Market Overview

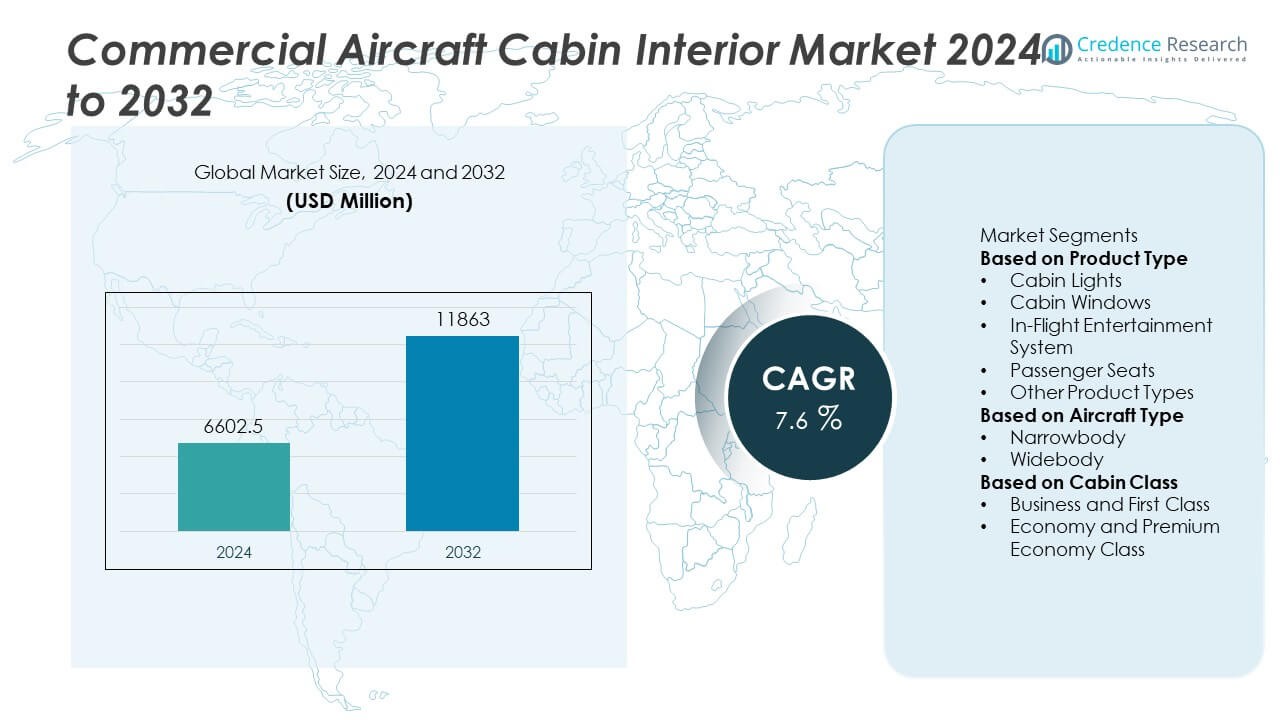

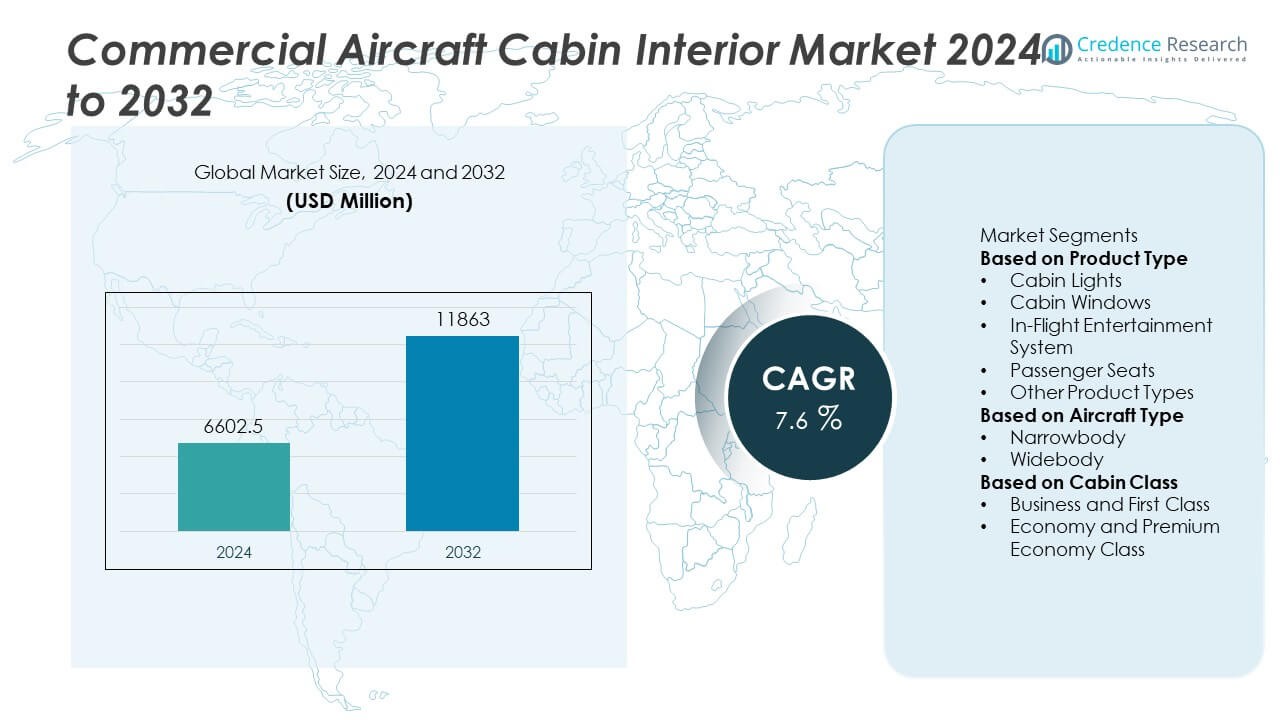

Commercial Air-Insulated Power Distribution Component Market size was valued at USD 6,302.5 million in 2024 and is projected to reach USD 10,828 million by 2032, growing at a CAGR of 7.0% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Commercial Air-Insulated Power Distribution Component Market Size 2024 |

USD 6,302.5 Million |

| Commercial Air-Insulated Power Distribution Component Market , CAGR |

7.0% |

| Commercial Air-Insulated Power Distribution Component Market Size 2032 |

USD 10,828 Million |

The Commercial Air-Insulated Power Distribution Component Market experiences robust growth driven by increasing industrialization, urban infrastructure expansion, and the rising demand for reliable medium-voltage power solutions. It benefits from supportive regulatory standards that enhance safety and performance, alongside growing investments in renewable energy integration and grid modernization.

The Commercial Air-Insulated Power Distribution Component Market spans key regions including Asia-Pacific, North America, Europe, the Middle East & Africa, and Latin America. Rapid urbanization and infrastructure development in Asia-Pacific drive significant demand, while North America focuses on grid modernization and renewable energy integration. Europe prioritizes sustainability and regulatory compliance, and the Middle East & Africa benefit from expanding industrial projects and harsh environmental conditions requiring durable equipment. Leading companies in this market include Hitachi Energy, ABB, Eaton, and GE Grid Solutions. These players emphasize innovation in compact designs, digital automation, and advanced insulation technologies to meet evolving customer needs. Their global presence and strategic investments in research and development position them to capitalize on the growing demand for efficient, reliable power distribution components.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Commercial Air-Insulated Power Distribution Component Market was valued at USD 6,302.5 million in 2024 and is expected to reach USD 10,828 million by 2032, growing at a CAGR of 7%.

- Rising industrialization and urban infrastructure expansion drive demand for reliable medium-voltage power distribution components.

- Market trends show increasing adoption of compact, modular designs that save space and allow faster installation in urban and industrial settings.

- Integration of smart monitoring and automation technologies enhances operational efficiency and fault detection, supporting grid modernization efforts.

- Competitive players like Hitachi Energy, ABB, Eaton, and GE Grid Solutions lead innovation and expand global footprints to meet diverse market needs.

- High initial capital investment and susceptibility to environmental factors restrain market growth, especially in budget-sensitive projects and harsh climates.

- Asia-Pacific leads regional growth with rapid urbanization, while North America and Europe focus on grid upgrades and sustainability initiatives, with emerging opportunities in the Middle East & Africa and Latin America.

Market Drivers

Rising Demand for Reliable Medium-Voltage Power Solutions in Industrial and Commercial Infrastructure

The Commercial Air-Insulated Power Distribution Component Market benefits from growing investments in industrial automation, manufacturing facilities, and large-scale commercial infrastructure. Expanding industries require stable and efficient power distribution systems to ensure uninterrupted operations. Air-insulated systems provide durability, reduced maintenance requirements, and safe operation in medium-voltage applications. It addresses the operational reliability needs of sectors such as oil and gas, mining, and manufacturing. Companies choose air-insulated designs for their proven performance in harsh environmental conditions. This trend is reinforced by infrastructure modernization projects across both developed and emerging economies.

- For instance, Hitachi Energy supplied over 10,000 units of medium-voltage air-insulated switchgear to industrial customers worldwide in 2024, enabling reliable power distribution in temperatures ranging from -40°C to 55°C.

Supportive Regulatory Framework and Safety Compliance Standards

Global and regional authorities enforce strict electrical safety and performance standards that drive adoption of advanced air-insulated power distribution components. Compliance with IEC, ANSI, and ISO standards ensures the products meet essential safety and operational benchmarks. It helps utilities and industrial operators reduce risk of electrical hazards while improving system reliability. Manufacturers develop innovative insulation materials and compact designs to align with evolving regulatory norms. Many projects in urban infrastructure and renewable energy rely on such systems to meet government-backed energy safety targets. The regulatory environment also promotes replacement of outdated switchgear with modern, air-insulated alternatives.

- For instance, ABB’s 2024 launch of an air-insulated switchgear series features insulation tested to withstand dielectric withstand voltage of up to 36 kV, meeting the IEC 62271-200 standards for medium-voltage switchgear safety and reliability.

Expansion of Renewable Energy Projects and Grid Modernization Initiatives

The shift toward clean energy generation accelerates demand for efficient, reliable, and environmentally safe distribution solutions. The Commercial Air-Insulated Power Distribution Component Market sees significant uptake in solar, wind, and hybrid power plants that require advanced medium-voltage equipment. It enables safe integration of renewable sources into existing grid networks. Utilities invest in grid upgrades to handle distributed energy resources and ensure stability during peak loads. These projects require equipment with high operational life and minimal environmental footprint. The focus on decarbonization further boosts demand for air-insulated designs over traditional oil-filled systems.

Technological Advancements Enhancing Operational Efficiency and Space Optimization

Manufacturers invest heavily in R&D to produce air-insulated components with improved dielectric performance, reduced footprint, and modular configurations. It supports easy installation in compact spaces without compromising operational safety. Integration of smart monitoring and control features improves fault detection, predictive maintenance, and overall system efficiency. These innovations align with utility and industrial trends toward digital substations and automated distribution networks. Clients seek flexible solutions that reduce downtime and optimize space usage in high-density urban projects. The continuous push for technical innovation strengthens the market’s long-term growth potential.

Market Trends

Growing Preference for Compact and Modular Medium-Voltage Solutions

The Commercial Air-Insulated Power Distribution Component Market experiences a shift toward compact and modular equipment that optimizes space without sacrificing performance. Urban infrastructure projects and industrial facilities require solutions that fit into constrained environments. It drives manufacturers to design products with reduced footprints and enhanced assembly flexibility. Modular configurations allow quicker installation, easier maintenance, and scalability for future expansion. This approach appeals to sectors facing high land costs and limited substation space. The trend supports broader adoption across utilities, data centers, and manufacturing plants.

- For instance, Eaton’s recently launched Power Xpert UX Air-Insulated Switchgear reduces installation space by approximately 30% compared to traditional models and can be assembled in under 48 hours, accelerating project timelines in urban deployments.

Integration of Digital Monitoring and Automation Capabilities

Smart grid development influences the market by encouraging integration of sensors, IoT connectivity, and remote monitoring in air-insulated systems. It enables operators to detect faults early, schedule predictive maintenance, and improve operational efficiency. Utilities and industrial users value the real-time visibility and control that these digital features offer. Automation capabilities enhance grid reliability while reducing manual intervention in routine operations. The technology supports energy efficiency targets by optimizing power flow and reducing losses. This trend strengthens the role of air-insulated solutions in modernized power distribution networks.

- For instance, GE Grid Solutions deployed over 5,000 digital sensor units integrated with their air-insulated switchgear systems globally in 2024, enabling predictive maintenance and reducing outage response time by up to 40%.

Increased Adoption in Renewable and Distributed Energy Applications

Renewable power generation growth fuels demand for reliable medium-voltage distribution equipment. The Commercial Air-Insulated Power Distribution Component Market benefits from deployment in wind, solar, and hybrid energy projects that require robust, low-maintenance systems. It helps integrate variable renewable sources into grid infrastructure while maintaining voltage stability. Equipment designed for outdoor and harsh environments meets the needs of remote renewable installations. Demand rises for air-insulated components that offer extended service life and minimal environmental impact. This alignment with clean energy expansion reinforces the market’s growth prospects.

Focus on Eco-Friendly Materials and Sustainable Manufacturing Practices

Manufacturers adopt sustainable design strategies to meet environmental regulations and corporate responsibility goals. It includes using recyclable materials, low-emission manufacturing processes, and insulation technologies with reduced environmental hazards. Eco-friendly product designs gain favor with utilities and industrial customers aiming to meet their sustainability targets. This approach also supports circular economy initiatives by extending product lifecycles and enabling component reuse. The emphasis on green engineering aligns with global decarbonization and waste reduction policies. This trend positions air-insulated solutions as a preferred choice in environmentally conscious projects.

Market Challenges Analysis

High Initial Capital Investment and Installation Complexity in Air-Insulated Systems

The Commercial Air-Insulated Power Distribution Component Market faces challenges due to the relatively high upfront costs associated with procurement and installation. Compared to alternative technologies like gas-insulated switchgear, air-insulated components often require more physical space and careful site preparation. It demands skilled labor and longer installation timelines, which can increase project expenses and delay deployment. These factors limit adoption in projects with tight budgets or aggressive schedules. Some end-users hesitate to upgrade legacy systems due to these financial and logistical constraints. The cost sensitivity impacts market growth, especially in emerging regions with budget limitations.

Susceptibility to Environmental Factors and Maintenance Requirements

Air-insulated components remain vulnerable to external environmental conditions such as dust, moisture, and temperature fluctuations. The Commercial Air-Insulated Power Distribution Component Market must address reliability concerns that arise from exposure to harsh outdoor environments. It requires frequent inspections and preventive maintenance to avoid performance degradation and potential failures. This ongoing maintenance demand increases operational costs for utilities and industrial operators. In regions with extreme weather or pollution, the reliability of air-insulated systems can become a significant challenge. These factors encourage some customers to consider alternative insulation technologies with better environmental resistance, impacting market penetration.

Market Opportunities

Expanding Infrastructure Development and Urbanization Driving Demand for Medium-Voltage Solutions

The Commercial Air-Insulated Power Distribution Component Market stands to benefit from rapid urbanization and infrastructure expansion worldwide. Growing investments in smart cities, industrial parks, and commercial complexes create increased demand for reliable power distribution equipment. It offers opportunities to replace aging electrical infrastructure with modern air-insulated systems that deliver enhanced safety and performance. The rising need for efficient energy management in densely populated areas encourages adoption of compact and scalable solutions. This environment allows manufacturers to introduce innovative designs tailored to space-constrained applications. Expanding electrification in emerging markets further broadens the market’s growth potential.

Integration of Renewable Energy and Grid Modernization Initiatives Fueling Market Expansion

Renewable energy integration and ongoing grid modernization efforts provide significant growth avenues for the Commercial Air-Insulated Power Distribution Component Market. It supports the growing penetration of solar, wind, and other distributed energy resources by enabling efficient medium-voltage power management. Utilities and independent power producers invest in upgrading existing substations and distribution networks to accommodate variable renewable inputs. Air-insulated systems with improved dielectric performance and modularity fit well within these upgrades. Opportunities exist to incorporate advanced digital monitoring and automation features that enhance grid resilience and operational efficiency. These trends drive long-term demand for air-insulated components in evolving energy landscapes.

Market Segmentation Analysis:

By Product Type

The Commercial Air-Insulated Power Distribution Component Market segments its offerings based on product type, configuration, and voltage rating to address diverse application needs. By product type, the market includes air-insulated switchgear, circuit breakers, disconnectors, busbars, and protective relays. Air-insulated switchgear holds a significant share due to its widespread use in medium-voltage distribution networks. It delivers reliable switching and protection functions critical to industrial, commercial, and utility applications. Circuit breakers gain traction for their ability to interrupt fault currents quickly and safeguard power systems. Protective relays complement these devices by enabling real-time fault detection and control.

- For instance, ABB reported the delivery of over 12,000 units of medium-voltage air-insulated switchgear globally in 2024, equipped with protective relays capable of detecting faults within milliseconds to prevent system damage.

By Configuration

By configuration, the market divides into single busbar, double busbar, and ring busbar systems. Single busbar configurations dominate due to their simpler design, ease of maintenance, and cost-effectiveness in small to medium installations. Double busbar and ring busbar configurations find preference in complex substations requiring higher reliability and flexibility in power routing. They provide redundancy and minimize downtime during maintenance or fault conditions. This segmentation allows utilities and industries to select optimal configurations based on operational priorities and budget constraints.

- For instance, GE Grid Solutions installed over 500 double busbar systems in 2024 across industrial substations, offering increased operational flexibility and reducing outage time during maintenance activities.

By Voltage Rating

The voltage rating segment categorizes components into low voltage (up to 1 kV), medium voltage (1 kV to 36 kV), and high voltage (above 36 kV) groups. Medium-voltage products command the largest share within the Commercial Air-Insulated Power Distribution Component Market due to their extensive deployment in power distribution networks and industrial setups. These components balance performance, safety, and cost, meeting requirements for commercial and industrial power delivery. High-voltage equipment, while less common, plays a critical role in transmission and large industrial facilities requiring robust insulation and fault tolerance. Low-voltage components support auxiliary power and control circuits.

Segments:

Based on Product

- Switchgear

- Switchboard

- Distribution Panel

- Motor Control Panels

Based on Configuration

- Fixed Mounting

- Plug-in

- Withdrawable

Based on Voltage Rating

- ≤ 11 kV

- > 11 kV to ≤ 33 kV

- > 33 kV to ≤ 66 kV

- > 66 kV to ≤ 132 kV

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

Asia-Pacific

The Commercial Air-Insulated Power Distribution Component Market demonstrates distinct regional dynamics driven by varying infrastructure development, regulatory environments, and energy demands. In 2024, Asia-Pacific leads the market with approximately 38% share, propelled by rapid industrialization, urbanization, and increasing investments in power infrastructure. Countries such as China, India, Japan, and South Korea continue to expand their medium-voltage power distribution networks to support growing commercial and industrial sectors. The region’s focus on smart grid implementation and renewable energy integration further accelerates demand for reliable and scalable air-insulated power distribution components. Government initiatives promoting electrification in rural and urban areas also contribute significantly to market growth. The Asia-Pacific region presents vast opportunities for manufacturers aiming to capitalize on emerging market demand and infrastructure modernization.

North America

North America holds a substantial 27% market share in the Commercial Air-Insulated Power Distribution Component Market, supported by well-established power grids and a strong push towards grid modernization and digitalization. The United States and Canada invest heavily in upgrading aging electrical infrastructure to enhance reliability and incorporate renewable energy sources. Utilities in this region emphasize adopting air-insulated switchgear and related components that offer flexibility, improved safety, and reduced maintenance. The region also benefits from advanced regulatory frameworks that enforce strict safety and performance standards, driving the adoption of technologically advanced air-insulated solutions. Continuous infrastructure spending and smart grid projects ensure North America remains a key market contributor.

Europe

Europe accounts for approximately 23% of the global market share, driven by stringent environmental regulations and the transition towards sustainable energy systems. The European Union’s aggressive decarbonization goals and investments in renewable energy integration necessitate advanced medium-voltage distribution solutions. Countries like Germany, France, the United Kingdom, and Italy actively modernize their power distribution infrastructure to improve efficiency and resilience. The preference for eco-friendly and compact air-insulated equipment aligns with Europe’s sustainability objectives. Demand also arises from expanding urban centers requiring reliable power supply and space-efficient solutions. The region’s mature market encourages innovation in digital monitoring and automation features within air-insulated components.

Middle East & Africa (MEA)

The Middle East & Africa (MEA) region holds around 8% market share, supported by growing urbanization, infrastructure development, and industrial expansion, especially in the Gulf Cooperation Council (GCC) countries. Nations such as the UAE, Saudi Arabia, and Qatar invest in large-scale power projects and smart city initiatives, increasing demand for robust and reliable air-insulated power distribution systems. The harsh environmental conditions in many parts of MEA drive preference for durable equipment with high resistance to dust, heat, and humidity. This region offers considerable growth potential due to ongoing electrification efforts and rising energy consumption. The MEA market provides opportunities for manufacturers focusing on tailored solutions for extreme climatic conditions.

Latin America

Latin America accounts for approximately 4% market share of the Commercial Air-Insulated Power Distribution Component Market. Brazil, Mexico, and Argentina dominate the regional market, driven by government initiatives to improve power infrastructure and expand grid coverage in rural and urban areas. The increasing demand for reliable power in commercial and industrial sectors fuels growth. However, economic fluctuations and infrastructure financing challenges limit faster expansion. The market in Latin America gradually adopts modern air-insulated systems due to their safety benefits and operational efficiency. Continued investments in renewable energy projects and smart grid technologies present opportunities for future growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

Leading players in the Commercial Air-Insulated Power Distribution Component Market include Hitachi Energy, ABB, Eaton, GE Grid Solutions, L&T Electrical & Automation, CG Power & Industrial Solutions Ltd., ALSTOM SA, G&W Electric, Lucy Group Ltd., and Meiden Europe GmbH. These companies maintain strong market positions through continuous innovation, strategic partnerships, and geographic expansion. Hitachi Energy and ABB focus heavily on developing advanced air-insulated switchgear with enhanced dielectric performance and integrated digital monitoring features. Their investments in research and development enable them to offer solutions that improve reliability and operational efficiency for utilities and industrial customers worldwide. Eaton and GE Grid Solutions emphasize modular designs and automation capabilities, targeting grid modernization projects in North America and Europe. L&T Electrical & Automation and CG Power & Industrial Solutions leverage their strong presence in emerging markets, particularly in Asia-Pacific, to cater to growing infrastructure demands. ALSTOM SA and Meiden Europe GmbH concentrate on sustainability and eco-friendly materials to align with stringent regulatory requirements, especially in Europe. G&W Electric and Lucy Group Ltd. focus on customized solutions tailored to harsh environmental conditions, such as those found in the Middle East & Africa region.

Recent Developments

- In May 2025, Hitachi Energy announced the delivery of the world’s first SF₆-free 550 kV gas-insulated switchgear to the Central China Branch of the State Grid Corporation of China, marking a significant step toward decarbonizing the power grid.

- In December 2024, L&T Electrical & Automation released its updated air-insulated switchgear catalog, featuring enhanced safety and reliability features to meet stringent international standards.

- In August 2024, ABB showcased its latest 550 kV SF₆-free gas-insulated switchgear at the CIGRE 2024 conference, emphasizing their commitment to sustainable energy solutions.

Market Concentration & Characteristics

The Commercial Air-Insulated Power Distribution Component Market exhibits a moderately concentrated structure dominated by a few global leaders alongside numerous regional players. Key companies such as Hitachi Energy, ABB, Eaton, and GE Grid Solutions control a significant share through extensive product portfolios, advanced technologies, and broad geographic reach. These players invest heavily in research and development to introduce innovations focused on enhancing safety, efficiency, and environmental sustainability. It creates high entry barriers for new competitors due to capital intensity, stringent regulatory requirements, and the need for technological expertise. Regional manufacturers often compete by offering cost-effective solutions tailored to local market conditions and regulatory standards. The market’s competitive landscape drives continuous product improvement and customization to meet diverse customer demands across industrial, commercial, and utility sectors. Customer preference for reliable, durable, and low-maintenance components further reinforces the dominance of established companies with proven track records. This competitive environment fosters collaboration between manufacturers, utilities, and technology providers to develop smart grid-compatible systems. Overall, the market balances global technological leadership with regional adaptability, shaping its growth trajectory and innovation pace.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Configuration, Voltage Rating and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily due to increasing industrialization and urban infrastructure development.

- Demand for compact and modular air-insulated components will rise to optimize space in urban substations.

- Integration of digital monitoring and automation features will enhance operational efficiency and fault detection.

- Renewable energy projects will drive the need for reliable medium-voltage power distribution equipment.

- Manufacturers will focus on developing eco-friendly and sustainable insulation materials.

- Grid modernization initiatives will increase adoption of advanced air-insulated switchgear.

- Emerging markets will present significant growth opportunities due to expanding electrification efforts.

- Technological innovation will reduce maintenance costs and improve the lifespan of components.

- Regulatory frameworks will continue to push for safer, more efficient, and environmentally responsible products.

- Strategic partnerships and mergers will shape the competitive landscape and expand global reach.