Market Overview

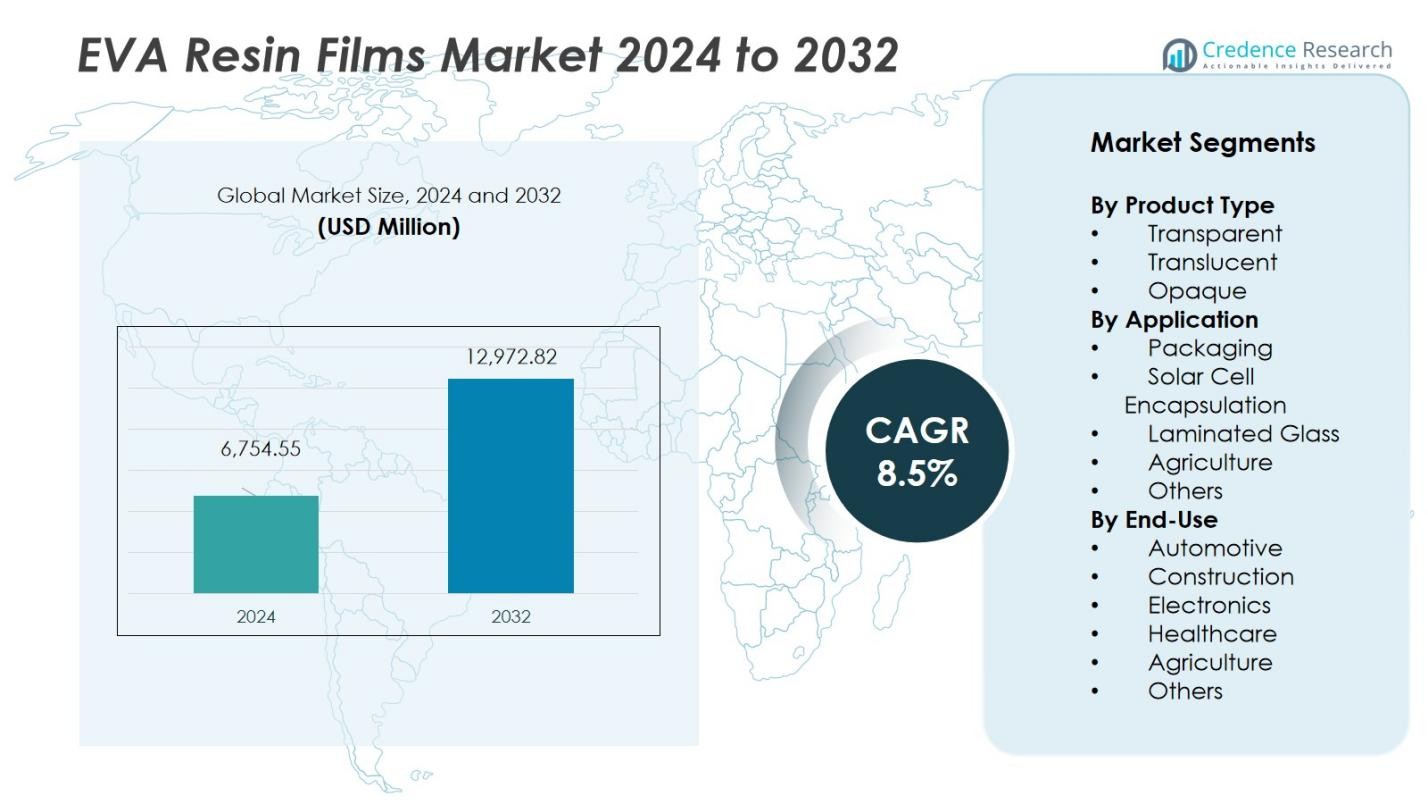

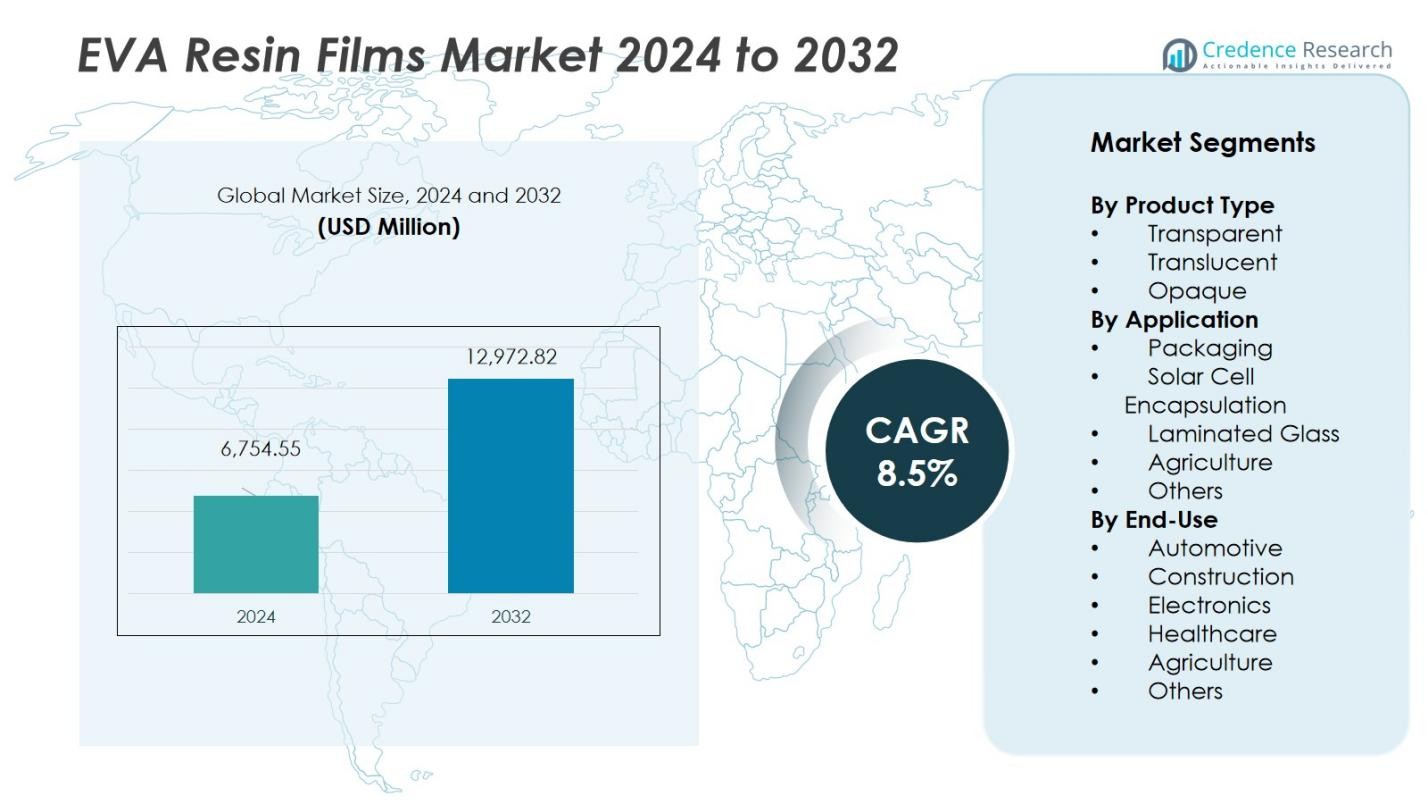

The EVA Resin Films Market size was valued at USD 6,754.55 million in 2024 and is anticipated to reach USD 12,972.82 million by 2032, growing at a CAGR of 8.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| EVA Resin Films Market Size 2024 |

USD 6,754.55 Million |

| EVA Resin Films Market , CAGR |

8.5% |

| EVA Resin Films Market Size 2032 |

USD 12,972.82 Million |

The EVA Resin Films Market is led by major players such as Hanwha Solutions Corporation, Celanese Corporation, 3M Company, Dow Inc., Kuraray Co., Ltd., LyondellBasell Industries Holdings B.V., Arkema S.A., Bridgestone Corporation, ExxonMobil Corporation, and STR Holdings, Inc. (Enstore). These companies focus on innovation, solar encapsulation technology, and sustainable film formulations to strengthen market presence. Strategic partnerships, mergers, and regional capacity expansions are common growth strategies. Asia-Pacific dominates the market with a 38.7% share in 2024, driven by large-scale solar energy projects, rapid construction growth, and the presence of leading EVA resin producers across China, Japan, India, and South Korea.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The EVA Resin Films Market was valued at USD 6,754.55 million in 2024 and is expected to reach USD 12,972.82 million by 2032, growing at a CAGR of 8.5%.

- Rising demand from the solar energy sector and construction industry drives market growth, supported by government incentives for renewable energy expansion and infrastructure modernization.

- Growing trends include the shift toward bio-based, recyclable EVA films and advancements in extrusion technology improving film transparency, adhesion, and durability.

- The market is moderately consolidated, with key players such as Hanwha Solutions, Dow Inc., and 3M Company focusing on innovation, capacity expansion, and strategic collaborations to enhance competitiveness.

- Asia-Pacific dominates with a 38.7% regional share, followed by North America at 26.4% and Europe at 23.1%, while the transparent product segment leads the market with over 48% share due to its wide use in solar cell encapsulation and laminated glass applications.

Market Segmentation Analysis:

By Product Type

The transparent segment dominates the EVA resin films market, accounting for over 48% share in 2024. Its high optical clarity, UV resistance, and strong adhesion make it ideal for solar cell encapsulation and laminated glass applications. Transparent EVA films are preferred for photovoltaic modules due to superior light transmission and durability. The translucent and opaque variants follow, mainly used in agricultural films, automotive interiors, and packaging. Growing solar energy projects and rising architectural glazing demand continue to strengthen transparent film adoption across global industries.

- For instance, Jiangsu Sveck Photovoltaic New Material Co., Ltd. produces transparent EVA films widely used in photovoltaic modules, ensuring durability and light transmission in over 20 countries worldwide.

By Application

The solar cell encapsulation segment holds the largest share of around 42% in 2024, driven by the rapid expansion of renewable energy installations. EVA films provide strong bonding, weather resistance, and long-term stability for photovoltaic modules, ensuring superior energy efficiency and durability. Packaging applications rank second, supported by increasing use in flexible and protective packaging materials. The laminated glass segment also shows solid growth, particularly in the construction and automotive sectors. Rising investments in solar infrastructure remain the key driver of application-based market growth.

By End-Use

The construction sector leads the EVA resin films market, representing about 36% share in 2024, supported by the growing use of laminated safety glass and solar-integrated buildings. EVA films are used for glazing, insulation, and waterproofing applications due to their excellent transparency, flexibility, and adhesion. The automotive industry follows, with expanding use in interior trims, laminated windshields, and lightweight components. Electronics and healthcare sectors contribute moderately, driven by demand for durable and flexible encapsulation materials. Rising infrastructure development and urbanization significantly boost construction-driven consumption of EVA resin films.

- For instance, Hanwha Solutions supplies EVA encapsulation films used in photovoltaic modules, improving long-term weather resistance and safety standards for new solar installations.

Key Growth Drivers

Rising Demand from Solar Energy Sector

The increasing installation of photovoltaic (PV) systems is a major growth driver for the EVA resin films market. EVA films are essential for solar module encapsulation, offering high transparency, durability, and weather resistance. Government incentives promoting solar adoption across countries such as China, India, and the U.S. have accelerated production capacity. As renewable energy targets expand, the need for reliable encapsulation materials grows. This surge in solar infrastructure development continues to position EVA resin films as a critical component in the clean energy value chain.

- For instance, Hangzhou First Applied Material Co., which commands over 50% of the global market share for solar EVA films, highlighting its strong presence in major solar panel manufacturing hubs.

Expanding Construction and Infrastructure Projects

Rapid urbanization and infrastructure development boost demand for EVA resin films in laminated glass and architectural glazing. These films enhance structural safety, insulation, and UV protection, making them preferred in high-rise and energy-efficient buildings. The construction of smart cities and commercial complexes further supports adoption. Additionally, increased use of laminated safety glass in public infrastructure improves energy efficiency and occupant safety. With growing emphasis on sustainable building materials, the construction industry remains a steady revenue source for EVA film manufacturers.

- For instance, KENGO super transparent EVA film is widely used by manufacturers for safety glass, decorative glass, and PDLC smart glass in high-profile construction projects, ensuring both clarity and durability.

Growing Application in Packaging and Automotive Industries

EVA resin films are gaining popularity in flexible packaging due to their strong sealability, clarity, and puncture resistance. Food, healthcare, and consumer goods sectors increasingly adopt EVA-based films for product protection and visual appeal. In the automotive sector, these films are used in windshields, headlamps, and interior components to reduce weight and improve durability. The rising global production of electric and hybrid vehicles also boosts EVA film usage in lightweight applications. Combined demand from packaging and automotive sectors supports long-term market expansion.

Key Trends & Opportunities

Shift Toward Sustainable and Recyclable Materials

Sustainability is reshaping the EVA resin films market as manufacturers adopt bio-based and recyclable formulations. Companies are investing in low-VOC, eco-friendly alternatives to meet environmental regulations and consumer expectations. This shift aligns with global goals to reduce carbon emissions and plastic waste. The transition to sustainable EVA films opens opportunities in green building materials and eco-conscious packaging. Growing interest from brands seeking circular economy solutions further accelerates innovation in renewable raw materials and recyclable film technologies.

- For instance, Arkema’s Evatane® line is advancing bio-based EVA copolymers for packaging and solar applications, highlighting their commitment to renewable raw materials and carbon reduction targets.

Technological Advancements in Film Production

Technological innovation is enhancing film performance, transparency, and adhesion properties. Advancements in extrusion and lamination technologies improve film uniformity and thermal stability, essential for high-efficiency solar modules and optical applications. Manufacturers are focusing on precision engineering to produce thinner, stronger, and more durable EVA films. Integration of smart manufacturing and automation also boosts production efficiency and cost control. These innovations are expanding the usability of EVA films across emerging applications such as flexible electronics and solar-integrated building materials.

- For instance, 3M has developed advanced EVA films with improved durability and thermal stability specifically designed for high-efficiency solar module encapsulation, helping to reduce the levelized cost of electricity.

Key Challenges

Volatility in Raw Material Prices

Fluctuations in the prices of ethylene and vinyl acetate monomers create cost instability for EVA resin producers. These petroleum-derived raw materials are subject to supply chain disruptions and crude oil price variations. Rising input costs can reduce profit margins and limit pricing flexibility for manufacturers. Dependence on fossil-based sources also raises environmental concerns. To mitigate these challenges, companies are exploring alternative feedstocks, long-term supply contracts, and process optimization to maintain product affordability and ensure consistent market competitiveness.

Competition from Alternative Polymers

The growing availability of alternative encapsulation and packaging materials poses a significant challenge to EVA resin films. Materials like polyolefin elastomers, TPU, and PVB offer competitive mechanical and optical properties. Some alternatives deliver better heat resistance and longer lifespan, particularly in advanced solar and automotive applications. This competitive landscape pressures EVA manufacturers to innovate through improved formulations and performance enhancements. Sustaining market share will depend on continuous R&D investments, cost optimization, and differentiation through superior product durability and sustainability features.

Regional Analysis

North America

North America holds a 26.4% share in 2024, driven by high demand from solar energy, automotive, and construction sectors. The U.S. leads regional growth with strong investments in renewable power and infrastructure modernization. The region’s focus on energy-efficient buildings and sustainable packaging further accelerates market expansion. Major manufacturers emphasize innovation in transparent EVA films for photovoltaic modules and laminated glass. Supportive government policies and ongoing advancements in encapsulation technology strengthen the regional outlook, positioning North America as a key contributor to global market revenues.

Europe

Europe accounts for a 23.1% market share in 2024, supported by stringent environmental regulations and the growing adoption of green construction materials. Countries such as Germany, France, and the U.K. drive demand through solar installation projects and automotive innovation. The region’s shift toward recyclable and bio-based EVA films aligns with sustainability goals under the EU Green Deal. Demand for laminated safety glass in commercial buildings and public infrastructure continues to grow. Continuous research and collaboration between film manufacturers and solar energy developers enhance Europe’s competitive presence in the market.

Asia-Pacific

Asia-Pacific dominates the EVA resin films market with a 38.7% share in 2024, led by China, Japan, India, and South Korea. Rapid industrialization, urbanization, and the expansion of solar energy infrastructure fuel strong demand. The region benefits from large-scale photovoltaic manufacturing, construction growth, and agricultural film applications. Rising investments in renewable energy and packaging sectors further strengthen market penetration. Local producers are increasing production capacities and technological advancements to meet global standards. Favorable government incentives and the availability of low-cost raw materials make Asia-Pacific the fastest-growing regional market.

Latin America

Latin America represents a 6.9% share in 2024, driven by increasing solar energy adoption and packaging industry growth. Brazil and Mexico lead regional consumption, supported by infrastructure expansion and sustainability-focused manufacturing. Rising demand for EVA films in agriculture and automotive applications is also gaining traction. Limited local production capabilities are balanced by growing imports from Asian and North American suppliers. Supportive energy policies and private investments in renewable projects contribute to gradual regional development, establishing Latin America as a promising emerging market for EVA resin films.

Middle East & Africa

The Middle East & Africa region holds a 5.0% market share in 2024, fueled by expanding construction, energy, and agricultural sectors. The Gulf countries, led by Saudi Arabia and the UAE, are investing heavily in solar energy projects, driving EVA film demand for encapsulation. Africa’s rising agricultural modernization further supports growth through greenhouse applications. The region’s increasing focus on sustainable infrastructure and renewable energy diversification fosters market potential. Although growth is at an early stage, improving manufacturing infrastructure and foreign partnerships are expected to enhance EVA resin film adoption.

Market Segmentations:

By Product Type

- Transparent

- Translucent

- Opaque

By Application

- Packaging

- Solar Cell Encapsulation

- Laminated Glass

- Agriculture

- Others

By End-Use

- Automotive

- Construction

- Electronics

- Healthcare

- Agriculture

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the EVA Resin Films Market features major players such as Hanwha Solutions Corporation, Celanese Corporation, 3M Company, Dow Inc., Kuraray Co., Ltd., LyondellBasell Industries Holdings B.V., Arkema S.A., Bridgestone Corporation, ExxonMobil Corporation, and STR Holdings, Inc. (Enstore). The market is moderately consolidated, with global companies focusing on expanding production capacity, improving film quality, and advancing technology to meet growing demand from solar energy, packaging, and construction sectors. Leading manufacturers emphasize product innovation, sustainable materials, and strategic partnerships to strengthen their market presence. Investments in solar encapsulation technology and eco-friendly formulations are key competitive differentiators. Mergers, acquisitions, and collaborations with photovoltaic module producers and packaging firms are common strategies to enhance supply chain integration and geographic reach. Strong R&D initiatives and regional expansion efforts help these players maintain their competitive edge in a rapidly evolving industrial landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hanwha Solutions Corporation

- Celanese Corporation

- 3M Company

- Dow Inc.

- Kuraray Co., Ltd.

- LyondellBasell Industries Holdings B.V.

- Arkema S.A.

- Bridgestone Corporation

- ExxonMobil Corporation

- STR Holdings, Inc. (Enstore)

Recent Developments

- In October 2025, Dow USA launched next-generation Ethylene Vinyl Acetate resins with improved flexibility, adhesion, and transparency specifically for packaging and solar panel applications, enhancing product performance and sustainability.

- In October 2025, Mitsubishi Chemical Japan introduced advanced EVA resins with enhanced clarity and flexibility designed for packaging, footwear, and solar applications, reinforcing its market leadership in specialty polymers.

- In January 2024, Braskem and FKUR Kunststoff expanded their longstanding partnership to include the distribution of bio-based EVA. FKUR became the official distributor for Braskem’s “I’m green” bio-based EVA in multiple countries including the EU, Switzerland, Norway, the United Kingdom, Turkey, Israel, and India.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The EVA resin films market will continue expanding with strong demand from the solar energy sector.

- Construction growth will drive higher adoption in laminated glass and architectural applications.

- Packaging innovation will boost usage of EVA films in flexible and food-safe materials.

- Technological advances will enhance film durability, clarity, and adhesion properties.

- Manufacturers will focus on bio-based and recyclable EVA film formulations.

- Asia-Pacific will remain the leading regional market due to large-scale solar investments.

- North America and Europe will see steady growth driven by sustainability initiatives.

- Strategic partnerships between resin producers and solar module manufacturers will increase.

- Rising demand for lightweight automotive materials will strengthen film applications.

- The market will move toward higher efficiency and environmentally friendly production practices.