Market Overview:

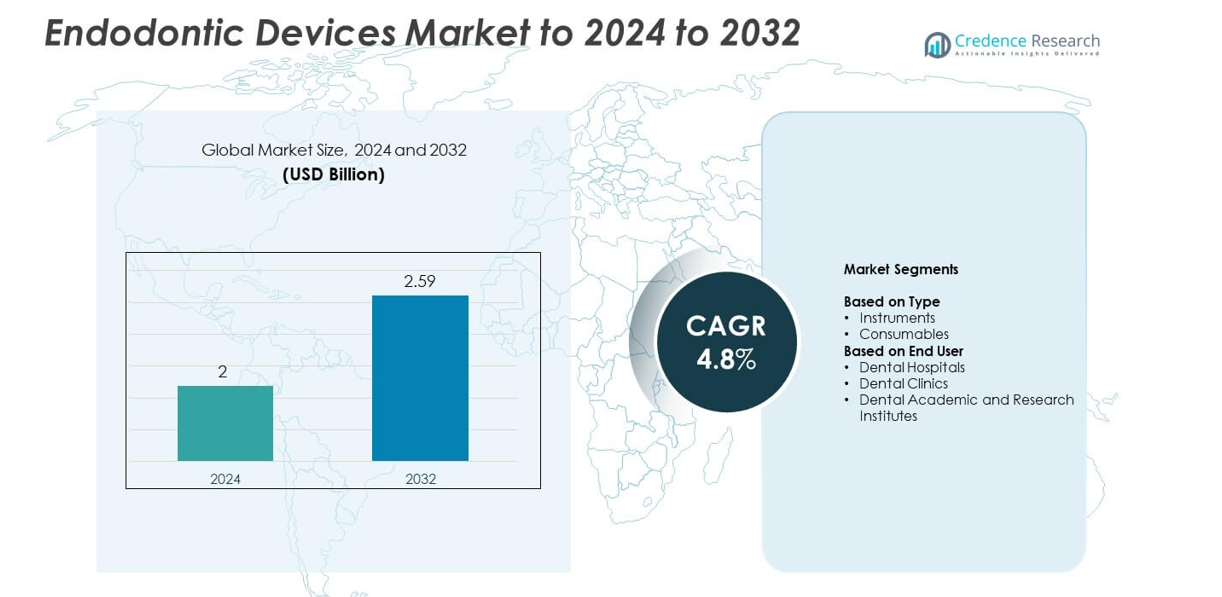

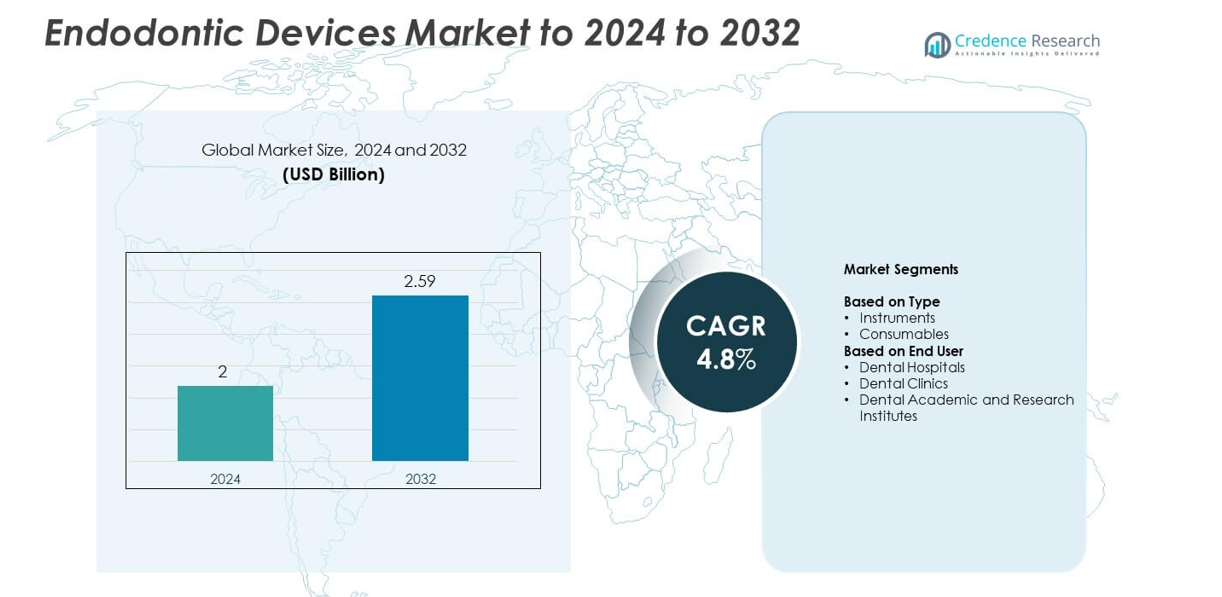

Endodontic Devices Market size was valued USD 2 Billion in 2024 and is anticipated to reach USD 2.59 Billion by 2032, at a CAGR of 4.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Endodontic Devices Market Size 2024 |

USD 2 billion |

| Endodontic Devices Market, CAGR |

4.8% |

| Endodontic Devices Market Size 2032 |

USD 2.59 Billion |

The Endodontic Devices Market is shaped by leading players such as Micro-Mega, Ultradent Products, Brasseler Holdings LLC, COLTENE, Septodont, Dentsply Sirona, DiaDent Group International, Danaher, Ivoclar Vivadent, and FKG Dentaire, each strengthening competition through innovation in rotary systems, obturation materials, and digital workflow tools. North America leads the market with a 37% share due to strong adoption of advanced endodontic technologies and high procedure volumes. Europe follows with a 29% share supported by strong clinical standards and widespread use of precision-based tools, while Asia Pacific holds a 24% share driven by growing dental infrastructure and rising awareness of restorative treatments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market reached 2 Billion in 2024 and is projected to hit 2.59 Billion by 2032, growing at a 4.8% CAGR.

- Rising dental caries cases and increasing root canal procedures drive strong demand for instruments, with the segment holding a 61% share.

- Digital integration, including automated file systems and advanced apex locators, shapes key trends as clinics adopt technology that improves workflow accuracy.

- Competition intensifies as major players focus on improved NiTi flexibility, stronger sealing materials, and expanded training programs to support device adoption.

- North America leads with a 37% share, followed by Europe at 29% and Asia Pacific at 23%, while dental clinics dominate the end-user segment with a 58% share due to high patient volumes and rapid uptake of advanced tools.

Market Segmentation Analysis:

By Type

Instruments hold the dominant position with a 61% share because dentists rely on rotary files, hand files, and apex locators for accurate canal shaping and cleaning. These tools improve procedural speed and reduce the risk of treatment failure, which boosts adoption in both general and specialty practices. Consumables such as sealers, obturators, and irrigation solutions also gain steady demand as rising root-canal volumes require repeat replenishment. Better biocompatibility, enhanced sealing ability, and workflow efficiency support continued growth in both categories.

- For instance, Dentsply Sirona produces over 140 million endodontic files annually, conducting more than 3 million individual quality checks across its global manufacturing sites. The WaveOne Gold system has been available since 2015 and is supported by over 200 peer-reviewed publications.

By End User

Dental clinics lead this segment with a 58% share due to high patient visits and rapid uptake of advanced endodontic systems. Clinics favor efficient rotary instrumentation and modern obturation devices that reduce chair time and improve treatment outcomes. Dental hospitals follow with strong demand for complex or multi-visit procedures that require specialized expertise. Academic and research institutes adopt updated instruments to train new professionals and support device development. Growing restorative dentistry needs and expanding digital workflows drive further end-user adoption across the region.

- For instance, Morita’s Root ZX II apex locator is the world’s best-selling apex locator and has an impressive accuracy rate typically cited at 97.5% within a tolerance of ±0.5 mm.

Key Growth Drivers

Rising Burden of Dental Caries and Root Canal Procedures

Growing cases of dental caries and pulp infections increase the need for root canal therapy, driving strong demand for modern endodontic devices. More patients choose tooth preservation over extraction, which boosts the use of rotary files, apex locators, and obturation systems. Rising awareness of oral health encourages earlier treatment, while higher procedure volumes across clinics strengthen market expansion. This factor acts as a major growth driver for long-term device adoption.

- For instance, Coltene’s HyFlex CM and HyFlex EDM files are manufactured using innovative technologies like controlled memory (CM) heat treatment and electric discharge machining (EDM), Manufacturer data and studies show HyFlex EDM files are up to 700% more resistant to fatigue than competitors’ products

Shift Toward Precision-Based and Minimally Invasive Dentistry

Clinicians prefer technologies that support accurate canal navigation, safer cleaning, and conservative tooth preparation. Advanced file systems, digital apex locators, and enhanced obturation platforms help improve workflow efficiency and reduce patient discomfort. This shift aligns with rising demand for quick recovery and predictable outcomes. As minimally invasive dentistry gains wider acceptance, the need for high-performance endodontic devices continues to grow across clinics and hospitals.

- For instance, Kerr’s Elements IC obturation unit provides controlled heat delivery with an adjustable range from 140°C to 400°C.

Expansion of Dental Clinics and Private Practices

An expanding network of private dental clinics increases access to specialized endodontic care and accelerates device purchases. Clinics upgrade their systems to offer improved treatment speed, greater comfort, and predictable results. Rising disposable income and wider dental insurance support encourage patients to seek timely care, which boosts procedural volume. This expansion strengthens manufacturer reach and drives sustained demand for instruments and consumables.

Key Trends & Opportunities

Integration of Digital and Automated Endodontic Systems

Digital tools and automated platforms reshape clinical workflows by improving accuracy and reducing operator variability. Connected endodontic motors, torque-controlled systems, and digital apex locators enhance treatment predictability. Clinics adopt these technologies to streamline procedures and reduce chair time. This trend offers strong opportunities for manufacturers developing integrated, digitally enabled ecosystems that support efficient and safe root canal therapy.

- For instance, NSK’s Endo-Mate DT2 endodontic motor operates across a speed range of 100 to 13,000 min⁻¹ (rpm) (depending on the geared head used), with the maximum torque reaching 7 N·cm when used with a 20:1 reduction head.

Growing Focus on Biocompatible and Advanced Material Innovations

Demand rises for advanced materials such as bioceramic sealers, flexible NiTi alloys, and enhanced irrigation solutions that improve long-term clinical outcomes. These materials help manage complex canal anatomies and reduce retreatment risks. Innovations in strength, flexibility, and sealing quality attract clinicians who prioritize higher success rates. The trend creates opportunities for companies offering differentiated products with proven performance benefits.

- For instance, Angelus Bio-C Sealer is a bioceramic root canal sealer that was tested according to the ISO 6876:2012 requirements for dental root canal-sealing materials. Its setting time is typically cited in product literature as varying depending on the clinical conditions: some literature indicates a specific time of 120 minutes (2 hours) when tested strictly in accordance with the ISO standard, while other technical information from the manufacturer and independent studies cite a setting time of ≤ 240 minutes (4 hours),

Key Challenges

High Cost of Advanced Endodontic Devices

Premium rotary systems, obturation devices, and digital tools require significant investment, limiting adoption among small clinics. Higher treatment costs also influence patient acceptance, especially in cost-sensitive markets. Limited reimbursement reduces affordability, slowing upgrades and replacements. This financial barrier remains a major challenge to wider market penetration.

Short Lifespan and Breakage Concerns in NiTi Instruments

NiTi rotary files offer strong flexibility but remain prone to cyclic fatigue and unexpected fracture. Breakage increases procedural complexity, adds replacement costs, and affects clinician confidence. Variations in canal shape and operator technique further impact file durability. These challenges push manufacturers to improve alloys, yet fatigue-related failures continue to restrain consistent adoption.

Regional Analysis

North America

The region leads the market with a 37% share supported by high demand for advanced endodontic systems across clinics and dental service groups. Strong insurance coverage and early adoption of digital tools drive steady device upgrades. The United States records the fastest uptake because many practices invest in rotary motors, apex locators, and bioceramic materials. Canada grows as more clinics adopt minimally invasive dentistry. Rising procedure volumes and strong specialist presence continue to support North America’s dominant position.

Europe

Europe holds a 29% share driven by well-established dental networks and high awareness of tooth-preservation procedures. Clinics across Germany, France, Italy, and the UK invest in precision systems that improve treatment reliability. Regulatory support for high-quality materials strengthens demand for advanced files, sealers, and obturation devices. Growing preference for minimally invasive care pushes clinics to upgrade their equipment. Increasing patient visits and strong reimbursement structures help Europe maintain a leading role in the global market.

Asia Pacific

Asia Pacific accounts for a 24% share and remains the fastest-growing region due to expanding clinic networks and rising dental tourism. China, India, Japan, and South Korea show rapid investment in digital endodontic devices as patients seek more reliable treatments. Growing middle-class income and better awareness of oral health drive procedure growth. Manufacturers expand distribution in the region to meet rising demand. Training programs also support adoption of modern instruments across emerging markets.

Latin America

Latin America holds a 6% share and grows as practices in Brazil, Mexico, and Argentina invest in improved endodontic tools. Rising focus on aesthetic and restorative dentistry increases the need for reliable canal treatment systems. Clinics adopt flexible NiTi files and digital apex locators to improve procedural accuracy. Economic improvements encourage more patients to seek professional dental care. Despite cost constraints, modernization of clinics supports steady regional expansion.

Middle East & Africa

The region captures a 4% share with gradual growth driven by expanding dental infrastructure in the UAE, Saudi Arabia, and South Africa. Clinics invest in advanced devices to meet rising demand for high-quality restorative procedures. Dental tourism boosts uptake in Gulf countries as practices adopt premium rotary systems and biocompatible materials. Limited access in some African countries slows wider adoption, yet urban centers show rising investment. Growing specialist training programs continue to support market development.

Market Segmentations:

By Type

By End User

- Dental Hospitals

- Dental Clinics

- Dental Academic and Research Institutes

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Micro-Mega, Ultradent Products, Brasseler Holdings LLC, COLTENE, Septodont, Dentsply Sirona, DiaDent Group International, Danaher, Ivoclar Vivadent, and FKG Dentaire shape the competitive landscape of the endodontic devices market. The market features strong competition driven by continuous upgrades in file systems, obturation technologies, and digital workflow tools. Companies focus on introducing flexible NiTi alloys, enhanced sealing materials, and safer shaping systems that reduce fatigue and improve canal accuracy. Many manufacturers expand their presence by strengthening distributor networks and offering training programs that support skilled device adoption. Product portfolios increasingly include digital apex locators, integrated motor systems, and advanced consumables to address rising demand for efficient and predictable treatments. Strategic collaborations with dental clinics and research institutions help accelerate innovation and clinical validation. Manufacturers also prioritize regulatory approvals and global expansion to widen market reach, while competitive pricing and improved durability remain key factors influencing purchasing decisions across clinics and hospitals.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Micro-Mega

- Ultradent Products

- Brasseler Holdings LLC

- COLTENE

- Septodont

- Dentsply Sirona

- DiaDent Group International

- Danaher

- Ivoclar Vivadent

- FKG Dentaire

Recent Developments

- In 2025, FKG Dentaire launched the 4D Workflow system, integrating shaping, irrigation, obturation, and equipment into one streamlined endodontic treatment process.

- In 2025, Septodont launched GenENDO, an easy-to-use rotary file system designed for efficient root canal shaping aimed at both general practitioners and specialists.

- In 2023, Dentsply Sirona Introduced the X-Smart Pro+ endodontic motor with an integrated apex locator.

Report Coverage

The research report offers an in-depth analysis based on Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see wider adoption of digital endodontic systems that improve procedural precision.

- Rotary and reciprocating file technologies will advance with better flexibility and reduced fracture risk.

- Clinics will invest more in bioceramic sealers that enhance long-term treatment outcomes.

- Minimally invasive endodontics will become a core focus across premium dental practices.

- Integration of AI-supported diagnostics will strengthen case planning and workflow accuracy.

- Demand for single-visit root canal treatments will increase with faster and safer devices.

- Private dental clinics will drive higher purchase volumes for updated endodontic tools.

- Training programs will expand to support skilled adoption of advanced systems.

- Manufacturers will focus on durable NiTi alloys to reduce file fatigue and breakage.

- Growth will strengthen in emerging markets as access to dental care improves.