Market Overview

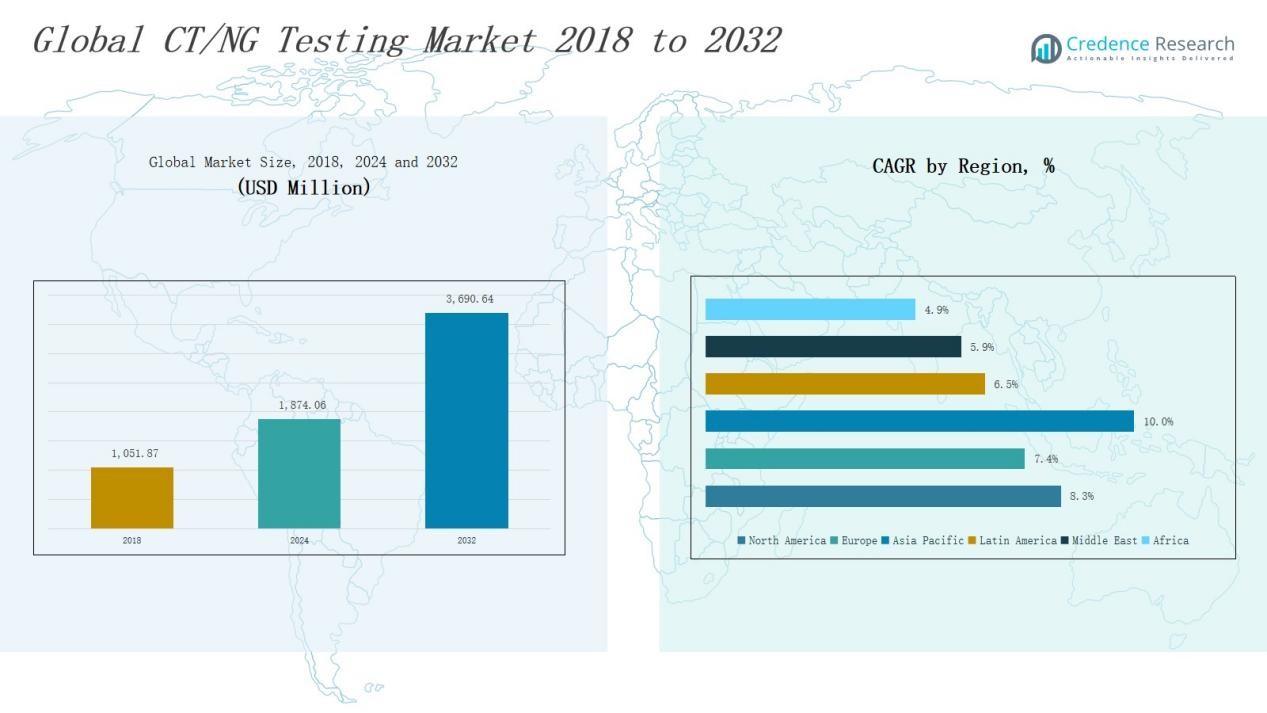

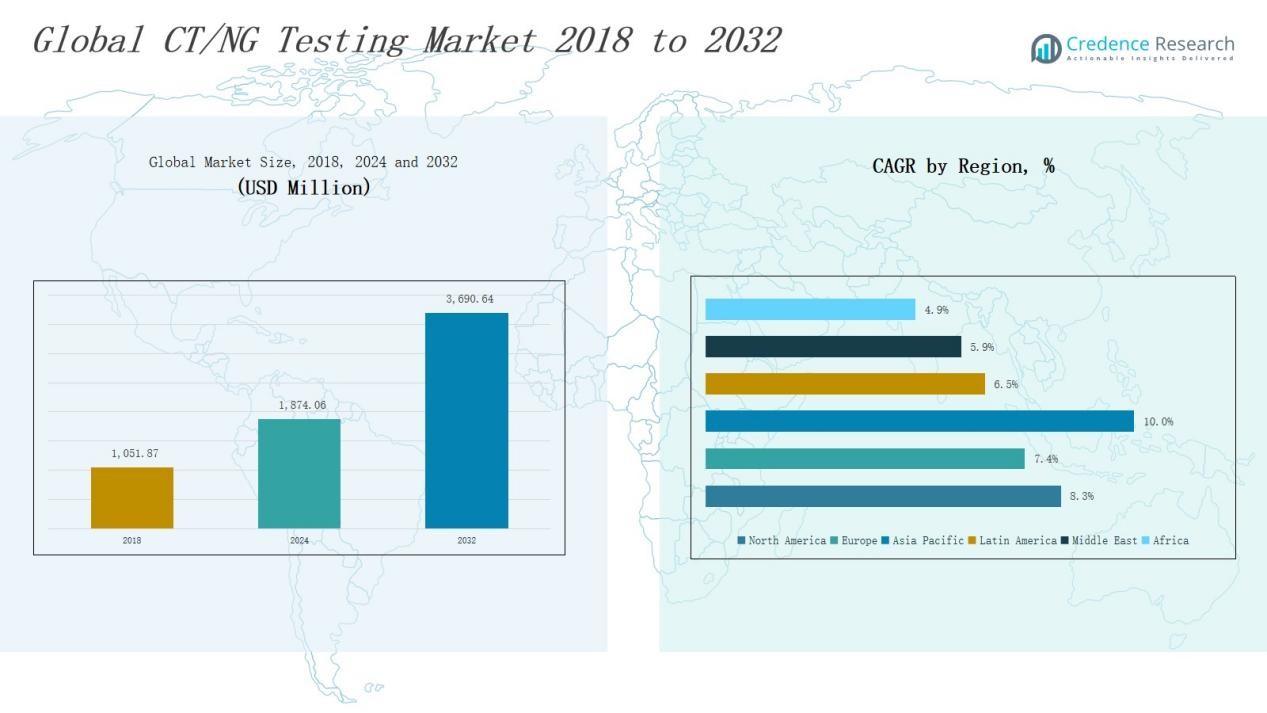

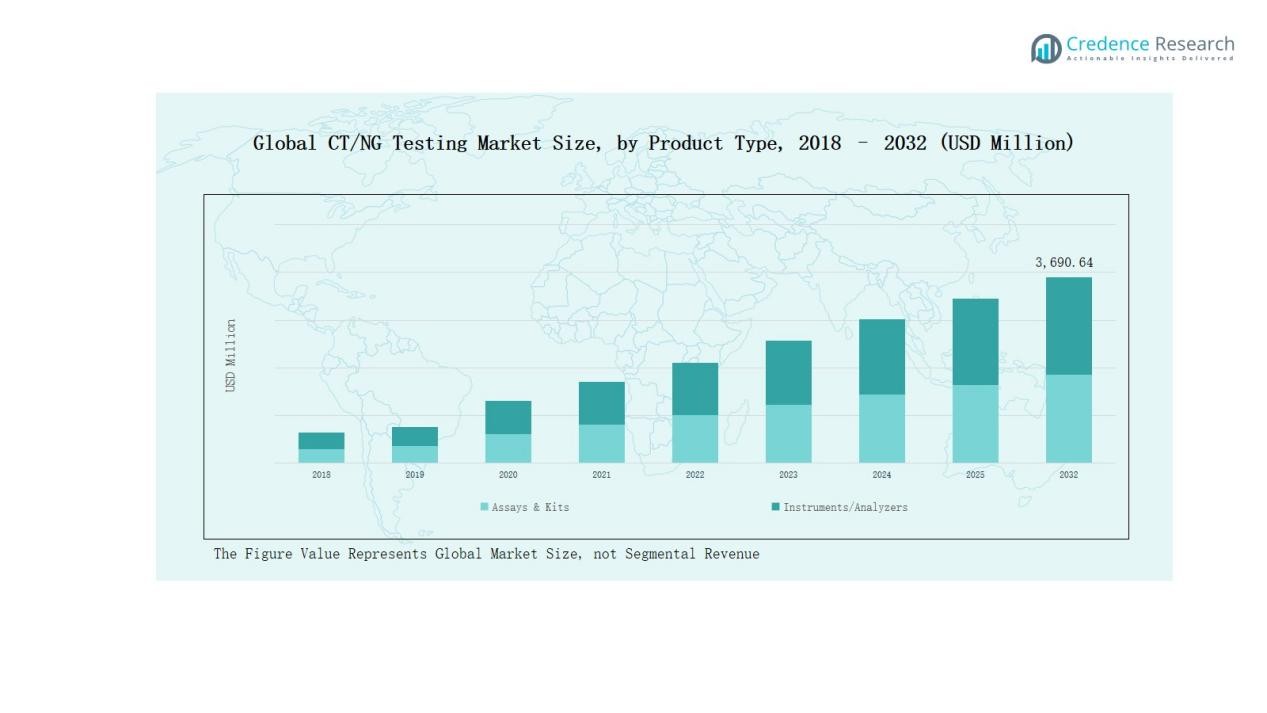

CT/NG Testing Market size was valued at USD 1,051.87 million in 2018 to USD 1,874.06 million in 2024 and is anticipated to reach USD 3,690.64 million by 2032, at a CAGR of 8.23% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| CT/NG Testing Market Size 2024 |

USD 1,874.06 Million |

| CT/NG Testing Market, CAGR |

8.23% |

| CT/NG Testing Market Size 2032 |

USD 3,690.64 Million |

The CT/NG Testing Market is led by prominent players such as Abbott Laboratories, Becton, Dickinson and Company, F. Hoffmann-La Roche Ltd., Hologic, Inc., Thermo Fisher Scientific, Qiagen N.V., Siemens AG, Bayer AG, and ZeptoMetrix LLC, all of which compete through advanced molecular diagnostic platforms, innovative assay kits, and strong distribution networks. These companies focus on expanding their portfolios with multiplex assays, automated analyzers, and point-of-care solutions to strengthen their global presence. North America emerged as the leading region in 2024, commanding 37% of the market share, driven by robust healthcare infrastructure, widespread adoption of nucleic acid amplification tests, and well-established screening programs.

Market Insights

- The CT/NG Testing Market grew from USD 1,051.87 million in 2018 to USD 1,874.06 million in 2024 and will reach USD 3,690.64 million by 2032.

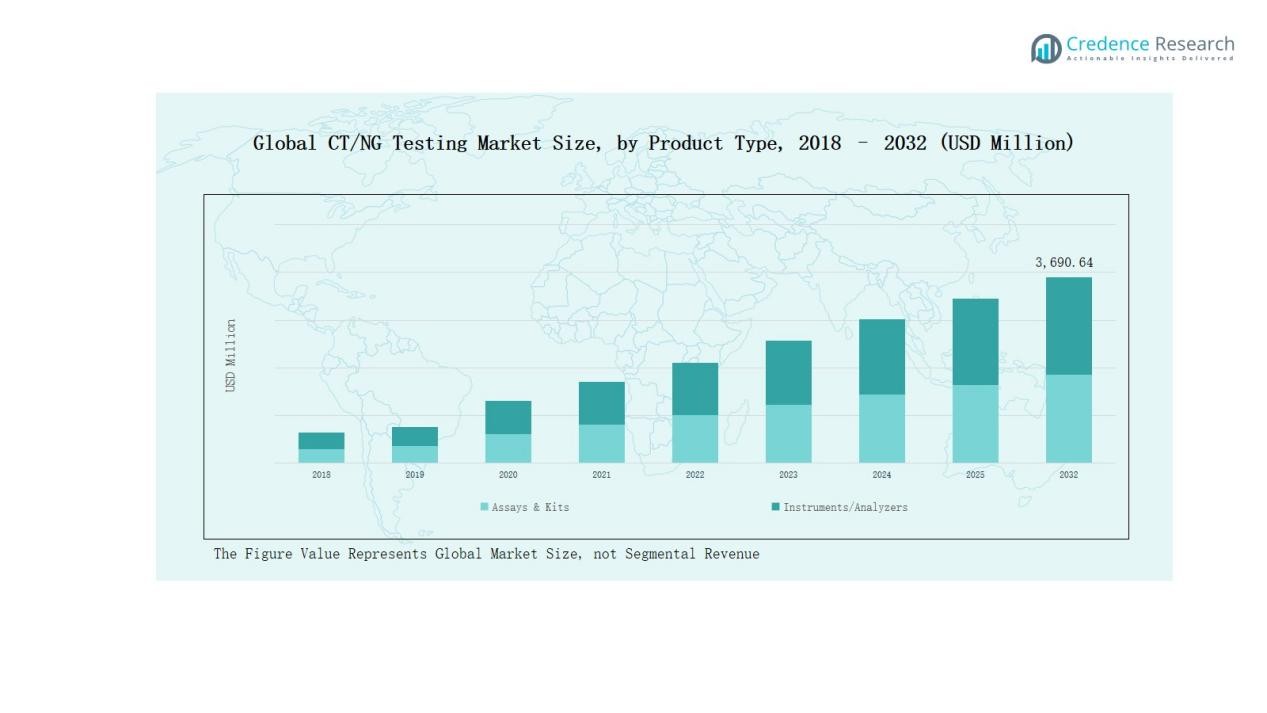

- The assays & kits segment dominated with 68% share in 2024, driven by their convenience, rapid accuracy, and strong adoption across laboratory and point-of-care diagnostic settings.

- The nucleic acid amplification tests (NAAT) segment led technology with 72% share in 2024, supported by unmatched sensitivity and specificity, with PCR further strengthening diagnostic accuracy.

- North America commanded 37% share in 2024, driven by advanced infrastructure, government-led screening programs, and the presence of major diagnostic companies in the region.

- Key players such as Abbott, Roche, Hologic, BD, Thermo Fisher, Qiagen, Siemens, Bayer, and ZeptoMetrix focus on molecular platforms, multiplex assays, and point-of-care solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product Type

The assays & kits segment accounted for 68% of the market share in 2024, making it the dominant product category. Its strong position is driven by the widespread adoption of ready-to-use kits for both laboratory and point-of-care testing. Increasing preference for accurate, rapid, and easy-to-use solutions further supports its growth, while instruments and analyzers contribute mainly through automation and advanced integration.

- For instance, Mankind Pharma launched RAPID NEWS self-test kits in September 2024 for conditions such as dengue and urinary tract infections, empowering individuals in India to perform quick and private testing at home

By Test Type

The laboratory testing segment held 61% of the share in 2024, maintaining dominance due to its high sensitivity, established infrastructure, and broad patient access. Centralized labs continue to support large-scale screening programs, while hospitals and reference labs rely on validated platforms. However, point-of-care testing is expanding quickly with rising demand for rapid results in clinics and community health settings.

- For example, Abbott’s ID NOW platform has enabled molecular COVID-19 testing with results in under 15 minutes and has been widely adopted in urgent care centers and pharmacies.

By Technology

The nucleic acid amplification tests (NAAT) segment captured 72% of the market in 2024, emerging as the clear leader. Its dominance is supported by superior sensitivity and specificity in detecting both Chlamydia trachomatis and Neisseria gonorrhoeae. Polymerase chain reaction (PCR), a core NAAT technology, further strengthens this segment, while immunodiagnostics hold a smaller share focused on low-cost, preliminary screening in resource-limited settings.

Key Growth Drivers

Rising Prevalence of STIs

The increasing incidence of Chlamydia trachomatis (CT) and Neisseria gonorrhoeae (NG) infections remains a major growth driver. Globally, these sexually transmitted infections are among the most commonly reported, creating strong demand for reliable diagnostics. Public health authorities emphasize large-scale screening and early detection, particularly among high-risk populations. This drives consistent adoption of molecular diagnostic technologies, ensuring sustained test volumes. Awareness campaigns and government initiatives further push testing uptake, cementing CT/NG testing as a vital public health priority worldwide.

- For instance, Abbott’s Alinity m STI assay, launched in 2021, offers automated detection of CT and NG along with other pathogens, providing higher throughput for hospital and reference labs.

Advancements in Molecular Diagnostics

Technological innovation in molecular diagnostics strongly propels market expansion. Widespread adoption of nucleic acid amplification tests (NAAT) and polymerase chain reaction (PCR) platforms delivers unmatched sensitivity and specificity. These tools detect infections even in asymptomatic individuals, which represent a large portion of cases. Continuous product innovation, such as multiplex assays and automated workflows, enhances speed and reduces operator errors. The growing preference for molecular technologies in laboratories and point-of-care settings significantly boosts their role in infection surveillance and patient management.

- For instance, the Abbott ID NOW platform, a widely used rapid NAAT system, delivers positive COVID-19 results in as little as five minutes and negative results in 13 minutes, making it a cornerstone for point-of-care testing.

Expansion of Point-of-Care Testing

The rapid growth of point-of-care (POC) testing drives accessibility and convenience in the CT/NG testing market. POC devices enable same-visit diagnosis and treatment, which is vital for improving patient compliance. Mobile clinics, urgent care centers, and community health programs increasingly use rapid kits to reduce diagnostic delays. Their ability to reach underserved and remote populations makes them essential in global control strategies. Combined with regulatory approvals and funding for decentralized testing, POC platforms provide strong momentum for market growth.

Key Trends & Opportunities

Integration of Multiplex Testing

Multiplex assays represent a rising trend, offering simultaneous detection of CT, NG, and other STIs in a single test. This reduces costs, saves time, and improves diagnostic efficiency. Healthcare systems adopting syndromic testing approaches prefer such tools for comprehensive infection panels. The opportunity lies in expanding multiplex offerings that integrate with automated platforms and point-of-care systems. This trend is likely to accelerate with growing demand for broad infection surveillance in public health initiatives.

- For instance, Cepheid’s Xpert® CT/NG test, integrated into the GeneXpert platform, delivers dual detection within 90 minutes and is widely used in U.S. public health clinics.

Adoption of Digital Health and Remote Diagnostics

Digital health integration and telemedicine adoption are opening new opportunities in CT/NG testing. Home-based sample collection kits linked with telehealth platforms allow patients to access results without visiting clinics. This enhances privacy, convenience, and accessibility, especially for younger populations hesitant to seek in-person testing. The trend of digital-enabled care and remote monitoring positions CT/NG diagnostics to expand beyond traditional healthcare facilities, offering vendors opportunities to diversify product portfolios and build patient-centric testing solutions.

- For instance, the Binx Health io CT/NG assay is a point-of-care clinical diagnostic test that delivers rapid results, supporting more efficient workflows for patient management, which can be complemented by telehealth services.

Key Challenges

Rising Antimicrobial Resistance

Antimicrobial resistance in Neisseria gonorrhoeae presents a critical challenge for disease management. Resistance reduces treatment efficacy, creating the need for constant surveillance and diagnostic updates. This complicates market dynamics, as diagnostics must evolve alongside emerging resistant strains. The pressure on manufacturers to integrate resistance detection capabilities in assays is increasing. Failure to address resistance risks undermining the long-term impact of current testing methods, posing both clinical and commercial hurdles for stakeholders in the CT/NG testing market.

Limited Access in Low-Resource Settings

Access to advanced CT/NG testing technologies remains limited in low-income and resource-constrained regions. High costs of molecular diagnostics, lack of trained personnel, and inadequate laboratory infrastructure hinder widespread adoption. Although point-of-care kits exist, their sensitivity is often lower compared to centralized lab systems. This disparity creates significant gaps in testing coverage and delays in treatment. Bridging affordability and accessibility challenges remains a pressing issue for governments and manufacturers seeking to expand market penetration globally.

Regulatory and Reimbursement Barriers

Complex regulatory pathways and inconsistent reimbursement policies restrain the CT/NG testing market. Obtaining approvals for new diagnostic assays often requires extensive clinical validation, delaying product launches. In several countries, reimbursement frameworks for STI testing are fragmented, limiting test affordability for patients. These factors discourage investment in innovative solutions and slow down adoption in both public and private healthcare systems. Streamlining regulatory approvals and creating uniform reimbursement models are essential to unlocking the market’s full growth potential.

Regional Analysis

North America

North America held the largest share of 37% in 2024, with revenues rising from USD 460.15 million in 2018 to USD 811.32 million in 2024. The region is projected to reach USD 1,602.19 million by 2032, growing at a CAGR of 8.3%. Strong healthcare infrastructure, favorable reimbursement policies, and high awareness of sexually transmitted infections (STIs) drive market leadership. The U.S. dominates due to extensive screening programs, adoption of nucleic acid amplification tests (NAAT), and strong presence of key diagnostic players. Expansion of point-of-care testing is further enhancing accessibility across urban and rural communities.

Europe

Europe accounted for 24% of the global share in 2024, with revenue increasing from USD 306.34 million in 2018 to USD 526.62 million in 2024. The market is forecasted to reach USD 978.05 million by 2032 at a CAGR of 7.4%. The region benefits from robust government-led STI surveillance programs and widespread use of molecular diagnostics. Germany, the UK, and France lead adoption due to advanced laboratory networks. Rising focus on multiplex testing and integration of digital health platforms enhances growth. However, uneven reimbursement policies across countries present challenges to uniform adoption.

Asia Pacific

Asia Pacific represented 17% of the market share in 2024, expanding rapidly from USD 193.23 million in 2018 to USD 374.50 million in 2024. It is projected to achieve USD 839.53 million by 2032, recording the highest CAGR of 10.0%. Rapid urbanization, rising STI prevalence, and government awareness programs drive demand. China, India, and Japan are key contributors due to large populations and increasing adoption of PCR-based assays. Growing acceptance of point-of-care diagnostics and telemedicine further supports expansion. Increasing healthcare investments and entry of global diagnostic firms make Asia Pacific the most dynamic growth region.

Latin America

Latin America captured 4% of the global share in 2024, with revenue rising from USD 47.58 million in 2018 to USD 83.67 million in 2024. The market is expected to reach USD 144.99 million by 2032, at a CAGR of 6.5%. Brazil and Mexico are the leading contributors, supported by expanding healthcare infrastructure and improved access to diagnostic kits. Rising public health initiatives targeting sexual health awareness also play a key role. However, inconsistent access to advanced molecular tests in rural areas limits widespread adoption. Partnerships with diagnostic companies are helping bridge these gaps.

Middle East

The Middle East accounted for 3% of the global market in 2024, growing from USD 29.58 million in 2018 to USD 48.19 million in 2024. It is projected to reach USD 80.14 million by 2032, reflecting a CAGR of 5.9%. GCC countries dominate due to better healthcare systems, while Turkey and Israel show rising adoption of PCR-based diagnostics. Increased government spending on infectious disease testing and screening campaigns supports demand. However, reliance on imported testing kits and limited regional manufacturing capacity remain significant barriers for long-term scalability.

Africa

Africa held the 2% market share in 2024, with revenues climbing from USD 15.00 million in 2018 to USD 29.75 million in 2024. The market is forecasted to reach USD 45.75 million by 2032, at a CAGR of 4.9%. The region faces challenges from limited laboratory infrastructure, high diagnostic costs, and lack of trained personnel. South Africa leads adoption due to relatively better healthcare infrastructure, followed by Egypt. Growing demand for affordable rapid point-of-care kits and international aid programs create opportunities. Yet, the gap between rural and urban access remains a persistent challenge.

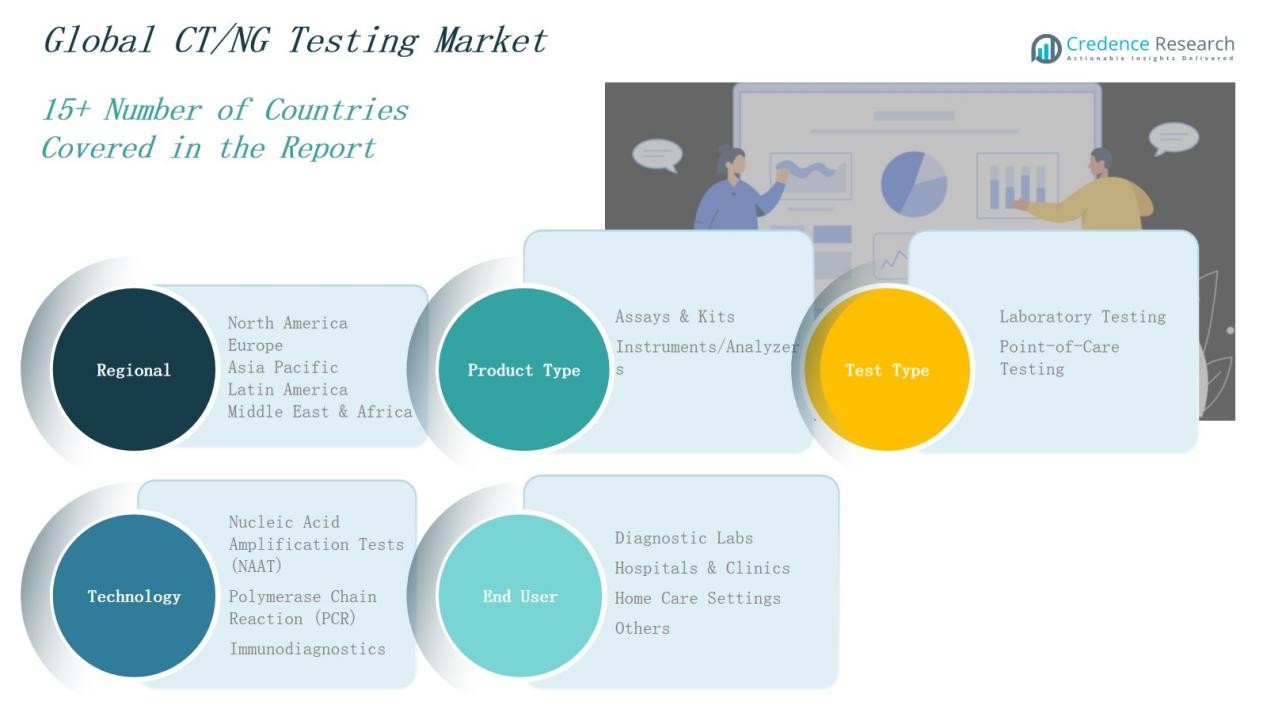

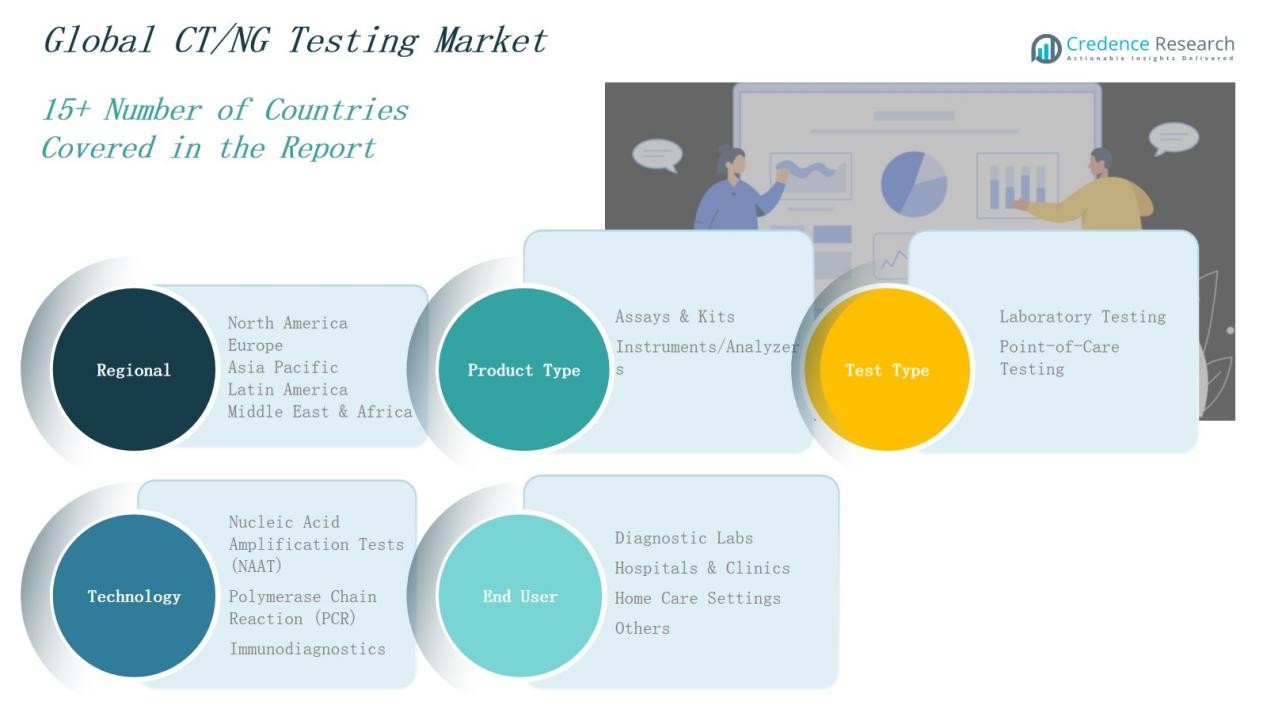

Market Segmentations:

By Product Type

- Assays & Kits

- Instruments/Analyzers

By Test Type

- Laboratory Testing

- Point-of-Care Testing

By Technology

- Nucleic Acid Amplification Tests (NAAT)

- Polymerase Chain Reaction (PCR)

- Immunodiagnostics

By End User

- Diagnostic Labs

- Hospitals & Clinics

- Home Care Settings

- Others

By Regions

- North America:S., Canada, Mexico

- Europe:UK, France, Germany, Italy, Spain, Russia, Rest of Europe

- Asia Pacific:China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific

- Latin America:Brazil, Argentina, Rest of Latin America

- Middle East:GCC Countries, Israel, Turkey, Rest of Middle East

- Africa:South Africa, Egypt, Rest of Africa

Competitive Landscape

The CT/NG Testing Market is moderately consolidated, with leading companies controlling a significant share through advanced product portfolios and global distribution networks. Major players such as Abbott Laboratories, Becton, Dickinson and Company, F. Hoffmann-La Roche Ltd., Hologic, Inc., and Thermo Fisher Scientific, Inc. dominate by offering highly accurate molecular diagnostic platforms, including nucleic acid amplification tests (NAAT) and PCR-based assays. These firms continuously invest in research and development to launch multiplex kits, automated analyzers, and point-of-care solutions, strengthening their competitive edge. Companies like Qiagen N.V., Bayer AG, and Siemens AG expand their presence through strategic partnerships, acquisitions, and regional collaborations to tap into emerging markets. Smaller players, including ZeptoMetrix LLC, enhance competitiveness by supplying quality control products and supporting diagnostic labs. Intense competition focuses on innovation, regulatory approvals, and pricing strategies, with companies seeking to expand reach across high-growth regions such as Asia Pacific and Latin America.

Key Players

- Abbott Laboratories

- Becton, Dickinson and Company

- ZeptoMetrix LLC (Antylia Scientific)

- Danaher Corporation

- Hoffmann-La Roche Ltd.

- Hologic, Inc.

- Thermo Fisher Scientific, Inc.

- Bayer AG

- Qiagen N.V.

- Siemens AG

Recent Developments

- In February 2023, Thermo Fisher Scientific Inc. acquired TIB Molbiol in Germany to expand its PCR-based diagnostic portfolio, strengthening CT/NG testing capabilities.

- In December 2024, OraSure Technologies acquired Sherlock Biosciences, Inc. to develop rapid, potentially self-testing solutions for sexually transmitted infections including CT/NG.

- In January 2025, Abbott gained FDA clearance for its simpli-COLLECT STI Test, a home-collection kit covering CT, NG, TV, and MG for lab processing.

- In January 2025, Roche’s cobas liat CT/NG and CT/NG/MG assays received FDA clearance and a CLIA waiver, enabling rapid, point‑of‑care molecular testing with results in 20 minutes. These assays enhance diagnostic speed and accessibility in clinical and non‑lab environments

Report Coverage

The research report offers an in-depth analysis based on Product Type, Test Type, Technology, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for rapid and accurate diagnostic solutions will keep growing with rising global infection prevalence.

- Point-of-care testing will increasingly expand across clinics, mobile healthcare units, and home-based diagnostic settings.

- Multiplex assays enabling simultaneous detection of multiple STIs will gain significant preference in healthcare facilities.

- Digital health platforms and home-based testing kits will improve accessibility, privacy, and patient diagnostic engagement.

- Public health initiatives will continue driving large-scale screening programs focused on prevention and early detection.

- Emerging economies will see rapid adoption supported by expanding healthcare infrastructure and increased testing investments.

- Rising antimicrobial resistance in Neisseria gonorrhoeae will accelerate diagnostic innovation and resistance surveillance integration globally.

- Laboratory automation and advanced analyzers will enhance diagnostic throughput, reduce costs, and improve turnaround efficiency.

- Strategic partnerships between diagnostic companies and governments will expand testing access across underserved global populations.

- Growing awareness campaigns will encourage voluntary STI testing, particularly among younger and high-risk population groups.