Market Overview:

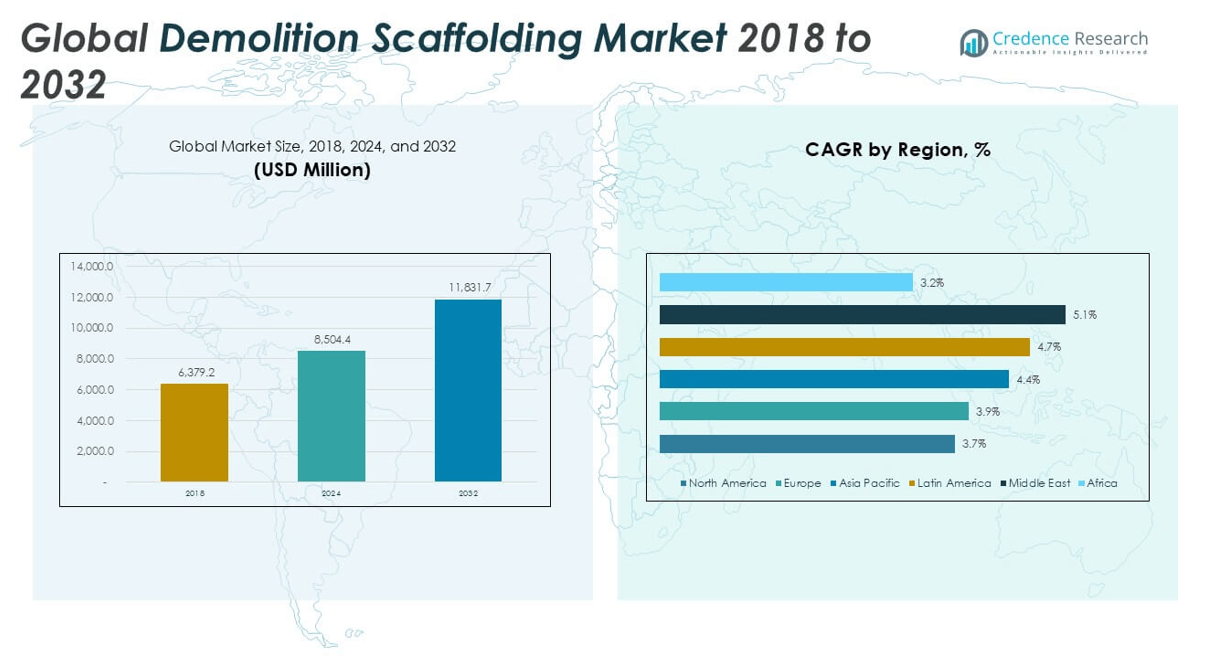

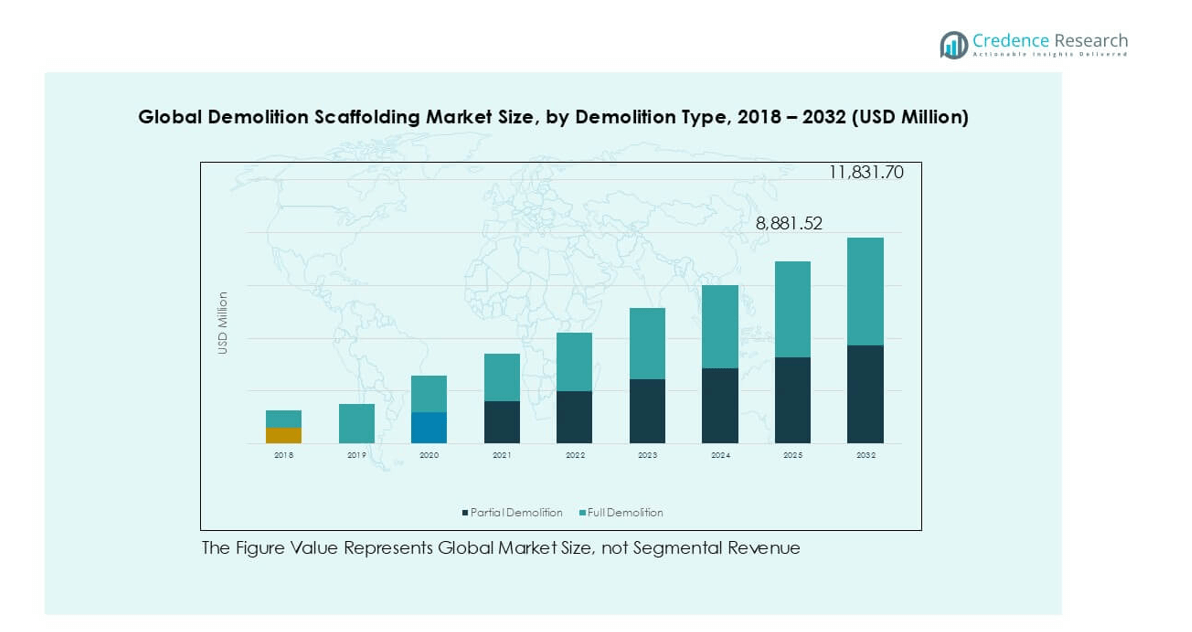

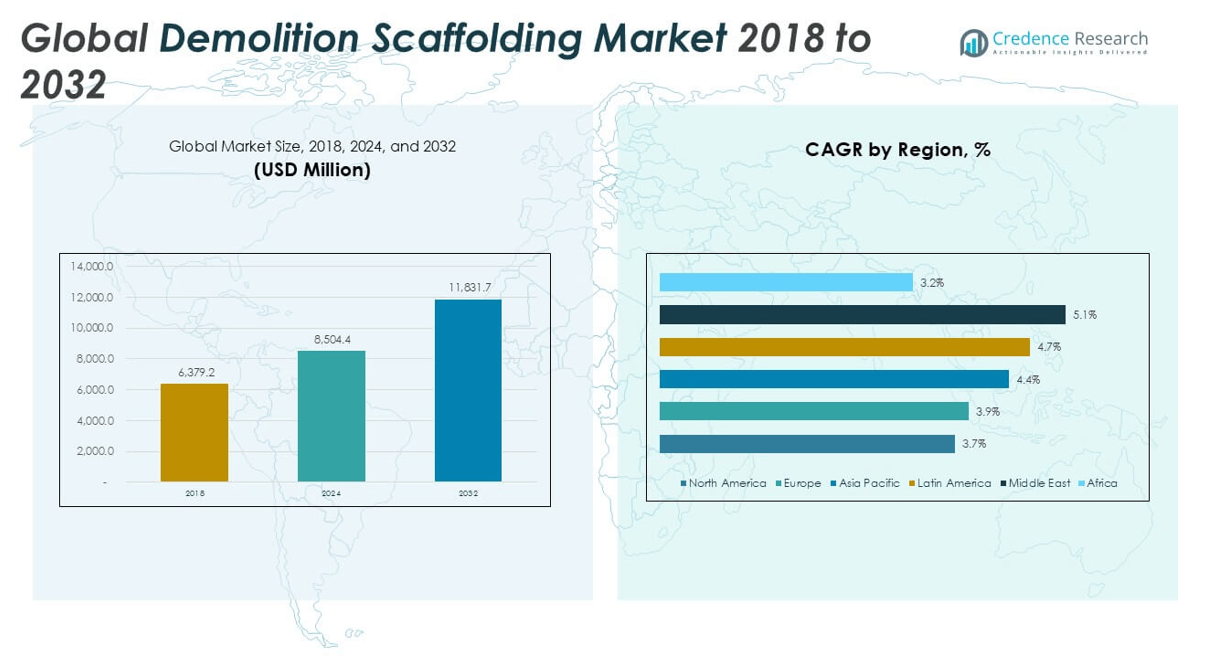

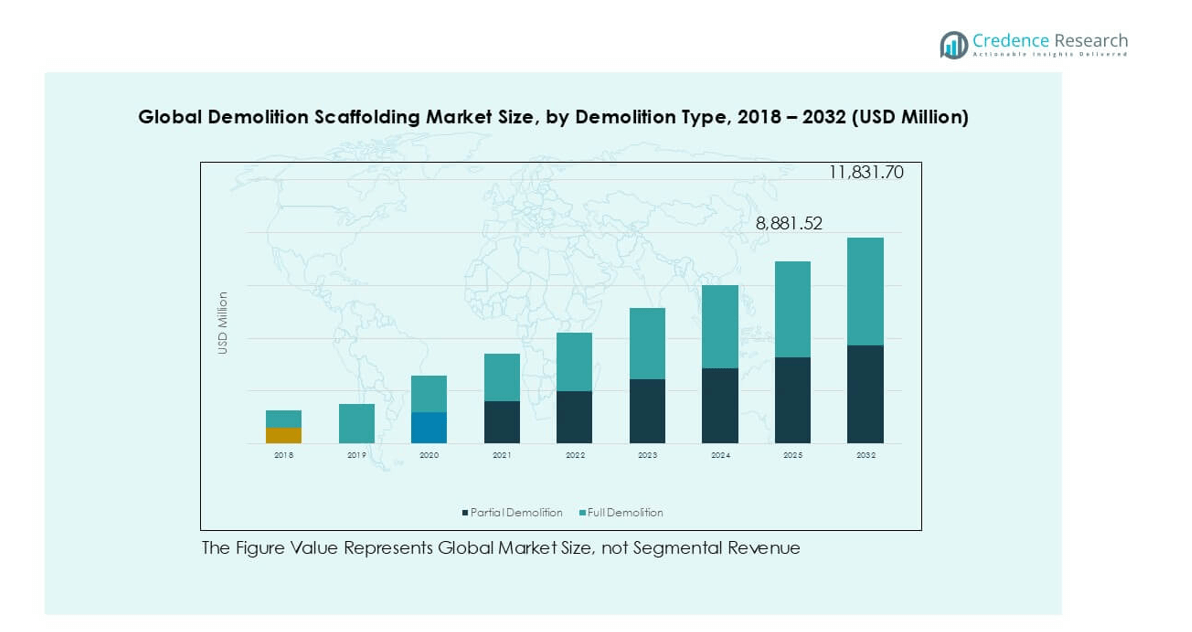

The Demolition Scaffolding market size was valued at USD 6,379.2 million in 2018, increased to USD 8,504.4 million in 2024, and is anticipated to reach USD 11,831.7 million by 2032, growing at a CAGR of 4.18% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Demolition Scaffolding Market Size 2024 |

USD 8,504.4 million |

| Demolition Scaffolding Market, CAGR |

4.18% |

| Demolition Scaffolding Market Size 2032 |

USD 11,831.7 million |

The demolition scaffolding market is led by prominent players such as PRISMEC, BrandSafway, Layher, Saudi Scaffolding Factory, and Wellmade Scaffold, which collectively hold a substantial share of the global market. These companies maintain a competitive edge through comprehensive service portfolios, strong global distribution networks, and continued investment in product safety and innovation. Among them, BrandSafway and Layher are recognized for their international presence and high-capacity scaffolding systems tailored for complex demolition projects. In terms of regional leadership, Asia Pacific emerged as the dominant market in 2024, accounting for 36.2% of the global revenue. This leadership is driven by rapid urbanization, large-scale infrastructure development, and increasing demand for safe demolition practices across China, India, and Southeast Asia. North America and Europe follow as significant contributors, supported by stringent safety regulations and ongoing redevelopment initiatives.

Market Insights

- The demolition scaffolding market was valued at USD 8,504.4 million in 2024 and is projected to reach USD 11,831.7 million by 2032, growing at a CAGR of 4.18% during the forecast period.

- Market growth is driven by increasing urban redevelopment, infrastructure replacement, and stringent safety regulations across construction and demolition sites.

- Rising demand for modular and eco-friendly scaffolding systems, along with advancements in lightweight materials and digital project planning, are shaping market trends.

- Key players such as BrandSafway, Layher, and PRISMEC dominate the competitive landscape, while regional companies expand with cost-effective and localized solutions.

- Asia Pacific held the largest market share in 2024 at 36.2%, followed by Europe (26.3%) and North America (18.2%); by segment, full demolition led with over 60% share, while infrastructure & civil construction dominated among end users.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The full demolition segment held the dominant share in the demolition scaffolding market in 2024, accounting for over 60% of total revenue. This dominance is attributed to the rising number of complete building teardowns in urban redevelopment and infrastructure replacement projects. Full demolitions often require extensive scaffolding structures for safety and efficiency, especially in densely populated zones. In contrast, the partial demolition segment is growing steadily, driven by renovations, structural modifications, and retrofit projects where selective removal is essential. Regulatory emphasis on safety and controlled dismantling supports growth across both segments.

- For instance, Layher supplied over 13,000 square meters of its Allround Scaffolding for a high-rise building demolition in Frankfurt, enabling safe dismantling under tight urban constraints.

By End User

The infrastructure & civil construction segment emerged as the leading end user in the demolition scaffolding market, capturing more than 35% market share in 2024. This dominance is fueled by ongoing investments in transport networks, bridges, and public infrastructure renewal worldwide. The industrial & energy sector follows closely, driven by the decommissioning of old facilities and plant modernization. Residential construction is another vital segment, gaining momentum through urban redevelopment and home reconstruction. The shipbuilding & marine segment and others contribute moderately, primarily through specialized demolition activities in ports, docks, and shipyards requiring tailored scaffolding solutions.

- For instance, C J Scaffold Service Inc served 3,200+ residential demolition projects in North America over five years using pre-engineered scaffolding kits optimized for rapid setup.

Market Overview

Urban Redevelopment and Infrastructure Renewal

Rapid urbanization and aging infrastructure across major economies have intensified the demand for demolition activities, particularly in urban centers. Governments and municipalities are investing in large-scale redevelopment projects to replace obsolete buildings and infrastructure. This trend is directly fueling the need for robust demolition scaffolding systems that ensure worker safety and structural stability during teardown processes. The integration of scaffolding into these projects has become critical, especially in cities undergoing smart urban planning and sustainable construction transformations.

- For instance, BrandSafway supported the demolition of 68 high-rise structures in New York City between 2020 and 2024 with engineered scaffolding systems designed to handle multi-story teardowns in confined zones.

Stringent Safety Regulations and Compliance Standards

Global regulatory bodies are enforcing stricter safety norms and compliance standards in construction and demolition sectors. These regulations mandate the use of certified scaffolding systems to minimize accidents and enhance site security. As a result, contractors and demolition service providers are increasingly adopting advanced scaffolding solutions that meet national and international safety benchmarks. This regulatory push is significantly driving the growth of the demolition scaffolding market by promoting standardized equipment usage across projects.

- For instance, Nassaco implemented ISO 45001-certified scaffolding systems across all demolition sites in the GCC region in 2023, reducing fall-related incidents by 70% compared to previous years.

Technological Advancements in Scaffolding Systems

Innovations such as modular scaffolding, lightweight yet durable materials, and automation in scaffold assembly have revolutionized the demolition scaffolding landscape. These advancements reduce labor costs, improve efficiency, and enhance adaptability to complex demolition sites. The integration of digital tools like BIM (Building Information Modeling) further enables precise planning and execution. As technology becomes a competitive differentiator, market players are increasingly investing in R&D to deliver more efficient, scalable, and safety-compliant scaffolding solutions.

Key Trends & Opportunities

Rising Demand for Green Demolition Practices

With the global push toward sustainability, green demolition practices are gaining traction. These practices emphasize recycling materials, minimizing dust and noise, and ensuring safe dismantling—all of which require specialized scaffolding systems. Environmentally conscious construction firms are integrating scaffolding solutions that support minimal disruption and material recovery. This trend presents an opportunity for manufacturers to develop eco-friendly scaffolding materials and systems tailored for low-impact demolitions in both urban and industrial settings.

- For instance, Guangzhou AJ Building End User Co., Ltd utilized recyclable aluminum scaffolding in all 45 eco-demolition projects it completed in 2024, eliminating nearly 260 tons of potential metal waste.

Growing Adoption in Emerging Economies

Emerging markets in Asia-Pacific, Latin America, and parts of Africa are witnessing accelerated construction and demolition activities. This surge is driven by economic growth, industrialization, and increasing public infrastructure investments. As these regions expand their urban footprint, the demand for high-quality and affordable scaffolding systems is rising. Manufacturers have the opportunity to tap into these markets by offering region-specific, cost-effective scaffolding solutions that comply with local safety standards and support rapid deployment.

- For instance, Qingdao Scaffolding shipped over 1.2 million scaffolding frames to Southeast Asian countries in 2023 alone, targeting fast-track demolition and reconstruction projects under regional smart city programs.

Key Challenges

High Initial Investment and Maintenance Costs

One of the key challenges in the demolition scaffolding market is the high initial cost of acquiring advanced scaffolding systems. In addition to purchase costs, ongoing expenses for maintenance, inspection, and compliance certifications add to the financial burden for contractors. Small and mid-sized demolition firms often struggle to justify these costs, leading them to opt for rental services or substandard alternatives, which can hinder market expansion and compromise safety.

Labor Shortage and Skill Gaps

A persistent shortage of skilled labor trained in scaffolding assembly and safe demolition practices poses a critical challenge. Proper erection and dismantling of scaffolding systems require technical expertise to meet regulatory standards and prevent site hazards. The lack of trained personnel leads to delays, safety risks, and increased project costs. Addressing this issue requires investment in workforce training and certification programs tailored to modern scaffolding technologies and safety protocols.

Supply Chain Disruptions and Raw Material Volatility

The demolition scaffolding market is vulnerable to fluctuations in raw material prices, especially steel and aluminum, which directly impact production costs. Additionally, global supply chain disruptions—stemming from geopolitical tensions, transportation bottlenecks, or pandemics—can delay equipment delivery and project timelines. These uncertainties create operational challenges for manufacturers and end users alike, necessitating flexible sourcing strategies and risk mitigation planning to ensure business continuity.

Regional Analysis

North America

North America accounted for approximately 18.2% of the global demolition scaffolding market in 2024, with a market size of USD 1,547.68 million, up from USD 1,190.99 million in 2018. The market is projected to reach USD 2,078.83 million by 2032, expanding at a CAGR of 3.7%. The growth is supported by ongoing urban redevelopment projects, particularly in the United States, and stringent safety regulations that promote the adoption of advanced scaffolding systems. Strong investments in infrastructure renewal and commercial demolitions continue to drive regional demand for reliable and compliant scaffolding solutions.

Europe

Europe held a 26.3% share of the global demolition scaffolding market in 2024, with revenues rising from USD 1,708.34 million in 2018 to USD 2,241.04 million in 2024. The market is expected to reach USD 3,050.21 million by 2032, registering a CAGR of 3.9%. Growth is driven by widespread infrastructure modernization, sustainable demolition practices, and strict adherence to occupational safety standards. Western European countries, especially Germany and the UK, are focusing on large-scale demolitions tied to green building initiatives, further boosting the need for high-performance and eco-compliant scaffolding systems.

Asia Pacific

Asia Pacific dominated the global demolition scaffolding market in 2024, capturing a leading 36.2% market share, with revenues growing from USD 2,275.44 million in 2018 to USD 3,073.98 million in 2024. The market is anticipated to reach USD 4,351.70 million by 2032, expanding at the fastest CAGR of 4.4% among all regions. This robust growth is attributed to rapid urbanization, industrial expansion, and government investments in infrastructure across China, India, and Southeast Asia. The increasing demand for efficient and safe demolition operations in densely populated cities continues to fuel regional scaffolding adoption.

Latin America

Latin America represented 8.6% of the global demolition scaffolding market in 2024, with its size increasing from USD 539.04 million in 2018 to USD 739.76 million. The market is expected to reach USD 1,068.40 million by 2032, growing at a CAGR of 4.7%. Brazil and Mexico lead regional demand, supported by construction growth, urban redevelopment, and expanding industrial sectors. As public and private sectors increasingly invest in residential and infrastructure demolitions, the need for affordable and adaptable scaffolding systems is rising, offering manufacturers significant opportunities for expansion in this region.

Middle East

The Middle East accounted for a 6.8% share of the global market in 2024, with the market value rising from USD 411.46 million in 2018 to USD 580.97 million. It is projected to reach USD 868.45 million by 2032, registering a CAGR of 5.1%, the highest among all regions. This growth is propelled by mega infrastructure projects, particularly in the Gulf Cooperation Council (GCC) countries, and the redevelopment of urban centers. Increased focus on modernization, coupled with a demand for advanced safety equipment in demolition projects, supports the rising adoption of scaffolding systems.

Africa

Africa contributed 3.7% to the global demolition scaffolding market in 2024, with market size growing from USD 253.89 million in 2018 to USD 320.98 million. The market is expected to reach USD 414.11 million by 2032, expanding at a CAGR of 3.2%. Growth remains modest but steady, driven by infrastructure development initiatives across major economies such as Nigeria, Egypt, and South Africa. Despite limited investments compared to other regions, increasing urban construction and rehabilitation projects are gradually creating demand for basic and cost-effective scaffolding systems in demolition applications across the continent.

Market Segmentations:

By Type:

- Partial Demolition

- Full Demolition

By End User:

- Infrastructure & Civil Construction

- Industrial & Energy

- Residential Construction

- Shipbuilding & Marine

- Others

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The demolition scaffolding market features a moderately fragmented competitive landscape, characterized by the presence of both global and regional players offering a wide range of products and services. Key companies such as PRISMEC, BrandSafway, Layher, and Saudi Scaffolding Factory dominate the market through extensive service portfolios, technological capabilities, and strategic partnerships. These players focus on product innovation, safety compliance, and customized scaffolding solutions to cater to varying demolition project requirements. Market participants are actively engaging in mergers, acquisitions, and geographic expansion to strengthen their market position. Additionally, rising demand for eco-friendly and modular scaffolding systems is pushing companies to invest in R&D. The competitive intensity is further heightened by the need to comply with evolving safety regulations, prompting firms to continuously upgrade their offerings to maintain relevance and client trust.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- PRISMEC

- BrandSafway

- Saudi Scaffolding Factory

- Layher

- C J Scaffold Service Inc

- Nassaco

- Wellmade Scaffold

- Qingdao Scaffolding

- Guangzhou AJ Building End User Co., Ltd

- EK Scaffolding

Recent Developments

- In June 2025, Layher hosted and powered the international “ScaffChamp” competition. This event showcased the efficiency and safety of Layher’s modular scaffolding system, particularly its relevance in demolition scaffolding for speed and compliance with modern standards. The competition, held in Vilnius, Lithuania, featured teams from around the world competing in timed scaffolding builds, emphasizing precision and teamwork.

- In April 2025, EK Scaffolding highlighted their modular ringlock scaffolding systems, emphasizing their suitability for industrial heavy construction, rapid deployment, and high durability, making them ideal for demolition projects demanding speed, strength, and safety. These systems utilize standardized components for efficient assembly and disassembly.

- In April 2025, Layher, a scaffolding solutions provider, opened a new facility in Baltimore County, USA, specifically designed to support the rapid deployment of scaffolding materials for renovation and demolition projects across North America.

- In February 2025, BrandSafway showcased new access solutions at World of Concrete, including battery-powered hoists, motorized access systems, and the Flexi Deck, a lightweight slab formwork system. The Flexi Deck allows for early dismantling in casting phases and increased efficiency during demolition and refurbishment.

Market Concentration & Characteristics

The Demolition Scaffolding Market shows a moderate to high level of market concentration, with several key players holding significant shares globally. Large companies such as BrandSafway, Layher, and PRISMEC maintain a strong competitive position due to their advanced service portfolios, broad geographic reach, and consistent investment in safety-compliant technologies. It includes both global manufacturers and regional providers that cater to diverse project scales, from large infrastructure teardowns to residential renovations. The market favors players that offer modular, durable, and easy-to-assemble scaffolding systems aligned with evolving safety regulations. Product differentiation relies heavily on innovation, regulatory compliance, and reliability in high-risk environments. Regional markets in Asia Pacific and Europe display strong growth momentum, supported by government infrastructure programs and increasing urban redevelopment. The market remains sensitive to raw material costs, safety standards, and project timelines. Competitive dynamics revolve around pricing strategies, rental offerings, and long-term service contracts, making technical expertise and operational efficiency critical to sustained leadership.

Report Coverage

The research report offers an in-depth analysis based on Type, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow steadily driven by increasing urban infrastructure redevelopment projects.

- Demand for modular and quick-assembly scaffolding systems will rise across large-scale demolition sites.

- Full demolition applications will maintain dominance due to expanding teardown activities in aging structures.

- Adoption of eco-friendly scaffolding materials will gain traction with the shift toward sustainable demolition practices.

- Asia Pacific will remain the leading region due to rapid urbanization and industrial expansion.

- North America and Europe will witness stable growth supported by regulatory compliance and safety modernization.

- Key players will focus on expanding rental services to serve small and mid-sized demolition contractors.

- Technological integration such as BIM and digital project mapping will enhance scaffolding deployment efficiency.

- Regional players will explore opportunities in emerging markets through cost-effective and standardized solutions.

- Investments in workforce training and safety certification programs will become essential to support industry growth.