Market Overview

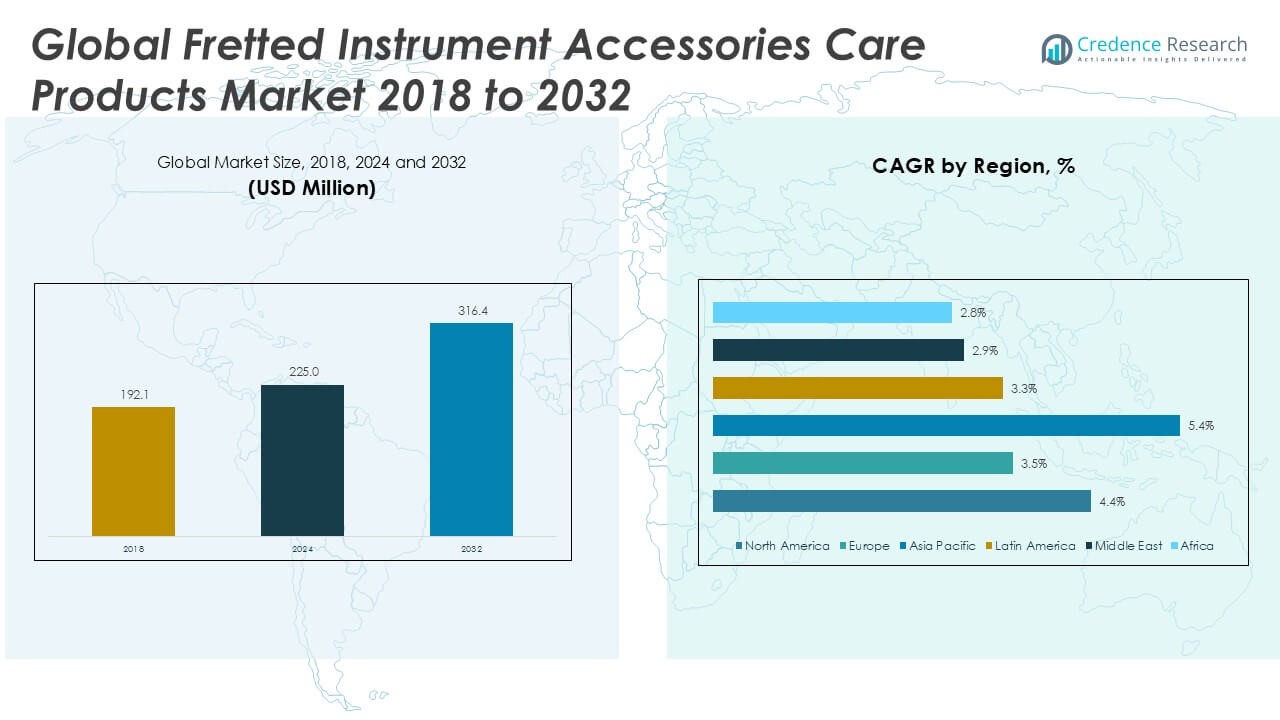

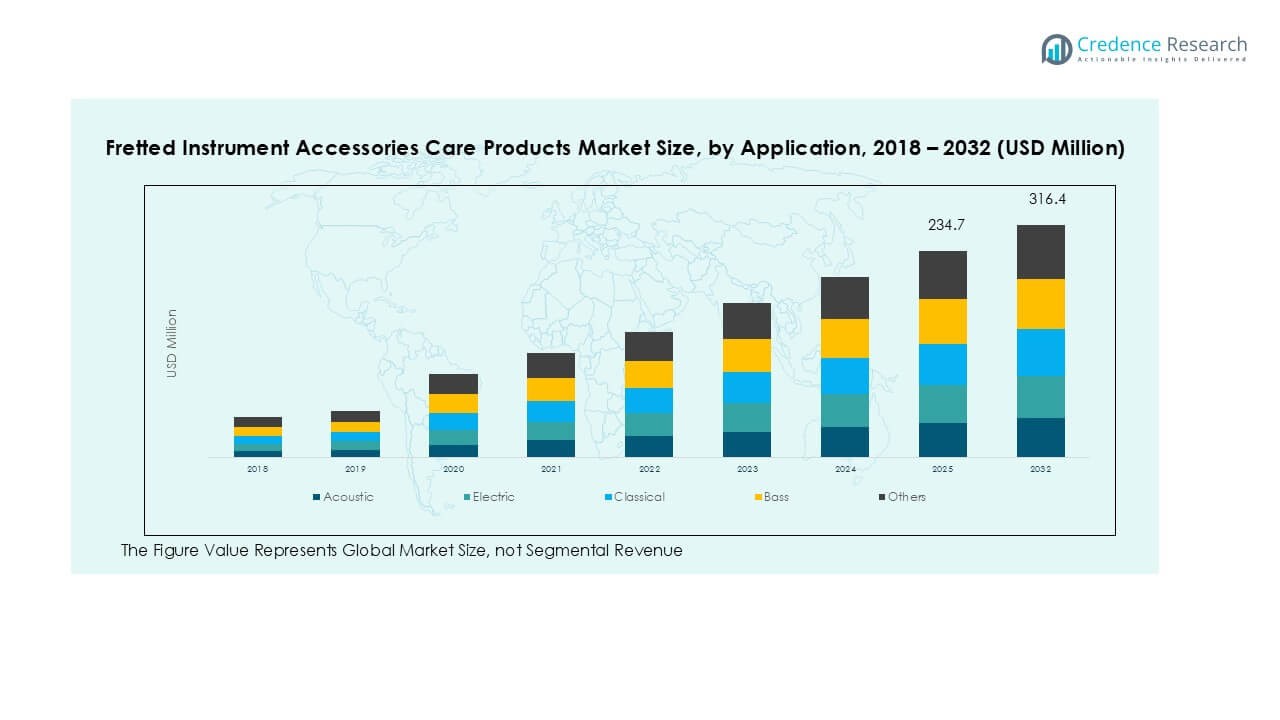

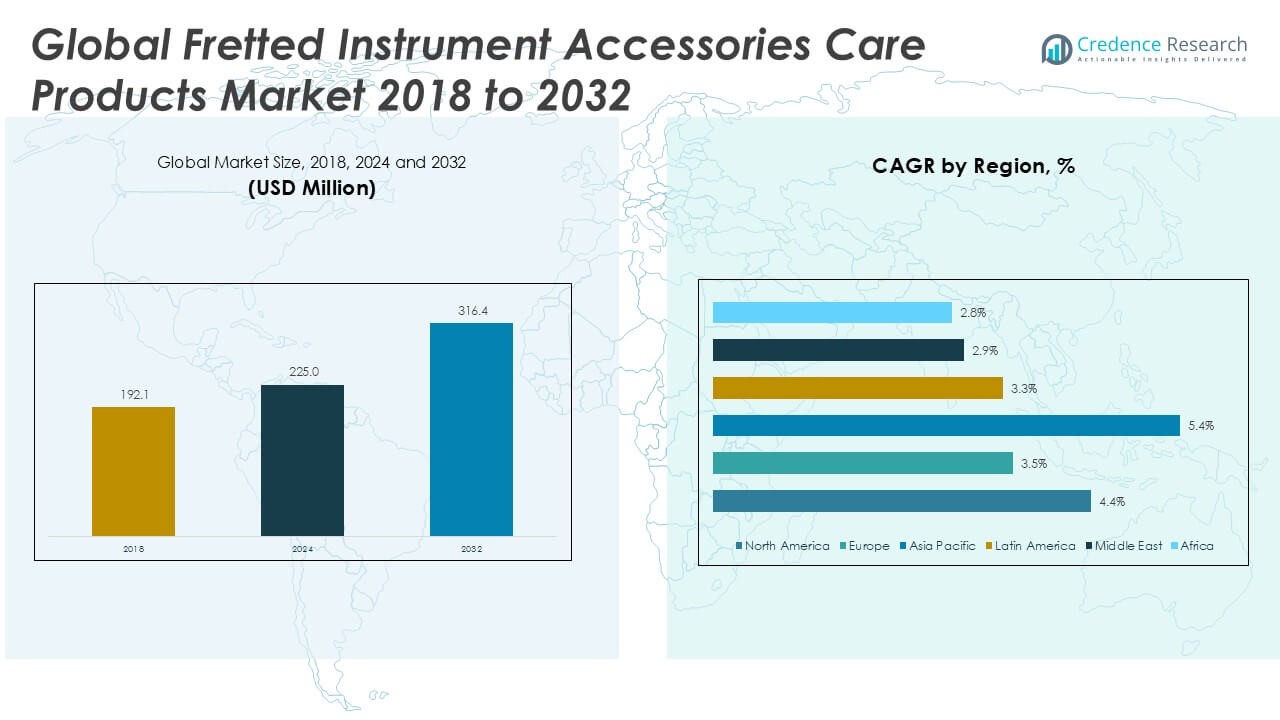

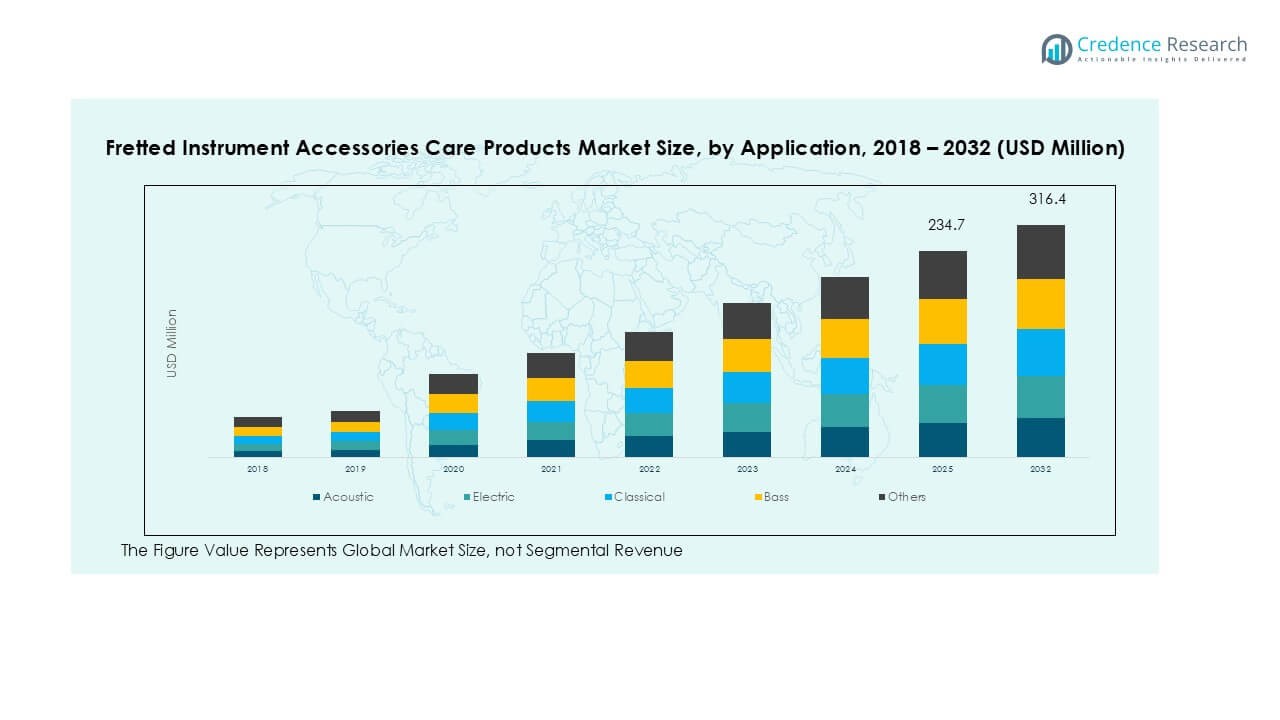

The Fretted Instrument Accessories Care Products Market was valued at USD 192.1 million in 2018 and grew to USD 225.0 million in 2024. It is anticipated to reach USD 316.4 million by 2032, expanding at a CAGR of 4.36% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fretted Instrument Accessories Care Products Market Size 2024 |

USD 225.0 Million |

| Fretted Instrument Accessories Care Products Market, CAGR |

4.36% |

| Fretted Instrument Accessories Care Products Market Size 2032 |

USD 316.4 Million |

The fretted instrument accessories care products market is driven by leading players such as Dunlop, Ernie Ball, Fender Musical Instruments Corporation, Gibson, MusicNomad, Planet Waves, and StewMac. These companies dominate through wide product portfolios, strong distribution networks, and continuous product innovation, particularly in polishes, fingerboard care, and maintenance tools. North America emerged as the leading region, holding a 36% market share in 2024, supported by high instrument ownership, professional musicians, and robust retail infrastructure. Asia Pacific followed with a 31% share, benefiting from rising disposable incomes and expanding music education programs, while Europe maintained a 20% share with strong demand for acoustic and classical instruments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The fretted instrument accessories care products market was valued at USD 225.0 million in 2024 and is projected to reach USD 316.4 million by 2032, growing at a CAGR of 4.36%.

- Rising awareness of instrument care and the increasing popularity of acoustic and electric guitars drive market growth, with polishes leading the type segment at over 35% share in 2024.

- Trends such as eco-friendly formulations, premium maintenance kits, and digital retail expansion are shaping product innovation and consumer purchasing behavior across global markets.

- The market is competitive, with key players including Dunlop, Ernie Ball, Fender, Gibson, MusicNomad, Planet Waves, and StewMac, focusing on product diversification and strategic retail partnerships.

- North America led with 36% share in 2024, followed by Asia Pacific at 31% and Europe at 20%, while acoustic and electric applications together dominated the application segment, reflecting strong adoption among professionals and hobbyists.

Market Segmentation Analysis:

By Type

The fretted instrument accessories care products market by type is led by polishes, which accounted for over 35% share in 2024. Their dominance is driven by the strong need to preserve instrument finish and enhance longevity, particularly among professionals and collectors. Fingerboard care is also gaining traction due to rising awareness of maintaining wood integrity and playability. Cloths and maintenance tools remain essential, though they hold smaller shares, supported by their low cost and routine usage. The “others” category, including specialty kits, caters to niche but growing demand.

- For instance, Dunlop Manufacturing, Inc., a respected name in instrument care, continues to see strong demand for its popular Formula 65 Guitar Polish and Cleaner, reinforcing its market presence.

By Application

Within applications, the electric segment commanded the largest share at nearly 40% in 2024, fueled by the widespread popularity of electric guitars in modern music genres. Acoustic instruments follow closely, benefiting from strong adoption in both professional and hobbyist communities. The classical segment maintains steady demand, particularly in traditional markets, while bass instruments form a smaller yet consistent share. The “others” segment, including niche stringed instruments, is expanding gradually as manufacturers introduce tailored care products to meet diverse instrument maintenance requirements.

- For instance, the musical instrument industry, which includes major manufacturers like Fender, relies on the consistent demand for care accessories. The continuous market for guitars drives steady sales of maintenance and polishing products.

Key Growth Drivers

Rising Popularity of Stringed Instruments

The growing popularity of stringed instruments such as guitars, basses, and ukuleles is a major driver for the fretted instrument accessories care products market. Increased adoption among both professional musicians and hobbyists has created consistent demand for care solutions to maintain instrument quality. Polishes, cloths, and fingerboard care products are essential to enhance durability and playability, which has pushed manufacturers to expand product offerings. Additionally, the rising presence of music education programs worldwide, combined with the influence of popular music genres like rock, pop, and classical, continues to boost sales. This trend is further strengthened by increasing participation in live performances, cultural events, and music festivals, which highlight the importance of well-maintained instruments.

- For instance, in its fiscal year 2023, Yamaha Corporation reported strong sales for its electric guitars, contributing to an overall increase in revenue for its musical instruments segment. This was accompanied by a general rise in the popularity of music-related leisure activities, potentially influencing demand for guitar care accessories across the market.

Growing Awareness of Instrument Preservation

Another significant driver is the heightened awareness among musicians regarding the long-term preservation of their instruments. Professional players and collectors understand that consistent maintenance enhances tone quality, prevents damage, and extends an instrument’s lifespan. This awareness has created rising demand for specialized products, such as fingerboard oils, anti-corrosion wipes, and high-quality polishes. Manufacturers are also emphasizing eco-friendly and non-toxic formulations, aligning with consumer demand for safe and sustainable options. The trend is particularly strong in developed markets, where premium instruments are common and care products are purchased as complementary necessities. Growing awareness campaigns by music schools and industry associations further promote proper instrument upkeep, ensuring steady market growth.

- For instance, D’Addario demonstrates a commitment to environmentally focused products through various initiatives, such as its Playback string recycling program and play. plant. preserve. reforestation effort.

Expansion of Online Retail Channels

The rapid growth of e-commerce platforms has significantly boosted product accessibility in the fretted instrument accessories care products market. Online retail channels allow brands to reach global consumers and offer a wide variety of maintenance tools, kits, and consumables. Players benefit from convenient access, product comparisons, and bundled deals, driving higher sales volumes. Manufacturers increasingly use digital marketing and partnerships with online music stores to target younger demographics, who prefer online purchasing over traditional channels. Subscription-based models and product customization options are also emerging, enabling recurring revenue streams. With improved logistics networks and global shipping options, even niche and specialized care products are now widely available, expanding market penetration across regions.

Key Trends & Opportunities

Customization and Premiumization

The market is witnessing strong demand for premium and customizable care products tailored to specific instruments and customer needs. High-value guitars and basses often require specialized maintenance solutions, encouraging brands to introduce differentiated product lines. Luxury packaging, bundled maintenance kits, and limited-edition care accessories appeal to professional musicians and collectors. Companies offering premium care solutions with enhanced performance and durability gain brand loyalty and higher margins. This trend also opens opportunities for collaborations between instrument makers and care product companies, creating co-branded solutions that enhance value and market appeal.

- For instance, in 2023, Gibson continued to sell its own branded guitar care kits, which include its proprietary fretboard conditioner. Separately, Big Bends sells its own popular line of guitar cleaning and conditioning products, including “Fret Board Juice”.

Shift Toward Eco-Friendly Products

Sustainability is becoming a defining trend in the fretted instrument accessories care products market. Consumers increasingly prefer biodegradable polishes, organic fingerboard oils, and cloths made from natural fibers. Companies are investing in green product lines that reduce chemical residues while maintaining performance standards. Eco-conscious branding also provides a competitive edge, as many musicians align their purchasing decisions with environmental values. Regulatory pressures in Europe and North America further support this transition. This creates opportunities for manufacturers to innovate in formulations and capture new customer segments seeking safe, sustainable, and premium-quality solutions.

Growing Penetration in Emerging Markets

Emerging markets in Asia-Pacific and Latin America present significant growth opportunities for care product manufacturers. Rising disposable incomes, expanding music education programs, and growing adoption of Western music instruments are fueling demand. Local players are entering the market with affordable solutions, while global brands are expanding distribution networks to capture market share. Urbanization and cultural exposure through digital media further accelerate instrument adoption in these regions. This trend highlights a strong opportunity for manufacturers to localize offerings, adapt pricing strategies, and build strong retail partnerships to expand their footprint.

Key Challenges

Price Sensitivity and Counterfeit Products

One of the major challenges in the market is high price sensitivity, especially in emerging regions where consumers often prioritize affordability over brand loyalty. Low-cost alternatives and counterfeit products create competitive pressure, reducing margins for established players. Counterfeits not only undermine revenues but also damage brand reputation when inferior products affect instrument quality. Ensuring authenticity through advanced labeling, QR codes, and supply chain transparency has become critical. However, the widespread availability of unregulated products on online platforms continues to be a barrier for premium brands targeting mass-market penetration.

Limited Awareness in Developing Regions

Despite rising demand for instruments, limited awareness of proper care practices in developing markets hampers growth. Many musicians, particularly beginners, neglect regular maintenance due to lack of knowledge or underestimation of its importance. This reduces the adoption of specialized care products, restricting market potential outside mature regions like North America and Europe. Overcoming this challenge requires targeted awareness campaigns, partnerships with music schools, and demonstration-based marketing strategies. Building strong educational initiatives on the role of maintenance in instrument performance can help expand product penetration in these untapped markets.

Regional Analysis

North America

North America held the largest share of the fretted instrument accessories care products market, accounting for nearly 36% in 2024. The market grew from USD 70.50 million in 2018 to USD 81.59 million in 2024 and is projected to reach USD 114.55 million by 2032 at a CAGR of 4.4%. Growth is supported by a large base of professional musicians, strong demand for electric and acoustic instruments, and well-established distribution networks. High consumer spending and awareness of instrument maintenance continue to strengthen product adoption across the U.S. and Canada.

Europe

Europe represented around 20% of the market in 2024, increasing from USD 41.49 million in 2018 to USD 46.30 million in 2024. It is projected to reach USD 60.67 million by 2032, expanding at a CAGR of 3.5%. Demand in Europe is fueled by the strong classical music tradition, steady sales of acoustic and classical guitars, and growth in premium care products. Key countries such as Germany, the U.K., and France drive the region’s adoption, supported by established retail outlets and a rising trend of eco-friendly formulations among manufacturers.

Asia Pacific

Asia Pacific accounted for nearly 31% of the global market in 2024, making it the second-largest region. The market expanded from USD 57.38 million in 2018 to USD 69.65 million in 2024 and is projected to reach USD 106.04 million by 2032 at a CAGR of 5.4%, the highest globally. Growth is driven by increasing disposable incomes, expanding music education, and rising popularity of Western music instruments in countries like China, India, and Japan. The region also benefits from strong e-commerce penetration, which enhances product accessibility and fuels sales momentum.

Latin America

Latin America contributed about 6% of the market in 2024, with values rising from USD 11.31 million in 2018 to USD 13.12 million in 2024. It is projected to reach USD 17.02 million by 2032 at a CAGR of 3.3%. The region’s growth is supported by increasing interest in music culture and the adoption of both acoustic and electric instruments across Brazil, Mexico, and Argentina. However, limited awareness of specialized maintenance products constrains rapid expansion. Online distribution and localized promotional campaigns are expected to enhance product penetration over the forecast period.

Middle East

The Middle East held nearly 3% of the global market in 2024, expanding from USD 6.63 million in 2018 to USD 7.22 million in 2024. It is projected to reach USD 9.05 million by 2032, growing at a CAGR of 2.9%. Growth is driven by rising interest in Western music culture among younger demographics, supported by expanding retail and specialty stores in the UAE and Saudi Arabia. Despite its small base, demand for high-quality polishes and fingerboard care products is rising, particularly among premium guitar users, making it a niche but stable market.

Africa

Africa accounted for nearly 3% of the market in 2024, growing from USD 4.78 million in 2018 to USD 7.13 million in 2024. The market is expected to reach USD 9.08 million by 2032 at a CAGR of 2.8%. Demand is driven by gradual adoption of acoustic and classical instruments in regions such as South Africa and Nigeria. However, limited awareness of care products and high price sensitivity restrict growth. Rising digital channels and collaborations with local distributors are expected to gradually enhance product availability and support market expansion in the coming years.

Market Segmentations:

By Type

- Polishes

- Fingerboard care

- Cloths

- Maintenance tools

- Other

By Application

- Acoustic

- Electric

- Classical

- Bass

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the fretted instrument accessories care products market is characterized by the presence of well-established brands and specialized niche players. Leading companies such as Dunlop, Ernie Ball, Fender Musical Instruments Corporation, Gibson, MusicNomad, Planet Waves, and StewMac dominate the industry with extensive product portfolios covering polishes, fingerboard care, maintenance tools, and cleaning kits. These players leverage strong brand reputation, global distribution networks, and endorsements from professional musicians to strengthen their market position. The focus is shifting toward eco-friendly and premium-quality products, with companies investing in sustainable formulations and customized care solutions. Competitive strategies include product innovation, acquisitions, and partnerships with retailers and online platforms to expand reach. Smaller players often compete through affordable, localized offerings, targeting price-sensitive markets. Overall, competition remains high, with innovation, quality differentiation, and marketing strategies serving as the key factors influencing brand loyalty and long-term growth across global regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, the Instrument Care Kit (D’Addario/Planet Waves) was refreshed, now featuring a 3-step polishing system, Hydrate fretboard cleaner, a headstand neck cradle, microfiber cloth, and more, in a modernized travel case.

- In March 2025, Fender Musical Instruments Corporation released Custom Shop 4-Step Cleaning Kit and new plush microfiber polishing cloth.

- In January 2025, StewMac and ShopBot Tools announced a partnership to produce educational content and tutorials for instrument builders, demonstrating how to use ShopBot’s CNC technology for instrument making and repair.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow steadily with rising adoption of stringed instruments.

- Electric instruments will drive strong demand for specialized care products.

- Polishes will remain the leading product category due to consistent maintenance needs.

- Fingerboard care solutions will gain more attention as musicians prioritize instrument longevity.

- Eco-friendly and non-toxic formulations will see increased adoption worldwide.

- Online retail platforms will expand product accessibility across both developed and emerging markets.

- Premium and customized care kits will appeal to professional musicians and collectors.

- Emerging regions such as Asia Pacific and Latin America will provide new growth opportunities.

- Competition will intensify as global brands and local players expand their portfolios.

- Educational campaigns and music institutions will strengthen awareness of proper instrument maintenance.