Market Overview

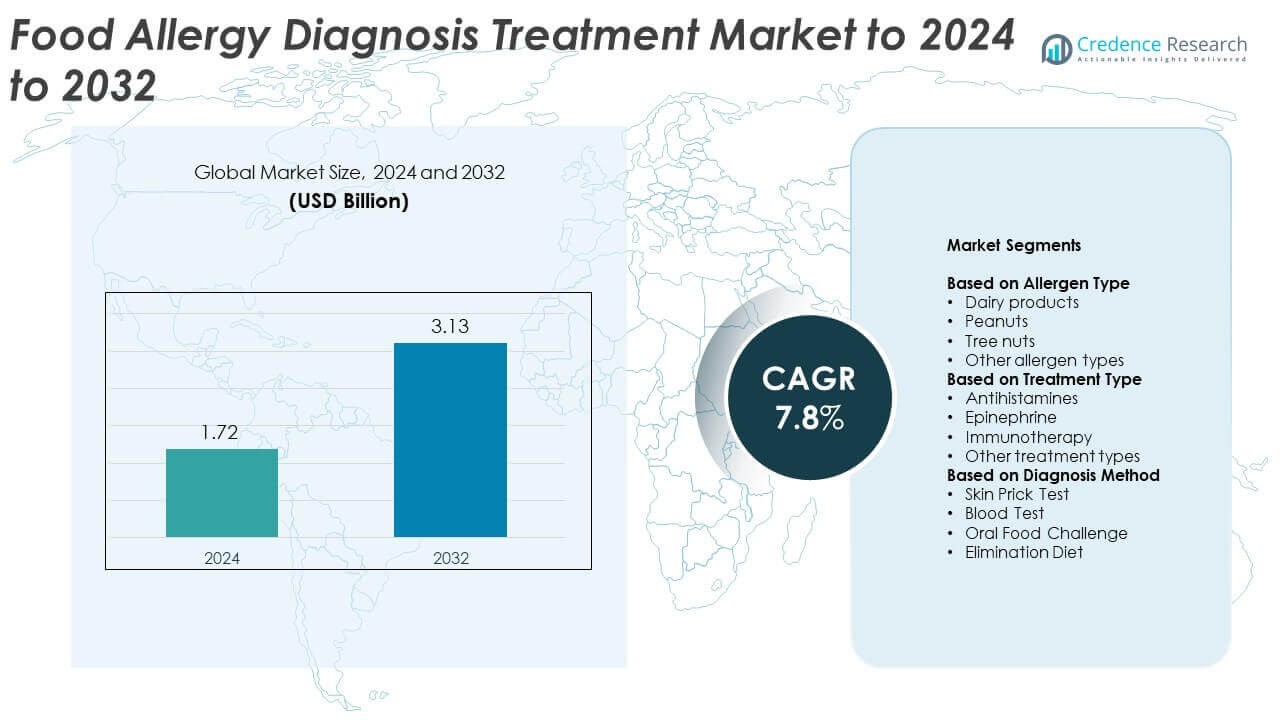

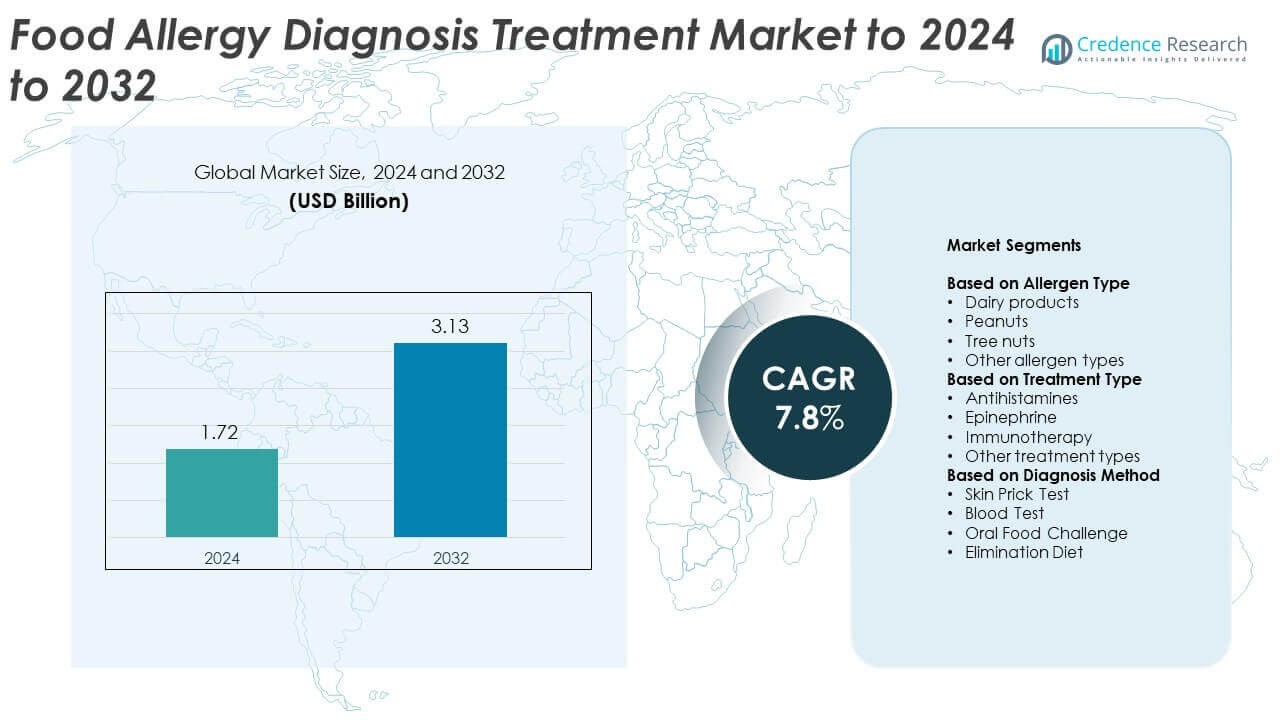

Food Allergy Diagnosis Treatment market size was valued at USD 1.72 billion in 2024 and is anticipated to reach USD 3.13 billion by 2032, at a CAGR of 7.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Allergy Diagnosis Treatment Market Size 2024 |

USD 1.72 Billion |

| Food Allergy Diagnosis Treatment Market, CAGR |

7.8% |

| Food Allergy Diagnosis Treatment Market Size 2032 |

USD 3.13 Billion |

The food allergy diagnosis and treatment market is led by major players such as Sanofi, Teva Pharmaceutical, Aimmune Therapeutics, DBV Technologies, Genentech, Celltrion, and Stallergenes Greer. These companies focus on developing advanced immunotherapies, biologics, and precise diagnostic technologies to enhance treatment outcomes. Strategic collaborations and product innovations are key factors driving their competitive advantage. North America dominated the global market in 2024 with a 39.8% share, supported by high healthcare spending and strong regulatory frameworks. Europe followed with 29.4%, while Asia-Pacific accounted for 21.7%, driven by growing allergy awareness and improved healthcare accessibility

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The food allergy diagnosis and treatment market was valued at USD 1.72 billion in 2024 and is projected to reach USD 3.13 billion by 2032, growing at a CAGR of 7.8%.

- Increasing prevalence of food allergies and rising awareness about early diagnosis are driving market demand, with peanut allergy accounting for 36.4% of the allergen type segment.

- Growing adoption of immunotherapy and digital diagnostic tools represents a key trend improving treatment accuracy and patient management.

- The market is competitive with companies investing in R&D, partnerships, and product innovation to enhance diagnostic precision and therapy accessibility.

- Regionally, North America led with a 39.8% share in 2024, followed by Europe at 29.4% and Asia-Pacific at 21.7%, supported by strong healthcare infrastructure and expanding awareness programs.

Market Segmentation Analysis:

By Allergen Type

The peanut segment dominated the food allergy diagnosis and treatment market in 2024 with a 36.4% share. This dominance stems from the high prevalence of peanut allergies, especially among children in North America and Europe. Increased awareness of severe anaphylactic reactions has led to greater adoption of advanced diagnostic tests and emergency therapies. Tree nut and dairy allergies follow due to rising cases of cross-reactivity and intolerance. Growing consumer focus on allergen labeling and preventive healthcare continues to boost diagnostic accuracy and treatment accessibility for multiple allergen types.

- For instance, DBV Technologies’ investigational Viaskin Peanut patch delivers 250 µg peanut protein daily (after an initial dose-finding period in some studies). The Phase 3 program EPITOPE evaluated efficacy using this dose in toddlers (ages 1–3 years) and met its primary endpoint. The ongoing VITESSE trial is evaluating the same 250 µg dose in children (ages 4-7 years). Data from open-label extension studies (like EPOPEX and PEOPLE) provide multi-year efficacy and safety information extending to 36 months or longer

By Treatment Type

The antihistamines segment held the largest market share of 41.7% in 2024, driven by their widespread use for mild-to-moderate allergic reactions. These medications are preferred for their quick relief, low cost, and over-the-counter availability. Epinephrine is also expanding rapidly as awareness of anaphylaxis management grows through auto-injector adoption. Increasing clinical research into oral and epicutaneous immunotherapies supports market diversification. Growing public education initiatives on emergency response and allergen desensitization further strengthen treatment uptake across global healthcare systems.

- For instance, Johnson & Johnson (Zyrtec/cetirizine) shows onset after a 10 mg dose in 20 minutes for 50% and within 1 hour for 95% of adults, with activity lasting 24 hours.

By Diagnosis Method

The skin prick test segment led the market with a 39.5% share in 2024, owing to its reliability, speed, and cost-effectiveness. This method remains the standard diagnostic tool for identifying IgE-mediated food allergies in clinical settings. Blood tests and oral food challenges are gaining ground for confirming complex or severe cases. Technological advancements in in-vitro testing and multiplex assays enhance diagnostic precision. Rising awareness of personalized allergy management and the growing number of certified allergy clinics are accelerating demand for comprehensive diagnostic solutions worldwide.

Key Growth Drivers

Rising Prevalence of Food Allergies

The growing global incidence of food allergies is a major factor driving market expansion. Increasing sensitization to allergens such as peanuts, tree nuts, and dairy products has created stronger demand for diagnostic accuracy and emergency treatments. Urbanization, lifestyle changes, and environmental exposure have heightened immune responses in children and adults. Healthcare systems are emphasizing early detection and standardized testing, which boosts adoption of skin prick and blood tests. This rising patient population continues to fuel consistent demand for effective allergy management solutions worldwide.

- For instance, Eurofins runs a global network of ISO 17025 allergen labs and reports hundreds of millions of clinical and analytical tests annually, supporting rising test demand.

Advancements in Diagnostic Technologies

Rapid innovation in allergy testing methods is significantly improving diagnostic reliability and speed. Advanced molecular assays, microarray testing, and multiplex immunoassays now enable clinicians to detect multiple allergens from a single sample. These tools reduce false positives and support personalized treatment planning. Automation and digital data integration also enhance laboratory efficiency. The growing availability of precise, non-invasive techniques is encouraging wider screening and early intervention, supporting continuous growth in the food allergy diagnosis segment.

- For instance, Siemens Healthineers’ ADVIA Centaur platforms process up to 240 tests/hour, enabling high-throughput IgE workflows and faster reporting.

Increased Awareness and Government Support

Expanding awareness programs by health organizations and regulatory bodies are promoting early diagnosis and treatment adherence. Governments across major economies are funding allergy education and implementing labeling regulations to minimize exposure risks. Schools and workplaces are adopting emergency preparedness protocols for anaphylactic reactions. These initiatives improve access to allergy care and encourage the use of epinephrine and antihistamine therapies. Combined with insurance coverage expansion, such policy efforts drive market development across both developed and emerging regions.

Key Trends & Opportunities

Rise of Immunotherapy and Desensitization Programs

Immunotherapy is gaining strong momentum as a long-term treatment for food allergies. Oral and sublingual desensitization methods help patients build tolerance to specific allergens over time. Growing clinical trials and FDA approvals of novel biologics are strengthening this trend. Pharmaceutical companies are also exploring peptide-based therapies and microbiome modulation. Increasing patient preference for sustainable treatment options over symptomatic relief is opening new revenue avenues in immunotherapy research and commercialization.

- For instance, Aimmune Therapeutics’ PTAH (Palforzia) uses a 300 mg daily maintenance dose; in PALISADE, active-treated participants significantly increased tolerated peanut protein versus placebo.

Integration of Digital Health Solutions

The adoption of mobile health apps and connected devices is transforming allergy management. Digital tools track allergic episodes, medication use, and dietary habits in real time. Cloud-based diagnostic data sharing improves collaboration between patients and specialists. Artificial intelligence and predictive analytics further enhance early detection accuracy. These innovations are expanding the reach of allergy monitoring and remote care, presenting major opportunities for technology-driven healthcare providers and diagnostics firms.

- For instance, Nima Partners’ peanut sensor detects ≥10 ppm peanut protein with ~98.7–99.2% accuracy reported at the device LOD, returning results in under 5 minutes.

Expansion in Emerging Markets

Developing regions such as Asia-Pacific and Latin America offer strong growth potential due to rising healthcare access and awareness. Increasing disposable incomes and modern dietary changes are raising food allergy prevalence. Multinational diagnostics companies are entering these markets through collaborations and affordable test offerings. Government initiatives promoting preventive healthcare and clinical infrastructure investment are also creating favorable conditions for allergy testing and treatment adoption.

Key Challenges

High Cost of Advanced Diagnostic and Treatment Options

Despite technological progress, allergy diagnosis and treatment remain expensive for many patients. Advanced molecular and multiplex testing can be costly, especially in regions with limited insurance coverage. Similarly, epinephrine auto-injectors and immunotherapy sessions impose recurring expenses. These high costs hinder large-scale adoption, particularly in low- and middle-income countries. Addressing affordability through cost-efficient production and policy support remains a critical challenge for market expansion.

Limited Standardization and Diagnostic Accuracy

Inconsistent diagnostic protocols across regions affect result accuracy and comparability. Variations in testing techniques and allergen extract quality often lead to misdiagnosis or underdiagnosis. Many healthcare facilities lack certified allergy specialists and updated laboratory infrastructure. This limits the effectiveness of existing diagnostic tools and slows clinical decision-making. Developing standardized global guidelines and improving practitioner training are essential to ensure consistent, high-quality diagnosis and treatment outcomes.

Regional Analysis

North America

North America dominated the food allergy diagnosis and treatment market in 2024 with a 39.8% share. The region’s strong position is supported by advanced healthcare infrastructure, high allergy awareness, and significant adoption of diagnostic testing. The United States leads due to widespread use of epinephrine auto-injectors and immunotherapy treatments. Regulatory initiatives promoting allergen labeling and school-based emergency response programs also drive growth. The presence of major pharmaceutical and diagnostics companies further supports innovation and accessibility, solidifying North America’s leadership in the global market.

Europe

Europe accounted for 29.4% of the market in 2024, driven by robust allergy management systems and high diagnostic adoption rates. Countries such as the United Kingdom, Germany, and France have strong clinical networks for allergy testing and patient education. The region emphasizes preventive measures through food labeling regulations and public health campaigns. Increasing investment in immunotherapy research and integration of digital diagnostic tools contribute to continued growth. Rising prevalence of food hypersensitivity and supportive reimbursement policies are further boosting Europe’s overall market performance.

Asia-Pacific

Asia-Pacific held a 21.7% share of the market in 2024 and is the fastest-growing region. The rising incidence of food allergies in children and adults, combined with growing healthcare awareness, drives strong demand for diagnostic services. Expanding medical infrastructure and urbanization in China, Japan, and India are key contributors. Increasing government initiatives toward food safety and healthcare modernization are fostering early diagnosis adoption. Additionally, partnerships between global diagnostics firms and local providers are improving accessibility, making Asia-Pacific a major contributor to future market expansion.

Latin America

Latin America captured a 5.6% share of the food allergy diagnosis and treatment market in 2024. The region is gradually expanding its allergy testing and treatment capabilities due to improving healthcare systems in Brazil, Mexico, and Argentina. Urbanization and dietary shifts are leading to increased food allergy cases. Limited diagnostic awareness and affordability still restrain wider adoption. However, ongoing collaborations between hospitals and international healthcare companies are enhancing testing infrastructure. Growing consumer health awareness and government focus on preventive care are expected to accelerate market growth.

Middle East and Africa

The Middle East and Africa accounted for 3.5% of the global market in 2024. Growth is primarily driven by rising allergy awareness, improving diagnostic capabilities, and increasing healthcare spending in Gulf countries and South Africa. Efforts to expand laboratory services and medical training programs are helping bridge the diagnostic gap. Despite lower adoption compared to developed regions, gradual improvements in access to epinephrine and antihistamine treatments are noticeable. Government-led health campaigns and private sector investments are expected to strengthen the region’s future market presence.

Market Segmentations:

By Allergen Type

- Dairy products

- Peanuts

- Tree nuts

- Other allergen types

By Treatment Type

- Antihistamines

- Epinephrine

- Immunotherapy

- Other treatment types

By Diagnosis Method

- Skin Prick Test

- Blood Test

- Oral Food Challenge

- Elimination Diet

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Key players in the food allergy diagnosis and treatment market include Sanofi, Teva Pharmaceutical, Aimmune Therapeutics, DBV Technologies, Genentech, Celltrion, ARS Pharma, Camallergy, Stallergenes Greer, AdvaCare, Hal Allergy, Kenvue, and Alerje. The market remains highly competitive, characterized by continuous product innovation, strategic alliances, and strong investment in research and development. Companies focus on expanding treatment portfolios, improving diagnostic precision, and developing immunotherapies that offer long-term desensitization benefits. Collaborations between pharmaceutical firms and clinical research organizations are enhancing global reach and accelerating clinical approvals. Emerging technologies in biologics, molecular testing, and patient monitoring are shaping competitive differentiation. Market participants are also strengthening regional distribution and leveraging digital platforms to expand accessibility. The increasing emphasis on regulatory compliance, safety standards, and patient-centric formulations further drives innovation, enabling companies to maintain a competitive edge in this rapidly evolving healthcare segment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sanofi

- Teva Pharmaceutical

- Aimmune Therapeutics

- DBV Technologies

- Genentech

- Celltrion

- ARS Pharma

- Camallergy

- Stallergenes Greer

- AdvaCare

- Hal Allergy

- Kenvue

- Alerje

Recent Developments

- In 2024, Novartis / Genentech’s Xolair (omalizumab) got FDA approved Xolair (omalizumab) for the reduction of allergic reactions, including anaphylaxis, in certain adults and children aged 1 year and older with food allergy (specifically IgE-mediated).

- In 2024, DBV Announces Positive Regulatory Updates for the Viaskin® Peanut Patch in the United States and Europe.

- In 2024, ARS Pharmaceuticals launched Neffy, an epinephrine nasal spray, in the US market.

Report Coverage

The research report offers an in-depth analysis based on Allergen Type, Treatment Type, Diagnosis Method and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising global awareness of food allergies.

- Demand for accurate diagnostic tools will grow with increasing allergy prevalence.

- Immunotherapy adoption will rise as long-term desensitization methods gain trust.

- Digital health platforms will enhance monitoring and treatment compliance.

- Pharmaceutical firms will focus on developing novel biologic therapies.

- Emerging markets will see strong growth due to better healthcare access.

- Regulatory support for allergen labeling will strengthen preventive care systems.

- Partnerships between diagnostics companies and clinics will improve test accessibility.

- Technological advances will drive precision and speed in allergy detection.

- Education programs will increase early diagnosis and reduce severe allergy risks