Market Overview

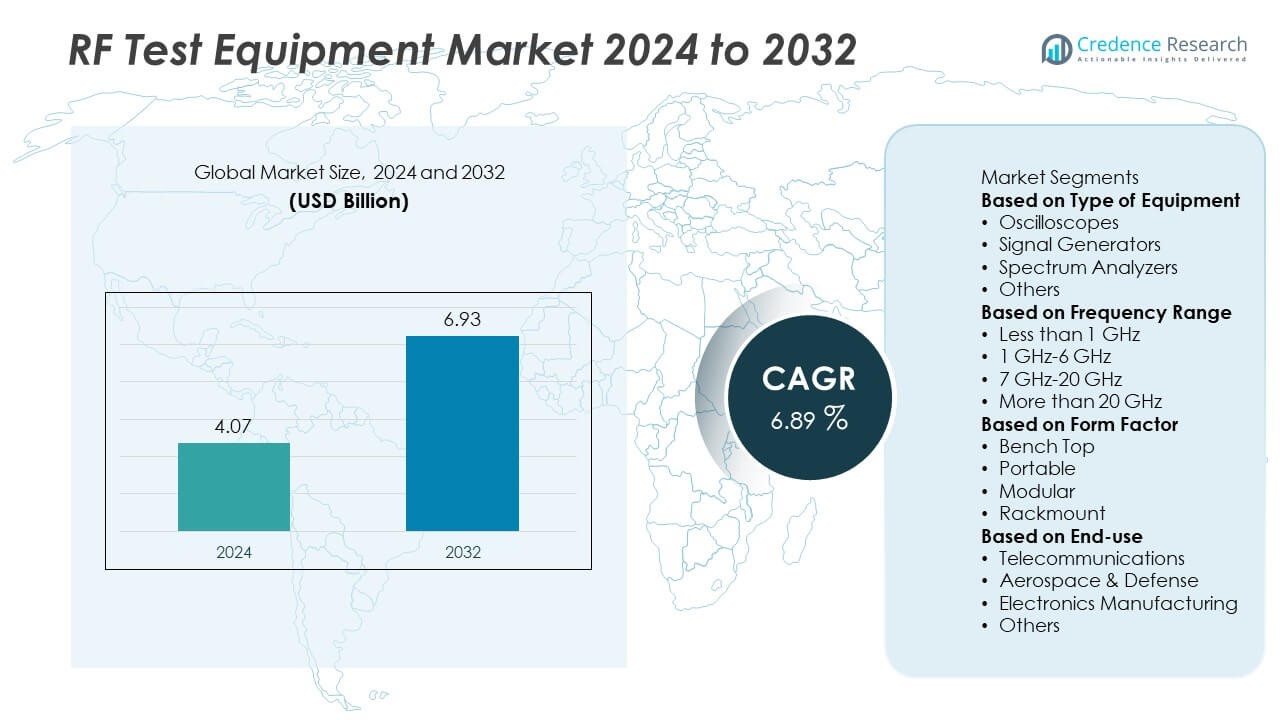

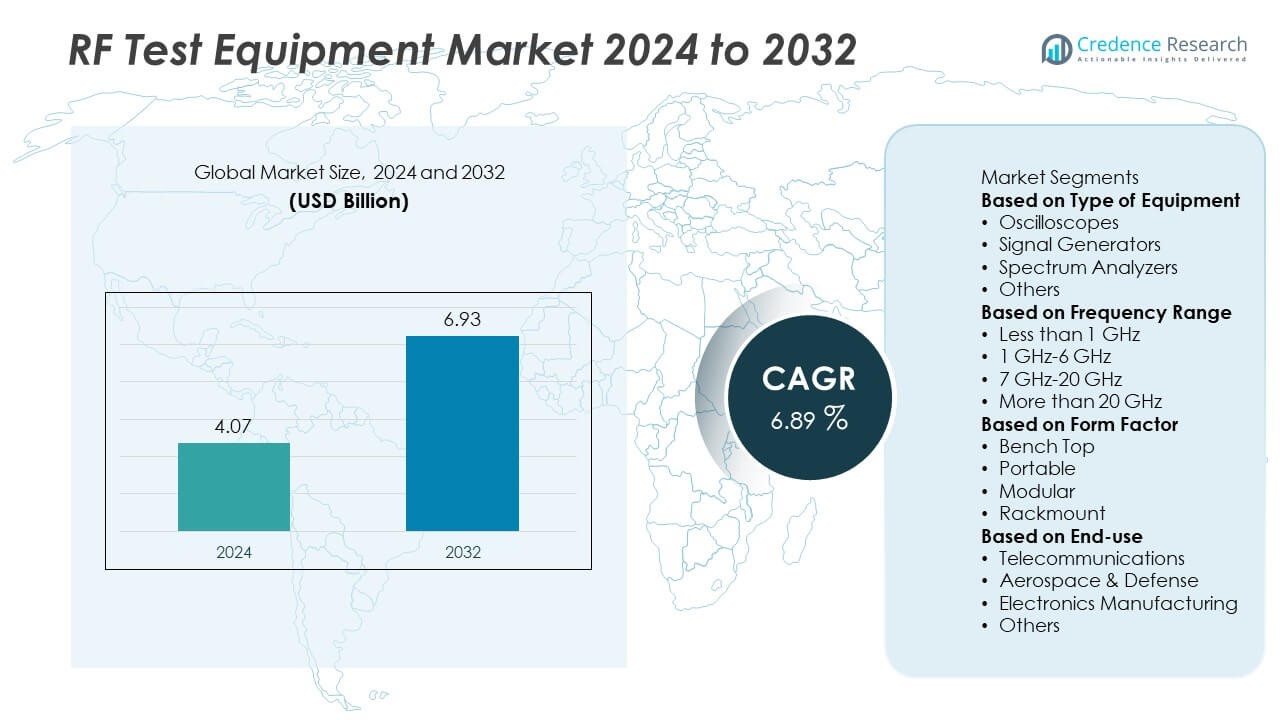

The RF Test Equipment market was valued at USD 4.07 billion in 2024 and is projected to reach USD 6.93 billion by 2032, expanding at a CAGR of 6.89% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| RF Test Equipment Market Size 2024 |

USD 4.07 Billion |

| RF Test Equipment Market, CAGR |

6.89% |

| RF Test Equipment Market Size 2032 |

USD 6.93 Billion |

The RF Test Equipment market is led by major players including Cobham PLC, Teledyne Technologies Incorporated, Rohde & Schwarz, Yokogawa Electric Corporation, Giga-Tronics Incorporated, Siemens, EXFO Inc., National Instruments, Tektronix, and Anritsu Group. These companies dominate through continuous innovation in high-frequency measurement, automation, and modular testing systems. North America leads the global market with a 38.4% share, driven by strong demand in aerospace, defense, and 5G testing applications. Europe follows with 31.1%, supported by advanced R&D in telecommunication infrastructure, while Asia-Pacific accounts for 24.7%, fueled by growing semiconductor and consumer electronics production. These regions collectively anchor the industry’s technological evolution and growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The RF Test Equipment market was valued at USD 4.07 billion in 2024 and is projected to reach USD 6.93 billion by 2032, growing at a CAGR of 6.89% during the forecast period.

- Rising demand for 5G communication systems and advanced wireless technologies is driving strong adoption of RF test equipment across telecom and electronics industries.

- The market is witnessing trends such as automation, modular testing platforms, and AI-based signal analysis tools that enhance testing accuracy and speed.

- Key players including Rohde & Schwarz, Anritsu, and Tektronix are focusing on R&D, strategic partnerships, and product diversification to maintain competitiveness.

- North America holds a 38.4% share, followed by Europe at 31.1% and Asia-Pacific at 24.7%, while the oscilloscopes segment dominates with a 34.2% share due to its extensive use in high-frequency signal testing across communication and aerospace sectors.

Market Segmentation Analysis:

By Type of Equipment

The spectrum analyzers segment dominated the RF Test Equipment market in 2024, holding a 36.4% share. This dominance is attributed to the increasing need for precise frequency analysis in wireless communication, aerospace, and defense testing. Spectrum analyzers play a vital role in identifying signal distortions, interference, and harmonics across advanced communication systems, including 5G networks and radar applications. Continuous innovation in real-time spectrum analysis and signal monitoring enhances measurement accuracy and speed. The rising adoption of multi-channel and high-frequency analyzers in R&D and manufacturing environments further supports market expansion.

- For instance, Rohde & Schwarz introduced the R&S FSV3050 spectrum analyzer, featuring a 50 GHz frequency range and a real-time bandwidth of 200 MHz. This model enables faster signal evaluation and supports wideband 5G and radar testing applications.

By Frequency Range

The 1 GHz–6 GHz segment accounted for the largest 41.2% share of the RF Test Equipment market in 2024. This range is widely used for 4G, 5G, Wi-Fi, and satellite communication testing. Growing demand for efficient connectivity and expanding telecommunication infrastructure are fueling segment growth. The frequency range is ideal for validating performance in consumer electronics, IoT devices, and automotive radar systems. Increasing investments in wireless network optimization and spectrum management, along with regulatory compliance testing, are further strengthening adoption within this frequency range across multiple end-use industries.

- For instance, Keysight Technologies launched its MXA Signal Analyzer N9020B, which covers a continuous frequency range up to 50 GHz with 89601B VSA software for demodulating Wi-Fi 6E and 5G signals. National Instruments’ PXIe-5842 VST platform supports testing from 9 kHz to 8.5 GHz with 1 GHz instantaneous bandwidth, enabling highly accurate 5G FR1 device validation and OTA measurements.

By Form Factor

The benchtop segment held a 44.7% share of the RF Test Equipment market in 2024, emerging as the dominant form factor. Benchtop instruments offer superior accuracy, extensive measurement capabilities, and high power handling, making them essential in laboratories and manufacturing test setups. These devices are widely adopted in telecommunications, aerospace, and defense sectors for design validation and compliance testing. Their precision and reliability make them the preferred choice for high-end R&D applications. However, increasing use of portable and modular equipment is gradually reshaping market dynamics toward more flexible and cost-effective testing solutions.

Key Growth Drivers

Rising Deployment of 5G Networks

The global rollout of 5G networks is a primary driver of the RF Test Equipment market. Telecom operators and equipment manufacturers require advanced testing tools to validate high-frequency performance and ensure low-latency communication. RF test systems are essential for spectrum analysis, signal integrity, and device certification in 5G-enabled products. Increasing base station installations and network densification efforts are accelerating demand. The shift toward millimeter-wave frequencies and massive MIMO technology continues to expand testing requirements across infrastructure and device manufacturing sectors.

- For instance, Anritsu introduced its MT8000A 5G Radio Communication Test Station, supporting sub-6 GHz and mmWave up to 43.5 GHz for 3GPP Release 17 validation.

Increasing Adoption of IoT and Connected Devices

The rapid expansion of IoT ecosystems is boosting demand for RF test equipment used to verify wireless connectivity and signal quality. Consumer electronics, automotive, and industrial applications rely on reliable RF testing for seamless device interoperability. As IoT devices proliferate across smart homes, healthcare, and logistics, manufacturers are emphasizing low-power, high-frequency performance validation. The integration of RF modules in sensors, wearables, and smart appliances necessitates accurate testing solutions, supporting the steady growth of the global RF test equipment industry.

- For instance, Yokogawa Electric Corporation’s WT5000 precision power analyzer offers 10 MS/s sampling rate for evaluating RF module efficiency in connected IoT devices and automotive telematics systems.

Growing Demand in Aerospace and Defense Applications

Aerospace and defense industries represent a significant growth area for RF test equipment due to rising investments in radar, satellite, and communication systems. High-frequency and high-precision measurements are critical for mission-critical applications such as electronic warfare and surveillance. Governments are investing heavily in upgrading radar and navigation infrastructure, fueling market demand. RF testing tools enable accurate verification of antennas, transmitters, and receivers, ensuring system reliability. The development of next-generation radar and space communication systems further strengthens adoption across this sector.

Key Trends & Opportunities

Emergence of Software-Defined and Modular Test Platforms

The growing shift toward software-defined and modular testing solutions is transforming the RF Test Equipment market. Modular platforms offer flexibility, scalability, and cost efficiency by allowing users to customize configurations based on testing needs. Software-driven controls enable faster updates, real-time analytics, and automation integration. This trend supports evolving requirements in 5G, aerospace, and IoT device testing. Vendors are increasingly focusing on hybrid solutions combining hardware precision with software intelligence to enhance measurement accuracy and operational efficiency across R&D and production environments.

- For instance, Accel‑RF offers plug-and-play “SMART Modules” where users can test multiple DC bias settings in one system: the “Multi-Channel Benchtop DC-HTOL” module supports 12 individual channels within a virtual multi-channel characterisation test subsystem.

Integration of AI and Machine Learning in Test Systems

Artificial intelligence and machine learning are being incorporated into RF testing to optimize signal analysis and fault detection. These technologies enhance pattern recognition, predictive maintenance, and automated calibration processes. AI-enabled test platforms help reduce measurement time and improve accuracy in large-scale testing operations. The integration of intelligent analytics supports faster troubleshooting and quality assurance in complex wireless systems. As AI-driven diagnostics gain traction, the RF test equipment market is poised to see improved efficiency, lower operational costs, and higher throughput across industries.

- For instance, USI (Unisonic Technologies) introduced an AI-based impedance-tuning solution where traditional tuning took up to 10 weeks, but the AI system reduced it to 2 weeks.

Key Challenges

High Cost of Advanced RF Test Systems

The high cost of advanced RF test equipment remains a major barrier for small and mid-sized enterprises. Devices capable of high-frequency testing, especially for 5G and aerospace applications, require complex design and calibration, increasing overall expenses. Maintenance, software upgrades, and specialized personnel further add to operational costs. Limited affordability restricts market penetration in developing regions. Manufacturers are addressing this challenge by developing scalable, modular, and rental-based solutions to make high-end RF testing more accessible without compromising performance standards.

Technical Complexity and Skill Shortage

The increasing sophistication of wireless technologies requires specialized expertise to operate and interpret RF test systems. Engineers must handle complex measurement environments involving wide frequency ranges, modulation schemes, and multi-channel configurations. However, the shortage of trained professionals limits efficient utilization of test equipment. This skill gap often leads to longer testing cycles and inconsistent results. Industry stakeholders are investing in training programs and automation technologies to mitigate these challenges and improve operational consistency across R&D and production facilities.

Regional Analysis

North America

North America held a 38.4% share of the RF Test Equipment market in 2024, maintaining its leadership through advanced technological infrastructure and strong industry presence. The United States dominates regional demand, driven by 5G deployment, aerospace innovation, and military modernization programs. Growing investments in high-frequency testing for radar and satellite systems further strengthen market growth. The presence of key manufacturers and R&D centers enhances innovation in spectrum and network testing. Expanding IoT adoption and continuous advancements in communication standards continue to support North America’s leadership in the global market.

Europe

Europe accounted for a 30.1% share of the RF Test Equipment market in 2024, supported by growing 5G infrastructure and strong automotive and aerospace sectors. Germany, the United Kingdom, and France are leading contributors, investing in advanced communication testing and electromagnetic compatibility (EMC) validation. Strict regulatory standards in telecommunications and defense ensure steady demand for precision instruments. Europe’s focus on smart manufacturing and Industry 4.0 integration is expanding RF testing applications. Continuous innovation in high-frequency and modular systems supports Europe’s role as a key hub for next-generation wireless testing technologies.

Asia-Pacific

Asia-Pacific captured a 25.6% share of the RF Test Equipment market in 2024, driven by rapid industrialization and massive 5G rollout initiatives. China, Japan, South Korea, and India are key markets leading in semiconductor manufacturing and consumer electronics production. Government-backed investments in communication infrastructure and the expansion of connected devices are fueling regional demand. The growth of automotive electronics and IoT-based solutions further supports adoption. Rising exports of RF components and increasing collaborations with global technology firms position Asia-Pacific as the fastest-growing region for RF testing solutions worldwide.

Middle East & Africa

The Middle East and Africa held a 3.3% share of the RF Test Equipment market in 2024, supported by rising investments in telecommunications and defense modernization. Gulf countries, including the UAE and Saudi Arabia, are rapidly deploying 5G and expanding smart city projects that require high-frequency testing solutions. In Africa, growing mobile connectivity and network expansion are driving adoption of portable test equipment. Limited technical infrastructure remains a restraint, but increasing partnerships with global technology firms are helping improve local testing capabilities and support gradual market development across the region.

Latin America

Latin America accounted for a 2.6% share of the RF Test Equipment market in 2024, with Brazil and Mexico leading regional adoption. Expanding telecommunications networks, combined with the introduction of 5G trials, are driving steady demand. The automotive and electronics sectors are emerging contributors as industries focus on product validation and connectivity testing. Growing digital transformation initiatives and modernization of defense systems are further supporting market expansion. Despite limited manufacturing capacity, foreign investments and government support for technology development are gradually strengthening Latin America’s position in the global RF testing ecosystem.

Market Segmentations:

By Type of Equipment

- Oscilloscopes

- Signal Generators

- Spectrum Analyzers

- Others

By Frequency Range

- Less than 1 GHz

- 1 GHz-6 GHz

- 7 GHz-20 GHz

- More than 20 GHz

By Form Factor

- Bench Top

- Portable

- Modular

- Rackmount

By End-use

- Telecommunications

- Aerospace & Defense

- Electronics Manufacturing

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the RF Test Equipment market features key players such as Cobham PLC, Teledyne Technologies Incorporated, Rohde & Schwarz, Yokogawa Electric Corporation, Giga-Tronics Incorporated, Siemens, EXFO Inc., National Instruments, Tektronix, and Anritsu Group. These companies compete through technological innovation, diversified product portfolios, and strong global distribution networks. Market leaders are investing in advanced testing solutions that support 5G, IoT, and satellite communication applications. Strategic collaborations with telecom operators and research institutions enhance their presence in high-growth markets. Continuous developments in modular and portable RF testing systems, automation integration, and AI-based analytics are key focus areas. Moreover, the shift toward software-defined testing platforms and cloud-enabled diagnostics is reshaping competition. Companies emphasizing precision measurement, cost efficiency, and multi-standard compliance continue to strengthen their market position in the evolving wireless communication ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cobham PLC

- Teledyne Technologies Incorporated

- Rohde & Schwarz

- Yokogawa Electric Corporation

- Giga-Tronics Incorporated

- Siemens

- EXFO Inc.

- National Instruments

- Tektronix

- Anritsu Group

Recent Developments

- In September 2025, Rohde & Schwarz announced new frequency models up to 54 GHz for its R&S ZNB3000 vector network analyzer.

- In September 2025, Tektronix also announced the upcoming 7 Series DPO oscilloscope (bandwidth up to 25 GHz) for high-performance test and measurement applications.

- In April 2025, Rohde & Schwarz expanded its test-equipment portfolio to support the Telesat Lightspeed LEO satellite network, including signal generators and spectrum/signal analyzers.

- In 2024, Tektronix introduced a new lineup of TICP Series IsoVu™ isolated current probes with RF isolation at its electronica 2024 launch.

Report Coverage

The research report offers an in-depth analysis based on Type of Equipment, Frequency Range, Form Factor, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing 5G network expansion will continue to boost demand for advanced RF test solutions.

- Increasing use of IoT devices will create a need for high-frequency signal testing systems.

- Integration of AI and machine learning will enhance test accuracy and automation efficiency.

- Rising demand for compact and modular instruments will drive product innovation.

- Development of next-generation semiconductors will expand RF testing applications.

- Aerospace and defense sectors will adopt more precision-based RF analyzers for mission-critical systems.

- Growth in consumer electronics and automotive radar systems will accelerate equipment adoption.

- Cloud-based testing platforms will gain traction for remote monitoring and performance validation.

- Key players will focus on strategic alliances to strengthen technology integration and market presence.

- North America, Europe, and Asia-Pacific will remain leading regions driven by telecom, defense, and electronics industries.