Market Overview:

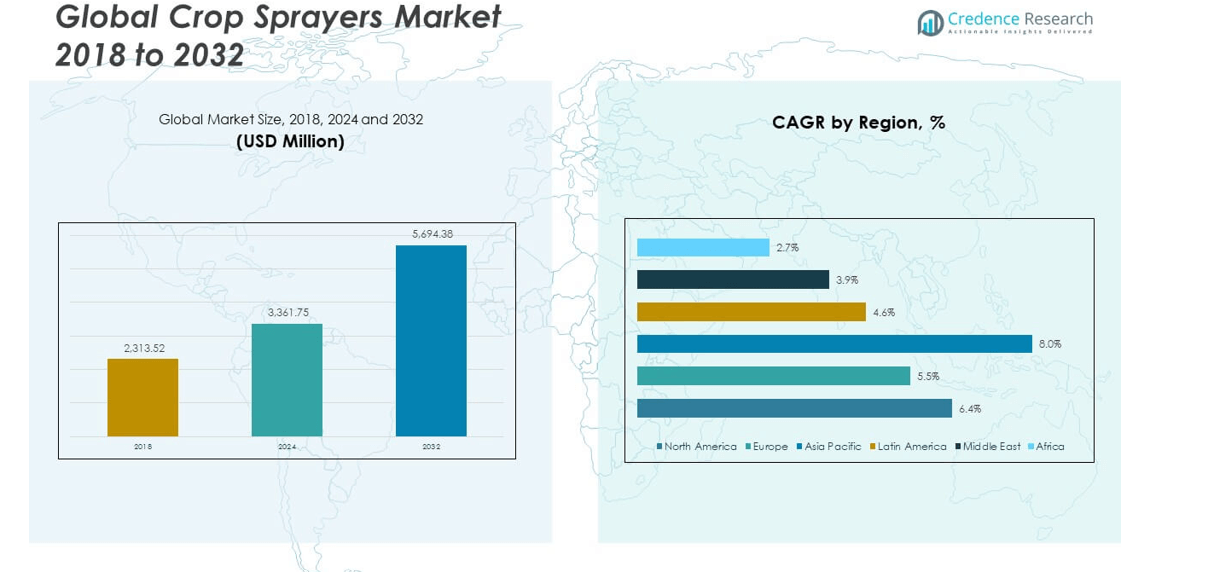

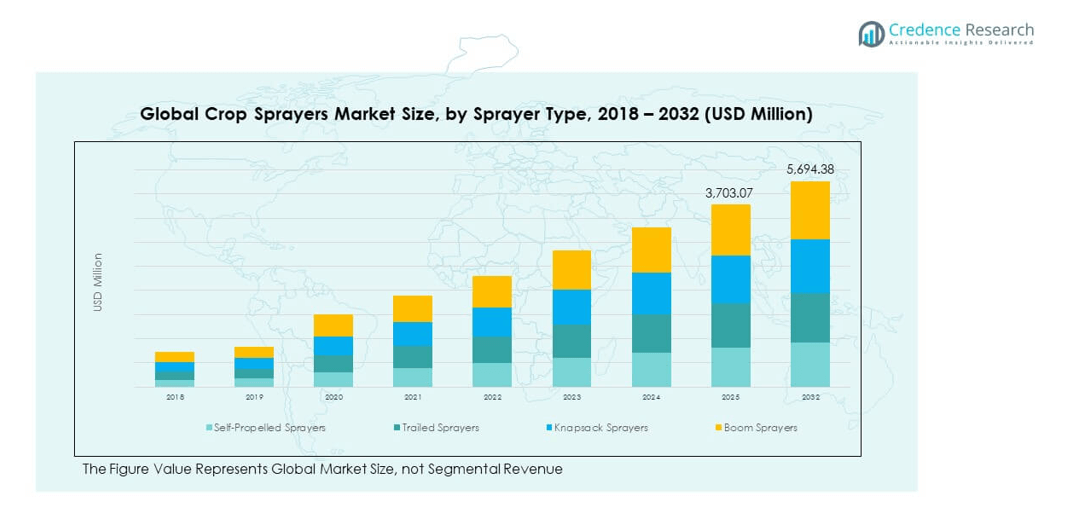

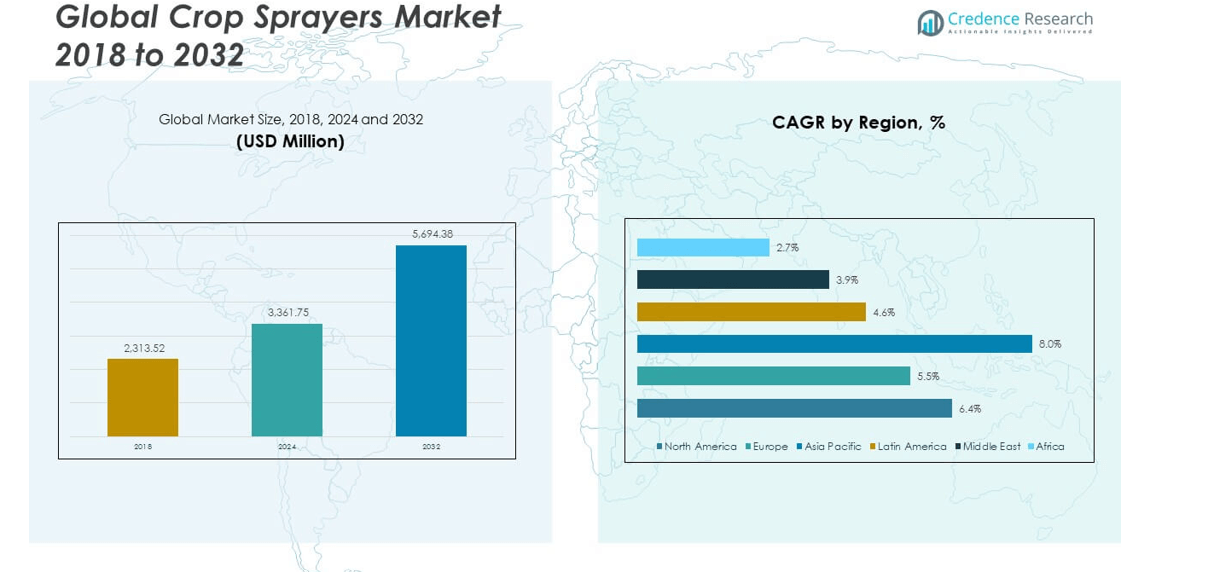

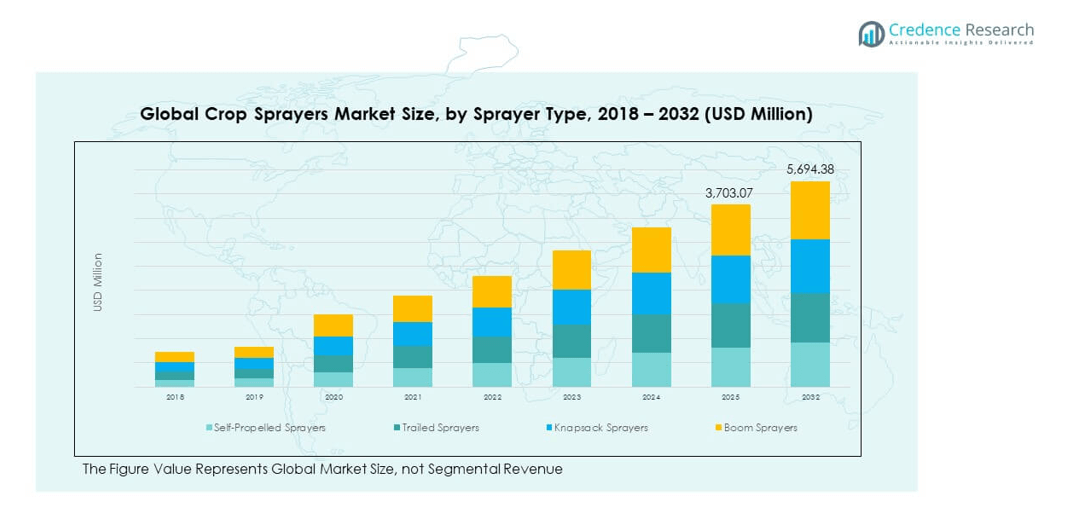

The Global Crop Sprayers Market size was valued at USD 2,313.52 million in 2018 to USD 3,361.75 million in 2024 and is anticipated to reach USD 5,694.38 million by 2032, at a CAGR of 6.34% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Crop Sprayers Market Size 2024 |

USD 3,361.75 million |

| Crop Sprayers Market, CAGR |

6.34% |

| Crop Sprayers Market Size 2032 |

USD 5,694.38 million |

The market is experiencing growth due to rising demand for agricultural mechanization and precision farming practices. Farmers are increasingly adopting crop sprayers to enhance productivity, reduce manual labor, and ensure uniform pesticide and fertilizer application. Growing food security concerns, coupled with government support for modern farming equipment, further strengthen adoption. Technological innovations such as drones and GPS-enabled sprayers are improving operational efficiency, while the shift towards sustainable farming practices is fueling demand for advanced spraying solutions across both developed and developing economies.

Regionally, North America and Europe lead the market due to established mechanized farming systems and the early adoption of precision agriculture technologies. Asia-Pacific is emerging as the fastest-growing region, driven by rising agricultural investments, large farming populations, and supportive government initiatives in countries such as India and China. Meanwhile, Latin America is witnessing increasing adoption, fueled by expanding agribusinesses and commercial farming, whereas regions like the Middle East and Africa are gradually adopting crop sprayers due to modernization efforts and growing focus on improving food production efficiency.

Market Insights:

- The Global Crop Sprayers Market was valued at USD 2,313.52 million in 2018, reached USD 3,361.75 million in 2024, and is projected to attain USD 5,694.38 million by 2032, growing at a CAGR of 6.34%.

- North America led with 27.4% share in 2024, supported by advanced mechanization; Europe followed with 17.1% due to strong sustainability policies; Asia Pacific ranked third with 13.0%, driven by farm modernization and rising food demand.

- Asia Pacific is the fastest-growing region with an 8.0% CAGR, supported by government subsidies, expanding agribusiness, and adoption of cost-effective spraying solutions across small and mid-sized farms.

- Self-propelled and boom sprayers together held nearly 65% of segment share in 2024, reflecting dominance in large-scale mechanized farming.

- Knapsack and trailed sprayers accounted for the remaining 35%, serving smallholders and cost-sensitive markets where affordability drives equipment choice.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Mechanization and Demand for Precision Agriculture Across Global Farming Practices

The Global Crop Sprayers Market is growing due to the widespread adoption of agricultural mechanization across both developed and developing economies. Farmers are shifting from manual practices to machine-based spraying solutions to ensure consistency in pesticide, herbicide, and fertilizer applications. It improves productivity, enhances crop protection, and reduces dependency on manual labor. Governments are promoting mechanized farming through subsidies and financial support for modern sprayer adoption. Precision agriculture practices, supported by sensors, GPS technology, and automated systems, strengthen demand for advanced crop sprayers. Farmers are adopting technologies that increase yield efficiency and reduce input wastage. The market continues to benefit from rising awareness of food security and sustainability.

- For example, John Deere’s R4045 self-propelled sprayer is equipped with Section Control technology, which automatically manages boom sections to reduce chemical overlap and improve precision. It also supports the ExactApply™ nozzle control system, enabling individual nozzle management for accurate chemical placement and minimized input wastage.

Expanding Global Food Demand and Agricultural Production Requirements

The rising global population is pushing demand for food production, which directly drives the use of efficient spraying equipment. The Global Crop Sprayers Market is experiencing strong adoption in large-scale farming operations that focus on maximizing output from limited arable land. It supports effective crop protection and balanced fertilizer distribution, which are crucial in addressing yield gaps. Increasing urbanization reduces cultivable land, creating the need for technology that enables higher productivity. Farmers are compelled to integrate crop sprayers to improve farm management efficiency. Investments in modern agriculture equipment ensure uniform crop growth and safeguard food supply. This rising pressure on production continues to push demand for reliable crop spraying solutions.

- For example, AGCO’s Fendt Rogator 600 is available with tank capacities of 5000 to 6000 liters and features advanced spraying technologies such as SectionControl, VariableRateControl, OptiSonic boom height management, and OptiNozzle systems, ensuring precise application and reduced input waste.

Strong Government Policies and Subsidy Programs Supporting Modern Agriculture

Government initiatives and supportive regulatory frameworks play a vital role in accelerating the adoption of advanced crop sprayers. The Global Crop Sprayers Market benefits from subsidies, tax benefits, and low-interest loans that encourage farmers to upgrade their equipment. It provides opportunities for both small-scale and large-scale farmers to transition from traditional methods to automated spraying solutions. Policies promoting sustainable agriculture create incentives for adopting sprayers that reduce chemical usage. Many developing nations are channeling funds into mechanization to increase rural productivity and food availability. The market experiences further growth due to schemes that link equipment manufacturers with farmers. Strong government backing ensures steady market expansion across regions.

Technological Advancements and Integration of Smart Features in Sprayers

Continuous technological progress in spraying equipment is shaping the Global Crop Sprayers Market. Smart features such as drone-based sprayers, GPS-enabled control systems, and automated nozzles are improving the efficiency of crop management. It reduces resource wastage and allows precise application of chemicals across large farmlands. Manufacturers are investing in R&D to introduce innovations that lower operational costs and optimize yields. Farmers benefit from solutions that enable data-driven decisions and reduce environmental risks. Increased adoption of unmanned aerial vehicles and IoT-integrated spraying technologies highlights the pace of innovation. This technological transformation is positioning crop sprayers as critical tools for sustainable agriculture.

Market Trends

Growing Popularity of Drone-Based Sprayers for Large-Scale Agricultural Applications

The Global Crop Sprayers Market is witnessing rising adoption of drones for spraying applications in large and mid-sized farms. Farmers prefer drones because they can cover larger areas in less time and with minimal labor involvement. It ensures precise spraying and reduces exposure to harmful chemicals. The ability to operate in varied terrains strengthens the appeal of drones for both developed and emerging markets. Increasing affordability and regulatory approvals are pushing drone adoption in agriculture. Farmers benefit from aerial monitoring and data integration with crop health management systems. This trend signals the increasing role of unmanned technology in farming practices.

- For example, DJI’s Agras T40 is documented by the company to achieve an average spraying efficiency of 21.33 hectares per hour under test conditions, supported by its high-capacity dual atomized spraying system and intelligent flight control features.

Integration of IoT and AI-Driven Solutions in Spraying Equipment

IoT-enabled sensors and AI-based analytics are becoming integral to advanced spraying equipment. The Global Crop Sprayers Market is adopting smart systems that optimize the timing, dosage, and distribution of chemicals. It helps farmers reduce wastage, cut costs, and ensure precise treatment of crops. AI algorithms analyze field data to guide real-time spraying decisions. Manufacturers are embedding these technologies into handheld, mounted, and aerial sprayers. The growing focus on automation and smart farming tools is reshaping product design and adoption. Farmers view IoT-driven tools as essential for achieving sustainable and cost-efficient farming operations.

- For example, John Deere’s ExactApply® technology features pulse-width modulation with individual nozzle control, enabling precise droplet sizing and reducing over-application, drift, and input wastage. It has been documented to deliver input savings of 2–5% and improve spraying efficiency across varied field conditions.

Rising Adoption of Electric and Battery-Powered Crop Sprayers in Farming Operations

Sustainability concerns and the need for energy efficiency are driving interest in electric crop sprayers. The Global Crop Sprayers Market is shifting towards battery-operated equipment that reduces dependency on fossil fuels. It provides quieter operations, lower emissions, and reduced maintenance requirements compared to conventional models. Farmers are choosing electric sprayers for small and medium-scale farms due to cost-effectiveness and ease of use. Manufacturers are improving battery capacity to extend operating hours and enhance efficiency. Regulatory pressures on emission reduction further support this trend. This shift marks a transition toward eco-friendly agricultural practices.

Increasing Demand for Customization and Flexible Spraying Equipment Solutions

Farmers are demanding crop sprayers that meet specific crop and field requirements. The Global Crop Sprayers Market is moving toward customizable solutions that adapt to diverse farm conditions. It encourages manufacturers to offer adjustable nozzles, variable spray rates, and modular sprayer attachments. Farmers are seeking equipment that balances affordability with performance. Customization ensures that both smallholders and large commercial farms achieve optimal efficiency. This trend aligns with the broader push toward farm-specific mechanization strategies. It strengthens the role of manufacturers in offering innovative and adaptable designs for global agriculture.

Market Challenges Analysis

High Initial Investment and Affordability Barriers for Small-Scale Farmers

The Global Crop Sprayers Market faces challenges due to the high cost of advanced equipment, limiting adoption among small and marginal farmers. It requires significant capital investment, which many farmers in developing nations cannot afford without subsidies. Limited access to financing and credit facilities further restricts adoption. High operational costs for advanced models also discourage use in regions with low farm incomes. Manufacturers face difficulties in addressing affordability without compromising product quality. The lack of awareness of long-term efficiency benefits slows the transition from manual to mechanized spraying. These financial barriers hinder widespread market penetration.

Limited Infrastructure, Training Gaps, and Concerns Regarding Chemical Use

Infrastructure limitations, lack of farmer training, and concerns about environmental impacts present challenges to the Global Crop Sprayers Market. It struggles with uneven adoption in regions with inadequate distribution and after-sales service networks. Many farmers lack training to operate advanced sprayers, leading to improper use and reduced effectiveness. Overuse of chemicals during spraying raises concerns regarding soil health and food safety. Regulatory restrictions on pesticide usage further complicate adoption. Farmers in remote areas continue to rely on traditional methods due to lack of awareness. Weak logistics and service support reduce overall efficiency of equipment deployment. These gaps slow down the pace of modernization.

Market Opportunities

Expanding Role of Smart and Sustainable Farming Solutions in Agriculture

The Global Crop Sprayers Market is gaining opportunities from the rising integration of smart and eco-friendly solutions in farming. It benefits from increasing investments in precision agriculture that emphasize sustainability and cost efficiency. Farmers are adopting digital platforms that connect with advanced sprayers to improve decision-making. Growing demand for equipment that supports organic and chemical-free practices is creating new prospects. Manufacturers are designing sprayers that use minimal water and chemical inputs. The market is positioned to serve future farming systems that balance productivity with sustainability.

Growing Demand in Emerging Economies with Expanding Agricultural Mechanization

Emerging markets in Asia-Pacific, Latin America, and Africa present significant opportunities for the Global Crop Sprayers Market. It benefits from government initiatives that encourage mechanization to boost rural productivity. Farmers in these regions are increasingly adopting modern equipment to address food demand. Rising agribusiness investments and rural development programs further expand market potential. Growing awareness of efficiency benefits strengthens adoption rates. These regions represent untapped opportunities for manufacturers seeking long-term growth. The combination of modernization, investment, and population growth creates fertile ground for crop sprayer adoption.

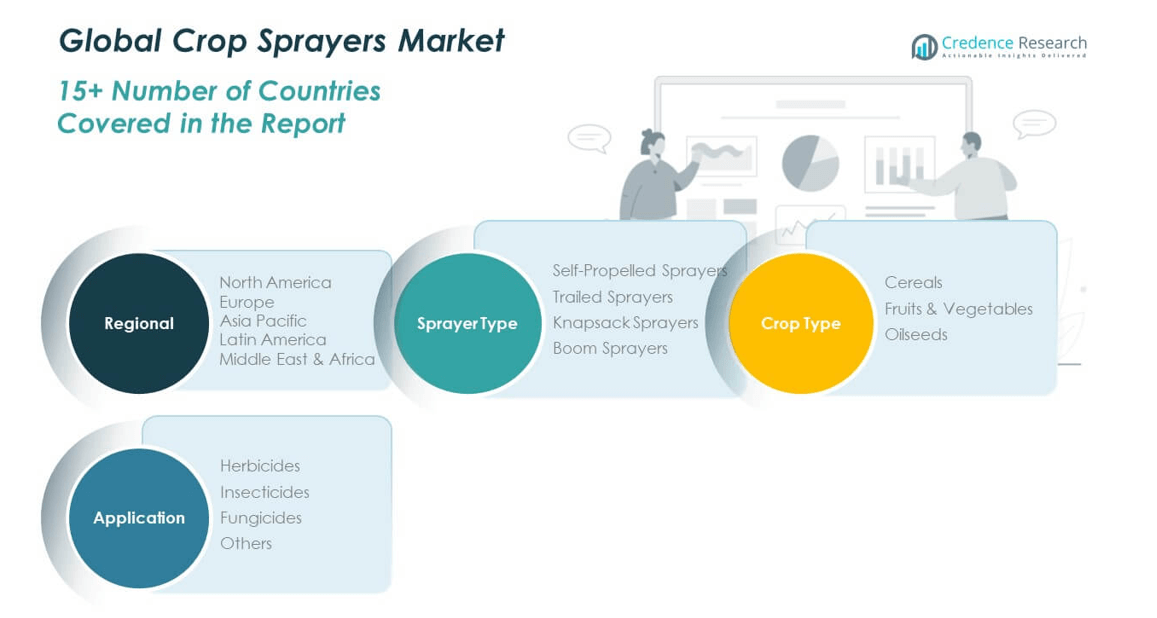

Market Segmentation Analysis:

The Global Crop Sprayers Market is segmented by sprayer type, crop type, and application, reflecting diverse adoption patterns across farming practices.

By sprayer type, self-propelled sprayers dominate large-scale commercial farming due to high efficiency and advanced precision features, while trailed sprayers remain popular in medium-sized farms for their balance of cost and performance. Knapsack sprayers serve small and marginal farmers, offering affordability and flexibility for limited landholdings. Boom sprayers continue to gain preference in mechanized farming regions for wide coverage and consistent chemical application. It highlights how equipment choice aligns with farm size, investment capacity, and productivity needs.

By crop type, cereals hold a major share, driven by their role in staple food production and the need for high-volume spraying to protect yield. Fruits and vegetables represent a growing segment due to rising demand for quality produce and the need for intensive pest and disease management. Oilseeds are gaining traction in global trade, which strengthens demand for efficient spraying to maintain crop health and export standards.

- For example, Solo’s backpack sprayers, available with 15–20-liter tank capacities, are widely used in orchards and vegetable plots for precise application of fungicides and insecticides, ensuring targeted coverage and effective crop protection.

By application, herbicides account for significant use as farmers focus on effective weed control to optimize soil nutrients. Insecticides support crop protection against pest outbreaks, particularly in tropical regions, while fungicides are essential in high-humidity zones prone to plant diseases. Other applications cover specialized spraying practices tailored to local crop requirements. This segmentation underlines the structural diversity within the market, where each category plays a strategic role in shaping adoption patterns and growth potential.

- For example, John Deere’s See & Spray Select technology uses computer vision to detect and spray only weeds in fallow fields, cutting herbicide use by up to 77%. It has been factory-installed on 400/600 Series sprayers since 2023, enhancing efficiency and reducing input costs.

Segmentation:

By Sprayer Type

- Self-Propelled Sprayers

- Trailed Sprayers

- Knapsack Sprayers

- Boom Sprayers

By Crop Type

- Cereals

- Fruits & Vegetables

- Oilseeds

By Application

- Herbicides

- Insecticides

- Fungicides

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Global Crop Sprayers Market size was valued at USD 1,020.80 million in 2018 to USD 1,468.07 million in 2024 and is anticipated to reach USD 2,493.56 million by 2032, at a CAGR of 6.4% during the forecast period. North America accounts for 27.4% of the global market share in 2024, driven by advanced mechanization and strong adoption of precision agriculture. The region benefits from widespread use of self-propelled and boom sprayers in large-scale commercial farms. It is supported by government policies encouraging sustainable farming practices and reduced chemical wastage. Leading manufacturers in the U.S. and Canada continue to innovate with GPS-enabled and drone-based sprayers. Farmers prioritize efficiency, labor reduction, and crop protection, which strengthens equipment demand. The rising focus on food security and climate resilience creates growth opportunities. Technological leadership positions North America as a core market for advanced spraying solutions.

Europe

The Europe Global Crop Sprayers Market size was valued at USD 655.01 million in 2018 to USD 917.41 million in 2024 and is anticipated to reach USD 1,462.86 million by 2032, at a CAGR of 5.5% during the forecast period. Europe contributes 17.1% of the global market share in 2024, with demand driven by sustainable agriculture policies and high regulatory standards. The region emphasizes eco-friendly spraying practices, supported by strict restrictions on pesticide use. It is witnessing increased adoption of electric and battery-powered sprayers to meet environmental targets. Farmers in Germany, France, and the UK are integrating digital technologies to optimize spraying efficiency. The presence of leading European manufacturers further strengthens product innovation. Strong demand for organic food production supports adoption of advanced spraying solutions. Europe remains a hub for sustainability-led innovations in sprayer design and functionality.

Asia Pacific

The Asia Pacific Global Crop Sprayers Market size was valued at USD 442.67 million in 2018 to USD 697.48 million in 2024 and is anticipated to reach USD 1,338.83 million by 2032, at a CAGR of 8.0% during the forecast period. Asia Pacific holds 13.0% of the global market share in 2024 and is the fastest-growing regional market. The region benefits from expanding agricultural investments in China, India, and Southeast Asia. It is driven by government initiatives promoting farm mechanization and higher crop yields. Farmers are increasingly adopting knapsack and trailed sprayers in small to mid-sized farms. The rapid growth of agribusiness and food demand fuels adoption of modern spraying systems. Manufacturers are introducing cost-effective solutions tailored to local needs. Rising awareness of productivity and resource efficiency accelerates mechanization in developing economies. Asia Pacific is expected to lead global growth due to its scale and agricultural intensity.

Latin America

The Latin America Global Crop Sprayers Market size was valued at USD 104.65 million in 2018 to USD 150.09 million in 2024 and is anticipated to reach USD 223.71 million by 2032, at a CAGR of 4.6% during the forecast period. Latin America represents 2.8% of the global market share in 2024, with Brazil and Argentina being the largest contributors. The region is experiencing rising adoption of crop sprayers in commercial farming of cereals and cash crops. It is supported by expansion in soybean and sugarcane cultivation. Farmers focus on improving efficiency in large farms through boom and self-propelled sprayers. Growing agribusiness investment strengthens demand for advanced spraying solutions. Local manufacturers and global suppliers compete to meet increasing needs. Awareness of environmental sustainability is encouraging adoption of modern spraying practices. Latin America continues to evolve as a promising market with untapped growth opportunities.

Middle East

The Middle East Global Crop Sprayers Market size was valued at USD 60.69 million in 2018 to USD 80.10 million in 2024 and is anticipated to reach USD 112.91 million by 2032, at a CAGR of 3.9% during the forecast period. The region holds 1.5% of the global market share in 2024, with demand concentrated in GCC countries, Israel, and Turkey. It is characterized by limited arable land and a strong focus on improving agricultural productivity. Farmers adopt modern sprayers to maximize crop yield in resource-constrained environments. Government investments in food security projects support mechanization in farming. The region imports most advanced equipment due to limited local manufacturing. Precision agriculture practices are gradually expanding in commercial farming. Rising interest in sustainable food production creates opportunities for high-efficiency sprayers. The Middle East market remains niche but strategically significant due to food self-sufficiency goals.

Africa

The Africa Global Crop Sprayers Market size was valued at USD 29.69 million in 2018 to USD 48.60 million in 2024 and is anticipated to reach USD 62.50 million by 2032, at a CAGR of 2.7% during the forecast period. Africa accounts for 0.9% of the global market share in 2024, with South Africa and Egypt being leading contributors. The market is at an early stage of mechanization with reliance on knapsack and basic sprayers. It is driven by growing food demand and government support for agricultural modernization. Farmers face challenges in affordability and access to financing. Adoption is higher in commercial farms compared to smallholders. International suppliers play a dominant role in meeting equipment needs. Awareness programs and subsidies are gradually improving adoption levels. Africa remains an emerging market with long-term potential for crop sprayers as modernization accelerates.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- John Deere

- CNH Industrial

- Kubota Corporation

- AGCO Corporation

- Mahindra & Mahindra Ltd.

- Bucher Industries

- Yamaha Motor Company

- Jacto Group

- Alamo Group Inc.

- Arag MAQ S.L.

Competitive Analysis:

The Global Crop Sprayers Market is highly competitive with the presence of multinational corporations and regional players focusing on innovation and expansion. Leading companies such as John Deere, CNH Industrial, Kubota Corporation, AGCO Corporation, and Mahindra & Mahindra dominate with strong product portfolios and extensive distribution networks. It is characterized by continuous investment in research to enhance precision, automation, and sustainability features. Companies are pursuing mergers, acquisitions, and partnerships to strengthen market reach and technology leadership. Drone-based and IoT-enabled sprayers are emerging as focal points of competition, driving differentiation across offerings. Regional players, including Jacto Group and Arag MAQ S.L., maintain strong positions in localized markets through cost-effective solutions. Competitive intensity remains high, with strategic developments emphasizing product diversification and geographic expansion to capture emerging growth opportunities.

Recent Developments:

- In August 2025, Rantizo, Inc. announced the strategic sale of its drone spraying operations business to a specialized investment group, resulting in the new business name, American Autonomy, Inc. This acquisition enables an enhanced focus on software solutions like AcreConnect™, allowing American Autonomy to continue supporting the American spray drone industry and drone operators with robust management tools.

- In May 2025, Fieldin partnered with ARAG to expand access to precision crop spraying technology among U.S. permanent crop growers, an area where adoption rates average just 10%. This partnership will integrate Fieldin’s farm management data with ARAG’s equipment to enable “data-driven spraying” and better chemical flow measurement; for intance, Fieldin reports West Coast U.S. precision spraying adoption at 10% among permanent crops—please verify on Google.

- In January 2025, Ecorobotix launched the ARA Ultra-High Precision Sprayer, which was recognized as one of the World Ag Expo Top 10 New Products for 2025. The ARA sprayer features advanced AI Plant-by-Plant™ software, enabling precise and individualized treatment of crops, with accuracy down to 2.4×2.4 inches and reported reductions in chemical usage by up to 95%.

Market Concentration & Characteristics:

The Global Crop Sprayers Market shows moderate to high concentration, led by a few dominant multinational companies supported by a network of regional manufacturers. It is defined by continuous innovation, rising mechanization, and adoption of precision technologies. The market exhibits strong brand loyalty for established players in developed regions, while cost-sensitive economies rely on local manufacturers. Technological differentiation, regulatory compliance, and sustainability remain critical factors shaping competitive strategies. The presence of both premium and low-cost product segments reflects a balanced structure that supports diverse farm sizes and needs.

Report Coverage:

The research report offers an in-depth analysis based on sprayer type, crop type, and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Crop Sprayers Market will advance with increasing adoption of precision agriculture technologies.

- Rising integration of drones and IoT-enabled solutions will redefine spraying efficiency and crop monitoring.

- Demand for sustainable and eco-friendly spraying equipment will expand due to stricter environmental regulations.

- Growth in mechanization across emerging economies will create new opportunities for manufacturers.

- Product innovation in battery-powered and electric sprayers will strengthen the shift toward low-emission solutions.

- Large-scale farms will drive demand for self-propelled and boom sprayers to enhance operational productivity.

- Smallholder farmers will continue to adopt cost-effective knapsack and trailed sprayers supported by government subsidies.

- Global agribusiness expansion and rising food demand will sustain long-term growth in spraying solutions.

- Competitive intensity will increase as multinational leaders and regional players invest in product diversification.

- The market will remain influenced by regulatory frameworks that promote efficiency, safety, and sustainable farming practices.