Market Overview

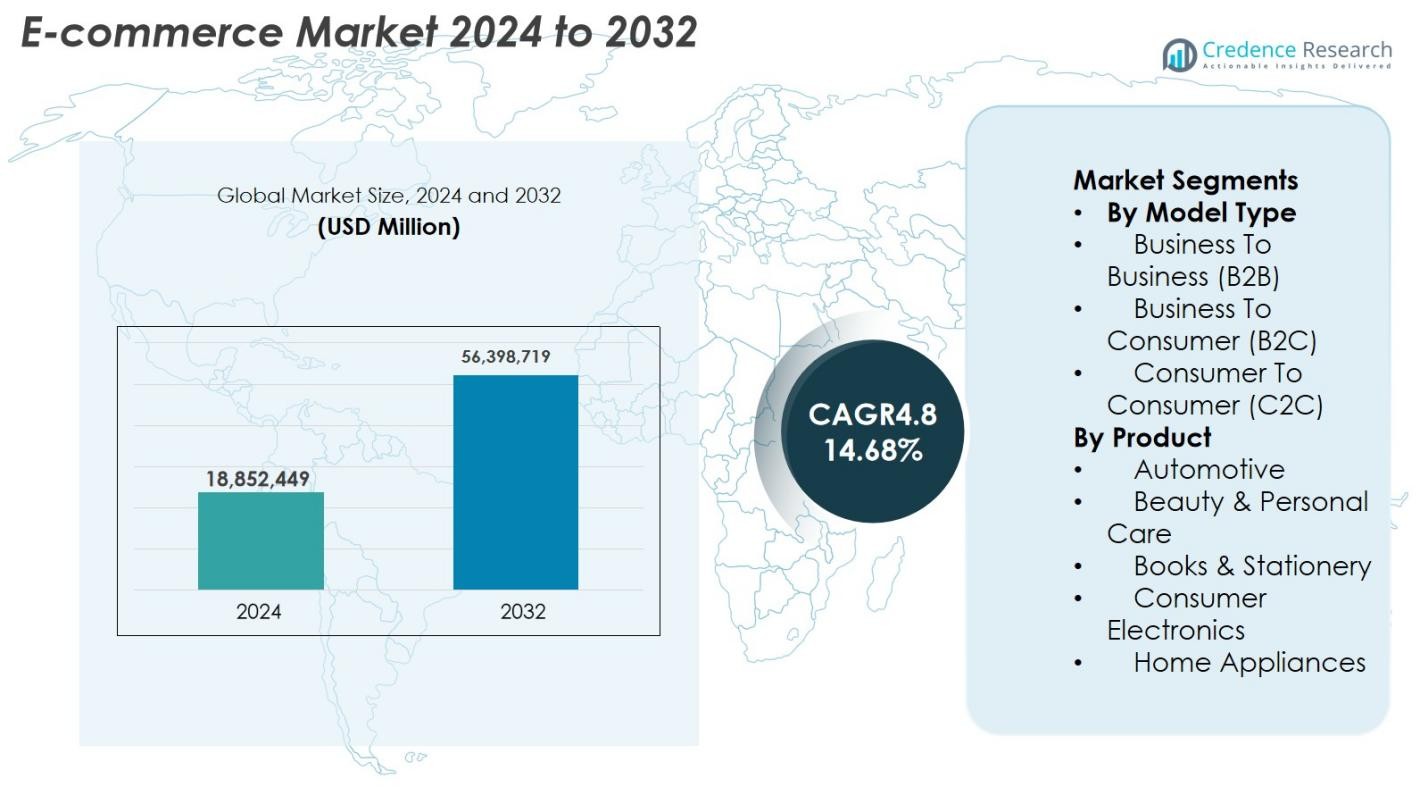

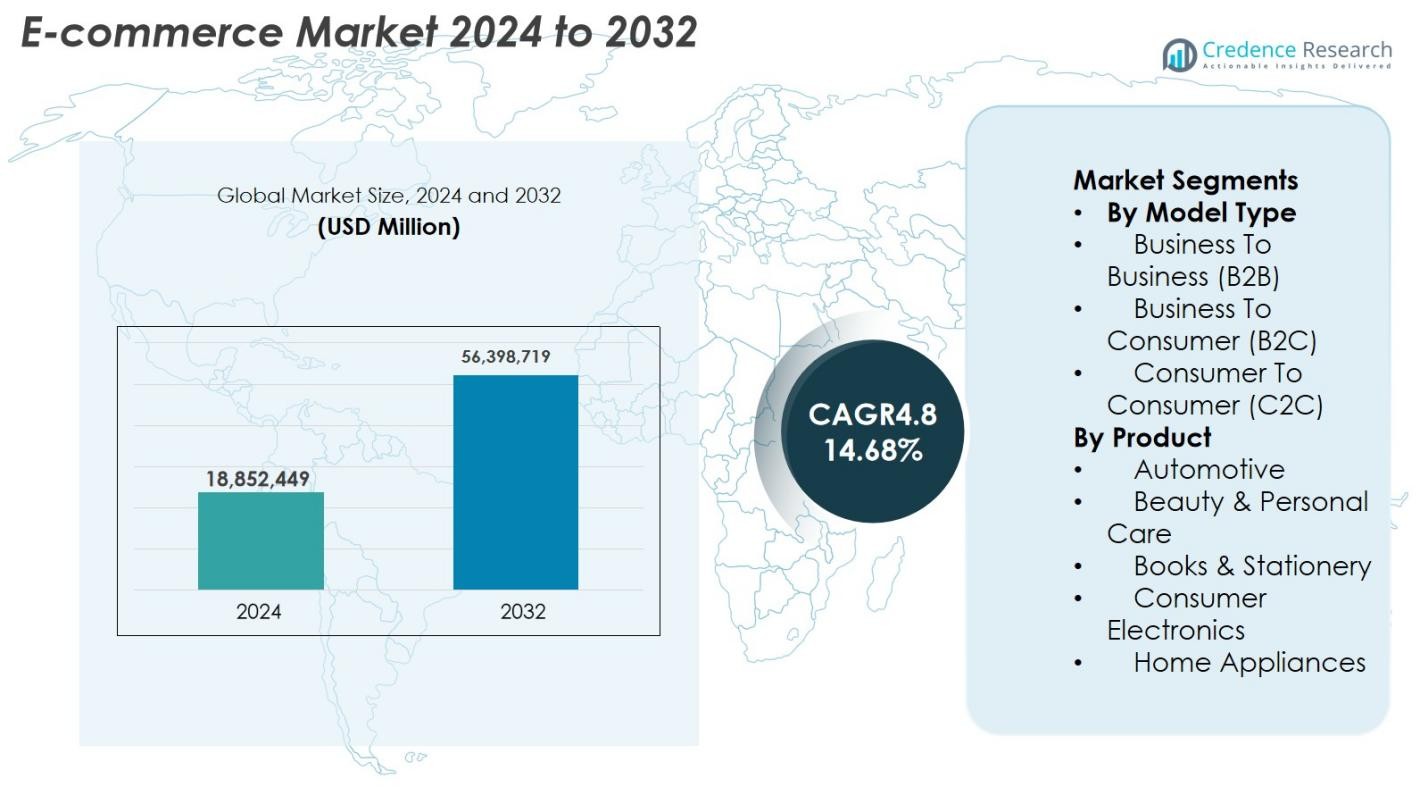

E-commerce Market size was valued at USD 18,852,449 Million in 2024 and is anticipated to reach USD 56,398,719 Million by 2032, at a CAGR of 14.68% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| E-commerce Market Size 2024 |

USD 18,852,449 Million |

| E-commerce Market, CAGR |

14.68% |

| E-commerce Market Size 2032 |

USD 56,398,719 Million |

E-commerce Market continues to expand rapidly, driven by strong participation from leading players such as Amazon.com, Inc., Alibaba.com, JD.com, eBay Inc., Flipkart, Mercado Libre, ASOS, Lazada, Costco Wholesale Corporation, and Dangdang, all of which strengthen their presence through advanced logistics, personalization technologies, and broader product ecosystems. These companies focus on faster delivery, secure payment systems, and enhanced user experience to capture rising online demand across categories. Asia Pacific leads the global market with 38.7% share in 2024, supported by a large digital consumer base and strong platform penetration, followed by North America with 28.6% share, benefiting from high spending power and mature digital infrastructure.

Market Insights

- E-commerce Market reached USD 18,852,449 Million in 2024 and will grow at a CAGR of 14.68% to reach USD 56,398,719 Million by 2032.

- Growth is driven by rising smartphone penetration, digital payment adoption, and increasing consumer preference for fast delivery, wide product choices, and seamless online shopping across B2C and B2B segments.

- Major trends include AI-enabled personalization, rapid expansion of social commerce, omnichannel integration, and strong demand for electronics, which held 22.8% share as the leading product segment in 2024.

- Key players such as Amazon, Alibaba, JD.com, Flipkart, MercadoLibre, ASOS, and Lazada expand through logistics upgrades, subscription models, and technology-led service enhancements despite challenges in cybersecurity, returns management, and last-mile delivery.

- Asia Pacific dominates with 38.7% share due to massive digital adoption, followed by North America at 28.6%, while Europe holds 22.3% share, supported by strong cross-border e-commerce and mature digital infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Model Type

The E-commerce Market shows robust expansion across model types, with B2C emerging as the dominant sub-segment with around 67.4% share in 2024. Its leadership is driven by rising smartphone penetration, accelerated delivery ecosystems, and extensive digital marketing initiatives by global platforms. Broader product availability, seamless checkout, and diverse payment solutions also enhance customer retention. B2B continues to scale as enterprises shift toward digital procurement, while C2C benefits from the growing resale economy and social commerce integration.

- For instance, Walmart introduced its AI-powered search and personalization upgrades in 2024, improving product discovery and customer engagement across categories.

By Product

Within product categories, Consumer Electronics remained the leading segment with 22.8% market share in 2024, driven by strong online demand for smartphones, wearables, laptops, and smart home devices. Frequent product refresh cycles, competitive pricing, and warranty-backed offerings attract large volumes of online buyers. Beauty & Personal Care and Home Appliances are also expanding quickly as consumers prefer online comparisons, influencer-led recommendations, and doorstep convenience. Automotive components, books, and daily essentials continue to grow steadily as logistics efficiency improves across regions.

- For instance, in 2024, Samsung’s Galaxy S24 series saw strong online pre-order volumes across major marketplaces due to AI-enabled features and bundled exchange offers.

Key Growth Drivers

Rapid Digitalization and Expanding Internet Penetration

Rapid digitalization continues to propel the E-commerce Market, supported by rising internet penetration, wider access to smartphones, and growing digital awareness across both developed and emerging economies. High-speed connectivity through 4G and 5G networks expands access to online retail, especially in semi-urban and rural regions. Digital payment systems such as UPI, mobile wallets, and BNPL reduce transaction friction, encouraging frequent online purchases. Government-led digital initiatives and identity systems enhance trust and accessibility, enabling smoother onboarding for consumers and sellers. At the same time, MSMEs increasingly adopt digital storefronts to expand visibility and reach broader customer bases. These combined factors create a favorable environment that strengthens long-term e-commerce expansion.

- For instance, India’s UPI crossed 10 billion monthly transactions in August 2023, boosting online payment adoption for retail purchases.

Rising Consumer Preference for Convenience and Omnichannel Experiences

Consumer behavior is shifting rapidly toward convenience-led shopping, driving strong E-commerce Market growth. Online platforms excel in offering wide product assortments, easy price comparison, fast delivery, and simplified return policies that support seamless buying experiences. Omnichannel models further enhance engagement by integrating mobile apps, physical stores, and digital touchpoints to provide consistent interaction across platforms. Advancements in same-day and next-day delivery, supported by micro-fulfillment centers and optimized logistics, elevate customer expectations globally. Subscription services for groceries, fashion, and essential goods strengthen brand loyalty and ensure recurring demand. AI-enabled recommendations, virtual try-ons, and voice commerce tools further enhance personalization and purchasing confidence, making convenience a primary growth lever across all demographics.

- For instance, Flipkart launched a “quick-commerce” service called “Flipkart Minutes” in August 2024, offering delivery of everyday essentials in 10–15 minutes to certain customers a concrete example of how subscription-like convenience and rapid delivery meet rising consumer demand.

Expansion of Global Supply Chains and Cross-Border E-commerce

Cross-border e-commerce continues to strengthen as consumers increasingly seek international brands and specialty products unavailable in local markets. Global platforms simplify international transactions through multicurrency support, transparent import processes, and localized checkout systems. Improvements in global logistics—such as bonded warehouses, automated distribution centers, and route optimization—significantly reduce delivery time and cost for international shipments. Easing trade regulations and supportive government policies enable smoother cross-border flows. Small and medium-sized businesses also benefit by reaching global customers through digital marketplaces without the need for physical store expansion. As product discovery becomes more global and logistics infrastructure matures, cross-border e-commerce strengthens its role as a vital driver of market growth.

Key Trends & Opportunities

Accelerating Adoption of AI, Automation, and Personalization Technologies

AI-driven innovation is transforming the E-commerce Market by improving operational efficiency, customer experience, and decision-making accuracy. AI algorithms enhance product recommendations, dynamic pricing, inventory forecasting, and automated customer support. Robotics and automation streamline warehouse operations, reducing errors and accelerating fulfillment. AR and visual search tools improve product discovery and boost purchase confidence by enabling virtual trials. Voice-enabled shopping and conversational commerce create hands-free and intuitive interactions that increase engagement. Fraud detection systems powered by machine learning enhance platform security, reinforcing trust. As generative AI evolves, future opportunities include automated product catalog creation, hyper-personalized marketing, and advanced virtual assistants. These advancements create substantial opportunities for differentiation and operational excellence.

- For instance, IKEA’s “IKEA Place” app allows customers to visualize furniture in real spaces with 98% scale accuracy, increasing conversion rates and lowering return volumes.

Growth of Social Commerce and Influencer-Driven Shopping Ecosystems

Social commerce is emerging as a major opportunity as consumers increasingly rely on social media for product discovery, reviews, and live demonstrations. Livestream shopping models, popular in Asia and now rapidly expanding globally, drive real-time engagement and immediate purchases. Influencers and content creators play a crucial role in shaping buying decisions, especially among younger demographics seeking authentic product insights. Social platforms integrate frictionless in-app checkout, allowing seamless transitions from viewing to purchasing. Small businesses gain greater visibility through targeted advertising and creator partnerships. User-generated content and community-driven shopping experiences enhance trust and brand loyalty. As analytics, creator tools, and social marketplace integrations advance, social commerce is positioned for strong sustained growth.

- For instance, Rodeo launched in 2024, this social shopping app lets users scroll a feed (similar to TikTok), browse shoppable content and purchase directly; it uses AI tools (e.g. from AWS and Google Vision) to identify products in user-generated content.

Key Challenges

Rising Logistics Costs and Last-Mile Delivery Constraints

Logistics and last-mile delivery remain significant challenges for the E-commerce Market due to rising fuel prices, delivery expectations, and infrastructure disparities across regions. Urban congestion, rural accessibility limitations, and regulatory restrictions increase operational complexity. Investments in warehousing, automation, delivery fleets, and workforce training further elevate costs. Reverse logistics, driven by free returns and order cancellations, adds a heavy financial burden as products must be inspected, restocked, or recycled. Seasonal demand spikes require scalable supply chain systems to avoid delays and inefficiencies. Sustainability expectations also pressure companies to adopt green packaging and electric fleets, increasing capital expenditure. These logistical challenges require strategic planning, technology adoption, and collaborative partnerships with logistics providers.

Data Privacy Risks, Cybersecurity Threats, and Consumer Trust Issues

Cybersecurity risks pose a major challenge as e-commerce platforms handle large volumes of transactions and sensitive personal data. Increasing incidents of data breaches, phishing attacks, account hacking, and payment fraud erode consumer trust. Compliance with global data protection regulations such as GDPR and CCPA demands robust security infrastructure and continuous monitoring. Misuse of consumer data for targeted advertising can create ethical concerns and harm brand reputation. Companies must invest in encryption, multi-factor authentication, secure payment systems, and AI-powered fraud detection to safeguard user data. Transparent communication around data usage and security policies is essential to maintaining trust. As digital commerce expands, ensuring resilient cybersecurity frameworks becomes critical to sustained market growth.

Regional Analysis

North America

North America accounted for 28.6% share of the E-commerce Market in 2024, driven by strong digital infrastructure, high consumer spending, and widespread adoption of advanced payment systems. The U.S. remains the dominant contributor, supported by major platforms that continue to expand fulfillment networks and same-day delivery capabilities. High smartphone penetration, AI-enabled personalization, and subscription commerce further accelerate adoption. Retailers increasingly integrate omnichannel models, enhancing customer experiences through curbside pickup and in-store digital touchpoints. Rising demand for convenience, rapid delivery, and premium online offerings supports continued regional market growth.

Europe

Europe captured 22.3% market share in 2024, supported by a mature digital ecosystem, high internet penetration, and strong regulations that promote secure and transparent online transactions. The U.K., Germany, and France lead growth due to efficient logistics systems and a strong preference for cross-border online shopping within the EU. Mobile commerce adoption continues to rise, supported by digital wallets and BNPL services. Sustainability-focused packaging and expanding online grocery segments also fuel momentum. Investments in automated warehousing, AI-driven retail tools, and omnichannel experiences further strengthen Europe’s e-commerce expansion.

Asia Pacific

Asia Pacific dominated the E-commerce Market with 38.7% share in 2024, driven by a massive digital consumer base, rapid urbanization, and widespread smartphone and low-cost internet access. China, India, and Southeast Asia lead growth through large-scale platforms that leverage social commerce, digital wallets, and super apps to boost engagement. Enhanced logistics networks, same-day delivery services, and major shopping festivals significantly elevate transaction volumes. Rising disposable incomes, expanding cross-border purchases, and strong demand for electronics, fashion, and personal care products reinforce Asia Pacific’s position as the fastest-growing regional market.

Latin America

Latin America recorded 6.8% share in 2024, supported by expanding digital payment adoption, improving logistics capabilities, and increasing consumer trust in online retail. Brazil and Mexico remain the strongest contributors, driven by mobile-first purchasing behavior and platforms offering localized payment options such as installments. Growth is supported by rising demand for categories like electronics, fashion, and home essentials. Although logistics fragmentation persists, investment in last-mile delivery, new fulfillment centers, and regional partnerships is improving efficiency. With fintech innovations and growing digital literacy, Latin America continues to emerge as a high-potential market.

Middle East & Africa

The Middle East & Africa accounted for 3.6% share in 2024, driven by increasing internet penetration, a young tech-savvy population, and expanding digital payment infrastructure. The UAE, Saudi Arabia, South Africa, and Egypt lead adoption as governments push digital transformation and retail modernization. Investments in logistics hubs, cross-border e-commerce, and last-mile solutions support growth for regional and global platforms. Strong demand for electronics, fashion, beauty, and lifestyle products drives online shopping uptake. While challenges in logistics and payment trust remain, rising digital inclusion positions the region for sustained long-term e-commerce development.

Market Segmentations

By Model Type

- Business To Business (B2B)

- Business To Consumer (B2C)

- Consumer To Consumer (C2C)

By Product

- Automotive

- Beauty & Personal Care

- Books & Stationery

- Consumer Electronics

- Home Appliances

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The E-commerce Market features a diverse and rapidly evolving competitive landscape, led by global giants and strong regional players that continuously expand their digital ecosystems. Major companies such as Amazon.com, Inc., Alibaba.com, JD.com, eBay Inc., Walmart, Flipkart, MercadoLibre, ASOS, and Lazada focus on strengthening logistics capabilities, enhancing last-mile delivery, and adopting AI-driven personalization to improve customer experience. These platforms invest heavily in automation, cloud infrastructure, and omnichannel retail integration to sustain growth and operational efficiency. Partnerships with fintech providers, expansion of digital payment systems, and the rollout of subscription-based services further enhance customer loyalty. Regional players differentiate through localized product assortments, faster delivery models, and competitive pricing strategies. Increasing use of social commerce, influencer-driven marketing, and cross-border e-commerce also shapes competition, enabling platforms to reach broader audiences. As market maturity rises, companies emphasize data analytics, sustainability initiatives, and strategic acquisitions to maintain leadership in this highly dynamic sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- JD.com

- Amazon.com, Inc.

- ASOS

- Lazada

- MercadoLibre S.R.L.

- Flipkart.com

- Alibaba.com

- Costco Wholesale Corporation

- eBay Inc.

- Dangdang

Recent Developments

- In July 2025, Global‑e acquired ReturnGo to enhance its post-purchase return and exchange technology for merchants.

- In February 2024, Flipkart expanded its logistics arm Ekart through a new nationwide same-day delivery initiative to strengthen its premium e-commerce delivery segment.

- In January 2023, Walmart partnered with Salesforce to integrate advanced AI and data solutions into its e-commerce operations, improving inventory planning and omnichannel fulfillment.

Report Coverage

The research report offers an in-depth analysis based on Model Type, Product and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The E-commerce Market will continue to grow strongly as consumers increasingly shift from offline to digital purchasing across all categories.

- AI-driven personalization and automation will enhance customer experience and improve operational efficiency.

- Social commerce and influencer-led shopping will gain greater traction, particularly among younger consumers.

- Same-day and hyperlocal delivery models will expand as logistics capabilities advance.

- Cross-border e-commerce will rise as global brands reach wider audiences through digital marketplaces.

- Mobile commerce will strengthen further with increasing smartphone penetration and super-app growth.

- Subscription-based services will boost customer retention and create stable recurring revenue streams.

- Retailers will invest more in omnichannel ecosystems that seamlessly integrate physical and digital channels.

- Sustainability initiatives, including eco-friendly packaging and green logistics, will become industry priorities.

- Data security and privacy protection will remain essential as companies reinforce cybersecurity measures to maintain consumer trust.