| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Data Analytics Outsourcing Market Size 2024 |

USD 11,921.98 Million |

| Data Analytics Outsourcing Market, CAGR |

31.52% |

| Data Analytics Outsourcing Market Size 2032 |

USD 1,06,445.36 Million |

Market Overview

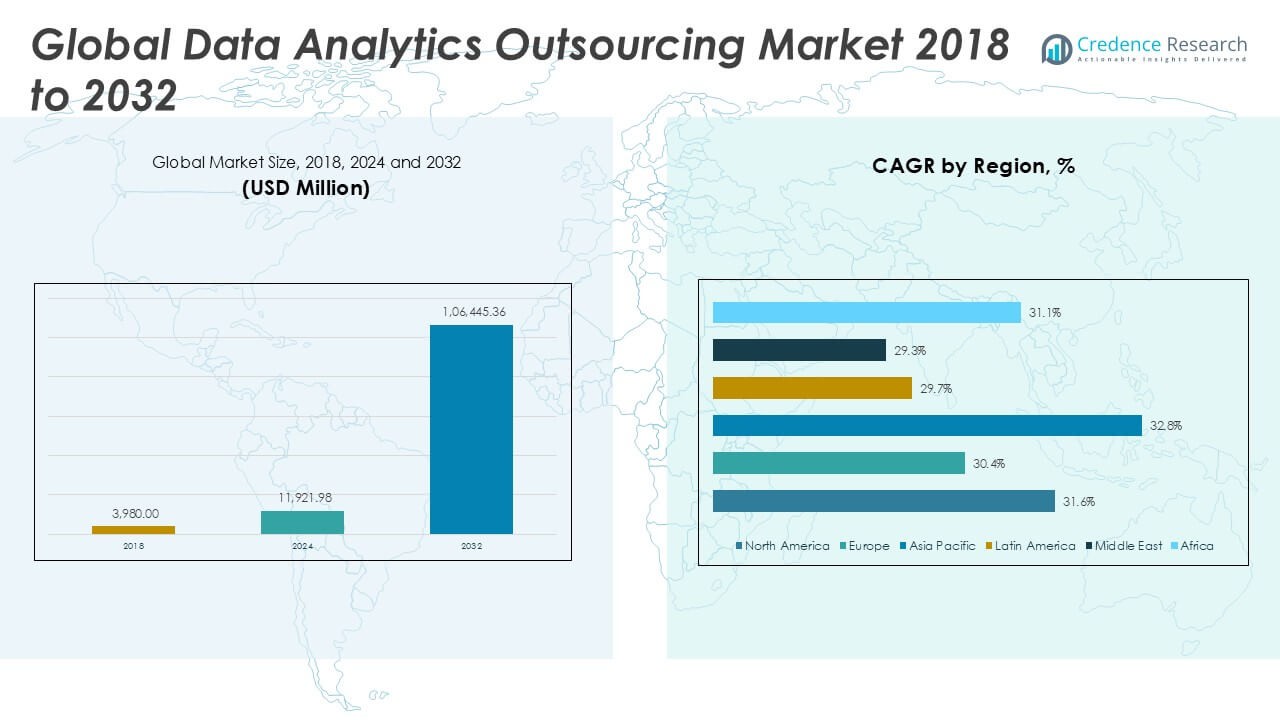

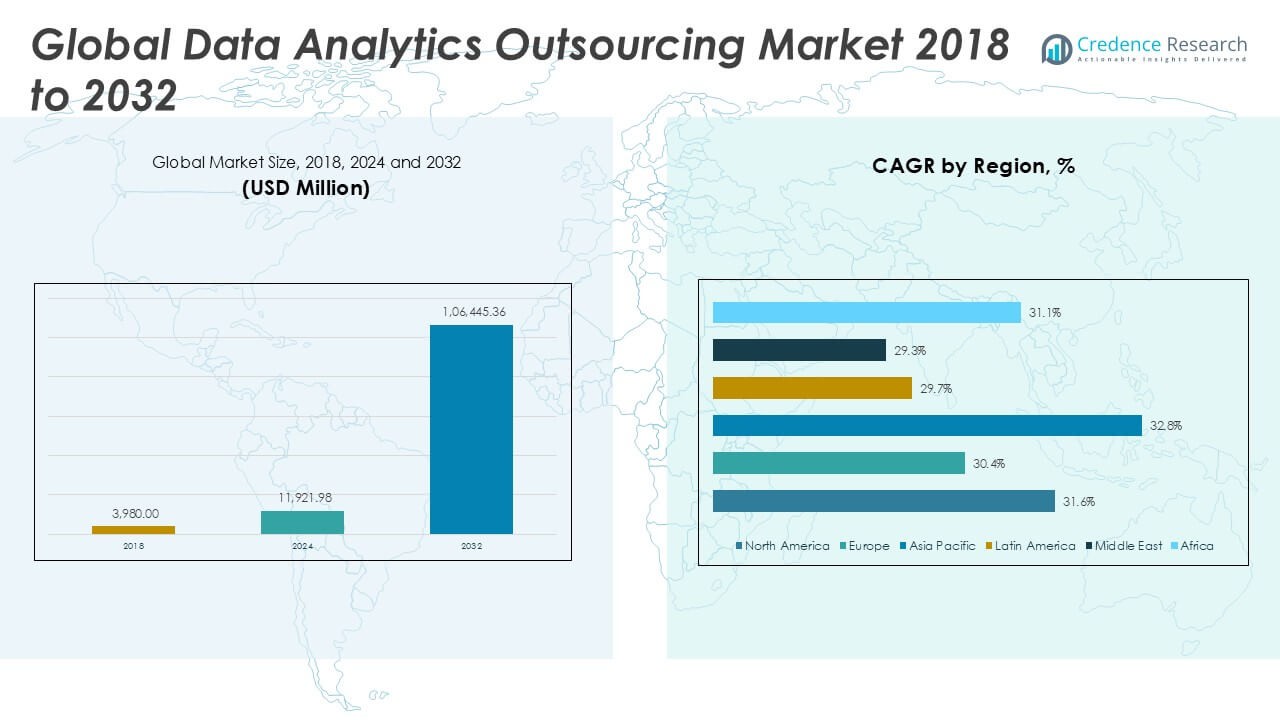

The Data Analytics Outsourcing Market was valued at USD 3,980.00 million in 2018, reached USD 11,921.98 million in 2024, and is anticipated to reach USD 1,06,445.36 million by 2032, at a CAGR of 31.52% during the forecast period.

The Data Analytics Outsourcing Market is driven by the increasing volume and complexity of business data, compelling organizations to seek external expertise for efficient data management and actionable insights. Companies aim to leverage advanced analytics without the high investment in in-house infrastructure or specialized talent, fueling demand for outsourcing partners with strong domain knowledge and technological capabilities. The widespread adoption of cloud-based analytics, AI, and machine learning further accelerates market growth by enabling scalable and flexible data processing. Businesses across sectors such as BFSI, healthcare, retail, and manufacturing are embracing analytics outsourcing to improve decision-making, customer experience, and operational efficiency. Key market trends include the integration of real-time analytics, rising focus on data security and compliance, and the emergence of industry-specific analytics solutions. As organizations continue to prioritize data-driven strategies, the market for data analytics outsourcing is expected to expand significantly, supporting both cost optimization and innovation.

Geographical analysis of the Data Analytics Outsourcing Market highlights strong growth in North America, Europe, and Asia Pacific, where organizations invest in advanced analytics to drive digital transformation and gain competitive advantage. North America and Europe lead adoption due to early technology uptake and the presence of established outsourcing providers, while Asia Pacific’s rapid digitization, large talent pool, and cost benefits make it a preferred destination for analytics outsourcing. Countries such as the United States, India, and the United Kingdom play critical roles in shaping market dynamics. Key players in the Data Analytics Outsourcing Market include Accenture, Capgemini, and Genpact, each offering comprehensive analytics solutions, industry expertise, and robust global delivery models. These companies support clients with innovative services that address data management, advanced analytics, and business strategy, helping organizations leverage actionable insights for improved decision-making and performance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Data Analytics Outsourcing Market was valued at USD 3,980.00 million in 2018, reached USD 11,921.98 million in 2024, and is projected to reach USD 1,06,445.36 million by 2032, with a CAGR of 31.52%.

- Rising data complexity and the need for actionable business insights are key drivers for organizations to outsource analytics functions to specialized providers.

- Cloud-based analytics adoption, integration of AI and machine learning, and increasing demand for real-time data processing are shaping market trends.

- North America, Europe, and Asia Pacific demonstrate significant growth, with the United States, India, and the United Kingdom leading regional adoption and innovation.

- Leading companies such as Accenture, Capgemini, and Genpact compete by offering advanced analytics solutions, global delivery capabilities, and industry-specific expertise.

- Market restraints include concerns over data privacy, security, and compliance with evolving regulations, which challenge service providers and clients alike.

- Demand in emerging markets, sector-focused solutions, and the expansion of digital infrastructure continue to fuel opportunities, while talent shortages and integration complexities may limit short-term growth.

Market Drivers

Rising Data Volumes and Complexity Elevate Outsourcing Demand

Organizations worldwide face exponential growth in data generation from digital transformation, IoT devices, and consumer interactions. Managing and analyzing this volume in-house requires significant resources and technical expertise. The Data Analytics Outsourcing Market benefits as companies seek partners to handle increasingly complex data streams and convert them into actionable insights. Outsourcing allows businesses to access specialized skills and technologies without the high costs of building dedicated teams. The ability to process structured and unstructured data from multiple sources remains crucial for organizations pursuing competitive advantage. Outsourcing firms provide scalable solutions that address the technical and operational challenges of big data environments. Many enterprises turn to outsourcing to streamline data management and support strategic decision-making.

- For instance, Accenture manages more than 120 zettabytes of data annually for clients, supporting advanced analytics and decision-making.

Cost Efficiency and Resource Optimization Encourage Outsourcing Adoption

Cost pressures and the need for operational efficiency drive organizations to consider data analytics outsourcing. Maintaining an in-house analytics infrastructure involves expenses for hardware, software, and ongoing talent development. Outsourcing enables companies to access advanced analytics capabilities at a predictable cost structure. Service providers invest in state-of-the-art platforms, tools, and analytics expertise, allowing clients to focus on core business functions. It reduces capital expenditure and minimizes the financial risks associated with scaling or upgrading analytics operations. Organizations benefit from faster deployment of analytics initiatives, improving agility in responding to market changes. Many enterprises choose outsourcing to maximize return on analytics investments while conserving resources.

- For instance, Genpact helped a leading global bank save USD 20 million annually by optimizing its analytics processes through automation and offshoring.

Access to Advanced Technologies and Industry Expertise Drives Growth

Outsourcing partners bring industry-specific knowledge and technical acumen, helping clients stay ahead in a rapidly evolving analytics landscape. The Data Analytics Outsourcing Market sees strong momentum from advancements in artificial intelligence, machine learning, and cloud computing. Service providers integrate these technologies into their offerings, enabling more accurate forecasting, customer segmentation, and real-time analytics. It allows businesses to take advantage of the latest developments without the burden of ongoing research and development. The partnership with skilled vendors helps organizations achieve higher data accuracy, regulatory compliance, and operational excellence. Outsourcing unlocks opportunities for companies to innovate and differentiate their offerings in competitive markets.

Increasing Emphasis on Core Competencies and Strategic Focus

Many organizations outsource data analytics functions to sharpen their focus on primary business activities. Delegating analytics to external experts enables leadership teams to allocate more resources to product development, customer service, and market expansion. The Data Analytics Outsourcing Market provides flexible models that align with evolving business needs, supporting both short-term projects and long-term transformation initiatives. It fosters a culture of innovation by freeing up internal teams from technical complexities. Strategic outsourcing partnerships often enhance business agility, accelerate time-to-market, and improve overall productivity. Companies pursuing digital transformation increasingly rely on outsourcing to strengthen their competitive position and achieve sustainable growth.

Market Trends

Expansion of Cloud-Based Analytics Solutions Transforming Outsourcing Landscape

Cloud-based analytics platforms continue to reshape the Data Analytics Outsourcing Market, providing clients with scalable, secure, and flexible data management options. Businesses increasingly migrate data workloads to the cloud, enabling real-time access and collaboration across geographies. Service providers leverage cloud infrastructure to deliver faster implementation, seamless integration, and cost-effective analytics services. It simplifies data storage, processing, and deployment, allowing organizations to benefit from advanced analytics without significant capital investments. The shift toward hybrid and multi-cloud models allows companies to optimize their technology stack for performance and compliance. Cloud adoption supports remote workforces and accelerates innovation cycles. The demand for cloud-enabled analytics outsourcing remains robust across industries.

- For instance, Capgemini manages over 100 exabytes of analytics data in the cloud for enterprise clients, driving operational agility and collaboration.

Integration of Artificial Intelligence and Machine Learning Driving Advanced Insights

Artificial intelligence (AI) and machine learning (ML) technologies play a critical role in advancing the capabilities of data analytics outsourcing providers. The Data Analytics Outsourcing Market witnesses strong momentum from AI-driven tools that enable predictive analytics, automation, and intelligent data interpretation. Providers embed AI and ML algorithms in their service offerings to enhance data accuracy and deliver actionable business insights. It empowers clients to identify patterns, forecast trends, and make informed decisions with greater confidence. AI-powered automation reduces manual intervention, shortens analysis cycles, and improves operational efficiency. The trend toward intelligent analytics solutions shapes client expectations for innovation and value-added outcomes.

- For instance, IBM Watson processes over 7 billion AI-driven queries per month for clients worldwide, enabling organizations to automate forecasting and operational decisions.

Growing Focus on Data Privacy, Security, and Regulatory Compliance

With increasing concerns about data privacy and regulatory scrutiny, organizations demand robust security protocols and transparent data governance from outsourcing partners. The Data Analytics Outsourcing Market responds with solutions that prioritize data protection, confidentiality, and adherence to international regulations such as GDPR and CCPA. Service providers implement advanced encryption, access controls, and audit trails to address client concerns and build trust. It enables businesses to outsource analytics without compromising sensitive information or breaching compliance requirements. The rise in cyber threats has accelerated the need for secure outsourcing environments. Regulatory compliance emerges as a key differentiator among analytics outsourcing providers.

Shift Toward Industry-Specific and Value-Based Analytics Solutions

Organizations seek tailored analytics solutions that address unique challenges within their industries, driving a trend toward sector-focused outsourcing models. The Data Analytics Outsourcing Market evolves to offer specialized services for verticals such as healthcare, finance, retail, and manufacturing. Providers develop domain expertise, custom frameworks, and targeted analytics applications to meet specific client objectives. It allows businesses to extract deeper, more relevant insights that drive competitive advantage and operational excellence. The emphasis on measurable outcomes and ROI encourages long-term, strategic outsourcing relationships. Value-based analytics services now play a central role in shaping market dynamics and client satisfaction.

Market Challenges Analysis

Data Security, Privacy Concerns, and Compliance Barriers Remain Significant

Protecting sensitive information and meeting complex regulatory requirements create major challenges for organizations seeking data analytics outsourcing solutions. The Data Analytics Outsourcing Market must address concerns about unauthorized access, data breaches, and potential misuse of proprietary data. Service providers need to implement advanced encryption, strict access controls, and transparent data handling policies to meet client expectations. Regulatory mandates such as GDPR and CCPA require ongoing vigilance and adaptation, particularly for clients operating in multiple jurisdictions. It demands comprehensive audit trails and regular compliance assessments to maintain trust. Any lapses in data governance can undermine outsourcing relationships and slow market growth.

Talent Shortage and Integration Complexities Impact Outsourcing Success

Access to highly skilled analytics professionals remains limited, creating competition among service providers and challenging talent retention strategies. The Data Analytics Outsourcing Market faces pressure to attract and develop expertise in AI, machine learning, and industry-specific analytics. Integration of outsourced solutions with existing IT infrastructure often introduces complexity, requiring alignment of data formats, workflows, and security standards. Misalignment between client expectations and provider capabilities can lead to project delays or suboptimal outcomes. It also makes effective communication and robust project management critical for long-term success. Addressing these integration and talent gaps will be essential to sustain the industry’s expansion.

Market Opportunities

Expansion into Emerging Markets and Untapped Industries Fuels Growth

Emerging economies present significant opportunities for service providers in the Data Analytics Outsourcing Market. Businesses in Asia-Pacific, Latin America, and Africa seek advanced analytics to support digital transformation and improve competitiveness. Service providers can capture new revenue streams by addressing localized needs and regulatory requirements unique to these regions. It creates potential for tailored analytics solutions, language support, and industry-specific expertise that align with regional business goals. Rapid urbanization and expanding internet connectivity increase data generation, strengthening demand for outsourced analytics. Providers that invest in regional partnerships and local talent stand to gain a competitive edge in these high-growth markets.

Innovation in Advanced Technologies and Sector-Specific Solutions Drives Value

Developments in artificial intelligence, machine learning, and automation create opportunities for analytics outsourcing providers to offer differentiated, value-added services. The Data Analytics Outsourcing Market can deliver sector-specific solutions for healthcare, finance, retail, and manufacturing by leveraging cutting-edge technologies and domain knowledge. It empowers clients to unlock actionable insights, drive operational efficiencies, and respond swiftly to evolving market conditions. Providers that invest in research, innovation, and workforce upskilling will address industry pain points more effectively. Collaboration with clients on custom analytics frameworks enhances business outcomes and fosters long-term strategic relationships.

Market Segmentation Analysis:

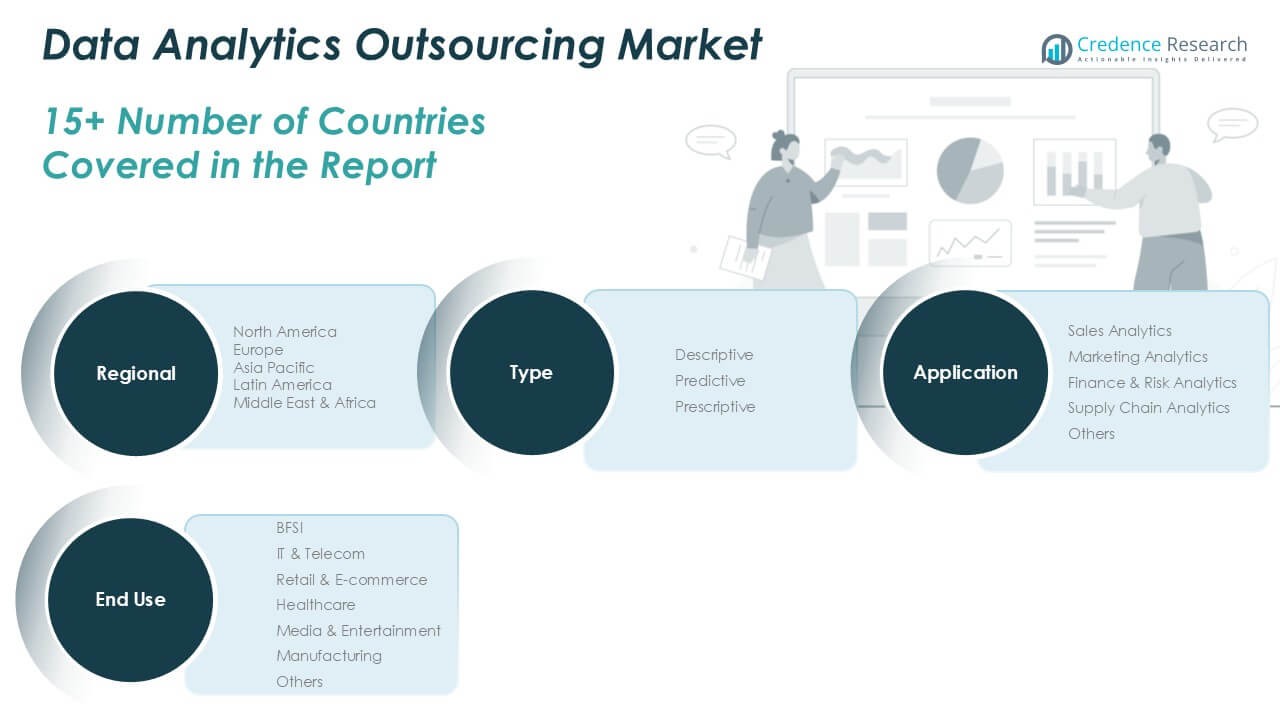

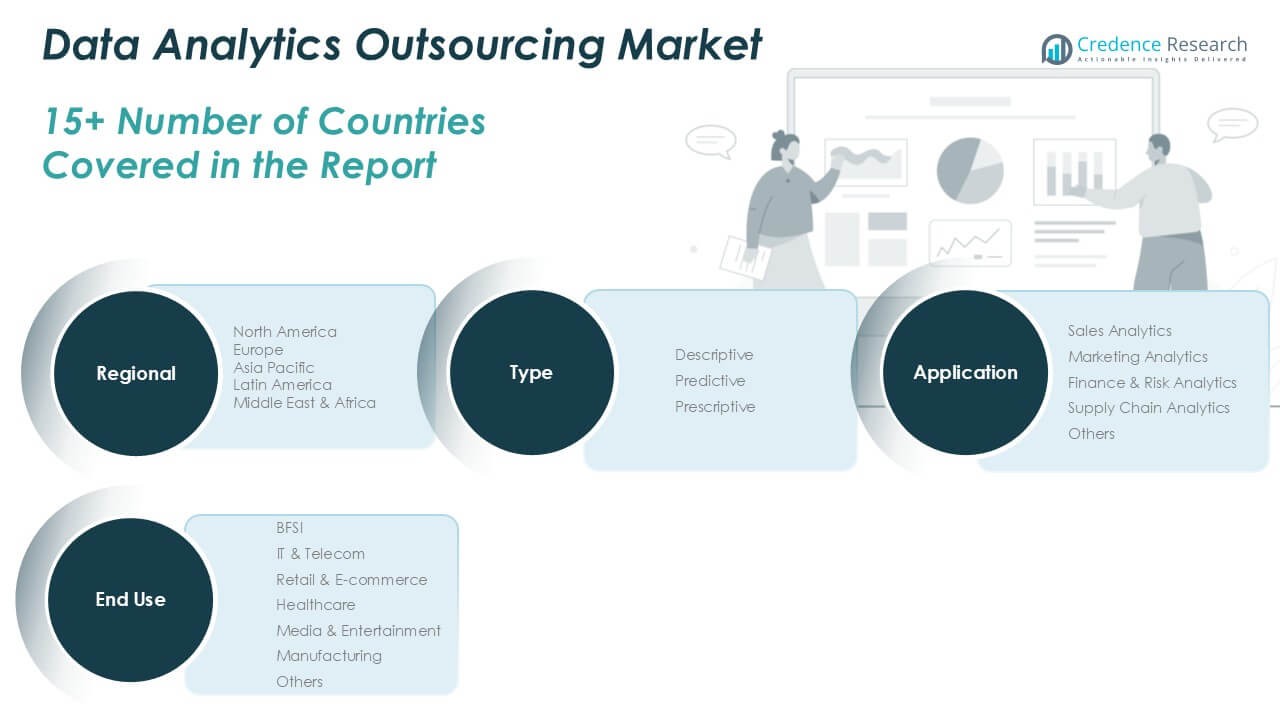

By Type:

The market includes descriptive, predictive, and prescriptive analytics. Descriptive analytics holds significant adoption due to its ability to summarize historical data and provide clear business insights. Predictive analytics is gaining traction for its power to forecast trends, behaviors, and potential outcomes using statistical techniques and machine learning. Prescriptive analytics is emerging as a critical tool for organizations seeking actionable recommendations and optimal decision paths, helping to drive efficiency and business growth.

- For instance, Mu Sigma deployed more than 16,000 predictive and prescriptive analytics models for Fortune 500 companies last year, enabling data-driven transformation initiatives.

By Application:

The market features sales analytics, marketing analytics, finance and risk analytics, supply chain analytics, and other specialized uses. Sales analytics dominates for its role in evaluating sales performance, customer segmentation, and revenue forecasting, which enables companies to identify growth opportunities and manage pipelines effectively. Marketing analytics supports campaign optimization, customer targeting, and market trend analysis, helping businesses maximize return on marketing investments. Finance and risk analytics address regulatory compliance, fraud detection, and portfolio management, which is vital for managing exposure and maintaining operational integrity. Supply chain analytics focuses on inventory management, demand planning, and supplier evaluation to improve operational efficiency and cost control. Other applications address custom business needs, such as workforce analytics or customer service improvements.

- For instance, Fractal Analytics enabled a major global retailer to cut inventory costs by USD 8 million and improve on-time deliveries by 2 million shipments through advanced analytics deployment.

By End-Use:

The Data Analytics Outsourcing Market serves a diverse range of sectors, including BFSI, IT and telecom, retail and e-commerce, healthcare, media and entertainment, manufacturing, and others. The BFSI sector remains a leading adopter due to the high demand for risk assessment, regulatory compliance, and customer analytics. IT and telecom leverage outsourcing to manage large data volumes, monitor network performance, and enhance service delivery. Retail and e-commerce benefit from real-time analytics to personalize experiences, optimize inventory, and predict consumer trends. Healthcare organizations outsource analytics to improve patient outcomes, support research, and streamline administrative functions. Media and entertainment companies use data analytics to refine content strategy and target audiences. Manufacturing focuses on process optimization, quality management, and predictive maintenance. Other sectors, such as logistics or education, are increasingly turning to outsourcing to address their unique data-driven challenges. Each segment contributes to the overall growth and sophistication of the Data Analytics Outsourcing Market.

Segments:

Based on Type:

- Descriptive

- Predictive

- Prescriptive

Based on Application:

- Sales Analytics

- Marketing Analytics

- Finance & Risk Analytics

- Supply Chain Analytics

- Others

Based on End-Use:

- BFSI

- IT & Telecom

- Retail & E-commerce

- Healthcare

- Media & Entertainment

- Manufacturing

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Data Analytics Outsourcing Market

North America Data Analytics Outsourcing Market grew from USD 1,441.16 million in 2018 to USD 4,271.94 million in 2024 and is projected to reach USD 38,336.83 million by 2032, reflecting a compound annual growth rate (CAGR) of 31.6%. North America is holding a 36% market share. The United States and Canada lead regional growth due to early adoption of advanced analytics, robust IT infrastructure, and the presence of leading outsourcing providers. Organizations in financial services, healthcare, and retail sectors outsource analytics functions to gain competitive advantages. Demand for data-driven decision-making and compliance with stringent data protection regulations drive market expansion. Investments in cloud-based analytics platforms and AI technologies support regional growth and foster innovation.

Europe Data Analytics Outsourcing Market

Europe Data Analytics Outsourcing Market grew from USD 1,006.94 million in 2018 to USD 2,894.33 million in 2024 and is set to reach USD 24,138.90 million by 2032, registering a CAGR of 30.4%. Europe accounts for 23% market share, with the United Kingdom, Germany, and France serving as key contributors. The market is driven by digital transformation initiatives, rising demand for advanced analytics, and compliance requirements such as GDPR. BFSI and manufacturing sectors lead outsourcing adoption, seeking operational efficiency and improved risk management. The shift toward industry-specific analytics solutions and rising investments in AI boost market opportunities. Service providers emphasize data privacy and secure analytics delivery to build trust among European enterprises.

Asia Pacific Data Analytics Outsourcing Market

Asia Pacific Data Analytics Outsourcing Market grew from USD 1,145.84 million in 2018 to USD 3,561.64 million in 2024 and is forecast to reach USD 34,386.41 million by 2032, at a CAGR of 32.8%. Asia Pacific is capturing 32% market share, driven by rapid digitization in countries like India, China, Japan, and Australia. Enterprises in e-commerce, telecom, and healthcare accelerate outsourcing adoption to support business agility and scalability. Access to a large talent pool and cost advantages position the region as a preferred outsourcing destination. Demand for cloud-based analytics and machine learning solutions strengthens regional market momentum. Government initiatives promoting digital transformation contribute to sustained growth.

Latin America Data Analytics Outsourcing Market

Latin America Data Analytics Outsourcing Market grew from USD 203.78 million in 2018 to USD 603.13 million in 2024 and will likely reach USD 4,814.52 million by 2032, representing a CAGR of 29.7%. Latin America secures 5% market share, with Brazil and Mexico at the forefront. The market benefits from increasing digital adoption in banking, retail, and manufacturing sectors. Regional businesses partner with outsourcing providers to access specialized analytics expertise and technology infrastructure. Growth in fintech and start-up activity stimulates demand for advanced analytics. Language capabilities and cultural alignment with North American clients also support outsourcing relationships.

Middle East Data Analytics Outsourcing Market

Middle East Data Analytics Outsourcing Market grew from USD 137.31 million in 2018 to USD 382.62 million in 2024 and is expected to reach USD 2,990.42 million by 2032, with a CAGR of 29.3%. The Middle East commands a 3% market share, led by the United Arab Emirates and Saudi Arabia. Market expansion is fueled by digital government initiatives, smart city projects, and the rapid modernization of banking and retail sectors. Organizations outsource analytics to address talent shortages and accelerate digital transformation goals. Investments in cybersecurity and compliance frameworks help overcome regional data privacy concerns. Adoption of cloud analytics solutions is on the rise.

Africa Data Analytics Outsourcing Market

Africa Data Analytics Outsourcing Market grew from USD 44.97 million in 2018 to USD 208.31 million in 2024 and is anticipated to reach USD 1,778.28 million by 2032, achieving a CAGR of 31.1%. Africa holds a 2% market share, with South Africa, Nigeria, and Kenya emerging as regional leaders. Market growth is supported by the expansion of internet connectivity, fintech innovation, and the modernization of banking and public services. Outsourcing analytics addresses local talent gaps and provides access to global best practices. The rising demand for digital services in healthcare, retail, and government sectors continues to drive regional adoption. Cloud and mobile analytics solutions offer scalability and cost efficiency for African enterprises.

Key Player Analysis

- Accenture

- Nipro Corporation

- Capgemini

- Fractal Analytics Inc.

- Genpact

- Infosys Limited

- IBM Corporation

- Mu Sigma

- TATA Consultancy Services Limited

- Trianz

- ZS Associates

Competitive Analysis

The Data Analytics Outsourcing Market features intense competition among leading players, each leveraging technology innovation, domain expertise, and global delivery networks to strengthen their market positions. Key players include Accenture, Capgemini, Genpact, Infosys Limited, IBM Corporation, Mu Sigma, TATA Consultancy Services Limited, ZS Associates, Trianz, Fractal Analytics Inc., and Nipro Corporation. These companies offer comprehensive analytics outsourcing services, ranging from data management and descriptive analytics to predictive and prescriptive modeling. These companies focus on innovation, driving the adoption of real-time analytics and automation to meet evolving business needs. Strong global delivery models and extensive consulting services enable them to serve large enterprises seeking end-to-end analytics support. Firms actively pursue strategic alliances and acquisitions to strengthen their domain expertise and expand their client base. The ability to address regulatory compliance, ensure data security, and deliver measurable business value remains a key differentiator. Competitive dynamics in the market continue to intensify as organizations prioritize digital transformation and demand for data-driven decision-making accelerates worldwide.

Recent Developments

- In February 2024, Wipro and IBM Expanded Partnership to Offer New AI Services and Support to Clients. Wipro launched an Enterprise AI-Ready Platform, leveraging IBM Watsonx, to advance enterprise adoption of Generative AI. As part of the expanded partnership, IBM and Wipro will establish a centralized tech hub to support joint clients in their AI pursuits. As part of this expanded partnership, Wipro associates will be trained in IBM hybrid cloud, AI, and data analytics technologies to help accelerate the development of joint solutions.

- In November 2023, Accenture and Salesforce work together to help life sciences companies differentiate themselves with data and AI. This will help to accelerate the deployment of data and analytics capabilities and support decision-making and operations.

- In October 2023, Krungsri announced a five-year partnership with IT infrastructure service provider Kyndryl. Through the implementation of data analytics, cloud solutions, and automation, Kyndryl strengthens banks’ ability to adapt to market changes, enhance traditional systems, and improve customer-focused digital banking services.

- In June 2023, Microsoft and Moody’s Corporation announced a new strategic partnership to deliver advanced data, analytics, research, collaboration, and risk solutions to financial services. The partnership is built on Moody’s robust data and analytics capabilities and the power and scale of Microsoft’s Azure OpenAI service, leveraging Microsoft AI to deliver Moody’s proprietary data and analytics.

- In May 2023, Capgemini and Google Cloud expanded their strategic partnership in data analytics and artificial intelligence (AI). The partnership launched a new platform for generative AI to assist enterprises in realizing the full potential of Exploit AI and created a global Google Cloud (CoE) technology.

Market Concentration & Characteristics

The Data Analytics Outsourcing Market exhibits moderate to high market concentration, with a few global firms holding substantial market share due to their advanced technical expertise, established client relationships, and ability to deliver large-scale projects. It features a blend of multinational service providers and niche firms, both addressing growing demand across industries such as BFSI, healthcare, retail, and manufacturing. Market participants distinguish themselves by offering comprehensive analytics solutions, proprietary platforms, and domain-specific services tailored to client needs. High entry barriers exist, driven by the need for specialized talent, strong data security frameworks, and continual technology upgrades. It remains highly dynamic, reflecting rapid innovation in artificial intelligence, machine learning, and automation, alongside the increasing complexity of regulatory environments. The market values deep industry knowledge, agility in service delivery, and the capacity to manage global delivery networks. Continuous investment in R&D and strategic partnerships strengthens the competitive position of leading players, shaping the market’s evolving characteristics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for advanced data analytics outsourcing is expected to rise due to growing digital transformation across industries.

- Businesses will increasingly rely on third-party analytics providers to reduce operational costs and focus on core competencies.

- The adoption of cloud-based analytics platforms is likely to accelerate the outsourcing trend further.

- AI and machine learning integration in outsourced analytics services will enhance data-driven decision-making.

- The BFSI, healthcare, and retail sectors will remain key contributors to market growth due to their data-intensive operations.

- Growing availability of skilled analytics professionals in emerging economies will support global outsourcing expansion.

- Demand for real-time analytics and predictive insights will drive partnerships with specialized outsourcing firms.

- Companies will prioritize vendors offering scalable and customizable analytics solutions.

- Increased regulatory compliance requirements will push organizations to seek outsourcing partners with robust data governance capabilities.

- North America and Asia Pacific are projected to witness strong growth in outsourced data analytics services.