster gradual regional growth in the coming years.

Market Segmentations:

By Material:

- Silicon nanoparticles

- Silicon nanowires/nanotubes

By Battery Type:

- Cylindrical cells

- Pouch cells

By Application:

- Battery electric vehicles

- Plug-in hybrid electric vehicles

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The silicone anodes market features strong participation from leading players such as Momentive, Elkem ASA, Shin-Etsu Chemical Co., Ltd., Wacker Chemie AG, Innospec Inc., KCC Corporation, Siltech Corporation, Gelest Inc., Evonik Industries AG, and The Dow Chemical Company. The silicone anodes market is defined by strong innovation, technological advancements, and expanding production capacities. Companies are focusing on developing nanostructured and composite-based silicon materials to enhance performance, energy density, and cycle stability. Strategic collaborations with automotive and battery manufacturers are accelerating the integration of silicon anodes into next-generation energy storage systems. Investments in sustainable manufacturing, pilot-scale facilities, and automation support scalable production. Firms are also emphasizing R&D to mitigate volume expansion issues and improve cost efficiency. This competitive environment fosters rapid technological evolution and strengthens market growth potential globally.

Key Player Analysis

- Momentive

- Elkem ASA

- Shin-Etsu Chemical Co., Ltd.

- Wacker Chemie AG

- Innospec Inc.

- KCC Corporation

- Siltech Corporation

- Gelest Inc.

- Evonik Industries AG

- The Dow Chemical Company

Recent Developments

- In May 2025, BASF and Group14 Technologies Reported a fully developed solution for silicon anode batteries incorporating BASF’s Licit’s binder and Group 14’s SCC55. They reached marked milestones which included fast charging with high energy density, over 500 cycles at 45°C, and further accelerating silicon battery adoption.

- In May 2025, Himadri Speciality Chemicals joined forces with Australia’s Sicona Battery Technologies establishing the first silicon-carbon anode plant in India. The partnership focused on commercializing and localizing Sicona’s SiCx technology which improves Lithium-ion batteries with 20% increase in energy density and 40% increase in charging efficiency.

- In April 2025, Sila Nanotechnologies began commissioning its Moses Lake, Washington facility to produce Titan Silicon, a next-gen silicon anode material. Developed in partnership with Panasonic, this material aims to boost EV battery energy density by up to 25% and cut charging times.

- In February 2025, NEO Battery Materials with Rockwell Automation worked on the automation of Neo’s new 240-ton silicon anode facility located in Windsor, Ontario. The goal is to compete supply chain gaps in northeastern America with scalable advanced/manufacturing capabilities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Material, Battery Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-capacity batteries will continue to drive silicon anode adoption across industries.

- Electric vehicle manufacturers will increasingly integrate silicon anodes to extend driving range.

- Advancements in nanotechnology will improve material stability and manufacturing scalability.

- Solid-state battery development will create new opportunities for silicon-based anodes.

- Collaboration between automakers and battery producers will accelerate large-scale commercialization.

- Research will focus on reducing volume expansion and enhancing cycle life of silicon anodes.

- Government support for clean energy projects will strengthen market expansion.

- Sustainability initiatives will encourage eco-friendly silicon production and recycling methods.

- Asia-Pacific will remain the leading region due to strong manufacturing and R&D investments.

- Continuous innovation will lower production costs and make silicon anodes more commercially viable.