Market Overview

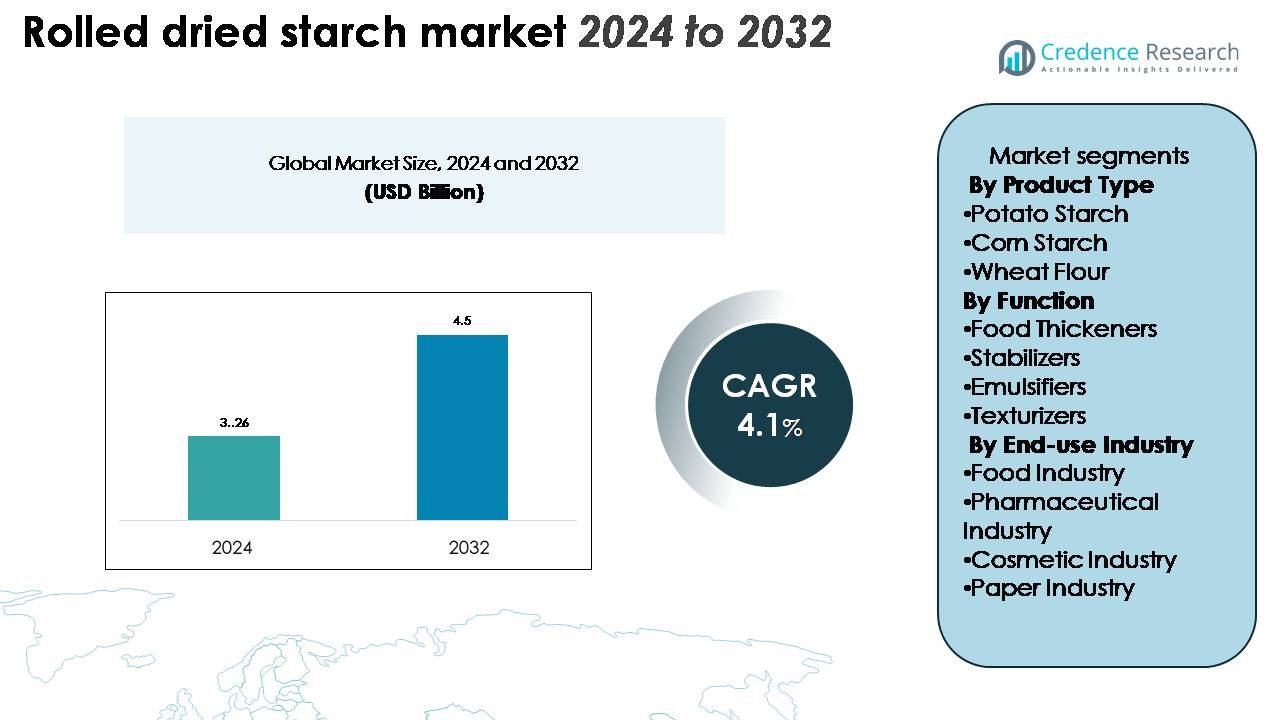

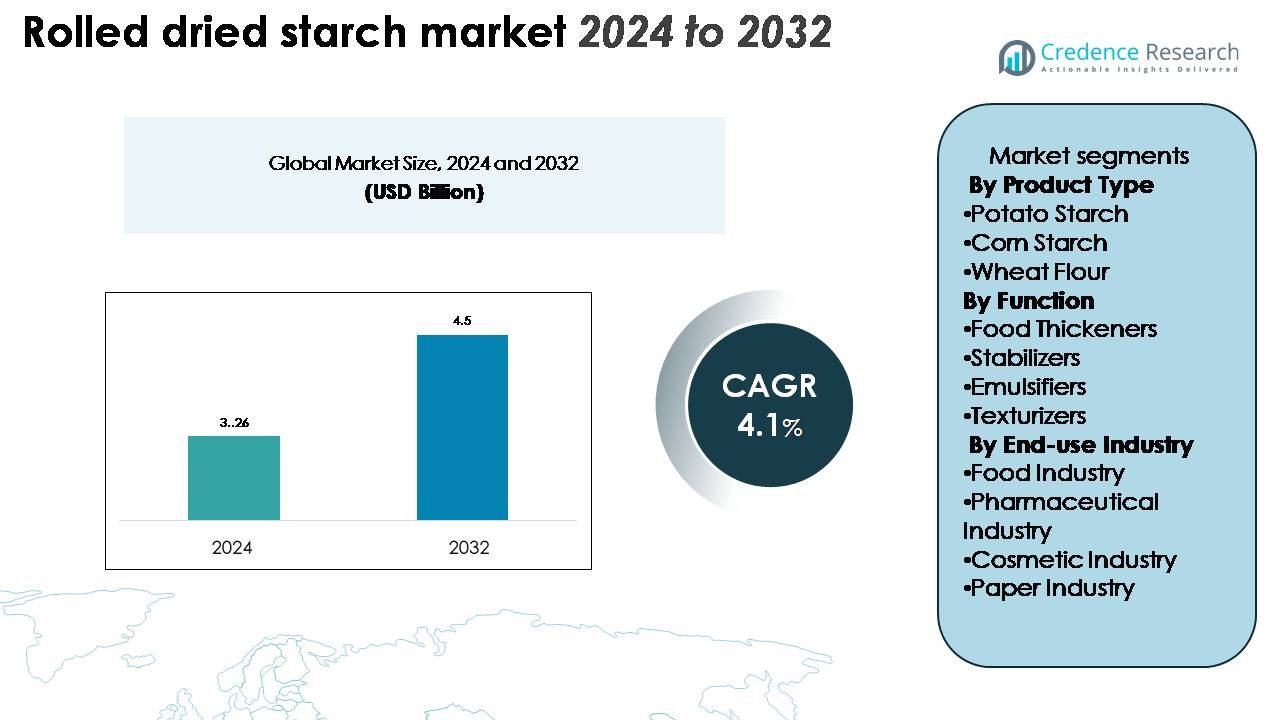

The Rolled Dried Starch Market was valued at USD 3.26 billion in 2024 and is projected to reach USD 4.5 billion by 2032, registering a CAGR of 4.1% during the forecast period (2024–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rolled Dried Starch Market Size 2024 |

USD 3.26 Billion |

| Rolled Dried Starch Market, CAGR |

4.1% |

| Rolled Dried Starch Market Size 2032 |

USD 4.5 Billion |

The rolled dried starch market is led by major players such as Cargill Incorporated, Ingredion Incorporated, Tate & Lyle PLC, Roquette Frères, AGRANA Beteiligungs-AG, and Archer Daniels Midland Company (ADM). These companies dominate through advanced processing technologies, diverse product portfolios, and strong global distribution networks. They focus on enhancing product functionality and sustainability to cater to food, pharmaceutical, and industrial applications. Asia-Pacific emerged as the leading region, holding a 33% market share, driven by large-scale food processing industries and abundant raw material availability. North America and Europe follow, collectively accounting for over half of global demand, supported by innovation and strong regulatory compliance in starch-based product manufacturing.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The rolled dried starch market was valued at USD 3.26 billion in 2024 and is projected to reach USD 4.5 billion by 2032, growing at a CAGR of 4.1% during the forecast period.

- Growing demand for processed and convenience foods is driving market growth, with potato starch leading the product segment due to its superior thickening and stabilizing properties.

- Rising adoption of clean-label and plant-based ingredients is a major trend, encouraging innovations in natural starch formulations for bakery, confectionery, and dairy applications.

- The market remains competitive, with key players such as Cargill, Ingredion, Tate & Lyle, Roquette Frères, and ADM focusing on sustainable production and product diversification.

- Asia-Pacific dominates with a 33% share, followed by North America (29%) and Europe (26%), driven by expanding food industries, regulatory compliance, and technological advancements in starch processing.

Market Segmentation Analysis:

By Product Type

Potato starch dominated the rolled dried starch market with the largest share, driven by its superior water-binding and thickening properties. It is widely used in instant soups, bakery items, and processed meats due to its neutral flavor and high viscosity. Corn starch follows as a key segment, offering versatile applications in confectionery and sauces. Wheat flour-based starch, though smaller in share, is gaining traction in bakery formulations and gluten alternatives. The growing demand for clean-label and plant-based food ingredients supports the continued expansion of these product types.

- For instance, Roquette Frères developed its pea-based (hydroxypropyl pea starch) product, LYCOAT® RS720, as an excipient primarily for pharmaceutical and nutraceutical applications, specifically for aqueous film coating of tablets and capsules.

By Function

Food thickeners held the dominant share in the rolled dried starch market, owing to their essential role in enhancing consistency and mouthfeel in soups, gravies, and desserts. Stabilizers and emulsifiers also form crucial segments, used extensively in dairy and ready-to-eat products to maintain product texture and uniformity. Texturizers are gaining momentum with rising demand for premium processed foods that emphasize sensory quality. The segment growth is fueled by increased consumer preference for natural, multifunctional additives in food manufacturing.

- For instance, Ingredion Incorporated introduced N-DULGE® C1, a chemically modified food starch (specifically, a hydroxypropyl distarch phosphate, E 1442) with a typical peak viscosity range of 480 to 820 MVU (Brabender Units), which provides improved creaminess and suspension stability in dairy-based desserts.

Key Growth Drivers

Expanding Processed Food and Convenience Product Demand

The growing consumption of processed and convenience foods is a primary driver for the rolled dried starch market. Manufacturers use rolled dried starch in ready-to-eat meals, instant soups, sauces, and bakery products to improve texture, consistency, and shelf life. Its ease of rehydration and excellent thickening capability make it a preferred ingredient across the food processing sector. For instance, leading food producers increasingly adopt rolled dried starch to replace synthetic thickeners, aligning with the clean-label movement. The rising urban population, evolving lifestyles, and increasing demand for instant and frozen foods further accelerate market adoption.

- For instance, Cargill Incorporated developed C*Dry® MD 01909M, a spray-dried maltodextrin with a typical moisture content of around 5%.

Rising Preference for Natural and Clean-Label Ingredients

Consumers are shifting toward natural and minimally processed food products, fueling demand for plant-derived starches. Rolled dried starch made from potato, corn, and wheat serves as a natural alternative to chemically modified additives. Food manufacturers leverage it to enhance transparency and meet labeling regulations in global markets. For instance, bakery and snack brands are reformulating recipes using natural starch-based thickeners to eliminate artificial components. The trend is strongly supported by growing health awareness and stricter food safety norms in Europe and North America. This shift toward clean-label formulations significantly drives market expansion.

- For instance, Ingredion Incorporated launched NOVATION® Indulge 3920, a functional native starch derived from tapioca, which provides a creamy, rich mouthfeel and excellent process tolerance in clean-label bakery and dairy formulations.

Expanding Applications in Non-Food Industries

Beyond food, rolled dried starch finds growing use in pharmaceuticals, textiles, and paper manufacturing due to its binding, coating, and film-forming properties. The pharmaceutical sector employs it as a disintegrant and filler in tablet formulations, ensuring controlled release and stability. In the textile and paper industries, it improves surface strength and printability. For instance, companies integrate rolled dried starch into bioplastic production processes to enhance biodegradability. The growing demand for sustainable and eco-friendly raw materials across industrial applications strengthens its market penetration and long-term growth potential.

Key Trends & Opportunities

Innovation in Product Formulation and Functional Performance

Manufacturers are focusing on improving the functional properties of rolled dried starch to expand its applicability across various sectors. Advanced processing technologies such as drum drying and enzymatic modification enhance solubility, viscosity, and stability under high temperatures. For instance, food ingredient producers are developing rolled starch variants that maintain texture in acidic environments, benefiting sauces and dairy desserts. The trend toward multifunctional starches supports the creation of innovative, low-calorie, and nutrient-enriched food products. Continuous R&D in formulation drives the emergence of high-performance rolled dried starch products tailored for niche applications.

- For instance, Roquette Frères offers CLEARAM® CH 20 20, a cook-up modified starch derived from waxy maize. This product is designed for resistance to high temperatures (up to 120°C), high shear, and a pH range of 3.5 to 7.5, making it highly suitable for maintaining texture integrity in applications like yogurt and fruit-based sauces during processing, including pasteurization.

Growing Adoption in Plant-Based and Gluten-Free Products

The global rise in plant-based and gluten-free diets presents a significant growth opportunity for rolled dried starch producers. Starches derived from potato and corn serve as effective gluten substitutes in bakery and snack formulations. For instance, food manufacturers incorporate rolled dried starch in vegan meat alternatives to replicate texture and binding properties. The demand for allergen-free and sustainable ingredients supports its use in functional foods and beverages. This trend aligns with the increasing consumer focus on dietary health, promoting higher market penetration in health-oriented product lines.

- For instance, Ingredion Incorporated launched VITESSENCE® Prista P 360, a plant-based protein–starch hybrid ingredient with a water absorption capacity of 2.7 g/g and an oil binding capacity of 1.9 g/g, designed to improve texture and binding strength in vegan meat and bakery products.

Sustainability and Circular Economy Initiatives

Sustainability-focused manufacturers are exploring rolled dried starch as a renewable raw material for biodegradable packaging and bio-based industrial products. Its natural origin and compostable nature make it suitable for replacing petroleum-based polymers. For instance, packaging companies are integrating starch-based films into flexible packaging solutions to reduce plastic waste. The circular economy approach and government initiatives promoting bio-based materials further enhance market opportunities. This trend positions rolled dried starch as a key contributor to environmentally sustainable manufacturing practices.

Key Challenges

High Production Costs and Raw Material Volatility

The cost-intensive production process and raw material price fluctuations pose a challenge to market stability. The availability and pricing of corn, potato, and wheat—key starch sources—depend heavily on climatic and agricultural conditions. For instance, unfavorable weather patterns or regional export restrictions can disrupt supply chains and increase operational costs. Energy consumption during drying and processing also raises production expenses. These factors collectively impact profit margins, particularly for small and mid-sized manufacturers, limiting competitive pricing in emerging markets.

Competition from Modified and Synthetic Starches

The growing use of modified and synthetic starches with superior functional stability presents a challenge for rolled dried starch adoption. Chemically treated starches offer better performance under extreme temperature and pH conditions, attracting industrial users. For instance, processed food companies often prefer modified starch for high-temperature applications like instant noodles and sauces. The limited heat and shear resistance of rolled dried starch restricts its use in specific formulations. Manufacturers must invest in technology upgrades and process innovations to enhance competitiveness against synthetic substitutes.

Regional Analysis

North America

North America held a 29% market share in the rolled dried starch market, driven by strong demand from the food processing and convenience food industries. The U.S. dominates the regional landscape due to its advanced food manufacturing infrastructure and widespread adoption of natural thickeners in packaged products. Canada and Mexico contribute through growing processed food consumption and industrial starch applications. The region’s focus on clean-label and non-GMO ingredients further strengthens market growth, with manufacturers investing in product innovation to meet regulatory and consumer requirements for healthier and sustainable food solutions.

Europe

Europe accounted for a 26% market share, supported by a mature food and beverage industry emphasizing sustainable and natural ingredients. Countries such as Germany, France, and the U.K. lead in adopting rolled dried starch for bakery, confectionery, and dairy applications. The region benefits from stringent food safety regulations and the rising popularity of plant-based products. European starch producers focus on improving yield efficiency and expanding bio-based industrial uses. The shift toward biodegradable materials and reduced reliance on chemical additives positions Europe as a key innovation hub for starch-based product development.

Asia-Pacific

Asia-Pacific dominated the global market with a 33% share, driven by expanding food processing industries in China, India, Japan, and Indonesia. Rapid urbanization, rising disposable incomes, and growing preference for ready-to-eat foods fuel demand for rolled dried starch. The region’s large agricultural base supports ample raw material availability, reducing production costs. Food manufacturers increasingly utilize potato and corn starch in noodles, sauces, and snacks. Government initiatives supporting agro-based industries further enhance market development. The shift toward sustainable, plant-derived ingredients strengthens Asia-Pacific’s position as the fastest-growing regional market.

Latin America

Latin America captured a 7% share, driven by increasing demand from bakery, confectionery, and dairy processing sectors. Brazil and Argentina lead the market due to their strong agricultural resources and rising export-oriented food manufacturing. Local producers are adopting rolled dried starch for texture improvement and shelf-life enhancement in packaged foods. The region is witnessing growing investments from global starch companies seeking cost advantages and expanding local supply chains. However, uneven infrastructure and fluctuating crop yields remain key challenges impacting consistent market expansion in Latin America.

Middle East & Africa (MEA)

The Middle East & Africa held a 5% market share, supported by growing processed food consumption and industrial diversification. Countries like South Africa, the UAE, and Saudi Arabia are driving demand through expanding food processing and packaging industries. The adoption of rolled dried starch in sauces, bakery mixes, and dairy formulations is increasing due to its functional versatility. Import dependence remains high, prompting regional initiatives to develop local starch processing units. Investments in food security and agro-industrial projects are expected to enhance MEA’s long-term market potential for rolled dried starch.

Market Segmentations:

By Product Type

- Potato Starch

- Corn Starch

- Wheat Flour

By Function

- Food Thickeners

- Stabilizers

- Emulsifiers

- Texturizers

By End-use Industry

- Food Industry

- Pharmaceutical Industry

- Cosmetic Industry

- Paper Industry

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The rolled dried starch market features a moderately consolidated structure with the presence of key global and regional manufacturers competing through product quality, technological innovation, and raw material integration. Leading companies such as Cargill Incorporated, Ingredion Incorporated, Tate & Lyle PLC, Roquette Frères, AGRANA Beteiligungs-AG, and Archer Daniels Midland Company (ADM) dominate the market through extensive distribution networks and strong R&D capabilities. These players focus on improving starch functionality, solubility, and thermal stability to meet the evolving needs of the food, pharmaceutical, and industrial sectors. Strategic partnerships and capacity expansions are common to secure regional supply chains and enhance competitiveness. For instance, companies are investing in sustainable production methods and bio-based product innovations to align with global clean-label and environmental goals. The entry of regional players offering cost-effective formulations further intensifies competition, pushing market leaders toward continuous process optimization and customized product development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Buhler AG

- Mesa Foods LLC.

- Galam

- Karandikars Cashell

- Archer Daniels Midland Company

- Roquette Frères

- Grain Processing Corporation

- S A Pharmachem Pvt Ltd

- Banpong Tapioca Flour Industrial

- Cargill Incorporated

Recent Developments

- In February 2025, Ingredion invested $50 million in its Cedar Rapids facility in Iowa, USA, to expand and modernize its production of specialty industrial starches. This strategic investment enhanced the facility’s capacity to serve a wide range of industrial applications, specifically for the packaging and papermaking industries, supporting demand for functional solutions that deliver on requirements for strength, biodegradability, and recyclability.

- In 2022, Cargill Incorporated has invested in specialty roll-dried starches to increase sustainable production. The increase in production capacity helped to better serve the dynamic functional food starch market and give a manufacturer competitive edge.

- In October 2022, Roquette launched a new line of organic pea ingredients, including organic pea starch and organic pea protein. This expansion strengthened the company’s position in the growing plant-based and organic food sector. By sourcing peas from a dedicated network of organic growers and processing them into high-quality starch and protein ingredients, Roquette addressed rising consumer demand for clean-label and sustainable alternatives. This move diversified the company’s product portfolio and also enabled food manufacturers to develop innovative, functional, and plant-based food products with improved texture, stability, and nutritional profile.

Report Coverage

The research report offers an in-depth analysis based on Product type, Function, End use industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for rolled dried starch will rise with growing processed and convenience food consumption.

- Manufacturers will focus on clean-label and plant-based ingredient formulations.

- Technological advancements will improve starch functionality and heat stability.

- Expansion in non-food sectors like pharmaceuticals and paper will boost adoption.

- Sustainable production practices will gain priority among global producers.

- Asia-Pacific will continue to lead due to strong industrial and agricultural bases.

- Product innovation will center on gluten-free and allergen-free food applications.

- Companies will invest in bio-based packaging and biodegradable material development.

- Strategic collaborations will strengthen supply chains and enhance global reach.

- Increasing R&D will drive the creation of multifunctional starches for diverse industries.