| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Middle East Multimode Dark Fiber Market Size 2024 |

USD 126.20 Million |

| Middle East Multimode Dark Fiber Market, CAGR |

5.47% |

| Middle East Multimode Dark Fiber Market Size 2032 |

USD 193.19 Million |

Market Overview

The Middle East Multimode Dark Fiber Market is projected to grow from USD 126.20 million in 2024 to an estimated USD 193.19 million by 2032, with a compound annual growth rate (CAGR) of 5.47% from 2025 to 2032. This growth is driven by increasing demand for high-speed internet, rising investments in telecommunications infrastructure, and the expansion of data centers across the region.

Several factors are fueling the growth of the Middle East Multimode Dark Fiber Market, including the surge in digital transformation, the growing need for data connectivity, and advancements in cloud computing. The region’s robust economic growth, alongside significant government initiatives like smart city projects, is driving demand for advanced networking solutions. The trend toward automation and the increasing number of internet-connected devices are further augmenting the market.

Geographically, the Middle East market is dominated by countries like the United Arab Emirates (UAE), Saudi Arabia, and Qatar, which are leading the way in digital infrastructure development. These nations are investing heavily in next-generation communication technologies, fostering a conducive environment for the expansion of the multimode dark fiber market. Key players in the market include companies like Etisalat, STC Group, and Ooredoo, which are pioneering the region’s digital connectivity efforts.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Middle East Multimode Dark Fiber Market is projected to grow from USD 126.20 million in 2024 to USD 193.19 million by 2032, with a CAGR of 5.47% from 2025 to 2032.

- The global multimode dark fiber market is expected to grow from USD 3,652.64 million in 2024 to USD 6,242.00 million by 2032, with a CAGR of 6.93% from 2025 to 2032.

- Increasing demand for high-speed internet and digital transformation initiatives are key drivers, pushing the need for robust fiber optic networks across the region.

- Significant investments in telecommunications infrastructure and the rise of cloud computing are further fueling the adoption of multimode dark fiber in the Middle East.

- High initial infrastructure costs and long-term capital investments are challenges for market entry, particularly for smaller telecom providers.

- Political instability and varying regulatory environments across different Middle Eastern countries pose hurdles in the widespread deployment of fiber optic networks.

- The UAE, Saudi Arabia, and Qatar dominate the Middle East Multimode Dark Fiber Market, with heavy investments in 5G rollouts and smart city development.

- Countries like Kuwait, Bahrain, and Iraq are gradually expanding their fiber optic networks, though growth is slower due to economic and geopolitical factors.

Market Drivers

Rise in Data Center Investments

The Middle East has emerged as a strategic hub for global data centers due to its geographic location, favorable business climate, and increasing demand for cloud computing services. The rise of large-scale data centers in the region is fueling the demand for multimode dark fiber, as these facilities require a reliable and high-capacity network infrastructure to handle vast amounts of data. Many global tech giants, such as Amazon Web Services (AWS), Google, and Microsoft, have started establishing their data centers in the region, further driving the need for multimode dark fiber solutions. These data centers need robust connectivity to link various servers, storage devices, and cloud platforms while ensuring low-latency and high-bandwidth access. As a result, the growing demand for data centers and the increasing investment in data infrastructure are key factors propelling the Middle East Multimode Dark Fiber Market forward. The rising trend of outsourcing data storage and management to these centralized facilities also drives the need for more extensive fiber optic networks across the region.

Emerging Technologies and Digitalization Across Industries

The digitalization of industries such as healthcare, manufacturing, finance, and retail is another key driver influencing the demand for multimode dark fiber in the Middle East. These industries are rapidly adopting technologies like the Internet of Things (IoT), artificial intelligence (AI), big data analytics, and blockchain to improve efficiency, enhance customer experiences, and reduce operational costs. As these technologies require high-speed, reliable, and secure communication channels for transmitting large volumes of data, the need for multimode dark fiber becomes more pronounced. For example, AI-powered applications demand a high throughput of data with minimal latency, which multimode dark fiber networks can effectively provide. Furthermore, the increasing reliance on remote working, virtual collaboration tools, and online education platforms in the wake of the COVID-19 pandemic has added pressure to the region’s digital infrastructure, further driving the adoption of multimode dark fiber solutions. As industries continue to embrace digital transformation, the demand for robust, scalable fiber optic infrastructure will continue to rise, driving market growth in the Middle East.

Increasing Demand for High-Speed Internet Connectivity

The growing demand for high-speed internet is one of the primary drivers behind the expansion of the Middle East Multimode Dark Fiber Market. As the region continues to undergo rapid digital transformation, there is an increasing need for robust and high-performance communication networks. Businesses, governments, and individuals are increasingly relying on high-bandwidth internet services to support various applications, such as cloud computing, e-commerce, social media, and streaming services. For instance, the UAE reported a 25% increase in internet traffic during peak hours in 2023, driven by the adoption of streaming platforms and cloud-based applications. The need for efficient, high-speed internet is compelling service providers to expand their infrastructure. Multimode dark fiber, with its ability to support high-capacity data transmission, is well-positioned to meet these demands. The growth in data traffic, both from enterprises and consumers, further accelerates the need for scalable solutions like dark fiber that can handle large volumes of data without compromising on speed or quality.

Government Investments in Digital Infrastructure and Smart Cities

Governments in the Middle East are heavily investing in modernizing and expanding the digital infrastructure to support national economic growth and development goals. The region’s governments are focusing on large-scale projects such as smart cities, which require advanced digital networks for efficient management of services like transportation, energy, healthcare, and security. For example, Saudi Arabia’s Vision 2030 initiative includes plans to deploy nationwide fiber-optic networks to support smart city projects. Dark fiber plays a crucial role in these smart city projects by providing high-speed, scalable, and secure connectivity. As these governments allocate substantial budgets for digital infrastructure, the adoption of multimode dark fiber is set to grow rapidly. The increasing number of government-backed initiatives aimed at enhancing digital capabilities is one of the key catalysts for the market’s expansion.

Market Trends

Expansion of 5G Networks

One of the most significant trends in the Middle East Multimode Dark Fiber Market is the rapid expansion of 5G networks. As 5G technology promises faster internet speeds, lower latency, and greater connectivity for a vast number of devices, it is driving the demand for advanced fiber optic infrastructure. For instance, the UAE achieved 97% population coverage for 5G networks by February 2023, with Etisalat and Du leading the rollout efforts. Multimode dark fiber is increasingly seen as a key enabler for 5G rollout, as it provides the necessary high-bandwidth capacity to support the high data rates required by 5G services. Telecom providers in the region are investing heavily in fiber networks to ensure they can handle the increased traffic that 5G will generate. Countries such as the UAE, Saudi Arabia, and Qatar are actively working to deploy 5G networks across urban centers, and multimode dark fiber is being used to build the backbone of these next-generation networks. As 5G services expand, there is a growing demand for dark fiber connections, making this a pivotal trend in the Middle East.

Adoption of Cloud Computing and Edge Computing

The continued rise of cloud computing and the growing importance of edge computing are key drivers in the Middle East’s demand for multimode dark fiber. As businesses and organizations increasingly shift to cloud-based infrastructure for scalability and efficiency, the demand for high-capacity, low-latency connectivity solutions has surged. For instance, cloud adoption in the Middle East has been bolstered by major investments from global providers like AWS and Microsoft Azure, which have established data centers in the region. Dark fiber, with its ability to provide high-speed and secure data transmission, is the ideal solution for connecting cloud data centers, enabling fast data processing and access. Edge computing, which brings data processing closer to the end-users, also requires fiber optic networks to ensure real-time data transfer. As the Middle East continues to embrace cloud and edge computing solutions, the demand for multimode dark fiber networks, which can support high-capacity and low-latency communications, will continue to grow.

Smart Cities Development

The development of smart cities across the Middle East is a prominent trend driving the growth of the multimode dark fiber market. Countries like the UAE, Saudi Arabia, and Qatar are leading the way in implementing smart city technologies that integrate IoT, data analytics, and cloud computing to improve urban living standards. These smart cities require robust digital infrastructures that can handle large volumes of data generated by sensors, cameras, and other connected devices. Multimode dark fiber is essential in providing the high-speed and scalable connectivity needed to support these applications. As smart cities continue to grow in the Middle East, the demand for multimode dark fiber networks to connect various urban systems and services will increase significantly. This trend is expected to drive further investments in fiber optic infrastructure to support the growing connectivity needs of modern urban environments.

Sustainability and Green Technology Initiatives

Sustainability and the push for green technology are shaping the Middle East Multimode Dark Fiber Market. As governments and corporations across the region focus on reducing their environmental impact, the demand for energy-efficient and environmentally friendly technologies has risen. Fiber optic networks, including multimode dark fiber, are seen as more energy-efficient than traditional copper-based networks, which makes them a favorable choice for telecom operators and businesses seeking to reduce their carbon footprint. Additionally, fiber networks are long-lasting, requiring less maintenance and contributing to lower resource consumption over time. As part of broader sustainability initiatives, many companies in the Middle East are investing in fiber optic infrastructure to meet both their technological needs and environmental goals. This trend of adopting green technologies is likely to continue influencing the market for multimode dark fiber in the coming years.

Market Challenges

High Initial Infrastructure Investment

One of the significant challenges facing the Middle East Multimode Dark Fiber Market is the high initial capital expenditure required for the deployment of fiber optic networks. For instance, the complexity of infrastructure requirements varies depending on factors such as terrain and urban density, which can significantly influence costs. Building and maintaining dark fiber infrastructure involves substantial investment in both physical components, such as fiber cables, data centers, and networking equipment, and operational expenses that accumulate over time. Additionally, the process of obtaining rights of way, navigating regulatory frameworks, and addressing logistical concerns adds to the financial burden faced by companies. Smaller companies and new market entrants may struggle to compete with larger, established players who are better equipped to absorb these costs. While the long-term benefits of dark fiber, such as higher speeds, lower maintenance, and scalability, are evident, the initial investment remains a critical hurdle for widespread deployment across the Middle East.

Regulatory and Political Instability

The Middle East region is characterized by diverse regulatory environments and political instability, which can pose significant challenges to the expansion of the multimode dark fiber market. Different countries in the region have varying regulations related to fiber optic deployments, which can complicate cross-border infrastructure development. These regulations can include restrictions on the construction of new fiber networks, approval delays, or the need to navigate complex bureaucratic procedures. Furthermore, geopolitical tensions and political instability in certain areas may disrupt the rollout of fiber optic infrastructure, particularly in conflict-prone regions. Such instability can deter foreign investments and slow down the implementation of critical telecommunications infrastructure. As a result, while some countries like the UAE and Qatar have made significant progress, other regions within the Middle East may face delays and limitations in deploying dark fiber solutions due to these regulatory and political challenges.

Market Opportunities

Expansion of 5G Infrastructure

One of the most significant opportunities for the Middle East Multimode Dark Fiber Market lies in the expansion of 5G infrastructure. As telecom operators across the region are actively rolling out 5G networks to meet the increasing demand for high-speed mobile internet, dark fiber plays a pivotal role in providing the necessary high-capacity, low-latency connectivity. Multimode dark fiber is essential for supporting the massive data traffic that 5G networks will generate, and it offers scalability to meet future demands. The rapid development of 5G technologies in countries like the UAE, Saudi Arabia, and Qatar presents a unique opportunity for telecom providers to expand their fiber optic networks and invest in fiber-to-the-tower (FTTT) solutions. This infrastructure investment will not only accelerate the growth of 5G but also increase the demand for multimode dark fiber as a reliable backbone for next-generation communications.

Smart City and IoT Integration

The ongoing development of smart cities in the Middle East presents another significant opportunity for the multimode dark fiber market. Smart city projects in countries like the UAE and Saudi Arabia require robust and scalable digital infrastructures to support the integration of Internet of Things (IoT) devices, data analytics, and cloud computing applications. Multimode dark fiber is essential for these initiatives as it enables the high-speed, secure data transfer needed for real-time monitoring and control of urban systems such as transportation, utilities, and public safety. As governments and private sector entities continue to invest in smart city projects, the demand for high-capacity fiber optic networks to connect the myriad of sensors, cameras, and devices within these cities will increase, offering substantial growth potential for the multimode dark fiber market in the region.

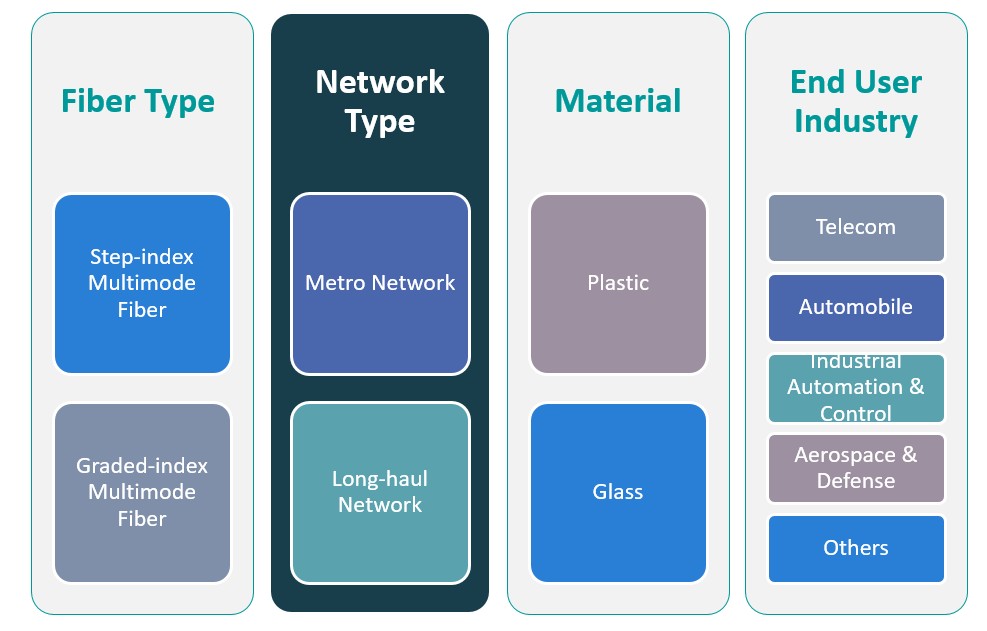

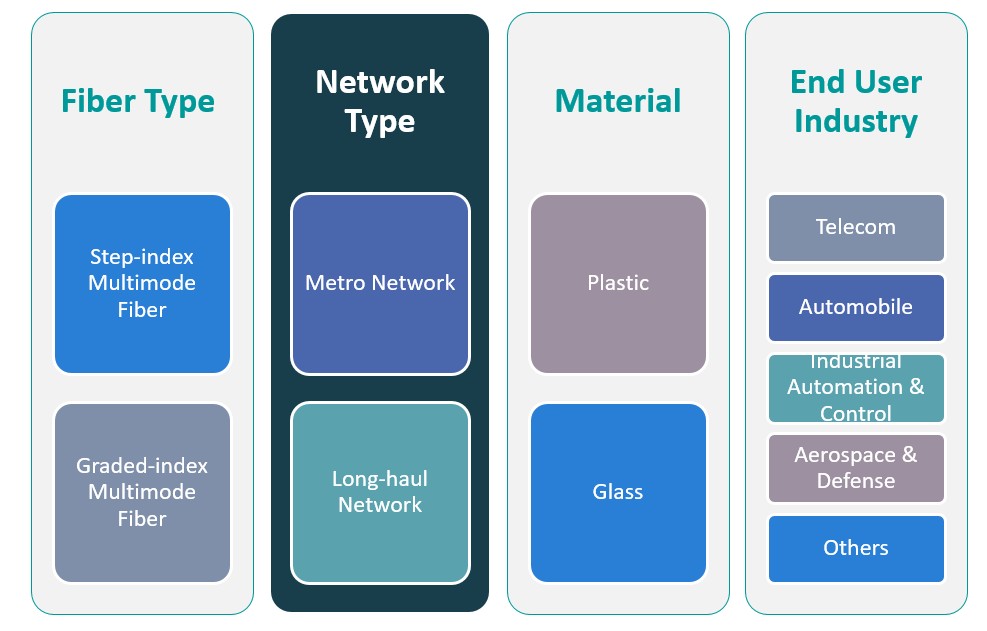

Market Segmentation Analysis

By Fiber Type:

The market is primarily segmented into step-index multimode fiber and graded-index multimode fiber. Step-index multimode fiber, with a simple structure, offers low cost and easier installation, making it a popular choice for short-distance applications. It is widely used in local area networks (LANs) and smaller-scale installations. Graded-index multimode fiber, on the other hand, has a more complex design and is suited for longer-distance data transmission. It reduces signal distortion, providing higher performance, and is typically used in larger networks such as campus-wide systems and metropolitan areas.

By Network Type:

The network type segment includes metro networks and long-haul networks. Metro networks are key drivers in urban areas where high-speed, high-capacity data transmission is required for services like internet, VoIP, and video streaming. These networks support local connections and typically have a shorter range, making them ideal for metropolitan areas. Long-haul networks, by contrast, are designed to cover long distances, such as between cities or countries. These networks require robust fiber infrastructure and offer opportunities for multinational telecommunications providers and global enterprises to expand their reach.

Segments

Based on Fiber Type

- Step-index Multimode Fiber

- Graded-index Multimode Fiber

Based on Network Type

- Metro Network

- Long-haul Network

Based on Material Type

Based on End User

- Telecom

- Automobile

- Industrial Automation & Control

- Aerospace & Defense

- Others

Based on Region

- UAE (United Arab Emirates)

- Saudi Arabia

- Qatar

- Kuwait and Bahrain

- Other Regions

Regional Analysis

UAE (35%)

The UAE is the dominant market in the Middle East for multimode dark fiber, accounting for approximately 35% of the market share. The country has made significant investments in telecommunications and digital infrastructure, especially in smart city projects like Dubai’s “Smart City” initiative and Abu Dhabi’s “Smart Government” projects. Additionally, the UAE’s 5G rollouts and increasing data consumption are pushing the demand for robust fiber optic networks. Telecom companies such as Etisalat and du are heavily investing in fiber optic infrastructure, making the UAE a key player in the region.

Saudi Arabia (30%)

Saudi Arabia holds a market share of around 30% and is the second-largest market in the region. The government’s Vision 2030 initiative, which aims to diversify the economy and enhance the country’s technological infrastructure, plays a crucial role in driving the demand for multimode dark fiber. The Saudi Arabian government is investing heavily in smart cities and large-scale projects like NEOM, which require high-capacity fiber networks. Major telecom providers such as STC (Saudi Telecom Company) are leading the way in deploying fiber optic solutions across the country, further propelling the market.

Key players

- Etisalat

- STC (Saudi Telecom Company)

- Du Telecom

- Ooredoo

- Menasat

Competitive Analysis

The Middle East Multimode Dark Fiber Market is highly competitive, with key players such as Etisalat, STC, Du Telecom, Ooredoo, and Menasat leading the way in providing advanced fiber optic solutions. Etisalat is a market leader in the UAE, driven by its strong investments in digital infrastructure and 5G networks. STC, with its dominant position in Saudi Arabia, benefits from the government’s Vision 2030 initiative, which is focused on expanding the country’s digital infrastructure. Du Telecom is a strong competitor in the UAE, offering integrated telecommunications solutions and fiber optic networks. Ooredoo, based in Qatar, also plays a pivotal role with its focus on advanced fiber networks to support smart city projects and the region’s digital growth. Menasat, while smaller, is positioning itself as a niche player by offering tailored fiber optic solutions for specialized applications. These companies are investing heavily in infrastructure and innovation to stay ahead in this rapidly growing market.

Recent Developments

- In June 2024, Telstra InfraCo’s intercity fiber network project completed approximately 1,800 kilometers of fiber construction, enhancing connectivity across Australia.

- As of June 2023, TPG Group held a wholesale market share of around 22% of Australian National Broadband Network services.

- As of June 2023, Optus had a wholesale market share of approximately 13% of Australian National Broadband Network residential broadband services.

- In August 2024, Lumen Technologies entered a two-year agreement with Corning Incorporated, securing 10% of Corning’s global fiber capacity to interconnect AI-enabled data centers. This deal is Lumen’s largest cable purchase to date and will more than double its U.S. intercity fiber miles, enhancing capacity for cloud data centers and high-bandwidth applications driven by AI workloads.

- In February 2025, Deutsche Telekom praised T-Systems for its improved performance in FY24, reflecting the company’s strategic focus on enhancing its dark fiber services for enterprise customers.

- In December 2024, the GCC Sustainability Innovation Hub, which includes Etisalat, released a white paper outlining pathways for telecom operators to achieve net-zero emissions, drive renewable adoption, and foster regional collaboration.

- In 2024, Claro Argentina reported an operating profit of 706 billion pesos, a 10.1% growth compared to 2023, indicating strong performance in its telecom operations, including dark fiber services.

Market Concentration and Characteristics

The Middle East Multimode Dark Fiber Market is moderately concentrated, with a few dominant players such as Etisalat, STC, Du Telecom, Ooredoo, and Menasat controlling a significant share of the market. These key players are strategically positioned in key regional markets like the UAE, Saudi Arabia, and Qatar, where high demand for advanced digital infrastructure and 5G networks drives investments in fiber optic solutions. The market is characterized by high capital intensity, with companies making substantial investments in infrastructure to cater to the increasing demand for high-speed, reliable, and scalable connectivity solutions. Competitive dynamics are largely driven by technological innovation, service diversification, and partnerships with government initiatives focused on smart cities and digital transformation. While the market is still expanding in less developed regions, such as Iraq and Lebanon, the concentration of market share among these key players ensures that competition remains strong in the more advanced markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Fiber Type, Network Type, Material Type, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for high-speed, low-latency internet will continue to grow as businesses and consumers increasingly rely on digital services, fueling the need for multimode dark fiber infrastructure.

- The widespread rollout of 5G networks across the region will significantly increase data traffic, driving demand for advanced fiber optic solutions like multimode dark fiber to support these high-bandwidth requirements.

- Continued investment in smart city initiatives across the Middle East, particularly in the UAE, Saudi Arabia, and Qatar, will create substantial demand for robust, scalable fiber optic infrastructure.

- Innovations in fiber optic technology, such as improved signal transmission and higher data capacity, will further enhance the capabilities of multimode dark fiber, encouraging greater adoption in various sectors.

- Government-backed projects, like Vision 2030 in Saudi Arabia and other national development plans, will continue to drive investments in digital infrastructure, boosting the growth of the multimode dark fiber market.

- As businesses transition to cloud-based solutions, the need for secure, high-capacity fiber networks will increase, positioning multimode dark fiber as a critical enabler of cloud connectivity.

- With global tech giants investing in data center facilities in the region, the demand for high-performance fiber optic solutions like multimode dark fiber will rise to connect these facilities and ensure fast data transfer.

- Industries such as manufacturing, healthcare, and logistics will adopt more automated systems requiring low-latency, high-capacity networks, further fueling demand for multimode dark fiber.

- Telecom companies in the region will continue expanding their fiber optic networks, particularly in metro and long-haul networks, to accommodate growing data traffic and the need for seamless connectivity.

- As geopolitical stability improves in certain Middle Eastern countries, international and regional investments in digital infrastructure, including fiber optic networks, are expected to increase, propelling market growth.