Market Overview

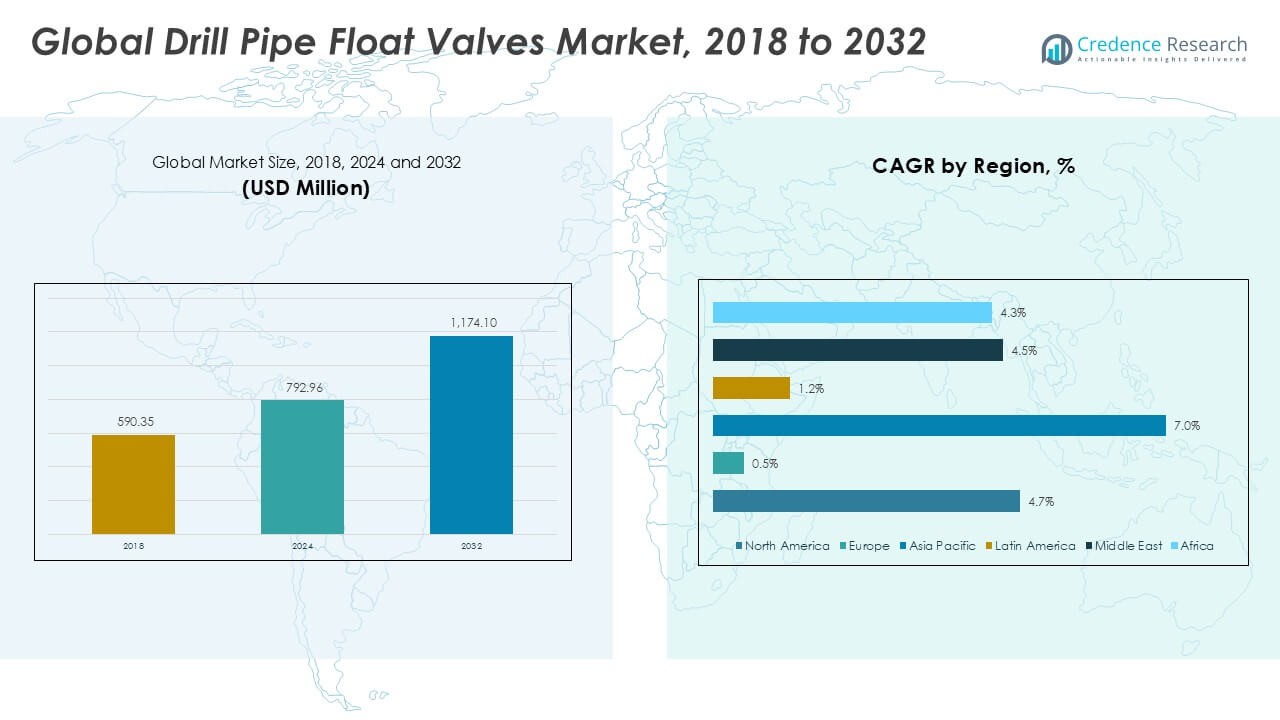

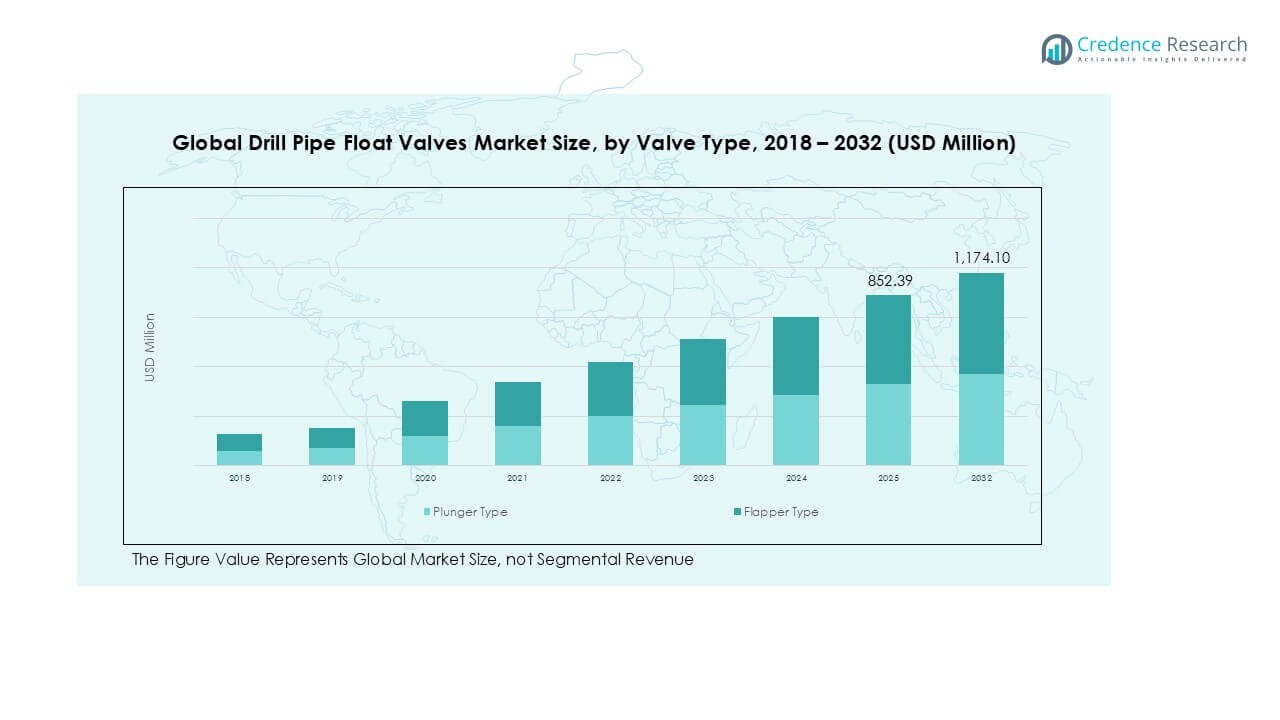

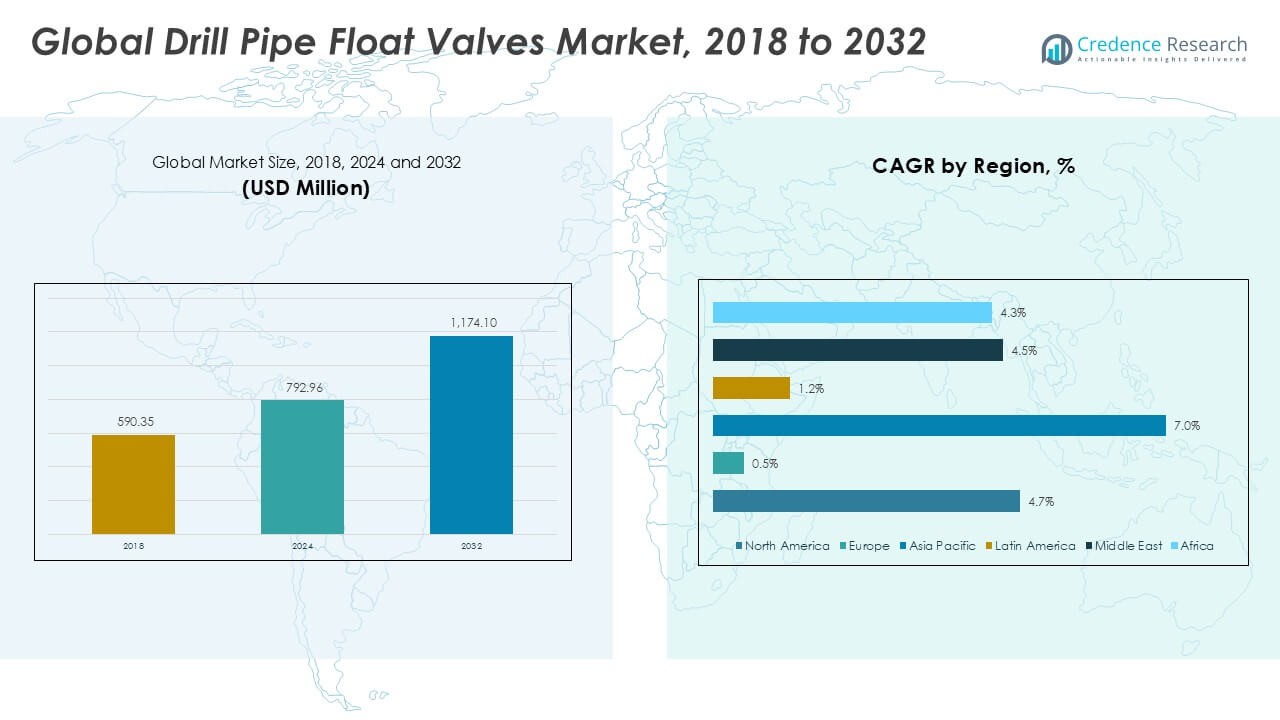

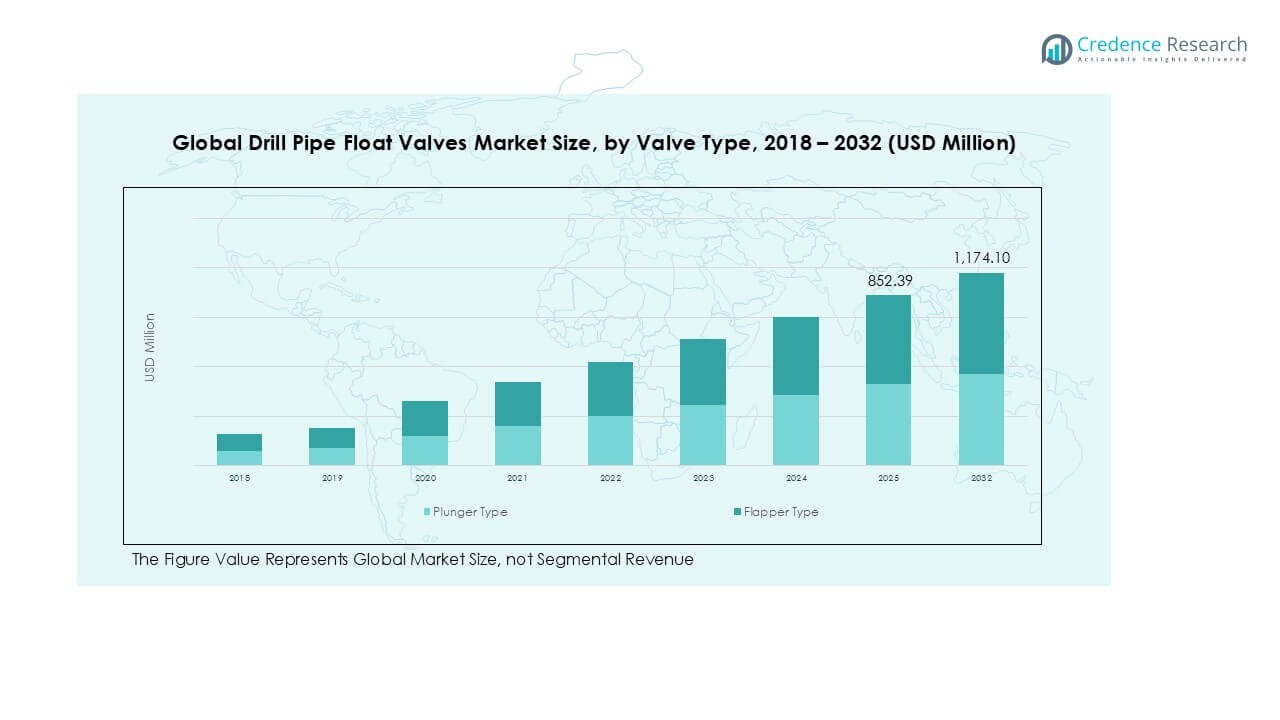

Drill Pipe Float Valves market size was valued at USD 590.35 million in 2018, reaching USD 792.96 million in 2024, and is anticipated to reach USD 1,174.10 million by 2032, at a CAGR of 4.68% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Drill Pipe Float Valves Market Size 2024 |

USD 792.96 Million |

| Drill Pipe Float Valves Market, CAGR |

4.68% |

| Drill Pipe Float Valves Market Size 2032 |

USD 1,174.10 Million |

The drill pipe float valves market is led by established players such as Forum Energy Technologies, Baker Hughes, Vallourec, Keystone Energy Tools, and M&M International, supported by regional firms like Drillmax Inc., TIW (Texas Iron Works), Sub-drill, D-Valves, and Unionlever International Group. These companies compete through product reliability, advanced materials, and strong distribution networks across major oilfield regions. North America emerged as the leading region in 2024, accounting for over 42% of the global market share, driven by shale gas exploration and technological advancements. The Middle East followed with 23% share, supported by large hydrocarbon reserves and high drilling intensity. Asia Pacific ranked third with 14%, reflecting its fast growth from rising onshore and offshore exploration projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The drill pipe float valves market was valued at USD 792.96 million in 2024 and is projected to reach USD 1,174.10 million by 2032, growing at a CAGR of 4.68% during the forecast period.

- Rising global drilling activities, especially in shale gas and deepwater projects, drive demand for float valves that ensure safety, durability, and operational efficiency in both onshore and offshore fields.

- Stainless steel valves dominate the material segment with nearly 50% share, while plunger type leads by valve type with over 55% share, supported by high-pressure applications.

- The market is moderately consolidated, with key players such as Forum Energy Technologies, Baker Hughes, Vallourec, and M&M International focusing on product innovation, durability, and regional expansion to sustain competitiveness.

- North America holds 42% share, followed by the Middle East at 23%, Asia Pacific at 14%, Africa at 12%, Europe at 6%, and Latin America at just over 2%.

Market Segmentation Analysis:

By Valve Type

The plunger type segment accounted for the dominant share of the drill pipe float valves market in 2024, holding over 55% of total revenue. Its leadership comes from strong demand in high-pressure drilling environments, where robust sealing and backflow prevention are critical. Plunger valves are widely preferred due to their durability, resistance to wear, and ability to handle abrasive drilling fluids. Continuous improvements in valve design and adoption in deep drilling projects further support this segment. Flapper type valves follow, finding use in operations requiring faster flow control at lower costs.

- For instance, in 2023, Weatherford focused on advancing its Managed Pressure Drilling (MPD) technology for ultra-deepwater applications. The company also announced a new Drill Pipe Riser (DPR) ultra-deepwater intervention system, with a contract award from Petrobras. In its completions product line, the IntegraLine® liner system is V0-rated for pressures up to 15,000 psi in ultradeepwater and HPHT wells.

By Material

Stainless steel dominated the market by material, representing nearly 50% of the revenue share in 2024. Its corrosion resistance, high tensile strength, and long operational lifespan make stainless steel a preferred choice for demanding drilling applications. Offshore drilling environments, where exposure to saline conditions is significant, strongly favor stainless steel float valves. Alloy steel also holds a considerable share, primarily in onshore operations, due to cost efficiency and flexibility in handling varied drilling conditions. The “others” category, including composite materials, is growing gradually with innovation in lightweight, durable alternatives.

- For instance, NOV supplies equipment, such as stainless-steel valves, to offshore rigs, and its products are subject to corrosion resistance tests, such as ASTM B117 salt spray testing.

By Application

Onshore oil and gas fields led the application segment, securing more than 60% of the market share in 2024. Their dominance is driven by the higher number of land-based drilling projects worldwide, supported by expanding exploration activities across North America, the Middle East, and Asia. Cost-effective deployment, easier logistics, and continuous investments in unconventional reserves, such as shale, further sustain the demand for float valves in onshore drilling. Offshore fields, while smaller in share, remain significant due to rising deepwater and ultra-deepwater projects requiring advanced, corrosion-resistant float valves for extreme drilling conditions.

Key Growth Drivers

Rising Global Oil and Gas Exploration Activities

Expanding oil and gas exploration projects worldwide act as a primary driver for the drill pipe float valves market. National oil companies and international operators are investing heavily in both conventional and unconventional reserves to meet rising energy demand. Increased drilling activity in shale basins, particularly across North America, and new offshore projects in Africa and the Middle East fuel demand for reliable float valves. The requirement for tools that ensure fluid control, maintain wellbore integrity, and reduce downtime boosts adoption. Additionally, exploration in ultra-deepwater and high-pressure environments strengthens the need for robust plunger and stainless steel-based valves.

- For instance, ExxonMobil and its partners are engaged in continuous drilling programs off the coast of Guyana. For example, in mid-2023, the Environmental Protection Agency approved a multi-year exploration and appraisal campaign to drill up to 35 new wells in the Stabroek block.

Technological Advancements in Valve Design

Advancements in float valve design are creating significant growth momentum. Manufacturers are focusing on developing valves that can withstand extreme pressures, corrosive environments, and abrasive drilling fluids. Enhanced sealing mechanisms, longer operational lifespans, and resistance to erosion improve drilling efficiency and safety. Automated and precision-engineered designs also reduce maintenance costs and operational risks, making them highly attractive to operators. Furthermore, integration of advanced alloys and composite materials ensures lightweight yet durable alternatives, expanding application across challenging drilling projects. These innovations not only enhance operational reliability but also provide a competitive edge to suppliers in a technology-driven market.

- For instance, NOV (National Oilwell Varco) offers high-pressure valves for the oil and gas industry, including various plunger and flapper-style float valves. NOV’s product line includes valves capable of handling up to 20,000 psi, though this rating is for specific products like their Service Master II valves and high-pressure check and gate valves

Expanding Deepwater and Ultra-Deepwater Projects

The rising number of deepwater and ultra-deepwater projects worldwide is another strong growth driver. These projects demand advanced drilling equipment capable of operating in extreme depths and high-pressure conditions. Drill pipe float valves play a critical role in preventing backflow and ensuring safety in such complex environments. Increasing investment in offshore reserves across regions like the Gulf of Mexico, Brazil, and West Africa is fueling demand for premium float valves, especially stainless steel and high-strength alloy variants. As energy companies push deeper for exploration, the reliance on reliable, high-performance float valves continues to grow significantly.

Key Trends & Opportunities

Growing Adoption of Stainless-Steel Valves

A notable trend shaping the market is the growing preference for stainless steel drill pipe float valves. Their superior corrosion resistance, high tensile strength, and longer service life make them indispensable in offshore projects, where exposure to saline water and harsh conditions is common. This trend is expected to intensify as offshore drilling expands in deepwater and ultra-deepwater zones, creating opportunities for manufacturers specializing in premium-grade stainless steel valves. The adoption also aligns with operators’ goals of reducing downtime and ensuring operational efficiency by deploying durable equipment.

- For instance, in 2024, Chevron initiated production at its Anchor project in the Gulf of Mexico, using industry-first subsea production systems rated for 20,000 psi. While Tenaris is a major supplier of steel tubular goods for high-pressure, high-temperature (HPHT) environments, the specific 20,000 psi subsea production and multiphase boosting system for Chevron’s Anchor project was supplied by OneSubsea, an SLB company.

Shift Toward Lightweight and Composite Materials

The industry is witnessing a gradual shift toward lightweight and composite material float valves. These materials offer reduced equipment weight, ease of handling, and enhanced wear resistance, making them suitable for modern drilling rigs. While stainless steel remains dominant, composites are gaining traction for niche applications requiring high flexibility and cost optimization. This trend presents opportunities for manufacturers to diversify product lines, attract environmentally conscious operators, and address growing demand for sustainable, efficient drilling solutions. Continuous R&D in material innovation could further accelerate adoption across onshore and offshore projects.

Key Challenges

High Operational and Maintenance Costs

One of the key challenges for the drill pipe float valves market is the high operational and maintenance costs associated with drilling equipment. Float valves are subjected to extreme wear from abrasive drilling fluids, requiring frequent inspection, repair, and replacement. For operators, this adds to the overall cost burden, particularly in deepwater projects where logistics and maintenance expenses are already significant. The need for reliable yet cost-effective solutions places pressure on manufacturers to balance performance with affordability. Failure to address this challenge could limit adoption in price-sensitive markets.

Volatility in Crude Oil Prices

Market growth is highly sensitive to fluctuations in crude oil prices. Volatile pricing often impacts drilling activity levels, directly influencing demand for drill pipe float valves. When oil prices decline, exploration budgets are cut, delaying or canceling projects, especially in high-cost offshore regions. This cyclical demand pattern creates uncertainty for manufacturers, affecting production planning and profitability. Sustained volatility may also discourage investment in new technologies, slowing innovation. Thus, dependency on oil price trends remains a significant barrier to stable, long-term growth in the market.

Regional Analysis

North America

North America dominated the drill pipe float valves market in 2024 with a value of USD 335.27 million, accounting for over 42% share. The region’s growth from USD 252.28 million in 2018 to an anticipated USD 497.83 million by 2032 reflects a steady CAGR of 4.7%. Strong shale gas exploration, rising unconventional drilling projects, and technological advancements drive demand across the U.S. and Canada. Increasing investments in horizontal drilling and deepwater reserves further strengthen market expansion. The region’s large-scale oilfield services sector secures its leading position in the global market outlook.

Europe

Europe’s market reached USD 46.09 million in 2024, representing about 6% of the global share. Growth has been modest, rising from USD 40.35 million in 2018, and it is projected to reach USD 49.45 million by 2032 at a CAGR of only 0.5%. Limited exploration activity, strong environmental regulations, and reduced investments in new oil projects restrain growth. However, certain countries like Norway and the UK sustain demand through offshore developments in the North Sea. The region’s focus remains on maintaining operational efficiency while gradually transitioning toward cleaner energy sources.

Asia Pacific

Asia Pacific is the fastest-growing regional market, expanding from USD 75.77 million in 2018 to USD 114.57 million in 2024, with expectations to reach USD 202.09 million by 2032. The region holds around 14% share in 2024 and grows at a CAGR of 7.0%, the highest globally. Increasing investments in exploration across China, India, and Southeast Asia fuel demand. Rising domestic energy consumption, coupled with expanding offshore projects in South China Sea and Australia, strengthen market prospects. Government-backed drilling initiatives further drive adoption of reliable float valve solutions across both onshore and offshore fields.

Latin America

Latin America’s market stood at USD 18.13 million in 2024, holding a share of just over 2%. The region has grown from USD 13.84 million in 2018 and is projected to reach USD 20.55 million by 2032, at a modest CAGR of 1.2%. Growth is mainly supported by ongoing exploration in Brazil’s pre-salt offshore fields and Argentina’s shale gas developments. However, political instability, economic constraints, and regulatory challenges limit wider adoption. Despite these hurdles, strategic offshore investments in Brazil continue to sustain market presence, although Latin America lags behind larger global markets.

Middle East

The Middle East accounted for nearly 23% of the global market in 2024, valued at USD 186.38 million. The region expanded from USD 140.18 million in 2018 and is anticipated to reach USD 271.27 million by 2032, growing at a CAGR of 4.5%. Its dominance comes from vast hydrocarbon reserves, high drilling intensity, and investments by national oil companies. Countries such as Saudi Arabia, UAE, and Qatar continue to strengthen demand through both onshore and offshore projects. Rising exploration in ultra-deep reserves supports the adoption of advanced float valves, ensuring the region’s strong global standing.

Africa

Africa’s market size reached USD 92.52 million in 2024, accounting for about 12% of the global share. It grew from USD 67.92 million in 2018 and is forecasted to reach USD 132.91 million by 2032 at a CAGR of 4.3%. The region’s growth is driven by increased offshore exploration in West Africa, particularly Nigeria and Angola, alongside new discoveries in Mozambique. Expanding deepwater projects and investments in natural gas further support demand. Despite infrastructure challenges, Africa remains a promising region as international oil companies invest heavily in untapped reserves, boosting reliance on drill pipe float valves.

Market Segmentations:

By Valve Type

- Plunger Type

- Flapper Type

By Material

- Stainless Steel

- Alloy Steel

- Others

By Application

- Onshore Oil & Gas Fields

- Offshore Oil & Gas Fields

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The drill pipe float valves market is moderately consolidated, with global and regional players competing through product innovation, pricing strategies, and geographic expansion. Leading companies such as Forum Energy Technologies, Baker Hughes, and Vallourec dominate the market with extensive product portfolios, strong distribution networks, and established customer relationships. Specialized firms like Keystone Energy Tools, Drillmax Inc., and M&M International strengthen competition by offering tailored solutions for specific drilling environments. Emerging players, including Sub-drill and D-Valves, focus on niche markets with cost-effective alternatives, while TIW (Texas Iron Works) leverages its legacy in drilling tools. Unionlever International Group expands global reach through partnerships and localized supply chains. Key strategies across the industry include investment in corrosion-resistant materials, R&D for high-pressure applications, and expansion into offshore drilling hubs. Frequent product upgrades and emphasis on durability and efficiency define competition, as companies strive to secure contracts in both onshore and offshore oil and gas projects.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Forum Energy Technologies

- Keystone Energy Tools

- Drillmax Inc.

- Baker Hughes

- M&M International

- TIW (Texas Iron Works)

- Vallourec

- Sub-drill

- D-Valves

- Unionlever International Group

Recent Developments

- In September 2025, M&M International updated its CANISTER GUARD® valve line, introducing new patented elements. The upgrades include LITE-TORC™ for easy closure under high-flow conditions, SURE-STOP™ for fail-safe positioning, and CHECK-SEAL™ to improve wellbore pressure sealing. These innovations enhance operational safety and reliability in demanding drilling environments.

- In November 2024, Keystone introduced or highlighted multiple enhanced models of drill pipe float valves specifically designed for harsh, corrosive, and high-flow drilling environments, such as the Model G (abrasive drilling fluids), Model GA (pressure monitoring), Model GC (automatic fill), Model GCA (combination features), and GS/GAS (high flow and pressure monitoring).

Report Coverage

The research report offers an in-depth analysis based on Valve Type, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see steady growth driven by rising oil and gas exploration.

- Demand for plunger type valves will remain strong due to high-pressure drilling projects.

- Stainless steel will continue to dominate material preference for offshore operations.

- Asia Pacific will emerge as the fastest-growing regional market with strong exploration activity.

- North America will retain leadership supported by shale gas and horizontal drilling projects.

- Deepwater and ultra-deepwater projects will boost demand for advanced float valve designs.

- Companies will focus on R&D to improve durability and corrosion resistance of valves.

- Adoption of lightweight composite materials will gradually expand in niche applications.

- Competitive pressure will drive strategic alliances and regional supply chain expansions.

- Market players will align strategies with energy transition while maintaining oilfield efficiency.