Market Overview

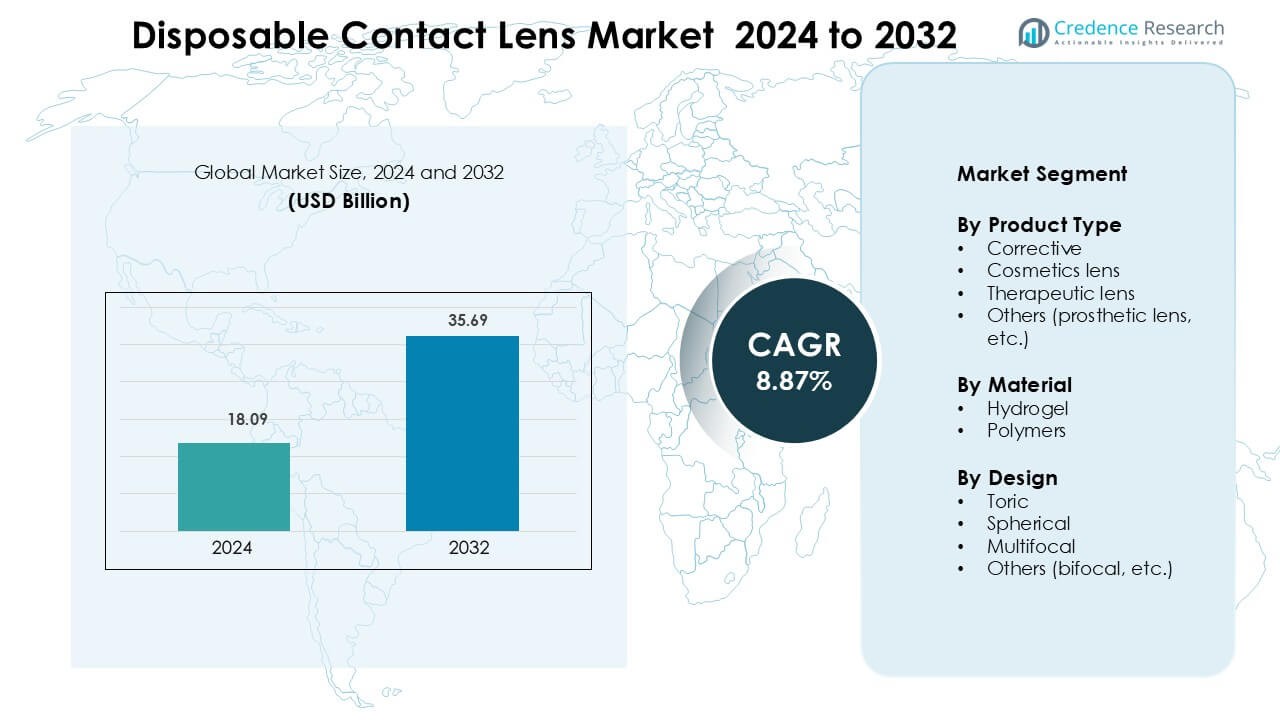

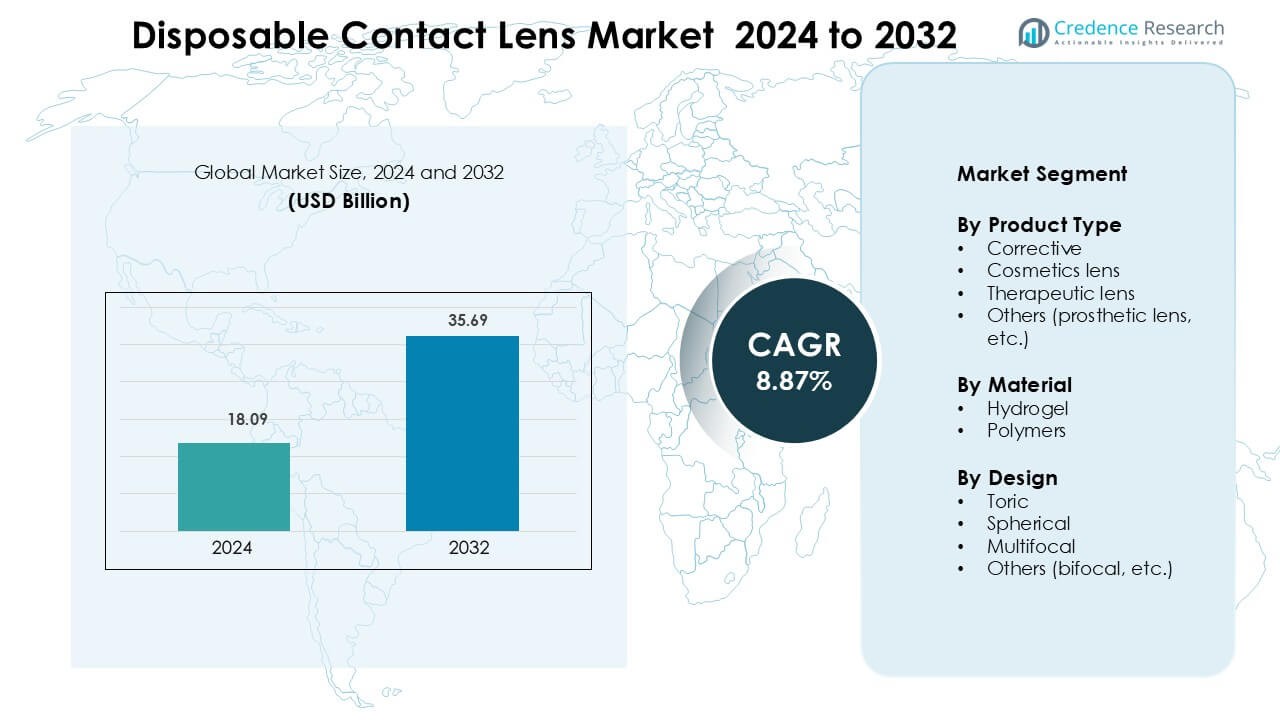

Disposable Contact Lens Market was valued at USD 18.09 billion in 2024 and is anticipated to reach USD 35.69 billion by 2032, growing at a CAGR of 8.87% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Disposable Contact Lens Market Size 2024 |

USD 18.09 Billion |

| Disposable Contact Lens Market, CAGR |

8.87% |

| Disposable Contact Lens Market Size 2032 |

USD 35.69 Billion |

The disposable contact lens market is led by major players such as Johnson & Johnson Vision Care, Alcon, CooperVision, Bausch + Lomb, and Hoya Corporation. These companies dominate through strong global distribution, advanced silicone hydrogel materials, and wide prescription ranges for spherical, toric, and multifocal users. Their continuous investments in comfort-enhancing coatings, oxygen-permeable polymers, and daily disposable formats strengthen brand loyalty among frequent wearers. Strategic partnerships with optometrists, subscription-based online sales, and targeted marketing help expand consumer reach. North America remains the leading region with 35 % market share, supported by high eye-health awareness, strong adoption of daily disposables, and a mature retail and e-commerce ecosystem.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The disposable contact lens market was valued at USD 18.09 in 2024 and is projected to grow at a CAGR of 8.87 % through 2032.

- Rising cases of myopia and astigmatism, combined with demand for hygienic daily-wear products, are driving adoption. Comfort-focused hydrogel and silicone hydrogel lenses dominate material share, supported by better moisture retention and oxygen permeability.

- Daily disposable formats show strong growth as consumers prefer easy replacement, reduced infection risk, and no cleaning solutions. Toric and multifocal lenses are expanding due to higher diagnosis of astigmatism and presbyopia.

- The competitive landscape is led by Johnson & Johnson Vision Care, Alcon, CooperVision, Bausch + Lomb, and Hoya, with investments in premium coatings, UV protection, and subscription-based distribution. Smaller regional brands compete on price and mass-market hydrogel options.

- North America holds 35 % market share and remains the leading region, while Asia-Pacific is the fastest-growing due to rising myopia rates and strong adoption among young consumers.

Market Segmentation Analysis:

By Product Type

The corrective lens segment holds the dominant share at nearly 65% of global revenue. Rising cases of myopia, hyperopia, and astigmatism drive widespread adoption among daily wearers, especially young adults and working professionals. Corrective lenses offer improved comfort, wider peripheral vision, and convenience compared with eyeglasses, supporting strong repeat purchases. Cosmetic and therapeutic lenses continue to grow as niche categories, driven by fashion appeal, eye injury recovery, and specialty ophthalmic applications, yet their adoption remains smaller than vision-correcting products.

- For instance, Johnson & Johnson Vision Care introduced the Acuvue Oasys with Transitions Light Intelligent Technology, integrating photochromic molecules that adjust to light changes within 90 seconds for improved visual comfort.

By Material

Hydrogel lenses account for more than 55% market share due to high compatibility with sensitive eyes and strong moisture retention. Their softness and oxygen permeability support extended wear and reduced irritation, making hydrogel the preferred choice for daily disposable users. Polymer-based silicone hydrogel lenses are gaining traction, as advanced oxygen transmission and dry-eye comfort appeal to active users and digital screen workers. However, price sensitivity in developing countries keeps hydrogel lenses dominant within the mass consumer base.

- For instance, Bausch + Lomb’s ULTRA contact lenses feature MoistureSeal technology that maintains 95% of lens moisture for up to 16 hours, minimizing dryness during prolonged wear.

By Design

Spherical lenses dominate the market with roughly 60% share because they address common refractive issues such as myopia and hyperopia. Their simple fitting process, affordability, and wide product availability strengthen demand across retail and e-commerce channels. Toric lenses are expanding as awareness of astigmatism correction improves and manufacturers introduce customizable fits with better rotational stability. Multifocal and bifocal designs remain smaller but attractive for presbyopia patients seeking glasses-free near-vision correction, supporting long-term category growth.

Key Growth Drivers

Rising Prevalence of Refractive Errors and Vision Correction Demand

A major driver in the disposable contact lens market is the continuous increase in refractive vision disorders such as myopia, hyperopia, and astigmatism. Rapid digitalization, prolonged screen time, and lifestyle changes are pushing younger and working-age populations toward corrective solutions that offer comfort and convenience. Disposable lenses reduce the risk of infection, minimize maintenance needs, and provide better hygiene than month-long use lenses, making them attractive to first-time users. The shift toward daily disposables also supports repeat purchases, improving sales cycles for manufacturers and retailers. Eye-care professionals recommend short-use lenses for allergy-prone and sensitive-eye patients, further boosting adoption. Growing awareness campaigns, higher access to optical clinics, and education on contact lens hygiene are expanding the buyer base across both developed and emerging regions. With rising urbanization and adoption of premium eye-care products, disposable lenses continue to gain traction.

- For instance, CooperVision’s MiSight 1day lenses, approved by the U.S. FDA in 2019, have shown a 59% reduction in myopia progression among children aged 8–12 during a three-year clinical study.

Shift Toward Comfort-Driven Material and Design Innovations

Material and design innovation is a key growth catalyst, as manufacturers focus on performance, extended hydration, and oxygen permeability. Modern hydrogel and silicone hydrogel lenses reduce dryness, irritation, and corneal stress, making long wear periods easier for frequent users. Companies invest heavily in breathable polymers, moisture-lock coatings, and smooth surface technologies that suppress protein buildup and maintain visual clarity. Designs such as toric and multifocal disposables offer precise correction for astigmatism and age-related presbyopia, expanding adoption among older demographics. These innovations help differentiate premium lenses from traditional eyeglasses, increasing customer conversion. High comfort levels encourage users to upgrade from monthly lenses to daily disposables, leading to higher lifetime spend per customer. As lens fitting digital tools and advanced diagnostics grow in optical clinics, personalized prescriptions support wider acceptance of specialized disposable lenses.

- For instance, Alcon’s DAILIES TOTAL1 Multifocal lenses feature a water gradient technology with 33% core and 80% surface water content, ensuring smooth lens-eye interaction for presbyopic users.

Growth of E-commerce and Subscription-Based Distribution Channels

Convenient distribution models are driving market expansion. E-commerce platforms and subscription programs make reordering predictable and hassle-free, reducing dependence on physical stores. Online players offer competitive pricing, bundled discounts, and doorstep delivery, helping capture price-sensitive and time-constrained customers. Subscription services send replacement packs on fixed intervals, improving consumer loyalty and reducing gaps between purchases. Digital eye exams and tele-optometry services are also emerging, making lens trials and renewals easier. In regions with limited optical clinic density, online channels fill accessibility gaps. Brand marketing, influencer outreach, and social media campaigns are raising awareness of disposable hygiene benefits. With seamless returns, virtual try-ons, transparent specifications, and secure payment systems, e-commerce is becoming a decisive channel for younger buyers adopting disposable lenses for lifestyle and cosmetic use.

Key Trends & Opportunities

Daily Disposable Products and Eco-friendly Lens Innovations

Daily disposable lenses are gaining popularity as users prioritize hygiene, convenience, and safe wear without cleaning solutions. Minimal handling reduces infection risks, making them suitable for teenagers and first-time wearers. Sustainable innovation is a rising opportunity, as companies explore recyclable blister packs, bio-based polymers, and reduced plastic packaging. Consumers with eco-conscious preferences favor brands offering greener materials and responsible disposal options. The market is witnessing new product launches focused on hydration retention, UV protection, anti-dryness coatings, and allergen-resistant formulations. Premium daily lenses are expanding across both online and optical store retail, attracting high repeat usage. Brands that pair hygiene benefits with sustainability claims gain faster acceptance and pricing power. As environmental regulations tighten and awareness rises, eco-friendly disposables are expected to become a key profit driver.

- For instance, CooperVision launched the clariti® 1 day lens made from silicone hydrogel.

Rising Demand for Toric and Multifocal Disposable Lenses

Product diversification creates strong opportunities, particularly for advanced toric and multifocal disposables that address astigmatism and presbyopia. Growing diagnosis rates and better eye health awareness allow opticians to prescribe precise lenses earlier in life. Toric designs with rotational stability and improved moisture control increase comfort for astigmatic users who previously relied on monthly lenses. Multifocal disposables attract older customers seeking glasses-free near- and far-vision without complex care routines. As populations age across Asia, Europe, and North America, demand for presbyopia correction continues to rise. Manufacturers are investing in expanded power ranges, seamless transitions, and thin-edge profiles to improve fit and visual clarity. These specialized designs help brands capture higher margins and strengthen long-term user loyalty, making them strong growth opportunities.

- For instance, Johnson & Johnson Vision’s Acuvue Oasys 1-Day for Astigmatism employs Accelerated Stabilization Design technology that delivers lens rotation stability within 1 second of blink, enhancing clarity for astigmatic users.

Key Challenges

High Cost of Daily Disposable Lenses for Price-Sensitive Consumers

Despite widespread adoption, daily disposable lenses remain costly compared to monthly and reusable alternatives. The higher price per unit discourages long-term use among students, low-income households, and emerging markets where affordability drives purchase decisions. Many consumers switch between glasses and lenses to extend usage rather than relying on disposables daily. Limited insurance coverage for contact lenses further restricts uptake in several countries. Manufacturers face cost pressures related to advanced materials, specialized coatings, and sterile packaging. Without broader price reductions, subsidies, or retail promotions, demand growth may slow in cost-sensitive regions. Companies investing in localized production and high-volume output can overcome this barrier, but smaller brands struggle to match low-price competition.

Risks of Misuse, Infection, and Low Consumer Awareness

Disposable lenses reduce hygiene risks, but improper use still causes complications. Users who exceed wear time, sleep in lenses, or skip replacement schedules are at higher risk of corneal inflammation and infections. Awareness gaps are common among new wearers who purchase lenses without professional fitting or follow-up care. In many developing markets, limited access to trained optometrists leads to self-prescription and incorrect power usage. Negative user experiences reduce repeat purchases and harm brand image. Companies and healthcare professionals need to expand guidance on cleaning, safe wearing hours, and replacement cycles. Education campaigns, clearer packaging instructions, and digital patient support tools can reduce misuse and build trust in disposable products.

Regional Analysis

North America

North America holds a significant share of nearly 35% of the disposable contact lens market, supported by high consumer awareness, strong eye-care infrastructure, and heavy adoption of daily disposable products. The United States leads due to large corrective lens demand, rising digital eye strain cases, and access to advanced hydrogel and silicone hydrogel designs. Subscription-based online delivery and strong retail networks increase repeat purchases across young professionals and students. Marketing campaigns and widespread availability of toric and multifocal disposables continue to strengthen the premium segment.

Europe

Europe accounts for approximately 30% of the global market, driven by growing demand for hygienic, comfortable, and eco-friendly disposable lenses. Countries such as the United Kingdom, Germany, and France show mature adoption with high awareness of corrective and cosmetic lenses. Retail opticians, e-commerce platforms, and optical chains encourage regular replacement cycles, improving long-term product turnover. Aging populations in Western Europe support expanding multifocal lens usage, while favorable regulations and focus on eye-health standards drive acceptance of premium silicone hydrogel products.

Asia-Pacific

Asia-Pacific holds nearly 25% market share and stands as the fastest-growing region due to rising myopia prevalence, urbanization, and wider availability of affordable disposables. China, Japan, and South Korea lead consumption, supported by strong fashion appeal and an expanding young user base that prefers cosmetic and corrective daily lenses. Local and international brands benefit from growing optical retail chains and online channels that provide price-competitive products. Increased diagnosis rates, higher disposable income, and consumer preference for hygienic eye-wear solutions continue to accelerate market penetration.

Latin America

Latin America captures close to 6% of the disposable contact lens market, driven by urban consumers in Brazil, Mexico, and Argentina adopting daily disposables for lifestyle and comfort. Awareness campaigns by optical chains and multinational brands support market expansion, but price sensitivity limits premium adoption. Growth in e-commerce and retail promotions improves accessibility, particularly among younger buyers. As eye-care infrastructure improves and astigmatism and myopia diagnoses rise, toric and spherical daily lenses are gaining traction, contributing to steady regional growth.

Middle East & Africa

The Middle East & Africa region accounts for roughly 4% of global share, with adoption concentrated in urban centers of the UAE, Saudi Arabia, and South Africa. Rising fashion interest, awareness of eye hygiene, and access to global brands are driving gradual growth. Retail optical outlets and international e-commerce platforms expand availability, while corrective disposable lenses remain the primary demand driver. However, limited affordability and uneven eye-care access across developing nations restrict broader penetration. As awareness increases and optical clinics expand, demand for safe, short-wear products is expected to improve.

Market Segmentations:

By Product Type

- Corrective

- Cosmetics lens

- Therapeutic lens

- Others (prosthetic lens, etc.)

By Material

By Design

- Toric

- Spherical

- Multifocal

- Others (bifocal, etc.)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The disposable contact lens market is highly competitive, with a mix of global optical giants, specialty eye-care companies, and fast-growing online retailers. Leading players focus on advanced material technologies, daily disposable portfolios, and customized fitting solutions to strengthen consumer retention. Companies continue to invest in breathable silicone hydrogel lenses, moisture-locking coatings, and UV-protection features to differentiate premium products. Toric and multifocal ranges are expanding, targeting astigmatism and presbyopia users seeking comfort and accurate correction. Strong distribution through optical chains, pharmacies, and e-commerce platforms supports recurring sales and subscription-based reorder models. Pricing strategies, marketing campaigns, and partnerships with optometrists help brands secure repeat customers. Growth in emerging markets has attracted regional manufacturers offering cost-effective hydrogel lenses, intensifying competition in the mass segment. As patient awareness, digital eye examinations, and virtual fitting tools increase, companies with broader prescription ranges and faster replenishment cycles maintain competitive advantage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2025, Alcon, Introduced PRECISION1® daily disposable lenses in India with a nationwide launch campaign.

- In June 2024, Bausch + Lomb launched INFUSE® for Astigmatism daily disposable lenses in the U.S.; shipments to eye-care practices began in July.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, Design and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Manufacturers will increasingly use silicone hydrogel materials to improve oxygen permeability and long-term comfort.

- Daily disposable lenses will gain preference as consumers prioritize hygiene and convenience.

- Smart contact lenses with embedded sensors and AR displays will move from prototype to early commercial stages.

- Sustainability initiatives will drive innovation in recyclable packaging and biodegradable lens materials.

- Online retail channels will continue to expand distribution, supported by subscription-based delivery models.

- Eye health awareness campaigns will boost adoption among younger and first-time users.

- Advances in manufacturing automation will reduce production costs and improve customization options.

- Partnerships between ophthalmic companies and tech firms will accelerate development of health-monitoring lenses.

- Emerging markets will experience strong demand growth driven by rising disposable income and access to eye care.

- Regulatory focus on lens safety and environmental compliance will shape product design and material selection.