Market Overview

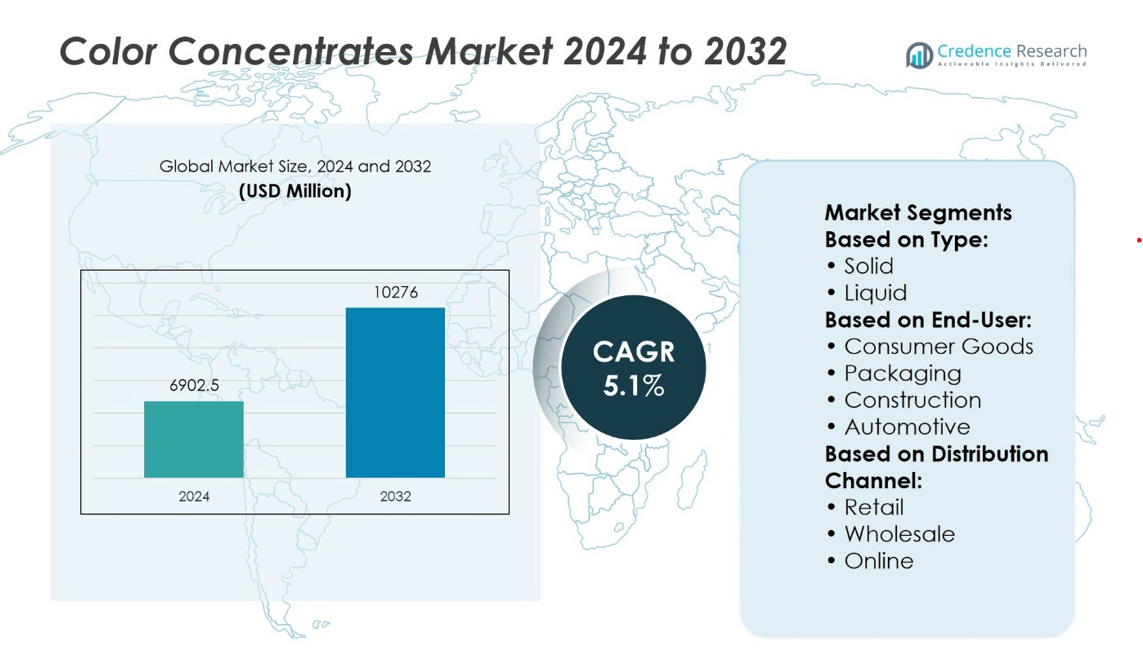

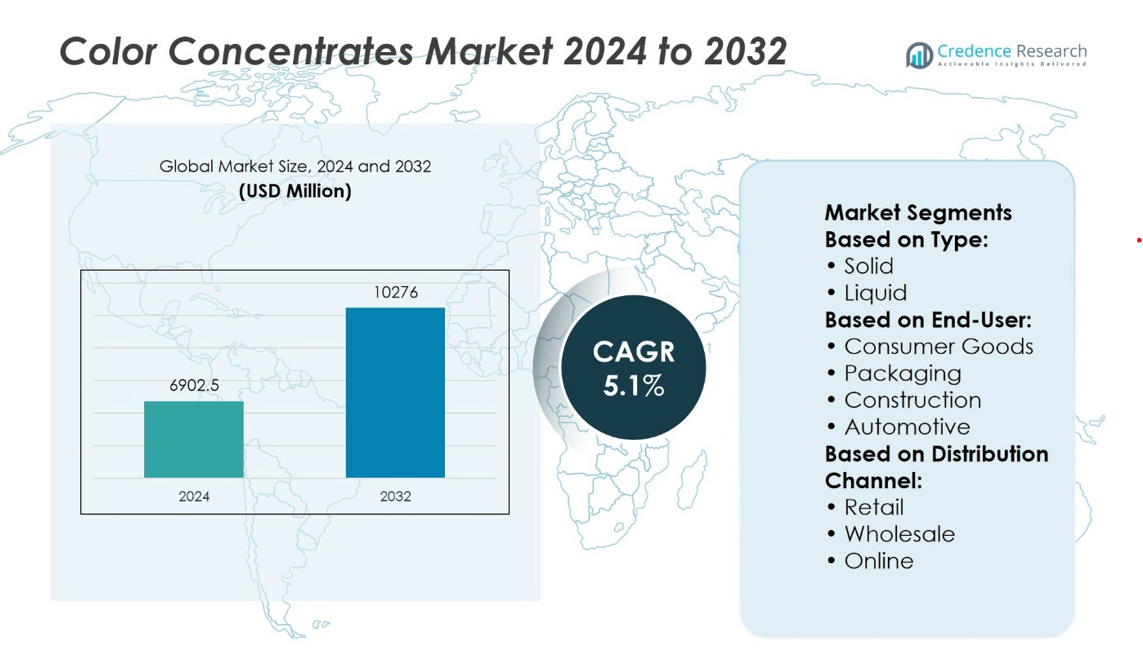

The Color Concentrates Market was valued at USD 6,902.5 million in 2024 and is expected to reach USD 10,276 million by 2032, growing at a CAGR of 5.1% during the Forecast.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Color Concentrates Market Size 2024 |

USD 6902.5 million |

| Color Concentrates Market, CAGR |

5.1% |

| Color Concentrates Market Size 2032 |

USD 10276 million |

The Color Concentrates Market grows driven by rising demand from automotive, packaging, and consumer goods sectors seeking vibrant, durable, and customizable color solutions. It benefits from technological advancements in digital color matching and sustainable formulations that comply with stringent environmental regulations. The market trends reflect a strong shift toward bio-based and multifunctional concentrates offering UV resistance and enhanced performance. Increasing industrialization in emerging economies and growing consumer preference for aesthetically appealing products further support expansion. Manufacturers focus on innovation and tailored solutions to meet evolving application requirements, positioning the market for sustained growth and increased adoption across diverse industries.

The Color Concentrates Market shows strong regional diversity, with Asia Pacific leading in production and consumption due to rapid industrial growth and manufacturing capabilities. North America and Europe emphasize innovation, sustainability, and regulatory compliance, supporting demand for high-performance concentrates. Latin America and the Middle East & Africa exhibit steady growth driven by expanding industrial sectors. Key players such as Clariant, Ampacet Corporation, CABOT Corporation, and A. Schulman, Inc. dominate the market through extensive R&D, global distribution networks, and focus on sustainable product development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Color Concentrates Market was valued at USD 6,902.5 million in 2024 and is expected to reach USD 10,276 million by 2032, growing at a CAGR of 5.1%.

- Demand from automotive, packaging, and consumer goods sectors drives market growth, with a focus on vibrant and durable color solutions.

- Technological advancements in digital color matching and sustainable formulations enhance product performance and regulatory compliance.

- Market trends show a shift toward bio-based and multifunctional concentrates offering UV resistance and improved durability.

- Intense competition among key players fuels innovation and expansion of global distribution networks.

- Raw material price volatility and strict environmental regulations pose challenges to consistent supply and product development.

- Asia Pacific leads production and consumption, while North America and Europe focus on innovation and sustainability, supporting market diversification.

Market Drivers

Rising Demand from Packaging Industry Driving the Need for Customized Color Solutions

The packaging industry remains a primary end-use sector fueling the Color Concentrates Market. With growing consumer preference for visually appealing and brand-distinct packaging, manufacturers rely on tailored color masterbatches to deliver unique product aesthetics. The demand for food-grade and FDA-compliant colorants in rigid and flexible packaging applications also supports market growth. It aligns with the rising emphasis on safety, traceability, and compliance in packaged food and beverage products. Companies are investing in R&D to enhance color consistency and dispersion across various resin systems. The Color Concentrates Market continues to benefit from the need for shelf differentiation and sustainable packaging formats.

- For instance, Avient Corporation developed its Smartbatch™ FX color and additive masterbatch solutions specifically for luxury packaging, offering over 500 unique color and effects formulations.

Automotive and Consumer Goods Industries Accelerate Adoption of Functional Color Concentrates

Industries such as automotive and consumer goods are adopting color concentrates to improve both performance and appearance of plastic components. It supports lightweighting initiatives by allowing color integration during molding, eliminating the need for secondary painting processes. Color concentrates also help deliver UV resistance, heat stability, and chemical durability, which are critical in exterior automotive parts. The market reflects growing interest in smart masterbatches that integrate functionality with design efficiency. In the consumer goods sector, product personalization and brand identity are key drivers behind color customization. The Color Concentrates Market benefits from this trend by offering flexible and efficient solutions tailored to end-use needs.

- For instance, Clariant developed its RENOL®-based color masterbatches for automotive interiors, which are used in over 2 million vehicle dashboards annually across Europe. These concentrates are engineered to withstand temperatures up to 130°C.

Emphasis on Sustainability and Biopolymer Compatibility Influences Product Innovation

Sustainability goals across industries have increased the demand for eco-friendly and recyclable color concentrate formulations. It requires compatibility with bioplastics and recycled polymers while maintaining color strength and processing stability. Manufacturers are developing non-toxic, heavy-metal-free colorants suitable for biodegradable and compostable packaging. The Color Concentrates Market is evolving with innovations that support closed-loop recycling systems and reduce environmental impact. Companies focus on reducing let-down ratios and using renewable carrier resins. These factors contribute to improving sustainability without compromising on color performance.

Technological Advancements in Dispersion and Carrier Systems Enhance Market Competitiveness

Progress in dispersion technologies and carrier resin systems is enabling improved performance of color concentrates in complex manufacturing processes. It leads to better pigment loading, thermal stability, and processing efficiency across extrusion, injection molding, and blow molding applications. Advanced formulations ensure uniform color distribution and reduced defects in end products. The Color Concentrates Market is seeing increased use of AI and digital tools for predictive color matching and real-time quality control. These capabilities help manufacturers optimize cost, reduce downtime, and meet demanding application standards. Continuous innovation in formulation technology strengthens the market’s value proposition across industries.

Market Trends

Increased Demand for High-Performance and Functional Colorants in End-Use Industries

End-use sectors are increasingly prioritizing functionality in colorants alongside aesthetics. Industries such as automotive, electronics, and consumer appliances require color concentrates that withstand high temperatures, UV exposure, and mechanical stress. The Color Concentrates Market is experiencing demand for formulations that enhance durability while maintaining consistent coloration across product lifecycles. It reflects the shift toward multifunctional materials that meet regulatory and environmental standards. Companies are introducing new grades with improved dispersion and reduced pigment migration to address quality expectations. This trend supports efficient manufacturing and extended product shelf life.

- For instance, Ampacet Corporation developed UV-stabilized masterbatches such as 11637-E, formulated for outdoor applications requiring long-term durability.

Growing Use of Color Concentrates in Bioplastics and Sustainable Packaging Applications

Sustainability goals are reshaping material selection across various industries, including packaging and consumer goods. Companies seek bio-based and recyclable color concentrates compatible with compostable and biodegradable polymers. The Color Concentrates Market is responding with solutions tailored to PLA, PHA, and starch-based substrates. It enables the production of eco-friendly packaging without compromising color vibrancy or processing efficiency. Brands are using these concentrates to support circular economy models and regulatory compliance. This trend is particularly strong in regions enforcing stricter environmental standards.

- For instance, Sukano developed a PLA-based color masterbatch compatible with industrial composting standards, verified according to EN 13432 certification. Their bio-based color concentrates are formulated with over 96% renewable carbon content.

Shift Toward Customization and Brand Differentiation Through Color Innovation

Brand owners are using color as a tool for differentiation, shelf impact, and consumer recall. Custom color matching, rapid prototyping, and regional preferences are driving innovation in color concentrate formulations. The Color Concentrates Market supports this shift by offering a wide palette of color options and fast turnaround times. It allows manufacturers to align product aesthetics with marketing goals and consumer expectations. Digital technologies are being integrated into color development for greater speed and accuracy. This enhances supply chain agility and design precision.

Advancements in Smart Colorants and Sensor-Enabled Masterbatches Support Innovation

Colorants with responsive or functional properties are gaining traction in industrial, medical, and security applications. Thermochromic, photochromic, and luminescent concentrates are enabling smart packaging and product monitoring. The Color Concentrates Market includes masterbatches that change color based on temperature or light exposure, helping detect spoilage or tampering. It drives innovation in consumer engagement and product safety. These smart solutions also support supply chain visibility and anti-counterfeiting efforts. Manufacturers continue investing in R&D to enhance the reliability and reproducibility of such technologies.

Market Challenges Analysis

Complex Regulatory Landscape and Compliance Costs Impact Product Development Cycles

Stringent environmental and chemical safety regulations challenge the pace of innovation in the Color Concentrates Market. Manufacturers must align with diverse regional laws such as REACH in Europe, TSCA in the U.S., and RoHS directives, which restrict certain pigments and additives. It increases compliance costs and slows product approvals, especially for new formulations targeting sensitive applications like food packaging or medical devices. Regulatory pressure also requires ongoing reformulation of existing products to eliminate restricted substances. Companies need to invest in extensive testing and certification, which raises entry barriers for smaller players. This regulatory complexity creates uncertainty in R&D pipelines and limits flexibility in global operations.

Fluctuating Raw Material Prices and Supply Chain Disruptions Reduce Profit Margins

Volatile costs of raw materials such as pigments, resins, and carrier polymers pose significant challenges for producers. The Color Concentrates Market depends on consistent access to high-quality inputs like titanium dioxide and carbon black, which are vulnerable to geopolitical tensions and environmental restrictions. It forces manufacturers to manage fluctuating input prices while maintaining competitive pricing for customers. Disruptions in logistics and sourcing, especially during global crises or regional conflicts, further affect production stability. Manufacturers often face delays in delivery schedules and struggle to meet client timelines. These supply chain issues hinder operational efficiency and pressure profit margins across the industry.

Market Opportunities

Demand for Sustainable and Bio-Based Color Solutions Creates New Avenues for Innovation

The growing focus on environmental responsibility drives demand for eco-friendly colorants in various industries. Brands seek sustainable packaging and product designs that align with corporate social responsibility goals. The Color Concentrates Market has the opportunity to deliver solutions based on bio-derived resins and natural pigments that meet these expectations. It can support manufacturers in reducing their carbon footprint while maintaining visual appeal and functional performance. Companies investing in low-VOC, heavy-metal-free, and recyclable formulations can differentiate their offerings in competitive sectors. Sustainability regulations also push industries to adopt safer alternatives, opening a wide scope for product innovation.

Growth in Emerging End-Use Sectors Expands Application Potential Across Geographies

End-use industries such as electric vehicles, consumer electronics, and smart packaging continue to expand and diversify their material needs. The Color Concentrates Market can tap into these segments by offering advanced formulations compatible with high-performance polymers and technical materials. It allows colorants to play a functional role beyond aesthetics, such as enhancing heat resistance or UV stability. Markets in Asia-Pacific, Latin America, and Africa offer significant room for growth due to rising industrial activity and increased plastic processing capacities. Localization of production and partnerships with regional compounders can accelerate adoption in these regions. The market can also benefit from the growing customization needs of niche brands and small-batch manufacturers.

Market Segmentation Analysis:

By Type:

The Color Concentrates Market segments by type into solid and liquid wheel categories. Solid wheels offer structural stability and are widely preferred for rugged terrains due to their resistance to deformation. It caters to consumers who prioritize durability over flexibility, especially in long-distance off-road travel. Liquid-type wheels, although less common, are used in specialized designs that emphasize weight reduction and unique damping characteristics. These innovations focus on enhancing comfort during mixed-terrain riding. Manufacturers exploring hybrid options often bridge the gap between solid strength and liquid flexibility for niche user bases.

- For instance, Clariant’s REMAFIN® solid color masterbatches are engineered for polyolefin applications and maintain thermal stability at processing temperatures of up to 260°C.

By End-User Industry:

Among end-use industries, automotive holds the dominant share due to direct relevance to motorcycle design and performance. The Color Concentrates Market aligns strongly with OEMs and aftermarket service providers who require precision-engineered wheel solutions for various bike models. It supports construction and consumer goods indirectly through materials and design input. The packaging sector shows limited integration, largely through logistics and protective technologies during transport. Construction industry trends influence demand for off-road utility motorcycles, creating marginal opportunities. Automotive-focused customization and high-performance expectations remain central to product development.

- For instance, according to Avient Corporation’s 2022 sustainability report, the company processed and delivered over 4,500 metric tons of color and additive concentrates for transportation-related applications globally, including two-wheeler and four-wheeler components.

By Distribution Channel:

Distribution channels include retail, wholesale, and online platforms. Retail stores retain value in providing physical inspection, personalized fitting, and installation services. Wholesale networks serve bulk buyers such as dealerships and repair centers, offering cost efficiencies and reliable inventory. The Color Concentrates Market benefits from a growing online presence where enthusiasts seek specialized parts, international brands, and performance upgrades. It allows users to compare specifications, access niche options, and review community feedback. E-commerce expansion continues to reshape purchase decisions, especially among younger and tech-savvy riders looking for variety and convenience.

Segments:

Based on Type:

Based on End-User:

- Consumer Goods

- Packaging

- Construction

- Automotive

Based on Distribution Channel:

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds around 29% of the global Color Concentrates Market share, driven by its strong industrial base, advanced manufacturing technologies, and demand for high-performance polymers. The region benefits from well-established plastics and packaging sectors, particularly in the United States, where color concentrates find extensive application in consumer goods, automotive interiors, and food-grade packaging materials. It supports increased production efficiencies by integrating automation and precision dosing systems. The rise in demand for recyclable and compliant materials in sectors like pharmaceuticals and food packaging promotes innovation in non-toxic, FDA-compliant formulations. Leading companies in the region invest in R&D for functional colorants with heat and UV resistance. The growing demand for customized, application-specific colors from brand-conscious manufacturers sustains consistent growth across end-use industries.

Europe

Europe accounts for about 26% of the Color Concentrates Market, shaped heavily by strict environmental policies and a mature plastics industry. Countries such as Germany, Italy, and France lead in manufacturing customized concentrates for high-end applications like automotive, healthcare, and electrical components. The market responds to EU directives promoting circular economy practices by offering bio-based and compostable concentrates. It emphasizes compliance with REACH regulations and heavy metal-free formulations. Color concentrates with halogen-free flame retardants and enhanced dispersion performance meet the region’s advanced product specifications. Growth in high-end consumer goods and electrical insulation materials further boosts the use of color concentrates tailored for technical precision and regulatory compliance. Sustainability targets drive collaborative innovation between concentrate manufacturers and polymer processors.

Asia Pacific

Asia Pacific leads the global Color Concentrates Market with approximately 33% share, supported by rapid industrialization, urban infrastructure development, and expanding consumer markets in China, India, and Southeast Asia. It experiences strong demand from automotive, packaging, textiles, and construction sectors. The region’s large-scale polymer production and cost-effective labor boost the integration of color concentrates in mass-produced plastic components. Consumer preferences for vibrant packaging, branded personal care items, and affordable electronics continue to influence demand. The market thrives on flexible production capabilities, localized customization, and a high consumption rate of polyethylene and polypropylene-based products. Growing awareness around product aesthetics and functionality enhances the usage of UV-stable and heat-resistant color concentrates across varying climatic zones.

Latin America

Latin America represents roughly 7% of the Color Concentrates Market, with demand centered around flexible packaging, agriculture films, and automotive interiors. Brazil and Mexico serve as primary hubs with active plastics manufacturing ecosystems. Regional buyers seek UV-stabilized and lightfast color solutions, especially in sectors where climate conditions require material resilience. Growing food processing industries and urbanization drive the packaging segment, leading to customized color solutions. The adoption of recycled plastics in packaging generates demand for concentrates that enhance color consistency and visual appeal in reprocessed materials. Manufacturers explore plant-based polymer compatibility to align with emerging environmental regulations.

Middle East & Africa

The Middle East & Africa region holds approximately 5% of the Color Concentrates Market. The market serves industrial, construction, and packaging sectors with a focus on utility over aesthetics. Infrastructure growth and urbanization support increased use of polymer pipes, panels, and fittings that incorporate color concentrates for differentiation and protection. The UAE, Saudi Arabia, and South Africa contribute significantly to demand, with rising investment in manufacturing. Hot climates necessitate the use of heat-reflective and UV-resistant color additives. Limited local production encourages import-driven strategies for high-performance concentrates. Manufacturers in the region emphasize durability and thermal stability, which align with material performance in harsh environments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Colorant Chromatics

- Clariant

- Far East Plastic Colours

- Colortech Inc.

- Breen Color Concentrates

- CABOT Corporation

- Ferro Corporation

- Dainichiseika

- Ampacet Corporation

- A. Schulman, Inc.

Competitive Analysis

The Color Concentrates Market include Clariant, Ampacet Corporation, CABOT Corporation, A. Schulman, Inc., Breen Color Concentrates, Colorant Chromatics, Colortech Inc., Dainichiseika, Far East Plastic Colours, and Ferro Corporation. The Color Concentrates Market is highly competitive, driven by continuous innovation, stringent regulatory requirements, and evolving customer demands. Companies focus on developing advanced formulations that enhance product performance while aligning with sustainability goals, including bio-based and low-emission concentrates. Customization remains a key differentiator, with manufacturers tailoring solutions to meet specific needs across automotive, packaging, and consumer goods sectors. Strategic partnerships and acquisitions enable players to expand their technological capabilities and global presence. Efficient supply chain management and strong technical support services strengthen customer relationships and improve market responsiveness. The pressure to comply with environmental regulations drives ongoing investment in safer, recyclable, and heavy metal-free products. While pricing remains an important factor, quality consistency and value-added services such as color matching and formulation expertise provide significant competitive advantages. The market landscape continues to evolve rapidly, with sustainability and innovation shaping its future trajectory.

Recent Developments

- In April 2025, India issued new guidelines supporting the use of environmentally friendly and recyclable materials in plastic production, urging producers to utilize more sustainable color concentration compositions.

- In April 2024, RTP Company enhanced their offering of high-temperature color concentrates intended for automotive applications. This discovery is in response to the increased demand for long-lasting and heat-resistant materials in electric vehicles (EVs) and other modern transportation technologies.

- In August 2024, Ampacet Corporation, said that they expanded its color concentrate production facility in Ohio to fulfill growing demand for eco-friendly and personalized color solutions.

Market Concentration & Characteristics

The Color Concentrates Market exhibits a moderately concentrated structure, with a mix of global leaders and regional players competing across various end-use sectors. It features a diverse product portfolio tailored to meet the specific needs of industries such as automotive, packaging, consumer goods, and construction. Large multinational companies maintain a dominant presence due to their extensive R&D capabilities, broad distribution networks, and strong compliance with environmental regulations. It requires continuous innovation to develop sustainable, high-performance, and customized color solutions that align with evolving industry standards. Smaller and mid-sized companies focus on niche markets and regional demands, often emphasizing specialized formulations or local regulatory adherence. The market operates under stringent regulatory frameworks, especially in North America and Europe, where safety and environmental compliance dictate product development and approval processes. It demonstrates a strong focus on sustainability, with companies investing heavily in bio-based and recyclable concentrates. Price competition exists, but differentiation primarily stems from technical expertise, product quality, and customer service. The Color Concentrates Market also reflects regional variations in demand patterns, production capacities, and raw material availability, influencing competitive dynamics.

Report Coverage

The research report offers an in-depth analysis based on Type, End-User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience increased demand for sustainable and bio-based color concentrates.

- Manufacturers will invest more in research to develop multifunctional and eco-friendly formulations.

- Adoption of digital color matching technologies will enhance precision and reduce waste.

- Asia Pacific will continue to lead production and consumption due to growing industrialization.

- Regulatory frameworks will push companies toward safer, non-toxic, and recyclable concentrates.

- End-user industries will prioritize color concentrates with enhanced durability and UV resistance.

- Strategic partnerships and mergers will drive global expansion and portfolio diversification.

- Customization and technical support services will gain importance to strengthen customer loyalty.

- Local sourcing and regional supply chains will become critical to mitigate logistics disruptions.

- Innovation in specialty concentrates for automotive and packaging sectors will accelerate market growth.