| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UAE Multimode Dark Fiber Market Size 2024 |

USD 14.54 Million |

| UAE Multimode Dark Fiber Market, CAGR |

5.60% |

| UAE Multimode Dark Fiber Market Size 2032 |

USD 22.50 Million |

Market Overview

The UAE Multimode Dark Fiber Market is projected to grow from USD 14.54 million in 2024 to an estimated USD 22.50 million by 2032, with a compound annual growth rate (CAGR) of 5.60% from 2025 to 2032. This growth trajectory reflects the increasing demand for high-speed, low-latency connectivity solutions across various sectors.

Key drivers propelling this market include the rapid expansion of data centers, the proliferation of cloud computing services, and the deployment of 5G networks. Additionally, smart city initiatives and the Internet of Things (IoT) are contributing to the heightened demand for robust and scalable network infrastructures. These trends underscore the necessity for multimode dark fiber solutions that can accommodate high bandwidth requirements and ensure reliable connectivity.

Geographically, the market is predominantly concentrated in the metropolitan regions of Dubai and Abu Dhabi, where digital transformation efforts are most pronounced. Leading players in the UAE Multimode Dark Fiber Market include Etisalat, du, and Dark Fiber Africa, all of which are actively investing in infrastructure development and technological advancements to enhance their service offerings and maintain a competitive edge.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UAE Multimode Dark Fiber Market is expected to grow from USD 14.54 million in 2024 to USD 22.50 million by 2032, with a CAGR of 5.60% from 2025 to 2032.

- The global multimode dark fiber market is expected to grow from USD 3,652.64 million in 2024 to USD 6,242.00 million by 2032, with a CAGR of 6.93% from 2025 to 2032.

- Key drivers include the rapid deployment of 5G networks, the expansion of data centers, and increasing cloud adoption. Additionally, smart city initiatives and IoT applications are fueling demand for reliable fiber networks.

- High capital investment requirements for fiber infrastructure deployment and limited fiber access in rural regions may hinder market growth. Furthermore, integration with legacy systems presents operational challenges.

- Dubai and Abu Dhabi dominate the market, driven by high-tech infrastructure, digital transformation efforts, and government-led smart city projects. Other emirates are seeing slower adoption but represent growth potential.

- Continuous innovations in fiber optics are enhancing multimode dark fiber performance, enabling better efficiency, scalability, and data transfer capabilities, supporting the growing demand for high-bandwidth solutions.

- Telecom, data centers, and enterprises in sectors like finance, healthcare, and government are the primary users of multimode dark fiber, requiring secure, high-speed connections to support digital operations.

- Government policies encouraging infrastructure development and private sector investments in smart cities present lucrative opportunities for market players to expand their fiber networks and capitalize on emerging digital trends.

Market Drivers

Acceleration of 5G Rollout and Smart City Initiatives

The UAE is at the forefront of 5G technology deployment and smart city development, both of which are key enablers for multimode dark fiber infrastructure. With 5G offering ultra-low latency and high-speed connectivity, its success depends heavily on the availability of dense and efficient fiber backhaul networks. Multimode dark fiber serves as a vital component in meeting these backhaul requirements within urban settings, particularly for small-cell deployments and edge computing infrastructure. Simultaneously, the UAE’s smart city initiatives—such as the Smart Dubai project—are increasing the demand for interconnected digital infrastructure that can support smart transportation, energy management, surveillance, and IoT ecosystems. These applications generate massive volumes of data that must be processed and transferred in real time, creating a pressing need for high-capacity, high-speed fiber networks. As cities become increasingly reliant on digital technologies to enhance urban living and optimize resource utilization, multimode dark fiber will play a crucial role in supporting the underlying infrastructure.

Government Support and Strategic Investments in Digital Transformation

Government-backed initiatives and strategic investments aimed at transforming the UAE into a knowledge-based, innovation-driven economy are further fueling the growth of the multimode dark fiber market. Programs such as UAE Vision 2031 and the Telecommunications and Digital Government Regulatory Authority’s (TDRA) digital infrastructure development plans underscore the importance of advanced connectivity solutions. These initiatives prioritize investments in fiber-optic networks, with multimode dark fiber forming a key part of the digital transformation strategy. Public-private partnerships (PPPs) are increasingly common, facilitating infrastructure sharing, reducing deployment costs, and improving accessibility to high-speed internet. Moreover, regulatory support for open access networks and initiatives to modernize telecom frameworks have encouraged competition and innovation among service providers. This conducive policy environment, along with attractive investment incentives for infrastructure development, has created a fertile ground for the expansion of the multimode dark fiber network across the UAE. As digital transformation continues to evolve, the government’s proactive stance will remain a pivotal force in sustaining market momentum.

Rising Demand for High-Bandwidth Communication Infrastructure

The exponential increase in data consumption and internet traffic across the UAE is driving the need for high-bandwidth communication infrastructure. With the rapid adoption of video conferencing, streaming platforms, cloud computing, and data-heavy enterprise applications, both private and public sectors are seeking robust and scalable network solutions. Multimode dark fiber, known for its ability to transmit large volumes of data over short to medium distances with minimal signal degradation, addresses these growing bandwidth demands efficiently. The UAE government’s emphasis on building a digitally advanced economy, as reflected in its “Digital Government Strategy 2025,” necessitates the expansion of reliable data transmission networks. For instance, enterprises and telecom operators are leveraging multimode dark fiber to enhance network performance, scalability, and security, ensuring seamless connectivity for critical applications. Furthermore, educational institutions, healthcare providers, and financial services increasingly rely on high-speed, low-latency connections to support digitized services, further accelerating the deployment of multimode dark fiber networks.

Expansion of Data Centers and Cloud Computing Ecosystems

The UAE has emerged as a strategic hub for data center infrastructure in the Middle East due to its geographic location, stable regulatory environment, and strong investment incentives. The proliferation of hyperscale and colocation data centers, especially in Dubai and Abu Dhabi, is a significant factor driving the multimode dark fiber market. Data centers require fast, secure, and redundant fiber-optic connections to meet the operational needs of cloud service providers, content delivery networks (CDNs), and enterprise clients. Multimode dark fiber, with its cost-effective support for high-speed data transfers over localized networks, is ideal for intra-data center and campus environments. For instance, major cloud providers are expanding their presence in the UAE by deploying multimode dark fiber to ensure reliable and scalable connectivity within their facilities. This investment supports the growing demand for cloud-based services and data storage solutions, sustaining long-term growth in multimode dark fiber deployment across the country.

Market Trends

Expansion of Data Centers Driving Localized Fiber Demand

The rapid expansion of hyperscale and edge data centers across the UAE is significantly impacting the multimode dark fiber market. As data localization policies, cloud adoption, and content delivery demands surge, the country is witnessing a wave of investment in colocation and private data center infrastructure. These facilities require high-speed, low-latency, and secure connectivity for server-to-server communication and intra-facility data management—requirements that multimode dark fiber effectively fulfills. Multimode fibers are particularly well-suited for the short-distance, high-density cabling environments common in data centers, where they support bandwidth-intensive workloads with minimal signal degradation. Leading telecom providers and neutral-host infrastructure companies are collaborating with real estate and technology firms to develop fiber-rich data center parks in strategic zones like Dubai Silicon Oasis and Abu Dhabi’s KIZAD. The trend also extends to the edge computing landscape, where data centers are positioned closer to end-users to reduce latency and enable real-time applications. This decentralized model necessitates robust fiber backhaul at the local level, accelerating multimode dark fiber deployments. As UAE’s digital economy grows, the symbiotic relationship between data center growth and fiber infrastructure will remain a cornerstone of the country’s ICT development strategy.

Increasing Investments in Smart Infrastructure and IoT Connectivity

The UAE’s push toward smart infrastructure and widespread IoT integration is fueling demand for high-speed, fiber-based connectivity solutions. Smart cities like Dubai and Abu Dhabi are deploying thousands of interconnected sensors, surveillance systems, and smart utility grids, all of which generate vast volumes of data that must be transmitted and analyzed in real time. Multimode dark fiber provides the backbone needed to manage these high-bandwidth, low-latency data flows within urban areas. This infrastructure is being embedded into the UAE’s urban planning and transport systems to support applications such as intelligent traffic management, automated public transit, and smart energy distribution. Municipal governments and infrastructure developers are collaborating with telecom companies to integrate dark fiber into new construction and retrofit projects. Moreover, the emergence of digital twins, AI-driven traffic systems, and automated environmental monitoring is reinforcing the need for redundant and scalable fiber networks. These smart infrastructure investments not only enhance quality of life but also position the UAE as a global leader in digital transformation. As such, multimode dark fiber continues to see increased adoption across public infrastructure projects, industrial zones, and mixed-use developments where reliable and high-speed connectivity is essential.

Integration of Dark Fiber in 5G Network Expansion

One of the most prominent trends in the UAE multimode dark fiber market is the strategic integration of dark fiber infrastructure to support the nationwide rollout of 5G networks. For instance, telecom operators are rapidly upgrading their backhaul capacity to accommodate the high bandwidth and low latency requirements of 5G services. Multimode dark fiber plays a critical role in facilitating dense network coverage, especially in urban areas where small-cell deployments and edge computing are essential. Operators are increasingly adopting dark fiber solutions to build scalable and future-proof networks, enabling them to retain control over traffic management and optimize bandwidth allocation. For instance, as the UAE strives to position itself as a leader in next-generation connectivity, multimode dark fiber networks offer the flexibility and performance needed to support not just consumer-level applications but also industrial IoT, autonomous vehicles, and smart infrastructure. This alignment between dark fiber development and 5G strategy is transforming the market, encouraging cross-sector collaborations and spurring investment in metro and intra-city fiber rings. The synergetic relationship between dark fiber and 5G will continue to define the market trajectory, particularly as demand for ultra-reliable and high-speed connectivity grows in sectors like logistics, healthcare, and manufacturing.

Growing Demand for Enterprise-Level Fiber Networks

A notable trend reshaping the UAE multimode dark fiber market is the growing demand among enterprises for dedicated, high-performance fiber infrastructure. For instance, as businesses increasingly rely on cloud platforms, video conferencing, real-time analytics, and data-intensive applications, the need for secure, private, and high-capacity networks has intensified. Multimode dark fiber offers organizations the ability to establish customized, cost-effective network solutions without reliance on shared bandwidth. This trend is particularly prevalent among banks, data centers, educational institutions, and healthcare providers—sectors that require robust security and operational continuity. For instance, UAE-based enterprises are moving away from managed bandwidth services and toward dark fiber leasing or ownership, allowing them to scale their network infrastructure in response to dynamic IT workloads. Furthermore, the trend toward hybrid work models and distributed office environments has created a surge in demand for metro dark fiber rings and point-to-point connections between branch locations. Managed service providers (MSPs) are also expanding their portfolios to include dark fiber solutions for SMEs and mid-sized firms that seek enhanced network control. This shift toward enterprise-grade infrastructure is fostering innovation in network architecture, resulting in increased deployment of multimode dark fiber across commercial zones and business districts.

Market Challenges

High Capital Investment and Infrastructure Deployment Barriers

The UAE multimode dark fiber market faces significant challenges, particularly the substantial capital investment required for network deployment and maintenance. Despite government support for digital infrastructure, the high upfront costs of laying fiber-optic cables, acquiring right-of-way permits, and establishing supporting infrastructure remain major hurdles, especially for smaller telecom operators and new entrants. For instance, multimode fiber installations, while cost-effective over short distances, still require extensive civil works. Trenching, duct installation, and network design customization are necessary steps that add to the financial burden. In densely populated urban zones such as Dubai and Abu Dhabi, securing space for new conduits and avoiding disruption to existing infrastructure is both technically complex and financially burdensome. Additionally, the integration of dark fiber into existing network architectures may involve compatibility issues with legacy systems. These challenges can further increase operational costs. While public-private partnerships and regulatory incentives attempt to ease the financial strain, the long payback period continues to deter investment from certain market players. These high capital and logistical barriers not only limit market participation but also slow down the pace of dark fiber network expansion, hindering the potential for wider accessibility and affordability across the UAE.

Limited Accessibility and Uneven Infrastructure Distribution

Another significant challenge in the UAE multimode dark fiber market is the limited accessibility and uneven distribution of fiber infrastructure across the country. While metropolitan regions such as Dubai and Abu Dhabi benefit from advanced digital infrastructure, other emirates and rural areas face constraints in fiber network availability. This urban-rural divide creates a disparity in high-speed internet access, restricting the adoption of advanced digital services and hindering inclusive digital transformation. Multimode dark fiber networks, which are most efficient over shorter distances, require dense deployment to be effective—something that remains economically unfeasible in sparsely populated or underdeveloped regions. Furthermore, the lack of open-access policies in certain areas restricts infrastructure sharing among service providers, resulting in duplication of efforts and inefficiencies. This fragmented deployment environment not only increases costs but also stifles innovation and competition. The challenge is compounded by a shortage of skilled labor and fiber-optic technicians, which can delay installation timelines and reduce service quality. Addressing these disparities is essential for achieving nationwide digital equity and unlocking the full potential of dark fiber solutions across the UAE.

Market Opportunities

Rising Demand from Smart City and Government Digitization Projects

The UAE’s strategic vision to transform into a globally recognized smart nation presents a significant opportunity for the multimode dark fiber market. Government-led initiatives, such as Smart Dubai and Abu Dhabi’s Digital Authority programs, emphasize the integration of digital infrastructure into every aspect of urban life. These initiatives require a high-performance backbone to support interconnected systems like smart traffic control, energy grids, security networks, and IoT-based city management. Multimode dark fiber, with its ability to handle high data throughput over short distances at lower costs, is ideally suited for intra-city connectivity and data-intensive smart applications. As more smart zones, innovation districts, and tech-forward infrastructure projects emerge across the UAE, fiber deployment opportunities will multiply, opening up long-term growth prospects for service providers and infrastructure developers.

Increasing Enterprise Shift Toward Private and Scalable Network Solutions

The growing reliance of UAE enterprises on cloud computing, big data analytics, and mission-critical applications is creating strong demand for secure, private, and scalable connectivity solutions. Multimode dark fiber offers businesses complete control over their network, enabling them to manage bandwidth allocation, reduce latency, and improve data security. This is especially relevant in sectors like finance, healthcare, education, and logistics, where uninterrupted data flow is essential. As more companies adopt hybrid work models and digitize their operations, the need for dedicated dark fiber connections will continue to rise. This trend provides a lucrative opportunity for telecom providers and managed service companies to expand their offerings and tap into the growing enterprise connectivity segment.

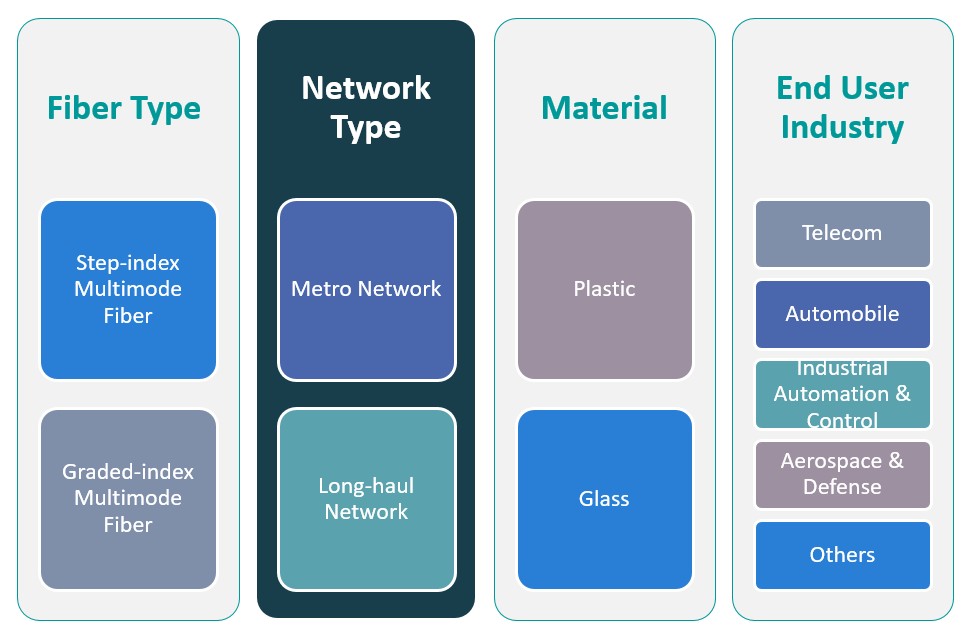

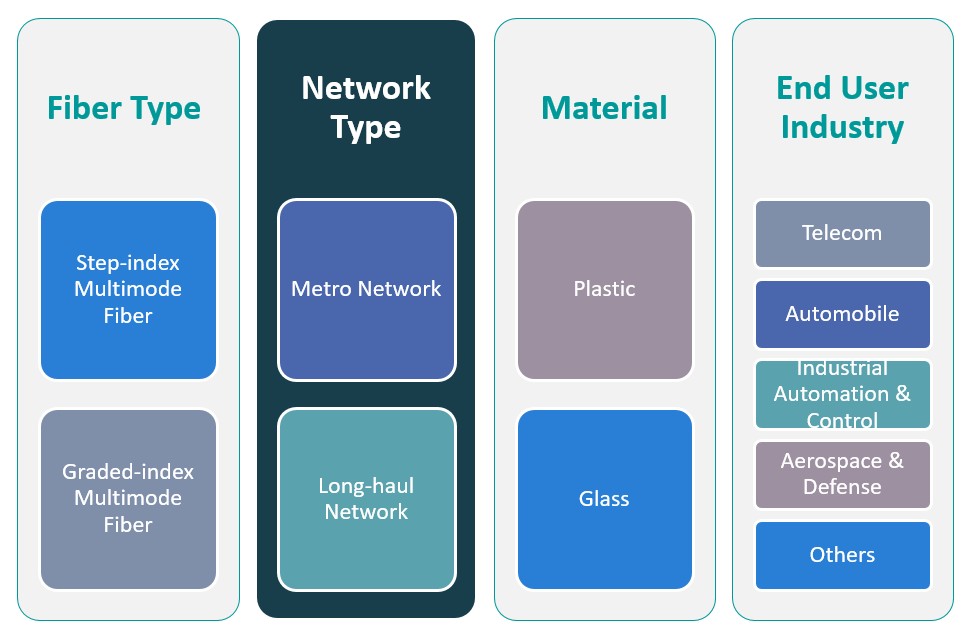

Market Segmentation Analysis

By Fiber Type

The market is divided into Step-index Multimode Fiber and Graded-index Multimode Fiber. Step-index fibers, due to their relatively simpler manufacturing and lower cost, are used in basic communication systems where precision and bandwidth are secondary. However, graded-index multimode fiber dominates the market owing to its superior bandwidth performance and reduced modal dispersion. It is widely adopted in high-speed, short-distance communication applications such as within buildings, campuses, and data centers.

By Network Type

The segmentation includes Metro Network and Long-haul Network. Metro networks hold a larger share in the UAE as they cater to dense urban areas like Dubai and Abu Dhabi, where enterprises, smart infrastructure, and government services require high-capacity intra-city connections. While long-haul networks also play a role in inter-emirate and cross-border connectivity, they are less relevant for multimode fiber, which is optimized for shorter distances.

Segments

Based on Fiber Type

- Step-index Multimode Fiber

- Graded-index Multimode Fiber

Based on Network Type

- Metro Network

- Long-haul Network

Based on Material Type

Based on End User

- Telecom

- Automobile

- Industrial Automation & Control

- Aerospace & Defense

- Others

Based on Region

Regional Analysis

Dubai (50%)

Dubai leads the UAE’s multimode dark fiber market, holding about 50% of the total share. This dominance is attributed to its status as the nation’s economic and technological hub, hosting a multitude of data centers, telecom operators, and enterprises that demand advanced network infrastructure. The city’s commitment to smart city projects and the expansion of 5G networks further amplifies the need for robust dark fiber connectivity. Continuous investments by both public and private sectors in infrastructure and technological advancements solidify Dubai’s position at the forefront of dark fiber deployment.

Abu Dhabi (30%)

Abu Dhabi, the UAE’s capital, commands approximately 30% of the multimode dark fiber market. The emirate’s growth in this sector is propelled by significant governmental and corporate investments in digital infrastructure. Abu Dhabi’s strategic importance in industries such as oil and gas necessitates secure and high-capacity communication networks, driving the demand for dark fiber solutions. Initiatives like the Abu Dhabi Economic Vision 2030, which focus on developing new business districts and smart city projects, further underscore the need for robust dark fiber infrastructure to meet current and future connectivity requirements.

Key players

- Etisalat

- Khazna Data Centers

- Mideast Data Systems

- iNNOVO Data Centers

- Nawras (Ooredoo Group)

Competitive Analysis

The UAE Multimode Dark Fiber Market is characterized by the presence of leading telecom and data infrastructure providers, each leveraging strategic advantages to maintain market competitiveness. Etisalat, as a dominant telecom operator, holds a significant market position owing to its vast network coverage, strong financial base, and continuous investments in fiber infrastructure. Khazna Data Centers and iNNOVO Data Centers focus on providing high-capacity, carrier-neutral colocation services, driving demand for intra-facility fiber connectivity. Mideast Data Systems supports enterprise clients with customized IT and network solutions, capitalizing on increasing data center integration. Nawras, under the Ooredoo Group, brings regional expertise and diversified telecom services, further intensifying market competition. These players compete on factors such as network scalability, reliability, speed, and integration with smart infrastructure projects. Ongoing digital transformation and enterprise demand for dedicated connectivity solutions are pushing these companies to innovate and expand fiber networks, particularly in Dubai and Abu Dhabi, to sustain growth and market share.

Recent Developments

- In June 2024, Telstra InfraCo’s intercity fiber network project completed approximately 1,800 kilometers of fiber construction, enhancing connectivity across Australia.

- As of June 2023, TPG Group held a wholesale market share of around 22% of Australian National Broadband Network services.

- As of June 2023, Optus had a wholesale market share of approximately 13% of Australian National Broadband Network residential broadband services.

- In August 2024, Lumen Technologies entered a two-year agreement with Corning Incorporated, securing 10% of Corning’s global fiber capacity to interconnect AI-enabled data centers. This deal is Lumen’s largest cable purchase to date and will more than double its U.S. intercity fiber miles, enhancing capacity for cloud data centers and high-bandwidth applications driven by AI workloads.

- In February 2025, Deutsche Telekom praised T-Systems for its improved performance in FY24, reflecting the company’s strategic focus on enhancing its dark fiber services for enterprise customers.

- In December 2024, the GCC Sustainability Innovation Hub, which includes Etisalat, released a white paper outlining pathways for telecom operators to achieve net-zero emissions, drive renewable adoption, and foster regional collaboration.

- In 2024, Claro Argentina reported an operating profit of 706 billion pesos, a 10.1% growth compared to 2023, indicating strong performance in its telecom operations, including dark fiber services.

Market Concentration and Characteristics

The UAE Multimode Dark Fiber Market exhibits a moderate to high level of market concentration, dominated by a few key players such as Etisalat, Khazna Data Centers, and Nawras (Ooredoo Group), who possess extensive infrastructure, financial resources, and strategic partnerships. The market is characterized by technological sophistication, demand for low-latency intra-city connectivity, and increasing integration with smart infrastructure and 5G deployment. While the core demand originates from metropolitan regions like Dubai and Abu Dhabi, where digital transformation initiatives are highly active, the market also shows potential in emerging emirates through government-led expansion and diversification efforts. Multimode dark fiber is primarily utilized in metro and enterprise environments for its high bandwidth over short distances, and the competitive landscape is shaped by innovation, service reliability, and end-to-end network customization.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Fiber Type, Network Type, Material Type, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The ongoing rollout of 5G networks will significantly increase the demand for multimode dark fiber for low-latency and high-bandwidth connectivity. Telecom operators will continue to invest in robust fiber infrastructure to support 5G backhaul requirements.

- UAE’s ambitious smart city projects, like Smart Dubai, will require extensive fiber networks to support IoT and connected infrastructure. This will drive a sustained increase in the demand for multimode dark fiber connectivity.

- The rapid growth of data centers in Dubai and Abu Dhabi will create a surge in demand for fiber connectivity solutions. Multimode dark fiber will be key in linking data centers with high-speed, scalable networks.

- The UAE government’s focus on digital transformation will continue to prioritize investments in high-performance fiber infrastructure. This will bolster the market as various sectors demand secure, high-capacity network solutions.

- The continued adoption of cloud computing services by businesses will accelerate the need for reliable, high-bandwidth connections. Dark fiber solutions will offer enterprises more control and flexibility for their cloud connectivity.

- Telecom giants like Etisalat and Ooredoo will continue to expand their fiber networks to meet rising demands from residential, business, and industrial customers. This expansion will include extensive multimode dark fiber installations.

- Enterprises are increasingly opting for private fiber networks to ensure better security and performance. The shift toward dedicated dark fiber infrastructure is expected to grow as more businesses seek bespoke connectivity solutions.

- As cybersecurity becomes a higher priority, the need for secure, scalable fiber networks will grow. Multimode dark fiber will be central to enabling secure, high-capacity private and enterprise networks.

- The continuous advancement in fiber optic technology will enhance the performance of multimode dark fiber networks. These innovations will enable faster, more reliable connections to support emerging technologies like AI and machine learning.

- The UAE’s plans to bridge the digital divide will see increased fiber deployment in less developed regions. This expansion into secondary and tertiary cities will provide new growth opportunities for multimode dark fiber solutions.