Market Overview

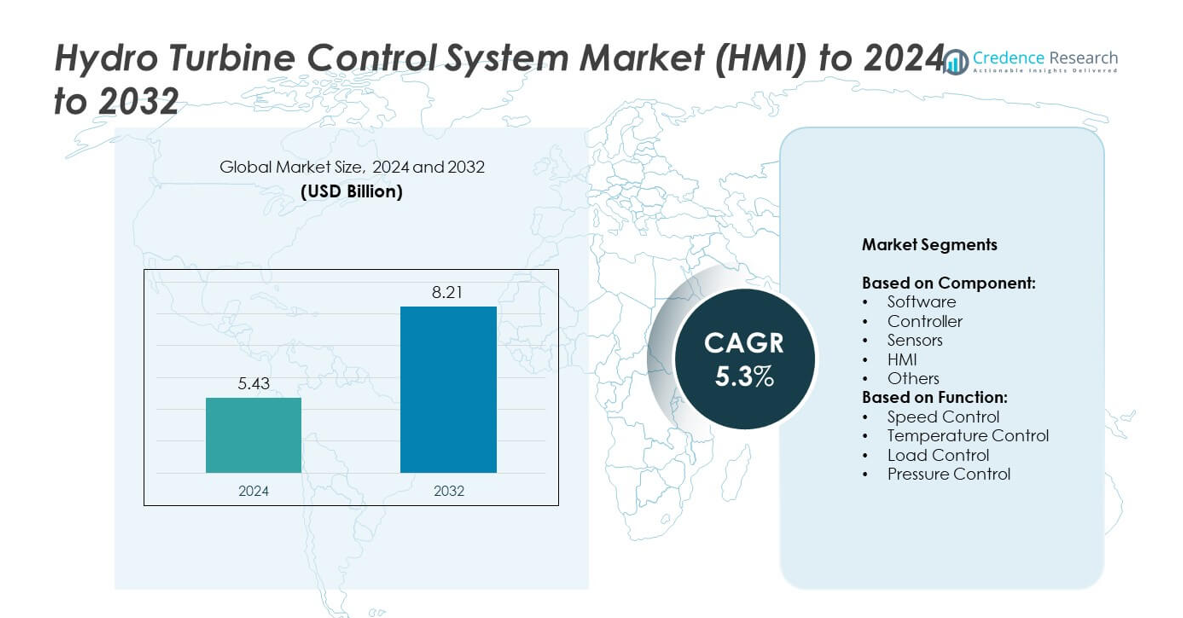

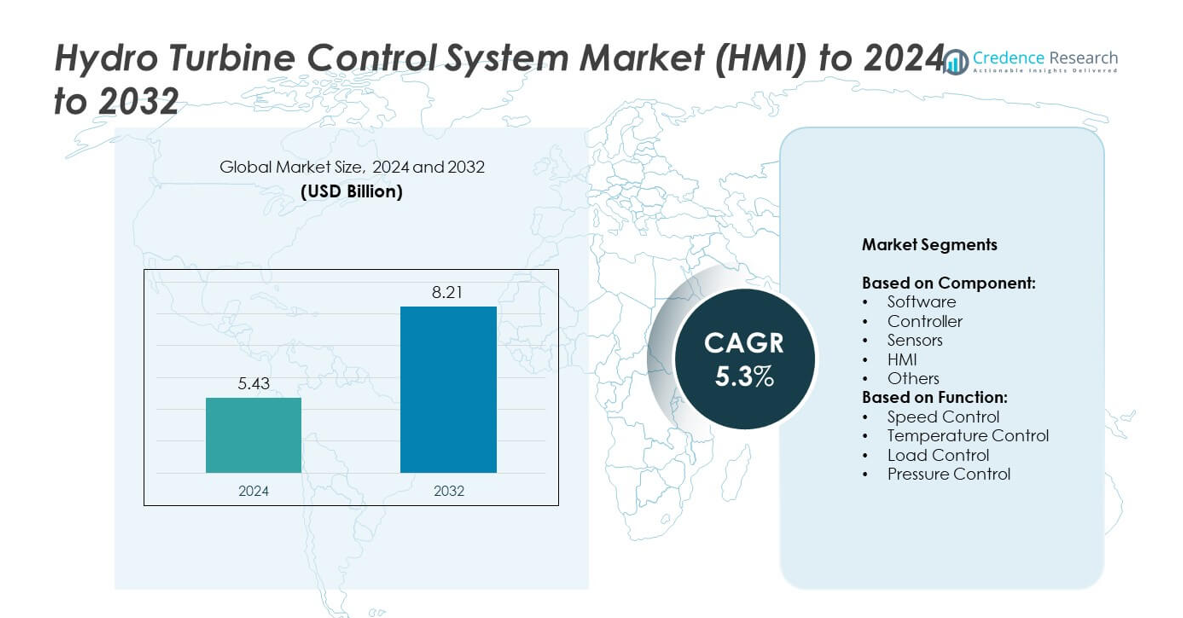

The Hydro Turbine Control System (HMI) market size was valued at USD 5.43 billion in 2024 and is anticipated to reach USD 8.21 billion by 2032, at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hydro Turbine Control System Market Size 2024 |

USD 5.43 billion |

| Hydro Turbine Control System Market, CAGR |

5.3% |

| Hydro Turbine Control System Market Size 2032 |

USD 8.21 billion |

The hydro turbine control system (HMI) market is shaped by leading players such as ABB, Siemens Energy, Voith, General Electric, Emerson Electric, and Schneider Electric, alongside specialized companies including ANDRITZ, Valmet, Yokogawa Electric, and Rockwell Automation. These firms focus on advanced automation, IoT integration, and predictive monitoring to enhance plant performance and grid stability. Competitive strategies emphasize modernization of existing hydropower plants and large-scale deployment in new projects. Regionally, Asia Pacific led the market with 34% share in 2024, driven by extensive hydropower expansion in China and India, while North America and Europe followed with significant investments in digital upgrades and sustainability-driven modernization programs.

Market Insights

- The hydro turbine control system (HMI) market was valued at USD 5.43 billion in 2024 and is expected to reach USD 8.21 billion by 2032, growing at a CAGR of 5.3%.

- Market growth is fueled by rising renewable energy integration, modernization of hydropower plants, and adoption of digital automation for enhanced efficiency and grid stability.

- Key trends include deployment of IoT-enabled sensors, predictive maintenance, and AI-driven monitoring to improve operational reliability and extend equipment lifespan.

- The market is competitive with major players such as ABB, Siemens Energy, Voith, General Electric, Emerson Electric, and Schneider Electric focusing on innovation, modernization projects, and global expansion.

- Asia Pacific led with 34% share in 2024, supported by hydropower growth in China and India, followed by North America with 32% and Europe with 28%, while Latin America held 4% and the Middle East & Africa accounted for 2%; the controller segment dominated with 36% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

In 2024, the controller segment held the dominant share in the hydro turbine control system (HMI) market, accounting for nearly 36% of the total. Controllers remain the backbone of system operations, enabling real-time monitoring and precise regulation of turbine performance. The growing demand for advanced digital controllers with higher processing speed, reliability, and compatibility with modern grid standards is driving this dominance. Additionally, rising adoption of automation and IoT-based control systems in hydropower plants further strengthens the controller segment, making it the most influential component in the market.

- For instance, Yokogawa has successfully replaced controls at multiple hydro plants, such as the Pal’eozersk hydro power plant in Russia. This modernization project for the plant, which had two 12.5 MW units, involved replacing aging equipment with the CENTUM VP distributed control system and the ProSafe-RS safety-instrumented system.

By Function

The load control segment emerged as the dominant function in the hydro turbine control system market in 2024, representing around 38% share. Load control systems are critical in balancing turbine output with grid demand, ensuring efficiency and operational stability. Increasing integration of renewable energy into grids has heightened the importance of advanced load control solutions, particularly in managing fluctuations and preventing blackouts. Furthermore, rising investments in digital load management and smart grid infrastructure contribute significantly to the growth and dominance of this segment in the overall market.

- For instance, Emerson states its Ovation power-and-water control platform covers 1.4 million MW across 60+ countries, including hydro governors for unit/load control.

Key Growth Drivers

Rising Demand for Renewable Energy Integration

The growing global focus on renewable energy integration stands as the key growth driver for the hydro turbine control system (HMI) market. Governments are pushing for cleaner energy sources, and hydropower remains a reliable option for large-scale generation. Advanced control systems ensure grid stability by managing variable loads and balancing power flow. With increasing hydropower capacity additions, the adoption of HMI-driven turbine controls is accelerating, enhancing operational efficiency and ensuring compliance with evolving environmental and energy efficiency regulations.

- For instance, Statkraft reported 14,245 MW installed hydropower capacity and 55 TWh hydropower generation in 2024.

Advancements in Digital Automation and IoT

The adoption of digital automation and IoT technologies in hydropower plants is driving rapid market growth. Smart control systems with IoT-enabled sensors, predictive analytics, and real-time monitoring improve turbine efficiency and minimize downtime. Enhanced connectivity also supports remote operation, reducing operational costs and improving safety in challenging environments. These advancements create significant opportunities for modernization projects, where legacy systems are replaced with digital controllers and automated HMIs, ensuring improved energy output and optimized resource utilization.

- For instance, ABB is digitalizing 33 of Enel Green Power’s hydropower plants in Italy as part of a project to transition to predictive and condition-based maintenance. As of September 2024, Enel’s total installed hydropower capacity was 27.543 GW.

Increasing Investments in Hydropower Infrastructure

Growing global investments in hydropower projects, both new installations and upgrades, act as a strong growth driver for the HMI hydro turbine control market. Emerging economies are expanding hydropower capacity to meet rising electricity demand, while developed regions are modernizing aging plants to enhance efficiency. Advanced turbine control systems play a critical role in optimizing generation and ensuring longer equipment life. This rising capital flow into hydropower development directly boosts demand for HMI systems, creating steady growth opportunities for market players.

Key Trends & Opportunities

Adoption of AI and Predictive Maintenance

One of the key trends is the integration of artificial intelligence and predictive maintenance in turbine control systems. AI-driven analytics allow operators to predict component failures before they occur, reducing downtime and maintenance costs. Predictive models also enhance turbine efficiency and extend equipment life, particularly in high-capacity plants. The opportunity lies in deploying AI-enabled HMIs that deliver actionable insights, which is increasingly valuable as utilities focus on operational excellence and minimizing lifecycle costs in competitive energy markets.

- For instance, Voith deployed acoustic/predictive monitoring at Iceland’s Búðarháls plant, 95 MW with about 585 GWh/year output.

Shift Toward Remote and Cloud-Based Monitoring

A major opportunity is emerging in the shift toward remote and cloud-based monitoring of hydropower plants. Operators can now oversee multiple facilities through centralized platforms, reducing the need for on-site staff and enabling faster response to issues. This trend supports enhanced data collection, advanced analytics, and improved cybersecurity features. With utilities seeking flexible and scalable solutions, cloud-enabled HMI control systems offer efficiency and cost-effectiveness, making them a key opportunity for equipment suppliers and technology providers in the sector.

- For instance, EDF centralized remote supervision for 300+ of its 450 hydro plants via five monitoring and control centers.

Key Challenges

High Cost of Installation and Upgrades

The high upfront cost of installing and upgrading advanced HMI turbine control systems is a major challenge. Hydropower operators in developing regions often face financial constraints, which limit the adoption of modern systems. Additionally, upgrading existing plants with digital HMIs requires significant capital and technical expertise, slowing down replacement cycles. These costs often delay modernization efforts, creating hurdles for market expansion despite strong long-term benefits.

Cybersecurity Risks in Digital Systems

With the increasing integration of digital technologies, cybersecurity has emerged as a critical challenge for hydro turbine control systems. Cloud-based platforms, remote monitoring, and IoT-connected sensors expand the attack surface for potential cyber threats. A successful cyberattack can disrupt power generation and compromise grid stability. Ensuring robust cybersecurity frameworks, continuous monitoring, and compliance with global standards remains essential for operators. Addressing these risks requires significant investment in both hardware and software security, adding to the complexity of adoption.

Regional Analysis

North America

North America accounted for 32% share of the hydro turbine control system (HMI) market in 2024, driven by modernization of aging hydropower plants and integration of digital monitoring technologies. The United States leads regional growth with significant investments in grid stability projects and advanced turbine control solutions. Canada’s extensive hydropower capacity also fuels steady adoption of HMI systems to enhance efficiency and reliability. Increasing focus on renewable energy targets and government support for clean energy transition further strengthens the region’s market presence. The region continues to prioritize automation and predictive maintenance for operational optimization.

Europe

Europe held 28% share of the hydro turbine control system market in 2024, supported by strong regulatory emphasis on clean energy generation and modernization of legacy hydropower infrastructure. Countries such as Norway, France, and Austria lead adoption with robust investments in upgrading control systems. The European Union’s decarbonization policies encourage integration of digital controllers and IoT-enabled HMIs to improve efficiency and environmental compliance. Rising demand for flexible load management, particularly with growing renewable energy integration, supports strong adoption trends. Advanced grid requirements and sustainability mandates will continue to drive growth across the European region.

Asia Pacific

Asia Pacific emerged as the largest market with 34% share in 2024, driven by massive hydropower expansion projects across China, India, and Southeast Asia. The region benefits from growing electricity demand and government-backed investments in renewable energy infrastructure. China dominates with large-scale projects requiring advanced turbine control systems for efficiency and load balancing. India is also scaling up hydropower capacity to meet rising demand, fueling opportunities for digital HMI solutions. Rapid urbanization and industrialization are further propelling regional adoption. Asia Pacific is expected to remain the fastest-growing regional market during the forecast period.

Latin America

Latin America captured 4% share of the hydro turbine control system market in 2024, supported by steady investments in renewable energy and modernization of existing hydropower facilities. Brazil dominates the regional market due to its significant hydropower capacity, followed by Chile and Colombia with emerging projects. Increasing focus on grid stability and efficiency improvements encourages adoption of HMI-based control solutions. However, limited financial resources and slower pace of modernization in certain countries restrain growth. Despite these challenges, rising renewable energy targets and regional energy security initiatives provide long-term opportunities for technology providers.

Middle East & Africa

The Middle East & Africa region accounted for 2% share of the hydro turbine control system market in 2024, reflecting its relatively small hydropower base. Growth is driven by emerging projects in countries such as Ethiopia, Egypt, and South Africa, where hydropower development is expanding to meet rising energy demand. The region is adopting digital control systems to enhance reliability and efficiency in new installations. However, political instability and financing challenges in some nations limit wider adoption. Long-term opportunities exist as governments increasingly prioritize renewable energy diversification, with hydro projects gaining gradual momentum.

Market Segmentations:

By Component:

- Software

- Controller

- Sensors

- HMI

- Others

By Function:

- Speed Control

- Temperature Control

- Load Control

- Pressure Control

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the hydro turbine control system (HMI) market features leading companies such as York Precision Machining & Hydraulics, Valmet, Rockwell Automation, Siemens Energy, Voith, ABB, Honeywell International, WWS Wasserkraft, Sulzer, Ingeteam, General Electric, MSHS, ANDRITZ, Yokogawa Electric, GE Vernova, Emerson Electric, and Schneider Electric. These players collectively focus on innovation, digital integration, and advanced automation technologies to strengthen their positions. The market is shaped by continuous investment in upgrading turbine control systems with IoT-enabled solutions, predictive analytics, and remote monitoring capabilities. Companies are emphasizing efficiency, safety, and grid compatibility to meet the rising demand for renewable energy integration. Strategic initiatives include mergers, partnerships, and regional expansion to cater to growing hydropower projects worldwide. Competitive differentiation is also driven by offering modular and scalable systems that optimize plant performance while meeting environmental standards. This dynamic competition fosters technological advancements and supports long-term growth across global hydropower operations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- York Precision Machining & Hydraulics

- Valmet

- Rockwell Automation

- Siemens Energy

- Voith

- ABB

- Honeywell International

- WWS Wasserkraft

- Sulzer

- Ingeteam

- General Electric

- MSHS

- ANDRITZ

- Yokogawa Electric

- GE Vernova

- Emerson Electric

- Schneider Electric

Recent Developments

- In 2025, ABB India secured a large order from Siemens Gamesa for wind turbine components, demonstrating its expanded capabilities in renewable energy sectors beyond hydro.

- In 2023, GE Vernova commissioned four Francis hydro turbines and generators at the Zungeru project in Nigeria. It also refurbished units at the Cushman II hydropower plant in the U.S. and upgraded a unit at the Qairokkum plant in Tajikistan.

- In 2022, ANDRITZ provided electromechanical equipment and technical services for significant hydropower projects, such as the Ialy Hydropower Plant extension in Vietnam

Report Coverage

The research report offers an in-depth analysis based on Component, Function and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with increasing adoption of renewable energy sources.

- Digitalization and automation will play a central role in modernizing hydropower plants.

- Controllers will remain the dominant component due to their critical role in performance optimization.

- Load control systems will gain higher demand with rising grid integration of renewables.

- Asia Pacific will lead growth, supported by large-scale hydropower projects in China and India.

- Europe will continue upgrading legacy plants to meet stricter sustainability and efficiency regulations.

- North America will invest in predictive maintenance and IoT-based monitoring solutions.

- Cybersecurity will become a priority as digital connectivity expands across hydropower facilities.

- Emerging economies in Latin America and Africa will adopt advanced systems gradually with new projects.

- Long-term opportunities will arise from integrating AI and cloud platforms in HMI control systems.