Market Overview

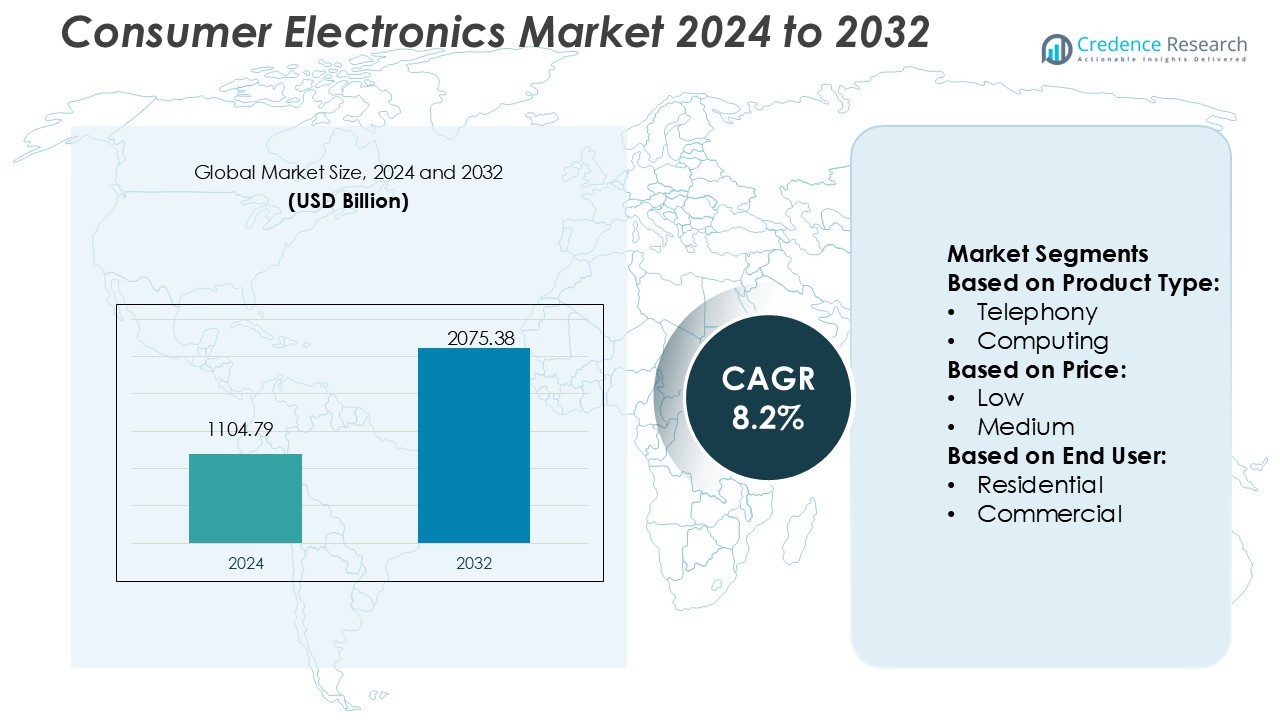

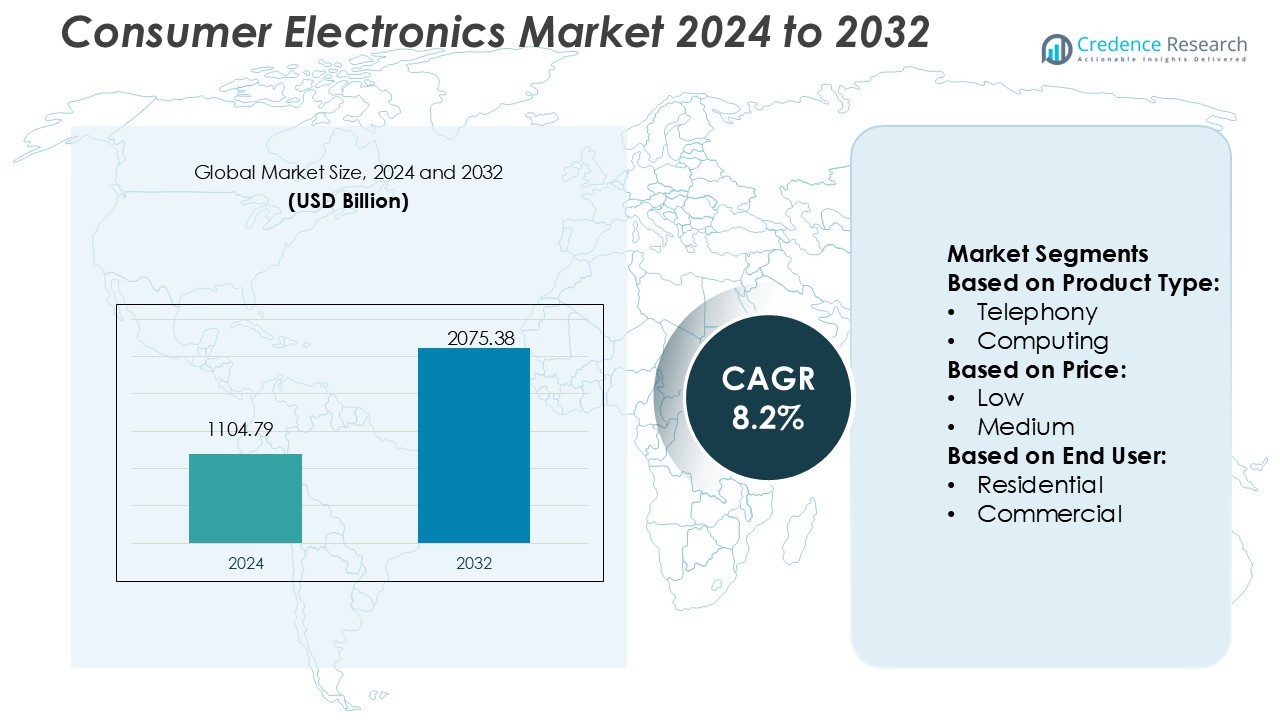

Consumer Electronics Market size was valued USD 1104.79 billion in 2024 and is anticipated to reach USD 2075.38 billion by 2032, at a CAGR of 8.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Consumer Electronics Market Size 2024 |

USD 1104.79 Billion |

| Consumer Electronics Market, CAGR |

8.2% |

| Consumer Electronics Market Size 2032 |

USD 2075.38 Billion |

The consumer electronics market is driven by major players including Samsung Electronics, Apple Inc., LG Electronics, Sony Group Corporation, Huawei Technologies, Microsoft Corp., Panasonic Corporation, Dell Technologies, HP Inc., and Lenovo Group. These companies focus on innovation, design efficiency, and digital integration to strengthen their market positions. They invest heavily in R&D, develop AI-powered devices, and expand global distribution networks to meet rising consumer demand. Asia-Pacific leads the global consumer electronics market with a 39% share in 2024, driven by strong manufacturing capabilities, urbanization, and growing middle-class income. The region’s dominance is further supported by technological innovation, large-scale production facilities, and expanding e-commerce penetration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The consumer electronics market was valued at USD 1104.79 billion in 2024 and is projected to reach USD 2075.38 billion by 2032, growing at a CAGR of 8.2%.

- Strong R&D investments and product innovation by Samsung, Apple, Sony, and LG drive technological growth, focusing on AI integration, sustainability, and energy-efficient designs.

- Key trends include the rising use of smart home devices, wearable technologies, and IoT-based automation enhancing consumer convenience and lifestyle personalization.

- High production costs and semiconductor supply fluctuations act as market restraints, impacting pricing strategies and product availability globally.

- Asia-Pacific dominates with a 39% regional share in 2024 due to strong manufacturing capabilities, expanding e-commerce, and growing middle-class income, while the computing and telephony segments hold the largest revenue share within product categories.

Market Segmentation Analysis:

By Product Type

The computing segment dominated the consumer electronics market, accounting for a 34% share in 2024. This segment leads due to strong demand for laptops, tablets, and hybrid devices supporting remote work and digital education. Advancements in AI-enabled processors, lightweight designs, and extended battery life fuel adoption. Increasing cloud integration and gaming performance optimization also attract both residential and professional users. Major players focus on integrating sustainable materials and faster chipsets, aligning with the growing consumer preference for eco-friendly and high-performance electronics.

- For instance, LG’s AI research division validated the Furiosa RNGD chip for use in computing and edge servers, achieving 512 TFLOPS FP8 throughput with a TDP of 150 W in LG’s internal benchmark tests.

By Price

The medium-price segment held the largest market share of 46% in 2024, driven by balanced affordability and advanced features. Mid-range products attract a wide customer base seeking durability and performance without premium costs. Rising disposable incomes and the availability of feature-rich smartphones, laptops, and smart TVs strengthen this category. Companies focus on modular designs, local manufacturing, and regional customization to enhance competitiveness. The segment benefits from technological diffusion from premium lines, offering consumers enhanced connectivity and smart integration at accessible price points.

- For instance, Microsoft announced Surface Copilot+ PCs that include on-device Neural Processing Units (NPUs) delivering over 40 TOPS of AI inferencing performance.

By End User

The residential segment dominated the market with a 68% share in 2024, supported by growing smart home adoption and lifestyle upgrades. Consumers increasingly prefer interconnected devices for entertainment, communication, and daily convenience. Expansion of IoT ecosystems, coupled with home automation systems and streaming services, boosts product integration across households. E-commerce platforms and brand-specific online stores further drive product accessibility. Continuous innovation in energy-efficient appliances and AI-powered smart assistants sustains strong demand within the residential electronics market.

Key Growth Drivers

Rising Adoption of Smart and Connected Devices

The growing demand for IoT-enabled and AI-integrated consumer electronics is a major growth driver. Devices such as smart TVs, wearables, and voice-assisted appliances are increasingly popular due to improved convenience and automation. The integration of AI enhances personalization and energy efficiency, attracting a wide consumer base. Manufacturers are also leveraging connectivity for remote operation and real-time monitoring. This trend is accelerating the replacement of traditional devices with smart counterparts, boosting global sales and expanding the consumer electronics market.

- For instance, Huawei in 2025 claimed that its WATCH GT 6 can run for 21 days on a single charge under its TruSense health monitoring framework. Huawei’s CloudMatrix384 supernode integrates 384 Ascend 910C NPUs and 192 Kunpeng CPUs, enabling 6,688 tokens/sec prefill throughput per NPU and 1,943 tokens/sec decode throughput per NPU in large language model inference operations.

Increasing Disposable Income and Urbanization

Rapid urbanization and rising disposable incomes are significantly fueling demand for advanced consumer electronics. Consumers in urban areas are adopting premium and multifunctional devices for better comfort and efficiency. Expanding middle-class populations in Asia-Pacific and Latin America further contribute to increased purchasing power. The availability of financing options and online retail platforms makes high-end electronics more accessible. This combination of lifestyle transformation and economic improvement continues to support strong global market growth.

- For instance, Panasonic developed the H₂ Kibou Field, a renewable energy demonstration facility in Kusatsu, Japan. The facility combines a 495 kW hydrogen fuel cell system, 570 kW of solar panels, and a 1.1 MWh lithium-ion storage system.

Advancements in Manufacturing and Energy Efficiency

Technological innovation in manufacturing and energy-efficient designs is driving market expansion. The introduction of lightweight materials, miniaturization, and enhanced battery performance improves product longevity and user experience. Energy-efficient electronics reduce power consumption, aligning with sustainability goals and government energy regulations. Automation and robotics in production lines have lowered costs and increased scalability. These advancements enable companies to deliver high-quality, affordable products while meeting eco-friendly standards and consumer expectations.

Key Trends & Opportunities

Growing Demand for Sustainable and Eco-Friendly Products

Consumers are increasingly favoring electronics designed with recyclable materials and low carbon footprints. Companies are developing energy-efficient products that comply with environmental regulations. The adoption of green technologies and circular economy principles presents strong growth opportunities. Firms investing in eco-certifications and sustainable packaging are gaining consumer trust and brand value. This shift toward sustainability enhances long-term competitiveness in the global market.

- For instance, HP reports that in its 2023 operations it incorporated 34,400 tonnes of post-consumer recycled (PCR) plastic into its product portfolio, meeting 18 % of its total plastic demand.

Expansion of E-Commerce and Omnichannel Retailing

E-commerce has become a vital distribution channel for consumer electronics. Online platforms enable product comparison, easy financing, and doorstep delivery, driving convenience-led purchasing behavior. Omnichannel strategies—combining digital and physical experiences—are helping brands strengthen customer engagement. Enhanced logistics, AR-based product visualization, and post-purchase support further improve user satisfaction. The digital retail ecosystem thus continues to shape the future of electronics sales.

Integration of Artificial Intelligence and Voice Assistance

AI-driven technologies are transforming user interaction with electronic devices. Voice assistants like Alexa and Google Assistant enable seamless control, enhancing convenience and personalization. Smart home ecosystems integrating AI-based recommendations are becoming mainstream. Manufacturers using predictive analytics and machine learning enhance product efficiency and user engagement. This trend continues to open new possibilities for innovation and premium product development.

- For instance, Samsung’s Latin America e-commerce team partnered with Kluge to deploy Web AR for over 200 3D product models, enabling users to place virtual TVs and appliances in their homes without installing an app.

Key Challenges

High Competition and Price Sensitivity

The consumer electronics market faces intense competition from numerous global and regional brands. Continuous innovation leads to frequent product launches, increasing price pressure. Many consumers prioritize affordability, forcing manufacturers to balance between quality and cost. This environment limits profit margins and compels firms to optimize supply chains. Price sensitivity, especially in emerging markets, remains a persistent challenge for sustainable growth.

Supply Chain Disruptions and Semiconductor Shortages

Global supply chain disruptions and chip shortages have severely impacted production cycles. Semiconductor scarcity affects manufacturing timelines and increases product costs. Dependence on limited suppliers makes the industry vulnerable to geopolitical and logistic risks. Companies are now investing in regional manufacturing and diversified sourcing to mitigate these issues. However, rebuilding supply resilience requires time and significant capital investment.

Regional Analysis

North America

North America holds a 27% share of the global consumer electronics market in 2024. The region benefits from high adoption of smart home devices, advanced connectivity, and strong purchasing power. Major players such as Apple, Samsung, and Sony dominate through continuous innovation in wearables, entertainment systems, and IoT-based appliances. The U.S. leads regional growth, supported by increasing demand for AI-integrated and energy-efficient devices. Expanding 5G infrastructure and the rise of digital lifestyles further accelerate product replacement cycles, strengthening market expansion across both residential and commercial sectors.

Europe

Europe accounts for a 24% share of the consumer electronics market in 2024. Strong environmental regulations and consumer demand for sustainable, energy-efficient products drive regional growth. Countries like Germany, the U.K., and France lead adoption due to high disposable incomes and tech-savvy consumers. European manufacturers focus on eco-friendly designs, smart connectivity, and compliance with the EU’s Green Deal. E-commerce expansion and smart home penetration continue to enhance product accessibility. The region’s focus on digital transformation and innovation in smart appliances ensures consistent growth within both premium and mid-range segments.

Asia-Pacific

Asia-Pacific dominates the global consumer electronics market with a 39% share in 2024. The region’s leadership is driven by high population density, rapid urbanization, and growing middle-class income. China, Japan, South Korea, and India serve as major production and consumption hubs. Strong government initiatives supporting manufacturing and smart city development fuel market expansion. The dominance of regional players like Samsung, LG, Xiaomi, and Sony enhances innovation and competitive pricing. Growing e-commerce networks and rising adoption of connected devices sustain the region’s growth momentum, making Asia-Pacific the fastest-evolving electronics market globally.

Latin America

Latin America holds a 6% share of the global consumer electronics market in 2024. Market growth is supported by increasing smartphone penetration, expanding internet access, and the popularity of e-commerce platforms. Brazil and Mexico dominate regional demand, driven by young consumers’ preference for smart and affordable devices. The adoption of 4G and emerging 5G networks stimulates sales of connected products. Local distributors and international brands are expanding partnerships to meet diverse consumer needs. Despite currency fluctuations and import costs, the region’s growing digital economy provides favorable conditions for steady market expansion.

Middle East & Africa

The Middle East & Africa region represents a 4% share of the consumer electronics market in 2024. Growth is driven by rising urbanization, improving living standards, and expanding retail infrastructure. Gulf countries like the UAE and Saudi Arabia lead adoption, supported by smart city initiatives and tech-friendly policies. Africa’s market is developing rapidly due to affordable smartphone availability and expanding internet access. Global brands are increasing investments in localized manufacturing and after-sales networks. Although the market faces challenges from price sensitivity and limited distribution, growing digitalization continues to enhance regional opportunities.

Market Segmentations:

By Product Type:

By Price:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- UK.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The competitive landscape of the consumer electronics market features key players such as LG Electronics, Microsoft Corp., Huawei Technologies, Panasonic Corporation, HP Inc., Samsung Electronics, Dell Technologies, Sony Group Corporation, Lenovo Group, and Apple Inc. The consumer electronics market is highly competitive, driven by continuous innovation, rapid technological advancement, and changing consumer preferences. Companies compete by offering smart, connected, and energy-efficient products tailored to modern digital lifestyles. The industry focuses on integrating artificial intelligence, the Internet of Things (IoT), and cloud-based ecosystems to enhance user experience. Manufacturers are investing heavily in research and development to introduce innovative designs and multifunctional features. The growing emphasis on sustainability, recyclability, and low-energy consumption further differentiates leading brands. Competitive intensity remains high, with global players expanding product portfolios and strengthening distribution networks to capture diverse market segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In February 2025, ZeroAvia secured its first commercial agreement for a standalone electric propulsion system, with Jetcruzer International purchasing the company’s 600kW system. The propulsion system will support Jetcruzer International’s ongoing electric aircraft development program.

- In January 2025, Samsung Electronics America unveiled its latest innovation, Samsung Vision AI1, at the CES First Look 2025 event. This advanced AI technology showcases groundbreaking applications designed to deliver exceptional picture quality and serve as adaptive, intelligent companions that simplify and enhance daily life.

- In June 2024, HORIBA introduced its STARS Battery software, aimed at improving battery testing capabilities in the mobility sector. This new software supports the testing of diverse battery types—single cells, modules, and packs—and provides performance and durability assessments essential for ensuring the reliability of electric propulsion systems.

- In May 2023, Sony Electronics Inc. launched the ‘Xperia 1V’ smartphone, fit with advanced and cutting edge technology, along with a CMOS image sensor with two-layer transistor pixel.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Price, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily due to rising demand for smart and connected devices.

- Artificial intelligence and IoT integration will enhance product performance and personalization.

- Energy-efficient and eco-friendly electronics will gain stronger consumer preference.

- E-commerce and direct-to-consumer channels will drive higher global sales.

- 5G connectivity will accelerate adoption of advanced mobile and home devices.

- Wearables and health-monitoring gadgets will become mainstream in consumer use.

- Cloud-based ecosystems will improve device interconnectivity and remote management.

- Emerging economies will witness strong growth through increased digital adoption.

- Companies will focus more on circular economy models and sustainable production.

- Continuous innovation in display, battery, and semiconductor technologies will shape future competitiveness.