Market Overview

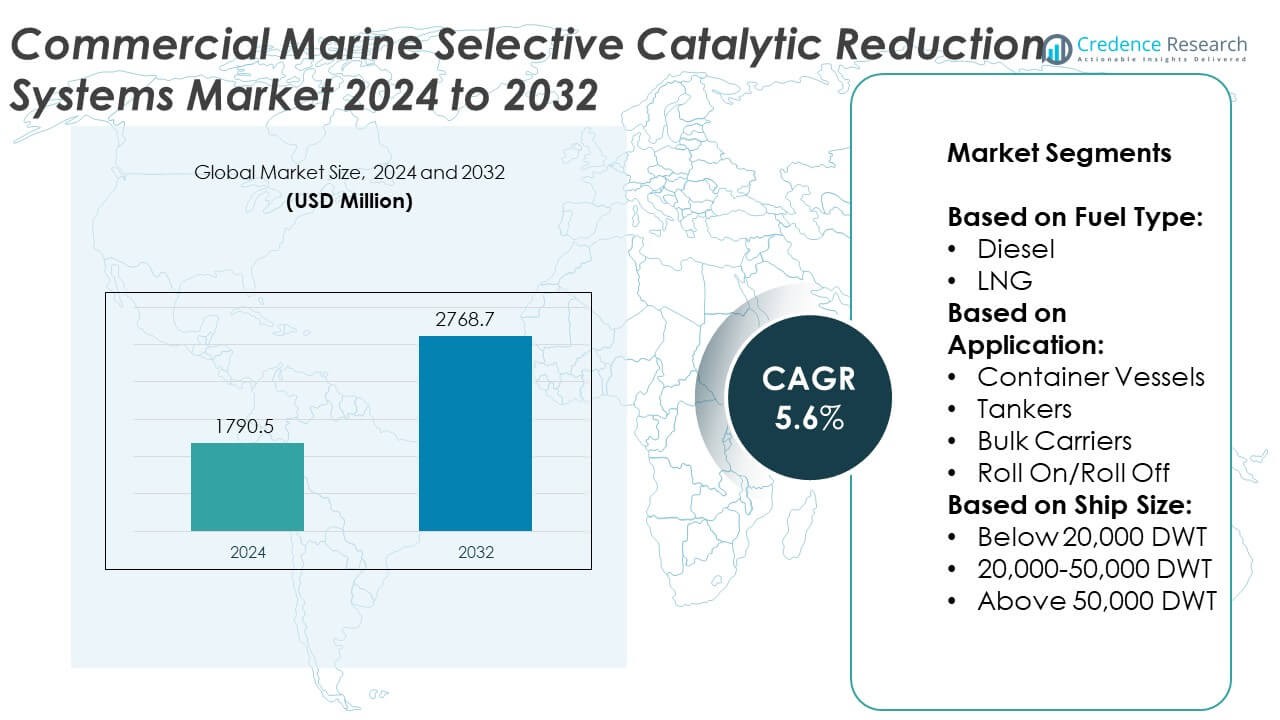

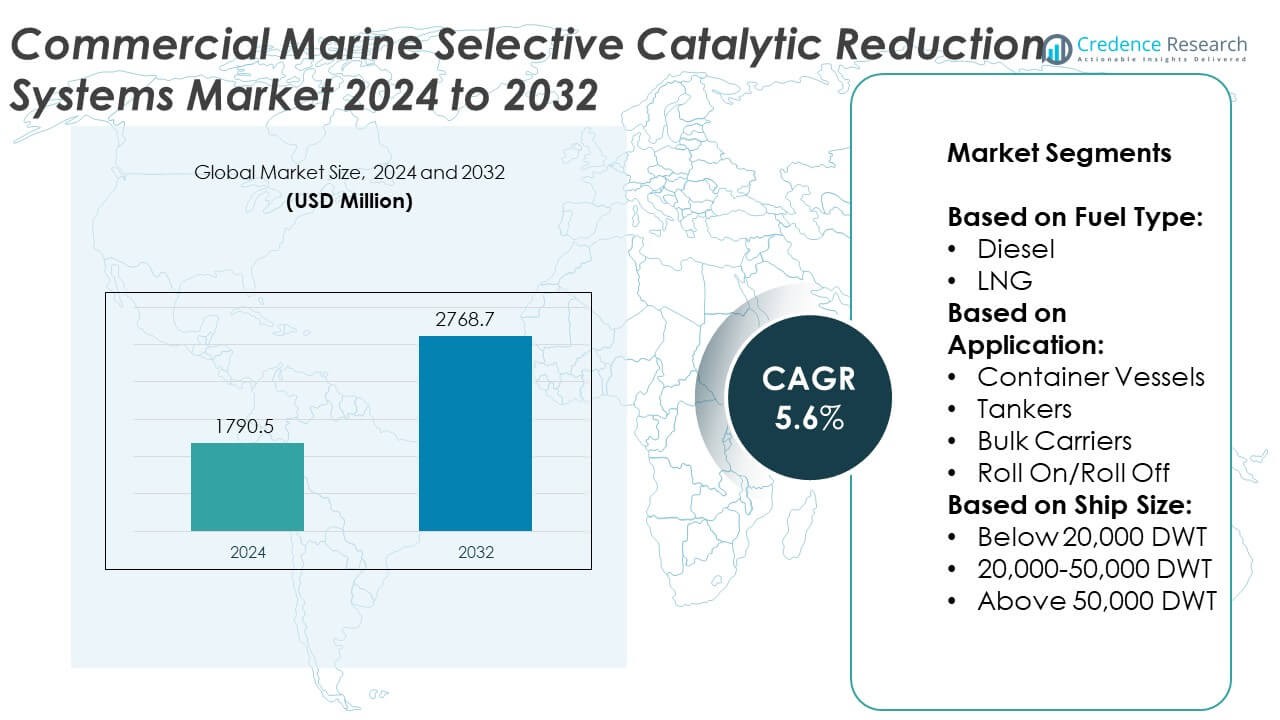

The Commercial Marine Selective Catalytic Reduction Systems Market was valued at USD 1790.5 million in 2024 and is expected to reach USD 2768.7 million by 2032, growing at a CAGR of 5.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Commercial Marine Selective Catalytic Reduction Systems Market Size 2024 |

USD 1790.5 Million |

| Commercial Marine Selective Catalytic Reduction Systems Market, CAGR |

5.6% |

| Commercial Marine Selective Catalytic Reduction Systems Market Size 2032 |

USD 2768.7 Million |

The Commercial Marine Selective Catalytic Reduction Systems market benefits from stringent global regulations targeting nitrogen oxide emissions, driving widespread adoption of SCR technologies. Growing demand for fuel-efficient and low-emission marine engines increases the need for reliable disconnect switches to ensure safe system operation and maintenance. Technological advancements enhance switch durability and enable remote monitoring, improving operational efficiency in harsh marine environments.

The Commercial Marine Selective Catalytic Reduction Systems market experiences strong growth across key regions, driven by increasing maritime regulations and expanding shipping activities. North America, Europe, and Asia-Pacific lead adoption, supported by advanced port infrastructure and robust shipbuilding industries. Key players such as Mitsubishi Heavy Industries, MAN Energy Solutions, Wartsila, and Hitachi Zosen Corporation dominate the market with their innovative disconnect switch technologies tailored for demanding marine environments. These companies focus on enhancing product reliability, corrosion resistance, and integration with SCR systems to meet evolving emission standards and operational requirements worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Commercial Marine Selective Catalytic Reduction Systems market was valued at USD 1790.5 million in 2024 and is projected to reach USD 2768.7 million by 2032, growing at a CAGR of 5.6% during the forecast period.

- Increasing regulatory pressure from international maritime organizations and governments to reduce nitrogen oxide emissions fuels the demand for SCR systems integrated with reliable disconnect switches.

- Technological trends indicate a shift toward automation, remote monitoring, and smart disconnect switches that improve operational efficiency and reduce maintenance downtime.

- Market competition intensifies among key players like Mitsubishi Heavy Industries, MAN Energy Solutions, Wartsila, and Hitachi Zosen Corporation, who focus on product innovation, corrosion resistance, and seamless integration with emission control systems.

- High costs of retrofitting existing fleets and the complexity of meeting diverse regional regulations hinder rapid adoption, especially among smaller shipping companies.

- Asia-Pacific leads regional growth, driven by expanding shipbuilding activities and maritime trade, while Europe and North America maintain strong demand supported by stringent environmental policies.

- Emerging markets in Latin America and the Middle East show potential due to increasing offshore exploration and upgrading of port infrastructure, presenting new opportunities for disconnect switch manufacturers.

Market Drivers

Key Drivers Accelerating Demand for Commercial Marine Selective Catalytic Reduction Systems Disconnect Switch Market

The increasing emphasis on stringent environmental regulations drives growth in the Commercial Marine Selective Catalytic Reduction Systems market. Governments and maritime authorities worldwide enforce regulations to reduce nitrogen oxide emissions from marine vessels. It compels ship operators to adopt advanced emission control technologies, including selective catalytic reduction (SCR) systems paired with reliable disconnect switches to ensure safety and operational efficiency. The push toward compliance fuels investment in upgrading existing fleets and outfitting new ships with SCR disconnect switches.

- For instance, MAN Energy Solutions reported that its SCR units installed on over 1,500 marine vessels worldwide comply with IMO Tier III regulations, illustrating the widespread adoption of advanced emission controls that rely on high-performance disconnect switches. The push toward compliance fuels investment in upgrading existing fleets and outfitting new ships with SCR disconnect switches.

Rising Demand for Fuel-Efficient and Low-Emission Marine Engines Supports Market Expansion

SCR systems help vessels meet emission standards while optimizing engine performance. It requires dependable disconnect switches to isolate SCR units during maintenance or fault conditions, ensuring uninterrupted marine operations. The drive for greener shipping solutions encourages manufacturers to innovate and improve the durability and safety features of disconnect switches in marine SCR systems.

- For instance, Wartsila’s SCR disconnect switch technology, implemented in over 600 vessels, has demonstrated a reduction in maintenance downtime by approximately 15%, contributing to improved operational efficiency and safety.

Technological Advancements Enhance Operational Reliability of Disconnect Switches

Technological advancements in disconnect switch design enhance operational reliability and ease of integration within marine SCR setups. Innovations such as remote monitoring, compact footprints, and corrosion-resistant materials suit the challenging marine environment. It offers shipbuilders and operators scalable solutions that reduce downtime and maintenance costs. These developments make thedisconnect switch a critical component in the evolving commercial marine emission control landscape.

Growth in Global Shipping and Offshore Activities Expands Market Need

Increasing trade volumes push for larger, more efficient vessels equipped with SCR systems for regulatory compliance. It leads to heightened installation of disconnect switches designed to handle high voltage and current loads specific to marine applications. This trend strengthens the Commercial Marine Selective Catalytic Reduction Systems market by broadening the customer base and application scope.

Market Trends

Emerging Adoption of Advanced Automation and Remote Monitoring in Disconnect Switches

The Commercial Marine Selective Catalytic Reduction Systems market shows a clear trend toward integrating automation and remote monitoring technologies. Operators seek to improve system diagnostics and maintenance efficiency through digital interfaces that allow real-time status updates. It enables prompt fault detection and reduces vessel downtime by streamlining switch operation and control remotely. This shift toward smart disconnect switches enhances overall reliability and supports predictive maintenance strategies within marine emission control systems.

- For instance, DEC Marine reports providing disconnect switch solutions on more than 180 tankers and bulk carriers combined. This indicates a significant presence in the maritime industry, specifically in providing safety and control solutions for large vessels. This indicates a focus on ensuring safe operation and control of critical electrical systems on these types of ships.

Growing Focus on Compact and Corrosion-Resistant Designs for Marine Applications

Compactness and durability dominate design trends used in commercial marine SCR systems. Space constraints onboard vessels require smaller switch units without compromising performance. It drives manufacturers to develop corrosion-resistant materials and ruggedized enclosures that withstand harsh marine environments, including saltwater exposure and vibration. These design improvements increase the lifespan and reduce maintenance needs of disconnect switches, meeting the operational demands of modern commercial vessels.

- For instance, Mitsubishi Heavy Industries developed compact disconnect switches constructed with marine-grade stainless steel alloys, installed on over 350 vessels, which have demonstrated up to a 20% increase in operational lifespan compared to traditional models.

Increased Integration with Emission Control Systems for Enhanced Safety and Compliance

Disconnect switches are evolving to integrate more seamlessly with SCR units and other emission control technologies on ships. The Commercial Marine Selective Catalytic Reduction Systems market benefits from solutions that allow coordinated operation and safety interlocks between components. It ensures quick isolation of SCR systems during emergencies or maintenance, minimizing risks to crew and equipment. This trend highlights the growing importance of system-level integration to meet strict maritime safety and environmental standards.

Expansion of Market Presence in Emerging Maritime Regions and Offshore Sectors

Growth in maritime trade routes and offshore exploration in emerging regions creates new opportunities for disconnect switch suppliers. Increasing demand for emission control technologies in these areas pushes adoption of SCR systems equipped with reliable . It encourages manufacturers to customize products that comply with regional regulations and address unique environmental conditions. This geographic diversification supports the Commercial Marine Selective Catalytic Reduction Systems Disconnect Switch market’s resilience and long-term growth potential.

Market Challenges Analysis

Complex Regulatory Compliance and High Implementation Costs Restrain Market Growth

The Commercial Marine Selective Catalytic Reduction Systems market faces challenges due to complex regulatory requirements imposed by international maritime organizations and regional authorities. Meeting diverse emission standards across different jurisdictions requires manufacturers to develop highly adaptable and certified products, which increases development timelines and costs. It also burdens ship operators with the expense of retrofitting existing vessels or investing in new compliant equipment. These financial constraints slow down widespread adoption and limit market penetration, particularly among smaller shipping companies with tight capital budgets.

Harsh Marine Environment and Technical Limitations Impact Product Reliability

Disconnect switches used in marine SCR systems must withstand extreme conditions such as saltwater corrosion, vibration, and temperature fluctuations. The Commercial Marine Selective Catalytic Reduction Systems market struggles with ensuring long-term durability and consistent performance under these demanding circumstances. It faces technical challenges related to material degradation and electrical reliability, which can lead to increased maintenance frequency and operational interruptions. Overcoming these issues requires continuous innovation and rigorous testing, placing additional pressure on manufacturers to balance robustness with cost-effectiveness.

Market Opportunities

Expansion of Green Shipping Initiatives Creates New Market Opportunities

The growing global focus on reducing maritime emissions opens significant opportunities for the Commercial Marine Selective Catalytic Reduction Systems market. Governments and international bodies promote stricter environmental regulations encouraging shipowners to invest in advanced emission control technologies. It creates demand for reliable disconnect switches that ensure safe operation and maintenance of SCR systems onboard vessels. The rising trend toward sustainable shipping practices presents scope for product innovation and wider adoption across commercial fleets, fueling market growth.

Technological Innovation Enables Entry into Emerging Maritime and Offshore Segments

Advancements in disconnect switch technology, including enhanced automation, remote monitoring, and durable materials, offer the market opportunities to address specialized marine environments. The Commercial Marine Selective Catalytic Reduction Systems market benefits from expanding offshore oil and gas exploration and growing regional maritime trade. It can capture new customers by tailoring solutions to meet the stringent safety and operational requirements of these sectors. These emerging applications broaden the market’s reach and support long-term expansion.

Market Segmentation Analysis:

By Fuel Type:

Diesel and LNG categories. Diesel-powered vessels dominate due to their widespread use in commercial shipping, driving significant demand compatible with diesel engine SCR systems. It supports emission reduction while maintaining engine efficiency. The LNG segment gains traction owing to the growing adoption of cleaner fuels that comply with stringent emission norms, creating opportunities for disconnect switches designed to operate under different fuel systems and associated electrical requirements.

- For instance, Yanmar Power Technology Co., Ltd., a subsidiary of the Yanmar Group, successfully secured orders for more than 2,200 units of its advanced exhaust gas after-treatment systems. Since the initial shipment in 2015, Yanmar has delivered over 1,500 units of its SCR systems. These catalytic reactors are compatible with Yanmar’s 6EY and 8EY series marine engines, effectively reducing emissions and aligning with environmental standards.

By Application:

The market covers container vessels, tankers, bulk carriers, and roll-on/roll-off (Ro-Ro) ships. Container vessels represent a substantial segment due to their critical role in global trade and the need for robust emission control solutions. The Commercial Marine Selective Catalytic Reduction Systems market caters to this segment with switches capable of handling high electrical loads and frequent operation cycles. Tankers and bulk carriers also contribute notably to market demand, given their size and regulatory pressure to reduce nitrogen oxide emissions. Ro-Ro ships benefit from disconnect switches designed for operational safety and quick maintenance access, supporting their specialized cargo handling processes.

- For instance, Mitsubishi Heavy Industries has supplied disconnect switch systems rated up to 3,500 Amps on many vessels within this size category, supporting both retrofit projects and new vessel constructions to comply with stringent emission regulations.

By Ship Size:

Vessels below 20,000 deadweight tonnage (DWT), between 20,000 and 50,000 DWT, and above 50,000 DWT. Smaller vessels below 20,000 DWT require compact and cost-effective disconnect switches that meet emission standards without compromising space constraints. It represents a growing niche due to increasing environmental awareness among regional operators. Mid-sized ships in the 20,000 to 50,000 DWT range demand reliable that integrate seamlessly with SCR systems for both new builds and retrofits. Large vessels above 50,000 DWT generate substantial demand for high-capacity disconnect switches capable of managing complex emission control setups and ensuring system safety during extensive marine operations.

Segments:

Based on Fuel Type:

Based on Application:

- Container Vessels

- Tankers

- Bulk Carriers

- Roll On/Roll Off

Based on Ship Size:

- Below 20,000 DWT

- 20,000-50,000 DWT

- Above 50,000 DWT

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a significant portion of the Commercial Marine Selective Catalytic Reduction Systems market, accounting for approximately 22% of the global share. The region benefits from a strong maritime industry supported by advanced port infrastructure and a high volume of commercial shipping activities. Strict environmental regulations enforced by the U.S. Environmental Protection Agency (EPA) and the International Maritime Organization (IMO) drive demand for emission control technologies, including SCR systems with reliable disconnect switches. North American shipping companies increasingly invest in retrofitting existing fleets and equipping new vessels to comply with stringent nitrogen oxide emission standards. It encourages manufacturers to develop innovative and durable disconnect switches that meet the operational demands of this market.

Europe

Europe commands the largest share in the Commercial Marine Selective Catalytic Reduction Systems market, with an estimated 28%. The region’s focus on green shipping initiatives and sustainability accelerates adoption of SCR technology in commercial vessels. European Union directives and IMO guidelines push for reduced emissions, compelling shipowners and operators to upgrade their fleets with advanced emission control systems. It drives demand for disconnect switches that enhance safety and reliability during SCR system operation. European manufacturers also emphasize the development of corrosion-resistant and compact disconnect switches suited for the harsh marine environment. The presence of leading maritime companies and shipyards further strengthens Europe’s position as a key market.

Asia-Pacific

The Asia-Pacific region represents the fastest-growing segment, accounting for approximately 30% of the Commercial Marine Selective Catalytic Reduction Systems market. Expanding maritime trade routes, increased shipbuilding activities, and growing offshore exploration fuel this growth. Regulatory enforcement in countries such as China, Japan, and South Korea promotes cleaner shipping solutions, which drives SCR system installations paired with reliable disconnect switches. It also benefits from investments in port modernization and shipping fleet expansion. The rising demand from bulk carriers, container vessels, and tankers in the region provides opportunities for suppliers to customize disconnect switches for diverse operational requirements and regional emission standards.

Latin America

Latin America contributes around 10% to the global market share for Commercial Marine Selective Catalytic Reduction Systems. The region is witnessing gradual growth due to increasing commercial shipping activities and the modernization of port infrastructure. Governments encourage the adoption of emission reduction technologies in compliance with international maritime norms. It creates opportunities for disconnect switch manufacturers to expand their presence in the market by offering cost-effective and reliable solutions tailored for the region’s specific operational challenges, including tropical marine conditions. Growth in offshore oil and gas exploration in Latin America further supports market expansion.

Middle East & Africa

The Middle East and Africa region holds approximately 10% of the market share. Maritime trade and offshore activities in the Gulf Cooperation Council (GCC) countries and along the African coastline drive demand for emission control systems. Increasing regulatory focus on environmental sustainability prompts shipowners to invest in SCR systems equipped with efficient. It faces challenges due to extreme environmental conditions, which encourages manufacturers to develop ruggedized and durable disconnect switches capable of long-term performance. Expanding port facilities and growing offshore exploration projects present additional growth opportunities in this region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

Key players in the Commercial Marine Selective Catalytic Reduction Systems market include Mitsubishi Heavy Industries, MAN Energy Solutions, Wartsila, Hitachi Zosen Corporation, DEC Marine, and Lindenberg-Anlagen. These companies maintain a competitive edge through continuous innovation, focusing on enhancing product reliability, durability, and ease of integration with SCR systems. They invest significantly in research and development to improve disconnect switch performance in harsh marine environments, such as resistance to corrosion, vibration, and temperature extremes. Leading manufacturers offer advanced automation and remote monitoring features that enable real-time diagnostics and predictive maintenance, reducing vessel downtime.Strong customer relationships and global service networks further strengthen their market positions, ensuring timely support and customized solutions for diverse marine applications. Partnerships with shipbuilders and retrofit service providers expand their reach and influence. Competitive pricing strategies and compliance with evolving international emission regulations remain key factors influencing buyer decisions. Smaller and regional manufacturers face challenges in matching the technological capabilities and global presence of these leaders but create niche opportunities through specialized products and localized services. Overall, the competitive landscape centers on technological advancement, operational reliability, and regulatory compliance to meet the growing demand in the commercial marine sector.

Recent Developments

- In May 2025, Wärtsilä secured an order to supply its Wärtsilä 20 main engine and SCR system for a 40.9-meter fishing vessel being built in Denmark for Canadian operator Clearwater Seafoods.

- In 2025, Mitsubishi Heavy Industries, Nett Technologies, Hitachi Zosen Corporation, DEC Marine, and Wärtsilä are recognized key players in the Marine Selective Catalytic Reduction Systems Market, which is poised for strong growth due to environmental regulation compliance needs.

- In March 2024, MAN Energy Solutions recently achieved a significant milestone in pollution control by producing a large-scale Cluster 5 Double Layer Selective Catalytic Reduction converter for MITSUI E&S. This advanced system, designed to be ammonia-ready, can reduce nitrogen oxide (NOx) emissions by up to 90%. It represents the largest SCR unit the company has manufactured to date. Primarily intended for use aboard cruise ships and commercial vessels, this innovative SCR system highlights a pivotal step forward in reducing environmental impact and advancing sustainable maritime technologies.

Market Concentration & Characteristics

The Commercial Marine Selective Catalytic Reduction Systems market exhibits a moderately concentrated structure dominated by a handful of key players with strong technological capabilities and extensive global reach. It features companies that invest heavily in research and development to deliver advanced disconnect switch solutions tailored for the demanding marine environment. These players leverage their expertise in materials engineering, automation, and system integration to provide reliable, corrosion-resistant, and compact products that meet stringent maritime emission standards. The market’s characteristics include a high level of product customization based on vessel type, fuel source, and regional regulatory requirements, which drives innovation and differentiation among competitors. It also experiences significant barriers to entry due to the specialized knowledge, certifications, and capital investment needed to develop compliant and durable disconnect switches. Customer relationships and after-sales support play critical roles in securing long-term contracts with shipbuilders, fleet operators, and retrofit service providers. The Commercial Marine Selective Catalytic Reduction Systems Disconnect Switch market’s competitive environment encourages continuous improvement in safety features, remote monitoring capabilities, and operational efficiency to maintain compliance and reduce downtime. This concentrated yet dynamic market structure positions leading companies to capitalize on growing global demand while encouraging niche players to target specific segments with specialized offerings.

Report Coverage

The research report offers an in-depth analysis based on Fuel Type, Application, Ship Size and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Commercial Marine Selective Catalytic Reduction Systems market will continue to grow due to tightening maritime emission regulations.

- Increasing adoption of automation and remote monitoring will enhance operational efficiency and safety.

- Demand for compact and corrosion-resistant disconnect switches will rise to meet space and environmental challenges onboard vessels.

- Innovation in materials and design will improve durability and reduce maintenance requirements.

- Expansion of green shipping initiatives will drive investment in SCR systems and related disconnect switches.

- Growth in global maritime trade and offshore activities will broaden market opportunities.

- Manufacturers will focus on integrating disconnect switches more seamlessly with emission control systems.

- Emerging markets will gain importance due to increased shipbuilding and regulatory enforcement.

- Collaboration between switch manufacturers and shipbuilders will increase to develop customized solutions.

- The market will see rising competition, pushing companies to continuously improve product performance and reliability.