Market Overview

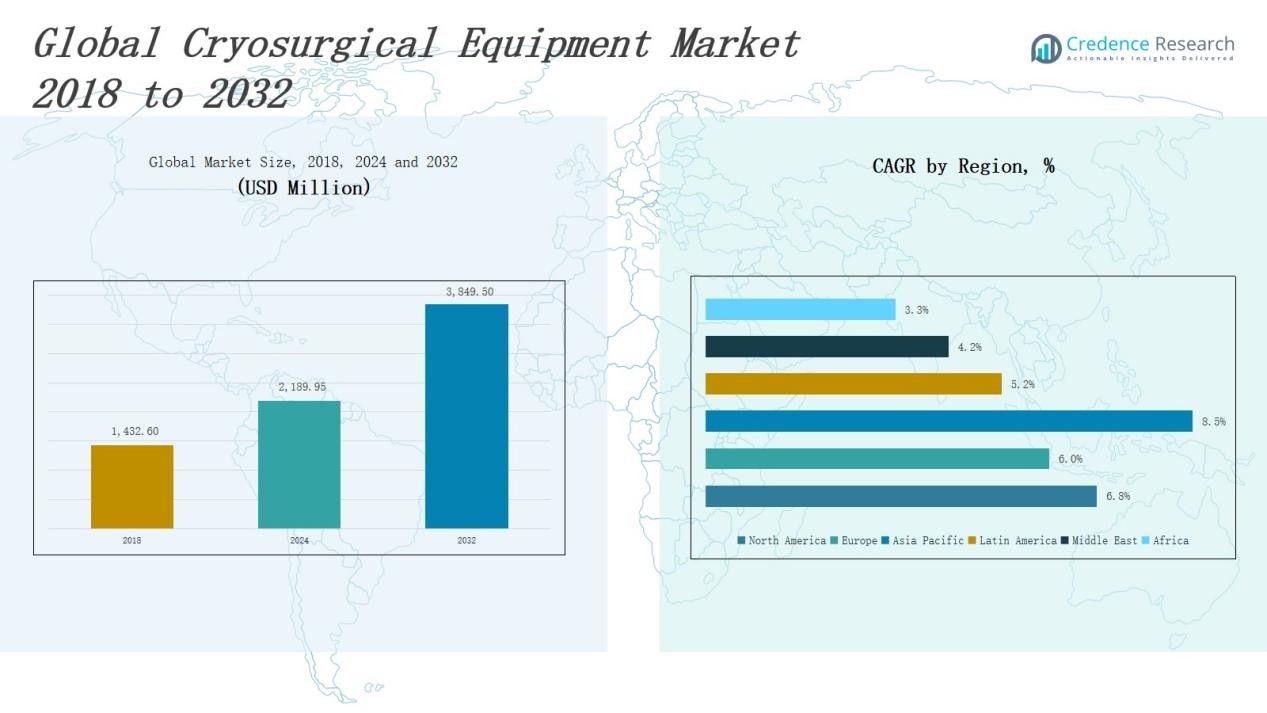

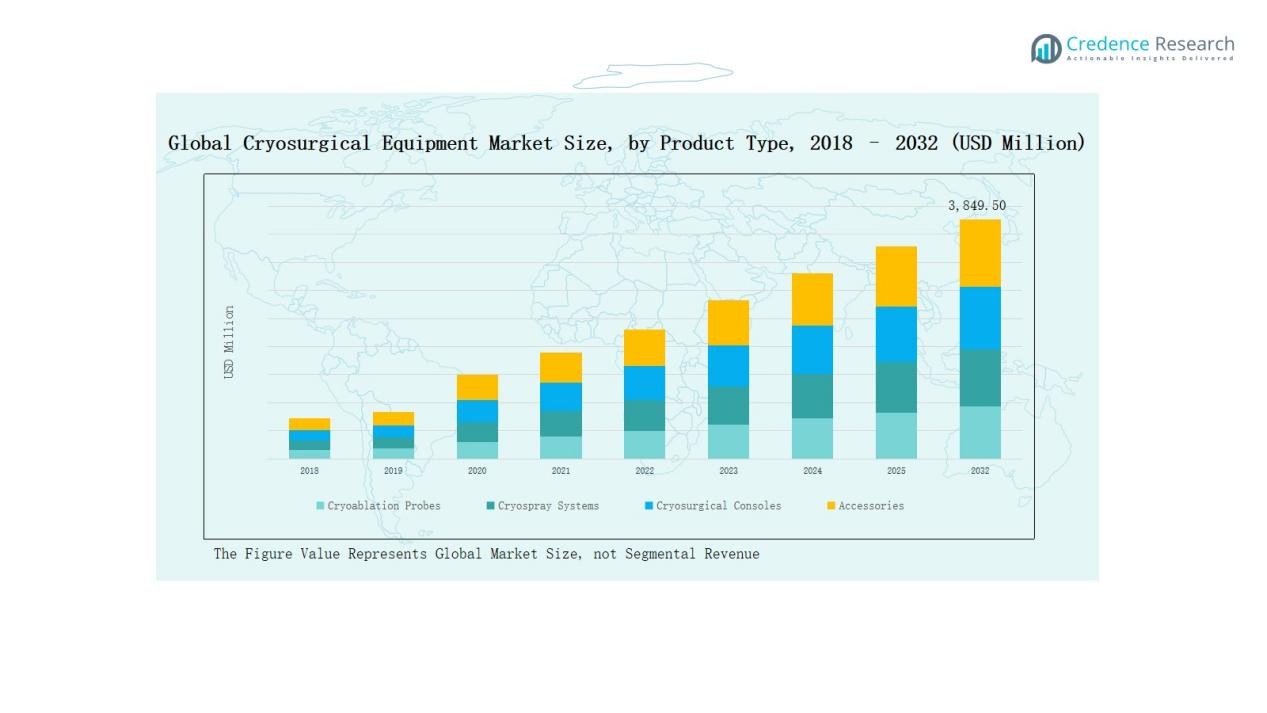

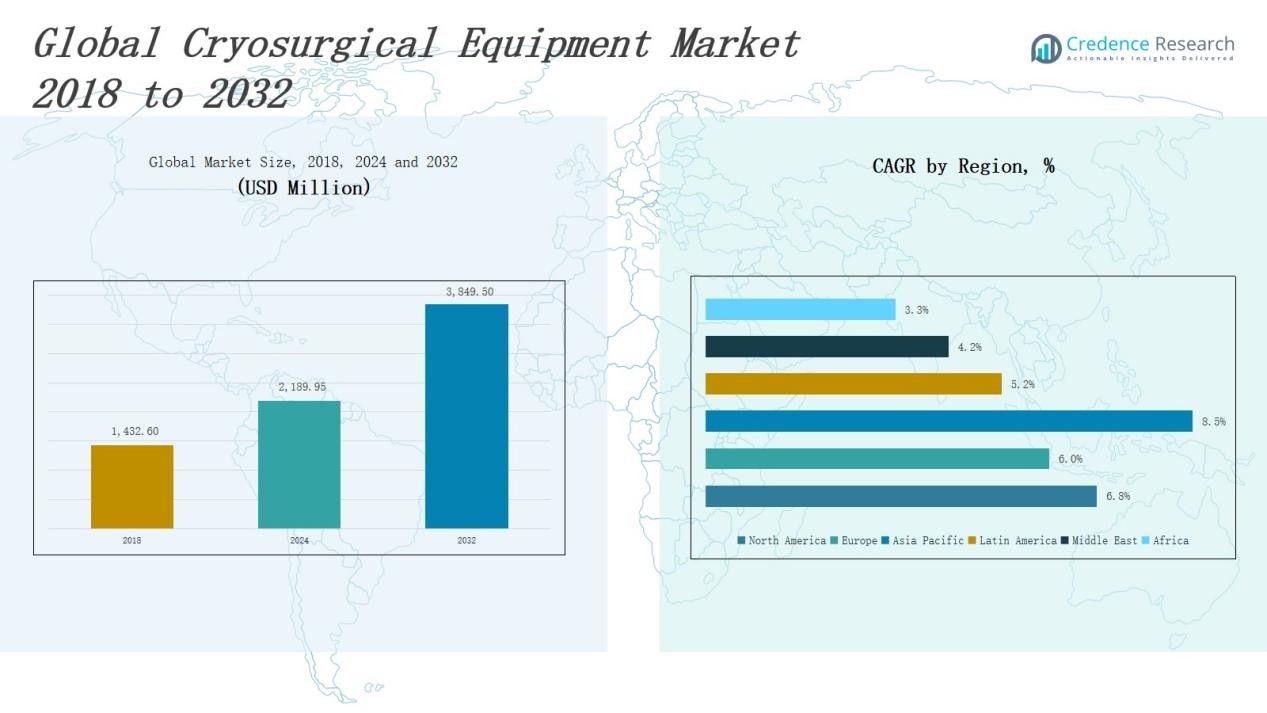

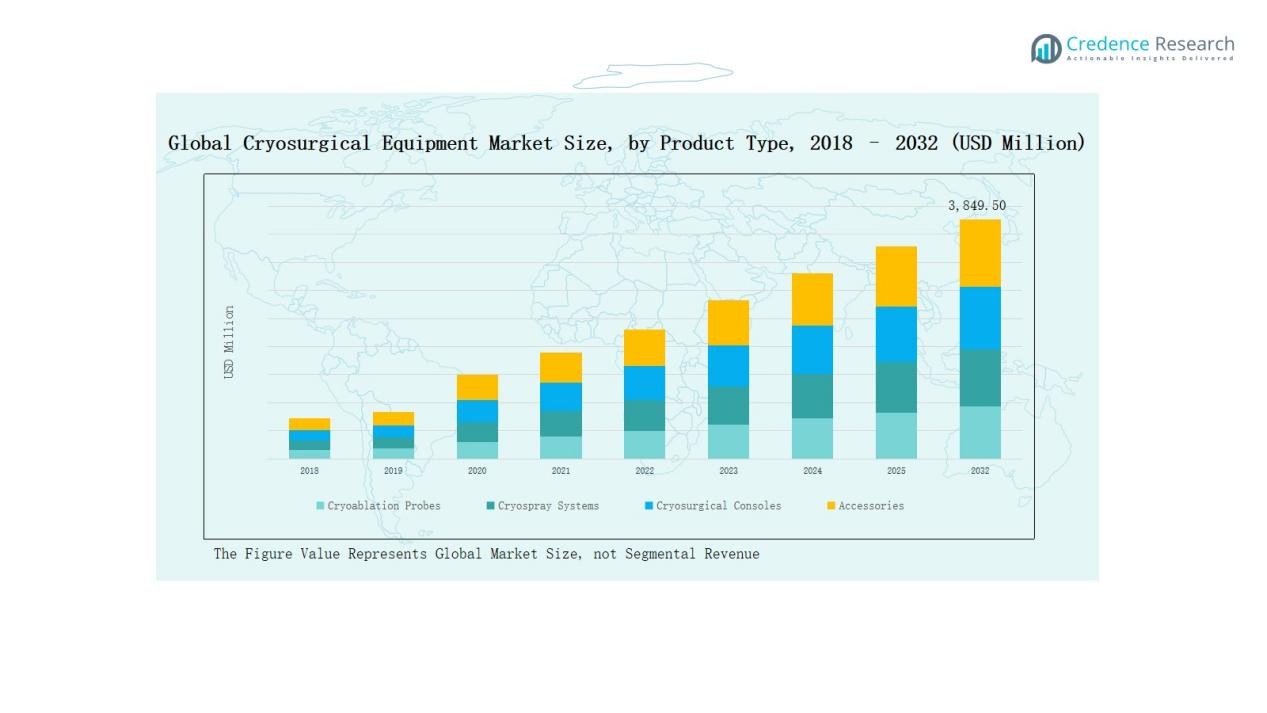

Cryosurgical Equipment Market size was valued at USD 1,432.60 million in 2018 to USD 2,189.95 million in 2024 and is anticipated to reach USD 3,849.50 million by 2032, at a CAGR of 6.80% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cryosurgical Equipment Market Size 2024 |

USD 2,189.95 Million |

| Cryosurgical Equipment Market, CAGR |

6.80% |

| Cryosurgical Equipment Market Size 2032 |

USD 3,849.50 Million |

The Cryosurgical Equipment Market is shaped by key players such as Wallach Surgical, WeMed, Brymill Cryogenic Systems, Princeton Cryo, Cryoalfa, MFI Medical, Bovie Medical, Cooltouch, CooperSurgical, and Cortex Technology. These companies compete through innovation in cryoablation probes, consoles, and cryospray systems, while strategic partnerships with hospitals and research institutes enhance clinical adoption. North America emerged as the leading region in 2024, commanding a 39% market share, supported by advanced healthcare infrastructure, high cancer prevalence, favorable reimbursement policies, and strong adoption of minimally invasive cryosurgical procedures.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Cryosurgical Equipment Market grew from USD 1,432.60 million in 2018 to USD 2,189.95 million in 2024 and is projected to reach USD 3,849.50 million by 2032 at 6.80% growth.

- Cryoablation probes led the product segment with 42% share in 2024, driven by precision in oncology and cardiovascular treatments, while consoles gained demand in hospitals and research facilities.

- Oncology dominated applications with 47% share in 2024, supported by effectiveness in treating cancers and strong clinical adoption, while dermatology followed with demand for skin lesion and wart treatments.

- Hospitals accounted for the largest end-user share at 55% in 2024 due to advanced infrastructure and skilled surgeons, while ambulatory surgical centers expanded through cost-effective outpatient-based procedures.

- North America led the global market with 39% share in 2024, supported by advanced healthcare infrastructure, favorable reimbursement, and strong cancer treatment adoption, followed by Europe at 25% and Asia Pacific at 18%.

Market Segment Insights

By Product Type

Cryoablation probes hold the largest share at 42% of the Cryosurgical Equipment Market in 2024. Their dominance stems from their precision in targeting tumors and abnormal tissues with minimal damage to surrounding cells. Growing adoption in oncology and cardiovascular treatments, coupled with technological advancements enabling better temperature control and improved catheter designs, sustains their leading position. Cryosurgical consoles follow with increasing demand from hospitals and research facilities for advanced treatment integration.

- For instance, Boston Scientific’s POLARx Cryoablation System, launched in Europe in 2021, features a balloon catheter designed for precise pulmonary vein isolation in atrial fibrillation procedures.

By Application

Oncology leads the market with a 47% share, driven by rising cancer incidence and the effectiveness of cryoablation in treating kidney, prostate, and liver cancers. Its ability to serve as a minimally invasive alternative to surgery attracts strong adoption. Dermatology follows as a significant application, supported by demand for removal of skin lesions, warts, and precancerous tissues. Expansion in oncology-focused clinical trials and favorable reimbursement policies further strengthen the segment’s market leadership.

- For instance, the IceCure Medical ProSense® Cryoablation System received a favorable FDA advisory panel recommendation in November 2024 for treating low-risk, early-stage breast cancer.

By End User

Hospitals account for the largest share at 55% of the Cryosurgical Equipment Market in 2024. Their dominance is attributed to extensive infrastructure, availability of skilled surgeons, and access to advanced cryosurgical consoles and probes. High patient inflow for oncology, dermatology, and gynecology procedures ensures hospitals remain the primary adopters. Ambulatory surgical centers are expanding steadily, supported by a preference for cost-effective, outpatient-based cryosurgical procedures with reduced recovery times.

Key Growth Drivers

Rising Cancer Incidence

The increasing global prevalence of cancer acts as a major driver for the cryosurgical equipment market. Cryoablation is gaining adoption as a minimally invasive option for treating prostate, kidney, liver, and lung cancers. Its ability to reduce surgical risks, minimize hospital stays, and preserve healthy tissues makes it highly effective. With cancer burden rising, especially in aging populations, healthcare providers are expanding the use of cryoablation systems. Favorable clinical trial outcomes and approvals further reinforce its growth trajectory in oncology applications.

- For instance, A five-year multicenter clinical trial (ECLIPSE) evaluated Endocare’s cryoablation for patients with metastatic pulmonary tumors, with results published in 2021 confirming its safety and efficacy for long-term local tumor control.

Growing Preference for Minimally Invasive Procedures

Patient demand for minimally invasive therapies supports strong adoption of cryosurgical equipment. Procedures involving cryoablation probes and cryospray systems offer reduced recovery times, minimal scarring, and lower post-operative complications compared to conventional surgery. Surgeons also benefit from enhanced precision and control in targeting tissues. Hospitals and ambulatory surgical centers increasingly integrate cryosurgery into routine care, reflecting broader healthcare trends favoring non-invasive solutions. This preference is expected to accelerate adoption, particularly in developed healthcare markets with advanced surgical infrastructure.

- For instance, the AtriCure CryoSPHERE probe has been widely adopted for post-operative pain management in cardiothoracic surgeries. It is used to perform a “Cryo Nerve Block” by temporarily ablating peripheral nerves, including intercostal nerves in the chest.

Technological Advancements in Cryoablation Devices

Continuous innovations in cryoablation probes, consoles, and imaging integration enhance treatment outcomes. Modern systems deliver improved temperature monitoring, real-time imaging guidance, and advanced catheter designs, leading to higher efficacy and safety. Integration of cryosurgical devices with robotic platforms and navigation software improves surgical precision, particularly in oncology and cardiology. Such advancements enable wider acceptance across specialties and expand the scope of cryosurgical applications. Manufacturers are investing heavily in R&D to differentiate offerings, strengthen portfolios, and capture growing demand across global markets.

Key Trends & Opportunities

Expansion into Dermatology and Gynecology

Beyond oncology, dermatology and gynecology are emerging as strong growth areas for cryosurgical equipment. Demand is rising for cryospray systems in treating warts, precancerous lesions, and benign growths. Gynecological cryotherapy procedures are increasingly applied for cervical dysplasia and other abnormalities, providing cost-effective outpatient care. With rising awareness and broader clinical acceptance, these applications offer significant opportunities for manufacturers to diversify product offerings and capture untapped patient populations. This expansion also aligns with the global shift toward preventive and outpatient-based treatments.

- For instance, Brymill Cryogenic Systems’ Cry-Ac® cryospray device is widely used by dermatologists for outpatient management of actinic keratoses and viral warts, offering precise liquid nitrogen delivery.

Adoption in Ambulatory Surgical Centers

Ambulatory surgical centers (ASCs) present a promising growth opportunity due to their focus on efficient, outpatient-based treatments. Cryosurgical equipment aligns well with ASC demand for cost-effective, minimally invasive solutions that enable same-day procedures. Rising healthcare cost pressures and patient preference for convenience are accelerating this shift. ASCs are increasingly equipped with cryoablation probes and compact consoles, expanding access beyond large hospitals. This trend highlights a growing market for portable, user-friendly cryosurgical systems tailored to decentralized care settings, especially in developed healthcare markets.

- For instance, IceCure Medical’s ProSense system, which has been in use for years with significant commercial milestones in 2023, utilizes real-time imaging for office-based, minimally invasive cryoablation to safely and quickly destroy tumors.

Key Challenges

High Equipment Costs

The high upfront cost of cryosurgical consoles and probes limits adoption, particularly in price-sensitive markets. Smaller hospitals and clinics often face budget constraints that restrict investment in advanced cryosurgical systems. Additionally, recurring costs related to consumables and maintenance add to financial pressure. This challenge is more pronounced in developing regions, where healthcare infrastructure and funding are limited. Cost remains a significant barrier to widespread adoption, compelling manufacturers to explore affordable solutions or financing models to improve accessibility.

Limited Awareness and Skilled Professionals

Despite proven benefits, awareness of cryosurgery among patients and general practitioners remains limited in many regions. The requirement for specialized training and expertise in using cryosurgical devices also restricts adoption. In low- and middle-income countries, shortages of trained surgeons and supporting staff further slow market penetration. Limited professional awareness reduces patient referrals to cryo-based therapies, confining usage primarily to large hospitals and specialized centers. Addressing this challenge will require targeted training programs and educational initiatives by industry players and healthcare institutions.

Reimbursement and Regulatory Barriers

Uncertain reimbursement frameworks and stringent regulatory requirements pose ongoing hurdles for the cryosurgical equipment market. In several countries, reimbursement policies for cryoablation procedures are unclear or insufficient, discouraging hospitals from adopting advanced systems. Obtaining regulatory approvals for new devices is also a lengthy and expensive process, delaying market entry. These barriers create disparities in access across regions and hinder manufacturers from achieving faster commercialization. Aligning regulatory standards and expanding reimbursement coverage will be critical for sustaining global growth in this market.

Regional Analysis

North America

North America dominates the Cryosurgical Equipment Market with a 39% share in 2024, reaching USD 956.35 million and projected to grow to USD 1,685.69 million by 2032 at a CAGR of 6.8%. The region benefits from advanced healthcare infrastructure, high adoption of minimally invasive procedures, and strong presence of key manufacturers. Rising cancer prevalence and favorable reimbursement policies further drive demand for cryoablation probes and consoles. The U.S. leads within the region due to extensive oncology and dermatology applications, while Canada and Mexico show steady growth with expanding healthcare investments.

Europe

Europe holds a 25% market share in 2024, valued at USD 604.68 million and expected to reach USD 1,001.32 million by 2032, growing at a CAGR of 6.0%. Strong adoption of cryosurgical systems in oncology, dermatology, and gynecology supports regional growth. Germany, the UK, and France lead due to technological advancements and established hospital networks. Regulatory frameworks ensuring safety and efficacy foster market confidence, while increased awareness of minimally invasive procedures strengthens adoption. Southern and Eastern Europe also contribute to expansion as healthcare modernization accelerates across emerging economies within the region.

Asia Pacific

Asia Pacific accounts for a 18% share in 2024, valued at USD 443.42 million, and is projected to reach USD 885.85 million by 2032, growing at the fastest CAGR of 8.5%. Rising cancer incidence, rapid healthcare infrastructure development, and increasing demand for affordable treatments drive growth. China, Japan, and India are the leading contributors, supported by government healthcare investments and clinical adoption of cryoablation devices. Growing medical tourism, particularly in South Korea and Southeast Asia, further enhances market potential. The region’s expanding population base and rising awareness of minimally invasive therapies position Asia Pacific as a key growth engine.

Latin America

Latin America represents a 7% market share in 2024, with the market reaching USD 102.15 million and expected to grow to USD 158.93 million by 2032 at a CAGR of 5.2%. Brazil leads the region, supported by a strong focus on oncology and dermatology applications. Increasing investments in healthcare infrastructure and broader availability of advanced surgical equipment are accelerating adoption. Argentina and Mexico show promising growth driven by expanding private healthcare facilities and medical tourism. However, uneven reimbursement structures and limited awareness remain challenges. Despite these barriers, gradual improvements in accessibility will support steady growth.

Middle East

The Middle East accounts for a 5% share in 2024, valued at USD 50.22 million, and is forecasted to reach USD 72.88 million by 2032 at a CAGR of 4.2%. The region’s growth is driven by increasing investments in healthcare modernization, particularly in the Gulf Cooperation Council (GCC) countries. Adoption is higher in oncology-focused treatments, with countries like the UAE and Saudi Arabia at the forefront of introducing advanced cryosurgical consoles. Israel contributes through technological innovations and clinical expertise. Broader adoption remains limited outside key hubs, but ongoing healthcare reforms provide future opportunities.

Africa

Africa holds the smallest share at 6% in 2024, valued at USD 33.12 million and expected to grow to USD 44.82 million by 2032, recording a CAGR of 3.3%. South Africa leads the region with its relatively advanced healthcare infrastructure and access to innovative therapies. Egypt and Nigeria are gradually adopting cryosurgical systems as awareness of minimally invasive procedures grows. However, market penetration remains low due to cost barriers, inadequate reimbursement, and limited availability of skilled professionals. International partnerships, donor-backed health initiatives, and government investments will be crucial in expanding access to cryosurgical technologies across Africa.

Market Segmentations:

By Product Type

- Cryoablation Probes

- Cryospray Systems

- Cryosurgical Consoles

- Accessories

By Application

- Oncology

- Dermatology

- Cardiology

- Gynecology

- Others

By End User

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Others

By Region

North America

Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Rest of Latin America

Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The Cryosurgical Equipment Market is moderately consolidated, with a mix of global manufacturers and regional players competing through technological innovation and product diversification. Leading companies such as Wallach Surgical, WeMed, Brymill Cryogenic Systems, CooperSurgical, Bovie Medical, and Cryoalfa dominate with strong product portfolios covering cryoablation probes, consoles, and cryospray systems. Their strategies focus on expanding applications in oncology and dermatology, while partnerships with hospitals and research institutes strengthen clinical adoption. Emerging players and distributors such as MFI Medical and Princeton Cryo emphasize cost-effective solutions and niche applications, catering to smaller healthcare facilities and ambulatory centers. Competition is driven by continuous advancements in device precision, integration with imaging technologies, and portable designs targeting outpatient care. Regional expansion into Asia Pacific and Latin America also reflects a key growth priority. Despite high entry barriers due to regulatory approvals and R&D costs, innovation in minimally invasive technologies creates opportunities for new entrants to carve niche positions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In May 2023, Cole-Parmer Instrument Company launched a new product named the Cryo-Blade, a powerful cryogenic grinder designed for sample processing in scientific and research applications.

- In 2025, H&O Equipment introduced the CryoPen X+, featuring interchangeable tips for treating multiple lesions—enhancing precision and versatility in dermatology and veterinary applications.

- On January 20, 2025, PSG (Dover Corporation) acquired Cryogenic Machinery Corp. (Cryo‑Mach), a designer and manufacturer of cryogenic centrifugal pumps and accessories used in cryogenic applications, including medical settings.

- In 2023, Medtronic launched a new-generation cryoablation system for cardiac arrhythmia, offering enhanced precision and improved safety features.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for cryoablation probes will continue to expand with rising cancer treatments.

- Adoption of cryospray systems will grow in dermatology and gynecology applications.

- Hospitals will remain the primary end users, supported by advanced infrastructure and patient inflow.

- Ambulatory surgical centers will gain traction due to preference for outpatient procedures.

- Technological innovations will improve device precision, safety, and integration with imaging systems.

- Portable and user-friendly cryosurgical consoles will see rising adoption in smaller facilities.

- Asia Pacific will emerge as the fastest-growing region, driven by healthcare expansion.

- North America and Europe will maintain leadership through established healthcare systems and high awareness.

- Regulatory harmonization and improved reimbursement policies will expand access in developing regions.

- Strategic collaborations between manufacturers and healthcare providers will shape future market competitiveness.