Market Overview

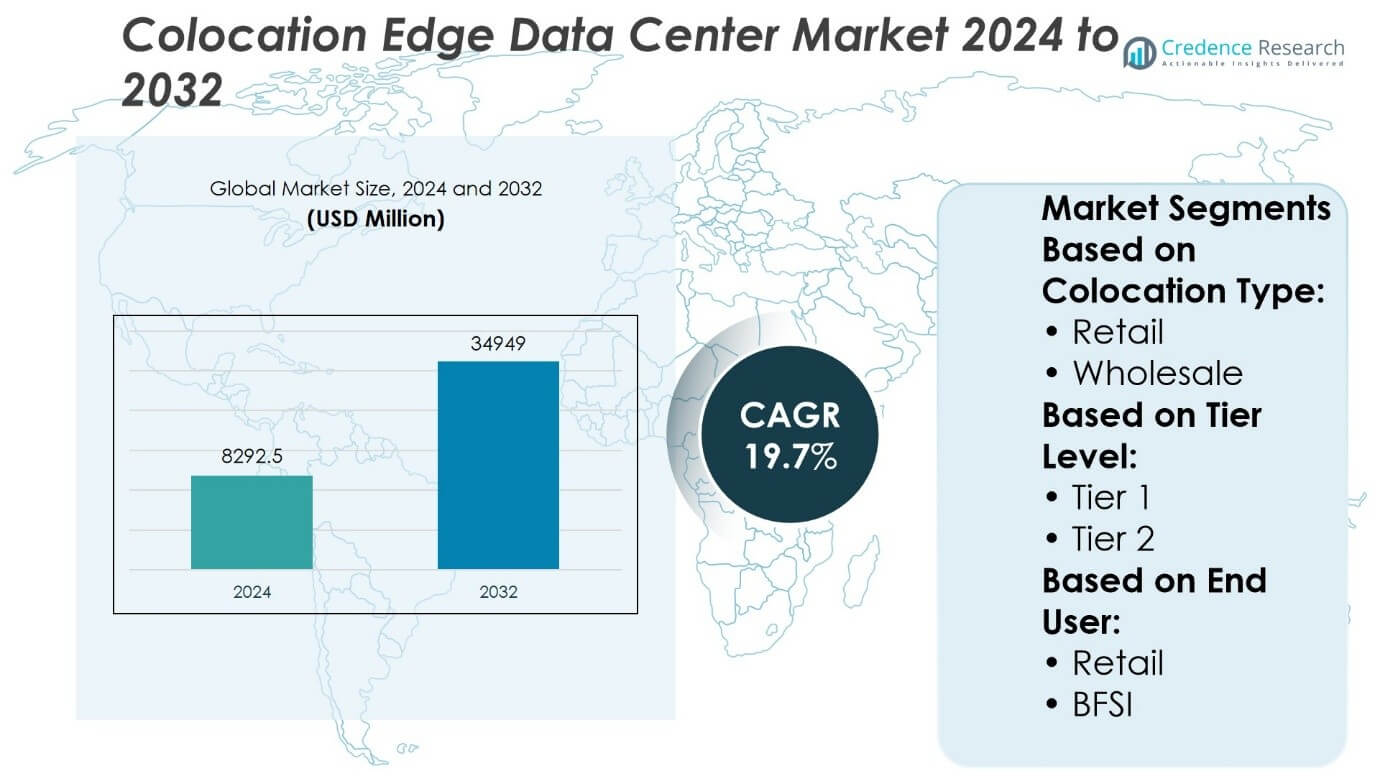

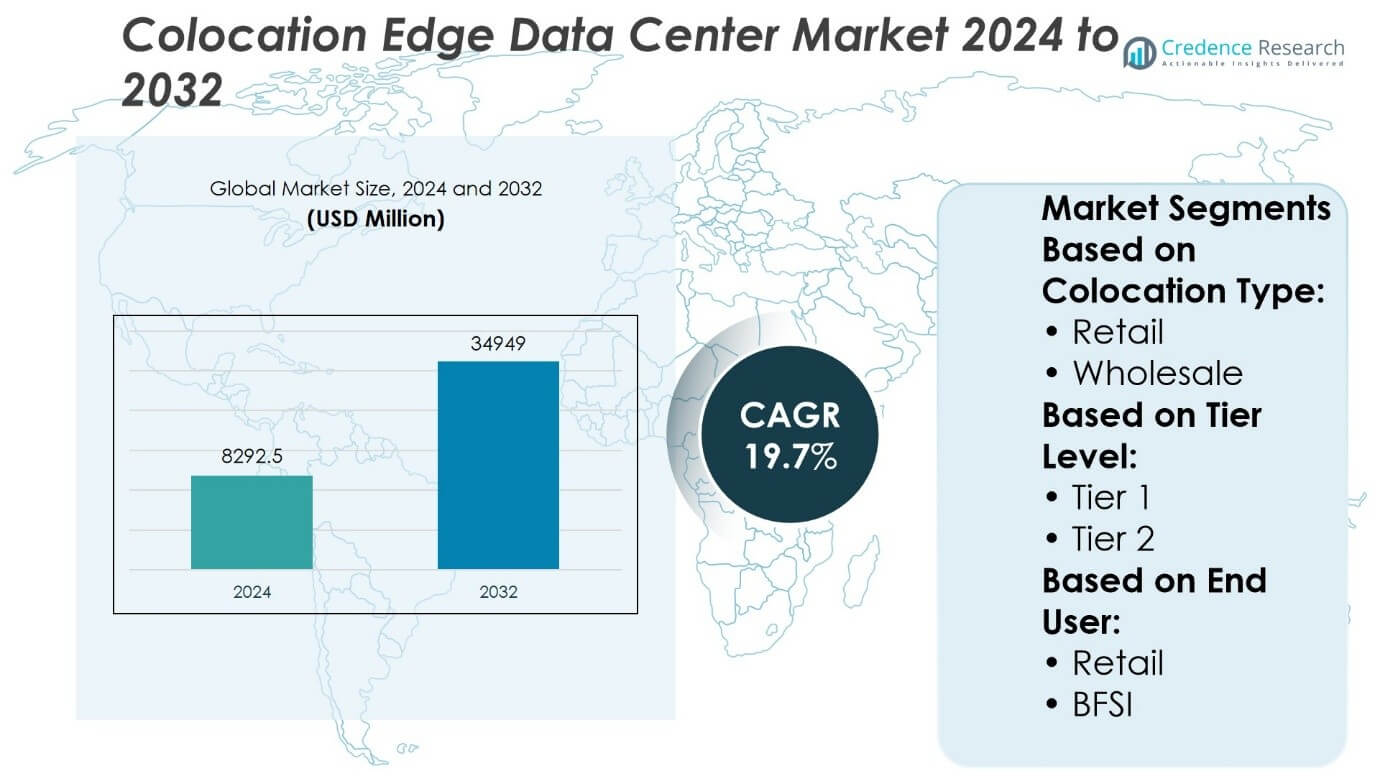

Colocation Edge Data Center Market size was valued at USD 8292.5 million in 2024 and is anticipated to reach USD 34949 million by 2032, at a CAGR of 19.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Colocation Edge Data Center Market Size 2024 |

USD 8292.5 million |

| Colocation Edge Data Center Market, CAGR |

19.7% |

| Colocation Edge Data Center Market Size 2032 |

USD 34949 million |

The Colocation Edge Data Center Market experiences strong growth driven by increasing demand for low-latency data processing and real-time analytics across industries. It benefits from rapid adoption of IoT, 5G, and cloud technologies that require localized computing power. Providers focus on deploying modular, scalable infrastructure near end users to reduce latency and enhance performance. Rising emphasis on energy efficiency and data security further shapes market developments. Trends highlight growing integration of hybrid cloud architectures, expansion into emerging regions, and strategic partnerships that enhance service delivery. These factors collectively propel innovation and widespread adoption of edge colocation solutions.

The Colocation Edge Data Center Market shows strong presence across North America, Europe, and Asia-Pacific, with North America holding the largest market share due to advanced infrastructure and high cloud adoption. Europe focuses on regulatory compliance and sustainability, while Asia-Pacific experiences rapid growth fueled by digital transformation and 5G rollout. Key players such as Dell, HPE, IBM, Huawei, Schneider Electric, and Vertiv lead the market, leveraging technological innovation and strategic expansions to capture regional opportunities and meet rising demand for edge computing services.

Market Insights

- The Colocation Edge Data Center Market size was valued at USD 8,292.5 million in 2024 and is expected to reach USD 34,949 million by 2032, growing at a CAGR of 19.7%.

- Demand for low-latency data processing and real-time analytics drives market growth across various industries.

- Rapid adoption of IoT, 5G, and cloud technologies fuels the need for localized, scalable edge infrastructure.

- Providers focus on modular deployments near end users to reduce latency and improve performance.

- Energy efficiency and data security requirements influence technology development and service models.

- North America leads the market with the largest share due to advanced infrastructure and cloud adoption, followed by Europe and Asia-Pacific, which show steady growth.

- Leading companies such as Dell, HPE, IBM, Huawei, Schneider Electric, and Vertiv compete through innovation, strategic partnerships, and regional expansions to meet rising edge computing demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rapid Growth in Data Consumption and Demand for Low-Latency Computing

The rising volume of data generated by IoT devices, streaming services, and connected applications fuels the demand for edge data centers. Colocation Edge Data Center Market benefits from the need to process data closer to the source to reduce latency and improve user experience. Enterprises prioritize infrastructure that delivers faster response times and supports real-time analytics. It enables businesses to handle large data streams without relying solely on centralized cloud facilities. This shift encourages investments in edge facilities located near end users to ensure minimal delay. The drive for low-latency computing stimulates the expansion of colocation services at the network edge.

- For instance, according to the Federal Communications Commission (FCC), average monthly data usage per fixed broadband subscriber in the U.S. reached 605 gigabytes in 2023, up from 513 gigabytes in 2022, driving edge infrastructure providers to deploy additional processing capacity closer to end users.

Increasing Adoption of Cloud Services and Hybrid IT Architectures

Cloud computing adoption propels the demand for colocation edge data centers by enabling hybrid IT environments. Organizations use edge colocation facilities to integrate public cloud resources with on-premises infrastructure, optimizing workload distribution. This approach enhances operational efficiency and improves disaster recovery capabilities. It also supports scalability by providing flexible resource allocation. The Colocation Edge Data Center Market grows as enterprises seek to balance cloud flexibility with the performance benefits of local processing. Providers develop solutions that accommodate complex hybrid architectures and varying application demands.

- For instance, Microsoft confirmed the deployment of 52 Azure edge zones, supported by a global network backbone of 289,000 kilometers of fiber, which allows cloud-native.

Emerging Use Cases in Industry 4.0 and Smart Cities Driving Infrastructure Expansion

Industry 4.0 applications such as autonomous vehicles, smart manufacturing, and healthcare monitoring require robust edge computing infrastructure. The Colocation Edge Data Center Market experiences growth driven by the need for localized computing power to manage these latency-sensitive operations. Smart city projects demand distributed data centers to support intelligent traffic management, public safety, and utility services. These developments push network operators and service providers to deploy edge colocation centers strategically. It ensures real-time data processing and improves overall system reliability in emerging urban ecosystems.

Stringent Data Security Regulations and Need for Compliance at the Edge

Regulatory frameworks emphasize data protection and privacy, compelling organizations to adopt edge colocation solutions that ensure compliance. Edge data centers provide controlled environments with enhanced physical security and localized data handling. The Colocation Edge Data Center Market responds to demand for secure, compliant infrastructure that minimizes data transmission risks. Enterprises use edge facilities to store sensitive data within geographic boundaries while benefiting from fast processing. Providers invest in certifications and technologies that meet stringent regulatory requirements. This focus on compliance supports market expansion across highly regulated industries.

Market Trends

Expansion of Distributed Infrastructure to Support Edge Computing Requirements

The Colocation Edge Data Center Market reflects a clear shift toward distributed infrastructure deployment. Companies place facilities closer to data sources to handle the growing demand for low-latency processing and real-time analytics. It supports applications across sectors like gaming, healthcare, and autonomous systems that require immediate data handling. Providers focus on establishing smaller, modular data centers in urban and suburban locations to reduce network congestion. This distribution minimizes data travel distances and enhances service reliability. The trend accelerates network modernization efforts and encourages partnerships between colocation providers and telecom operators.

- For instance, Amazon Web Services (AWS) launched 32 AWS Local Zones across major U.S. cities as of 2024 and announced plans for 19 additional zones globally, each designed to deliver compute, storage, and database services within 15 kilometers of end users, enabling workloads with latency requirements below 10 milliseconds.

Integration of Advanced Cooling and Energy-Efficient Technologies in Edge Facilities

Energy consumption remains a critical concern in the Colocation Edge Data Center Market. Operators adopt innovative cooling methods, such as liquid cooling and free-air cooling, to reduce power usage and environmental impact. It allows facilities to maintain high performance without compromising sustainability goals. Efficient energy management systems and renewable energy sources gain traction to support operational costs and regulatory compliance. Providers prioritize solutions that balance performance with ecological responsibility. This trend reflects a broader industry move toward greener infrastructure in response to rising energy demands.

- For instance, according to a 2024 report by the U.S. Department of Energy, advanced immersion cooling technologies implemented in federally supported data facilities reduced cooling-related energy use by 1,180,000 kilowatt-hours annually.

Rising Demand for Enhanced Security Protocols and Compliance at the Edge

The Colocation Edge Data Center Market observes increasing emphasis on data security and regulatory adherence. Edge facilities incorporate advanced access controls, biometric authentication, and real-time monitoring to safeguard sensitive information. It helps clients comply with data sovereignty laws by localizing data processing and storage. The market responds to growing cybersecurity threats by deploying layered defense mechanisms and encryption standards. Providers offer tailored security packages to meet the requirements of industries like finance, healthcare, and government. This focus on security strengthens client trust and drives adoption.

Growth in Partnerships and Ecosystem Collaborations to Expand Edge Services

Market players in the Colocation Edge Data Center Market form strategic alliances to enhance service offerings and geographic reach. Collaborations between cloud providers, network operators, and colocation firms enable integrated edge computing solutions. It facilitates seamless connectivity and improves customer experience through combined infrastructure and expertise. Joint ventures accelerate deployment timelines and reduce capital expenditure risks. The trend encourages innovation in edge applications and drives competitive differentiation. Such partnerships establish a robust ecosystem that supports future market growth.

Market Challenges Analysis

Complexities in Managing Distributed Infrastructure and Operational Efficiency

The Colocation Edge Data Center Market faces significant challenges due to the complexity of managing highly distributed facilities. Operators must ensure consistent performance, maintenance, and security across multiple remote locations. It requires sophisticated monitoring tools and automation to maintain uptime and optimize resource utilization. Coordinating logistics and skilled workforce deployment presents operational hurdles. The diversity of edge sites demands customized solutions that increase management overhead and cost. These factors complicate scalability and can delay deployment timelines, impacting overall market growth.

Constraints Related to Energy Supply, Security, and Regulatory Compliance at the Edge

Energy availability and sustainability remain critical concerns for edge data centers operating in diverse geographic locations. The Colocation Edge Data Center Market contends with power supply inconsistencies and limitations in adopting renewable energy at smaller facilities. It also faces heightened risks related to physical and cybersecurity threats, requiring robust security frameworks tailored for decentralized environments. Navigating varied regional regulations on data privacy and sovereignty adds complexity to compliance efforts. These challenges increase operational costs and require continuous investments in technology and expertise, restraining rapid market expansion.

Market Opportunities

Expansion into Untapped Geographies to Address Growing Demand for Edge Services

The Colocation Edge Data Center Market presents significant opportunities in emerging regions with increasing digital adoption. Many areas lack adequate edge infrastructure to support burgeoning IoT, 5G, and cloud applications. It enables providers to capture new customer bases by deploying facilities in underserved urban and rural locations. Growing government initiatives focused on digital transformation create a favorable environment for rapid infrastructure rollout. Providers can leverage partnerships with local telecom operators to accelerate network integration. This expansion supports enhanced connectivity and reduces latency for regional users, driving market growth.

Development of Customized Solutions Catering to Industry-Specific Edge Computing Needs

Industries such as healthcare, manufacturing, and retail require tailored edge data center solutions to meet unique operational demands. The Colocation Edge Data Center Market can capitalize on this by designing specialized offerings that address strict latency, security, and compliance requirements. It supports vertical-specific applications like remote patient monitoring, smart factories, and real-time inventory management. Providers offering flexible, scalable, and secure edge services attract enterprise customers seeking competitive advantages. Innovation in modular and containerized data centers further enables rapid deployment and customization. This focus on industry-driven solutions expands market reach and creates long-term client relationships.

Market Segmentation Analysis:

By Colocation Type:

The Adventure Motorcycle Wheels Market divides into retail and wholesale channels. Retail outlets cater directly to individual consumers seeking customization and immediate availability, often emphasizing premium and branded wheels. Wholesale distributors focus on bulk supply to manufacturers, service centers, and smaller retailers, supporting broad market penetration through efficient supply chains. It balances personalized service with volume-driven distribution, meeting diverse customer needs.

- For instance, Digital Realty reported in its 2024 infrastructure summary that it delivered 36 new retail colocation suites globally, each averaging 600 square meters, while simultaneously completing 9 wholesale build-to-suit halls, each supporting up to 5 megawatts of IT load dedicated to hyperscale clients.

By Tier Level:

Tier 1 companies hold significant market share through strong brand recognition, extensive R&D, and global presence. They lead trends with innovations such as lightweight materials and enhanced durability. Tier 2 players offer cost-effective alternatives focused on regional markets. Their agility enables quick responses to shifting customer demands and local regulations, maintaining market competitiveness.

By End User:

The BFSI sector utilizes adventure motorcycle wheels for fleet vehicles engaged in on-site security and rapid transport, requiring durable wheels for diverse terrains. The retail segment includes individual riders and enthusiasts prioritizing performance and style. It drives demand for innovative designs and high-quality materials to improve safety and riding experience.

- For instance, according to a long‑term field durability study by Royal Enfield in 2024, Himalayan motorcycles equipped with stock spoke wheels completed over 4,000 kilometers of mixed-terrain operations.

Segments:

Based on Colocation Type:

Based on Tier Level:

Based on End User:

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America leads the global colocation edge data center market with an estimated 40% share. The region drives growth through its advanced digital infrastructure, high adoption of 5G and IoT technologies, and the strong presence of major cloud service providers and hyperscalers. Enterprises and service providers seek low‑latency, reliable edge data center deployments closer to end‑users. Technological innovation and substantial investment in edge capabilities reinforce its dominance.

Asia Pacific

Asia Pacific stands as the second largest region, capturing about 30% of the global colocation edge data center market. The region demonstrates the fastest growth, with a projected CAGR around 15%, fueled by rapid urbanization, increasing internet penetration, and rapid deployment of smart‑city and 5G initiatives in countries like China, India, and Japan. Governments within APAC actively back digital transformation, while rising IoT adoption and mobile data consumption further accelerate demand for edge colocation facilities. The combination of policy support, cost‑competitive development, and vast digital economies positions Asia Pacific as a central growth engine.

Europe

Europe represents approximately 20% of the colocation edge data center market. The region benefits from strong regulatory drivers—particularly GDPR—that encourage onshore data processing and storage. Enterprises demand edge capabilities that align with stringent data sovereignty and privacy mandates. The support for sustainability and energy efficiency, combined with robust digital infrastructure in countries such as Germany, the UK, and the Netherlands, supports steady market growth in Europe. Its projected growth rate remains solid, with a near‑double‑digit CAGR expected in the forecast period.

Latin America & Middle East & Africa (MEA)

Latin America and MEA each hold around 5% of the global colocation edge data center market share. Although their current shares remain modest, both regions exhibit rising momentum. In Latin America, burgeoning internet penetration, digital transformation across industries like e‑commerce, and investments in edge infrastructure (especially in Brazil and Mexico) are accelerating growth. In MEA, expanding digital services, streaming platforms, and the comparative advantages of energy and geographic positioning stimulate the adoption of colocation edge facilities

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fujitsu Ltd.

- IBM

- Schneider

- Dell

- Vertiv, Co.

- Huawei

- Eaton

- NVIDIA

- Rittal

- HPE

Competitive Analysis

The Colocation Edge Data Center Market features intense competition among global and regional players include Dell, Eaton, Fujitsu Ltd., HPE, Huawei, IBM, NVIDIA, Rittal, Schneider Electric, and Vertiv, Co. The Colocation Edge Data Center Market experiences intense competition driven by innovation, capacity expansion, and service differentiation. Companies leverage advanced technology and robust infrastructure to deliver scalable, energy-efficient, and secure colocation services tailored to edge computing needs. Market leaders focus on modular and containerized data centers that enable rapid deployment and flexible scalability. Emphasis on integrated power and cooling solutions improves operational efficiency and sustainability. Providers prioritize hybrid cloud integration and AI-driven management platforms to enhance automation and service flexibility. Geographic expansion and strategic partnerships remain central to competitive strategies, enabling access to emerging markets and supporting regional digital transformation initiatives. Differentiation occurs through customized offerings that address specific verticals, including healthcare, telecommunications, and smart cities. This competitive landscape fosters continuous innovation, operational excellence, and customer-centric approaches, positioning companies to effectively capitalize on the evolving demands of the colocation edge data center sector.

Recent Developments

- In January 2024, IBM and American Tower announced a strategic collaboration aimed at enhancing edge cloud services for enterprises. This partnership will focus on deploying a hybrid, multi-cloud computing platform at the edge, leveraging both companies’ strengths in digital infrastructure and cloud technologies.

- In February 2024, NTT DATA, a global player in IT infrastructure and services, and Schneider Electric, partnered to unveil a first-of-a-kind co-innovation that empowers enterprises to harness the power of edge computing. The strategic partnership introduces a unique solution that seamlessly integrates Edge Data Centers, providing unparalleled connectivity and supporting the computational demands of Generative AI applications deployed at the edge.

- In July 2024, Digital Realty Trust announced the acquisition of a colocation data center located in the Slough Trading Estate for USD 200 million. This acquisition expands the company’s West London market presence and enhances its colocation capabilities in the City and Docklands areas.

- In April 2024, enLighten acquired seven edge data centers from EXA Infrastructure. This expanded enLightens European footprint to include new markets in Belgium, Switzerland, and Spain, while also growing its presence in existing markets like France, the UK, and the Netherlands.

Market Concentration & Characteristics

The Colocation Edge Data Center Market demonstrates a moderately concentrated landscape characterized by the presence of several key global players alongside numerous regional and niche providers. It exhibits a competitive environment where leading companies leverage technological innovation, extensive infrastructure, and strategic partnerships to maintain market dominance. The market structure favors those that can rapidly deploy modular, scalable solutions to meet growing demand for low-latency and localized data processing. While large players focus on expanding capacity and enhancing service offerings through integrated power management and hybrid cloud capabilities, smaller firms differentiate by targeting specific verticals or regional requirements with customized solutions. The market’s fragmented nature also reflects varied customer needs across industries such as telecommunications, healthcare, retail, and smart cities, which drive demand for tailored edge colocation services. Barriers to entry remain significant due to high capital investment, technological expertise, and regulatory compliance requirements. However, the growing adoption of edge computing and increasing demand for distributed infrastructure create opportunities for emerging players that can offer innovative, flexible, and energy-efficient solutions. Overall, the market balances competitive intensity with strategic collaborations, encouraging continuous advancement and diversification to address evolving enterprise and consumer needs.

Report Coverage

The research report offers an in-depth analysis based on Colocation Type, Tier Level, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Colocation Edge Data Center Market will expand rapidly due to rising demand for low-latency data processing.

- Providers will increase investments in modular and scalable edge infrastructure.

- Integration with 5G networks will accelerate edge data center deployments globally.

- Growth will focus on expanding facilities in tier-2 and tier-3 cities.

- Companies will prioritize energy-efficient and sustainable technologies in new builds.

- Hybrid cloud and multi-cloud edge solutions will gain prominence among enterprises.

- Security and compliance requirements will drive advancements in edge data center management.

- Strategic partnerships between cloud providers, telecom operators, and colocation firms will strengthen.

- Industry-specific customization of edge services will become a key differentiator.

- Emerging markets will present significant opportunities for edge data center expansion.