Market Overview

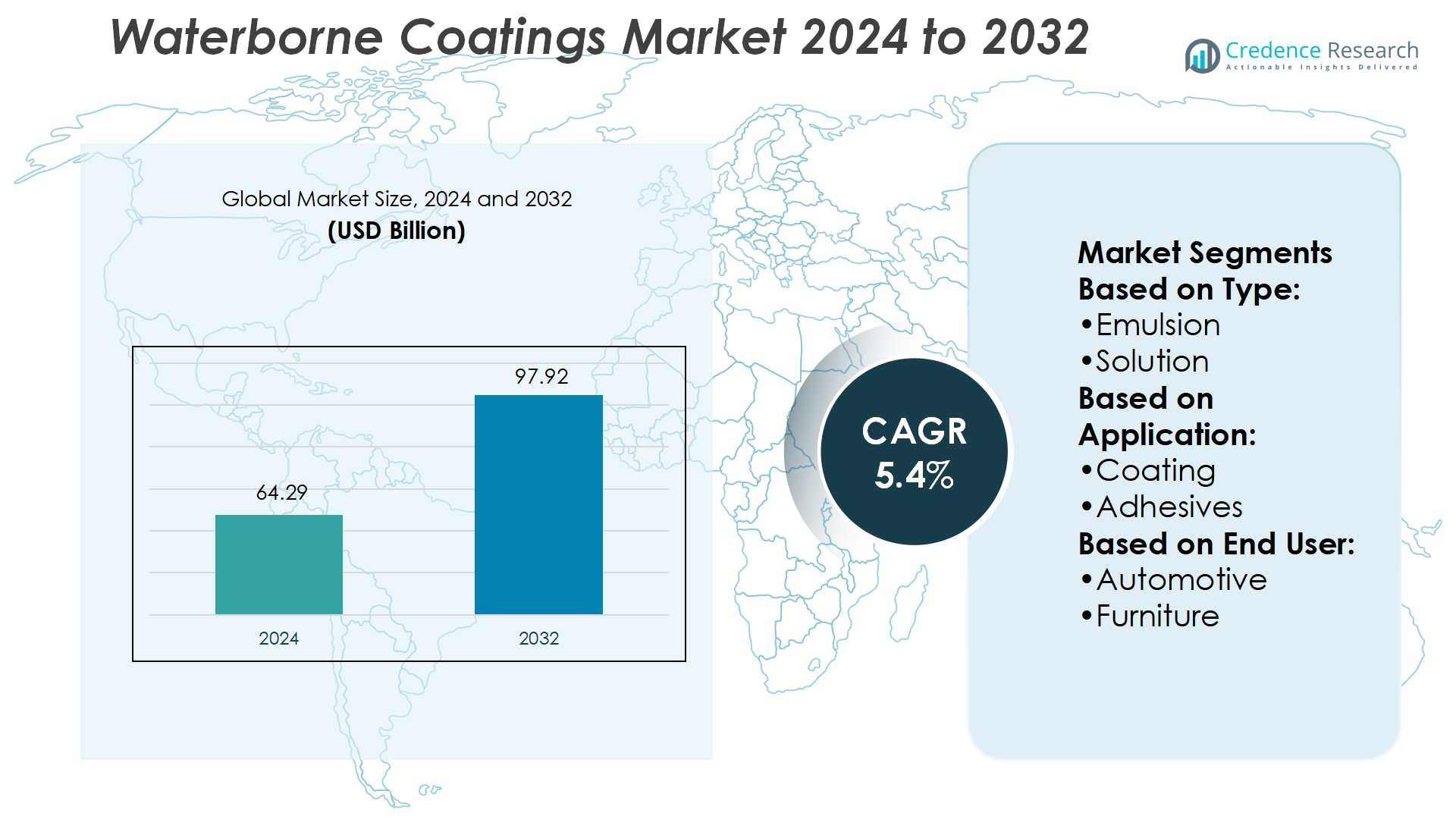

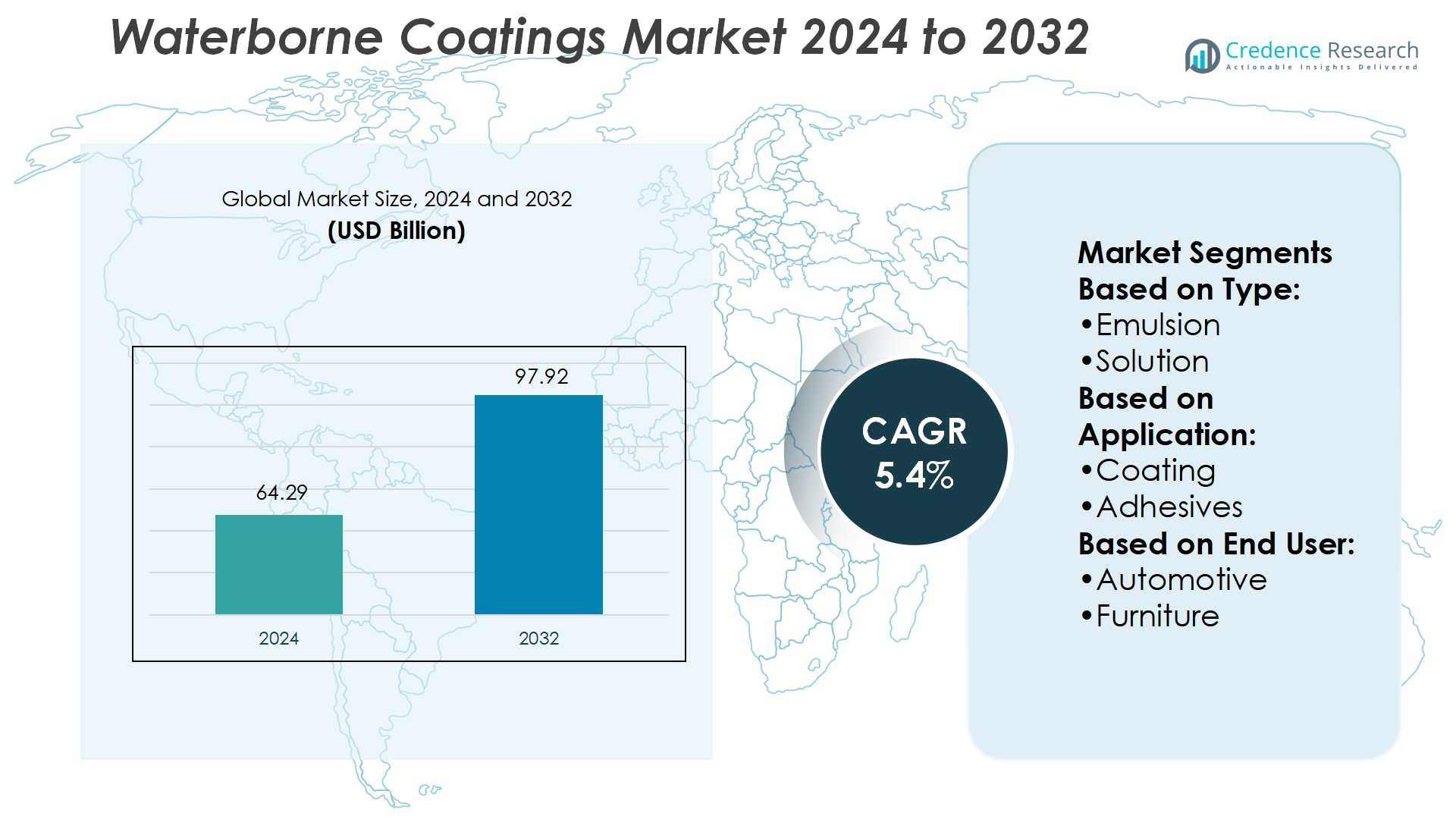

Waterborne Coatings Market size was valued USD 64.29 billion in 2024 and is anticipated to reach USD 97.92 billion by 2032, at a CAGR of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Waterborne Coatings Market Size 2024 |

USD 64.29 Billion |

| Waterborne Coatings Market, CAGR |

5.4% |

| Waterborne Coatings Market Size 2032 |

USD 97.92 Billion |

The waterborne coatings market is highly competitive, with top players including BASF, AkzoNobel, PPG Industries, Dow Chemical, Evonik Industries, Huntsman, Arkema, Eastman Chemical, Nippon Paint, and Nippon Shokubai driving innovation and growth. These companies focus on developing sustainable, low-VOC solutions to meet tightening environmental regulations while expanding their presence in high-demand industries such as automotive, construction, and industrial manufacturing. Strategic partnerships, capacity expansions, and advanced resin technologies strengthen their global positioning. Regionally, North America leads the market with a 34% share, supported by strong adoption in construction and automotive applications, robust R&D capabilities, and strict regulatory frameworks that accelerate the transition toward eco-friendly waterborne technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Waterborne Coatings Market size was valued at USD 64.29 billion in 2024 and is projected to reach USD 97.92 billion by 2032, growing at a CAGR of 5.4%.

- Rising demand for eco-friendly, low-VOC coatings in construction, automotive, and industrial sectors is a key driver, supported by strict global environmental regulations.

- Key players such as BASF, AkzoNobel, PPG Industries, and Dow Chemical focus on sustainable innovation, resin advancements, and strategic partnerships, driving strong competition across regions.

- Challenges include higher production costs compared to solvent-based coatings and performance limitations in extreme environments, which may hinder wider adoption.

- North America leads with a 34% regional share due to strong regulatory compliance and R&D strength, while Europe follows with 29%, and Asia-Pacific holds 28% as the fastest-growing market; architectural coatings remain the dominant application segment, supported by rapid construction and infrastructure expansion globally.

Market Segmentation Analysis:

By Type

The emulsion segment dominates the waterborne coatings market, holding the largest share. Its leadership is driven by excellent adhesion, durability, and eco-friendly profile that complies with VOC regulations. Emulsion-based coatings are widely used across construction, automotive, and furniture industries due to superior film formation and cost efficiency. Solution-based and urethane-acrylic coatings are also gaining adoption for high-performance needs, while other specialty formulations cater to niche applications. The dominance of emulsion coatings continues to expand as industries prioritize sustainability and regulatory compliance in surface finishing.

- For instance, Arkema’s ENCOR® 3560 vinyl acrylic emulsion has solid content of 60.0 % by weight, a minimum film forming temperature of 11 °C, and glass transition temperature of 22 °C.

By Application

Coating applications account for the highest share in the waterborne coatings market, supported by broad use in protective and decorative finishes. The segment benefits from growing infrastructure projects, automotive refinishing, and furniture aesthetics that demand performance and sustainability. Adhesives and textile finishes show steady growth, driven by flexible packaging demand and fabric treatment innovations. Other applications, though smaller in share, contribute to specialized industrial needs. The coatings segment’s dominance remains strong due to versatility, reduced environmental impact, and alignment with evolving customer preferences.

- For instance, High-performance coating systems, including those that incorporate adhesion promoters, can achieve salt-spray resistance exceeding 1,000 hours, but the specific performance, including the level of blistering, is dependent on the entire coating formulation and test conditions.

By End User

The building and construction sector holds the leading share among end users of waterborne coatings. Demand is fueled by rising urbanization, infrastructure investments, and preference for low-VOC materials in architectural paints. Automotive ranks as another significant user, driven by OEM finishing and aftermarket refinishing. Furniture and packaging industries also contribute, supported by design trends and sustainable packaging shifts. Textile and adhesive & sealant applications add further diversity. The construction sector’s leadership reflects both volume demand and increasing alignment with green building standards.

Key Growth Drivers

Environmental Regulations and Low VOC Compliance

Stringent global regulations on volatile organic compounds (VOC) drive adoption of waterborne coatings. These coatings emit fewer harmful substances, meeting environmental standards in construction, automotive, and packaging. Rising consumer demand for eco-friendly products further supports their uptake. Companies continue to invest in water-based solutions to replace solvent-based coatings, aligning with government initiatives promoting sustainable manufacturing. This regulatory push positions waterborne coatings as the preferred choice, especially in developed markets where green building certifications and compliance remain a strong purchase driver.

- For instance, Eastman Solus™ 2100 performance additive enabled 2K coatings with VOC content of 420 g/L or less, while helping reduce dry-to-touch times and improve anti-sag behavior.

Expansion in Construction and Infrastructure Projects

Rapid urbanization and infrastructure development fuel strong demand for waterborne coatings in architectural and decorative applications. Government-backed housing programs, coupled with renovation activities in developed countries, increase market opportunities. Their superior adhesion, durability, and weather resistance make them essential for walls, facades, and flooring. Builders favor waterborne coatings due to their ease of application and compliance with indoor air quality standards. Growth in commercial real estate and residential construction continues to reinforce the segment, ensuring steady revenue generation for coating manufacturers worldwide.

- For instance, AkzoNobel’s Sikkens Autowave Optima basecoat delivers a VOC content of 380 g/L, requires just 1.5 layers for full coverage vs conventional two layers, and enables up to 50% faster process time in body shop repair applications.

Growing Demand from Automotive and Industrial Sectors

Automotive OEMs and refinishers are shifting toward waterborne coatings to meet environmental standards while maintaining performance. These coatings provide excellent finish quality, corrosion resistance, and color retention. Increasing automotive production in emerging economies and demand for lightweight, fuel-efficient vehicles expand opportunities. Industrial sectors, including machinery and equipment manufacturing, also adopt waterborne coatings for protective and decorative purposes. The ability to combine sustainability with high performance makes them an attractive choice across industries, strengthening their position in global supply chains.

Key Trends & Opportunities

Shift Toward Bio-Based and Sustainable Formulations

Manufacturers are investing in bio-based raw materials to reduce carbon footprints and differentiate offerings. Innovations in plant-derived resins and water-dilutable binders address sustainability concerns while meeting performance requirements. This trend aligns with corporate ESG goals and consumer preference for green products. Companies developing biodegradable and recyclable coating solutions are likely to gain a competitive edge. The bio-based shift also opens opportunities for partnerships with renewable material suppliers, driving product innovation and expanding adoption across construction, packaging, and automotive markets.

- For instance, BASF’s Rheovis® range additives produced at Ludwigshafen and Bradford now use bio-based ethyl acrylate with up to 35 % biogenic content (ASTM D6866-18) and achieve a Product Carbon Footprint up to 30 % lower than fossil-based versions.

Advancements in Nanotechnology and Performance Enhancement

Nanotechnology is increasingly applied in waterborne coatings to improve scratch resistance, UV stability, and barrier properties. These innovations enhance the durability of coatings while maintaining eco-friendly features. High-performance waterborne coatings are gaining traction in automotive and aerospace sectors, where resistance to extreme conditions is critical. Continuous R&D investments in nano-additives and hybrid resin systems present opportunities for market differentiation. As industries demand both sustainability and superior performance, nanotechnology integration creates significant growth potential and strengthens the premium product segment.

- For instance, Dow’s DOWSIL™ 8016 waterborne resin is a silicone resin emulsion that maintains integrity at temperatures of 500 °C and above, while providing elevated coating hardness in pigmented systems.

Rising Adoption in Emerging Economies

Emerging markets in Asia-Pacific and Latin America are witnessing growing adoption of waterborne coatings. Rapid industrialization, rising disposable incomes, and expanding automotive and construction sectors fuel demand. Local governments promote sustainable industrial practices, creating a favorable regulatory environment. With rising awareness of eco-friendly solutions, manufacturers are setting up regional facilities to capture growth opportunities. The shift from solvent-based coatings in these regions offers a substantial long-term market expansion pathway, supported by strong population growth and evolving consumer preferences.

Key Challenges

High Production Costs and Performance Limitations

Waterborne coatings often face higher production costs compared to solvent-based alternatives due to advanced formulation requirements and raw material prices. Performance limitations, such as lower resistance in certain industrial applications, also restrict adoption. Manufacturers must balance cost competitiveness with sustainability and performance. Small-scale producers, in particular, struggle to invest in R&D needed to enhance product durability. These challenges can slow down penetration in price-sensitive markets, especially where solvent-based coatings continue to offer cost-effective solutions for basic applications.

Complex Application and Drying Constraints

Application of waterborne coatings requires controlled environments, as factors like humidity and temperature can affect drying times and finish quality. In regions with extreme climates, achieving consistent application results becomes challenging. The need for specialized equipment or processes can increase operational costs for end users. Automotive and industrial segments often demand faster curing, making solvent-based coatings more attractive in certain cases. Addressing these technical constraints is essential for waterborne coatings to achieve wider acceptance across diverse end-use industries.

Regional Analysis

North America

North America accounts for 34% of the global waterborne coatings market, making it the leading region. Strong demand comes from the construction and automotive sectors, where sustainability regulations encourage low-VOC coatings. The United States dominates regional revenue due to rapid urban development and stringent EPA environmental guidelines. Growth is further driven by technological advancements in emulsion polymers and resin formulations. Canada contributes with rising adoption in infrastructure and furniture industries. A well-established manufacturing base, combined with government-led environmental initiatives, continues to reinforce the region’s leadership in the market.

Europe

Europe holds 29% of the global waterborne coatings market, supported by strict EU regulations on solvent-based coatings. Countries like Germany, France, and Italy lead adoption, driven by strong automotive, industrial, and architectural applications. Investments in eco-friendly technologies, such as urethane-acrylic systems, enhance demand. The region also benefits from rising renovation activities and an increased preference for durable, low-emission coatings in the construction sector. Sustainability-focused strategies by European manufacturers ensure compliance with REACH and Green Deal frameworks, strengthening market growth. Europe maintains its position as the second-largest contributor in the waterborne coatings landscape.

Asia-Pacific

Asia-Pacific represents 28% of the global waterborne coatings market and shows the fastest growth. China and India dominate due to rapid industrialization, expanding construction activities, and rising automobile production. Government restrictions on VOC emissions fuel the shift from solvent-based to waterborne formulations. In addition, growing middle-class populations and urbanization increase demand for furniture, packaging, and protective coatings. Japan and South Korea contribute through advanced manufacturing technologies and R&D in resin chemistry. Strong infrastructure investments, combined with rising consumer awareness of eco-friendly products, position Asia-Pacific as the most dynamic and high-potential market globally.

Latin America

Latin America contributes 5% of the global waterborne coatings market, with Brazil and Mexico leading adoption. The construction industry, driven by urban housing projects, supports steady demand for architectural coatings. Rising investments in automotive and industrial manufacturing further enhance growth opportunities. Environmental policies are gradually pushing companies to reduce VOC emissions, encouraging wider use of waterborne solutions. However, the market faces challenges from economic fluctuations and limited technological infrastructure in smaller economies. Despite these barriers, growing awareness of sustainable practices continues to support incremental adoption across Latin America.

Middle East & Africa (MEA)

The Middle East & Africa holds a 4% share in the global waterborne coatings market. Growth is led by the construction boom in the UAE, Saudi Arabia, and South Africa, where large-scale infrastructure projects demand durable and eco-friendly coatings. Increasing environmental regulations and government sustainability programs encourage wider adoption of waterborne formulations. Industrial applications, including protective and marine coatings, also contribute to demand. However, market expansion is constrained by limited awareness and reliance on imports. Despite these hurdles, MEA presents growth opportunities as infrastructure modernization and sustainable building practices gain traction.

Market Segmentations:

By Type:

By Application:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The competitive landscape of the waterborne coatings market is shaped by key players including Huntsman, Arkema, PPG Industries, Nippon Shokubai, Eastman Chemical, AkzoNobel, BASF, Dow Chemical, Nippon Paint, and Evonik Industries. The competitive landscape of the waterborne coatings market is defined by innovation, sustainability, and strategic expansion. Companies actively invest in research and development to improve resin technologies, enhance performance, and reduce VOC emissions, aligning with global regulatory standards. The market sees strong competition as participants introduce advanced formulations tailored for automotive, construction, furniture, and packaging industries. Expansion into high-growth regions, particularly in Asia-Pacific, remains a core strategy, supported by rising infrastructure projects and industrial activities. Firms also focus on mergers, acquisitions, and collaborations to strengthen distribution networks and broaden product offerings. Sustainability initiatives, including the development of bio-based and low-carbon coatings, play a central role in differentiation. With increasing customer demand for high-performance yet eco-friendly solutions, market participants concentrate on balancing cost efficiency with advanced performance. Overall, competition is driven by the dual goals of technological innovation and compliance with environmental standards, positioning the market for steady long-term growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Huntsman

- Arkema

- PPG Industries

- Nippon Shokubai

- Eastman Chemical

- AkzoNobel

- BASF

- Dow Chemical

- Nippon Paint

- Evonik Industries

Recent Developments

- In March 2025, PPG Industries, Inc., started up a dedicated waterborne automotive coatings plant in Thailand, citing strong regional demand for sustainably advantaged products.

- In March 2024, DIC Corporation’s subsidiary, IDEAL CHEMI PLAST PRIVATE LTD., opened a new production facility for coating resins in Maharashtra’s Supa Japanese Industrial Zone. The facility tripled the production capacity of IDEAL CHEMI PLAST, positioning it to expand its business in India, South Asia, and the Middle East.

- In February 2024, Covestro company developed a waterborne and waterborne UV family of high-performing resin solutions. This new product is for industrial coating applications such as building products, cabinetry, and wood furniture.

- In June 2023, AkzoNobel N.V. obtained approval to provide its water-based refinishing products to Porsche China, currently one of the largest markets for the luxury auto brand. To cater to Porsche China’s comprehensive refinishing needs, the company will offer its complete water-based Sikkens range, encompassing basecoats, clearcoats, and primer.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising demand for eco-friendly coating solutions.

- Construction and infrastructure growth will remain a major driver for adoption.

- Automotive coatings will see higher demand due to stricter emission regulations.

- Technological innovations in resin chemistry will enhance coating durability and performance.

- Asia-Pacific will continue to be the fastest-growing regional market.

- European markets will strengthen through compliance with strict environmental frameworks.

- Increased investment in R&D will accelerate development of bio-based waterborne coatings.

- Digitalization and smart manufacturing will improve production efficiency and customization.

- Strategic mergers and acquisitions will shape competitive positioning in key regions.

- Consumer preference for low-VOC and sustainable products will reinforce long-term market growth.