Market Overview

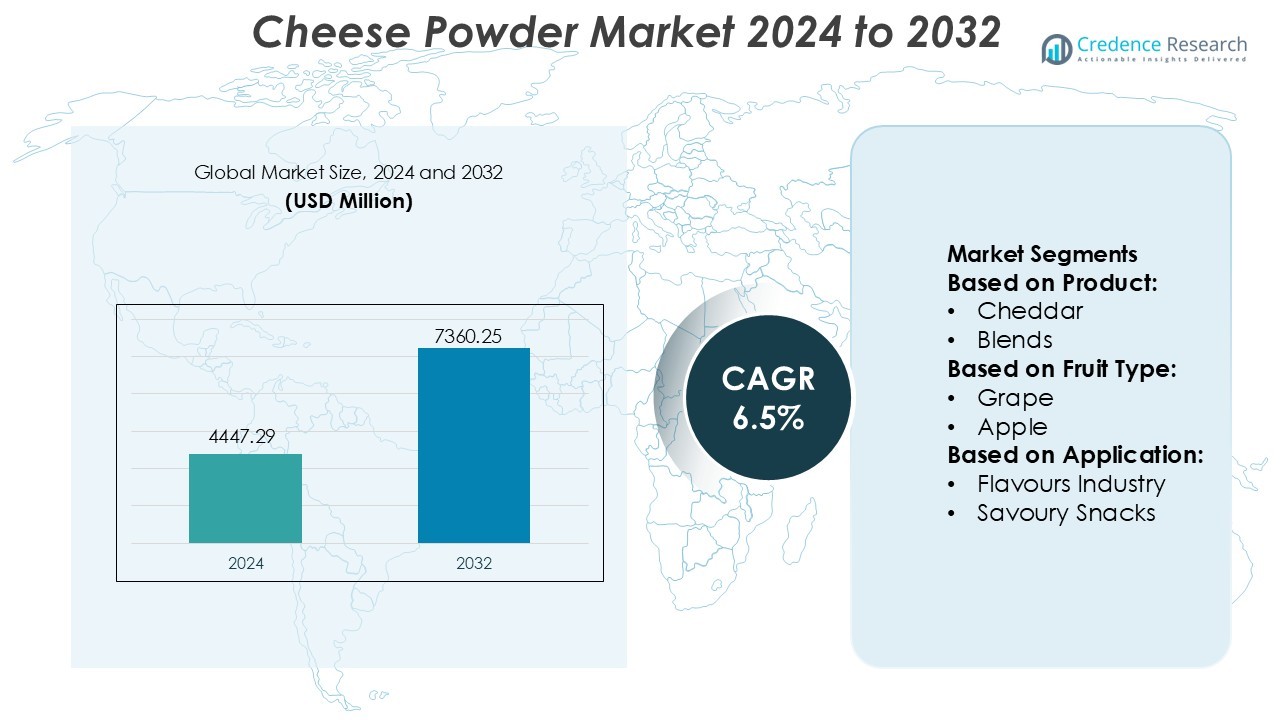

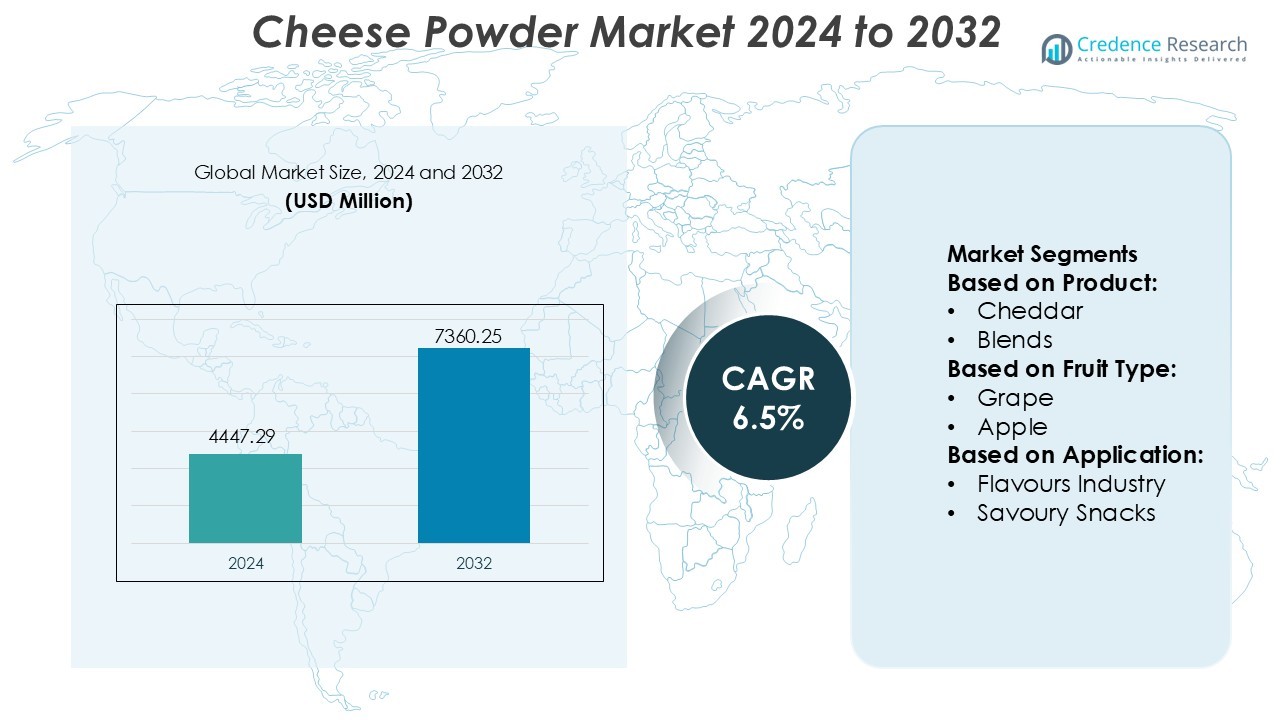

Cheese Powder Market size was valued USD 4447.29 million in 2024 and is anticipated to reach USD 7360.25 million by 2032, at a CAGR of 6.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cheese Powder Market Size 2024 |

USD 4447.29 Million |

| Cheese Powder Market, CAGR |

6.5% |

| Cheese Powder Market Size 2032 |

USD 7360.25 Million |

The cheese powder market include Kerry Inc, WILD Flavors and Specialty Ingredients (ADM), Land O’Lakes Inc, Lactosan Group, Aarkay Food Products Ltd, Vika B.V, All American Foods Inc, SM Foods, Kanegrade Ltd, Del-Val Food Ingredients, and Ace International LLP. These companies compete through product innovation, clean-label formulations, and wide foodservice partnerships. They supply cheddar, mozzarella, parmesan, and blended powders for snacks, sauces, bakery mixes, and ready meals. North America leads the global market with a 34% share, supported by strong snack consumption, developed dairy processing capacity, and high adoption in ready-to-eat foods and quick-service restaurant channels.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Cheese Powder Market size was valued at USD 4447.29 million in 2024 and is expected to reach USD 7360.25 million by 2032, growing at a CAGR of 6.5%.

- Rising demand for convenient snacks, ready meals, and packaged seasoning mixes drives strong adoption of cheddar, mozzarella, parmesan, and blended cheese powders across food manufacturing.

- Clean-label, organic, and lactose-free variants support new product launches, while snack brands introduce gourmet and regional flavor profiles to attract younger consumers.

- Kerry Inc, ADM, Land O’Lakes Inc, Lactosan Group, and other players invest in technology upgrades and foodservice partnerships, but price volatility of dairy raw materials remains a restraint.

- North America leads with a 34% share due to strong snack consumption and efficient dairy processing, while Asia-Pacific shows the fastest growth as local snack makers increase use of cheese powder in flavored chips, noodles, and bakery mixes.

Market Segmentation Analysis:

By Product

Cheddar cheese powder holds the dominant share of 27%, driven by strong use in snacks, bakery fillings, and ready meals. The mild taste, creamy texture, and easy solubility make Cheddar the preferred choice for flavor manufacturers. Blends and Mozzarella powders grow due to rising demand for pizza toppings and instant pasta mixes. Parmesan, Asiago, and Romano gain traction in premium sauces and seasoning mixes. Gouda, Blue, and Feta powders serve niche gourmet applications. The expanding processed food sector and higher consumption of savory snacks continue to support segment growth.

- For instance, Lactosan Cheese Powder Type 133230.The preliminary data sheet specifies a fat content range of 37–44 g per 100 g (or 37-44%). The maximum lactose content is specified as max. 5 g per 100 g (or 5%). The pH is listed as approximately 6.0 (± 0.2).

By Fruit Type

Grape-based cheese powder dominates with a 25% share, supported by broad applications in baked snacks, flavored nuts, and confectionery coatings. Its antioxidant content and sweetness-enhancing ability help manufacturers create clean-label ingredient blends. Apple and berry-infused variants grow in cereals, kids’ snacks, and yogurt toppings. Mango and banana powders find use in tropical-flavored cheese sauces and dessert mixes. Rising demand for fruit-forward dairy flavors and fortified snack mixes drives innovation across this segment.

- For instance, Aarkay uses a low-temperature spray-drying process that allows more than 10,000 metric tons per annum of fruit & vegetable powders production from its facility.

By Application

Savoury snacks lead with a 33% share, as manufacturers use cheese powder for instant flavor delivery, long shelf life, and consistent quality. Chips, popcorn, nachos, crackers, and extruded snacks rely on cheese seasoning to achieve strong taste appeal. Dips, dressings, and dry mixes expand with convenience food adoption. Ready-to-eat meals and bakery items add cheese powder for intensified flavor without refrigeration. Imitation cheese production and pet food also grow, driven by cost savings and stable nutritional content.

Key Growth Drivers

- Rising Demand for Convenient and Ready-to-Use Food Products

Consumers prefer convenient cooking solutions due to busy lifestyles and limited preparation time. Cheese powder offers long shelf life, easy storage, and simple blending into snacks, sauces, and ready meals. Food processors use powdered cheese to enhance taste without cold-chain dependency. Growing use in instant pasta, soups, bakery mixes, and packaged snacks supports steady volume growth. Rising working populations and expanding quick-service restaurant chains further lift demand. Urban households also favor multilayer flavoring in retail snack packs, which drives large-scale cheese powder adoption in global food manufacturing.

- For instance, Saputo Inc. is a major producer of string cheese products, including the Frigo Cheese Heads® brand, which are widely distributed across North America. The company processed approximately 11 billion litres of milk annually across its global facilities in 2023, supplying extensive retail and foodservice networks.

- Strong Expansion of Savory Snacks and Flavored Products

Branded snacks, extruded foods, and flavored coatings remain top commercial users of cheese powder. Manufacturers apply cheddar, mozzarella, parmesan, and blended powders to popcorn, chips, nachos, crackers, and baked snacks for enhanced taste and aroma. Flavored snack launches continue to increase in North America, Asia-Pacific, and Latin America. Food brands rely on dehydrated cheese to maintain consistency, reduce moisture issues, and improve product stability. Growth in kids’ snacks and portion-controlled packs further strengthens demand. Globalization of Western snacking trends also supports widespread use across developing markets.

- For instance, Braun’s EasyPrep 4-Cup Chopper (model CH3012BK) features QuadBlade™ technology with four layered stainless-steel blades, allowing up to 25 % more ingredients to be processed in one cycle (versus dual blade designs).

- Innovation in Cheese Blends and Clean-Label Formulations

Producers invest in cleaner ingredient lists, reduced artificial additives, and natural dairy-based powders. Food processors ask for lower-sodium, allergen-friendly, and specialty blends to meet evolving dietary preferences. Product development focuses on organic, non-GMO, and enzyme-modified cheese powders that offer strong flavor intensity at lower dosage levels. Demand rises from bakery, sauces, and meal kits targeting health-conscious buyers. Sustainable packaging and improved spray-drying technologies enhance product quality, solubility, and uniformity. As more brands reformulate, natural cheese powders gain strong adoption across premium product lines globally.

Key Trends & Opportunities

- Expanding Use in Ready-to-Eat and HoReCa Channels

Hotels, restaurants, catering services, and QSR chains use cheese powders in seasoning mixes, breading, pizza toppings, and creamy sauces. Powdered cheese simplifies inventory management and reduces waste compared with fresh cheese blocks. Growing fast-food culture and menu diversification increase usage in burgers, loaded fries, tacos, and fusion cuisines. Ready-to-eat convenience foods incorporate blends to enhance aroma and thickness without refrigeration. Manufacturers targeting institutional buyers and bulk pack formats see strong revenue potential as dine-out trends grow across developing economies.

- For instance, Breville’s Sous Chef 16 Peel & Dice features a 1 200 W high-torque induction motor, a 12 mm dicing attachment, and 24 slicing settings, enabling precise processing with one compact unit.

- Growth of Plant-Based and Lactose-Free Cheese Powder Alternatives

A shift toward vegan, plant-based, and lactose-intolerant segments creates new product opportunities. Producers develop nut-based, soy-based, and nutritional yeast formulations to match dairy flavor and melt characteristics. Rising awareness of dairy allergies, digestive concerns, and ethical consumption accelerates demand. Global brands launch allergen-free cheese seasoning for snacks, sauces, and meal kits. As flexitarian diets expand, food manufacturers incorporate plant-based cheese powder into new bakery and snack ranges, opening attractive growth prospects in retail and foodservice channels.

- For instance, Berry and Nestlé Purina’s 20 oz and 30 oz Friskies® Party Mix® treat canisters are now made with 100% mechanically recycled PET (excluding lid/label), eliminating more than 500 metric tons of virgin plastic annually.

- Premium Flavor Customization and Regional Taste Profiles

Snacking companies release localized seasoning blends, including spicy cheddar, smoky parmesan, herbs, chili, and garlic-flavored powders. Demand rises for gourmet snacks and limited-edition variants targeted at young consumers. Custom coatings and international flavors strengthen brand differentiation on retail shelves. Manufacturers use advanced drying systems to retain authentic cheese notes, creating high-intensity powders for premium products. Regional fusion flavors drive expansions in Asia-Pacific, Middle East, and Latin America, offering new margins beyond standard cheddar and mozzarella.

Key Challenges

- Volatility in Milk Prices and Supply Chain Pressures

Cheese powder is closely linked to raw milk availability and dairy price fluctuations. Seasonal supply cycles, weather disruptions, and global feed cost changes impact final production cost. Manufacturers face pressure on margins when procurement prices rise faster than retail adjustments. Import restrictions and logistics delays increase volatility in developing markets. Companies rely on long-term contracts and diversified sourcing to manage risk, but high input prices still affect affordability for small food processors.

- Competition from Fresh Cheese and Plant-Based Seasonings

Fresh cheese, processed cheese slices, and liquid cheese sauces remain strong substitutes in foodservice and home cooking. Some consumers perceive fresh cheese as more natural, reducing powdered cheese preference in certain segments. Rapid growth of plant-based cheese sauces and nutritional yeast seasonings adds competitive pressure. Brands need continuous innovation in clean-label and high-flavor formulations to retain customers. Misconceptions about preservatives and additives may also limit adoption in premium health-focused products unless addressed through transparent labeling.

Regional Analysis

North America

North America holds the leading position in the cheese powder market with a 34% share, driven by high consumption of packaged snacks, ready meals, and flavored convenience foods. The U.S. dominates regional demand as major snack producers use cheddar, mozzarella, and blended cheese powders for coatings, dips, and seasoning mixes. Quick-service restaurants, pizza chains, and food manufacturers prefer powder over fresh cheese due to longer shelf life and easier distribution. Clean-label, low-sodium, and organic variants gain attention among health-focused buyers. Strong dairy processing infrastructure and continuous product launches from branded food companies support steady growth in this region.

Europe

Europe accounts for nearly 28% of the global market share, supported by strong dairy production and developed food processing industries. Italy, France, Germany, and the U.K. drive demand for parmesan, mozzarella, gouda, and specialty cheese powders used in bakery mixes, gourmet snacks, and premium sauces. Rising adoption of natural and additive-free formulations aligns with strict EU food safety regulations. Producers supply powders for plant-based and lactose-free applications as vegan diets expand. Growth in private-label retail snacks and frozen meals also boosts volume. Strong export activity from leading cheese manufacturers helps maintain Europe’s steady regional presence.

Asia-Pacific

Asia-Pacific represents around 22% of the market share and is the fastest-growing regional segment. Demand rises in India, China, Japan, and Southeast Asia due to rapid urbanization, Western-style snacking, and expanding foodservice chains. Local snack companies use cheddar and blended cheese powders to launch flavored chips, popcorn, and instant noodles. Rising disposable income drives premium snack purchases and ready-to-eat meals. International dairy brands invest in regional manufacturing and partnerships to reduce import dependence. Growing e-commerce and youth-oriented consumption continue to strengthen distribution. The region offers strong long-term opportunities, especially in affordable flavored packaged foods.

Latin America

Latin America captures an estimated 9% market share, led by Brazil and Mexico. Cheese powders are widely used in nacho chips, tortillas, bakery fillings, and seasoning mixes for snacks and ready meals. Foodservice expansion and global fast-food brands fuel higher consumption, especially in urban centers. Local dairy processors produce cheddar and parmesan powders for domestic snack companies, reducing reliance on imports. Economic recovery and rising interest in flavored packaged foods support growth. However, pricing sensitivity and fluctuating dairy input costs influence purchase decisions. Despite challenges, rising supermarket penetration creates room for premium and clean-label cheese powder products.

Middle East & Africa

The Middle East & Africa region holds nearly 7% of global market share and shows steady expansion due to growing tourism, hospitality, and Western fast-food influence. Countries such as the UAE, Saudi Arabia, and South Africa lead demand for cheese powders used in bakery mixes, pasta seasoning, and flavored snack coatings. Imported varieties hold a strong retail presence, though regional dairy producers are scaling manufacturing to serve local brands. Convenience foods and frozen snacks gain popularity among young consumers and working households. Despite moderate awareness and high import costs, the region remains an emerging growth market for affordable cheese powder products.

Market Segmentations:

By Product:

By Fruit Type:

By Application:

- Flavours Industry

- Savoury Snacks

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the cheese powder market players such as SM Foods, Lactosan Group, Aarkay Food Products Ltd, Kerry Inc, Del-Val Food Ingredients, Kanegrade Ltd, Ace International LLP, Land O’Lakes, Inc, All American Foods Inc, Vika B.V, and WILD Flavors and Specialty Ingredients (ADM). The cheese powder market is defined by continuous product innovation, strong distribution networks, and expanding partnerships across the food processing industry. Manufacturers focus on improving spray-drying techniques, solubility, and clean-label formulations to meet rising demand from snack brands, dairy processors, and ready-meal producers. Companies introduce organic, low-sodium, and enzyme-modified powders that enhance flavor intensity and stability in sauces, coatings, and seasoning blends. Regional suppliers compete through affordable bulk offerings, while global players invest in new production facilities to reduce logistics costs and ensure consistent supply. As the market grows, firms strengthen product portfolios, pursue strategic acquisitions, and work closely with food manufacturers to develop customized blends for gourmet and functional product lines.Top of FormBottom of Form

Key Player Analysis

- SM Foods

- Lactosan Group

- Aarkay Food Products Ltd

- Kerry Inc

- Del-Val Food Ingredients

- Kanegrade Ltd

- Ace International LLP

- Land O’Lakes, Inc

- All American Foods Inc

- Vika B.V

- WILD Flavors and Specialty Ingredients (ADM)

Recent Developments

- In May 2025, Oerlikon Metco, headquartered in Winterthur, Switzerland, has launched its new MetcoMed brand with metal powders the release of two materials tailored for the Additive Manufacturing of medical components and implants.

- In February 2025, Dole has partnered with Givaudan to distribute Green Banana Powder, a recycled ingredient developed by Dole Specialty Ingredients (DSI). The collaboration will enhance Givaudan Sense Texture range with sustainable emulsifier and texturizer solutions.

- In May 2024, Döhler expanded its Paarl facility in South Africa by adding new production lines for powdered flavors and compounds, including fruit powders, to enhance local processing capabilities.

- In April 2024, Butter Buds Inc. launched Cheese Buds Simple Cheddar Cheese Concentrate to provide a clean-label, natural cheddar flavor that meets consumer demand for simple ingredients and gourmet taste.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Fruit Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Manufacturers will expand clean-label, organic, and natural ingredient formulations to meet health-focused demand.

- Plant-based and lactose-free cheese powder alternatives will gain wider acceptance in retail and foodservice.

- Snack companies will launch more flavored and gourmet variants to attract young and premium buyers.

- Ready-to-eat and instant meal producers will increase usage to improve taste, shelf life, and convenience.

- Regional flavor customization will grow as brands target local taste preferences in emerging markets.

- Food processors will invest in advanced drying technology to enhance texture, solubility, and flavor intensity.

- Partnerships between dairy processors and snack manufacturers will support new product innovations.

- E-commerce distribution will strengthen sales of consumer-sized cheese powder packs.

- Hotels, restaurants, and QSR chains will boost adoption for sauces, toppings, and seasoning mixes.

- Sustainability and recyclable packaging will become key focus areas for global suppliers.