Market Overview:

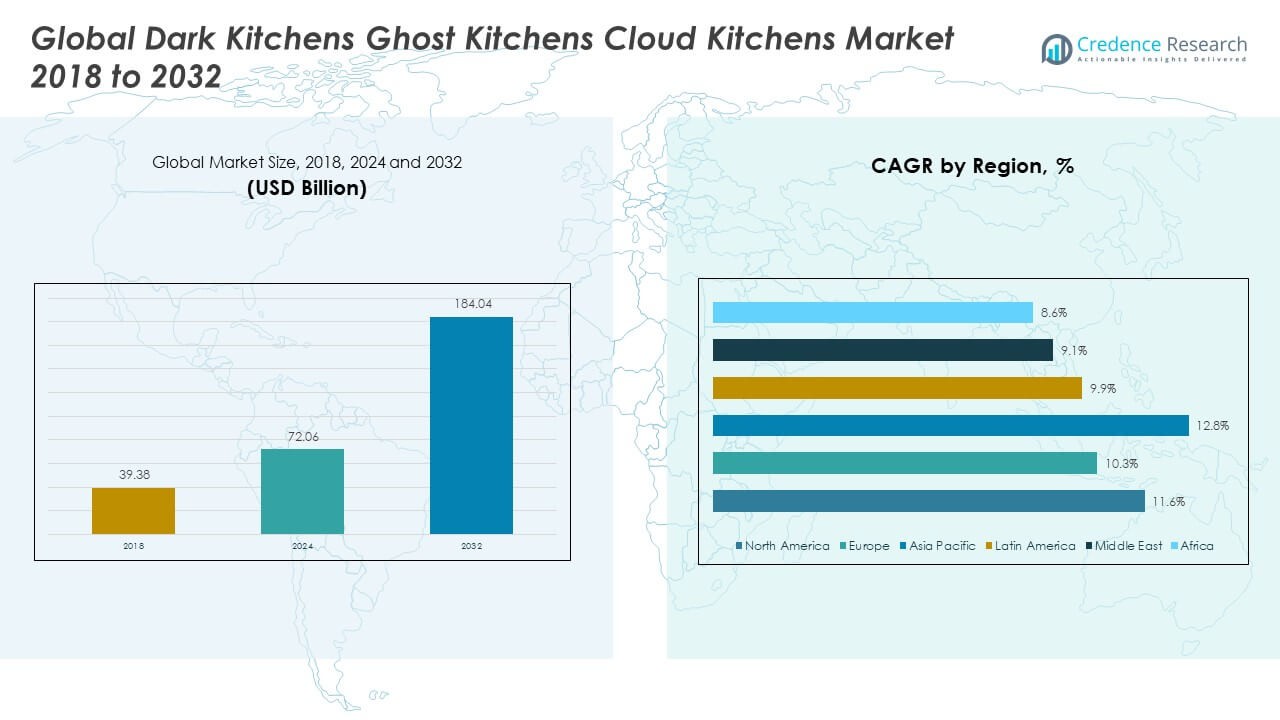

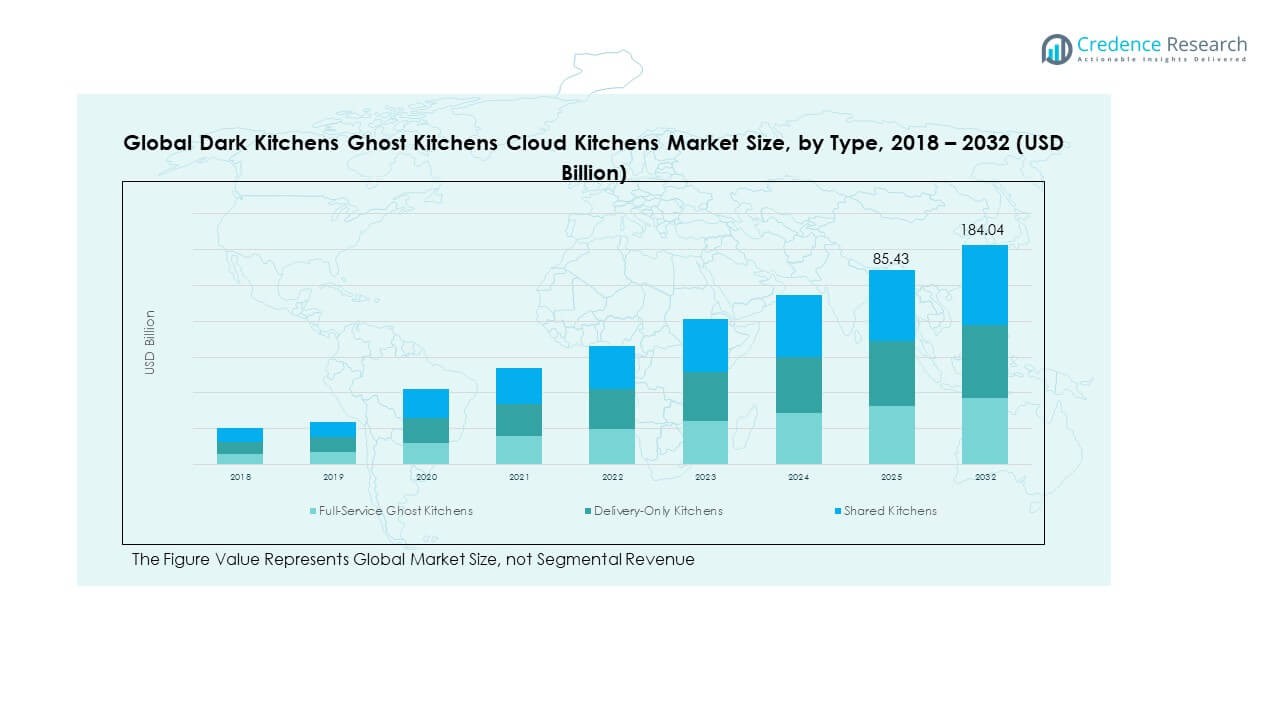

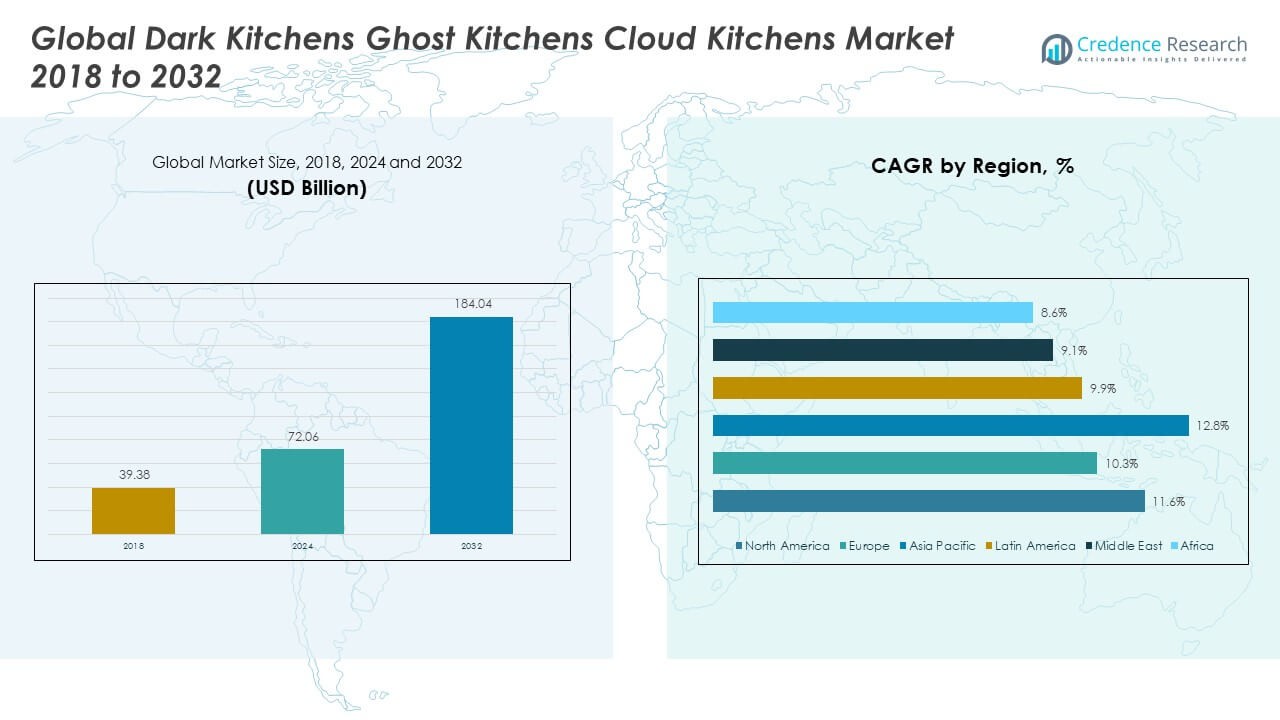

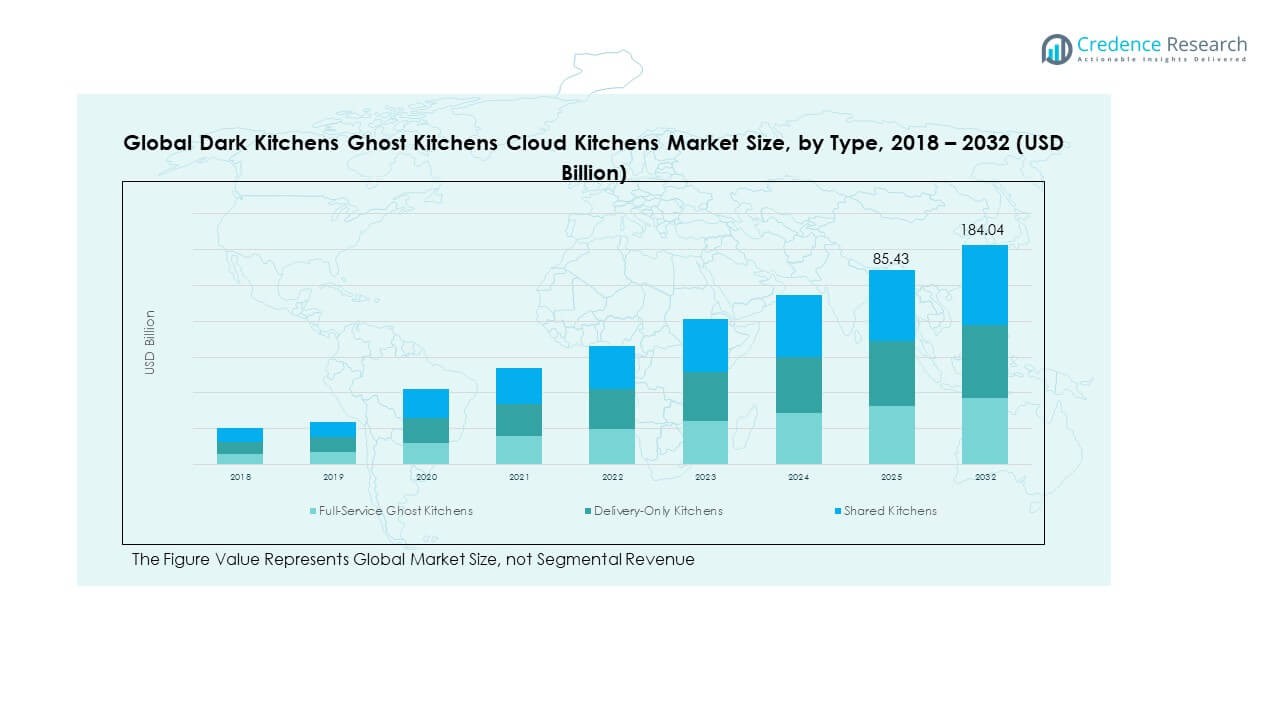

The Global Dark Kitchens Ghost Kitchens Cloud Kitchens Market size was valued at USD 39.38 billion in 2018 to USD 72.06 billion in 2024 and is anticipated to reach USD 184.04 billion by 2032, at a CAGR of 11.59% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dark Kitchens Ghost Kitchens Cloud Kitchens Market Size 2024 |

USD 72.06 Million |

| Dark Kitchens Ghost Kitchens Cloud Kitchens Market, CAGR |

11.59% |

| Dark Kitchens Ghost Kitchens Cloud Kitchens Market Size 2032 |

USD 184.04 Million |

The market is being driven by the rapid rise of online food delivery platforms, shifting consumer preference toward convenience, and the reduced overhead costs compared to traditional restaurants. Operators are increasingly leveraging technology for order management, kitchen automation, and virtual brand creation, which strengthens profitability. Growing urbanization, busy lifestyles, and demand for diverse cuisines are accelerating adoption, while investments from both established restaurant chains and new-age startups further support the growth momentum of this delivery-first dining model.

Geographically, North America and Europe are leading the adoption of ghost kitchens due to mature online food delivery infrastructure and high digital penetration. Asia-Pacific is emerging as the fastest-growing region, with countries like India and China experiencing rapid expansion driven by rising middle-class populations, smartphone usage, and food delivery app dominance. Meanwhile, the Middle East is gaining traction with its thriving hospitality sector and supportive investment climate, while Latin America shows steady growth fueled by evolving consumer eating habits and digital adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Dark Kitchens Ghost Kitchens Cloud Kitchens Market was valued at USD 39.38 billion in 2018, reached USD 72.06 billion in 2024, and is projected to hit USD 184.04 billion by 2032, growing at a CAGR of 11.59%.

- North America (42.19%), Asia Pacific (30.24%), and Europe (18.79%) held the top shares in 2024, driven by mature delivery ecosystems, strong digital infrastructure, and high consumer demand for convenience.

- Asia Pacific is the fastest-growing region with a 24% share, supported by rising middle-class consumption, expanding smartphone penetration, and strong aggregator dominance in markets like China and India.

- In 2024, Delivery-Only Kitchens accounted for 41% of the Global Dark Kitchens Ghost Kitchens Cloud Kitchens Market, making them the leading type segment due to their scalability and low overhead costs.

- Full-Service Ghost Kitchens represented 36%, while Shared Kitchens held 23%, reflecting rising adoption among startups and small-scale operators seeking flexible and cost-efficient entry models.

Market Drivers

Rising Consumer Preference for Convenience and On-Demand Food Choices

The Global Dark Kitchens Ghost Kitchens Cloud Kitchens Market is expanding due to consumers demanding fast, flexible, and convenient meal options. Growing urban populations and long working hours drive higher adoption of food delivery compared to dine-in. Customers prefer app-based ordering that offers a wide range of cuisines from multiple brands under one platform. It benefits households, professionals, and students who want time-saving food solutions. Rising smartphone penetration strengthens the ease of access to these services. Technology-enabled delivery infrastructure ensures reliable order fulfillment. Strategic partnerships between kitchens and delivery platforms improve customer experience. The combination of digital integration and lifestyle changes ensures consistent demand growth.

- For instance, Reef Technology partnered with Wendy’s in 2021 with plans to develop up to 700 delivery-only kitchens across the U.S., Canada, and the UK by 2025, and it has also collaborated with brands such as TGI Fridays and DJ Khaled’s Another Wing to expand its virtual restaurant portfolio.

Cost Efficiency and Operational Flexibility Attracting Restaurant Operators

Cost-saving opportunities act as a significant driver for operators. The Global Dark Kitchens Ghost Kitchens Cloud Kitchens Market benefits restaurants that avoid expenses linked to prime locations, décor, and front-of-house staff. It allows operators to redirect funds into technology, kitchen upgrades, and menu diversification. Businesses can operate multiple virtual brands from one kitchen, maximizing utilization. It offers scalability with relatively low financial risk. Demand fluctuations can be managed with flexible staffing and smaller facilities. Operators leverage data analytics to predict consumer behavior and optimize menus. The model supports quick market entry for new brands without requiring a physical storefront.

Expansion Supported by Digital Delivery Platforms and Technology Adoption

Technology integration strengthens growth across the Global Dark Kitchens Ghost Kitchens Cloud Kitchens Market. Delivery platforms provide visibility, marketing, and logistics that small brands cannot achieve independently. It creates a reliable ecosystem that connects customers and kitchens seamlessly. Artificial intelligence enhances order accuracy, delivery optimization, and menu personalization. Automation within kitchens ensures higher productivity and quality control. Cloud-based systems simplify supply chain management and inventory tracking. Smart kitchen equipment reduces waste and increases efficiency. The collaborative model between technology providers and operators accelerates adoption worldwide.

Growing Investments and Entry of Global Foodservice Leaders

Strong financial investments accelerate growth in the Global Dark Kitchens Ghost Kitchens Cloud Kitchens Market. Venture capital firms and multinational corporations recognize its long-term profitability. Established restaurant chains use ghost kitchens to test new menus or expand into new regions without major capital expenditure. Technology startups enter the market with innovative solutions that improve efficiency. Food delivery giants support these models with infrastructure, data sharing, and marketing. It attracts significant private equity interest, fueling international expansion. Strong investor confidence provides long-term stability and resources for scaling operations. Consumer familiarity with delivery-first dining enhances trust in new entrants.

- For instance, Brinker International’s Chili’s partnered with its own virtual brand It’s Just Wings, which generated over $170 million in first-year sales through ghost kitchens, marking one of the most significant entries into delivery-first dining.

Market Trends

Emergence of Multi-Brand and Hybrid Kitchen Models

The Global Dark Kitchens Ghost Kitchens Cloud Kitchens Market is witnessing the rise of hybrid and multi-brand operations. Single facilities host several virtual restaurants targeting different cuisines and demographics. It allows brands to diversify revenue streams while minimizing infrastructure costs. Operators create kitchen clusters in urban centers to reduce delivery time and maximize reach. Hybrid kitchens also combine delivery-only models with limited pickup counters to increase flexibility. Food aggregators are promoting co-branded offerings under one platform. Strong digital branding enables customers to view these virtual restaurants as distinct entities. The ability to test multiple formats strengthens adaptability to consumer demand.

- For instance, Kitopi, a UAE-based managed cloud kitchen platform, has built hybrid kitchen hubs that support 200+ partner brands, with operations enabled by centralized supply chain systems and advanced kitchen infrastructure to manage high-volume order fulfillment.

Integration of Sustainability Practices in Kitchen Operations

Sustainability is shaping the Global Dark Kitchens Ghost Kitchens Cloud Kitchens Market with eco-friendly practices gaining importance. Operators adopt energy-efficient equipment to lower operating costs and emissions. Packaging innovation supports recyclable and biodegradable alternatives, meeting consumer expectations. Kitchens track food waste through smart monitoring systems. Local sourcing reduces supply chain costs and environmental impact. Sustainability certifications enhance customer trust and brand image. Partnerships with eco-friendly packaging suppliers expand market value. Regulatory pressure on waste management encourages further adoption of green practices. Environmental responsibility strengthens the long-term reputation of delivery-first dining models.

Influence of Artificial Intelligence and Data Analytics in Virtual Restaurant Success

Technology-driven data insights define growth in the Global Dark Kitchens Ghost Kitchens Cloud Kitchens Market. AI helps in predicting demand patterns based on customer habits and seasonal trends. It improves delivery route optimization and reduces operational delays. Machine learning tools support menu engineering by identifying high-margin and trending dishes. Consumer personalization creates loyalty through targeted offers. Predictive analytics enhances inventory management by minimizing wastage. Smart dashboards allow operators to evaluate performance metrics in real time. Competitive advantage emerges from adopting analytics-driven decisions. The integration of AI improves profitability and enhances consumer experience.

- For instance, Nextbite uses predictive menu analytics to identify trending dishes influenced by social media activity, allowing partner brands to quickly launch limited-time items and strengthen revenue opportunities during campaign windows.

Rising Popularity of Subscription-Based and Direct-to-Consumer Food Services

Changing business models influence the Global Dark Kitchens Ghost Kitchens Cloud Kitchens Market. Subscription-based services provide customers with flexible meal plans tailored to lifestyle needs. Direct-to-consumer models strengthen brand-customer relationships outside aggregator platforms. Operators build proprietary apps and websites to capture customer data directly. Subscription formats increase customer loyalty and predictable revenue streams. Partnerships with corporates for office meal plans expand new segments. Social media-driven marketing enhances brand visibility in younger demographics. Loyalty programs reward consistent customers with personalized deals. The evolution of these models reflects the increasing importance of customer retention strategies.

Market Challenges Analysis

High Competition and Market Saturation Across Key Regions

The Global Dark Kitchens Ghost Kitchens Cloud Kitchens Market faces intense competition due to the low entry barriers. Operators must differentiate their offerings in markets dominated by multiple virtual brands. It creates pressure on pricing, leading to thinner margins. High dependency on aggregator platforms limits control over visibility and delivery pricing. Smaller brands struggle to maintain profitability when competing against well-funded global chains. Marketing costs increase as companies attempt to secure digital presence. Consumer loyalty is harder to sustain when menus are easily substitutable. Constant innovation is necessary to maintain brand relevance in saturated regions.

Regulatory Hurdles, Supply Chain Pressures, and Quality Control Issues

The Global Dark Kitchens Ghost Kitchens Cloud Kitchens Market experiences challenges linked to regulations and logistics. Food safety compliance varies across countries, requiring operators to adapt to multiple standards. Delivery logistics face strain during peak demand, affecting consistency. Quality assurance is difficult to maintain across multiple virtual brands within one kitchen. Rising labor costs in urban regions add pressure to operating margins. Supply chain disruptions, including ingredient shortages, impact timely service. Governments are scrutinizing labor practices within delivery services, adding further complexity. Balancing scale with compliance remains a key operational challenge.

Market Opportunities

Expansion Potential in Emerging Economies with Untapped Delivery Infrastructure

Emerging economies provide strong opportunities for the Global Dark Kitchens Ghost Kitchens Cloud Kitchens Market. Rising disposable incomes and smartphone adoption create favorable conditions for delivery-first dining. It benefits from large populations seeking convenient food solutions at affordable prices. Untapped urban and semi-urban regions provide scope for new kitchen clusters. Local operators can partner with international platforms to scale rapidly. Growing youth populations with digital habits strengthen the opportunity. Foodservice players can establish strong customer loyalty in less competitive regions. The ability to shape consumer preferences early creates long-term growth.

Strategic Collaborations and Technology-Driven Business Models

Collaborations between technology providers, food aggregators, and kitchen operators expand opportunities for the Global Dark Kitchens Ghost Kitchens Cloud Kitchens Market. It benefits from AI-powered automation that optimizes processes and reduces costs. Strategic alliances with corporates for office meals or subscription packages expand revenue channels. Proprietary apps create independence from third-party platforms, securing direct customer engagement. Partnerships with eco-friendly packaging companies attract sustainability-focused consumers. Cross-brand collaborations inside one kitchen allow wider menu choices for customers. Technology-driven integration creates higher scalability and strengthens competitive positioning. Global foodservice leaders can explore new verticals through innovative digital-first strategies.

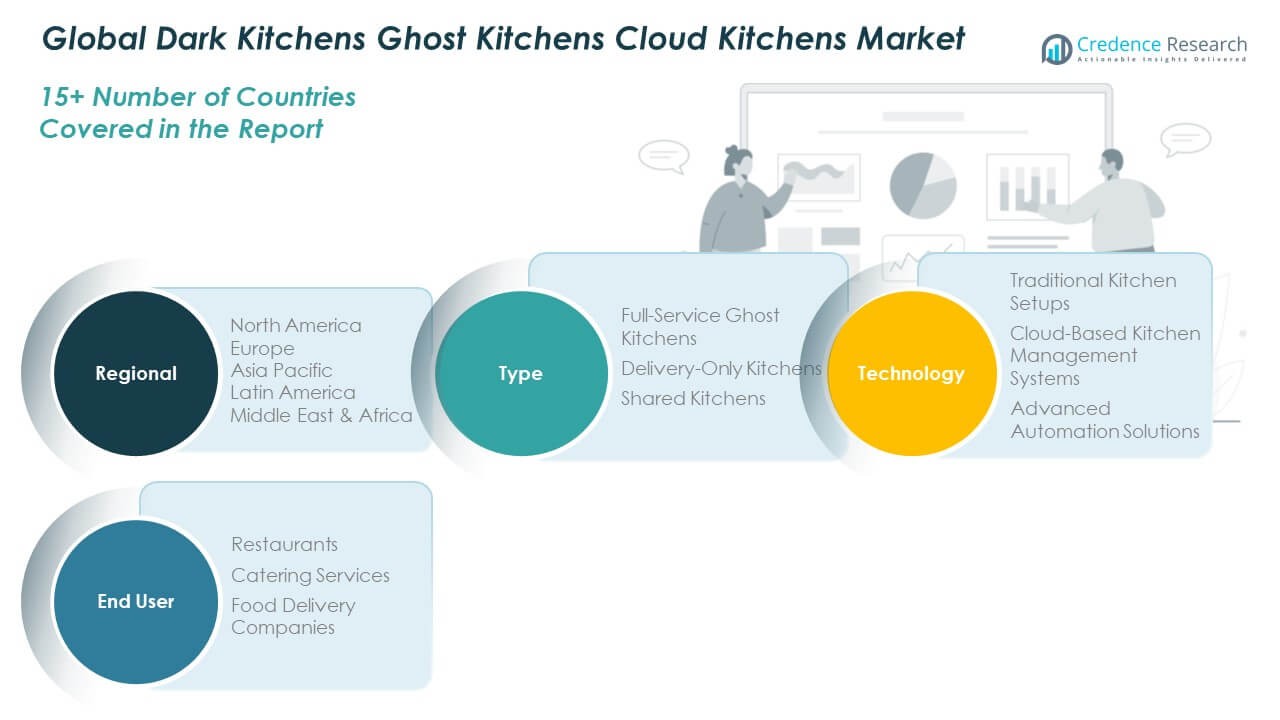

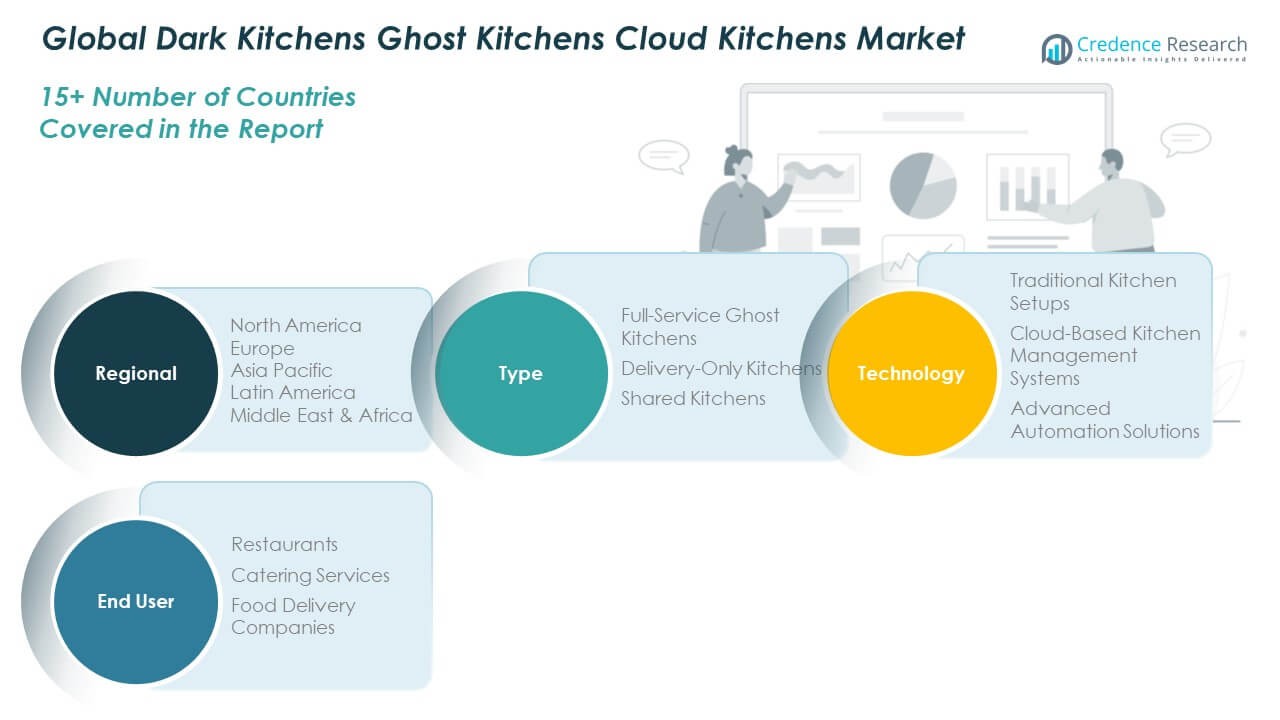

Market Segmentation Analysis:

The Global Dark Kitchens Ghost Kitchens Cloud Kitchens Market is segmented

By type into full-service ghost kitchens, delivery-only kitchens, and shared kitchens. Full-service formats dominate due to their ability to operate multiple brands under one infrastructure, attracting established restaurants and startups. Delivery-only kitchens record strong adoption among food entrepreneurs leveraging digital-first models with minimal investment. Shared kitchens gain traction by offering flexible rental solutions that appeal to small operators and catering businesses seeking cost efficiency without long-term commitments.

- For instance, ClusterTruck in Dallas operates a delivery-only model supported by its proprietary Empower Delivery software, which synchronizes cooking with driver arrival to ensure speed, freshness, and operational efficiency.

By technology, the market includes traditional kitchen setups, cloud-based kitchen management systems, and advanced automation solutions. Traditional kitchens still hold relevance in emerging markets, though they face limitations in scalability. Cloud-based management systems enhance efficiency with real-time order tracking, menu optimization, and seamless integration with delivery platforms. Advanced automation solutions are emerging as a high-growth segment, reducing operational costs and improving consistency through robotics, AI-enabled cooking, and predictive analytics. It demonstrates significant potential in regions with rising labor costs and high consumer demand for faster delivery.

- For instance, CloudKitchens invests in proprietary technology through its Lab37 division, focusing on automation and kitchen management systems designed to streamline meal preparation, reduce labor requirements, and increase throughput across partner brands’ operations.

By end user, the market is divided into restaurants, catering services, and food delivery companies. Restaurants represent the largest segment, using ghost kitchens to expand delivery reach without investing in new physical outlets. Catering services are adopting these models to streamline large-order management and extend their customer base beyond events. Food delivery companies are building dedicated kitchens to optimize logistics and introduce proprietary brands, reinforcing vertical integration strategies. Each end-user group leverages the model to achieve scalability, efficiency, and market differentiation.

Segmentation:

By Type

- Full-Service Ghost Kitchens

- Delivery-Only Kitchens

- Shared Kitchens

By Technology

- Traditional Kitchen Setups

- Cloud-Based Kitchen Management Systems

- Advanced Automation Solutions

By End User

- Restaurants

- Catering Services

- Food Delivery Companies

By Region

- North America (U.S., Canada, Mexico)

- Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Australia, Southeast Asia, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East (GCC Countries, Israel, Turkey, Rest of Middle East)

- Africa (South Africa, Egypt, Rest of Africa)

Regional Analysis:

North America

The North America Global Dark Kitchens Ghost Kitchens Cloud Kitchens Market size was valued at USD 16.75 billion in 2018 to USD 30.32 billion in 2024 and is anticipated to reach USD 77.67 billion by 2032, at a CAGR of 11.6% during the forecast period. It accounts for 42.19% of the global share in 2024, making it the leading region. Strong digital infrastructure and widespread adoption of food delivery apps drive growth. Consumers prioritize convenience and variety, encouraging restaurants to adopt delivery-only models. Venture capital funding and entry of large delivery platforms enhance the ecosystem. Regulatory clarity in the U.S. supports scalability and operational consistency. It benefits from advanced automation adoption, allowing brands to reduce costs and improve service levels. Urban centers like New York, Los Angeles, and Toronto act as hubs for multi-brand kitchen facilities.

Europe

The Europe Global Dark Kitchens Ghost Kitchens Cloud Kitchens Market size was valued at USD 7.77 billion in 2018 to USD 13.48 billion in 2024 and is anticipated to reach USD 31.49 billion by 2032, at a CAGR of 10.3% during the forecast period. It contributes 18.79% of the global share in 2024. The region benefits from rising urbanization and high internet penetration. Operators expand rapidly across the UK, Germany, and France, where food delivery penetration is strong. Consumers demand diverse and premium food options, driving the popularity of virtual brands. Restaurants embrace the model to reduce overheads and extend delivery coverage. Shared kitchens are gaining popularity among startups and small operators. It faces challenges with fragmented regulations across member states, but strong collaboration with delivery platforms sustains momentum. The market shows resilience with demand for efficient, technology-driven food service models.

Asia Pacific

The Asia Pacific Global Dark Kitchens Ghost Kitchens Cloud Kitchens Market size was valued at USD 11.24 billion in 2018 to USD 21.73 billion in 2024 and is anticipated to reach USD 60.59 billion by 2032, at a CAGR of 12.8% during the forecast period. It represents 30.24% of the global share in 2024, making it the fastest-growing region. Large populations in China and India drive high demand for affordable delivery options. Rising middle-class incomes and rapid smartphone adoption accelerate expansion. Global players invest heavily in cloud kitchen operations across metropolitan hubs. Shared kitchen models attract food entrepreneurs entering the digital-first dining market. It benefits from strong dominance of delivery aggregators like Swiggy, Zomato, Meituan, and Grab. Japan, South Korea, and Australia contribute to premium market segments with advanced automation adoption. The region demonstrates long-term potential with both scale and affordability advantages.

Latin America

The Latin America Global Dark Kitchens Ghost Kitchens Cloud Kitchens Market size was valued at USD 1.89 billion in 2018 to USD 3.43 billion in 2024 and is anticipated to reach USD 7.76 billion by 2032, at a CAGR of 9.9% during the forecast period. It holds 4.77% of the global share in 2024. The region witnesses rapid adoption of delivery platforms in urban centers such as São Paulo, Mexico City, and Buenos Aires. Young consumers with digital lifestyles drive demand for fast and affordable meals. Restaurants adopt ghost kitchens to reach underserved areas with limited dine-in infrastructure. Investments from international food delivery companies increase competitive intensity. It faces operational challenges with logistics and supply chain inconsistencies. Brazil leads the regional market, supported by a large consumer base and growing delivery ecosystem. Argentina and Mexico follow with expanding middle-class demand. The growth outlook remains positive, though slower than Asia Pacific.

Middle East

The Middle East Global Dark Kitchens Ghost Kitchens Cloud Kitchens Market size was valued at USD 1.07 billion in 2018 to USD 1.79 billion in 2024 and is anticipated to reach USD 3.83 billion by 2032, at a CAGR of 9.1% during the forecast period. It accounts for 2.49% of the global share in 2024. The region benefits from strong hospitality industries and rising demand for premium food delivery services. GCC countries lead growth, supported by high disposable incomes and rapid digital adoption. International players collaborate with regional operators to scale delivery networks. Governments encourage entrepreneurship in food services, supporting shared and delivery-only kitchens. It faces challenges with labor costs and operational efficiency in high-rent zones. UAE and Saudi Arabia dominate the landscape with advanced infrastructure. Partnerships between delivery aggregators and restaurants reinforce adoption. The market shows strong resilience with rising demand for convenience and lifestyle-driven dining.

Africa

The Africa Global Dark Kitchens Ghost Kitchens Cloud Kitchens Market size was valued at USD 0.65 billion in 2018 to USD 1.31 billion in 2024 and is anticipated to reach USD 2.69 billion by 2032, at a CAGR of 8.6% during the forecast period. It contributes 1.71% of the global share in 2024. Growth is supported by rising urban populations and expanding access to smartphones. South Africa and Egypt act as primary hubs due to stronger infrastructure and food delivery ecosystems. It faces challenges with fragmented logistics and limited internet penetration in rural areas. Entrepreneurs leverage shared kitchens to test new concepts with lower costs. Demand for affordable meals supports delivery-only models in major cities. International platforms are expanding cautiously due to infrastructure barriers. The region demonstrates early-stage adoption, with potential growth from urban middle-class segments. Rising investments in mobile payments and delivery logistics will enhance long-term prospects.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Global Dark Kitchens Ghost Kitchens Cloud Kitchens Market features an evolving competitive landscape with a mix of global technology-led platforms and regional foodservice innovators. Leading companies such as Kitchen United, CloudKitchens, Kitopi, and REEF Technology invest in infrastructure, automation, and proprietary platforms to secure operational scale. It demonstrates strong collaboration between kitchen operators, delivery aggregators, and virtual restaurant brands. Competitive differentiation centers on kitchen efficiency, menu diversity, delivery speed, and customer experience. Startups focus on niche cuisines or health-conscious offerings to build brand loyalty. Global players acquire regional firms to expand geographic presence and strengthen market access. Technology-driven models enable faster replication across cities, reducing time-to-market. The competition remains intense in mature economies, while emerging regions offer untapped potential for new entrants and strategic partnerships.

Recent Developments:

- In July 2025, Greek foodtech startup STIQ secured €20 million in funding from the European Investment Bank to expand its AI-powered cloud kitchen platform across Europe. The investment, structured as venture debt with quasi-equity features, will help STIQ grow its virtual restaurant model, which leverages artificial intelligence for demand forecasting, dynamic menu engineering, and grouped deliveries to cut CO2 emissions and optimize delivery times.

- In June 2025, Bengaluru-based cloud kitchen company Curefoods, known for brands like EatFit and CakeZone, filed its Draft Red Herring Prospectus with SEBI to raise INR 800 crore through an IPO. The company plans to direct the proceeds toward expansion across new cloud kitchens and retail formats, with a significant investment in its recently acquired franchise, Krispy Kreme.

- In March 2024, Sam Nazarian, the founder of SBE and C3, acquired Kitchen United’s intellectual property and ghost kitchen assets, merging them with C3 and Nextbite to form a new holding company called Everybody Eats. This move aims to create a major QSR and CPG brand platform and signals a consolidation trend in the ghost kitchen sector.

- In March 2023, Dubai-based Kitopi acquired leading F&B group AWJ, adding more than 30 restaurants and several well-known brands to its network. The deal strengthened Kitopi’s in-house brand portfolio and bolstered its expansion in the dine-in market, leveraging Kitopi’s proprietary Smart Kitchen Operating System (SKOS).

Market Concentration & Characteristics:

The Global Dark Kitchens Ghost Kitchens Cloud Kitchens Market exhibits moderate-to-high market concentration in developed regions where established players dominate urban clusters. It reflects a dual structure where global platforms control large-scale operations while local entrepreneurs operate niche virtual brands. Market characteristics include strong digital integration, flexible cost structures, and high scalability potential. Barriers to entry remain low for shared kitchens, while full-service models demand higher investment and operational expertise. Pricing pressure is common due to multiple virtual brands competing on aggregator platforms. It shows rapid evolution driven by consumer behavior shifts, delivery app innovation, and investor confidence. Operational efficiency and brand differentiation define long-term competitiveness.

Report Coverage:

The research report offers an in-depth analysis based on Type, Technology and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Expansion of delivery-first dining models will strengthen with urbanization and lifestyle-driven demand.

- Technology integration in kitchen management and automation will enhance operational efficiency.

- Virtual restaurant brands will multiply, diversifying consumer choices across cuisines and formats.

- Partnerships between operators and delivery platforms will deepen to optimize reach and logistics.

- Sustainability initiatives will reshape packaging and energy use within shared and delivery-only kitchens.

- Investments from global foodservice leaders and venture capital firms will accelerate market consolidation.

- Emerging economies will provide strong opportunities through rising middle-class consumption.

- Proprietary apps and direct-to-consumer channels will reduce dependency on aggregators.

- Data-driven personalization will improve customer loyalty and revenue predictability.

- Regulatory clarity and compliance frameworks will influence scalability and long-term adoption.