Market Overview:

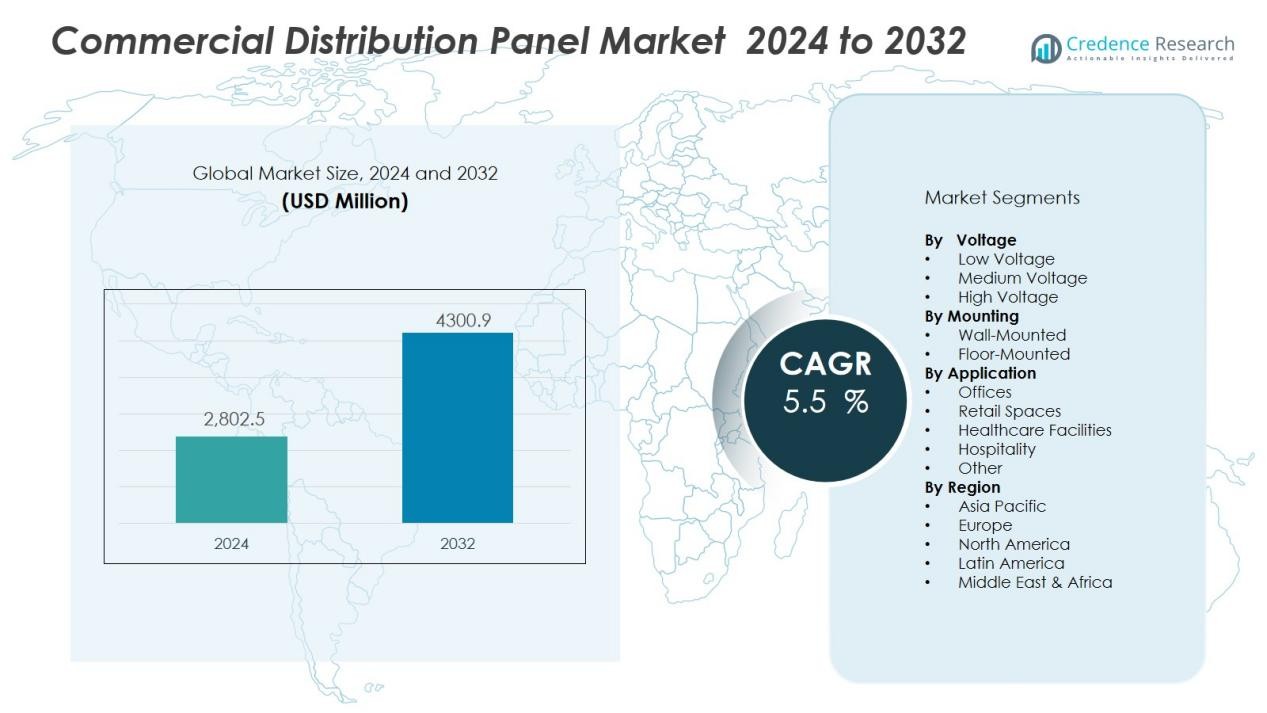

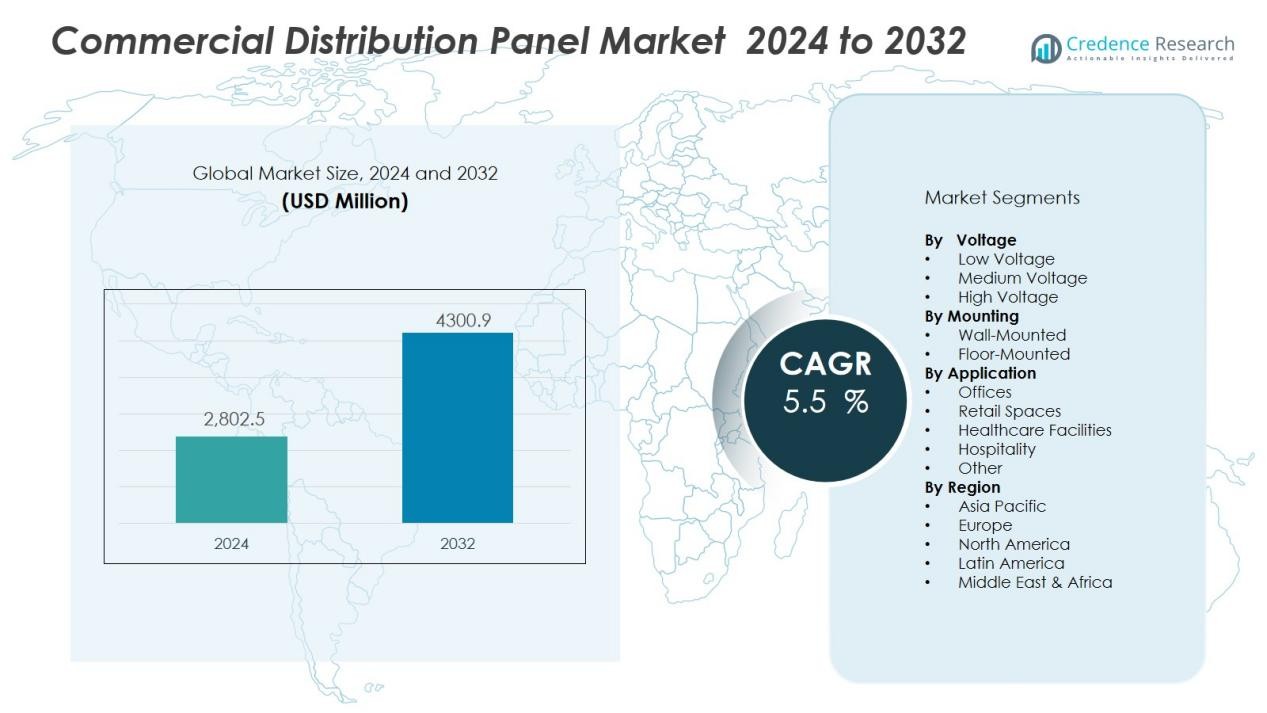

The Commercial distribution panel market size was valued at USD 2,802.5 million in 2024 and is anticipated to reach USD 4300.9 million by 2032, at a CAGR of 5.5 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Commercial distribution panel Market Size 2024 |

USD 2,802.5 Million |

| Commercial distribution panel Market, CAGR |

5.5 % |

| Commercial distribution panel Market Size 2032 |

USD 4300.9 Million |

The market is primarily driven by the rapid urbanization and development of commercial infrastructure, coupled with rising demand for uninterrupted and efficient power distribution. Growing integration of smart monitoring systems, enhanced circuit protection, and modular designs are boosting operational efficiency and safety standards. Regulatory mandates for electrical safety and the shift toward renewable energy integration in commercial facilities are further accelerating the adoption of modern distribution panels.

Regionally, North America holds a dominant share of the commercial distribution panel market, supported by advanced infrastructure, stringent safety regulations, and high adoption of energy-efficient solutions. Europe follows, driven by modernization of aging power distribution networks and smart building initiatives. The Asia-Pacific region is poised for the fastest growth, fueled by large-scale commercial construction, rapid urban development, and rising investment in energy infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The commercial distribution panel market was valued at USD 2,802.5 million in 2024 and is projected to reach USD 4,300.9 million by 2032, growing at a CAGR of 5.5% during 2024–2032

- Rapid urbanization, expansion of commercial infrastructure, and increasing demand for uninterrupted power supply are key growth drivers.

- Smart monitoring systems, IoT-enabled controls, and modular designs are enhancing operational efficiency, safety, and energy optimization in modern facilities.

- Regulatory mandates on electrical safety and energy efficiency are accelerating the replacement of outdated systems with advanced, compliant panels.

- North America held 36.4% market share in 2024, driven by advanced infrastructure, strict regulations, and high adoption of energy-efficient solutions.

- Europe accounted for 28.7% market share in 2024, supported by modernization of power networks, smart building initiatives, and renewable energy integration.

- Asia-Pacific held 24.9% market share in 2024 and is expected to grow fastest due to large-scale commercial construction, rapid urban development, and rising investment in energy infrastructure.

Market Drivers:

Rising Demand for Reliable and Efficient Power Distribution in Commercial Infrastructure:

The commercial distribution panel market is witnessing strong demand due to the expansion of commercial buildings, data centers, retail outlets, and institutional facilities. It serves as a critical component for managing electrical load distribution, ensuring operational continuity, and preventing power-related disruptions. Businesses are prioritizing reliable and efficient power systems to support sensitive equipment and uninterrupted services. The growing need for consistent energy supply in high-demand environments is driving the installation of advanced distribution panels.

- For instance, Schneider Electric introduced its Square D QO Smart Panel Solution, which provides a software-based energy management feature that helps avoid costly electrical service upgrades, supporting a 15-20% increase in electric load demand without requiring a traditional 400 amp upgrade.

Integration of Smart Technologies and Advanced Safety Features:

The adoption of smart monitoring systems, IoT-enabled controls, and real-time fault detection is transforming the functionality of commercial distribution panels. It enables facility managers to optimize energy consumption, enhance safety, and reduce downtime. Advanced features such as remote diagnostics, automated load management, and circuit protection are improving system reliability. This technological shift is attracting investments from commercial facility owners aiming to reduce maintenance costs and improve energy efficiency.

Stringent Regulatory Standards for Electrical Safety and Energy Efficiency:

Government regulations and industry standards are compelling businesses to upgrade outdated electrical infrastructure. The commercial distribution panel market benefits from compliance-driven investments, as organizations seek panels that meet safety certifications and energy efficiency requirements. It ensures adherence to fire safety, overload protection, and environmental sustainability guidelines. These mandates are accelerating the replacement of conventional systems with modern, compliant solutions.

- For instance, Siemens conducts rigorous testing based on IEC 61439 standards, ensuring panels meet clearances, creepage distances, and high temperature and voltage requirements, which reinforces their suitability for contemporary safety and sustainability needs.

Growing Integration of Renewable Energy into Commercial Power Networks:

The transition toward sustainable energy sources is reshaping commercial power distribution systems. It is prompting the deployment of panels capable of integrating solar, wind, and other renewable energy inputs alongside grid supply. Such configurations require advanced load balancing and protection mechanisms, which modern distribution panels provide. This trend supports both environmental goals and cost-saving initiatives in commercial operations.

Market Trends:

Adoption of Smart and IoT-Enabled Distribution Panels for Enhanced Operational Control:

The commercial distribution panel market is experiencing a shift toward smart and IoT-enabled solutions that provide real-time monitoring, predictive maintenance, and remote control capabilities. It allows facility managers to optimize energy consumption, identify faults instantly, and enhance overall operational efficiency. Integration with building management systems is becoming a standard practice, enabling centralized control over multiple electrical loads. Demand for panels with embedded sensors and data analytics tools is growing in commercial sectors such as data centers, retail, and hospitality. The ability to track performance metrics and implement proactive maintenance strategies is reducing downtime and operational costs. Manufacturers are focusing on developing panels that combine safety, automation, and energy intelligence in one compact system.

- For instance, China Telecom plans to connect about 1.2 million appliances including air conditioners and water purifiers in commercial/residential complexes in major cities like Beijing and Shanghai using NB-IoT-enabled sensors to monitor operational status and reduce faults through real-time data collection.

Rising Preference for Modular and Customizable Distribution Panel Designs:

Customization is emerging as a key trend in the commercial distribution panel market, driven by diverse application requirements and space constraints in commercial facilities. It is prompting manufacturers to design modular panels that can be easily expanded or reconfigured without significant downtime. Such flexibility supports future capacity upgrades and integration with renewable energy systems. Lightweight and compact designs are gaining popularity for high-density commercial spaces, while durable enclosures are preferred for industrial-grade applications. Demand for solutions that balance high performance with easy installation and maintenance is increasing among contractors and facility managers. The emphasis on adaptable configurations is reshaping competitive strategies and influencing product innovation across the market.

- For instance, Hager offers compact hybrid distribution boards handling up to 125A capacity in small commercial buildings, combining size efficiency with high functionality.

Market Challenges Analysis:

High Initial Costs and Complex Installation Requirements:

The commercial distribution panel market faces constraints due to the significant upfront investment required for advanced systems. It often demands specialized installation procedures, skilled labor, and adherence to strict regulatory codes, increasing project costs. Smaller commercial enterprises may delay upgrades due to budget limitations, impacting market penetration. Complex wiring, load balancing, and integration with existing infrastructure require precise engineering, which can extend project timelines. Limited availability of trained professionals in certain regions further slows adoption. These factors create barriers for widespread implementation, particularly in developing markets.

Maintenance Challenges and Vulnerability to Technological Obsolescence:

Ongoing maintenance requirements and the risk of rapid technological changes pose challenges for the commercial distribution panel market. It necessitates periodic inspections, component replacements, and software updates to maintain optimal performance. Facilities that fail to keep systems updated may face operational inefficiencies or safety hazards. Rapid advancements in smart and renewable-integrated panels can render older models obsolete, compelling costly replacements. Incompatibility between legacy infrastructure and modern systems can hinder seamless upgrades. This creates operational and financial pressures for commercial facility owners seeking long-term value.

Market Opportunities:

Expansion of Smart Building and Energy Management Solutions:

The commercial distribution panel market holds significant potential through integration with smart building technologies and advanced energy management systems. It can leverage IoT connectivity, AI-driven analytics, and real-time monitoring to deliver precise load control and predictive maintenance. Growing investments in intelligent commercial infrastructure create demand for panels that enhance efficiency and sustainability. The shift toward automation in commercial facilities offers opportunities for customized, feature-rich distribution panels. Rising emphasis on operational cost reduction and carbon footprint minimization strengthens the adoption of such solutions. Manufacturers that align with smart infrastructure trends can capture a larger market share.

Rising Adoption of Renewable Energy in Commercial Facilities:

The transition toward renewable energy integration presents a strong growth avenue for the commercial distribution panel market. It requires advanced panels capable of managing hybrid power sources, including solar, wind, and grid supply. Demand is growing for systems that support seamless energy switching, peak load management, and safety compliance in renewable-powered facilities. Commercial spaces aiming for energy independence and compliance with sustainability goals are driving this requirement. Government incentives for green energy adoption further encourage panel upgrades. This shift creates opportunities for innovation in hybrid-compatible and energy-efficient distribution panel designs.

Market Segmentation Analysis:

By Voltage:

The commercial distribution panel market is segmented by voltage into low voltage, medium voltage, and high voltage panels. Low voltage panels hold the largest share due to their widespread use in offices, retail outlets, and institutional buildings where electrical loads are moderate. Medium voltage panels are gaining traction in commercial complexes, hospitals, and industrial-grade facilities that require stable power distribution across larger areas. High voltage panels serve specialized applications in data centers, airports, and large-scale commercial hubs with significant energy demands.

- For instance, Siemens is the 8DJH series switchgear that supports configurations up to 24 kV, demonstrating robust technical adaptability for complex power distribution needs.

By Mounting:

By mounting type, the market includes wall-mounted and floor-mounted distribution panels. Wall-mounted panels dominate small and medium-sized commercial spaces for their compact design and ease of installation. Floor-mounted panels are preferred in high-load applications, offering greater capacity and flexibility for integration with complex electrical systems. Demand for modular mounting designs is growing to facilitate future expansions.

- For instance, ABB’s SACE Tmax T5 floor-mounted distribution boards support up to 630 A continuous current and deliver a fault-clearing capacity of 200 kA at 415 VAC, ensuring robust protection for heavy-duty installations.

By Application:

By application, the commercial distribution panel market serves offices, retail spaces, healthcare facilities, hospitality, and others. Offices and corporate complexes represent the leading application segment due to rising demand for uninterrupted power supply and energy management systems. Healthcare facilities require highly reliable panels to ensure operational continuity for critical equipment. Retail and hospitality sectors are adopting advanced panels with smart monitoring features to improve efficiency and safety standards.

Segmentations:

By Voltage:

- Low Voltage

- Medium Voltage

- High Voltage

By Mounting:

- Wall-Mounted

- Floor-Mounted

By Application:

- Offices

- Retail Spaces

- Healthcare Facilities

- Hospitality

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America :

North America accounted for 36.4% market share in the commercial distribution panel market in 2024, driven by a mature commercial infrastructure and high adoption of advanced electrical systems. The region benefits from strict regulatory frameworks that mandate safety compliance and energy efficiency. It is witnessing growing demand from sectors such as data centers, retail chains, healthcare facilities, and corporate offices. Technological advancements, including IoT-enabled panels and automated load management, are driving replacement and upgrade cycles. Strong presence of leading manufacturers and robust distribution networks further support market growth. Government initiatives for renewable energy integration are also influencing product innovations in the region.

Europe :

Europe held 28.7% market share in the commercial distribution panel market in 2024, supported by modernization of aging electrical grids and increasing focus on sustainability. The European Union’s stringent energy efficiency directives are accelerating the adoption of smart and energy-optimized panels. It is witnessing substantial demand from commercial sectors upgrading to comply with safety and environmental regulations. Countries such as Germany, France, and the UK are leading adopters due to high investment in green building initiatives. Growth is also supported by the integration of renewable energy systems into commercial facilities. Market players are targeting this region with modular, customizable, and compact panel solutions.

Asia-Pacific :

Asia-Pacific captured 24.9% market share in the commercial distribution panel market in 2024 and is projected to register the fastest growth rate through 2032. Rapid urbanization, rising infrastructure investment, and the expansion of commercial complexes are key drivers. It is experiencing increased demand for panels that can manage high energy loads while offering operational safety. Countries such as China, India, and Japan are major contributors due to large-scale commercial development and government-backed energy efficiency programs. Growing adoption of renewable energy in commercial projects is creating opportunities for hybrid-compatible panels. Rising presence of domestic manufacturers offering cost-effective solutions further fuels market expansion in this region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- ABB

- AGS.

- EAMFCO

- Schneider Electric

- Eaton

- Legrand

- Meba Electric Co.,Ltd

- Hager Group

- LARSEN & TOUBRO LIMITED

- General Electric Company

- alfanar

- Siemens

Competitive Analysis:

The commercial distribution panel market is characterized by strong competition among global and regional players focusing on product innovation, quality, and regulatory compliance. Key companies include ABB, AGS, EAMFCO, Schneider Electric, Eaton, Legrand, Meba Electric Co., Ltd, and Hager Group. It is shaped by technological advancements such as IoT-enabled monitoring, modular configurations, and enhanced safety features that address evolving commercial power distribution needs. Leading manufacturers leverage extensive distribution networks, strategic partnerships, and R&D investments to strengthen their market presence. Competitive strategies emphasize customization, energy efficiency, and integration with smart building systems. Regional players compete by offering cost-effective solutions tailored to local infrastructure requirements. The market’s dynamics favor companies capable of delivering reliable, compliant, and scalable solutions for diverse commercial applications.

Recent Developments:

- In January 2025, AviAlliance completed the acquisition of AGS Airports, encompassing the Aberdeen, Glasgow, and Southampton airports.

- In October 2024, Hager Group acquired Advizeo, a French leader in building energy management services.

- In June 2025, Larsen & Toubro Limited (L&T) announced new major orders for grid infrastructure projects in and outside India, supporting high-voltage transmission lines and substations.

Market Concentration & Characteristics:

The commercial distribution panel market is moderately concentrated, with a mix of global manufacturers and regional players competing through technological innovation, product quality, and compliance with safety standards. It features companies offering advanced solutions such as IoT-enabled monitoring, modular designs, and renewable energy integration capabilities. Leading players maintain strong distribution networks and long-term contracts with commercial infrastructure developers. The market is characterized by steady demand from both new construction and retrofit projects, driven by regulatory compliance and energy efficiency goals. Product differentiation often centers on safety features, ease of installation, and adaptability to evolving power distribution needs. Continuous R&D investment is shaping competitive dynamics and influencing market positioning.

Report Coverage:

The research report offers an in-depth analysis based on Voltage, Mounting, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Increasing adoption of smart and IoT-enabled distribution panels will enhance real-time monitoring, fault detection, and energy optimization in commercial facilities.

- Rising demand for renewable energy integration will drive the need for panels capable of managing hybrid power sources efficiently.

- Expansion of commercial construction projects in emerging economies will create substantial opportunities for new installations.

- Upgrades of aging electrical infrastructure in developed markets will sustain replacement demand for modern, compliant panels.

- Regulatory emphasis on energy efficiency and safety standards will influence design innovation and product certifications.

- Growth in data centers and high-energy-demand sectors will boost demand for advanced load management solutions.

- Customizable and modular panel designs will gain preference for their scalability and ease of installation.

- Manufacturers will focus on compact, space-efficient designs to cater to high-density commercial environments.

- Increasing use of advanced materials and manufacturing technologies will improve panel durability and performance.

- Strategic collaborations between panel manufacturers and building automation system providers will strengthen integrated energy management solutions.