Market Overview

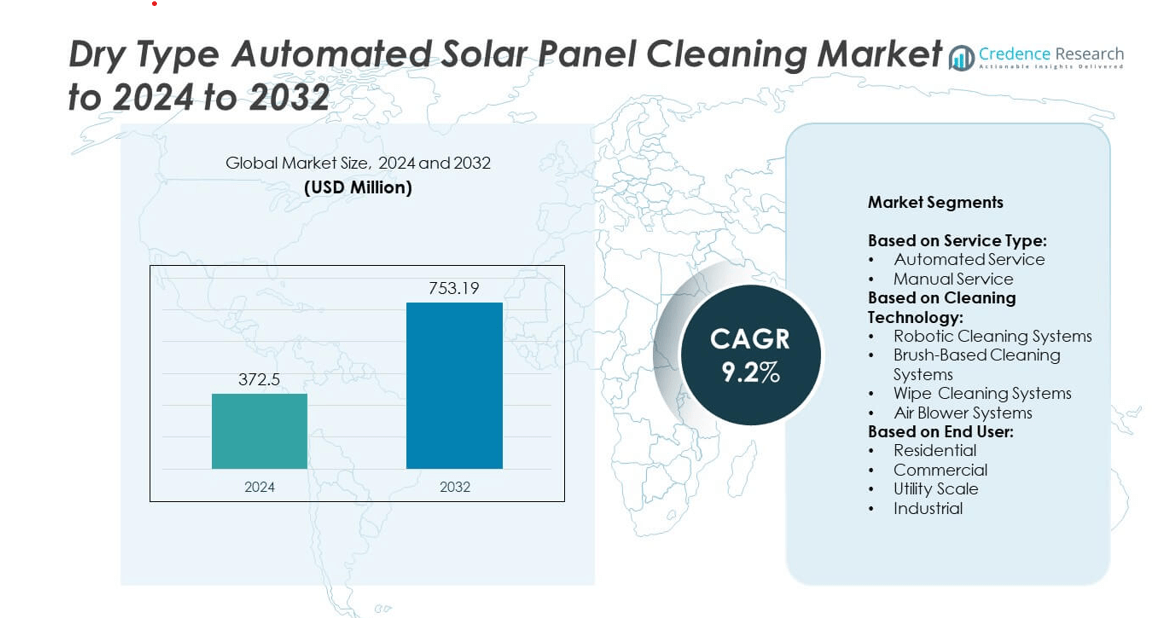

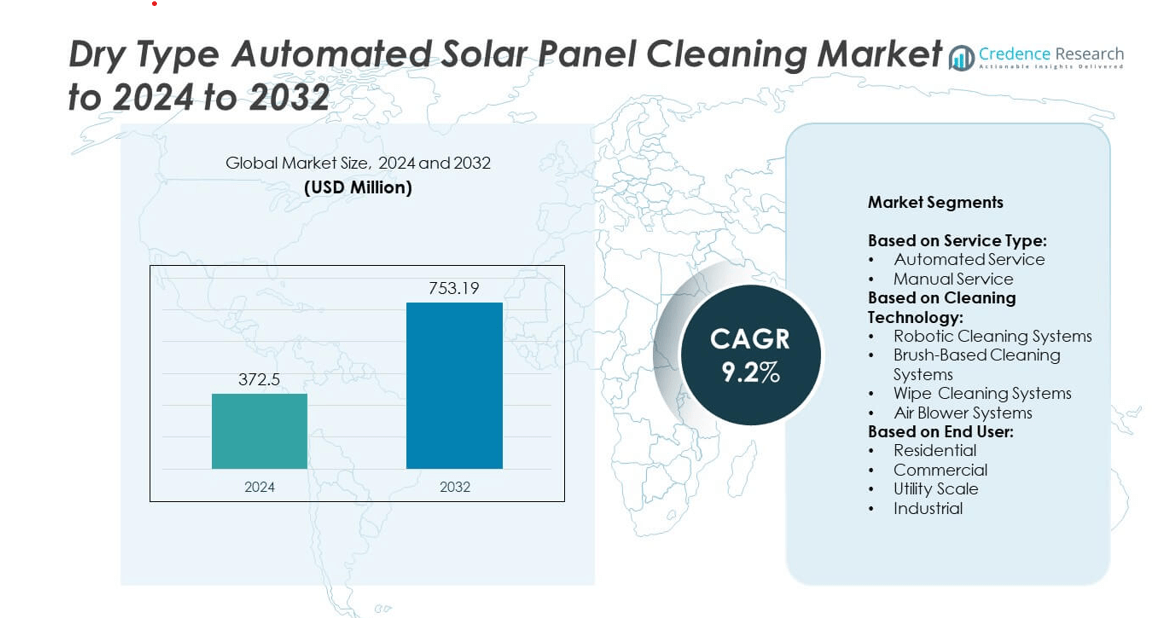

The Dry Type Automated Solar Panel Cleaning Market size was valued at USD 372.5 million in 2024 and is anticipated to reach USD 753.19 million by 2032, at a CAGR of 9.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dry Type Automated Solar Panel Cleaning Market Size 2024 |

USD 372.5 million |

| Dry Type Automated Solar Panel Cleaning Market, CAGR |

9.2% |

| Dry Type Automated Solar Panel Cleaning Market Size 2032 |

USD 753.19 million |

The Dry Type Automated Solar Panel Cleaning Market is driven by major players such as SolarCleano, Ecoppia, NOMADD, Heliotex, BEIJING MULTIFIT ELECTRICAL TECHNOLOGY CO., LTD., SunBrush mobil GmbH, Zhejiang Ganghang Solar Technology Co., Ltd., and Boson Robotics Ltd. These companies lead through innovations in robotics, AI-driven control systems, and IoT-based monitoring for efficient, waterless cleaning operations. Their focus on automation, energy efficiency, and durable design strengthens their global presence across utility and commercial sectors. Asia-Pacific emerged as the leading region in 2024, capturing a 34% market share, supported by large-scale solar installations, government incentives, and high adoption of autonomous maintenance technologies.

Market Insights

- The dry type automated solar panel cleaning market was valued at USD 372.5 million in 2024 and is projected to reach USD 753.19 million by 2032, growing at a CAGR of 9.2%.

- Rising solar capacity installations, growing water scarcity, and government focus on sustainable energy practices are key factors driving market expansion globally.

- Increasing adoption of robotic cleaning systems and AI-integrated solutions is shaping market trends toward smart, automated maintenance systems.

- The market is moderately consolidated, with leading players focusing on innovation, automation efficiency, and global partnerships to strengthen competitiveness.

- Asia-Pacific held the largest share at 34% in 2024, followed by North America at 32% and Europe at 27%, while the automated service segment accounted for 68% of the total market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Service Type

The automated service segment dominated the Dry Type Automated Solar Panel Cleaning Market in 2024, holding a market share of around 68%. This dominance is driven by rising solar installations and the demand for consistent, cost-effective cleaning operations. Automated systems reduce water usage, labor dependency, and panel downtime, offering higher operational efficiency. Manual service remains relevant in smaller installations and remote areas but faces declining adoption. The shift toward autonomous cleaning robots and AI-driven systems continues to strengthen the automated service segment across utility and commercial solar farms.

- For instance, SolarCleano’s F1 robot cleans up to 1,600 m² per hour; one F1 can clean about 2 MW per day under typical layouts.

By Cleaning Technology

Robotic cleaning systems held the largest share of about 54% in 2024 within the cleaning technology segment. Their dominance is fueled by high precision, minimal maintenance, and suitability for large-scale installations. Robotic systems enhance performance by preventing dust accumulation without using water, reducing operational costs. Brush-based and air blower systems serve niche applications where modular design or cost sensitivity is vital. The growing adoption of dry-cleaning robots integrated with IoT sensors and remote monitoring capabilities further drives efficiency and reliability in large solar farms.

- For instance, Adani Green Energy’s Kamuthi plant in Tamil Nadu uses robotic cleaning across 648 MW and 2.5 million modules; the project was completed in 8 months.

By End User

The utility-scale segment accounted for the largest market share of nearly 47% in 2024. This growth is driven by extensive deployment of large solar farms that demand automated, waterless cleaning to sustain power output. Rising renewable energy investments, especially in arid and dusty regions, have increased the need for continuous, maintenance-free solutions. Commercial and industrial users are also adopting dry cleaning systems to reduce O&M costs and enhance energy yield. Residential adoption is emerging gradually with smaller robotic units designed for rooftop installations.

Key Growth Drivers

Rising Deployment of Large-Scale Solar Farms

The growing installation of large-scale solar farms, particularly in arid and semi-arid regions, is a major growth driver for the dry type automated solar panel cleaning market. These installations require frequent and efficient cleaning to prevent energy losses caused by dust and debris accumulation. Dry cleaning systems offer a waterless, fully automated solution that ensures high operational uptime and energy efficiency. With increasing solar capacity additions in countries such as India, China, Saudi Arabia, and the United States, the demand for large-scale automated cleaning robots continues to rise, making this the key growth driver shaping the market.

- For instance, At Dubai’s Solar Park (Phase 3), Masdar notes the first 200 MW stage used 50 custom robots to clean panels without water.

Water Scarcity and Environmental Regulations

The rising global concern over water scarcity and stricter environmental regulations are fueling the shift toward dry-type solar panel cleaning solutions. Conventional water-based cleaning methods are no longer sustainable in regions facing drought and water stress. Governments and solar developers are now prioritizing technologies that support water conservation and align with environmental mandates. Dry cleaning systems eliminate water usage entirely, reducing operational costs and ecological impact. This makes them an essential component in achieving clean energy goals and regulatory compliance, particularly in water-stressed markets across the Middle East, Africa, and parts of Asia-Pacific.

- For instance, Airtouch Solar’s AT 4.0 autonomous robot is water-free and can travel up to 2,000 meters per charge, managed via a cloud-based control system.

Advancements in Robotics and AI Integration

Technological innovation remains a key force driving the market forward, with robotics, AI, and sensor integration transforming cleaning efficiency and reliability. Modern dry cleaning systems use AI-driven algorithms to map panel layouts, optimize cleaning routes, and operate autonomously under varying conditions. These advancements reduce manual intervention, extend equipment lifespan, and improve panel performance. Continuous innovation in automation and smart connectivity also enables predictive maintenance and remote monitoring, further lowering operating expenses. Such developments are fostering a new generation of intelligent, self-learning cleaning robots that enhance productivity in both utility and commercial solar projects.

Key Trends & Opportunities

Adoption of IoT-Enabled Monitoring Solutions

The integration of IoT technology in dry solar panel cleaning systems is emerging as a major trend, improving the precision and predictability of maintenance activities. IoT-enabled devices allow operators to monitor system status, energy performance, and environmental conditions in real time. This digitalization supports data-driven decision-making, helping optimize cleaning frequency and efficiency. As solar asset owners aim to minimize maintenance costs and enhance energy yield, IoT-based predictive maintenance platforms are becoming vital. This trend opens opportunities for software developers and system integrators to offer customized digital solutions for remote operation.

- For instance, In Saudi Arabia, ACWA Power’s 1,500 MW Sudair PV IPP uses automated robotic cleaning with bifacial tracking technology, now fully operational.

Expansion in Emerging Solar Markets

Developing regions such as Africa, Southeast Asia, and Latin America are rapidly expanding their solar energy capacity, creating strong market opportunities for dry-type cleaning systems. These areas often experience high dust levels and limited water resources, making automated dry cleaning a practical choice. Government-backed renewable energy initiatives, combined with foreign investments in solar infrastructure, are further driving adoption. Local manufacturing partnerships and region-specific product customization are helping companies penetrate these fast-growing markets. The expanding renewable energy landscape in these regions represents a major opportunity for global and regional players.

- For instance, the hyCLEANER solarROBOT pro is designed for larger installations, delivering 1,100–2,400 m² per hour cleaning capacity and is battery-powered with a 36–42 V ion battery. The smaller solarROBOT compact model has a lower capacity of up to 1,100 m² per hour and also operates on a 36–42 V ion battery.

Development of Portable Robotic Cleaning Systems

Manufacturers are focusing on the development of compact, portable robotic cleaning systems designed for residential and small commercial applications. These solutions are lightweight, energy-efficient, and easy to install, enabling users to automate cleaning without complex setups. The rising adoption of rooftop solar installations in urban and industrial areas has increased demand for such devices. The ability to operate without water and perform in limited spaces enhances their appeal. This trend presents a significant growth opportunity for companies developing affordable, modular dry-cleaning robots for decentralized solar systems.

Key Challenges

High Initial Investment Costs

The high upfront cost of dry automated cleaning systems remains a key barrier to market penetration, particularly for small-scale solar users. The advanced robotics, sensor technology, and automation components contribute to higher system prices compared to manual cleaning methods. Smaller project developers often face budget limitations that prevent large-scale automation deployment. However, declining component costs, growing competition, and economies of scale are expected to gradually reduce overall system costs. The adoption of rental or service-based business models can further ease capital burdens for smaller operators in the coming years.

Limited Awareness and Technical Expertise

A major challenge for market growth lies in the lack of awareness and skilled personnel to operate and maintain automated cleaning systems. Many solar plant operators, especially in emerging economies, still rely on traditional cleaning methods due to limited technical knowledge. Improper installation or system misuse can lead to reduced cleaning efficiency and potential panel damage. Strengthening training programs, technical support, and after-sales services will be vital for improving user confidence. As awareness and technical competence increase, market adoption is expected to accelerate across developing regions.

Regional Analysis

North America

North America held a 32% share of the global dry type automated solar panel cleaning market in 2024. The United States dominates the regional landscape due to large solar installations across arid states such as California, Nevada, and Arizona. Rising emphasis on automated maintenance systems and strong investment in renewable energy projects drive growth. The presence of established solar technology manufacturers and early adoption of robotics-based solutions further supports market expansion. Canada is also witnessing steady growth, supported by solar farm development and increasing demand for water-free cleaning systems in industrial installations.

Europe

Europe accounted for around 27% of the global market share in 2024, driven by strong environmental policies and renewable energy targets under the European Green Deal. Countries such as Germany, Spain, and Italy are key contributors, emphasizing automation and sustainability in solar operations. The region’s focus on reducing water consumption and labor-intensive processes supports dry cleaning technology adoption. The growing integration of AI and IoT in robotic cleaning systems enhances performance efficiency. Continuous investment in large-scale solar farms and favorable government incentives further promote market growth across Europe.

Asia-Pacific

Asia-Pacific dominated the global market with a 34% share in 2024, led by China, India, Japan, and Australia. Rapid solar energy expansion, coupled with large-scale installations in dusty and dry regions, fuels strong demand for dry cleaning systems. Governments in India and China actively promote renewable energy infrastructure, creating substantial opportunities for automation providers. The region benefits from a growing base of local manufacturers and lower production costs. Rising awareness of water conservation, combined with technological innovation in cost-effective robotic systems, positions Asia-Pacific as the fastest-growing regional market.

Latin America

Latin America represented around 4% of the global market share in 2024, with Brazil, Chile, and Mexico being the major contributors. Expanding solar energy capacity and favorable climatic conditions for solar installations encourage the use of dry-type cleaning systems. Government-backed renewable energy projects and partnerships with international technology suppliers support market adoption. However, higher equipment costs and limited technical expertise remain challenges. Increasing investment in smart solar maintenance solutions is expected to improve efficiency and accelerate regional market growth during the forecast period.

Middle East & Africa

The Middle East & Africa region captured a 3% share of the global market in 2024. The region’s hot, arid climate makes dry cleaning technologies essential for maintaining solar panel efficiency. Countries such as Saudi Arabia, the UAE, and South Africa lead adoption, driven by large-scale solar projects under national energy diversification plans. Water scarcity and high dust accumulation further strengthen demand for automated dry cleaning solutions. Growing collaborations with global technology developers and the establishment of new solar farms are expected to expand market penetration across the region.

Market Segmentations:

By Service Type:

- Automated Service

- Manual Service

By Cleaning Technology:

- Robotic Cleaning Systems

- Brush-Based Cleaning Systems

- Wipe Cleaning Systems

- Air Blower Systems

By End User:

- Residential

- Commercial

- Utility Scale

- Industrial

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The dry type automated solar panel cleaning market is led by key players such as SolarCleano, Ecoppia, NOMADD, Heliotex, BEIJING MULTIFIT ELECTRICAL TECHNOLOGY CO., LTD., SunBrush mobil GmbH, Zhejiang Ganghang Solar Technology Co., Ltd., Boson Robotics Ltd., BladeRanger, Jurchen Technology GmbH, Hekabot, Foshan Neexgent Energy Co., Ltd., Sharp Corporation, scmsolar, and Wuxi Wanlv Intelligent Technology Co., Ltd. The competitive landscape is defined by continuous innovation in autonomous cleaning technology, robotics integration, and IoT-enabled monitoring systems. Companies are focusing on waterless, energy-efficient, and low-maintenance solutions suitable for both large-scale and rooftop solar installations. Strategic partnerships, regional manufacturing expansion, and customized product portfolios are helping firms enhance their global presence. Competition is intensifying as emerging players introduce cost-effective robotic systems and digital maintenance platforms. The market’s future competitiveness will hinge on product reliability, operational precision, and sustainability-driven design improvements aligned with the renewable energy sector’s evolving demands.\

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- SolarCleano

- Ecoppia

- NOMADD

- Heliotex

- BEIJING MULTIFIT ELECTRICAL TECHNOLOGY CO.,LTD.

- SunBrush mobil GmbH

- Zhejiang Ganghang Solar Technology Co., Ltd.

- Boson Robotics Ltd.

- BladeRanger

- Jurchen Technology GmbH

- Hekabot

- Foshan Neexgent Energy Co.,Ltd.

- Sharp Corporation

- scmsolar

- Wuxi Wanlv Intelligent Technology Co., Ltd.

Recent Developments

- In 2025, Solarcleano, a Luxembourg-based solar panel cleaning systems specialist, has launched L1, a portable and semi-automatic cleaning system.

- In 2024, SunBrush announced a robotic cleaning solution specifically for commercial rooftop solar systems in Australia. This radio-controlled system was designed for mechanically simple operation, featuring integrated cameras for the operator.

- In 2023, Ecoppia expanded its global footprint by entering into strategic partnerships with major solar developers in the Middle East and North America.

Report Coverage

The research report offers an in-depth analysis based on Service Type, Cleaning Technology, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily due to increasing global solar capacity additions.

- Automation and robotics will remain central to improving cleaning efficiency and reliability.

- AI and IoT integration will enhance real-time monitoring and predictive maintenance capabilities.

- Water scarcity concerns will continue to drive demand for dry-cleaning solutions in arid regions.

- The utility-scale solar segment will maintain dominance due to large project deployments.

- Manufacturers will focus on developing cost-effective and portable robotic systems for smaller users.

- Strategic partnerships and regional manufacturing expansion will boost market penetration.

- Government incentives for renewable energy projects will encourage wider adoption of automated systems.

- Increased awareness and training programs will improve operational efficiency and system longevity.

- Continuous innovation in materials and sensor technology will enhance durability and performance of dry-cleaning robots.