Market Overview

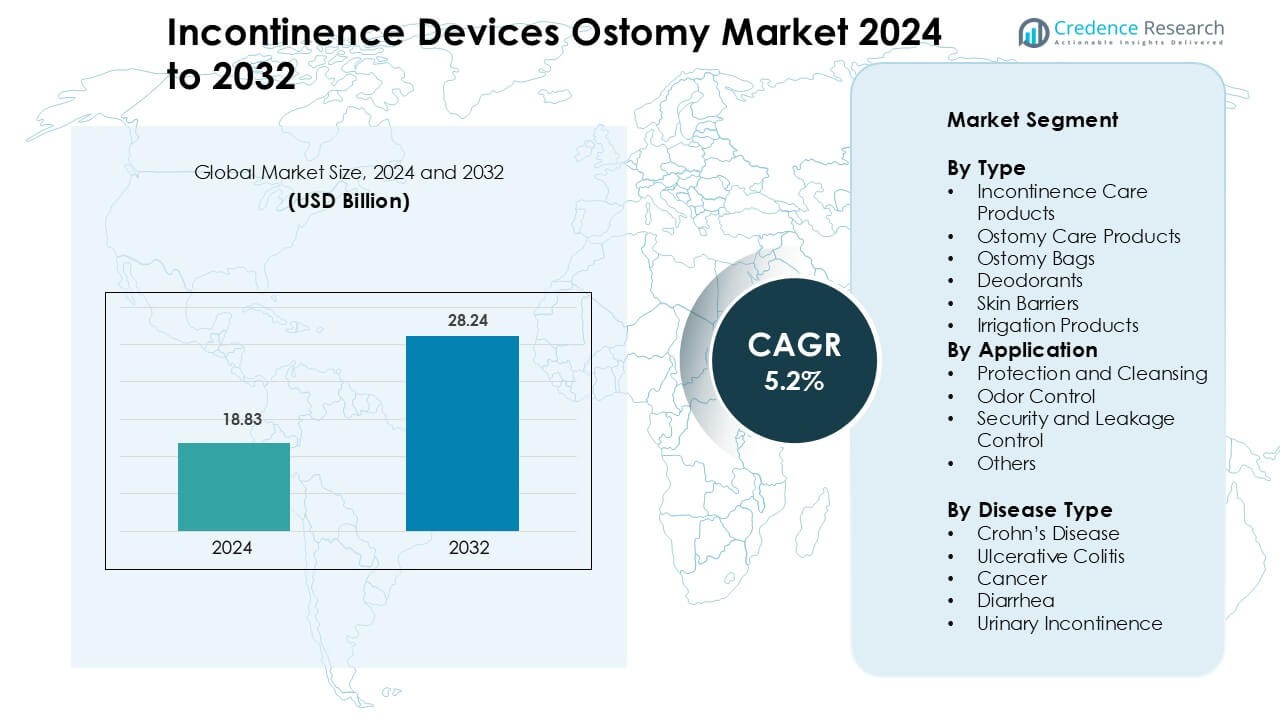

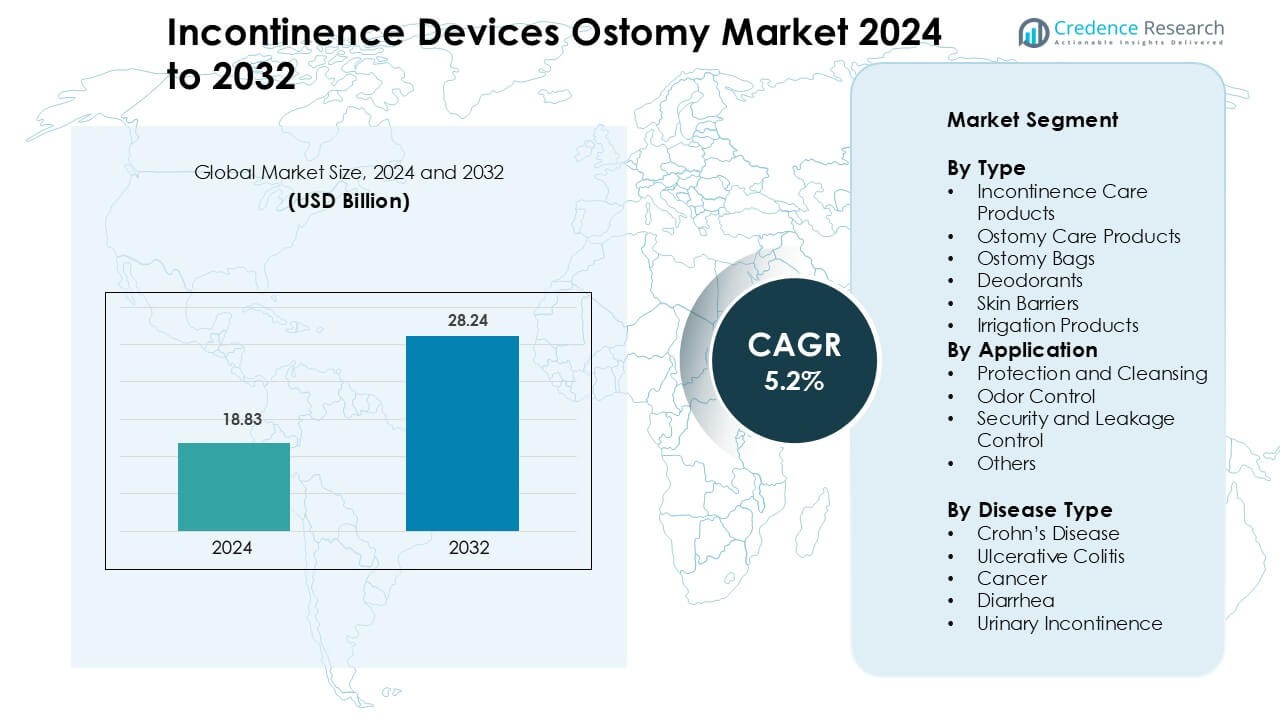

Incontinence Devices Ostomy Market was valued at USD 18.83 billion in 2024 and is anticipated to reach USD 28.24 billion by 2032, growing at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Incontinence Devices Ostomy Market Size 2024 |

USD 18.83 Billion |

| Incontinence Devices Ostomy Market, CAGR |

5.2% |

| Incontinence Devices Ostomy Market Size 2032 |

USD 28.24 Billion |

The top players in the incontinence devices and ostomy market include Coloplast AG, ConvaTec Inc., B. Braun Melsungen AG, Kimberly-Clark Corporation, and Medtronic, Inc., each holding a significant portion of the market. These companies are renowned for their extensive product ranges, innovative solutions, and strong global presence. Coloplast and ConvaTec are particularly prominent, with a focus on advanced ostomy care and incontinence products that emphasize comfort and reliability. The Asia-Pacific region leads the market with an approximate share of 40%, driven by the growing elderly population and increasing healthcare awareness in countries such as Japan, China, and India. The region benefits from substantial investments in healthcare infrastructure, along with rising demand for both incontinence care products and ostomy solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global incontinence devices and ostomy market was valued at USD 18.83 billion in 2024 and is projected to grow at a CAGR of 5.2% from 2025 to 2032.

- Increasing prevalence of urinary incontinence and ostomy-related surgeries, especially in the aging population, is a major driver for market growth.

- Innovations in skin-friendly materials, odor control, and smart technology in ostomy bags and incontinence products are key trends enhancing market growth.

- Major companies such as Coloplast AG, ConvaTec Inc., and B. Braun Melsungen AG dominate the market, focusing on product innovation, global expansion, and strategic partnerships to strengthen their positions.

- The Asia-Pacific region holds the largest market share, approximately 40%, with increasing demand for incontinence care products driven by growing healthcare access and an aging population.

Market Segmentation Analysis:

By Type

The incontinence and ostomy care products market is dominated by the Incontinence Care Products sub-segment, which held an estimated share of around 75% in 2023. Rapid growth is driven by an ageing population, rising incidence of urinary incontinence and fecal incontinence, and greater acceptance of adult-absorbent products. Concurrently, the Ostomy Care Products sub-segment (including ostomy bags, deodorants, skin barriers, and irrigation products) is gaining traction especially the ostomy bags sub-category underpinned by increasing surgeries related to colorectal cancer and inflammatory bowel disease (IBD).

- For instance, Essity AB operates approximately 70 production facilities globally across its three business areas. It delivers its adult-absorbent products in over 150 countries, reflecting its global leadership in the adult care market with brands like TENA.

By Application

The Protection & Cleansing category currently leads, reflecting its dominant role in managing incontinence and stoma care, with adult briefs/diapers and skin cleansing wipes at the forefront. Growth is driven by heightened home care demand, innovations in protective absorbents and cleansing technologies, and expanding awareness of hygiene-related complications. The Odor Control and Security & Leakage Control segments are emerging rapidly, propelled by patient expectations for discretion, improved quality of life, and advanced materials that help reduce leakage and odour from ostomy or incontinence appliances.

- For instance, Ontex Group NV launched two innovations Dreamshield™ and X-CORE within its adult disposable pants portfolio; X-CORE features a channeled core designed to enhance leakage protection and comfort.

By Disease Type

The Urinary Incontinence category represents the dominant driver, owing to its widespread prevalence, particularly among women and the elderly, and substantial underlying need for continence care. The other key disease categories such as Crohn’s disease, Ulcerative Colitis, and cancer (especially colorectal) act as significant growth engines for the ostomy care side of the market, since these conditions often lead to stoma surgery and subsequent long-term device usage.

Key Growth Drivers

Demographic Shift and Ageing Population

Population ageing remains the primary growth engine for the incontinence and ostomy market. As life expectancy rises, prevalence of urinary and fecal incontinence and age-related chronic conditions increases, driving sustained demand for absorbent products, skin-protective barriers, and ostomy appliances. Healthcare systems and caregivers now prioritize long-term, home-based management, which expands consumption of disposable and reusable solutions. Manufacturers respond with product lines tailored to geriatric physiology softer adhesives, higher-capacity absorbents, and gentle cleansers while payers increasingly recognise cost savings from preventing skin breakdown and infection. This demographic pressure stimulates both volume growth and incremental product innovation, encouraging companies to scale manufacturing, extend distribution into community pharmacies and online channels, and invest in educational programs that accelerate adoption among older adults and their caregivers.

- For instance, Essity AB launched its “TENA SmartCare” digital sensor system in 2020, which attaches to adult incontinence products and alerts caregivers when a change is needed, supporting improved hygiene for over 400 million people globally who suffer from some form of incontinence.

Clinical Incidence of Chronic Gastrointestinal and Urological Conditions

Rising diagnoses of colorectal cancer, inflammatory bowel disease (Crohn’s disease and ulcerative colitis), and neurogenic bladder disorders underpin demand for ostomy and incontinence products. Surgical interventions that create stomas or long-term catheterization produce durable product need, while chronic disease management necessitates routine use of skin barriers, irrigation systems, and specialized bags. Hospitals and ambulatory surgical centres act as critical adoption points: postoperative protocols increasingly include standardized stoma care kits and discharge plans that prescribe specific consumables. Concurrently, earlier detection and improved survival rates mean more patients live longer with ostomies or continence challenges, creating predictable, recurring revenue streams for suppliers and motivating clinical partnerships that integrate product selection into care pathways and rehabilitation programs.

- For instance, Coloplast A/S launched its SenSura® Mio range to address body-profile variability and improve fit, reflecting a clinical study with 1,686 patients showing nearly 60 % had irregular abdominal surfaces.

Technological Innovation and Materials Science

Advances in materials science and device engineering drive market expansion through better performance and user experience. New super-absorbent polymers, breathable multilayer films, and softer, skin-friendly adhesives reduce leakage, irritation, and odour directly addressing patient priorities. Smart features such as integrated wear-time indicators, low-profile designs, and modular coupling systems for ostomy bags improve discretion and mobility, increasing user confidence and retention. Manufacturers also invest in packaging and dosing technologies for deodorants and sealants that simplify use at home. These innovations enable premium positioning and support value-based procurement by demonstrating longer wear times, fewer skin complications, and reduced nursing interventions, prompting payers and health systems to support upgraded products despite higher unit prices.

Key Trends & Opportunities

Telehealth, Remote Care, and Consumer Channels

Telemedicine and remote nursing create a major opportunity to reconfigure sales and support models. Virtual stoma consultations, remote fitting sessions, and tele-nurse follow-ups reduce clinic visits and speed product selection, while digital platforms enable subscription delivery of consumables directly to patients’ homes. E-commerce channels and D2C subscription models improve adherence and provide manufacturers with usage data to refine offerings. Companies that combine telehealth services with product bundles and educational content gain differentiation and increase lifetime customer value. This trend also opens partnership opportunities with payer programs and home-health agencies to embed product delivery into remote care pathways, reducing total cost of care and improving patient outcomes.

- For instance, the United Ostomy Associations of America (UOAA), in partnership with The Wound Company, now offers a Virtual Ostomy Clinic that provides a 30-day support program via Zoom, email and SMS, enabling certified ostomy nurses to consult patients in 48 US cities and handle intake, product-recommendation and follow-up communications.

Personalization and Patient-Centric Design

Patients now expect solutions that reflect lifestyle needs and body diversity, creating demand for customizable fittings, a range of sizes, skin tones, and low-visibility aesthetics. Personalized stoma belts, adjustable wafer shapes, and modular bag options enable clinicians to match products to surgical anatomy and activity levels. Brands that invest in user research and modular product platforms can cross-sell accessories (odor control, specialized adhesives, irrigation kits) and develop premium tiers for active users. Personalization also extends to education—tailored training materials, language options, and support communities enhance adherence. This shift toward patient-centric design improves satisfaction and reduces device abandonment, translating to stronger brand loyalty and higher recurring revenue.

- For instance, The Coloplast 0421 belt (Brava Belt) is confirmed to be adjustable, soft, comfortable, washable, and designed for a secure fit across different body shapes.

Sustainability and Circularity Opportunities

Environmental concerns around single-use consumables are prompting manufacturers to explore recyclable materials, biodegradable components, and take-back programs. Sustainable product innovation—such as compostable outer films, reduced packaging, and refillable deodorant systems—addresses consumer and institutional demand for greener options. Hospitals and large procurement groups increasingly evaluate environmental impact alongside cost and clinical performance, presenting an opportunity for firms that can demonstrate lower lifecycle footprints. Companies that pilot recycling logistics or offer mixed portfolios (single-use for acute care, reusable options for home use) can capture progressive buyers and anticipate regulatory trends that may incentivize reduced medical waste.

Key Challenges

Reimbursement Pressure and Price Sensitivity

The market faces persistent reimbursement constraints and procurement scrutiny, especially in public healthcare systems and cost-conscious insurers. Buyers emphasize unit cost and total cost of care, often prioritizing cheaper commodity products over higher-performance alternatives. This environment compresses margins and discourages investment in premium innovations unless suppliers can clearly quantify downstream savings (fewer readmissions, reduced skin complications). Price sensitivity also affects private consumers in markets with limited coverage, reducing willingness to adopt higher-priced discrete or personalized options. Vendors must therefore balance R&D and material costs with demonstrable clinical and economic outcomes—and pursue value-based contracting or bundled procurement to protect margins.

Clinical Complexity and User Training Burden

Successful product adoption depends on effective clinical training and patient education, yet healthcare providers and caregivers often lack time and resources for comprehensive stoma and continence management instruction. Improper fitting or misuse increases leakage, skin injury, and product abandonment, undermining perceived value. The diversity of surgical anatomies and comorbidities further complicates standardization of product kits and protocols. Manufacturers must invest in scalable education digital tutorials, certified training programs, and clinician liaisons to ensure correct usage. Achieving consistent training at discharge and in community settings remains a logistical and cost challenge that can limit market penetration despite strong product performance.

Regional Analysis

North America

The North American market dominates the global incontinence and ostomy care device market with a revenue share of approximately 40 – 42%. Its strong position reflects mature healthcare infrastructure, high per-capita healthcare spending, favourable reimbursement policies and well-established home care channels. The region also benefits from high prevalence of chronic urological and gastrointestinal conditions, as well as rapid uptake of advanced, premium consumables and telehealth-enabled care models. Together these factors underpin steady market growth, though expansion is more moderate compared to emerging regions.

Europe

Europe holds the second-largest share globally about 30-32%. The market is supported by an ageing population, high awareness of stoma and continence care needs, and robust public healthcare systems covering consumables. Key EU regulatory frameworks drive product quality and safety, while sustainability initiatives and reimbursement support encourage adoption of advanced solutions. Growth in Europe remains stable but somewhat slower, reflecting mature penetration and cost-control pressures in public healthcare systems.

Asia Pacific

Asia Pacific accounts for roughly 15-16% of the global market today but is the fastest-growing region, with a pronounced CAGR driven by rising healthcare infrastructure investment, expanding middle class and increasing awareness of incontinence and ostomy care. Countries such as China and India are scaling distribution networks and local manufacturing, enabling greater access to advanced devices and consumables. The region offers significant growth opportunity as home-care adoption and tele-health penetration expand.

Latin America

Latin America contributes around 5-10% of global revenue. Growth in this region is driven by improving healthcare access, rising disposable incomes, increasing awareness of continence and ostomy management and a gradual shift from basic to more advanced care products. Nevertheless, barriers such as variable reimbursement, fragmented markets and lower product awareness limit growth compared to mature regions.

Middle East & Africa (MEA)

The Middle East & Africa region holds approximately 5-8% of the global market share. Growth is supported by sovereign-wealth-driven healthcare infrastructure investments, rising awareness of chronic conditions, and expansion of medical device distribution networks. However, the market remains constrained by wide variation in healthcare system maturity, reimbursement coverage and patient awareness across countries within the region.

Market Segmentations:

By Type

- Incontinence Care Products

- Ostomy Care Products

- Ostomy Bags

- Deodorants

- Skin Barriers

- Irrigation Products

By Application

- Protection and Cleansing

- Odor Control

- Security and Leakage Control

- Others

By Disease Type

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

In the competitive landscape of the incontinence devices and ostomy market, several key players dominate with strong brand recognition and innovative product offerings. Companies like Coloplast AG, ConvaTec Inc., and B. Braun Melsungen AG have established themselves as market leaders through a combination of extensive product portfolios, advanced manufacturing capabilities, and robust global distribution networks. These companies focus on continuous innovation, including the development of skin-friendly, high-absorbency products and ostomy solutions that improve patient comfort and quality of life. Additionally, players such as Kimberly-Clark Corporation and Medtronic, Inc. are leveraging their expertise in consumer healthcare and medical technologies to provide integrated care solutions. Competitive pressures are heightened by regional players like Salts Healthcare Ltd. and Torbot Group, Inc., which focus on specialized, cost-effective products to cater to niche markets. The market is also seeing increased competition from emerging players introducing new technologies and expanding market reach through strategic partnerships and acquisitions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Coloplast AG (Denmark)

- Torbot Group, Inc. (U.S.)

- Kimberly-Clark Corporation (U.S.)

- Salts Healthcare Ltd. (U.K.)

- Braun Melsungen AG (Germany)

- Medtronic, Inc. (U.S.)

- Unicharm Corporation (Japan)

- ConvaTec Inc. (U.S.)

- Hollister Inc. (U.S.)

- SvenskaCellulosaAktiebolaget (Sweden)

Recent Developments

- In September 2025, Coloplast A/S unveiled the “Impact4” strategy, prioritizing Ostomy Care innovation.

- In April 2025, Kimberly-Clark (Goodnites) introduced XXL nighttime underwear for kids up to 165 lbs.

- In April 2024, Torbot Group, Inc. listed in UOAA’s updated New Ostomy Patient Guide.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Disease Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of smart sensor‑enabled incontinence and ostomy devices will rise.

- Preference for skin‑friendly, hypoallergenic materials will strengthen.

- Growth in home‑care and outpatient settings will drive product demand.

- Telehealth integration and remote monitoring will expand care models.

- Emerging markets will show increased uptake due to infrastructure build‑out.

- Modular disposable systems will become standard for ostomy management.

- Premium odor‑control and leak‑prevention technologies will lead product upgrades.

- Strategic partnerships and acquisitions will accelerate market consolidation.

- Regulatory changes and reimbursement policies will influence device accessibility.

- Environmental sustainability and recycling initiatives will gain traction in product development.