Market Overview

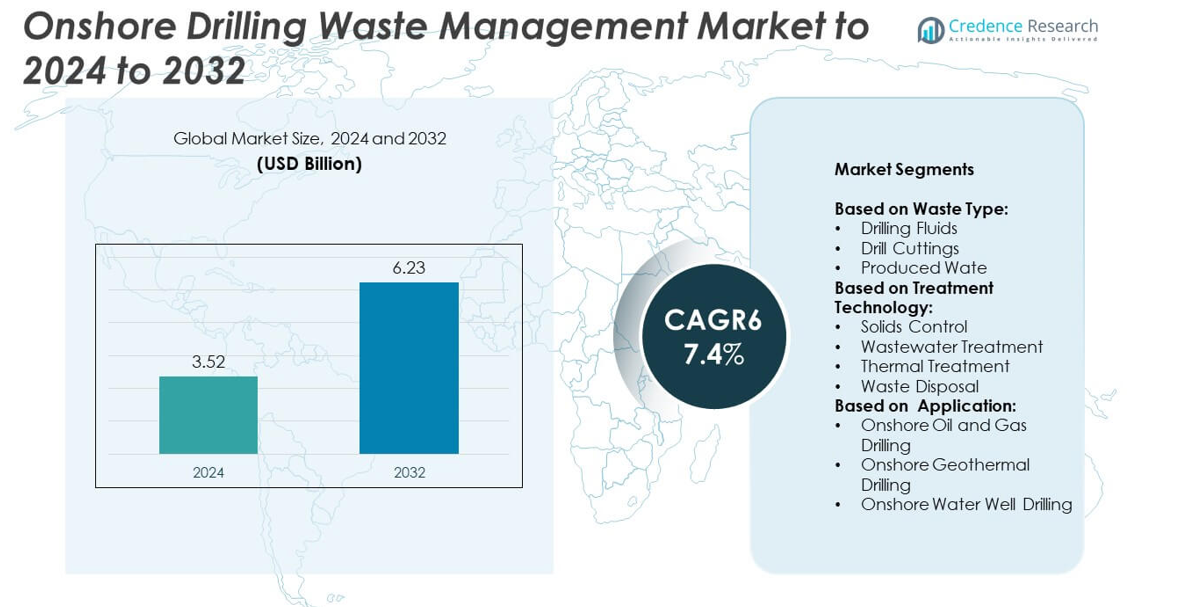

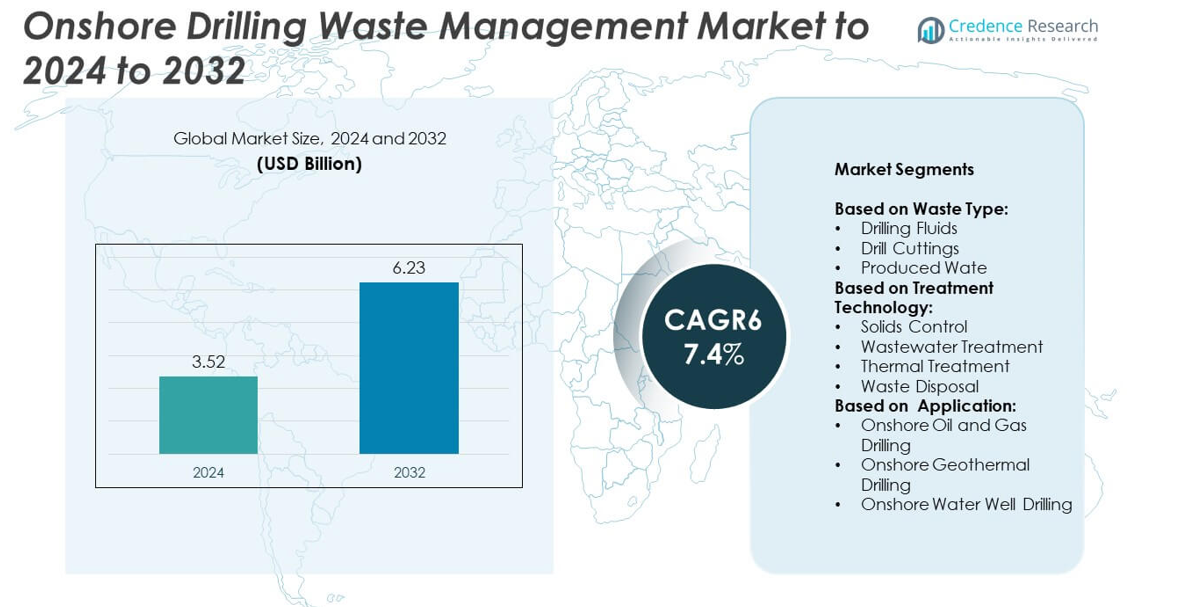

The Onshore Drilling Waste Management Market size was valued at USD 3.52 billion in 2024 and is anticipated to reach USD 6.23 billion by 2032, at a CAGR of 7.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Onshore Drilling Waste Management Market Size 2024 |

USD 3.52 billion |

| Onshore Drilling Waste Management Market, CAGR |

7.4% |

| Onshore Drilling Waste Management Market Size 2032 |

USD 6.23 billion |

The onshore drilling waste management market is led by key players such as NOV Mud Systems, Baker Hughes, Pioneer Energy Services, Terra Nitrogen Company, Schlumberger, Veolia North America, Nabors Industries, Superior Energy Services, Halliburton, Ensign Energy Services, Weatherford, Trican Well Service, MI Drilling Fluids, and National Oilwell Varco. These companies focus on providing advanced waste treatment solutions, including solids control, wastewater treatment, and thermal technologies, to meet stringent environmental regulations. North America dominates the market with a 38% share, driven by extensive shale and tight oil exploration. Asia Pacific follows with 25%, fueled by rising drilling activities in China, India, and Australia. Europe accounts for 22%, supported by strict regulatory frameworks and sustainable drilling practices, while the Middle East & Africa and Latin America hold 10% and 5% respectively, driven by growing onshore oil and gas operations and emerging reserve development.

Market Insights

- The onshore drilling waste management market was valued at USD 3.52 billion in 2024 and is projected to reach USD 6.23 billion by 2032, growing at a CAGR of 7.4%. Drill cuttings held the largest share in 2024.

- Market growth is driven by increasing onshore drilling activities, stringent environmental regulations, and adoption of advanced treatment technologies such as solids control and thermal treatment.

- Key trends include the shift toward sustainable waste management, recycling of drilling fluids, and integration of digital monitoring systems to improve efficiency and compliance.

- The market is highly competitive, with leading players focusing on technology innovation, service differentiation, and regional expansion to strengthen their presence. Companies invest in advanced treatment solutions to meet regulatory and sustainability requirements.

- North America holds 38% of the market, Asia Pacific 25%, Europe 22%, Middle East & Africa 10%, and Latin America 5%, reflecting high drilling activity and regulatory enforcement across regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Waste Type

Drill cuttings accounted for the largest share of the onshore drilling waste management market in 2024. Their dominance stems from the significant volume generated during oil and gas drilling operations. Effective management of drill cuttings is critical due to environmental concerns and strict disposal regulations. Technologies such as cuttings reinjection and bioremediation are increasingly used to minimize ecological impact. Growth in global drilling activity, particularly in shale and tight oil exploration, further drives the demand for efficient drill cuttings treatment solutions across major onshore drilling regions.

- For instance, ZADCO’s island drilling project treated non-aqueous fluid (NAF) drill cuttings using thermal desorption (TCC RotoMill®) and achieved recovery of 99.9 % of hydrocarbon content, leaving residual solids typically with <0.1 % hydrocarbon by weight.

By Treatment Technology

Solids control emerged as the dominant treatment technology in 2024, holding the largest share of the market. Its leadership is due to the role it plays in separating drilling fluids from solids, reducing waste volumes and costs. The technology enables efficient recycling and reuse of drilling fluids, supporting both cost savings and sustainability goals. Stringent environmental regulations and operators’ focus on reducing operational footprints reinforce adoption. The increasing complexity of drilling operations in unconventional reserves further strengthens the reliance on advanced solids control systems in onshore drilling projects.

- For instance, GN Solids Control’s decanter centrifuges (e.g. high configuration) achieve capacities up to 114 m³/h (500 GPM) in some models.

By Application

Onshore oil and gas drilling represented the dominant application segment in 2024, accounting for the largest market share. The segment’s strength arises from the extensive global exploration and production activities, particularly in North America, the Middle East, and Asia-Pacific. Growing energy demand and continued investments in onshore reserves sustain drilling activity, thereby driving waste generation. Strict regulatory frameworks regarding drilling waste disposal fuel demand for advanced management solutions in this segment. The integration of efficient treatment technologies further enhances compliance and environmental sustainability in large-scale onshore oil and gas drilling projects.

Key Growth Drivers

Stringent Environmental Regulations

Stringent environmental regulations act as the primary growth driver for the onshore drilling waste management market. Governments and regulatory bodies enforce strict disposal norms for drill cuttings, fluids, and produced water to prevent soil and groundwater contamination. These mandates compel operators to invest in advanced treatment technologies such as solids control and wastewater treatment. Compliance pressure not only ensures environmental safety but also drives continuous innovation in eco-friendly waste management practices, making this the key growth driver shaping the industry’s future direction.

- For instance, TotalEnergies’ offshore operations in Congo, such as the Moho project, are subject to national and international environmental regulations that limit hydrocarbon discharge. According to an infographic published by TotalEnergies in July 2024, the company’s average hydrocarbon content across its global aqueous discharges was 1.9 mg/L in 2023.

Expansion of Onshore Oil and Gas Drilling

The expansion of onshore oil and gas drilling strongly supports market growth by increasing waste volumes. Rising energy demand and renewed investments in shale, tight oil, and conventional reserves fuel drilling activities across North America, the Middle East, and Asia-Pacific. This surge in exploration and production intensifies the need for efficient waste management to ensure compliance and operational sustainability. As drilling intensity grows, operators depend more on specialized treatment solutions, thereby reinforcing market expansion and long-term adoption of waste management technologies.

- For instance, Baker Hughes injected 104,204 barrels of drilling and completion waste into the Pozo Sandstone formation in the Piraña field in Peru, utilizing cuttings reinjection (CRI) technology during an eight-well drilling campaign.

Technological Advancements in Treatment Solutions

Rapid technological advancements in waste treatment solutions significantly drive market adoption. Innovations in solids control, thermal treatment, and bioremediation help reduce disposal costs while improving efficiency and environmental performance. Automated and digital monitoring systems enhance real-time control over waste streams, ensuring regulatory compliance and operational transparency. These advancements make waste management more economical and scalable, particularly in large onshore projects. Growing industry focus on sustainability further boosts investment in new technologies, contributing to a more competitive and innovation-driven market landscape.

Key Trends & Opportunities

Shift Toward Sustainable Waste Management

The shift toward sustainable waste management represents a key trend in the market. Operators are adopting recycling and reuse practices to minimize environmental impact and reduce costs. Technologies that allow recovery of drilling fluids and reinjection of cuttings align with sustainability goals and stricter disposal regulations. This approach enhances resource efficiency while lowering carbon footprints. The trend creates opportunities for service providers offering eco-friendly, closed-loop solutions, positioning them as preferred partners for operators focusing on long-term environmental responsibility.

- For instance, TWMA reports its wellsite processing solution can reduce carbon emissions in drilling operations by 50 % compared to conventional methods.

Rising Investments in Emerging Onshore Reserves

Rising investments in emerging onshore reserves present a major growth opportunity. Countries in Asia-Pacific, Africa, and Latin America are ramping up onshore drilling to meet energy demand and strengthen domestic supply. These developments increase waste generation and drive demand for specialized treatment services in regions with evolving regulatory frameworks. Global service providers are expanding their footprint to cater to these markets, capitalizing on untapped opportunities. The trend also encourages collaboration between governments and companies to develop sustainable waste management infrastructure.

- For instance, SLB’s SCREEN PULSE separator recovered 923.47 barrels of drilling fluid in a Colombia onshore project, reducing waste and enabling reuse of fluids.

Key Challenges

High Operational Costs

High operational costs remain a key challenge in the onshore drilling waste management market. Advanced treatment technologies such as thermal desorption and bioremediation require significant capital investment and maintenance expenses. Smaller operators often struggle to allocate budgets for these solutions, leading to limited adoption. Rising energy prices and fluctuating oil markets further intensify cost pressures. Balancing compliance with financial feasibility remains a persistent challenge, creating demand for more cost-effective yet environmentally responsible waste management solutions.

Infrastructural and Logistical Constraints

Infrastructural and logistical constraints form another critical challenge for market growth. Remote onshore drilling sites often lack adequate waste handling and disposal facilities, making efficient treatment difficult. Transporting large volumes of waste to centralized treatment locations increases operational costs and risks. In developing regions, insufficient infrastructure and weaker regulatory enforcement amplify the problem. These barriers hinder consistent adoption of advanced solutions, restricting market expansion and creating a reliance on localized, less effective waste management practices.

Regional Analysis

North America

North America held the largest share of the onshore drilling waste management market in 2024, accounting for 38%. The region’s dominance is driven by extensive shale gas and tight oil exploration activities, particularly in the United States. Strict regulatory frameworks, including the EPA’s environmental mandates, encourage the adoption of advanced treatment technologies such as solids control and thermal treatment. Canada also contributes significantly due to rising investments in unconventional reserves. Continuous drilling activity, combined with stringent waste disposal standards, ensures steady demand for efficient solutions, positioning North America as a leader in this market.

Europe

Europe accounted for 22% of the onshore drilling waste management market in 2024. The region’s growth is influenced by strict environmental compliance requirements under the EU Waste Framework Directive and regional sustainability goals. Countries such as Norway and the United Kingdom lead in implementing advanced treatment technologies to support offshore and onshore operations. Demand is further supported by a focus on recycling drilling fluids and reducing carbon emissions. The maturity of the oil and gas sector, coupled with emerging geothermal projects, ensures steady market demand while reinforcing Europe’s commitment to sustainable drilling practices.

Asia Pacific

Asia Pacific captured 25% of the onshore drilling waste management market in 2024, supported by growing drilling activities in China, India, and Australia. Rising domestic energy demand and ongoing investments in conventional and unconventional reserves drive market growth. Developing regulatory frameworks are gradually pushing operators to adopt advanced waste management solutions. The region also benefits from increasing exploration in emerging reserves, creating strong demand for cost-effective treatment services. With governments promoting energy independence and sustainability, Asia Pacific is becoming a rapidly expanding market for drilling waste management, supported by both international and local service providers.

Middle East & Africa

The Middle East and Africa together accounted for 10% of the onshore drilling waste management market in 2024. The Middle East’s share is strengthened by large-scale oil exploration projects in Saudi Arabia, the UAE, and Kuwait. Strict waste disposal norms are being enforced to minimize environmental risks, boosting demand for thermal and solids control technologies. In Africa, countries like Nigeria and Angola are expanding their onshore activities, though infrastructure limitations challenge efficient waste handling. Increasing investments in drilling operations and regulatory improvements are expected to gradually enhance adoption of advanced solutions across the region.

Latin America

Latin America represented 5% of the onshore drilling waste management market in 2024. Countries such as Brazil, Argentina, and Mexico are investing in both conventional and unconventional drilling projects, contributing to waste generation. The market is gradually gaining momentum as regulatory frameworks strengthen to address environmental risks linked to drilling activities. Opportunities exist for service providers to deliver cost-effective treatment solutions in regions with growing exploration activity. While the current market share remains modest, increasing demand for energy security and government-led sustainability initiatives are expected to support steady growth in Latin America over the forecast period.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Waste Type:

- Drilling Fluids

- Drill Cuttings

- Produced Wate

By Treatment Technology:

- Solids Control

- Wastewater Treatment

- Thermal Treatment

- Waste Disposal

By Application:

- Onshore Oil and Gas Drilling

- Onshore Geothermal Drilling

- Onshore Water Well Drilling

By Geography:

North America

Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Rest of Latin America

Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The competitive landscape of the onshore drilling waste management market is shaped by leading companies including NOV Mud Systems, Baker Hughes, Pioneer Energy Services, Terra Nitrogen Company, Schlumberger, Veolia North America, Nabors Industries, Superior Energy Services, Halliburton, Ensign Energy Services, Weatherford, Trican Well Service, MI Drilling Fluids, and National Oilwell Varco. These players compete through advanced treatment technologies, diverse service portfolios, and compliance-driven solutions tailored to regional regulations. The market is characterized by strong investments in solids control, wastewater treatment, and thermal technologies to address rising environmental concerns. Companies are increasingly focusing on innovation, digital integration, and automation to enhance efficiency and reduce costs in waste management operations. Strategic partnerships and regional expansions play a key role in strengthening market presence, particularly in emerging drilling regions. With growing demand for sustainable and cost-effective solutions, competition continues to intensify, driving continuous innovation and service differentiation across the market.

Key Player Analysis

- NOV Mud Systems

- Baker Hughes

- Pioneer Energy Services

- Terra Nitrogen Company

- Schlumberger

- Veolia North America

- Nabors Industries

- Superior Energy Services

- Halliburton

- Ensign Energy Services

- Weatherford

- Trican Well Service

- MI Drilling Fluids

- National Oilwell Varco

Recent Developments

- In 2024, Veolia North America launched a new waste treatment service specifically tailored for onshore drilling operations in North America in December.

- In 2024, Halliburton Expanded its waste management capabilities with advanced thermal treatment solutions specifically for onshore drilling operations. This move responded to tightening regulations and demand for more effective waste treatment.

- In 2023, Schlumberger (SLB) launched new lines of environmentally friendly drilling fluids, a proactive step to minimize waste toxicity at the source.

Report Coverage

The research report offers an in-depth analysis based on Waste Type, Treatment Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily as drilling activities increase in emerging reserves.

- Adoption of advanced solids control technologies will rise to reduce waste volumes.

- Regulatory pressure will continue to drive demand for eco-friendly treatment solutions.

- Recycling and reuse of drilling fluids will gain more importance for cost savings.

- Thermal treatment methods will see wider adoption in high-volume drilling operations.

- Digital monitoring systems will improve efficiency and compliance in waste management.

- Service providers will expand into developing regions with growing onshore drilling.

- Investments in infrastructure will ease logistical challenges in remote drilling areas.

- Strategic collaborations between operators and technology firms will accelerate innovation.

- Sustainability goals will remain a central focus shaping market strategies globally.